Professional Documents

Culture Documents

Commodity Outlook 30.09.11

Uploaded by

Mitesh ThackerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Commodity Outlook 30.09.11

Uploaded by

Mitesh ThackerCopyright:

Available Formats

DAILY COMMODITY OUTLOOK

30 Sep, 11

th

MCX ALUMINIUM OCT. CONTRACT OPEN `107.70

HIGH

`109.25

LOW

`107.20

CLOSE

`109.15

MCX ALUMINIUM OCT Contract Technical Outlook & Trading Strategy The price of Aluminium witnessed a mild correction from its downtrend line resistance levels which brought it into its strong support zones of `106.25--`107.80 levels. We would like to point out that this strong support held on even when the other base metals witnessed severe correction on the back of huge supply during the previous few sessions of trade. The steady rise in volumes over the past few sessions of trade is probably a sign of accumulation in the counter at these support levels. The RSI indicator has also given a buy signal backed by a positive divergence. All the above mentioned technical factors point that the price of aluminium are likely to witness a pullback towards the `112.25 / `113 levels and test its downtrend line resistance.

We recommend traders to buy between `109.25--`108.75 levels with a stop loss placed below `107.45 levels for upside targets mentioned above.

DAILY COMMODITY OUTLOOK

COMMODITIES TO WATCH

30 Sep, 11

th

NCDEX Turmeric Oct CMP`4566.00

Technical Outlook & Trading Strategy:-

The price of turmeric has been in a strong downtrend since the past 1year and the prices have gone through severe correction. But, the first technical factor that signals a near term to short term reversal in the trend is that the momentum indicators are giving a buy signal. Secondly, the price has registered a close above its 8day moving average which had been acting as stiff resistance on every pullback and finally the steady rise in volumes signal a reversal. We recommend day / positional traders to take long positions between `4600--`4520 levels with a stop loss placed below `4449 levels for upside targets of `4725 / `4850 levels expected to be achieved over the upcoming 2-3 sessions of trade.

INVENTORY DATA

LME Warehouse Stocks (Inventory) and Volume

29 Sep 2011 METALS

Inventory MT 4,569,075 134,900 151,400 470,700 373,425 97,164 21,165 824,125 +/-3,950 0 0 4,025 -275 -126 -285 -3,200

Volume MT 7,311,675 40,080 51,100 5,084,875 1,182,150 214,452 46,630 2,976,050 +/223,600 -8,420 -30,840 471,075 88,875 -1,506 10,615 654,800

Aluminum Al Alloy NASAAC Copper Lead Nickel Tin Zinc

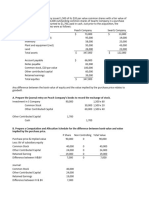

KEY SUPPORT RESISTANCE LEVELS

Commodity NCDEX Chana NCDEX Pepper NCDEX Soya Oil NCDEX Jeera NCDEX Guarseed Support 1 3347 35253 620 14862 4631 Support 2 3305 34587 617 14642 4647 CLOSE-PRICE 3389 35290 623.95 15083 4614 Resistance 1 3473 36293 627 15421 4624 Resistance - 2 3557 36667 630 15760 4633

DAILY COMMODITY OUTLOOK

MCX Copper MCX Nickel MCX Lead MCX Silver MCX Gold MCX Crude 347 897 97 49852 25466 3997 339 879 95 48459 25192 3918 355.65 916.90 99.75 51245 25740 4076 362 932 101 52614 25977 4136 368 947 103 53983 26214 4196

30 Sep, 11

th

Disclaimer

The views expressed are based purely on Technical studies. The calls made herein are for information purpose only. The information and views presented here are prepared by Matrix Solutions and his associates. The information contained herein is based on their analysis of the Charts and up on sources that are considered reliable. We, however, do not vouch for the accuracy or the completeness thereof. This material is for personal information and we are not responsible for any loss incurred based upon it. The investments discussed or recommended on this Website may not be suitable for all investors. Past performance may not be indicative of future performance. Some of the securities/commodities presented herein should be considered speculative with a high degree of volatility and risk. Investors must make their own investment decisions based on their specific investment objectives and financial position and using such independent advice, as they believe necessary. You specifically agree to consult with a registered investment advisor, which we are not, prior to making any trading decision of any kind. While acting upon any information or analysis mentioned on this website, investors may please note that neither Matrix Solutions nor any person connected with him accepts any liability arising from the use of this information and views mentioned herein. Matrix Solutions and his affiliates may hold long or short positions in the securities/commodities discussed herein from time to time the services are intended for a restricted audience and we are not soliciting any action based on it. Neither the information nor any opinion expressed herein constitutes an offer or an invitation to make an offer, to buy or sell any securities/commodities, or any options, futures or other derivatives related to such securities/commodities. Part of this website may contain advertising and other material submitted to us by third parties. We do not accept liability in respect of any advertisements. You acknowledge that any warranty that is provided in connection with any of the products or services advertised on this website described herein is provided solely by the owner, advertiser, manufacturer or supplier of that product and/or service, and not by us. We do not warrant that your access to the Website and/or related services will be uninterrupted or error-free, that defects will be corrected, or that this site or the server that makes it available is free of viruses or other harmful components. Subscribers are advised to understand that the services can fail due to failure of hardware, software, and Internet connection. Access to and use of this site and the information is at your risk and we do not undertake any accountability for any irregularities, viruses or damage to any computer or Mobiles that results from accessing, availing or downloading of any information from this site. We do not warrant or make any representations regarding the use or the results of the use of any product and/or service purchased in terms of its compatibility, correctness, accuracy, reliability or otherwise. You assume total responsibility and risk for your use of this site and site-related services. A possibility exists that the site could include inaccuracies or errors. Additionally, a possibility exists that unauthorized additions, deletions or alterations could be made by third parties to the site. Although we attempt to ensure the integrity, correctness and authenticity of the site, it makes no guarantees whatsoever as to its completeness, correctness or accuracy. In the event that such an inaccuracy arises, please inform our staff so that it can be corrected. Price and availability of products and services offered on the site are subject to change without prior notice. To the extent we provide information on the availability of products or services you should not rely on such information. We will not be liable for any lack of availability of products and services you may order through the site. Transactions shall be governed by and construed in accordance with the laws of India, without regard to the laws regarding conflicts of law. Any litigation or any action at law or in equity arising out of or relating to these agreement or transaction shall be subject to Mumbai jurisdiction only and the customer hereby agrees consents and submits to the jurisdiction of such courts for the purpose of litigating any such action. A CALL ON SMS is a service given only to members with the sole intention to aid their information means. We do not guarantee any accuracy of generation, databases, delivery timings etc. while giving this facility. Depending on your location, service provider, medium of communication and delivery, the service may be at times slow or not there at all. We do not guarantee completion of delivery. We shall in no way be responsible for delays in receiving SMS on the mobile caused due to delivery methods chosen by the Service Provider, rush on the Service Providers Servers or any other reason whatsoever that may cause such a delay. Use of this website and its services constitutes acceptance of Disclaimer, Privacy Policy and Terms of Use.

You might also like

- How to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!From EverandHow to Build an "Instant" Million-Dollar Direct Marketing Advertising Swipe File!Rating: 3.5 out of 5 stars3.5/5 (7)

- Commodity Outlook 14.10.11Document3 pagesCommodity Outlook 14.10.11Devang VisariaNo ratings yet

- Commodity Outlook 03.10.11Document3 pagesCommodity Outlook 03.10.11Devang VisariaNo ratings yet

- Commodity Outlook 25.10.11Document3 pagesCommodity Outlook 25.10.11Devang VisariaNo ratings yet

- Commodity Outlook 16.09.11Document2 pagesCommodity Outlook 16.09.11Devang VisariaNo ratings yet

- Commodity Outlook 29.09.11Document3 pagesCommodity Outlook 29.09.11Devang VisariaNo ratings yet

- Commodity Outlook 27.09.11Document3 pagesCommodity Outlook 27.09.11Devang VisariaNo ratings yet

- Commodity Outlook 23.09.11Document3 pagesCommodity Outlook 23.09.11Devang VisariaNo ratings yet

- Commodity Outlook 11.10Document3 pagesCommodity Outlook 11.10Devang VisariaNo ratings yet

- Commodity Outlook 22.09.11Document3 pagesCommodity Outlook 22.09.11Devang VisariaNo ratings yet

- Commodity Outlook 07.10.11Document3 pagesCommodity Outlook 07.10.11Devang VisariaNo ratings yet

- Commodity Outlook 10.10Document3 pagesCommodity Outlook 10.10Mitesh ThackerNo ratings yet

- Commodity Outlook 05.10.11Document3 pagesCommodity Outlook 05.10.11Devang VisariaNo ratings yet

- Commodity Outlook 21.09.11Document3 pagesCommodity Outlook 21.09.11Devang VisariaNo ratings yet

- Commodity Outlook 13.10.11Document3 pagesCommodity Outlook 13.10.11Devang VisariaNo ratings yet

- Daily Morning Update 21 Oct 2011Document2 pagesDaily Morning Update 21 Oct 2011Devang VisariaNo ratings yet

- Commodity Outlook 04.10.11Document3 pagesCommodity Outlook 04.10.11Devang VisariaNo ratings yet

- Daily Trading Note Commodity Outlook 28.07.11 From MatrixDocument2 pagesDaily Trading Note Commodity Outlook 28.07.11 From MatrixMitesh Thacker100% (1)

- Commodity Outlook 02 Nov 2011Document3 pagesCommodity Outlook 02 Nov 2011Mitesh ThackerNo ratings yet

- Commodity Outlook 28.10.11Document3 pagesCommodity Outlook 28.10.11Devang VisariaNo ratings yet

- Commodity Outlook 28.09.11Document3 pagesCommodity Outlook 28.09.11Devang VisariaNo ratings yet

- Daily Morning Update 26 Oct 2011Document2 pagesDaily Morning Update 26 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 Sept 2011Document3 pagesDaily Morning Update 28 Sept 2011Devang Visaria100% (1)

- Daily Morning Update 26 Sept 2011Document2 pagesDaily Morning Update 26 Sept 2011Mitesh ThackerNo ratings yet

- Daily Morning Update 28 Sept 2011Document2 pagesDaily Morning Update 28 Sept 2011Mitesh ThackerNo ratings yet

- Daily Morning Update 11 Oct 2011Document2 pagesDaily Morning Update 11 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 27sept 2011Document2 pagesDaily Morning Update 27sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 15 Dec 2011Document3 pagesDaily Morning Update 15 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument5 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 19 Dec 2011Document3 pagesDaily Morning Update 19 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 Dec 2011Document2 pagesDaily Morning Update 28 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 12dec 2011Document3 pagesDaily Morning Update 12dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 24 Oct 2011Document2 pagesDaily Morning Update 24 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 8dec 2011Document3 pagesDaily Morning Update 8dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 7dec 2011Document3 pagesDaily Morning Update 7dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 9dec 2011Document3 pagesDaily Morning Update 9dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 10 Oct 2011Document2 pagesDaily Morning Update 10 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 5dec 2011Document3 pagesDaily Morning Update 5dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 13 Dec 2011Document3 pagesDaily Morning Update 13 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 22 Sept 2011Document2 pagesDaily Morning Update 22 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 09 Sept 2011Document2 pagesDaily Morning Update 09 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 04 Oct 2011Document2 pagesDaily Morning Update 04 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 2dec 2011Document2 pagesDaily Morning Update 2dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 14 Oct 2011Document2 pagesDaily Morning Update 14 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 29 Sept 2011Document2 pagesDaily Morning Update 29 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 12 Oct 2011Document2 pagesDaily Morning Update 12 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 2 Jan 2012Document2 pagesDaily Morning Update 2 Jan 2012Devang VisariaNo ratings yet

- Daily Morning Update 30 Dec 2011Document2 pagesDaily Morning Update 30 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 23 Dec 2011Document2 pagesDaily Morning Update 23 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 21 Sept 2011Document2 pagesDaily Morning Update 21 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 07 Oct 2011Document2 pagesDaily Morning Update 07 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 03 Oct 2011Document2 pagesDaily Morning Update 03 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 1dec 2011Document3 pagesDaily Morning Update 1dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 18 Oct 2011Document2 pagesDaily Morning Update 18 Oct 2011Devang VisariaNo ratings yet

- Daily Morning Update 21 Dec 2011Document2 pagesDaily Morning Update 21 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 14 Dec 2011Document2 pagesDaily Morning Update 14 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 30 Sept 2011Document2 pagesDaily Morning Update 30 Sept 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 July 2011 From MatrixDocument2 pagesDaily Morning Update 28 July 2011 From MatrixDevang VisariaNo ratings yet

- Daily Morning Update 28 Nov 2011Document2 pagesDaily Morning Update 28 Nov 2011Devang VisariaNo ratings yet

- MCX Gold Aug Special Report 22.07.11Document2 pagesMCX Gold Aug Special Report 22.07.11Mitesh ThackerNo ratings yet

- Daily Morning Update 30 Dec 2011Document2 pagesDaily Morning Update 30 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument5 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Weekly Update 31 Dec 2011Document5 pagesWeekly Update 31 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 2 Jan 2012Document2 pagesDaily Morning Update 2 Jan 2012Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 05 Jan 2012Document2 pagesDaily Morning Update 05 Jan 2012Devang VisariaNo ratings yet

- Daily Morning Update 22 Dec 2011Document3 pagesDaily Morning Update 22 Dec 2011Devang VisariaNo ratings yet

- DTN 28.12Document6 pagesDTN 28.12Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 23 Dec 2011Document2 pagesDaily Morning Update 23 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 28 Dec 2011Document2 pagesDaily Morning Update 28 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 15 Dec 2011Document3 pagesDaily Morning Update 15 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 29 Dec 2011Document2 pagesDaily Morning Update 29 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Weekly Update 17th Dec 2011Document6 pagesWeekly Update 17th Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 21 Dec 2011Document2 pagesDaily Morning Update 21 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 20 Dec 2011Document3 pagesDaily Morning Update 20 Dec 2011Devang VisariaNo ratings yet

- DTN 16.12Document6 pagesDTN 16.12Devang VisariaNo ratings yet

- Daily Morning Update 16 Dec 2011Document3 pagesDaily Morning Update 16 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Commodity Update 20-12-2011Document6 pagesDaily Commodity Update 20-12-2011Devang VisariaNo ratings yet

- Daily Morning Update 19 Dec 2011Document3 pagesDaily Morning Update 19 Dec 2011Devang VisariaNo ratings yet

- Market Review & Outlook: Precious MetalsDocument6 pagesMarket Review & Outlook: Precious MetalsDevang VisariaNo ratings yet

- Daily Morning Update 14 Dec 2011Document2 pagesDaily Morning Update 14 Dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 12dec 2011Document3 pagesDaily Morning Update 12dec 2011Devang VisariaNo ratings yet

- Daily Morning Update 13 Dec 2011Document3 pagesDaily Morning Update 13 Dec 2011Devang VisariaNo ratings yet

- Weekly Update 10nd Dec 2011Document5 pagesWeekly Update 10nd Dec 2011Devang VisariaNo ratings yet

- Set8 Maths Classviii PDFDocument6 pagesSet8 Maths Classviii PDFLubna KaziNo ratings yet

- Affiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Document20 pagesAffiliated To University of Mumbai Program: COMMERCE Program Code: RJCUCOM (CBCS 2018-19)Endubai SuryawanshiNo ratings yet

- Pengaruh Kompensasi Dan MotivasiDocument9 pagesPengaruh Kompensasi Dan Motivasibpbj kabproboNo ratings yet

- Pip Calculator - Forex Pip Calculator - Pip Value CalculatorDocument1 pagePip Calculator - Forex Pip Calculator - Pip Value Calculatorl100% (1)

- Top 10 Warehouse ManagementDocument48 pagesTop 10 Warehouse ManagementmmarizNo ratings yet

- Artikel MMT Lisa Nilhuda 17002060Document7 pagesArtikel MMT Lisa Nilhuda 17002060Erlianaeka SaputriNo ratings yet

- Bs in Business Administration Marketing Management: St. Nicolas College of Business and TechnologyDocument6 pagesBs in Business Administration Marketing Management: St. Nicolas College of Business and TechnologyMaria Charise TongolNo ratings yet

- OneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporeDocument11 pagesOneMotoring - Driving The Digital Transformation of Vehicle Services in SingaporejaitleyarushiNo ratings yet

- Guide To SQL 9th Edition by Pratt Last Solution ManualDocument13 pagesGuide To SQL 9th Edition by Pratt Last Solution Manualcatherinebergtjkxfanwod100% (25)

- Tribune 17th June 2023Document30 pagesTribune 17th June 2023adam shingeNo ratings yet

- PJSC National Bank Trust and Anor V Boris Mints and OrsDocument33 pagesPJSC National Bank Trust and Anor V Boris Mints and OrshyenadogNo ratings yet

- CA2 Cost Concepts and ClassificationDocument19 pagesCA2 Cost Concepts and ClassificationhellokittysaranghaeNo ratings yet

- Effect of Vishal Mega Mart On Traditional RetailingDocument38 pagesEffect of Vishal Mega Mart On Traditional Retailingdebiprasadpaik6393100% (1)

- AshZjxFuEemP8Qpm209XvA Rewiring-Trade-FinanceDocument5 pagesAshZjxFuEemP8Qpm209XvA Rewiring-Trade-Financezvishavane zvishNo ratings yet

- State of Afghan Cities 2015 Volume - 1Document156 pagesState of Afghan Cities 2015 Volume - 1United Nations Human Settlements Programme (UN-HABITAT)No ratings yet

- Midterm International Economics 2023Document4 pagesMidterm International Economics 2023Nhi Nguyễn YếnNo ratings yet

- 2023 Macroeconomics Final Test SampleDocument2 pages2023 Macroeconomics Final Test Samplek. nastyasNo ratings yet

- Change Management at UnileverDocument10 pagesChange Management at UnileverAnika JahanNo ratings yet

- Indicated in Syllabus: See Only Footnote #1: (2) Albano V. ReyesDocument1 pageIndicated in Syllabus: See Only Footnote #1: (2) Albano V. ReyesJul A.No ratings yet

- Problems On Ages Questions Specially For Sbi Po PrelimsDocument18 pagesProblems On Ages Questions Specially For Sbi Po Prelimsabinusundaram0No ratings yet

- 5.tender Process N DocumentationDocument35 pages5.tender Process N DocumentationDilanka MJ Dassanayake100% (1)

- Fundamental Analysis of StocksDocument34 pagesFundamental Analysis of StocksPrajwal nayakNo ratings yet

- Network Marketing Business Plan ExampleDocument50 pagesNetwork Marketing Business Plan ExampleJoseph QuillNo ratings yet

- Evolution of Accounting Standard in The PhillipinesDocument7 pagesEvolution of Accounting Standard in The PhillipinesJonathan SiguinNo ratings yet

- Capstone Project-Grainger and Bosch: Digital Marketing CampaignDocument25 pagesCapstone Project-Grainger and Bosch: Digital Marketing Campaignk.saikumar100% (1)

- Option Valuation Black ScholesDocument18 pagesOption Valuation Black ScholessanchiNo ratings yet

- Consolidated Financial Statement Excercise 3-4Document2 pagesConsolidated Financial Statement Excercise 3-4Winnie TanNo ratings yet

- The Challenges of Globalization On The Industrial Sector of BangladeshDocument18 pagesThe Challenges of Globalization On The Industrial Sector of Bangladeshsyed_sazidNo ratings yet

- DR Batra's Healthcare - WikipediaDocument2 pagesDR Batra's Healthcare - WikipediaRajshekhar ReddyNo ratings yet

- DNV's Maritime Academy Schedule 2021 (November-December)Document2 pagesDNV's Maritime Academy Schedule 2021 (November-December)Fotini HalouvaNo ratings yet