Professional Documents

Culture Documents

Deposits

Uploaded by

Jeremy Kuizon PacuanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Deposits

Uploaded by

Jeremy Kuizon PacuanCopyright:

Available Formats

DEPOSITS

POWER AND DUTY OF BANKS TO RECEIVE DEPOSITS Traditionally, the authority to receive savings and time deposits should be the preserve of thrift banks, like savings banks, which are the classical institutions devoted to the accumulation of the savings of the people. Generally, a banking corporation, like any other ordinary corporation, is wholly a creature of statute and thus exercises only such powers expressly authorized by law or incident to its existence. DUTY TO RECEIVE DEPOSITS A bank and its depositor are essentially contractual and may be created only y mutual agreement. One reason why a bank should be allowed to open bank accounts might be undesirable, financially unstable or of bad moral character. RELATIONSHIP BETWEEN A BANK AND DEPOSITOR A deposit, in the strict legal sense and as known in Civil Law is a contract whereby one party delivers to another exclusively for SAFEKEEPING with the obligation of returning the very same thing upon demand. DEPOSITS the term deposits has two connotations: the first is that of a contract of strict deposit whereby one person receives a thing belonging to another with the obligation of safely keeping it and of returning the same. The second is that of a bank deposit. The term bank deposit may be understood to mean a.) the act of placing, b.) the amount of money placed, or c.) the state of being placed, for safekeeping in a bank. DEPOSITOR the person in a contract of strict deposit who delivers a thing for safekeeping with the expectation of receiving the very same thing in return. The bank depositor who delivers or leaves money to a bank for safekeeping subject to his order. DEPOSIT SUBSTITUTES consists in the borrowing of funds for the borrowers own account through the issuance, endorsement or acceptance of debt instrument of any kind other that deposits or through the issuance of participations, certificates, or of repurchase agreements. PARTICULAR KINDS OF DEPOSIT GENERAL DEPOSIT which is the ordinary form is the delivery of money into a bank to be withdrawn by the depositor in the usual course of banking business, whether on demand or as agreed upon with or without interest. SPECIAL DEPOSIT is the delivery of money into a bank for the purpose of safekeeping subject to the return of the identical thing. SPECIFIC DEPOSIT or a deposit for a specific purpose, consists in the delivery of money or property to a bank to be used for a particular object or designated purpose such as the payment of maturing obligation or taxes. GOVERNMENT DEPOSIT private banks not allowed to accept as depository any fund or money from the government, its branches, agencies, subsidiaries, instrumentalities, including government-owned or controlled corporations.

ELEMENTS OF DEPOSITS CONSENT: OFFER AND ACCEPTANCE Consent is the concurrence of offer and acceptance upon the object and the consideration of a contract. OBJECT The object or subject matter of a contract of bank deposit is money. CURRENCY FOR DEPOSIT Foreign Currency Deposit Act of the Philippines, as implemented by CB Circular NO. 343, foreign currency acceptable as part of the international reserves became lawful objects of bank deposits. DEPOSIT OF CHECKS Check deposits as items for collection and, therefore, the relation established is that of principal and agent. CHECKS DRAWN AGAINST SAME BANK The situation is different in case the check deposited is drawn against the same bank to which it is deposited. In this situation, the bank does not have to collect against anybody because the check is drawn against itself. CONSIDERATION The consideration or cause of a contract is the impelling reason for which a party enters into a contract. The consideration for entering into the contract of bank deposit is the promise of the bank to repay the same amount deposited. DELIVERY AND RECEIOT OF MONEY A contract of bank deposit is real contract which requires for its perfection the actual and physical delivery and receipt of the money by the bank. BANKING HOURS The hours during which all banks including their branches, agencies and extension offices, shall transact business shall not be less than six (6) hors a day. AUTHORIZED PERSON In order to bind the bank, the deposit must be made with the proper officer or employee. The receiving teller, as distinguished from the paying teller is the usual employee to whom deposits must be given. NIGHT DEPOSITORY The privilege to deposit through the night depository system is made only by special arrangement between the bank and the depositor. BANKING BY MAIL This is a special service made available to depositors for their convenience. The depositor may open the account by personally going to the bank and conduct subsequent transactions by mail.

TYPES OF ACCOUNTS INDIVIDUAL ACCOUNTS

Is placed in the depositors real name. The depositor is presumed to be the owner of the funds standing in his name in a bank deposit. DEPOSITS BY MARRIED WOMEN the future spouses, in fixing their property relations by contract, may agree upon either the system of absolute community of property, the system of complete separation of property or the conjugal partnership of gains. DEPOSIT IN FICTITIOUS OR ASSUMED NAME it is lawful for any person to use different names and surnames. The bank should refuse any offer or proposal to open account under a fictitious or assumed name. DEPOSIT IN THE NAME OF ANOTHER made in either two way: 1) by simply opening the account in the name of the principal depositor alone, or 2) by placing both the names of the principal and agent. JOINT AND ACCOUNT There is co-ownership of an undivided thing or right belong to different person. The share of the co-depositors is in proportion to their respective interest. It is presumed that the deposit belongs to the co-depositor equally. JOINT AND/OR ACCOUNT Either one of the co-depositors may deposit and withdraw from the account without the knowledge, consent and signature of the other. Upon the death of one, the survivor may withdraw the entire balance on deposit. This is known as the SURVIVORSHIP agreement. BUSINESS NAME ACCOUNT It is unlawful for any person to use any business or firm name without registering the same with the Bureau of Domestic Trade. The purpose of the law is not so much to protect the public dealing with the person concerned by requiring the registration of the business name as well as the true name of the registrant. PARTNERSHIP ACCOUNT It is may be constituted in any form, except where immovable property or real rights are contributed thereto, in which case a public instrument shall be necessary. CORPORATE ACCOUNTS It may be opened in the name of the corporation. Funds in a corporate account belong to the corporation, the officers acting merely as agents of the corporation.

ACCOUNTS OF UNREGISTERED OR UNINCORPORATED ASSOCIATIONS It is not unusual that the social clubs, associations, parish or religious organizations and other unregistered or unincorporated groups apply for deposit accounts. The bank should require a copy of the articles of the association or constitution and by-laws of the organization.

ACCOUNTS OF MINORS A minor may acquire and own property. If the property consists of money, he may deposit the same with a bank and exercise free control over it. A minor may also negotiate instruments like checks. ACCOUNTS OF ILLITERATES

The Civil Code in enumerating the persons who cannot give valid consent to a contract, has excluded illiteracy. An illiterate may open and maintain a deposit account in his name. ACCOUNTS OF INCOMPETENTS It includes a person suffering the penalty of civil interdiction or who are hospitalized lepers, prodigals, and deaf and dumb who are unable to read and write, those who are of unsound mind even though they have lucid intervals. DEPOSIT IN TRUST AND TRUST ACCOUNTS A deposit in trust constitutes a general deposit and creates a debtor-creditor relation between the owner of the funds and the bank. RENTAL DEOSITS The New Control Law governs rental of residential units not exceeding P480.00 per month. Under the Law, arrears in payment of rent for a total of three months is a ground for ejectment. MARGIN DEPOSITS The Monetary Board may at any time prescribe minimum cash margins for the opening of letters of credit, and may relate the size of the required margin to the nature of the transaction to be financed.

WITHDRAWAL OF DEPOSITS The relation between the bank and the depositor is that of debtor-creditor. As debtor, the obligation of the bank is to pay back the depositor, consequent to the receipt of the deposits; the bank incurs the corresponding duty to allow withdrawal of the deposit. EFFECT OF AGREEMENT The contracting parties may establish such stipulations, clauses, terms and conditions that they may deem convenient provided they are not contrary to law, morals, good customs, public order or public policy. TO WHOM PAYMENT MADE By the general rules on payment of obligations, payment must be made to the person in whose favor the obligation has been constituted, or his successor in interest, or any person authorized to receive it. PAYMENT TO AUTHORIZED REPRESENTATIVE Withdrawal by representative may also be allowed if the authorized representative is armed with a power of attorney, special or general. WITHDRAWAL BY LEGAL REPRESENTATIVE A legal representative should be distinguished from an authorized representative. An authorized representative is a person voluntarily and personally designated by the depositor. PRESENTATION OF DEPOSIT BOOK Banks are prohibited from issuing/accepting withdrawal authority slip or any other similar instruments designed to effect withdrawals of saving deposits without following the usual practice of requiring the depositors concerned to present their passbooks and accomplish the necessary withdrawal slips. NOTICE OF WITHDRAWAL

Some bank rules may acquire that notice of a specific period be given of intended withdrawals as a condition to repayment. The purpose of these rules is to protect the bank and its depositors in times of public excitement. WITHDRAWAL THROUGH ANOTHER BANK This is done by delivering the deposit book to and executing a bank instruction form empowering another bank to collect the withdrawal from the bank where the depositor maintains his account. UNAUTHORIZED WITHDRAWALS Payment to Person Other than Depositor Presenting Deposit Book A bank is under obligation to allow withdrawals only by the depositor or his duly authorized or legal representatives. It becomes liable for wrongful payment to a person who fraudulently obtains possession of the deposit book and forges to signature of the real depositor on the withdrawal slip even if the bank acted in good faith and in the exercise the ordinary care and diligence. ASSIGNMENT OF DEPOSIT An assignment is a contract whereby a person transmits to another his right against a third party. Strictly, an assignment is a contract of sale. ASSIGNABILITY OF DEPOSITS A deposit is debt which the bank owes the depositor. The depositor is a creditor of the bank. PURPOSE OF ASSIGNMENT An assignment may therefore be validly made for the purpose of securing the payment of a loan, or to serve as a cash bond, or to serve as a counter bound to secure a surety that issued a bond in favor of the depositor or some other party. FORM OF ASSIGNMENT As between the assignor and the assignee, the assignment of bank deposit is completed from the moment there is a meeting of minds.

EVIDENCE OF DEPOSIT DEPOSIT BOOK the bank book of the depositor of a bank in which the cashier or teller, whenever a deposit or withdrawal is made, enters the amount and date thereof. DEPOSIT SLIP is a receipt or acknowledgement that the amount of money stated therein has been received by the bank. BANK STATEMENT OF ACCOUNT is a summary of transactions in a depositors account indicating the deposits and withdrawals thereon from the opening of the account, or for a specified length of time, with the corresponding balance remaining. BANK CERTIFICATION is a statement indicating the depositors balance as of particular date. It sometimes indicates the manner in which the account has been handled.

SECRECY OF BANK DEPOSITS R.A NO.1405 or the Law on the Secrecy of Bank Deposits contains only three exceptions that the bank deposits are of an absolutely confidential nature. All deposits of whatever nature with banks are considered as of an absolutely confidential nature may not be examined, inquired or looked into by any other person, government official, bureau or office. SAFE DEPOSIT BOXES are not strictly deposits. Actually the relationship between the bank and the renter is that of lessor and lessee. EXCEPTIONS Existing laws and jurisprudence provide the following exceptions when information concerning bank deposits may be disclosed. 1. Upon written permission of the depositor, 2. In case of impeachment, 3. Upon order of a competent court in the following cases: a.) Bribery or dereliction of duty of public officials b.) Where the money deposited or invested is the subject matter of litigation. 4. Prosecution of unexplained wealth under R.A. 3019 otherwise known as the AntiGraft and Corrupt Practices Act, 5. When examination is made in the course of a special or general examination of a bank and is especially authorized by the Monetary Board. 6. When the examination is made by an independent auditor hired by the bank to conduct its regular audit provided that the examination is for audit process only and the results thereof shall be for exclusive use of the bank, 7. Authority of the Commissioner of Internal Revenue to inquire into bank deposits of a decedent for estate purposes. PENALTIES Violation of the secrecy of bank deposits will subject the offender upon conviction to imprisonment of not more than five years or a fine of not more than P2,000.00 or both in the discretion of the court. UNCLAIMED BALANCES Act No. 3936 also known as the Unclaimed Balance Law which took effect on January 1, 1933, amended by P.D No.679 promulgated on April 2, 1975. The term includes credits or deposits of money, bullion, security or other evidence of indebtedness of any kind of interest thereon with banks, buildings and loan associations, and trust corporations, in favor of any person known to be dead or who has not made further deposits or withdrawals during the preceding ten years or more. P.D 769 has modified the definition of unclaimed balances from in favor of any person unheard from for a period of ten years or more to in favor of any person known to be dead or who has not made further deposits or withdrawals during the preceding ten years or more. ELEMENTS OF UNCLAIMED BALANCE

1. There must be a credit or deposit of: a.) b.) c.) d.) money bullion security, or other evidence of indebtedness

2. The credit or deposit must be with a bank, building and loan association or trust corporation, and 2. The credit or deposit in favor of a person. PROCEDURE The procedure before unclaimed balances may be escheated in favor of the government may be summarized as follows: 1. Notice by the bank to the person in whose name the unclaimed balance stands. 2. Filing of a sworn statement by the bank with the Treasurer of the Philippines stating the credits and deposits held in favor of persons known to be dead or who have not made deposits or withdrawals during the preceding ten years or more. 3. Posting of a copy of the sworn statement within the bank premises. 4. Notification by the Treasurer of the Philippines to the Solicitor General. 5. Commencement of escheat proceedings in court by the Solicitor General. 6. Service of Process by: a.) Delivery of a copy of the complaint and summons to the president, cashier or managing officer of the bank. b.) Publication summons c.) Publication, together with summons, of a notice directed to all persons claiming interest on the unclaimed balance. 7. Trial 8. Judgment NOTICE Before filing the sworn statement, the bank is duty bound to communicate with the person in whose favor the unclaimed balance stands at his last known place of residence or post office address. FILING OF SWORN STATEMENT Within the month of January every odd year, all banks, building and loan associations, and trust corporations shall forward to the Treasurer of the Philippines a statement, under oath, of their respective managing officers, of all credits and deposits held by them in favor of persons known to be dead, or who have not made further deposits or withdrawals during the preceding ten years or more. PENALTIES If the president, cashier or managing officer of any bank, building and loan association, or trust corporation neglects or refuses to make and file the sworn statement required by this Act, such bank, building, loan association, or trust corporation shall pay the Government the sum of five hundred pesos a month for each month or fraction thereof during which such default such continue.

FOREIGN CURRENCY DEPOSITS Foreign Currency deposits are governed by R.A No. 6426. This law is now implemented by CB Circular No.960 dated October 21, 1983 which has repealed and superseded Circulars 343, 547 and other circulars inconsistent therewith.

A.

Basic Policy and General Provisions

Sec. 96 Basic Policy. R.A No. 6426 authorized the establishment of a foreign currency deposit system in the Philippines. The CB has since encouraged banks to participate in the system by attractive qualification requirements. Sec. 97 Definition of Terms a.) Foreign Currency Deposit Unit or FDCU shall refer to banks authorized to operate solely under R.A No. 6426 which was previously implemented under CB Circular No. 343. b.) Expanded Foreign Currency Deposit Unit or EFCDU shall refer to such local banks and local branches of foreign banks which are authorized to operate under R.A No. 6426, as amended by P.D. No. 1035 dated September 30, 1976, which was previously implemented by CB Circular No. 547.

EXPANDED FOREIGN CURRENCY DEPOSIT SYSTEM Sec. 22 Basic Policy. Encourage by the impressive development of the Asian dollar market in Singapore and in view of increasing demands for various foreign financing, P.D No. 1035 was promulgated. Sec. 23 Definition of Terms.

a.) Offshore Banking Unit OBU shall refer to a branch, subsidiary or affiliate of foreign Banking Corporation which is duly authorized by the CB of the Philippines, as a separate accounting unit, to transact offshore banking business in the Philippines. b.) Resident shall mean1. An individual citizen of the Philippines residing therein; or 2. An individual who is not a citizen of the Philippines but is permanently residing therein; or 3. A corporation or other juridical person organized under laws of the Philippines; or 4. A branch, subsidiary, affiliate, extension office or any other unit of corporations or juridical persons organized under the laws of foreign country operating in the Philippines. c.) Non-resident shall mean an individual, corporation or other juridical person not included in the above definition of resident. c.) Expanded Foreign Currency Deposit Unit or EFCDU shall refer to such local banks and existing local branches of foreign banks which are authorized to operate

under R.A. NO. 6426, as amended, by P.D. No. 1035 dated September 30, 1976, which was previously implemented by CB Circular No. 547. d.) Foreign Currency Deposit Unit or FDCU shall refer to banks authorized to operate solely under R.A No. 6426 which was previously implemented under CB Circular No. 343. CHECKS A check is indisputably a negotiable instrument and is governed by the Negotiable Instruments Law. ELEMENTS OF A CHECK A check being a negotiable instrument, it must contain all the elements of a negotiable instrument. These elements are: a.) b.) c.) d.) e.) It must be in writing and signed by the maker or drawer, Must contain an unconditional promise or order to pay a sum certain in money Must be payable on demand, or at a fixed or determinable future time; Must be payable to order or to bearer; and Where the instrument is addressed to a drawee, he must be named or otherwise indicated therein with reasonable certainty.

FACE OF THE CHECK A cursory examination of the face of an ordinary check will reveal five basic items on its face, namely, 1) date 2) amount 3) drawer 4) drawee and 5) payee. DATE OF THE CHECK When check is dated, such date is deemed prima facie to be the true date when it was drawn. This presumption is only rebuttable and may be shown not to be the true date of the issuance. AMOUNT OF THE CHECK One of the essential requisites of a negotiable instrument like a check is that it must contain an unconditional order to pay a sum certain money. DRAWER AND PAYEE The drawer is the person or entity that issues the check and addresses or directs to the drawee to pay the payee named in the check. By drawing the check, the drawer: a.) Admits the existence of the payee and his capacity to endorse, b.) Agrees that upon presentation the checks will be paid, and c.) That if the check is dishonored, he will pay the amount thereof to the holder or to any subsequent indorser who may be compelled to pay it. PAYEE The payee is the person named in the check entitled to payment. To be negotiable, a check must be payable to bearer. The check is payable to a bearer when a.) It is expressed to be so payable, b.) It is payable to a person named therein or to bearer, c.) It is payable to the order of a fictitious or non-existing person and such fact was known to the person making it so payable, d.) The name of the payee does not purport to be the name of any person,

e.) The only or last indorsement is an indorsement in blank NEGOTIATION AND INDORSEMENT A check is negotiated when it is transferred from one person to another in such a manner as to constitute the transferee the holder thereof. The indorsement must be written on the check itself although it may be written on a separate paper it was known as a detached indorsement. KINDS OF INDORSEMENTS An indorsement may be either special, in blank, restrictive, qualified or conditional. A SPECIAL indorsement specifies to whom, or to whose order, the check is payable, and the indorsement of such imdorsee is necessary for the further negotiation of the check. An indorsement in BLANK specifies no indorsee, and a check so indorsed is payable tobearer and may be negotiated by delivery. Qualified indorsement- constitutes the indorser a mere assignor of the title to the check.it may be made adding to the indorsers signature the words without recourse or words of similar import. Conditional indorsement- is one coupled with a conditional and the efficacy of the indorsement depends on the fulfillment of the condition.

KINDS OF CHECKS a.) Cashiers and managers check- a cashiers check is drawn by the cashier of the bank against the same bank of which he is the cashier similar with the managers check. b.) Ordinary check- may either be personal or corporate. Any other personal check is one drawn by a natural person against his current or checking account with a bank, an ordinary corporate check is drawn by a corporate depositor against its current account with a depository bank. c.) Travelers check- purchased from and issued by a bank to a person to be used for travel purposes. d.) Stale check- is one which has not been presented for payment for an unreasonable length of time and has therefore become useless and valueless. e.) Certified check- certification of a check is the undertaking of the drawee bank to pay the check upon presentation. f.) Crossed check- a check is crossed generally by placing two parallel lines across its face and writing between the lines & coor and co.

FORGERY Is the counterfeiting making or fraudulent alteration of any writing and may consist in the signing of anothers name, or the alteration of an instrument in the same, amount, and the like.

You might also like

- An Allonge Is Not An AssignmentDocument3 pagesAn Allonge Is Not An Assignmentdbush2778No ratings yet

- Equitable AssignmentDocument17 pagesEquitable AssignmentSHAHEERANo ratings yet

- Florida Banker's Association - Lost Notes 09-1460 - 093009 - Comments (Fba) 1Document9 pagesFlorida Banker's Association - Lost Notes 09-1460 - 093009 - Comments (Fba) 1A. CampbellNo ratings yet

- Sales Notes Deposit in General and Its Different Kinds (Art 1962-1967)Document34 pagesSales Notes Deposit in General and Its Different Kinds (Art 1962-1967)LeeJongSuk isLife0% (1)

- Special Commercial Laws NotesDocument226 pagesSpecial Commercial Laws NotesMarianne Hope Villas100% (2)

- Chapter 4 - Deposit FunctionDocument26 pagesChapter 4 - Deposit FunctionShasharu Fei-fei LimNo ratings yet

- Allonge IndorsementDocument1 pageAllonge IndorsementA. CampbellNo ratings yet

- 20151113-WOLF Vs WELLS FARGO Robosigning Fraud $5.4m-v1Document2 pages20151113-WOLF Vs WELLS FARGO Robosigning Fraud $5.4m-v1RESEARCH100% (2)

- The Surety Is Discharged From His Liability On 6 CircumstancesDocument5 pagesThe Surety Is Discharged From His Liability On 6 CircumstancesPriyankaJainNo ratings yet

- The Exempt Offering Secondary MarketDocument8 pagesThe Exempt Offering Secondary MarketDouglas SlainNo ratings yet

- Banker As SuretyDocument10 pagesBanker As SuretyManu AyilyathNo ratings yet

- Am. Jur. 2d Cumulative Summary of Contents (2021)Document11 pagesAm. Jur. 2d Cumulative Summary of Contents (2021)MinisterNo ratings yet

- All About TrustsDocument8 pagesAll About TrustsJaysonmaleroNo ratings yet

- Loans Create DepositsDocument6 pagesLoans Create DepositsPeter OnyangoNo ratings yet

- SEC Rule 144A - Private Placement For Investment PurposesDocument2 pagesSEC Rule 144A - Private Placement For Investment PurposesLinda Rougeux100% (1)

- Negotiable Instruments Used As Collateral SecurityDocument5 pagesNegotiable Instruments Used As Collateral Securityaweb1100% (1)

- Negotiable InstrumentsDocument9 pagesNegotiable InstrumentsJANE MARIE DOROMALNo ratings yet

- Bankers AcceptanceDocument1 pageBankers AcceptanceVarad LaghateNo ratings yet

- Collateral SecurityDocument2 pagesCollateral SecurityThanga pandiyanNo ratings yet

- TRUST RECEIPTS LAW NOTES by SAPDocument5 pagesTRUST RECEIPTS LAW NOTES by SAPStephany PolinarNo ratings yet

- NEGO - Letters of Credit - (3) Bank of America v. CA (228 SCRA 357)Document12 pagesNEGO - Letters of Credit - (3) Bank of America v. CA (228 SCRA 357)Choi ChoiNo ratings yet

- Letters of Credit and Trust Receipts LawDocument7 pagesLetters of Credit and Trust Receipts LawLou100% (1)

- Bond Purchase Contract (Executed Copy)Document15 pagesBond Purchase Contract (Executed Copy)argo alfathNo ratings yet

- Banking - Deposit FunctionDocument41 pagesBanking - Deposit FunctionMary Megan Tabora100% (1)

- Negotiable Instrument Act 1881Document29 pagesNegotiable Instrument Act 1881Anonymous WtjVcZCgNo ratings yet

- Master Account Agreement Oc1 App1 RVDocument1 pageMaster Account Agreement Oc1 App1 RVbrandoncroyleNo ratings yet

- Secrecy in Bank Deposits - FinalDocument32 pagesSecrecy in Bank Deposits - FinalDeb BieNo ratings yet

- ASA Below 40: How To Draft Prayers For Relief: Melissa MaglianaDocument9 pagesASA Below 40: How To Draft Prayers For Relief: Melissa Maglianaseshadrimn seshadrimn0% (1)

- 04-2013 b10 Form Court VersionDocument3 pages04-2013 b10 Form Court Versionjmaglich1100% (1)

- Quit Claim Informational PacketDocument10 pagesQuit Claim Informational PacketzaidNo ratings yet

- Assignment of Security or DebtDocument2 pagesAssignment of Security or DebtvauditNo ratings yet

- Surety 2Document10 pagesSurety 2ramilflecoNo ratings yet

- Securities Registration InstructionsDocument11 pagesSecurities Registration InstructionssukitraderNo ratings yet

- TRP Change Ownership FormDocument2 pagesTRP Change Ownership Formambasyapare1100% (1)

- (Proposed) Stipulated Final Judgment and OrderDocument20 pages(Proposed) Stipulated Final Judgment and OrderTiggle MadaleneNo ratings yet

- I. Letters Ofcredit and Trust Receipts 2019Document5 pagesI. Letters Ofcredit and Trust Receipts 2019Jayson AbabaNo ratings yet

- Bihar Treasury Code 2011 enDocument268 pagesBihar Treasury Code 2011 enसंजय कुमार चौधरी100% (1)

- Obligor Obligee Grantor GranteeDocument1 pageObligor Obligee Grantor GranteeA. CampbellNo ratings yet

- How They List Grantor and Grantee Per DocumentDocument7 pagesHow They List Grantor and Grantee Per DocumentSamj18100% (1)

- Tax Form W-8BEN-E PDFDocument17 pagesTax Form W-8BEN-E PDFNEWKHALSA ENTNo ratings yet

- Imilo: 4jestDocument19 pagesImilo: 4jestMikhael Yah-Shah Dean: VeilourNo ratings yet

- Negotiable Instruments LawDocument13 pagesNegotiable Instruments LawApple MarieNo ratings yet

- Rule 144Document7 pagesRule 144JoelMFunk100% (1)

- Or To Use It and Return It in KindDocument1 pageOr To Use It and Return It in KindRESEARCH83% (6)

- Negotiation and AssignmentDocument6 pagesNegotiation and AssignmentartiNo ratings yet

- Contructive TrustsDocument79 pagesContructive Trustsjoannak100% (1)

- Negotiable Instruments TerminologiesDocument4 pagesNegotiable Instruments Terminologiesxsar_x100% (2)

- Notes Bank SecrecyDocument9 pagesNotes Bank SecrecyLudica Oja100% (1)

- Contract of BailmentDocument5 pagesContract of BailmentSesa GillNo ratings yet

- The Doctrine of Merger 2002Document4 pagesThe Doctrine of Merger 2002mptacly9152100% (2)

- Public Law Debt Insurance Securities Under Private Accounts PDFDocument2 pagesPublic Law Debt Insurance Securities Under Private Accounts PDFJuliet Lalonne100% (5)

- Non Marketable Financial Assets & Money Market SecuritiesDocument3 pagesNon Marketable Financial Assets & Money Market Securities020Elisya MufadilahNo ratings yet

- First Schedule - Notice of Protest: Form of Protest Which Is Being Used When The Services of A Notary Cannot Be ObtainedDocument1 pageFirst Schedule - Notice of Protest: Form of Protest Which Is Being Used When The Services of A Notary Cannot Be ObtainedCruz HernandezNo ratings yet

- Affidavit of Thomas Adams For US Bank V CongressDocument9 pagesAffidavit of Thomas Adams For US Bank V CongressJohn StupNo ratings yet

- Obligation of Customers Towards The BankerDocument14 pagesObligation of Customers Towards The BankerFlorosia StarshineNo ratings yet

- Meaning of Bank: A Bank Is An Institution, Incorporated With The Authority and The Responsibility ToDocument18 pagesMeaning of Bank: A Bank Is An Institution, Incorporated With The Authority and The Responsibility To657 Suleman Khan100% (1)

- Unit-2: by - Divya AgrawalDocument161 pagesUnit-2: by - Divya AgrawalHardik PrajapatiNo ratings yet

- Bankruptcy Act Is Ignored by BankersDocument4 pagesBankruptcy Act Is Ignored by BankersMohammad Shahjahan SiddiquiNo ratings yet

- Certificate of AppreciationDocument1 pageCertificate of AppreciationJeremy Kuizon PacuanNo ratings yet

- Premiums, Basics Plans and Riders Classification According To CoverageDocument21 pagesPremiums, Basics Plans and Riders Classification According To CoverageJeremy Kuizon PacuanNo ratings yet

- BookkeepingRegulationsRRV 1Document80 pagesBookkeepingRegulationsRRV 1Jeremy Kuizon Pacuan100% (1)

- ReferralDocument1 pageReferralJeremy Kuizon PacuanNo ratings yet

- Marketing Aspect-Feasibility StudyDocument9 pagesMarketing Aspect-Feasibility StudyJeremy Kuizon Pacuan50% (2)

- I DonDocument9 pagesI DonJeremy Kuizon PacuanNo ratings yet

- Corporate GovernanceDocument64 pagesCorporate GovernanceRamapriyaiyengarNo ratings yet

- Air Transport: Britishunitedstrike AvertedDocument1 pageAir Transport: Britishunitedstrike AvertedBharat TailorNo ratings yet

- A Report On Advertising IndiaDocument10 pagesA Report On Advertising IndiaMayank ShekharNo ratings yet

- Outline 1 PDFDocument7 pagesOutline 1 PDFfajarNo ratings yet

- BFSIDocument38 pagesBFSIsikkamNo ratings yet

- PWC Budget Summary 2016-2017Document44 pagesPWC Budget Summary 2016-2017L'express MauriceNo ratings yet

- Description: Tags: lr00Document30 pagesDescription: Tags: lr00anon-536171No ratings yet

- Group 2 - The Global EconomyDocument64 pagesGroup 2 - The Global EconomySansuri Zet Su100% (1)

- Auditing and Assurance Standard (AAS) 25 ComparativesDocument8 pagesAuditing and Assurance Standard (AAS) 25 ComparativesRishabh GuptaNo ratings yet

- Cost Acctg Chapter 4 True or FalseDocument2 pagesCost Acctg Chapter 4 True or FalseWendors Wendors58% (12)

- Format For Company Bank Account Opening PDFDocument2 pagesFormat For Company Bank Account Opening PDFNorberto Carpiso CasonoNo ratings yet

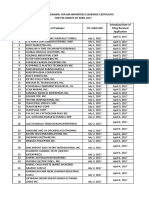

- Schedule of Renewal For BIR-Importers Clearance Certificate For April 2017Document11 pagesSchedule of Renewal For BIR-Importers Clearance Certificate For April 2017PortCallsNo ratings yet

- Advanced-Accounting-Part 2-Dayag-2015-Chapter-16Document82 pagesAdvanced-Accounting-Part 2-Dayag-2015-Chapter-16Kate Alvarez75% (4)

- CRG 660 Past Year Question CollectionsDocument5 pagesCRG 660 Past Year Question CollectionsZulaikha HananiNo ratings yet

- List of Prequalified Manufacturers Suppliers For Main Distribution Networks MaterialsDocument62 pagesList of Prequalified Manufacturers Suppliers For Main Distribution Networks MaterialsthangbinhbkNo ratings yet

- A Study of Customer Preference Towards Product and Services of Axis Bank With Respect To Pimpalgaon Branch.Document15 pagesA Study of Customer Preference Towards Product and Services of Axis Bank With Respect To Pimpalgaon Branch.Pavan ShindeNo ratings yet

- 30 Something DirectorDocument6 pages30 Something DirectorazharaqNo ratings yet

- Dabur Coke Case AnalysisDocument6 pagesDabur Coke Case AnalysisNiku Thali100% (1)

- DB SLSDocument1 pageDB SLSmastanvali.shaik84359No ratings yet

- Nisms05a PDFDocument235 pagesNisms05a PDFAtul SharmaNo ratings yet

- Bir Ruling 18 80 and 99 90Document5 pagesBir Ruling 18 80 and 99 90Aleli Joyce BucuNo ratings yet

- Proposed Enka Village Project in Asheville, North CarolinaDocument12 pagesProposed Enka Village Project in Asheville, North CarolinaDillon DavisNo ratings yet

- Newmass w9Document4 pagesNewmass w9Tabitha HowardNo ratings yet

- Commentary Power Words TemplateDocument12 pagesCommentary Power Words TemplateJohn Johnstone100% (1)

- List of Companies-2009Document1,194 pagesList of Companies-2009Om PrakashNo ratings yet

- Medical Claim Form / Borang Tuntutan PerubatanDocument4 pagesMedical Claim Form / Borang Tuntutan PerubatanEsplanadeNo ratings yet

- Revised Tax QuestionsDocument25 pagesRevised Tax QuestionssophiaNo ratings yet

- Weld Alloy PPT - Ship BuildingDocument53 pagesWeld Alloy PPT - Ship BuildingstutikapoorNo ratings yet

- G.R. No. 210773, January 23, 2019 GSIS Family Bank Vs Villanueva PDFDocument2 pagesG.R. No. 210773, January 23, 2019 GSIS Family Bank Vs Villanueva PDFMarkNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (98)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersFrom EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersNo ratings yet

- Contract Law in America: A Social and Economic Case StudyFrom EverandContract Law in America: A Social and Economic Case StudyNo ratings yet

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Eagle on the Street: The SEC and Wall Street during the Reagan YearsFrom EverandEagle on the Street: The SEC and Wall Street during the Reagan YearsRating: 5 out of 5 stars5/5 (1)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooFrom EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooRating: 5 out of 5 stars5/5 (2)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsRating: 5 out of 5 stars5/5 (24)

- Secrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global EliteFrom EverandSecrecy World: Inside the Panama Papers Investigation of Illicit Money Networks and the Global EliteRating: 4.5 out of 5 stars4.5/5 (6)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistFrom EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistRating: 4 out of 5 stars4/5 (34)

- Side Hustles for Dummies: The Key to Unlocking Extra Income and Entrepreneurial Success through Side HustlesFrom EverandSide Hustles for Dummies: The Key to Unlocking Extra Income and Entrepreneurial Success through Side HustlesNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (215)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesFrom EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesRating: 4 out of 5 stars4/5 (1)