Professional Documents

Culture Documents

2010-2011 Austin Visitor Inquiry Study

Uploaded by

KUTNewsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2010-2011 Austin Visitor Inquiry Study

Uploaded by

KUTNewsCopyright:

Available Formats

2010-2011 Austin Visitor Inquiry Study

Conducted by: Jason Draper, Ph.D. (Principal Investigator) and Jiaping (Bailey) Bai University of Houston Conrad N. Hilton College of Hotel and Restaurant Management

May 2011

Project funded by the Austin Convention & Visitors Bureau and Austin Convention Center Department

Acknowledgments The research team would like to thank the Austin Convention and Visitors Bureau (CVB) and Austin Convention Center for funding this study. Margo Richards and Jennifer Walker of the Austin CVB were extremely helpful with providing feedback throughout the study, especially during questionnaire development. Finally, we would like to thank the more than 600 respondents who took the time to respond to the online questionnaire and provide valuable feedback to the Austin CVB.

Research team: Jason Draper, Ph.D. Assistant Professor University of Houston Conrad N. Hilton College of Hotel and Restaurant Management 229 C. N. Hilton Hotel & College Houston, TX 77204-3028 jadraper@uh.edu (713) 743-2416 Jiaping Bailey Bai Graduate Student University of Houston Conrad N. Hilton College of Hotel and Restaurant Management

This research was done by University of Houston in accordance with the guidelines and standards of the University Standard Research Agreement. The results of this study in no way express the promotion of the outcome by the University of Houston.

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Executive Summary During the spring of 2011 the University of Houstons Hilton College of Hotel and Restaurant Management conducted a visitor inquiry study for the Austin Convention & Visitors Bureau (CVB). The study was conducted online by sending email requests to inquirers of the Austin CVB who requested the Official Visitors Guide to Austin or signed up to receive the Austin Insiders Club: eNews over the past 2 years. A total of 627 questionnaires were completed. Of the inquirers who completed a questionnaire, 48.5% indicated they visited Austin in the past 2 years, 17.2% had not visited, and 34.3% were local area residents. Of the respondents who visited Austin in the past 2 years, most visited multiple times. The area of Austin visitors indicated they most like to visit is the Downtown/Capitol area. The most popular primary purpose for visiting Austin was pleasure/vacation, but additional interest in visiting Austin included the live music and culture/history. Most of the visits to Austin were overnight trips and typically visitors stayed in a hotel/motel. Visitors indicated the Austin CVB website and Official Visitors Guide to Austin were important sources of information for both planning and during their trip to Austin. Visitors were highly satisfied with their most recent visit to Austin and indicated high levels of likelihood to both visit again and recommend their friends and/or relatives visit Austin. Respondents who did not visit Austin in the past 2 years also had positive images of Austin as a travel destination and indicated they are likely to visit in the next 2 years. For respondents who have not yet visited Austin, some of the important sources of information for them to learn about Austin as a destination were the Austin CVB website, friends, and the Official Visitors Guide to Austin. This group of respondents indicated the Downtown/Capitol area of Austin is the area they would most like to visit in the future. Visitors, non-visitors, and residents all generally had favorable images of Austin as a travel destination. However, a series of comparisons on the images of Austin as a travel destination were conducted between the groups of inquirers to examine any differences that may exist. There was a consensus between the groups of respondents that Austin is a destination for entertainment and special events. The groups were significantly different in their level of agreement with Austin as a destination for a weekend getaway, with residents having the highest level of agreement, followed by visitors and then respondents who have not visited Austin in the past 2 years. Similar results were found for the level of agreement with Austin being a day trip destination. Although all respondents generally agreed with going to Austin to enjoy live music, residents had a significantly higher level of agreement compared to both visitors and non-visitors. The same results were found with Austin being a destination to enjoy nightlife. Inherently, visitors and residents have better knowledge of what Austin offers travelers compared to non-visitors. The result for Austin being a destination where visitors can enjoy a wide variety of food reflects this knowledge with visitors and residents having significantly higher levels of agreement compared to respondents who have not visited. A similar pattern in the results was revealed for

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Austin being a destination with great natural scenery/landscape and being a destination that does not require a lot of pre-planning. Respondents were asked to indicate their level of agreement with a series of adjectives and phrases to describe Austin as a travel destination. For a number of adjectives and phrases visitors, non-visitors, and residents had significantly different levels of agreement with residents having the highest levels of agreement, followed by visitors and then non-visitors. Examples of adjectives and phrases where all three groups were significantly different with residents having the highest levels of agreement, followed by visitors and then non-visitors included creative, eclectic, friendly, outdoorsy, environmentally friendly, intelligent, unlike the rest of Texas, weird, and family oriented. Results of this study were compared to a 2003 visitor inquiry study (conducted by Behavior Research Center, Inc.) and recent qualitative study (conducted by Fire Studios, 2010). In 2003, 75.0% of visitors agreed Austin is a great destination to enjoy live music. The percentage of visitors that agreed or strongly agreed Austin is a destination to enjoy live music in this study increased to 94.2%. The recent qualitative study and this study both indicated friends and editorials were important sources of information in the decision to visit Austin. Both studies also revealed visitors think Austin is a unique destination. For example, visitors in the qualitative study used phrases such as western chic, hip, and just the right amount of Texas friendly southern culture to describe Austin. In this study visitors had very high levels of agreement that Austin is creative and eclectic. In sum, visitors, non-visitors, and local residents had favorable images of Austin as a travel destination, especially regarding the promotion of Austin as the Live Music Capital of the World and nightlife. Not only did Austin being a live music scene result in a large increase in terms of agreement by visitors from 2003 to the current study, but was a unique characteristic that appealed to all groups of inquirers, including respondents who have not visited Austin and experienced the live music scene. A related characteristic of Austin that appealed to all groups was the nightlife. Austin appears to have a unique image in the minds of visitors, as well as inquirers who have not yet visited.

ii

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table of Contents Executive Summary ............................................................................................................ i List of Tables ...................................................................................................................... iv List of Figures ..................................................................................................................... viii Introduction ......................................................................................................................... 1 Study Purpose ............................................................................................................... 1 Report Outline............................................................................................................... 1 Research Design and Methods ............................................................................................ 2 Sample........................................................................................................................... 2 Questionnaire Design ....................................................................................................3 Online/Email Questionnaire.......................................................................................... 3 Pilot Test ....................................................................................................................... 4 Main Study .................................................................................................................... 4 Results .................................................................................................................................7 Type of Inquirer ............................................................................................................ 8 Sample Demographics ..................................................................................................8 Visitor Inquirers ............................................................................................................ 11 Non-Visitor Inquirers ....................................................................................................31 Resident Inquirers .........................................................................................................41 Comparisons of Inquirers .............................................................................................. 50 Discussion ........................................................................................................................... 65 References ........................................................................................................................... 68 Appendices .......................................................................................................................... 69 Appendix A: Cover Letters ........................................................................................... 70 Appendix B: Questionnaire........................................................................................... 76 Appendix C: Social Media, Mobile Apps, and Other Websites Used to Find Out About Austin ..................................................................................... 109 Appendix D: Reason for Ranking Area of Austin to Visit as the Number One Area ..................................................................................................118 Appendix E: Visitors and Residents Explanations of Why Travelers Should Visit Austin .............................................................................................. 156 Appendix F: Non-Visitor Inquirers Explanation for Not Visiting Since Inquiring ......175 Appendix G: Other Destinations that Come to Mind When Thinking About Taking a Trip............................................................................................ 180 Appendix H: Other Thoughts About Austin .................................................................192

iii

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College List of Tables Table 1: Frequency Distribution by Type of Inquirer ......................................................... 8 Table 2: Frequency Distribution for Demographics ........................................................... 9 Table 3: Frequency Distribution for Number of Times Visiting Austin in Past 2 Years ...11 Table 4: Frequency Distribution for Importance of Sources of Information for Visitors Deciding to Visit ...................................................................................................12 Table 5: Frequency Distribution for Visitors Rankings of Top Areas They Like to Visit in Austin ......................................................................................................14 Table 6: Frequency Distribution for Knowledge of Austin Prior to Most Recent Visit .....14 Table 7: Frequency Distribution for Approximate Number of Days in Advance for Trip Decision .......................................................................................................15 Table 8: Frequency Distribution for Primary Purpose and Additional Interests or Reasons for Visiting Austin ................................................................................................ 15 Table 9: Frequency Distribution for Travel Party and Size ................................................ 16 Table 10: Frequency Distribution for Day and Overnight Trip ..........................................17 Table 11: Frequency Distribution for Overnight Trip Characteristics................................ 17 Table 12: Frequency Distribution for Transportation To and Around Austin .................... 18 Table 13: Frequency Distribution for Satisfaction with Most Recent Visit ....................... 19 Table 14: Frequency Distribution for Usefulness of Resources While Planning Visit to Austin ............................................................................................................. 20 Table 15: Frequency Distribution for Usefulness of Resources During Visit to Austin ....20 Table 16: Comparison of Usefulness of Resources While Planning and During Visit to Austin ............................................................................................................. 21 Table 17: Frequency Distribution for Overall Satisfaction with Most Recent Visit to Austin ................................................................................................................ 22 Table 18: Frequency Distribution for Likelihood of Visiting Again and Recommending to Friends/Relatives ................................................................................................ 22

iv

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 19: Frequency Distribution for Visitors Agreement with Visiting Austin during Four Seasons.......................................................................................................23 Table 20: Frequency Distribution for Visitors Agreement with Visiting Austin for Various Types of Trips ....................................................................................... 23 Table 21: Frequency Distribution for Visitors Agreement with Visiting Austin for Various Types of Activities ................................................................................ 24 Table 22: Frequency Distribution for Visitors Agreement with Various Attributes of Austin ............................................................................................................. 25 Table 23: Frequency Distribution for Visitors Agreement with Adjectives to Describe Austin ..................................................................................................27 Table 24: Frequency Distribution for Visitors Agreement with Emotional Solidarity with Austin Residents ......................................................................................... 28 Table 25: Per Party Per Day Spending by Overnight Visitors............................................ 29 Table 26: Visitors Travel Experience in the Past 2 Years ................................................. 29 Table 27: Frequency Distribution for Visitors Agreement with Tourism Destinations ....30 Table 28: Non-Visitors Likelihood of Visiting Austin in the Next 2 Years...................... 31 Table 29: Frequency Distribution for Importance of Sources of Information for Non-Visitors Deciding to Visit........................................................................... 31 Table 30: Frequency Distribution for Non-Visitors Rankings of Top Areas They would Like to Visit in Austin in the Future........................................................ 34 Table 31: Frequency Distribution for Non-Visitors Agreement with Visiting Austin during Four Seasons ........................................................................................... 34 Table 32: Frequency Distribution for Non-Visitors Agreement with Visiting Austin for Various Types of Trips ................................................................................. 35 Table 33: Frequency Distribution for Non-Visitors Agreement with Visiting Austin for Various Types of Activities ..........................................................................36 Table 34: Frequency Distribution for Non-Visitors Agreement with Various Attributes of Austin ............................................................................................ 37

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 35: Frequency Distribution for Non-Visitors Agreement with Adjectives to Describe Austin ..................................................................................................38 Table 36: Non-Visitors Travel Experience in the Past 2 Years .........................................39 Table 37: Frequency Distribution for Non-Visitors Agreement with Tourism Destinations ........................................................................................................40 Table 38: Frequency Distribution for Top Areas Residents Would Recommend Visitors Go .........................................................................................................42 Table 39: Frequency Distribution for Residents Agreement with Visiting Austin during Four Seasons ........................................................................................... 42 Table 40: Frequency Distribution for Residents Agreement with Visiting Austin for Various Types of Trips ................................................................................. 43 Table 41: Frequency Distribution for Residents Agreement with Visiting Austin for Various Types of Activities ..........................................................................44 Table 42: Frequency Distribution for Residents Agreement with Various Attributes of Austin ............................................................................................................. 45 Table 43: Frequency Distribution for Residents Agreement with Adjectives to Describe Austin ..................................................................................................46 Table 44: Frequency Distribution for Residents Agreement with Emotional Solidarity with Austin Visitors............................................................................................ 48 Table 45: Residents Travel Experience in the Past 2 Years .............................................. 49 Table 46: Frequency Distribution for Residents Agreement with Tourism Destinations .......................................................................................................49 Table 47: Comparison of Inquirers on Areas to Visit in Austin .........................................50 Table 48: Comparison of Inquirers on Seasons to Visit Austin..........................................51 Table 49: Comparison of Inquirers on Types of Trips to Austin ........................................52 Table 50: Comparison of Inquirers on Types of Activities to do in Austin ....................... 54 Table 51: Comparison of Inquirers on Various Attributes of Austin .................................57 Table 52: Comparison of Inquirers on Adjectives to Describe Austin ............................... 60

vi

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 53: Comparison of Inquirers on Destinations to Visit .............................................. 63

vii

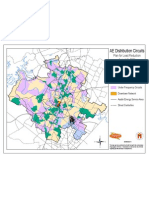

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College List of Figures Figure 1: Map of the Origin of Austin CVB Inquirers ....................................................... 2 Figure 2: Map of the Origin of Austin CVB Inquirers in North America .......................... 3 Figure 3: Map of the Origin of All Respondents ................................................................ 5 Figure 4: Map of the Origin of Respondents Who Visited Austin in the Past 2 Years ......6 Figure 5: Map of the Origin of Respondents Who did not Visit Austin in the Past 2 Years ................................................................................................................. 7 Figure 6: Map of Austin for Ranking Top Areas Visitors Like to Visit ............................. 13 Figure 7: Map of Austin for Ranking Top Areas Non-Visitors Would Like to Visit .........33 Figure 8: Map of Austin for Ranking Top Areas Residents Would Recommend Visitors Go ........................................................................................................... 41

viii

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Introduction A key role of destination marketing organizations (DMOs) such as convention and visitor bureaus (CVBs) is to market the destination to various segments of travelers. Inherently, to market and promote a destination effectively DMOs require an understanding of the characteristics of their visitors and potential visitors, their images or perceptions of the destination, as well as trip characteristics of actual visitors. Both visitors and potential visitors images or perceptions of a destination are important for CVBs to assess. As a destination, one of the biggest challenges is to identify how to effectively position the destination (Echtner & Ritchie, 2003). Molina, Gomez, and Martin-Consuegra (2010) suggest destination images are a critical component for successful marketing and management in tourism. The images visitors and non-visitors have of a destination are important for tourism marketing and management agencies to understand in order to identify if the intended message is being received. In addition, it is important to determine if visitors and non-visitors have different images of a destination. Destination images can change over time and it is important for a destination to have a current assessment of the images both visitors and nonvisitors have of the respective destination. The last visitor inquiry study conducted for the Austin CVB was in 2003 by the Behavior Research Center, Inc. Study Purpose The primary purpose of this study was to examine the images of Austin as a travel destination. Image items and phrases that reflect what visitor and non-visitor inquirers might think of when they think of Austin were developed during the questionnaire development phase of the study. Another important component of this study was to test for differences of the images of Austin as a destination between different types of inquirers of the Austin CVB (i.e., those who visited, those who did not, and Austin area residents). In addition to the primary purpose of the study, inquirers who indicated they visited Austin in the past two years were asked about trip characteristics of their most recent visit. Report Outline The remainder of this report includes three main sections. The research design and methods section describes the sample used to conduct the study, questionnaire design, pilot test, and how the main part of the study was conducted. Next, the results of the study are presented, including demographic information, descriptive statistics for the questions asked of each group, and comparisons of the three groups for similar questions asked of all three types of inquirers. The main portion of the report concludes with a discussion of the findings. The appendices include the cover letters (Appendix A) sent to the sample, the final questionnaire (Appendix B), and responses to the open ended questions asked in the study (Appendix C thru H).

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Research Design and Methods Sample Participants for this study consisted of inquirers of the Austin Convention & Visitors Bureau. Inquiries were made to receive the Official Visitors Guide to Austin and/or sign up to receive the Austin Insiders Club: eNews on the Austin Convention & Visitors Bureau website (www.austintexas.org). The study limited the inquirers included in the sample to those who made an inquiry in the past two years and provided an email address (n = 4,619). The list did not provide an indicator of who visited and who did not visit Austin. The list included a sizeable amount of Austin area residents that were included in the sample. The zip codes provided for inquirers were mapped to provide an overview of where the inquirers live (Figure 1). As shown, inquirers lived throughout the world, but most lived in the United States.

Figure 1: Map of the Origin of Austin CVB Inquirers

To generate a better image of inquirers who resided in North America another map was generated (Figure 2). There was a heavy concentration of inquirers in the east part of Texas, as well as along the east coast of the United States. California and Florida also appeared to have large numbers of inquirers of the Austin CVB.

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College

Figure 2: Map of the Origin of Austin CVB Inquirers in North America

Questionnaire Design The questionnaire for this study was developed by the University of Houston research team after preliminary meetings with the Austin CVB. At several stages during the project the questionnaire was reviewed by the Austin CVB for feedback to ensure approval of the questions. The destination image section of the questionnaire was developed by reviewing contents of the Official Visitors Guide to Austin, the Austin CVB website (www.austintexas.org), Facebook, Google searches, and informal discussions with people who both visited and did not visit Austin. A number of questions asked respondents to rate items on a Likert-type scale (e.g., level of agreement measured by 1 = Strongly Disagree to 5 = Strongly Agree). The questionnaire can be found in Appendix B. Online/Email Questionnaire This study used an online data collection method whereby inquirers were sent a series of emails (explained in more detail later) to recruit participation in the study. Prior to the pilot test and subsequent main study data collection, the online questionnaire was programmed and tested. The questionnaire was programmed in Qualtrics, an online survey software program. Once programmed, the research team sent emails to a group of individuals at the Austin CVB and Austin Convention Center Department, who sponsored the study. The purpose of this phase of the study was to internally test the online questionnaire and make any necessary modifications prior to sending to the list of inquirers for the pilot test and main study.

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Pilot Test A pilot test was conducted in order to replicate a portion of the methods used for the full study. A random sample of 200 email addresses was drawn from the full sample provided by the Austin CVB to conduct the pilot test. The purpose of the pilot test was to ensure the system was working properly, estimate a response rate, and determine if any modifications to the questionnaire and/or data collection process were needed. Pilot testing also helps ensure clarity of the questions and acceptability (Rea & Parker, 2005). Acceptability includes assessing the length of the questionnaire by identifying if there are too many participants who do not complete it in its entirety. In order to encourage completion of the questionnaire two incentives were included. First, the first 400 respondents who completed the questionnaire and provided an email address as the last item received free Austin music download cards. Second, a drawing was included for the Austin Rock Star Weekend. These incentives were included in the pilot test in order replicate how the main data collection procedures were conducted. The first email for the pilot test was sent on the afternoon of Friday, April 1, 2011. As of Sunday in the early afternoon seven people had begun the survey and five completed the online questionnaire. A reminder was programmed and sent shortly before 1:30pm on Sunday, April 3rd and remained active through the morning of Monday, April 4, 2011. The pilot test responses were only used to determine if changes needed to be made to the questionnaire and data collection procedures. Responses to the pilot test were not included in any data analysis for this report. Main Study A modified Dillman (2009) method that included multiple contacts (n = 3) was used to collect data for this study. The remaining 4,419 email addresses provided by the Austin CVB were sent an email introducing the study, its purpose, incentives, rights as participants, and a unique link to the online questionnaire on Monday, April 4, 2011. The unique link provided a way for followup or reminder emails to be sent to those who had not completed the online questionnaire at the time of subsequent reminder emails. The first reminder email was sent Thursday, April, 7, 2011. The final reminder was sent on Monday, April 11, 2011. The cover letters from the body of the emails sent to the sample can be found in Appendix A. The final questionnaire (found in Appendix B) was sent to 4,419 inquirers for the main portion of this study. Twenty email addresses returned a message indicating the email was undeliverable, the potential respondent was out of the office or no longer with the company, the person no longer uses the email account, the email account currently is not accepting emails because the capacity was exceeded, or there was a filter blocking it from reaching the person. Once these 20 potential respondents were subtracted from the sample size of 4,419, the total of 627 usable questionnaires resulted in a net or effective response rate of 14.25%. Respondents were asked to provide their zip code at the beginning of the demographics questions. Figure 3 displays pushpins representing the origin of respondents who provided a zip code. Figure 4 displays the origin of respondents who visited Austin in the past 2 years. Figure 5 displays the origin of respondents who did not visit Austin in the past 2 years.

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College

Figure 3: Map of the Origin of All Respondents

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College

Figure 4: Map of the Origin of Respondents Who Visited Austin in the Past 2 Years

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College

Figure 5: Map of the Origin of Respondents Who did not Visit in the Past 2 Years

Results This section includes the descriptive results of this study, as well as statistical comparisons of inquirer groups for the images of Austin as a travel destination. Results are presented by a summary followed by a table that includes results for each variable included in the study. The results begin with the branching question that asked what type of inquirer (i.e., visited Austin in past 2 years, NOT visited Austin in past 2 years, local area resident) best describes the respondents. Then, the demographic characteristics of the three groups are presented. The results of the rest of the questions asked of each group are then presented in the following order: visitors, non-visitors, and residents. The results section concludes with a section that statistically compares the three groups for items asked of all three groups of inquirers. The following are definitions of abbreviations and terms found in the results: Valid cases (n) the number of respondents that answered the question. Mean (M) the mathematical average score. Standard deviation (SD) average distance an individual score differs from the mean.

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Median (Mdn) when all observations or measurements for a variable are placed in ascending order the median is the center point. The median is often used when the mean is skewed by extreme responses to a question. Significant difference (e.g., = 0.05) scores are statistically different with less than 5% chance the difference is an error. In other words, there is 95% or more confidence there is a significant difference. When comparisons are made, asterisks are used to indicate the alpha () level as 0.05 (*), 0.01 (**), or 0.001 (***). For the 0.01 and 0.001 alpha () levels, the confidence levels are 99% and 99.9%, respectively.

Type of Inquirer The first item of the questionnaire asked respondents to indicate the type of inquirer that best described them (Table 1). The question served to branch respondents to subsequent sections of the questionnaire. Close to half (48.5%) of respondents visited Austin in the past 2 years, 17.2% did not visit, and 34.3% of respondents were local area residents. Table 1: Frequency Distribution by Type of Inquirer I visited Austin in the past the past 2 years I have NOT visited Austin in the past 2 years I am a local area resident Frequency 304 108 215 627 Percent 48.5 17.2 34.3 100.0

Sample Demographics The demographic questions were asked of all respondents at the end of the online questionnaire (Table 2). In all three sub-samples, females more frequently completed the online questionnaire with 66.6% for visitors and 61.3% non-visitors. For the resident sub-sample, 82.5% of the completed online questionnaires were completed by females. The average age of visitor and non-visitor inquirers was nearly 50 years, while residents average age was just over 43. All three groups are well educated with 66.5% of visitors, 58.0% of non-visitors, and 71.2% of residents having a four-year college degree or higher level of education. Two-thirds or more for each of the three groups of inquirers was employed full-time with 66.0% for visitors, 67.9% nonvisitors, and 70.1% residents. The most frequent household income interval for each group was $100,000-149,999 with at least 20% of respondents in each group of inquirers indicating this interval as their household income. The majority of respondents in each inquirer group indicated their ethnicity as white, with 85.6% for visitors, 86.4% non-visitors, and 73.7% residents.

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 2: Frequency Distribution for Demographics Visitors Non-Visitors Frequency (Percent) Frequency (Percent) Gender Female 199 (66.6) 65 (61.3) Male 100 (33.4) 41 (38.7) 299 (100.0) 106 (100.0) Age 18 29 30 39 40 49 50 59 60 69 70 79 Residents Frequency (Percent) 174 (82.5) 37 (17.5) 211 (100.0)

24 (8.1) 41 (13.9) 70 (23.6) 105 (35.5) 51 (17.2) 5 (1.7) 296 (100.0) M = 49.23; SD = 11.88

5 (4.8) 16 (15.4) 23 (22.1) 42 (40.4) 13 (12.5) 5 (4.8) 104 (100.0) M = 49.94; SD = 11.60

33 (15.9) 56 (27.1) 49 (23.7) 48 (23.2) 18 (8.7) 3 (1.4) 207 (100.0) M = 43.02; SD = 12.69

Household Makeup Children (< 18) Adults

n = 246; M = 0.49; SD = 0.89 n = 295; M = 1.95; SD = 0.80

n = 90; M = 0.32; SD = 0.68 n = 106; M = 1.98; SD = 0.81

n = 195; M = 0.41; SD = 0.82 n = 211; M = 1.89; SD = 0.82

Highest Education Level Grade school or some high school High school diploma or GED Technical, vocational, or trade school Some college (including junior college) Four-year college (B.A., B.S., B.F.A.) Masters Degree (M.A., M.S., M.F.A., M.Arch., M.B.A.)

1 (0.3) 23 (7.7) 11 (3.7) 65 (21.8)

0 (0.0) 4 (3.7) 5 (4.7) 36 (33.6)

1 (0.5) 3 (1.4) 4 (1.9) 53 (25.0)

109 (36.6)

41 (38.3)

92 (43.4)

70 (23.5)

16 (15.0)

52 (24.5)

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 2 (continued) Ph.D./Professional (M.D., J.D., D.V.M., D.D.M.) 19 (6.4) 5 (4.7) 7 (3.3)

298 (100.0) Employment Status Employed full-time Employed part-time Retired Homemaker Student Unemployed

107 (100.0)

212 (100.0)

196 (66.0) 38 (12.8) 38 (12.8) 13 (4.4) 7 (2.4) 5 (1.7) 297 (100.0)

72 (67.9) 7 (6.6) 16 (15.1) 5 (4.7) 5 (4.7) 1 (0.9) 106 (100.0)

148 (70.1) 22 (10.4) 14 (6.6) 9 (4.3) 13 (6.2) 5 (2.4) 211 (100.0)

Household Income Less than $10,000 $10,00024,999 $25,00039,999 $40,00054,999 $55,000-69,999 $70,000-84,999 $85,000-99,999 $100,000-149,999 $150,000-199,999 $200,000 or greater

4 (1.4) 9 (3.2) 25 (9.0) 34 (12.3) 28 (10.1) 34 (12.3) 30 (10.8) 65 (23.5) 25 (9.0) 23 (8.3) 277 (100.0)

0 (0.0) 3 (3.2) 8 (7.4) 17 (18.3) 13 (14.0) 11 (11.8) 9 (9.7) 19 (20.4) 7 (7.5) 6 (6.5) 93 (100.0)

5 (2.5) 12 (6.0) 19 (9.5) 29 (14.6) 24 (12.1) 18 (9.0) 23 (11.6) 43 (21.6) 15 (7.5) 11 (5.5) 199 (100.0)

Ethnicity White Hispanic African American Asian Other

250 (85.6) 22 (7.5) 8 (2.7) 4 (1.4) 8 (2.7) 292 (100.0)

89 (86.4) 7 (6.8) 3 (2.9) 0 (0.0) 4 (3.9) 103 (100.0)

154 (73.7) 29 (13.9) 13 (6.2) 5 (2.4) 8 (3.8) 209 (100.0)

LGBT traveler Yes No

16 (5.8) 258 (94.2) 274 (100.0) n = valid cases; M = mean; SD = standard deviation

4 (4.2) 91 (95.8) 95 (100.0)

16 (7.8) 189 (92.2) 205 (100.0)

10

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College The next three sections provide an overview of the results for the three respective groups included in this study (i.e., visited in past 2 years, did not visit in past 2 years, and local area residents). Following the three sections for each of the types of inquirers is a section that provides a statistical comparison of the three inquirer groups for the destination image questions that were asked of all three groups. Visitor Inquirers Respondents who indicated they visited Austin in the past 2 years were asked a series of questions about visiting Austin. First, they were asked how many times they visited in the past 2 years (Table 3). Aside from providing just the number of times, a number of respondents typed a note about having family in Austin who they frequently visit or that they themselves live in a nearby city, such as San Antonio, and make frequent trips to Austin. The average number of trips visitors made to Austin in the past 2 years was 4.80. Table 3: Frequency Distribution for Number of Times Visiting Austin in Past 2 Years Frequency 1 105 2 43 3 33 4 32 5 17 6 18 7 0 8 11 10-19 18 20-29 10 30 or more 5 292 M = 4.80; SD = 8.63 M = mean; SD = standard deviation

Percent 36.0 14.7 11.3 11.0 5.8 6.2 0.0 3.8 6.2 3.4 1.7 100.0

Next, visitor inquirers were asked to rate the importance of various sources of information in the decision to visit Austin on a scale of 1 = Not at all Important to 5 = Extremely Important (Table 4). Previous trips to Austin were the most important source of information with a mean of 3.66 out of 5.00, which falls between moderately and very important. Other sources of information that exceeded the moderately important level (3.00) were friends (M = 3.43), the Austin CVB website (M = 3.20), and relatives (M = 3.10). The Official Visitors Guide to Austin was also moderately important with a mean 2.98. This series of questions was followed by asking respondents to list the social media, mobile apps, and other websites they used to find out about Austin as a travel destination. The responses to the open ended question can be found in Appendix C.

11

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 4: Frequency Distribution for Importance of Sources of Information for Visitors Deciding to Visit Not at all Slightly Moderately Very Extremely Important Important Important Important Important Values given are percentages Previous trips to Austin 18.4 3.1 11.3 29.0 38.2 (n = 293; M = 3.66; SD = 1.47) Friends 15.9 10.0 18.3 26.6 29.3 (n = 290; M = 3.43; SD = 1.41) Austin Convention & Visitors 16.8 12.3 23.6 28.8 18.5 Bureau Website (www.austintexas.org) (n = 292; M = 3.20; SD = 1.34) Relatives 33.4 7.2 10.0 14.5 34.8 (n = 290; M = 3.10; SD = 1.72) Official Visitors Guide to Austin 19.3 16.9 24.1 25.4 14.2 (n = 295; M = 2.98; SD = 1.33) Magazines/editorial (e.g., articles 23.0 13.2 28.9 25.8 9.1 or stories (n = 287; M = 2.85; SD = 1.29) Online ad 33.1 14.4 22.2 23.6 6.7 (n = 284; M = 2.56; SD = 1.34) Online booking engine (e.g., 37.6 14.6 20.2 16.4 11.1 Expedia, Travelocity, Orbitz, etc.) (n = 287; M = 2.49; SD = 1.42) Other websites 36.0 12.0 24.4 21.6 6.0 (n = 283; M = 2.49; SD = 1.33) Austin eNEWS 40.4 10.5 24.4 16.7 8.0 (n = 287; M = 2.41; SD = 1.37) Print ad 48.8 14.6 20.9 11.1 4.5 (n = 287; M = 2.08; SD = 1.24) Social media (e.g., Facebook, 54.2 12.8 19.1 9.0 4.9 Twitter) (n = 288; M = 1.98; SD = 1.24) Mobile apps 64.6 13.3 11.6 7.0 3.5 (n = 285; M = 1.72; SD = 1.13) Travel agent/tour operator 80.1 7.7 7.7 2.1 2.4 (n = 287; M = 1.39; SD = 0.90) n = valid cases; M = mean; SD = standard deviation

12

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Next, visitors were shown the map in Figure 6. The instructions for the question asked respondents to rank up to the top five areas of Austin they like to visit. Respondents were shown the names of the five areas on the map and dragged their responses to a Top Areas box on the screen. Respondents could also click and drag the options in the Top Areas box to reorder their rankings.

Figure 6: Map of Austin for Ranking Top Areas Visitors Like to Visit

13

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Visitors responses to ranking the top areas they like to visit in Austin are presented in Table 5. With the lower mean representing the area visitors ranked as the top area, it is easily the Downtown/Capitol area with a mean of 1.40 and almost three-fourths (71.4%) of visitors indicating it as the number one area they like to visit in Austin. The area that resulted with the second lowest mean was South at 2.84, followed by University at 2.90 as the third ranked area visitors like to visit in Austin. Respondents were asked to explain why they selected the respective area of Austin as the top area they like to visit. Responses to the open ended question can be found in Appendix D. Table 5: Frequency Distribution for Visitors Rankings of Top Areas They Like to Visit in Austin Downtown/ Ranking Capitol University South East West Frequency (Percentage) 1 195 (71.4) 23 (10.1) 32 (13.9) 15 (7.2) 11 (5.2) 2 53 (19.4) 79 (34.8) 76 (33.0) 22 (10.6) 32 (15.2) 3 19 (7.0) 58 (25.6) 49 (21.3) 36 (17.3) 60 (28.6) 4 5 (1.8) 32 (14.1) 43 (18.7) 59 (28.4) 60 (28.6) 5 1 (0.4) 35 (15.4) 30 (13.0) 76 (36.5) 47 (22.4) 273 (100.0) 227 (100.0) 230 (100.0) 208 (100.0) 210 (100.0) M = 1.40; M = 2.90; M = 2.84; M = 3.76; M = 3.48; SD = 0.73 SD = 1.23 SD = 1.26 SD = 1.25 SD = 1.15 M = mean; SD = standard deviation

The next question asked Austin visitors how knowledgeable they were about Austin prior to their most recent visit on a scale of 1 = Not at all Knowledgeable to 5 = Extremely Knowledgeable (Table 6). About one-fourth (26.0%) were very or extremely knowledgeable prior to visiting Austin on their most recent visit. Table 6: Frequency Distribution for Knowledge of Austin Prior to Most Recent Visit Frequency Not at all Knowledgeable 23 Slightly Knowledgeable 102 Moderately Knowledgeable 100 Very Knowledgeable 60 Extremely Knowledgeable 19 304 M = 2.84; SD = 1.03 M = mean; SD = standard deviation

Percent 7.6 33.6 32.9 19.7 6.3 100.0

14

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College On average, inquirers who visited Austin in the past 2 years made the decision to visit Austin 63.42 days prior to their actual trip (Table 7). Almost one-third (31.4%) made the decision between 50 and 99 days prior to visiting. Table 7: Frequency Distribution for Approximate Number of Days in Advance for Trip Decision Frequency Percent 0 3 1.0 1-9 50 17.4 10-19 23 8.0 20-29 13 4.5 30-39 48 16.7 40-49 9 3.1 50-99 90 31.4 100-199 41 14.3 200 or more 10 3.5 287 100.0 M = 63.42; SD = 68.57 M = mean; SD = standard deviation

Two questions were asked of visitor inquirers about their primary purpose and additional reasons for visiting Austin on their most recent visit (Table 8). Over one-third (34.9%) of visitors indicated their primary purpose for visiting Austin was pleasure/vacation, followed by 24.0% to visit relatives, and 15.1% a weekend getaway. The second item asked respondents to check all that apply for additional interests or reasons for visiting Austin. Over half (59.5%) indicated live music as an additional reason for visiting Austin and 47.7% for the culture/history. Two additional interests or reasons that more than one-third of visitors selected were special event(s) (39.8%) and outdoor recreation (37.2%). Table 8: Frequency Distribution for Primary Purpose and Additional Interests or Reasons for Visiting Austin Frequency Percent Primary Purpose Pleasure/vacation 106 34.9 Visit relatives 73 24.0 Weekend getaway 46 15.1 Visit friends 20 6.6 Business travel 19 6.3 Group meeting/convention 9 3.0 Other 31 10.2 304 100.0

15

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 8 (continued) Additional Interests or Reasons* Live music Culture/history Special event (e.g., festival) Outdoor recreation Sporting event(s) Golf

181 145 121 113 30 20

59.5 47.7 39.8 37.2 9.9 6.6

*Check all that apply (the percentage is based on n = 304 of inquirers who indicated they visited in past 2 years)

Just over half (52.0%) of the visitors indicated they traveled with a spouse/partner on their most recent visit to Austin (Table 9). One fifth of visitors indicated they traveled by themselves (20.1%) or with friends (20.1%). The average travel party included 2.45 adults. Table 9: Frequency Distribution for Travel Party and Size Frequency Travel Party* Spouse/partner By yourself Friends With kids Other family Work colleagues Club Group tour Other 158 61 61 60 32 15 2 0 4 Percent 52.0 20.1 20.1 15.4 14.8 4.9 0.7 0.0 1.3

Number of Adults n = 293; M = 2.45; SD = 2.01 Number of Children (under 18) n = 127; M = 0.76; SD = 1.96 n = valid cases; M = mean; SD = standard deviation *Check all that apply (the percentage is based on n = 304 who indicated they visited in past 2 years)

16

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College The majority (85.0%) of visitor inquirers most recent visit to Austin was an overnight trip (Table 10). Overnight visitors were asked a few subsequent questions regarding the type of accommodations and number of nights they spent in Austin on their most recent visit. Table 10: Frequency Distribution for Day and Overnight Trip A day trip An overnight trip Frequency 44 249 293 Percent 15.0 85.0 100.0

Over half (64.5%) of the overnight visitors to Austin stayed in a hotel/motel on their most recent visit (Table 11). Another 26.6% of overnight visitors to Austin indicated they stayed with friends/relatives (Table 11). The average length of stay for overnight visitors was over four (4.31) nights. However, some respondents had an extended length of stay. Therefore, the median of 3.00 is a more accurate measure of the average length of stay. An adjusted length of stay was measured by excluding cases where respondents indicated extended lengths of stay. Most of the lengths of stay ranged from one to 11 nights. Then, there was a jump in the number of nights and responses such as 14, 20, 21, and higher were reported for the number of nights overnight visitors stayed in Austin. As a result an adjusted length of stay was calculated excluding responses above 11 nights as the length of stay. The adjusted length of stay that excluded the extended stays (i.e., greater than 11 nights) was 3.61 for the mean and 3.00 for the median. The average length of stay for overnight visitors who reported staying in a hotel/motel was 3.48 nights. The median for hotel/motel overnight stays was also 3.00 nights. Table 11: Frequency Distribution for Overnight Trip Characteristics Frequency Accommodations Hotel/motel 160 Friends/relatives 66 Rental home/condo 13 Campground/RV park 2 Other 7 248

Percent 64.5 26.6 5.2 0.8 2.8 100.0

Number of nights n = 246; M = 4.31; SD = 7.89; Mdn = 3.00 Adjusted number of nights n = 241; M = 3.61; SD = 2.04; Mdn = 3.00 Hotel/motel number of nights n = 159; M = 3.48; SD = 1.80; Mdn = 3.00 n = valid cases; M = mean; SD = standard deviation; Mdn = median

17

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College The most frequent type of transportation used to get to Austin was a personal car (48.7%), followed by airplane (44.4%) (Table 12). A personal car (57.9%) was also the most common type of transportation to get around Austin while visiting. Rental cars were used by over onefourth (29.3%) and walking by almost one-fourth (24.0%) of visitors to get around Austin while visiting. Table 12: Frequency Distribution for Transportation To and Around Austin Frequency To Austin Personal car 148 Airplane 135 Rental car 15 Recreational vehicle 2 Tour bus 0 Other 4 304 Get Around Austin* Personal car Rental car Walk Taxi Metro Bus Transit Bicycle Pedicab

Percent 48.7 44.4 4.9 0.7 0.0 1.3 100.0

176 89 73 34 19 13 5

57.9 29.3 24.0 11.2 6.3 4.3 1.6

*Check all that apply (the percentage is based on n = 304 who indicated they visited in past 2 years)

Visitors were asked to indicate their level of satisfaction with a series of items about their most recent visit on a scale of 1 = Not at all Satisfied to 5 = Extremely Satisfied (Table 13). A Not Applicable option was offered in case an item(s) (e.g., accommodations for day visitors) was not used or experienced by visitors. Only two items resulted in a mean score below very satisfied (4). Those items were public transportation (M = 3.61) and directional signage (M = 3.89). The top five items with which visitors were most satisfied included the local cuisine (M = 4.46), recreational activities (M = 4.45), nightlife (M = 4.42), special events (M = 4.39), and historical/cultural attractions (M = 4.35). The next two items with the highest means were information on the Austin CVB website (M = 4.28), and information in the Official Visitors Guide to Austin (M = 4.25).

18

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table13: Frequency Distribution for Satisfaction with Most Recent Visit Not at all Slightly Moderately Very Extremely Satisfied Satisfied Satisfied Satisfied Satisfied Values given are percentages Local cuisine 0.0 0.7 5.7 40.2 53.4 (n = 296; M = 4.46; SD = 0.64) Recreational activities 0.0 1.3 7.1 36.9 54.7 (n = 225; M = 4.45; SD = 0.69) Nightlife 0.8 2.1 6.4 35.2 55.5 (n = 236; M = 4.42; SD = 0.78) Special events 0.5 2.6 10.3 30.4 56.2 (n = 194; M = 4.39; SD = 0.82) Historical/cultural attractions 0.0 1.6 7.1 45.7 45.7 (n = 254; M = 4.35; SD = 0.68) Information on the Austin CVB 0.0 3.0 13.5 36.1 47.4 Website (www.austintexas.org) (n = 230; M = 4.28; SD = 0.81) Information in the Official 0.0 3.2 12.9 39.2 44.7 Visitors Guide to Austin (n = 217; M = 4.25; SD = 0.80) Accommodations 0.4 2.1 11.9 45.1 40.4 (n = 235; M = 4.23; SD = 0.77) Shopping 1.2 2.0 15.9 35.0 45.9 (n = 246; M = 4.22; SD = 0.87) Austin visitor center 0.9 8.1 11.7 28.8 50.5 (n = 111; M = 4.20; SD = 1.00) Information about Austins live 1.0 4.8 12.9 38.1 43.3 music (n = 210; M = 4.18; SD = 0.90) Safety 0.7 3.7 14.3 46.0 35.3 (n = 272; M = 4.11; SD = 0.84) Affordability of Austin as a 0.7 2.1 22.0 45.1 30.1 destination (n = 286; M = 4.02; SD = 0.82) City tours 0.0 10.5 12.8 43.0 33.7 (n = 86; M = 4.00; SD = 0.95) Directional signage 3.1 3.1 25.4 38.7 29.7 (n = 256; M = 3.89; SD = 0.97) Public transportation 4.9 9.8 31.4 27.5 26.5 (n = 102; M = 3.61; SD = 1.13) n = valid cases; M = mean; SD = standard deviation

19

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College On a scale of 1 = Not at all Useful to 5 = Extremely Useful, visitors indicated that the Austin CVB website (M = 4.00) and Official Visitors Guide to Austin (M = 3.97) were the most useful resources while planning their most recent visit to Austin (Table 14). The least useful resource was Twitter (M = 2.29). The two most useful resources were the only two created and distributed by the Austin CVB. The rest of the items in the list are social media. Table 14: Frequency Distribution for Usefulness of Resources While Planning Visit to Austin Not at all Slightly Moderately Very Extremely Useful Useful Useful Useful Useful Values given are percentages Austin CVB Website 0.9 4.8 24.5 33.2 36.7 (www.austintexas.org) (n = 229; M = 4.00; SD = 0.94) Official Visitors Guide to Austin 1.9 4.2 25.1 33.0 35.8 (n = 215; M = 3.97; SD = 0.97) Yelp 21.6 9.5 20.3 32.4 16.2 (n = 74; M = 3.12; SD = 1.39) Facebook 25.9 11.1 17.3 22.2 23.5 (n = 81; M = 3.06; SD = 1.53) Urbanspoon 23.0 6.8 21.6 39.2 9.5 (n = 74; M = 3.05; SD = 1.33) Austin Way 35.8 7.5 13.2 22.6 20.8 (n = 53; M = 2.85; SD = 1.61) Twitter 45.1 19.6 7.8 15.7 11.8 (n = 51; M = 2.29; SD = 1.47) n = valid cases; M = mean; SD = standard deviation

Visitors were also asked how useful resources were during their most recent visit to Austin on a scale of 1 = Not at all Useful to 5 = Extremely Useful (Table 15). The Official Visitors Guide to Austin (M = 4.09) was the most useful, followed by the Austin CVB website (M = 4.00). The top two resources that were useful during visitors most recent visit to Austin were created by the Austin CVB, while the rest are social media. Table 15: Frequency Distribution for Usefulness of Resources During Visit to Austin Not at all Slightly Moderately Very Extremely Useful Useful Useful Useful Useful Values given are percentages Official Visitors Guide to Austin 2.4 4.1 19.4 30.6 43.5 (n = 170; M = 4.09; SD = 1.00) Austin CVB Website 4.7 5.3 18.0 29.3 42.7 (www.austintexas.org) (n = 150; M = 4.00; SD = 1.12)

20

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 15 (continued) Urbanspoon 27.3 (n = 66; M = 3.23; SD = 1.59) Yelp 25.8 (n = 62; M = 3.18; SD = 1.55) Facebook 29.2 (n = 65; M = 2.91; SD = 1.55) Austin Way 38.1 (n = 42; M = 2.86; SD = 1.66) Twitter 51.3 (n = 39; M = 2.21; SD = 1.45) n = valid cases; M = mean; SD = standard deviation 4.5 9.7 12.3 4.8 12.8 15.2 9.7 20.0 14.3 7.7 24.2 30.6 15.4 19.0 20.5 28.8 24.2 23.1 23.8 7.7

There was a noticeable change in the percent of respondents that indicated Extremely Useful for resources while planning visitors most recent visit and during their most recent visit. Table 16 provides a comparison of the percent of respondents that indicated Extremely Useful for resources while planning and during their most recent visit to Austin for the resources asked about in the study. The order of the resources is descending by the percent of visitors that indicated Extremely Useful for the resources during their most recent visit to Austin. The most notable increase is for Urbanspoon as a resource. Almost one out of ten (9.5%) visitors indicated Urbanspoon was Extremely Useful while planning their most recent visit, but over one-fourth (28.8%) indicated Urbanspoon was Extremely Useful during their most recent visit to Austin. The Official Visitors Guide to Austin and the Austin CVB website were the number one and two resources both while planning the trip and during the trip to Austin when ranked by percent of visitors rating them as Extremely Useful. Table 16: Comparison of Usefulness of Resources While Planning and During Visit to Austin Extremely Useful While Extremely Useful During Planning Trip Values given are percentages Official Visitors Guide to Austin 35.8 43.5 Austin CVB Website 36.7 42.7 (www.austintexas.org) Urbanspoon 9.5 28.8 Yelp 16.2 24.2 Austin Way 20.8 23.8 Facebook 23.5 23.1 Twitter 11.8 7.7

21

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College The majority (93.4%) of visitors were Very or Extremely Satisfied with their most recent visit to Austin (Table 17). On a scale of 1 = Not at all Satisfied to 5 = Extremely Satisfied, the mean of 4.38 indicates visitors had a high level of overall satisfaction with their most recent visit to Austin. Table 17: Frequency Distribution for Overall Satisfaction with Most Recent Visit to Austin Frequency Percent Not at all Satisfied 0 0.0 Slightly Satisfied 3 1.0 Moderately Satisfied 17 5.6 Very Satisfied 144 47.5 Extremely Satisfied 139 45.9 304 100.0 M = 4.38; SD = 0.64 M = mean; SD = standard deviation

On a scale of 1 = Not at all Likely to 5 = Extremely Likely, visitors were asked how likely they are to visit Austin again within the next 2 years, as well as to recommend their friends and/or relatives visit (Table 18). Visitors were Very to Extremely Likely (M = 4.56) to visit again and even more likely to recommend their friends and/or relatives visit Austin (M = 4.65). Table 18: Frequency Distribution for Likelihood of Visiting Again and Recommending to Friends/Relatives Not at all Slightly Moderately Very Extremely Likely Likely Likely Likely Likely How likely are you to... Values given are percentages visit Austin again within the next 0.7 3.0 6.7 19.4 70.2 2 years (n = 299; M = 4.56; SD = 0.80) recommend your friends and/or 0.3 1.0 4.3 22.4 71.9 relatives visit Austin (n = 299; M = 4.65; SD = 0.65) n = valid cases; M = mean; SD = standard deviation

On a scale of 1 = Strongly Disagree to 5 = Strongly Agree, visitors were asked their level of agreement with Austin being a destination to visit during different times of the year (i.e., winter, spring, summer, fall) (Table 19). Visitors indicated the spring (M = 4.61) and fall (M = 4.50) as the two seasons they agreed with the most for times of the year during which Austin is a destination to visit.

22

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 19: Frequency Distribution for Visitors Agreement with Visiting Austin during Four Seasons Strongly Strongly Austin is a destination to go in Disagree Disagree Neutral Agree Agree the... Values given are percentages winter (December, January, 1.7 4.8 28.0 34.3 31.1 February) (n = 289; M = 3.88; SD = 0.96 ) spring (March, April, May) 0.3 0.3 3.0 30.1 66.2 (n = 296; M =4.61; SD = 0.60 ) summer (June, July, August) 6.2 11.3 21.2 33.6 27.7 (n = 292 ; M = 3.65 ; SD = 1.18) fall (September, October, 0.3 0.3 7.5 32.7 59.2 November) (n = 294; M = 4.50; SD = 0.68 ) n = valid cases; M = mean; SD = standard deviation

On a scale of 1 = Strongly Disagree to 5 = Strongly Agree, visitors indicated their level of agreement with different types of trips for which Austin is a destination (Table 20). The top five items according to the means were Austin is a destination to go for entertainment (M = 4.63), weekend getaway (M = 4.57), leisure (M = 4.55), special events (M = 4.54), and a last minute getaway (M = 4.38). The only item that did not exceed the 4 = Agree level was a day trip with a mean of 3.94. Table 20: Frequency Distribution for Visitors Agreement with Visiting Austin for Various Types of Trips Strongly Strongly Austin is a destination to go Disagree Disagree Neutral Agree Agree for... Values given are percentages entertainment 0.0 0.0 4.4 27.9 67.7 (n = 297; M = 4.63; SD = 0.57) a weekend getaway 1.3 0.7 6.1 23.6 68.4 (n = 297; M = 4.57; SD = 0.76) leisure 0.0 1.0 5.4 31.0 62.6 (n = 294; M = 4.55; SD = 0.65) special events 0.0 0.3 7.1 30.5 62.0 (n = 295; M = 4.54; SD = 0.64) a last minute getaway 0.7 2.8 9.7 31.1 55.7 (n = 289; M = 4.38; SD = 0.83) a vacation (about a week or 1.0 4.4 14.5 28.6 51.5 longer) (n = 297; M = 4.25; SD = 0.93)

23

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 20 (continued) business trips 0.0 (n = 286; M = 4.18; SD = 0.80) conventions 0.4 (n = 282; M = 4.16; SD = 0.79) group meetings 0.0 (n = 286; M = 4.11; SD = 0.82) a day trip 5.6 (n = 286; M = 3.94; SD = 1.15) n = valid cases; M = mean; SD = standard deviation

0.7 0.0 0.7 6.6

22.0 23.0 26.2 15.4

35.7 36.5 34.3 33.2

41.6 40.1 38.8 39.2

When asked about agreement (1 = Strongly Disagree to 5 = Strongly Agree) with various types of activities and experiences Austin provides as a destination visitors most highly agreed Austin is a destination to enjoy live music (M = 4.70), enjoy a variety of food (M = 4.54), enjoy night life (M = 4.50), and see performing arts (M = 4.49) (Table 21). Agreement with Austin is a destination to experience the unique community and attend special events tied for the fifth highest mean at 4.44. The two items visitors least agreed with were Austin is a destination to play golf (M = 3.40) participate in sports (M = 3.51), and watch sporting events (M = 3.66). Table 21: Frequency Distribution for Visitors Agreement with Visiting Austin for Various Types of Activities Strongly Strongly Disagree Disagree Neutral Agree Agree Austin is a destination to... Values given are percentages enjoy live music 0.3 0.7 4.7 16.9 77.3 (n = 295; M = 4.70; SD = 0.62) enjoy a variety of food 0.0 0.7 5.7 33.1 60.5 (n = 299; M = 4.54; SD = 0.64) enjoy nightlife 0.3 0.3 9.5 28.5 61.4 (n = 295; M = 4.50; SD = 0.71) see performing arts (e.g., music, 0.3 1.0 8.7 29.1 60.9 drama, dance) (n = 299; M = 4.49; SD = 0.73) experience the unique community 0.3 0.7 9.2 34.2 55.6 (n = 295; M = 4.44; SD = 0.72) attend special events 0.0 0.3 9.9 35.7 54.1 (n = 294; M = 4.44; SD = 0.68) go to cultural/historical sites 0.3 1.7 9.1 50.2 38.7 (n = 297; M = 4.25; SD = 0.72) participate in outdoor recreation 0.7 0.7 17.5 37.1 44.0 activities (n = 291; M = 4.23; SD = 0.81)

24

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 21 (continued) experience the multicultural arts 0.7 scene (n = 294; M = 4.21; SD = 0.80) experience many unique cultures 0.7 (n = 293; M = 4.09; SD = 0.89) go shopping 1.4 (n = 296; M = 4.07; SD = 0.86) experience ethnic diversity 0.7 (n = 292; M = 3.83; SD = 0.91) enjoy kid friendly activities 1.1 (n = 281; M = 3.74; SD = 0.92) watch sporting events 2.1 (n = 286; M = 3.66; SD = 0.90) participate in sports 2.1 (n = 284; M = 3.51; SD = 0.89) play golf 2.8 (n = 286; M = 3.40; SD = 0.86) n = valid cases; M = mean; SD = standard deviation

1.4

15.6

40.8

41.5

3.1 2.0 5.1 2.5 2.8 2.5 4.5

21.8 19.3 31.2 44.8 42.0 55.6 62.9

35.8 42.9 36.3 24.2 32.9 21.5 17.5

38.6 34.5 26.7 27.4 20.3 18.3 15.0

The top five attributes visitors agreed (1 = Strongly Disagree to 5 = Strongly Agree) with for Austin as a destination were Austin is a destination where people like them would enjoy visiting (M = 4.44), with a lot to do downtown (M = 4.43), offers visitors a wide variety of things to do (M = 4.41), is a destination with great natural scenery/landscape (M = 4.37), and unique restaurants (M = 4.34) (Table 22). Two of the items visitors agreed with the least were related to transportation. Visitors rated Austin is a destination with convenient transportation to get around the city (M = 3.67) and with convenient transportation to get to the city (M = 3.74) between neutral and agree. The other items based on the average that visitors rated between neutral (3) and agree (4) were Austin is a destination that is LGBT friendly (M = 3.74) and Austin is a destination with pleasant year round weather (M = 3.89). Table 22: Frequency Distribution for Visitors Agreement with Various Attributes of Austin Strongly Strongly Disagree Disagree Neutral Agree Agree Austin is a destination... Values given are percentages where people like me would 0.0 2.0 5.1 39.3 53.6 enjoy visiting (n = 295; M = 4.44; SD = 0.69) with a lot to do downtown 0.3 2.3 5.7 37.5 54.1 (n = 296; M = 4.43; SD = 0.74) that offers visitors a wide variety 0.3 1.4 4.4 44.4 49.5 of things to do (n = 295; M = 4.41; SD = 0.67)

25

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 22 (continued) with great natural 0.0 scenery/landscape (n = 291; M = 4.37; SD = 0.70) with unique restaurants 0.0 (n = 293; M = 4.34; SD = 0.67) with friendly local residents 0.3 (n = 294; M = 4.33; SD = 0.73) that does not require a lot of pre0.3 planning (n = 292; M = 4.20; SD = 0.81) with a variety of types of lodging 0.3 facilities (e.g., hotels, campgrounds, bed & breakfasts, resorts) (n = 295; M = 4.12; SD = 0.81) with top notch lodging facilities 0.7 (n = 292; M = 4.11; SD = 0.82) with unique retail stores 1.4 (n = 294; M = 4.10; SD = 0.85) that is walkable for visitors 0.7 (n = 296; M = 4.05; SD = 0.89) that is reasonably priced for 0.0 visitors (n = 296; M = 4.01; SD = 0.74) that is safe 1.0 (n = 296; M = 4.00; SD = 0.78) with pleasant year round weather 1.4 (n = 294; M = 3.89; SD = 0.98) that is a LGBT friendly 0.0 destination (n = 285; M = 3.74; SD = 0.84) with convenient transportation to 1.4 get to the city (n = 287; M = 3.74; SD = 0.94) with convenient transportation to 1.7 get around the city (n = 287; M = 3.67; SD = 0.99) n = valid cases; M = mean; SD = standard deviation 1.0 10.0 39.9 49.1

0.7 1.0 4.8

9.2 10.2 8.6

45.1 42.2 46.9

45.1 46.3 39.4

2.0

19.0

42.4

36.3

1.7 2.4 6.1 2.7

19.5 16.3 14.9 18.6

42.1 44.9 43.9 54.1

36.0 35.0 34.5 24.7

2.4 9.5 1.1

17.2 16.7 48.4

54.1 43.2 25.6

25.3 29.3 24.9

4.5

39.0

28.9

26.1

6.3

42.2

23.3

26.5

26

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College When asked about level of agreement (1 = Strongly Disagree to 5 = Strongly Agree) with adjectives and phrases to describe Austin, the top five items according to visitors were creative (M = 4.42), eclectic (M = 4.41), friendly (M = 4.40), scenic (M = 4.37), and outdoorsy (M = 4.34) (Table 23). Visitors were somewhat neutral that Austin is stereotypically country (M = 2.75), but agreed it is unlike the rest of Texas (M = 4.12). Table 23: Frequency Distribution for Visitors Agreement with Adjectives to Describe Austin Strongly Strongly Disagree Disagree Neutral Agree Agree Austin is... Values given are percentages Creative 0.3 0.0 6.2 43.8 49.7 (n = 292; M = 4.42; SD = 0.64) Eclectic 0.3 0.3 9.9 36.9 52.6 (n = 293; M = 4.41; SD = 0.71) Friendly 0.3 1.0 7.2 41.3 50.2 (n = 293; M = 4.40; SD = 0.70) Scenic 0.0 1.0 7.9 44.2 46.9 (n = 292; M = 4.37; SD = 0.67) Outdoorsy 0.3 1.0 8.6 44.5 45.5 (n = 290; M = 4.34; SD = 0.71) Exciting 0.3 1.0 9.6 43.3 45.7 (n = 291; M = 4.33; SD = 0.72) Relaxing 0.3 0.7 8.6 48.6 41.7 (n = 290; M = 4.31; SD = 0.69) Historical 0.3 1.4 9.9 49.8 38.6 (n = 293; M = 4.25; SD = 0.71) Charming 0.3 1.4 14.0 45.2 39.0 (n = 292; M = 4.21; SD = 0.76) Environmentally friendly 0.0 1.0 17.5 41.6 39.9 (n = 286; M = 4.20; SD = 0.76) Intelligent 0.7 0.3 16.6 45.2 37.2 (n = 290; M = 4.18; SD = 0.76) Clean 0.7 1.0 14.3 49.0 35.0 (n = 294; M = 4.17; SD = 0.75) Diverse 0.7 2.8 16.3 41.2 39.1 (n = 289; M = 4.15; SD = 0.84) Unlike the rest of Texas 0.7 3.1 23.2 29.8 43.3 (n = 289; M = 4.12; SD = 0.92) Sincere 0.0 1.4 24.3 42.4 31.9 (n = 288; M = 4.05; SD = 0.79) Family oriented 0.3 2.8 29.8 39.8 27.3 (n = 289; M = 3.91; SD = 0.84) Weird 3.1 8.6 20.6 31.6 36.1 (n = 291; M = 3.89; SD = 1.09)

27

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 23 (continued) Fashionable 0.7 (n = 292; M = 3.88; SD = 0.85) Stereotypically country 12.1 (n = 289; M = 2.75; SD = 1.14) n = valid cases; M = mean; SD = standard deviation 3.8 32.9 27.1 32.9 43.8 11.8 24.7 10.4

On a scale of 1 = Strongly Disagree to 5 = Strongly Agree, visitors agreed they had positive interactions with Austin residents (M = 4.26) and felt welcomed as a visitor to Austin (M = 4.22) (Table 24). Visitors rated the remaining items about emotional solidarity with Austin residents between neutral and agree. Table 24: Frequency Distribution for Visitors Agreement with Emotional Solidarity with Austin Residents Strongly Strongly Disagree Disagree Neutral Agree Agree Values given are percentages I had positive interactions with 0.0 0.3 9.4 53.7 36.2 Austin residents (n = 298; M = 4.26; SD = 0.65) I felt welcomed as a visitor to 0.3 1.3 9.8 52.9 35.7 Austin (n = 297; M = 4.22; SD = 0.70) I feel Austin residents appreciate 0.3 3.0 24.6 51.2 20.9 visitors for the contribution we (as visitors) make to the local economy (n = 297; M = 3.89; SD = 0.77) I identify with Austin residents 1.4 3.7 25.4 43.1 26.4 (n = 295; M = 3.89; SD = 0.88) I have a lot in common with 0.7 5.1 25.9 43.8 24.6 Austin residents (n = 297; M = 3.87; SD = 0.87) I feel Austin residents appreciate 0.3 3.0 28.2 47.3 21.1 the benefits associated with me (a visitor) coming to the community (n = 298; M = 3.86; SD = 0.72) I feel close to some residents I 1.4 6.8 37.8 29.7 24.3 have met in Austin (n = 296; M = 3.69; SD = 0.96) I have made friends with some 1.3 9.4 34.0 29.3 25.9 Austin residents (n = 297; M = 3.69; SD = 1.00) n = valid cases; M = mean; SD = standard deviation

28

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Average trip expenditures were calculated on a per party per day basis for overnight visitors (Table 25). There were insufficient responses from day trip visitors to include their spending. Overnight travel parties spent an average of $126.04 per day on their hotel, $59.06 in restaurants, and $39.51 in retail stores. The total average daily spending for overnight travel parties was almost $400 ($395.14). Table 25: Per Party Per Day Spending by Overnight Visitors Average Daily Spending Per Overnight Travel Party 126.04 59.06 44.84 39.51 33.27 27.93 26.34 24.67 13.48 $395.14

Sector Hotel/Motel/Other Lodging Restaurants Other transportation (e.g., airplane, shuttles, limo) Retail shopping Entertainment (e.g., movies, performing arts, music, etc) Automobile transportation (e.g., parking, gas, service, rental car Grocery Nightclubs and bars Recreational activities (e.g., golf, fishing) Total

Visitors to Austin averaged 7.51 total leisure and 3.43 business trips in the past 2 years (Table 26). Of the total trips just over one (1.02) were outside the United States. Table 26: Visitors Travel Experience in the Past 2 Years Leisure (n = 286) Business (n = 221) Outside the United States (n = 261) n = valid cases; M = mean; SD = standard deviation M 7.51 3.43 1.02 SD 9.55 7.48 2.22

29

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Visitors were asked their level of agreement (1 = Strongly Disagree to 5 = Strongly Agree) with various tourism destinations they would like to visit (Table 27). The five destinations visitors had the highest levels of agreement with were Austin, Texas (M = 4.62), San Francisco, California (M = 4.10), New York, New York (M = 4.04), San Diego, California (M =- 4.01), and San Antonio, Texas (M = 3.98). Table 27: Frequency Distribution for Visitors Agreement with Tourism Destinations Strongly Disagree Disagree Neutral Agree Values given are percentages Austin, Texas 1.0 0.7 2.7 26.9 (n = 294; M = 4.62; SD = 0.68) San Francisco, California 5.9 5.2 10.4 29.9 (n = 288; M = 4.10; SD = 1.15) New York, New York 5.5 5.9 14.5 27.6 (n = 290; M = 4.04; SD = 1.16) San Diego, California 3.8 4.9 17.0 35.4 (n = 288; M = 4.01; SD = 1.05) San Antonio, Texas 2.4 5.2 15.8 45.0 (n = 291; M = 3.98; SD = 0.95) New Orleans, Louisiana 4.2 9.8 13.7 35.4 (n = 285; M = 3.91; SD = 1.13) Seattle, Washington 3.5 5.3 21.8 37.7 (n = 284; M = 3.89; SD = 1.03) Santa Fe, New Mexico 3.1 4.1 24.8 40.7 (n = 290; M = 3.84; SD = 0.97) Chicago, Illinois 7.4 10.2 20.1 34.6 (n = 283; M = 3.65; SD = 1.20) Nashville, Tennessee 3.9 9.5 26.5 41.7 (n = 283; M = 3.61; SD = 1.02) Portland, Oregon 7.7 8.8 27.5 28.9 (n = 284; M = 3.59; SD = 1.20) Los Angeles, California 11.5 16.4 23.3 25.1 (n = 287; M = 3.33; SD = 1.31) Dallas/Fort Worth, Texas 10.0 12.2 36.3 28.5 (n = 281; M = 3.23; SD = 1.13) Houston, Texas 12.3 31.2 36.1 24.2 (n = 285; M = 2.98; SD = 1.12) n = valid cases; M = mean; SD = standard deviation

Strongly Agree 68.7 48.6 46.6 38.9 31.6 36.8 31.7 27.2 27.6 18.4 27.1 23.7 13.2 8.4

30

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Non-Visitor Inquirers The second group of respondents in this study included those who inquired about Austin as a destination, but did not visit in the past 2 years. On a scale of 1 = Not at all Likely to 5 = Extremely Likely, non-visitor inquirers were asked how likely they are to visit Austin in the next 2 years (Table 28). On average, non-visitor inquirers are moderately to very likely to visit Austin in the next 2 years (M = 3.50). Almost half (49.1%) of the non-visitor inquirers indicated they are very (27.4%) or extremely likely (21.7%) to visit Austin in the next 2 years. Table 28: Non-Visitors Likelihood of Visiting Austin in the Next 2 Years Frequency Not at all Likely 3 Slightly Likely 16 Moderately Likely 35 Very Likely 29 Extremely Likely 23 106 M = 3.50; SD = 1.08 M = mean; SD = standard deviation

Percent 2.8 15.1 33.0 27.4 21.7 100.0

When asked about the importance (1 = Not at all Important to 5 = Extremely Important) of sources of information in deciding to visit Austin or not, non-visitors generally rated most sources of information below the moderately important level according to the mean (Table 29). The Official Visitors Guide to Austin (M = 3.25) and Austin Convention & Visitors Bureau website (www.austintexas.org) (M = 3.37) were two of four sources of information with a mean above moderately important. Friends (M = 3.26) and magazines/editorial (M = 3.08) were also rated above moderately important. Table 29: Frequency Distribution for Importance of Sources of Information for Non-Visitors Deciding to Visit Not at all Slightly Moderately Very Extremely Important Important Important Important Important Values given are percentages Austin Convention & Visitors 9.5 8.6 31.4 36.2 14.3 Bureau Website (www.austintexas.org) (n = 105; M = 3.37; SD = 1.13) Friends 23.8 4.8 17.1 30.5 23.8 (n = 105; M = 3.26; SD = 1.49) Official Visitors Guide to Austin 14.2 11.3 27.4 30.2 17.0 (n = 106; M = 3.25; SD = 1.27) Magazines/editorial (e.g., articles 11.5 13.5 38.5 28.8 7.7 or stories (n = 104; M = 3.08; SD = 1.09)

31

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Table 29 (continue) Previous trips to Austin 48.5 (n = 99; M = 2.63; SD = 1.71) Online booking engine (e.g., 31.1 Expedia, Travelocity, Orbitz, etc.) (n = 103; M = 2.61; SD = 1.33) Relatives 41.7 (n = 103; M = 2.60; SD = 1.50) Online ad 29.0 (n = 100; M = 2.58; SD = 1.26) Austin eNEWS 33.3 (n = 102; M = 2.49; SD = 1.27) Other websites 36.0 (n = 100; M = 2.43; SD = 1.30) Print ad 39.4 (n = 99; M = 2.17; SD = 1.12) Social media (e.g., Facebook, 53.0 Twitter) (n = 100; M = 1.88; SD = 1.15) Travel agent/tour operator 70.0 (n = 100; M = 1.63; SD = 1.08) Mobile apps 66.7 (n = 99; M = 1.60; SD = 0.95) n = valid cases; M = mean; SD = standard deviation 3.0 13.6 7.1 26.2 20.2 21.4 21.2 7.8

3.9 14.0 13.7 15.0 19.2 21.0

17.5 34.0 28.4 25.0 27.3 15.0

26.2 16.0 19.6 18.0 13.1 7.0

10.7 7.0 4.9 6.0 1.0 4.0

8.0 12.1

13.0 17.2

7.0 3.0

2.0 1.0

32

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College Next, the non-visitor inquirers were shown the map in Figure 7. The instructions asked respondents to rank up to the top five areas of Austin they would like to visit in the future. Respondents were shown the names of the five areas on the map and dragged their responses to a Top Areas box on the screen. Respondents could also click and drag the options in the Top Areas box to reorder their rankings.

Figure 7: Map of Austin for Ranking Top Areas Non-Visitors Would Like to Visit

33

2010-2011 Austin Visitor Inquiry Study University of Houston Conrad N. Hilton College The area of Austin non-visitors would most like to visit in the future is Downtown/Capitol (M = 1.31) (Table 30). The second area non-visitors would most like to visit in Austin is the University area (M = 2.95), followed by East (M = 3.29). Following this ranking question respondents were asked to explain why they selected the area they did as the number one area they would like to visit. The explanations can be found in Appendix D. Table 30: Frequency Distribution for Non-Visitors Rankings of Top Areas They would Like to Visit in Austin in the Future Ranking (Area on Downtown/ map) Capitol (1) University (2) South (3) East (4) West (5) Frequency (Percentage) 1 71 (80.7) 4 (5.3) 7 (10.1) 4 (5.5) 2 (2.9) 2 12 (13.6) 36 (48.0) 11 (15.9) 17 (23.3) 7 (10.0) 3 2 (2.3) 12 (16.0) 15 (21.7) 16 (21.9) 26 (37.1) 4 1 (1.1) 6 (8.0) 19 (27.5) 26 (35.6) 17 (24.3) 5 2 (2.3) 17 (22.7) 17 (24.6) 10 (13.7) 18 (25.7) 88 (100.0) 75 (100.0) 69 (100.0) 73 (100.0) 70 (100.0) M = 1.31; M = 2.95; M = 3.41; M = 3.29; M = 3.60; SD = 0.78 SD = 1.30 SD = 1.30 SD = 1.14 SD = 1.07 M = mean; SD = standard deviation

Non-visitors had the highest levels of agreement (1 = Strongly Disagree to 5 = Strongly Agree) with Austin being a destination to go to in the spring (M = 4.39) and fall (M = 4.21) (Table 31). On average, non-visitors ratings of Austin as a destination to visit in the winter (M = 3.36) and summer (M = 3.29) were between neutral and agree. Table 31: Frequency Distribution for Non-Visitors Agreement with Visiting Austin during Four Seasons Strongly Strongly Austin is a destination to go in Disagree Disagree Neutral Agree Agree the... Values given are percentages winter (December, January, 2.9 13.7 35.3 40.2 7.8 February) (n = 102 ; M = 3.36; SD = 0.92) spring (March, April, May) 0.9 5.7 46.2 47.2 47.2 (n = 106; M = 4.39; SD =0.68) summer (June, July, August) 3.8 24.0 23.1 37.5 11.5 (n = 104; M = 3.29; SD = 1.08) fall (September, October, 1.0 1.0 11.4 49.5 37.1 November) (n = 105; M = 4.21; SD = 0.76) n = valid cases; M = mean; SD = standard deviation

34