Professional Documents

Culture Documents

Mayer Steel Corp V CA

Uploaded by

amazing_pinoyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mayer Steel Corp V CA

Uploaded by

amazing_pinoyCopyright:

Available Formats

MAYER STEEL PIPE CORP V. COURT OF APPEALS (1997) Puno, J.

Petition for review on certiorari to annul and set aside the decision of the Court of Appeals RATIO DECIDENDI The insurer's liability is based on the contract of insurance. When private respondents issued the "all risks" policies to petitioner, they bound themselves to indemnify the latter in case of loss or damage to the goods insured. This obligation prescribes in ten years. FACTS Petitioners: Mayer Steel Pipe Corporation, Hongkong Government Supplies Department Respondents: Court of Appeals, South Sea Surety and Insurance Co., Inc., Charter Insurance Corp. In 1983, Hongkong Government Supplies Department contracted Mayer Steel Pipe Corporation to make and supply steel pipes and fittings. Mayer shipped the pipes and fittings to Hongkong.

Prior to shipping, Mayer insured the pipes and fittings against all risks with South Sea Surety and Insurance and Charter Insurance. The pipes and fittings covered by Invoices MSPC-1014, 1015 and 1025 worth US$212,772.09 were insured with South Sea. Those covered by Invoices 1020, 1017 and 1022 worth US$149,470.00 were insured with Charter. Mayer and Hongkong appointed Industrial Inspection (International) Inc. as third-party inspector. Industrial Inspection certified all the pipes and fittings to be in good condition before they were loaded in the vessel. When the goods reached Hongkong, a substantial portion was damaged. Petitioners filed a claim against private respondents for indemnity under the insurance contract. Charter paid Hongkong HK$64,904.75. Petitioners demanded payment of the balance of HK$299,345.30 representing the cost of repair of the damaged pipes. Private respondents refused to pay because the insurance surveyor's report showed that the damage is a factory defect. In 1986, petitioners filed an action against private respondents to recover HK$299,345.30. Private respondents said that they have no obligation to pay the amount claimed because the damage to the goods is due to factory defects not covered by insurance policies. RTC: Ruled in favor of petitioners. Damage to goods is not due to manufacturing defects. Insurance contracts of Mayer and private respondents are "all risks" policies which insure against all causes of conceivable loss or damage. Only exceptions are those excluded in the policy, or those sustained due to fraud or intentional misconduct of insured. Respondents must pay petitioners: 1. Sum equivalent in Philippine currency of HK$299,345.30 with legal rate of interest 2. P100,000.00 as and for attorney's fees 3. Costs of suit CA: Set aside decision of trial court and dismissed complaint on the ground of prescription. Action is barred under Section 3(6) of the Carriage of Goods by Sea Act since it was filed more than two years from the time the goods were unloaded from the vessel. The carrier and the ship shall be discharged from all liability in respect of loss or damage unless suit is brought within one year after delivery of the goods or the date when the goods should have been delivered.

ISSUE Whether or not cause of action had already prescribed HELD No. Section 3(6) of the Carriage of Goods by Sea Act states that the carrier and the ship shall be discharged from all liability for loss or damage to the goods if no suit is filed within one year after delivery of the goods or the date when they should have been delivered. Only the carrier's liability is extinguished if no suit is brought within one year. But the liability of the insurer is not extinguished because the insurer's liability is based not on the contract of carriage but on the contract of insurance. The Carriage of Goods by Sea Act governs the relationship between the carrier on the one hand and the shipper, the consignee and/or the insurer on the other hand. It defines the obligations of the carrier

under the contract of carriage. It does not affect the relationship between the shipper and the insurer. The latter case is governed by the Insurance Code. In Filipino Merchants Insurance v. Alejandro, the shipper filed a complaint against the insurer for recovery of of money as indemnity for loss and damage of insured goods. The insurer filed a thirdparty complaint against the carrier for reimbursement of the amount it paid to the shipper. The insurer filed the third-party complaint more than one year after delivery of the goods. The court held that the insurer was already barred from filing a claim against the carrier because under the Carriage of Goods by Sea Act, the suit against the carrier must be filed within one year after delivery of the goods or the date when the goods should have been delivered. The Filipino Merchants case is different from the case at bar. In Filipino Merchants, it was the insurer which filed a claim against the carrier for reimbursement of the amount it paid to the shipper. In the present case, it was the shipper which filed a claim against the insurer. The basis of the shipper's claim is the "all risks" insurance policies issued by private respondents to Mayer. The ruling in Filipino Merchants should apply only to suits against the carrier filed by the shipper, the consignee or the insurer. The insurer may no longer file a claim against the carrier beyond the oneyear period. But it does not mean that the shipper may no longer file a claim against the insurer because the basis of the insurer's liability is the insurance contract. An insurance contract is a contract whereby one party, for a consideration known as the premium, agrees to indemnify another for loss or damage which he may suffer from a specified peril. An "all risks" insurance policy covers all kinds of loss other than those due to willful and fraudulent act of the insured. When private respondents issued the "all risks" policies to Mayer, they bound themselves to indemnify the latter in case of loss or damage to goods insured. This obligation prescribes in ten years, according to Article 1144 of the Civil Code

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Law of War Part 3Document3 pagesLaw of War Part 3amazing_pinoyNo ratings yet

- Law of War Part 4Document6 pagesLaw of War Part 4amazing_pinoyNo ratings yet

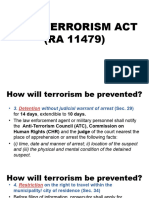

- Anti-Terrorism Act Part 5Document4 pagesAnti-Terrorism Act Part 5amazing_pinoyNo ratings yet

- Military Justice System Part 3Document6 pagesMilitary Justice System Part 3amazing_pinoyNo ratings yet

- Law of War Part 1Document3 pagesLaw of War Part 1amazing_pinoyNo ratings yet

- JR 2 RRDDocument3 pagesJR 2 RRDamazing_pinoyNo ratings yet

- Anti-Terrorism Act Part 2Document4 pagesAnti-Terrorism Act Part 2amazing_pinoyNo ratings yet

- Law of War Part 5Document3 pagesLaw of War Part 5amazing_pinoyNo ratings yet

- Law of War Part 2Document5 pagesLaw of War Part 2amazing_pinoyNo ratings yet

- Anti-Terrorism Act Part 4Document4 pagesAnti-Terrorism Act Part 4amazing_pinoyNo ratings yet

- Military Justice System Part 4Document5 pagesMilitary Justice System Part 4amazing_pinoyNo ratings yet

- Anti-Terrorism Act Part 3Document4 pagesAnti-Terrorism Act Part 3amazing_pinoyNo ratings yet

- Language RoutineDocument1 pageLanguage Routineamazing_pinoyNo ratings yet

- Military Justice System Part 2Document7 pagesMilitary Justice System Part 2amazing_pinoyNo ratings yet

- Ra 7055Document2 pagesRa 7055zrewtNo ratings yet

- Blue Sands AttireDocument1 pageBlue Sands Attireamazing_pinoyNo ratings yet

- Fully Booked Reading ChallengeDocument1 pageFully Booked Reading Challengeamazing_pinoyNo ratings yet

- Planner Cover PageDocument1 pagePlanner Cover Pageamazing_pinoyNo ratings yet

- Annex B - AffidavitDocument1 pageAnnex B - Affidavitamazing_pinoyNo ratings yet

- INTERVIEW QUESTIONS (INCIDENT+IQ) - Ebanking Channels - FT, Bills Payment, Cardless WithdrawalDocument2 pagesINTERVIEW QUESTIONS (INCIDENT+IQ) - Ebanking Channels - FT, Bills Payment, Cardless Withdrawalamazing_pinoyNo ratings yet

- Mnemonic Phrase "Every Good Boy Does FineDocument1 pageMnemonic Phrase "Every Good Boy Does Fineamazing_pinoyNo ratings yet

- Approved Revised Transaction Dispute Form 062618 PDFDocument2 pagesApproved Revised Transaction Dispute Form 062618 PDFGersonCallejaNo ratings yet

- Motion To Release Firearm SampleDocument2 pagesMotion To Release Firearm Sampleamazing_pinoyNo ratings yet

- Philippine Government Agencies Directory 2022Document293 pagesPhilippine Government Agencies Directory 2022amazing_pinoyNo ratings yet

- NLRC Notice On PICOPDocument11 pagesNLRC Notice On PICOPamazing_pinoyNo ratings yet

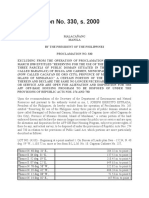

- PP 330Document2 pagesPP 330amazing_pinoyNo ratings yet

- Philippines Map ChartDocument1 pagePhilippines Map Chartamazing_pinoyNo ratings yet

- Filings and Procedures at the Office of the City ProsecutorDocument7 pagesFilings and Procedures at the Office of the City Prosecutoramazing_pinoyNo ratings yet

- Jurisprudence on Estafa by MisappropriationDocument241 pagesJurisprudence on Estafa by Misappropriationamazing_pinoyNo ratings yet

- Ra 10121Document23 pagesRa 10121amazing_pinoyNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 6 Unregistered Trade Marks - Passing OffDocument67 pages6 Unregistered Trade Marks - Passing Offzurul zainolNo ratings yet

- Conditional Land Sales Agreement TemplateDocument7 pagesConditional Land Sales Agreement TemplateREY VILLAMARNo ratings yet

- Court Rules Unlawful Detainer Case Should Proceed Separately from Annulment CaseDocument3 pagesCourt Rules Unlawful Detainer Case Should Proceed Separately from Annulment CaseAra TabaNo ratings yet

- Vavra V Bakalar Cert Petition - Nazi Looted Art at US Supreme CourtDocument158 pagesVavra V Bakalar Cert Petition - Nazi Looted Art at US Supreme CourtRay DowdNo ratings yet

- TrademarksDocument28 pagesTrademarksLusajo MwakibingaNo ratings yet

- Admission Form 8th ClassDocument3 pagesAdmission Form 8th ClassLindsay Miller75% (4)

- Heirs of John Sycip vs. CA G.R. No. 76487 November 9 1990Document3 pagesHeirs of John Sycip vs. CA G.R. No. 76487 November 9 1990Mariel D. Portillo100% (1)

- Consignment AgreementDocument3 pagesConsignment AgreementPranav JainNo ratings yet

- Material Transfer Agreement (Mta)Document2 pagesMaterial Transfer Agreement (Mta)Ali BousadiaNo ratings yet

- Bliss Development Vs CallejaDocument1 pageBliss Development Vs CallejaXing Keet LuNo ratings yet

- BMV 4625Document2 pagesBMV 4625Frank WagnerNo ratings yet

- Croda Whitepaperpdf RenderDocument2 pagesCroda Whitepaperpdf RenderLeonardo Fabián Arboleda Mosquera100% (1)

- Memorandum of AgreementDocument6 pagesMemorandum of AgreementJullie Anne RamosNo ratings yet

- Adr CaseDocument17 pagesAdr Caseshilpasingh1297No ratings yet

- Week 3 TRUST TutorDocument2 pagesWeek 3 TRUST TutorlawyernNo ratings yet

- Role of Minors in Limited Liability PartnershipDocument5 pagesRole of Minors in Limited Liability PartnershipVanessa ThomasNo ratings yet

- Review Estate and Business Tax ExemptionsDocument2 pagesReview Estate and Business Tax ExemptionsAndre CarrerasNo ratings yet

- Chapt 24Document14 pagesChapt 24farhadsamimNo ratings yet

- Aida Eugenio Vs CSC DigestDocument3 pagesAida Eugenio Vs CSC DigestLynlyn Oprenario PajamutanNo ratings yet

- Peoria County Booking Sheet 04/02/14Document11 pagesPeoria County Booking Sheet 04/02/14Journal Star police documentsNo ratings yet

- Blank Deed of Assignment - BusinessDocument1 pageBlank Deed of Assignment - BusinessBon HartNo ratings yet

- LAB Space For Sublease, Houston, TX.Document9 pagesLAB Space For Sublease, Houston, TX.Coy DavidsonNo ratings yet

- Alliance of Quezon City Homeowners' Association, Inc. vs. The Quezon City Government (Full Text, Word Version)Document15 pagesAlliance of Quezon City Homeowners' Association, Inc. vs. The Quezon City Government (Full Text, Word Version)Emir MendozaNo ratings yet

- Millare V.hernandoDocument8 pagesMillare V.hernandoWinter WoodsNo ratings yet

- Freedom Papers Section 2Document47 pagesFreedom Papers Section 2John Downs100% (5)

- 1 Persuasive Legal AnalysisDocument60 pages1 Persuasive Legal AnalysisSam de la Cruz100% (2)

- Retainer ContractDocument4 pagesRetainer ContractAmado Vallejo IIINo ratings yet

- Main - Product - Report-Guangzhou Shi Pin Han Sports Appliances Co., LTD PDFDocument8 pagesMain - Product - Report-Guangzhou Shi Pin Han Sports Appliances Co., LTD PDFРуслан ТарасовNo ratings yet

- Bank Guarantees in International TradeDocument4 pagesBank Guarantees in International TradeMohammad Shahjahan SiddiquiNo ratings yet

- The Indian Contract Act, 1872: Unit - 1: BackgroundDocument65 pagesThe Indian Contract Act, 1872: Unit - 1: BackgroundMaheswar SethiNo ratings yet