Professional Documents

Culture Documents

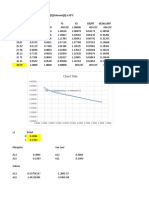

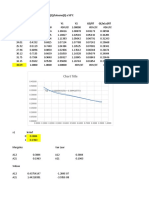

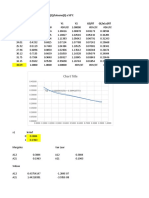

Table 1

Uploaded by

Joel SequeiraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Table 1

Uploaded by

Joel SequeiraCopyright:

Available Formats

TableA

11:43 Tuesday, October 19, 2010 1

Obs fyear _TYPE_ _FREQ_ mean_ch mean_ivst mean_rect mean_invt mean_aco mean_act mean_ppent

1

1971

4089

0.0543

0.0429

0.2148

0.2308

0.0150

0.5149

0.3640

1975

6427

0.0521

0.0420

0.2124

0.2133

0.0166

0.5316

0.3502

1980

6526

0.0461

0.0610

0.2211

0.1899

0.0197

0.5349

0.3489

1985

7797

0.0494

0.0848

0.2028

0.1591

0.0240

0.5228

0.3379

1990

8463

0.0972

0.0345

0.2144

0.1471

0.0273

0.5120

0.3155

1995

10696

0.1093

0.0467

0.2311

0.1227

0.0311

0.5323

0.2639

1998

10472

0.1295

0.0494

0.2173

0.1086

0.0342

0.5282

0.2473

Obs mean_ivaeq mean_ivao mean_intan mean_ao mean_at mean_dlc mean_ap mean_txp mean_lco

1

0.0168

0.0482

0.0356

0.0263

1.0000

21.7370

104.3236

5.1803

13.2695

0.0141

0.0698

0.0296

0.0248

1.0000

30.5369

111.3210

5.8377

16.4789

0.0153

0.0800

0.0209

0.0288

1.0000

67.5331

201.1821

11.9179

34.1693

0.0160

0.0787

0.0324

0.0411

1.0000

129.5804

267.9826

10.0584

45.6680

0.0115

0.0594

0.0602

0.0584

1.0000

229.7247

390.6663

12.2012

65.5694

0.0106

0.0838

0.0637

0.0631

1.0000

271.4419

372.4842

9.7474

71.3378

0.0106

0.0766

0.0888

0.0679

1.0000

413.7450

518.4306

11.5853

93.2735

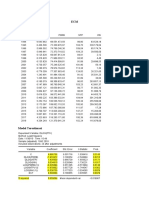

Obs mean_lct mean_dltt mean_lo mean_txditc mean_mib

mean_lt mean_pstk mean_ceq mean_seq

51.2158

73.3462

13.2695

7.2736

1.8260

233.6557

6.4265

115.2966

133.6877

61.8481

80.1034

24.3500

12.0196

1.8206

278.0920

6.8993

115.2757

122.3342

119.7671

130.7480

55.1241

31.2934

2.6721

525.9860

11.3447

192.9711

204.2855

142.9829

175.7888

86.0856

51.5549

2.6670

758.8909

14.0209

231.9178

245.7703

194.8404

297.1896

171.9772

63.1749

5.9964 1211.5533

13.9906

280.9745

294.4869

200.0702

293.0510

278.2052

54.4012

8.1349 1309.7066

11.5264

293.3006

304.6055

260.1466

435.9707

555.8684

64.8838

12.9389 2026.3475

11.4964

418.1516

429.5045

TableA

11:43 Tuesday, October 19, 2010 2

The UNIVARIATE Procedure

Variable: fyear (Data Year - Fiscal)

Moments

N

54470 Sum Weights

54470

Mean

1987.40986 Sum Observations

108254215

Std Deviation

8.92823377 Variance

79.7133582

Skewness

-0.4090008 Kurtosis

-1.1610213

Uncorrected SS

2.1515E11 Corrected SS

4341906.91

Coeff Variation 0.44923968 Std Error Mean

0.03825488

Basic Statistical Measures

Location

Mean

Variability

1987.410 Std Deviation

8.92823

Median 1990.000 Variance

79.71336

Mode

27.00000

1995.000 Range

Interquartile Range 15.00000

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

51951.8 Pr > |t|

<.0001

27235 Pr >= |M| <.0001

7.4176E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1998

99%

1998

95%

1998

90%

1998

75% Q3

1995

50% Median

1990

25% Q1

1980

10%

1975

5%

1971

1%

1971

0% Min

1971

<.0001

TableA

11:43 Tuesday, October 19, 2010 3

The UNIVARIATE Procedure

Variable: fyear (Data Year - Fiscal)

Extreme Observations

Lowest

Highest

Value Obs Value

Obs

1971 4089

1998 54466

1971 4088

1998 54467

1971 4087

1998 54468

1971 4086

1998 54469

1971 4085

1998 54470

TableA

11:43 Tuesday, October 19, 2010 4

The UNIVARIATE Procedure

Variable: aco (Current Assets - Other - Total)

Moments

N

45933 Sum Weights

45933

Mean

0.02552929 Sum Observations 1172.63707

Std Deviation

0.04442773 Variance

0.00197382

Skewness

8.26303016 Kurtosis

113.20089

Uncorrected SS 120.598226 Corrected SS

90.6616294

Coeff Variation 174.026455 Std Error Mean

0.0002073

Basic Statistical Measures

Location

Mean

Variability

0.025529 Std Deviation

0.04443

Median 0.014559 Variance

0.00197

Mode

1.05880

0.000000 Range

Interquartile Range 0.02539

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

123.1536 Pr > |t|

20307.5 Pr >= |M| <.0001

4.1274E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.00000000

99%

0.19214876

95%

0.08015782

90%

0.05590278

75% Q3

0.03066743

50% Median

0.01455854

25% Q1

0.00527768

10%

0.00000000

5%

0.00000000

1%

0.00000000

0% Min

<.0001

-0.05880301

<.0001

TableA

11:43 Tuesday, October 19, 2010 5

The UNIVARIATE Procedure

Variable: aco (Current Assets - Other - Total)

Extreme Observations

Lowest

Value

-0.05880301

Highest

Obs

Value

Obs

2712 0.992647 34344

-0.02071006 31684 0.997454 26287

-0.02016615 20452 0.999523 26157

-0.00708938 21086 1.000000 14434

-0.00522560 35254 1.000000 52949

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

8537

15.67

100.00

TableA

11:43 Tuesday, October 19, 2010 6

The UNIVARIATE Procedure

Variable: act (Current Assets - Total)

Moments

N

42229 Sum Weights

42229

Mean

0.52599265 Sum Observations 22212.1436

Std Deviation

0.26078645 Variance

0.06800957

Skewness

-0.2274142 Kurtosis

-1.0249005

Uncorrected SS 14555.3324 Corrected SS

2871.90818

Coeff Variation 49.5798654 Std Error Mean

0.00126905

Basic Statistical Measures

Location

Mean

Variability

0.525993 Std Deviation

0.26079

Median 0.558504 Variance

0.06801

Mode

1.00000

1.000000 Range

Interquartile Range 0.42363

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

p Value

414.4766 Pr > |t|

Signed Rank S

<.0001

21092.5 Pr >= |M| <.0001

4.449E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.0000000

99%

0.9794773

95%

0.9112293

90%

0.8586084

75% Q3

0.7373087

50% Median

0.5585044

25% Q1

0.3136817

10%

0.1344863

5%

0.0837418

1%

0.0333407

0% Min

0.0000000

<.0001

TableA

11:43 Tuesday, October 19, 2010 7

The UNIVARIATE Procedure

Variable: act (Current Assets - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

0 54253

1 53950

0 54067

1 53992

0 53099

1 54198

0 52792

1 54209

0 51887

1 54304

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

12241

22.47

100.00

TableA

11:43 Tuesday, October 19, 2010 8

The UNIVARIATE Procedure

Variable: ao (Assets - Other)

Moments

N

48956 Sum Weights

48956

Mean

0.04817383 Sum Observations 2358.39794

Std Deviation

0.09240345 Variance

0.0085384

Skewness

4.80878029 Kurtosis

30.6284207

Uncorrected SS 531.610336 Corrected SS

417.997278

Coeff Variation 191.812558 Std Error Mean

0.00041762

Basic Statistical Measures

Location

Mean

Variability

0.048174 Std Deviation

0.09240

Median 0.019041 Variance

0.00854

Mode

1.26525

0.000000 Range

Interquartile Range 0.04052

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

115.3522 Pr > |t|

22377 Pr >= |M| <.0001

5.0113E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.000000000

99%

0.486984366

95%

0.195540708

90%

0.114423651

75% Q3

0.047264935

50% Median

0.019040904

25% Q1

0.006749281

10%

0.000790514

5%

0.000000000

1%

0.000000000

0% Min

<.0001

-0.265251989

<.0001

TableA

11:43 Tuesday, October 19, 2010 9

The UNIVARIATE Procedure

Variable: ao (Assets - Other)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

-0.2652520 29778

1 35103

-0.0928593 37617

1 36761

-0.0691779 35320

1 36842

-0.0550592 20033

1 45592

-0.0406392 39135

1 47413

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5514

10.12

100.00

TableA

11:43 Tuesday, October 19, 2010 10

The UNIVARIATE Procedure

Variable: ap (Accounts Payable - Trade)

Moments

N

48329 Sum Weights

48329

Mean

313.507472 Sum Observations 15151502.6

Std Deviation

3900.33109 Variance

15212582.6

Skewness

42.0514393 Kurtosis

2583.5379

Uncorrected SS 7.39944E11 Corrected SS

7.35194E11

Coeff Variation

17.7417956

1244.0951 Std Error Mean

Basic Statistical Measures

Location

Mean

Variability

313.5075 Std Deviation

Median

3.7480 Variance

Mode

0.0000 Range

3900

15212583

357260

Interquartile Range 23.23000

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

17.67056 Pr > |t|

23748 Pr >= |M| <.0001

5.6403E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

357260.000

99%

4958.337

95%

590.500

90%

175.366

75% Q3

23.972

50% Median

3.748

25% Q1

0.742

10%

0.178

5%

0.059

1%

0.000

0% Min

<.0001

-0.001

<.0001

TableA

11:43 Tuesday, October 19, 2010 11

The UNIVARIATE Procedure

Variable: ap (Accounts Payable - Trade)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

-0.001 23749 171534 33851

0.000 54282 212437 44455

0.000 54245 225813 44486

0.000 54244 231416 44533

0.000 54094 357260 45587

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

6141

11.27

100.00

TableA

11:43 Tuesday, October 19, 2010 12

The UNIVARIATE Procedure

Variable: at (Assets - Total)

Moments

N

49162 Sum Weights

49162

Mean

1 Sum Observations 49162

Std Deviation

0 Variance

Skewness

. Kurtosis

Uncorrected SS 49162 Corrected SS

Coeff Variation

0 Std Error Mean

Basic Statistical Measures

Location

Mean

Variability

1.000000 Std Deviation

Median 1.000000 Variance

Mode

1.000000 Range

Interquartile Range

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

. Pr > |t|

24581 Pr >= |M| <.0001

6.0424E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

99%

95%

90%

75% Q3

50% Median

25% Q1

10%

5%

1%

0% Min

<.0001

TableA

11:43 Tuesday, October 19, 2010 13

The UNIVARIATE Procedure

Variable: at (Assets - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

1 54468

1 54326

1 54467

1 54330

1 54445

1 54445

1 54330

1 54467

1 54326

1 54468

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5308

9.74

100.00

TableA

11:43 Tuesday, October 19, 2010 14

The UNIVARIATE Procedure

Variable: ceq (Common/Ordinary Equity - Total)

Moments

N

49084 Sum Weights

Mean

49084

257.55785 Sum Observations 12641969.5

Std Deviation

1289.29918 Variance

1662292.37

Skewness

17.1069125 Kurtosis

453.612104

Uncorrected SS 8.48463E10 Corrected SS

8.15903E10

Coeff Variation 500.586247 Std Error Mean

5.81947399

Basic Statistical Measures

Location

Mean

Median

Variability

257.5579 Std Deviation

1289

20.6780 Variance

Mode

1662292

0.0000 Range

62257

Interquartile Range 101.05900

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

44.25793 Pr > |t|

20428.5 Pr >= |M| <.0001

5.4549E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

57403.0000

99%

4502.1090

95%

1051.4000

90%

453.2190

75% Q3

104.5275

50% Median

20.6780

25% Q1

3.4685

10%

0.2500

5%

-1.9070

1%

-55.3600

0% Min

<.0001

-4854.1000

<.0001

TableA

11:43 Tuesday, October 19, 2010 15

The UNIVARIATE Procedure

Variable: ceq (Common/Ordinary Equity - Total)

Extreme Observations

Lowest

Value

Obs

Highest

Value

Obs

-4854.10 26865 45003.0 44033

-4191.00 42232 45003.0 54307

-3521.30 26868 45913.0 45587

-3435.31 28359 49447.6 10851

-2860.46 26852 57403.0 44273

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5386

9.89

100.00

TableA

11:43 Tuesday, October 19, 2010 16

The UNIVARIATE Procedure

Variable: ch (Cash)

Moments

N

43965 Sum Weights

43965

Mean

0.08665813 Sum Observations 3809.92477

Std Deviation

0.14590135 Variance

0.0212872

Skewness

3.27649122 Kurtosis

12.3953602

Uncorrected SS 1266.03161 Corrected SS

935.870649

Coeff Variation 168.364293 Std Error Mean

0.00069583

Basic Statistical Measures

Location

Mean

Variability

0.086658 Std Deviation

0.14590

Median 0.032748 Variance

0.02129

Mode

1.07692

0.000000 Range

Interquartile Range 0.07626

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

124.5385 Pr > |t|

21525.5 Pr >= |M| <.0001

4.6576E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.00000000

99%

0.77841342

95%

0.38677339

90%

0.22965226

75% Q3

0.08829021

50% Median

0.03274801

25% Q1

0.01203163

10%

0.00366084

5%

0.00130853

1%

0.00000000

0% Min

<.0001

-0.07692308

<.0001

TableA

11:43 Tuesday, October 19, 2010 17

The UNIVARIATE Procedure

Variable: ch (Cash)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

-0.0769231 38596

1 53541

-0.0691380 18944

1 53595

-0.0672190

6990

1 53622

-0.0608696 29549

1 53785

-0.0580912 19140

1 54304

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

10505

19.29

100.00

TableA

11:43 Tuesday, October 19, 2010 18

The UNIVARIATE Procedure

Variable: dlc (Debt in Current Liabilities - Total)

Moments

N

48865 Sum Weights

48865

Mean

197.028028 Sum Observations 9627774.57

Std Deviation

3486.18468 Variance

12153483.6

Skewness

38.7077827 Kurtosis

1833.92925

Uncorrected SS 5.95765E11 Corrected SS

5.93868E11

Coeff Variation 1769.38516 Std Error Mean

15.770717

Basic Statistical Measures

Location

Mean

Variability

197.0280 Std Deviation

Median

1.4310 Variance

Mode

0.0000 Range

3486

12153484

239250

Interquartile Range 10.25700

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

12.49328 Pr > |t|

20707 Pr >= |M| <.0001

4.2883E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

239249.693

99%

2024.050

95%

221.305

90%

70.364

75% Q3

10.397

50% Median

1.431

25% Q1

0.140

10%

0.000

5%

0.000

1%

0.000

0% Min

<.0001

-0.069

<.0001

TableA

11:43 Tuesday, October 19, 2010 19

The UNIVARIATE Procedure

Variable: dlc (Debt in Current Liabilities - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

-0.069 25421 171146 43680

0.000 54445 186839 46702

0.000 54326 193871 47643

0.000 54304 205413 44854

0.000 54299 239250 53083

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5605

10.29

100.00

TableA

11:43 Tuesday, October 19, 2010 20

The UNIVARIATE Procedure

Variable: dltt (Long-Term Debt - Total)

Moments

N

48936 Sum Weights

48936

Mean

239.821143 Sum Observations 11735887.4

Std Deviation

2104.45494 Variance

4428730.62

Skewness

56.2062408 Kurtosis

5298.77222

Uncorrected SS 2.19534E11 Corrected SS

2.1672E11

Coeff Variation 877.510181 Std Error Mean

9.51317308

Basic Statistical Measures

Location

Mean

Variability

239.8211 Std Deviation

Median

5.3815 Variance

Mode

0.0000 Range

2104

4428731

254878

Interquartile Range 55.31550

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

25.20937 Pr > |t|

<.0001

20451.5 Pr >= |M| <.0001

4.1827E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

254878.0000

99%

4148.0000

95%

848.4360

90%

343.2360

75% Q3

55.5815

50% Median

5.3815

25% Q1

0.2660

10%

0.0000

5%

0.0000

1%

0.0000

0% Min

0.0000

<.0001

TableA

11:43 Tuesday, October 19, 2010 21

The UNIVARIATE Procedure

Variable: dltt (Long-Term Debt - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

0 54445

73734 34407

0 54304

84950 26167

0 54299

93525 47643

0 54286 153021 34336

0 54284 254878 44854

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5534

10.16

100.00

TableA

11:43 Tuesday, October 19, 2010 22

The UNIVARIATE Procedure

Variable: intan (Intangible Assets - Total)

Moments

N

42724 Sum Weights

Mean

42724

0.05146364 Sum Observations 2198.73269

Std Deviation

Skewness

0.1156983 Variance

0.0133861

3.41741112 Kurtosis

13.6732423

Uncorrected SS 685.048974 Corrected SS

571.894179

Coeff Variation 224.815599 Std Error Mean

0.00055975

Basic Statistical Measures

Location

Mean

Variability

0.051464 Std Deviation

0.11570

Median 0.000000 Variance

0.01339

Mode

1.00000

0.000000 Range

Interquartile Range 0.04193

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

91.94106 Pr > |t|

<.0001

9929.5 Pr >= |M| <.0001

98599935 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.0000000

99%

0.5824305

95%

0.2959212

90%

0.1700758

75% Q3

0.0419297

50% Median

0.0000000

25% Q1

0.0000000

10%

0.0000000

5%

0.0000000

1%

0.0000000

0% Min

0.0000000

<.0001

TableA

11:43 Tuesday, October 19, 2010 23

The UNIVARIATE Procedure

Variable: intan (Intangible Assets - Total)

Extreme Observations

Lowest

Value

Obs

Highest

Value

Obs

0 54468 0.995769 29477

0 54445 0.996966 39459

0 54320 1.000000 27925

0 54289 1.000000 34263

0 54287 1.000000 50817

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

11746

21.56

100.00

TableA

11:43 Tuesday, October 19, 2010 24

The UNIVARIATE Procedure

Variable: invt (Inventories - Total)

Moments

N

47678 Sum Weights

47678

Mean

0.15644295 Sum Observations 7458.88707

Std Deviation

0.17247932 Variance

0.02974912

Skewness

1.12446274 Kurtosis

0.8106436

Uncorrected SS 2585.23897 Corrected SS

1418.34865

Coeff Variation 110.250619 Std Error Mean

0.00078991

Basic Statistical Measures

Location

Mean

Variability

0.156443 Std Deviation

0.17248

Median 0.096123 Variance

0.02975

Mode

1.00000

0.000000 Range

Interquartile Range 0.26391

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

198.0514 Pr > |t|

<.0001

18808.5 Pr >= |M| <.0001

3.5377E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.00000000

99%

0.67149447

95%

0.48925529

90%

0.40503109

75% Q3

0.26829283

50% Median

0.09612306

25% Q1

0.00438232

10%

0.00000000

5%

0.00000000

1%

0.00000000

0% Min

0.00000000

<.0001

TableA

11:43 Tuesday, October 19, 2010 25

The UNIVARIATE Procedure

Variable: invt (Inventories - Total)

Extreme Observations

Lowest

Value

Obs

Highest

Value

Obs

0 54445 0.970139 52978

0 54307 0.985981 35235

0 54304 0.990741 26605

0 54289 0.993458 19662

0 54280 1.000000 38678

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

6792

12.47

100.00

TableA

11:43 Tuesday, October 19, 2010 26

The UNIVARIATE Procedure

Variable: ivaeq (Investment and Advances - Equity)

Moments

N

44888 Sum Weights

44888

Mean

0.01300366 Sum Observations 583.708083

Std Deviation

0.05909414 Variance

0.00349212

Skewness

9.02619504 Kurtosis

104.620186

Uncorrected SS

164.34103 Corrected SS

Coeff Variation 454.442552 Std Error Mean

156.750691

0.00027892

Basic Statistical Measures

Location

Mean

Variability

0.013004 Std Deviation

0.05909

Median 0.000000 Variance

0.00349

Mode

1.05738

0.000000 Range

Interquartile Range

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

46.62149 Pr > |t|

4328.5 Pr >= |M| <.0001

18887271 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.0000000

99%

0.2640604

95%

0.0654617

90%

0.0255321

75% Q3

0.0000000

50% Median

0.0000000

25% Q1

0.0000000

10%

0.0000000

5%

0.0000000

1%

0.0000000

0% Min

<.0001

-0.0573831

<.0001

TableA

11:43 Tuesday, October 19, 2010 27

The UNIVARIATE Procedure

Variable: ivaeq (Investment and Advances - Equity)

Extreme Observations

Lowest

Value

Highest

Obs

Value

Obs

-0.0573831 18946 0.998374 46681

-0.0515972

4616 0.998912 38453

-0.0374142 38839 1.000000

5419

-0.0364532 17914 1.000000 12449

-0.0332787 52303 1.000000 28084

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

9582

17.59

100.00

TableA

11:43 Tuesday, October 19, 2010 28

The UNIVARIATE Procedure

Variable: ivao (Investment and Advances - Other)

Moments

N

46392 Sum Weights

46392

Mean

0.07325525 Sum Observations 3398.45763

Std Deviation

0.18252686 Variance

0.03331606

Skewness

3.35507639 Kurtosis

11.3166617

Uncorrected SS 1794.52004 Corrected SS

1545.56517

Coeff Variation

0.00084743

249.16557 Std Error Mean

Basic Statistical Measures

Location

Mean

Variability

0.073255 Std Deviation

0.18253

Median 0.000000 Variance

0.03332

Mode

1.00183

0.000000 Range

Interquartile Range 0.03685

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

86.44373 Pr > |t|

10254 Pr >= |M| <.0001

1.0517E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.00000000

99%

0.94607188

95%

0.48006431

90%

0.23145933

75% Q3

0.03685387

50% Median

0.00000000

25% Q1

0.00000000

10%

0.00000000

5%

0.00000000

1%

0.00000000

0% Min

<.0001

-0.00183007

<.0001

TableA

11:43 Tuesday, October 19, 2010 29

The UNIVARIATE Procedure

Variable: ivao (Investment and Advances - Other)

Extreme Observations

Lowest

Value

Highest

Obs

Value

Obs

-0.00183007 38658 0.999984 19611

0.00000000 54468 1.000000 20037

0.00000000 54467 1.000000 34770

0.00000000 54330 1.000000 36852

0.00000000 54304 1.000000 45133

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

8078

14.83

100.00

TableA

11:43 Tuesday, October 19, 2010 30

The UNIVARIATE Procedure

Variable: ivst (Short-Term Investments - Total)

Moments

N

43872 Sum Weights

43872

Mean

0.05026118 Sum Observations 2205.05837

Std Deviation

0.11979608 Variance

0.0143511

Skewness

3.65401164 Kurtosis

15.6592529

Uncorrected SS 740.425933 Corrected SS

629.597103

Coeff Variation 238.347135 Std Error Mean

0.00057194

Basic Statistical Measures

Location

Mean

Variability

0.050261 Std Deviation

0.11980

Median 0.000000 Variance

0.01435

Mode

1.00690

0.000000 Range

Interquartile Range 0.03686

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

87.87873 Pr > |t|

9220.5 Pr >= |M| <.0001

85074763 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.0000000

99%

0.6200585

95%

0.2929278

90%

0.1622254

75% Q3

0.0368558

50% Median

0.0000000

25% Q1

0.0000000

10%

0.0000000

5%

0.0000000

1%

0.0000000

0% Min

<.0001

-0.0069002

<.0001

TableA

11:43 Tuesday, October 19, 2010 31

The UNIVARIATE Procedure

Variable: ivst (Short-Term Investments - Total)

Extreme Observations

Lowest

Value

Highest

Obs

Value

Obs

-6.90020E-03 19931 0.987034 18847

-1.40825E-04

1153 0.988889 46975

-1.01881E-05

1542 1.000000 20803

0.00000E+00 54468 1.000000 27398

0.00000E+00 54467 1.000000 33968

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

10598

19.46

100.00

TableA

11:43 Tuesday, October 19, 2010 32

The UNIVARIATE Procedure

Variable: lco (Current Liabilities - Other - Total)

Moments

N

45932 Sum Weights

45932

Mean

54.5609773 Sum Observations

Std Deviation

386.140868 Variance

149104.77

29.449044 Kurtosis

1342.20754

Skewness

2506094.81

Uncorrected SS 6985266156 Corrected SS

6848531174

Coeff Variation 707.723518 Std Error Mean

1.80172328

Basic Statistical Measures

Location

Mean

Variability

54.56098 Std Deviation

Median

2.52450 Variance

Mode

0.00000 Range

386.14087

149105

26191

Interquartile Range

14.58000

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

30.28266 Pr > |t|

21414 Pr >= |M| <.0001

4.5861E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

26191.0000

99%

983.9870

95%

181.7030

90%

72.5940

75% Q3

15.0130

50% Median

2.5245

25% Q1

0.4330

10%

0.0470

5%

0.0000

1%

0.0000

0% Min

<.0001

-0.1360

<.0001

TableA

11:43 Tuesday, October 19, 2010 33

The UNIVARIATE Procedure

Variable: lco (Current Liabilities - Other - Total)

Extreme Observations

Lowest

Value

Obs

Highest

Value

Obs

-14E-2 23491 15712.0 33459

0.E+00 54304 18695.7 34467

0.E+00 54263 19750.0 44912

0.E+00 54222 23471.1 26331

0.E+00 54213 26191.0 44959

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

8538

15.67

100.00

TableA

11:43 Tuesday, October 19, 2010 34

The UNIVARIATE Procedure

Variable: lct (Current Liabilities - Total)

Moments

N

43351 Sum Weights

43351

Mean

159.623557 Sum Observations 6919840.82

Std Deviation

1474.73397 Variance

2174840.28

Skewness

57.4866756 Kurtosis

4442.36891

Uncorrected SS 9.53839E10 Corrected SS

9.42793E10

Coeff Variation 923.882413 Std Error Mean

7.08294916

Basic Statistical Measures

Location

Mean

Median

Variability

159.6236 Std Deviation

1475

10.2870 Variance

Mode

2174840

0.0000 Range

141579

Interquartile Range 46.52600

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

22.53631 Pr > |t|

<.0001

21646 Pr >= |M| <.0001

4.6856E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

141579.000

99%

2705.053

95%

542.900

90%

221.535

75% Q3

48.961

50% Median

10.287

25% Q1

2.435

10%

0.674

5%

0.302

1%

0.043

0% Min

0.000

<.0001

TableA

11:43 Tuesday, October 19, 2010 35

The UNIVARIATE Procedure

Variable: lct (Current Liabilities - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

.0 54067

82001 34456

.0 53595

93022 26319

.0 52590 101601 41034

.0 52241 126812 50199

.0 52169 141579 44950

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

11119

20.41

100.00

TableA

11:43 Tuesday, October 19, 2010 36

The UNIVARIATE Procedure

Variable: lo (Liabilities - Other - Total)

Moments

N

48803 Sum Weights

48803

Mean

209.344965 Sum Observations 10216662.3

Std Deviation

3371.27751 Variance

11365512

Skewness

37.0586834 Kurtosis

1844.16495

Uncorrected SS 5.56799E11 Corrected SS

5.5466E11

Coeff Variation 1610.39341 Std Error Mean

15.2605871

Basic Statistical Measures

Location

Mean

Variability

209.3450 Std Deviation

Median

0.0670 Variance

Mode

0.0000 Range

3371

11365512

244141

Interquartile Range

4.56000

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

13.71802 Pr > |t|

13014.5 Pr >= |M| <.0001

1.6952E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

243391.365

99%

2450.067

95%

215.090

90%

55.010

75% Q3

4.560

50% Median

0.067

25% Q1

0.000

10%

0.000

5%

0.000

1%

0.000

0% Min

<.0001

-750.000

<.0001

TableA

11:43 Tuesday, October 19, 2010 37

The UNIVARIATE Procedure

Variable: lo (Liabilities - Other - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

-7.5E+02 29184 186607 44533

-6.0E+02 43281 192664 53538

-1.1E+01 42860 192769 53981

-9.1E+00 32496 216169 50391

-2.5E+00 13947 243391 54047

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5667

10.40

100.00

TableA

11:43 Tuesday, October 19, 2010 38

The UNIVARIATE Procedure

Variable: lt (Liabilities - Total)

Moments

N

48995 Sum Weights

48995

Mean

1042.22344 Sum Observations 51063737.4

Std Deviation

9273.55451 Variance

85998813.3

Skewness

29.0645046 Kurtosis

1236.28607

Uncorrected SS 4.26665E12 Corrected SS

4.21343E12

Coeff Variation 889.785642 Std Error Mean

41.8957865

Basic Statistical Measures

Location

Mean

Variability

1042.223 Std Deviation

Median

Mode

9274

26.411 Variance

85998813

0.000 Range

625793

Interquartile Range 198.78400

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

24.87657 Pr > |t|

<.0001

24475.5 Pr >= |M| <.0001

5.9906E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

625793.000

99%

16406.000

95%

2899.656

90%

1154.121

75% Q3

50% Median

203.545

26.411

25% Q1

4.761

10%

1.195

5%

0.525

1%

0.072

0% Min

0.000

<.0001

TableA

11:43 Tuesday, October 19, 2010 39

The UNIVARIATE Procedure

Variable: lt (Liabilities - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

.0 53595 321051 44486

.0 52590 341487 44455

.0 52241 469561 44854

.0 52169 571741 45587

.0 49520 625793 44533

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5475

10.05

100.00

TableA

11:43 Tuesday, October 19, 2010 40

The UNIVARIATE Procedure

Variable: mib (Minority Interest (Balance Sheet))

Moments

N

46299 Sum Weights

46299

Mean

5.94089516 Sum Observations 275057.505

Std Deviation

77.2255995 Variance

5963.79321

Skewness

29.5585851 Kurtosis

1131.96769

Uncorrected SS 277745786 Corrected SS

276111698

Coeff Variation 1299.89837 Std Error Mean

0.35890167

Basic Statistical Measures

Location

Mean

Variability

5.940895 Std Deviation

77.22560

Median 0.000000 Variance

5964

Mode

4283

0.000000 Range

Interquartile Range

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

p Value

16.55299 Pr > |t|

Signed Rank S

2952.5 Pr >= |M| <.0001

8979622 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

4275.000

99%

115.000

95%

4.409

90%

0.272

75% Q3

0.000

50% Median

0.000

25% Q1

0.000

10%

0.000

5%

0.000

1%

0.000

0% Min

<.0001

-8.000

<.0001

TableA

11:43 Tuesday, October 19, 2010 41

The UNIVARIATE Procedure

Variable: mib (Minority Interest (Balance Sheet))

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

-8E0 38671 3633.6 49301

-6E0 43472 3705.0 45482

-42E-1 50475 3724.0 44033

-36E-1 52626 3724.0 54307

-2E0 43321 4275.0 44950

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

8171

15.00

100.00

TableA

11:43 Tuesday, October 19, 2010 42

The UNIVARIATE Procedure

Variable: ppent (Property, Plant and Equipment - Total (Net))

Moments

N

48422 Sum Weights

48422

Mean

0.30848698 Sum Observations 14937.5567

Std Deviation

0.25925473 Variance

0.06721302

Skewness

0.79338392 Kurtosis

-0.3809929

Uncorrected SS 7862.56318 Corrected SS

3254.52141

Coeff Variation

0.00117816

84.040736 Std Error Mean

Basic Statistical Measures

Location

Mean

Variability

0.308487 Std Deviation

0.25925

Median 0.243806 Variance

0.06721

Mode

1.00000

0.000000 Range

Interquartile Range 0.37320

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

261.8373 Pr > |t|

<.0001

23507 Pr >= |M| <.0001

5.5259E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.00000000

99%

0.93065841

95%

0.83620489

90%

0.73258980

75% Q3

0.46674404

50% Median

0.24380588

25% Q1

0.09354892

10%

0.01842385

5%

0.00743699

1%

0.00000000

0% Min

0.00000000

<.0001

TableA

11:43 Tuesday, October 19, 2010 43

The UNIVARIATE Procedure

Variable: ppent (Property, Plant and Equipment - Total (Net))

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

.0 54304

1 28958

.0 54209

1 50266

.0 54198

1 51879

.0 54069

1 51887

.0 54047

1 54253

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

6048

11.10

100.00

TableA

11:43 Tuesday, October 19, 2010 44

The UNIVARIATE Procedure

Variable: pstk (Preferred/Preference Stock (Capital) - Total)

Moments

N

49090 Sum Weights

49090

Mean

11.2062487 Sum Observations

Std Deviation

77.0391365 Variance

5935.02855

Skewness

16.2108279 Kurtosis

401.346592

550114.75

Uncorrected SS 297509339 Corrected SS

291344617

Coeff Variation 687.465881 Std Error Mean

0.34770817

Basic Statistical Measures

Location

Mean

Variability

11.20625 Std Deviation

77.03914

Median

0.00000 Variance

5935

Mode

0.00000 Range

3072

Interquartile Range

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

32.22889 Pr > |t|

5525.5 Pr >= |M| <.0001

30541041 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

3071.0000

99%

291.8060

95%

33.3200

90%

5.2375

75% Q3

0.0000

50% Median

0.0000

25% Q1

0.0000

10%

0.0000

5%

0.0000

1%

0.0000

0% Min

<.0001

-1.0020

<.0001

TableA

11:43 Tuesday, October 19, 2010 45

The UNIVARIATE Procedure

Variable: pstk (Preferred/Preference Stock (Capital) - Total)

Extreme Observations

Lowest

Value

Obs

Highest

Value

Obs

-1E0 28408 2623.00 33594

0.E+00 54468 2650.00 33851

0.E+00 54445 2807.00 47643

0.E+00 54330 2995.78

4404

0.E+00 54307 3071.00 33888

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5380

9.88

100.00

TableA

11:43 Tuesday, October 19, 2010 46

The UNIVARIATE Procedure

Variable: rect (Receivables - Total)

Moments

N

47298 Sum Weights

47298

Mean

0.21729597 Sum Observations 10277.6649

Std Deviation

0.18496127 Variance

0.03421067

Skewness

1.35268638 Kurtosis

1.9093828

Uncorrected SS 3851.35732 Corrected SS

1618.06214

Coeff Variation 85.1195121 Std Error Mean

0.00085047

Basic Statistical Measures

Location

Mean

Variability

0.217296 Std Deviation

0.18496

Median 0.180031 Variance

0.03421

Mode

1.00000

0.000000 Range

Interquartile Range 0.21632

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

255.5008 Pr > |t|

<.0001

22996.5 Pr >= |M| <.0001

5.2885E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

1.00000000

99%

0.83030361

95%

0.61808183

90%

0.47621654

75% Q3

0.29403307

50% Median

0.18003065

25% Q1

0.07771563

10%

0.02395106

5%

0.00772583

1%

0.00000000

0% Min

0.00000000

<.0001

TableA

11:43 Tuesday, October 19, 2010 47

The UNIVARIATE Procedure

Variable: rect (Receivables - Total)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

.0 54304

1 37799

.0 54289

1 45804

.0 54272

1 48203

.0 54265

1 54198

.0 54261

1 54209

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

7172

13.17

100.00

TableA

11:43 Tuesday, October 19, 2010 48

The UNIVARIATE Procedure

Variable: seq (Stockholders' Equity - Total)

Moments

N

48695 Sum Weights

48695

Mean

270.887662 Sum Observations 13190874.7

Std Deviation

1322.21636 Variance

1748256.11

Skewness

16.6675593 Kurtosis

432.860652

Uncorrected SS 8.87028E10 Corrected SS

8.51296E10

Coeff Variation 488.105052 Std Error Mean

5.99184186

Basic Statistical Measures

Location

Mean

Median

Variability

270.8877 Std Deviation

1322

21.8330 Variance

Mode

1748256

0.0000 Range

62179

Interquartile Range 105.18800

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

45.20941 Pr > |t|

21112 Pr >= |M| <.0001

5.5138E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

57403.000

99%

4792.000

95%

1128.300

90%

482.964

75% Q3

109.190

50% Median

21.833

25% Q1

4.002

10%

0.515

5%

-0.529

1%

-42.486

0% Min

<.0001

-4775.600

<.0001

TableA

11:43 Tuesday, October 19, 2010 49

The UNIVARIATE Procedure

Variable: seq (Stockholders' Equity - Total)

Extreme Observations

Lowest

Value

Obs

Highest

Value

Obs

-4.8E+03 26865 45003.0 44033

-4.2E+03 42232 45003.0 54307

-3.5E+03 26868 45938.0 45587

-3.3E+03 28359 51407.3 10851

-2.9E+03 26852 57403.0 44273

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

5775

10.60

100.00

TableA

11:43 Tuesday, October 19, 2010 50

The UNIVARIATE Procedure

Variable: txditc (Deferred Taxes and Investment Tax Credit)

Moments

N

45602 Sum Weights

45602

Mean

44.7961609 Sum Observations

2042794.53

Std Deviation

318.433423 Variance

101399.845

Skewness

18.9298463 Kurtosis

578.730872

Uncorrected SS 4715443673 Corrected SS

4623934320

Coeff Variation 710.849805 Std Error Mean

1.49116843

Basic Statistical Measures

Location

Mean

Variability

44.79616 Std Deviation

Median

0.00000 Variance

Mode

0.00000 Range

318.43342

101400

17652

Interquartile Range

2.75400

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

30.04098 Pr > |t|

11299.5 Pr >= |M| <.0001

1.2784E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

Estimate

100% Max

17641.301

99%

986.000

95%

138.893

90%

35.900

75% Q3

2.754

50% Median

0.000

25% Q1

0.000

10%

0.000

5%

0.000

1%

0.000

0% Min

<.0001

-10.258

<.0001

TableA

11:43 Tuesday, October 19, 2010 51

The UNIVARIATE Procedure

Variable: txditc (Deferred Taxes and Investment Tax Credit)

Extreme Observations

Lowest

Value

Obs

Highest

Value

Obs

-1.E+01 20933 11042.0 18963

-9.E+00 26938 12431.0 34304

-6.E+00 26568 12568.0 26128

-2.E+00 29581 13142.0 44830

-4.E-01 47869 17641.3 10851

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

8868

16.28

100.00

TableA

11:43 Tuesday, October 19, 2010 52

The UNIVARIATE Procedure

Variable: txp (Income Taxes Payable)

Moments

N

45503 Sum Weights

Mean

45503

9.8934763 Sum Observations 450182.852

Std Deviation

83.4471557 Variance

6963.4278

Skewness

24.0574611 Kurtosis

758.589653

Uncorrected SS 321303765 Corrected SS

316849892

Coeff Variation 843.456367 Std Error Mean

0.3911934

Basic Statistical Measures

Location

Mean

Variability

9.893476 Std Deviation

83.44716

Median 0.016000 Variance

6963

Mode

4114

0.000000 Range

Interquartile Range

1.18400

Tests for Location: Mu0=0

Test

Statistic

Student's t

Sign

Signed Rank S

p Value

25.2905 Pr > |t|

11904 Pr >= |M| <.0001

1.4296E8 Pr >= |S|

Quantiles (Definition 5)

Quantile

100% Max

Estimate

3959.600

99%

183.415

95%

28.639

90%

9.314

75% Q3

1.184

50% Median

0.016

25% Q1

0.000

10%

0.000

5%

0.000

1%

0.000

0% Min

<.0001

-154.600

<.0001

TableA

11:43 Tuesday, October 19, 2010 53

The UNIVARIATE Procedure

Variable: txp (Income Taxes Payable)

Extreme Observations

Lowest

Value

Highest

Obs Value

Obs

-1.5E+02 32279 3159.0 26689

-1.5E+02 28433 3218.0 14346

-5.3E+01 33428 3231.6 34467

-3.1E+01 34748 3415.0 44950

-2.6E+01 22085 3959.6 26331

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

8967

16.46

100.00

TableA

11:43 Tuesday, October 19, 2010 54

The UNIVARIATE Procedure

Variable: Naicsh

Missing Values

Percent Of

Missing

Missing

Value Count All Obs

Obs

.

54470

100.00

100.00

You might also like

- United States Census Figures Back to 1630From EverandUnited States Census Figures Back to 1630No ratings yet

- Data SetDocument16 pagesData SetKibegwa MoriaNo ratings yet

- Inflasi ARIMA ModelDocument7 pagesInflasi ARIMA ModelAnto TomodachiRent SusiloNo ratings yet

- TheisMatchFt ComDocument21 pagesTheisMatchFt ComBarbu IonelNo ratings yet

- 2008 Harsh KadamDocument54 pages2008 Harsh KadamhiremeNo ratings yet

- 0903 Abdul BasitDocument4 pages0903 Abdul BasitMR ANo ratings yet

- Tugas 1 Trial and Error-Qori Aina Indrianti MTK2Document4 pagesTugas 1 Trial and Error-Qori Aina Indrianti MTK2qoriainaNo ratings yet

- Autocorrelation Function: AmountDocument3 pagesAutocorrelation Function: AmountMuh AkilNo ratings yet

- Analisi Saham JII (BRIS, TLKM, UNVR)Document9 pagesAnalisi Saham JII (BRIS, TLKM, UNVR)Alfia safraocNo ratings yet

- Regression StatisticsDocument2 pagesRegression StatisticsprabindraNo ratings yet

- BT 3Document8 pagesBT 3Linh VuNo ratings yet

- Ass No 4Document10 pagesAss No 4Muhammad Bilal MakhdoomNo ratings yet

- DD444Document5 pagesDD444Alejandro Moral ArandaNo ratings yet

- X Variable 1 Residual PlotDocument7 pagesX Variable 1 Residual PlotjagramanNo ratings yet

- BoojbooooDocument1 pageBoojbooooAyron Yasser Aspiazu FanolaNo ratings yet

- Nested Anova RevisedDocument6 pagesNested Anova RevisedRanjeet Dongre100% (1)

- Y Ssa Da La Y-Predict Et Error E 2 Et-E (T-1)Document3 pagesY Ssa Da La Y-Predict Et Error E 2 Et-E (T-1)Chirag GujralNo ratings yet

- 2 Entrega - GabaritoDocument21 pages2 Entrega - GabaritoÁlvaro Amitai Livramento SantosNo ratings yet

- Book1 XlsxuuuDocument9 pagesBook1 XlsxuuuKenn SenadosNo ratings yet

- Jindal Aluminium DoorDocument921 pagesJindal Aluminium DoorRajat KoleyNo ratings yet

- Y X X X: 11.36 Data For BiomarkersDocument3 pagesY X X X: 11.36 Data For BiomarkersReenam SalujaNo ratings yet

- (Output) Obs Q L KDocument7 pages(Output) Obs Q L KHồ Phi PhụngNo ratings yet

- 300 Kelvin After Reached EqulibriumDocument3 pages300 Kelvin After Reached EqulibriumNavin Kumar (B21MT022)No ratings yet

- Chart Title: Datos de Elv para Metiletilcetona (1) /tolueno (2) A 50°C P (Kpa) Y1 Y2 Ge/Rt Ge/X1X2Rt X YDocument6 pagesChart Title: Datos de Elv para Metiletilcetona (1) /tolueno (2) A 50°C P (Kpa) Y1 Y2 Ge/Rt Ge/X1X2Rt X YanomimoNo ratings yet

- Datos de EjemploDocument6 pagesDatos de EjemploanomimoNo ratings yet

- Chart Title: Datos de Elv para Metiletilcetona (1) /tolueno (2) A 50°C P (Kpa) Y1 Y2 Ge/Rt Ge/X1X2Rt X YDocument6 pagesChart Title: Datos de Elv para Metiletilcetona (1) /tolueno (2) A 50°C P (Kpa) Y1 Y2 Ge/Rt Ge/X1X2Rt X YanomimoNo ratings yet

- N1 2256 Tr/min (40HZ) : PR Opt (W) Popt (Pa)Document3 pagesN1 2256 Tr/min (40HZ) : PR Opt (W) Popt (Pa)Khene Mohamed LamineNo ratings yet

- U:Magnitude PI: COLUMN-1 N: 49Document4 pagesU:Magnitude PI: COLUMN-1 N: 49Varun Singh ChandelNo ratings yet

- Pertemuan 8 SPSSDocument4 pagesPertemuan 8 SPSSnabbila agustinNo ratings yet

- Date TLKM Ihsg Return: Regression StatisticsDocument4 pagesDate TLKM Ihsg Return: Regression StatisticsKojiro FuumaNo ratings yet

- Proiect 2003Document10 pagesProiect 2003Cristian TerescuNo ratings yet

- Ejercicios Mercado de Trabajo Carlos Flores TapullimaDocument17 pagesEjercicios Mercado de Trabajo Carlos Flores TapullimaCARLOS ZEHIR FLORES TAPULLIMANo ratings yet

- Shelf Location Residual PlotDocument16 pagesShelf Location Residual PlotVikram VishwanathNo ratings yet

- ECM Lampiran 1 DataDocument12 pagesECM Lampiran 1 DataDevi SantikasariNo ratings yet

- Safa WatDocument5 pagesSafa WatSafawat GaniNo ratings yet

- Summary Output: Multiple R R Square Adjusted R Square Standard Error Observations Anova Regression Residual TotalDocument12 pagesSummary Output: Multiple R R Square Adjusted R Square Standard Error Observations Anova Regression Residual Totalabdikarim_omarNo ratings yet

- Spreadsheets To Eurocode 2: M:N Interaction Chart For 800 X 1,000 Section, Grade 40 ConcreteDocument7 pagesSpreadsheets To Eurocode 2: M:N Interaction Chart For 800 X 1,000 Section, Grade 40 ConcreteAnbalaganVNo ratings yet

- Regression Statistics: Summary OutputDocument10 pagesRegression Statistics: Summary OutputDheeraj SahuNo ratings yet

- MAKSI - Khoirunisa Arifah - MAT 37 BDocument7 pagesMAKSI - Khoirunisa Arifah - MAT 37 BKhoirunisa ArifahNo ratings yet

- Analisis Sismo y DiseñoDocument23 pagesAnalisis Sismo y DiseñomontezaedyNo ratings yet

- Book 1Document60 pagesBook 1Evi diah phitalokANo ratings yet

- LM01 L1TP 040030 19720929 20200330 02 T2 GCPDocument19 pagesLM01 L1TP 040030 19720929 20200330 02 T2 GCPone GooglerNo ratings yet

- Regression Statistics: Respingem Si Avem Valori HeteroscedasticeDocument71 pagesRegression Statistics: Respingem Si Avem Valori HeteroscedasticeVlad StefanNo ratings yet

- Galimi ModeliaiDocument4 pagesGalimi ModeliaiInga BaranauskaitėNo ratings yet

- Cuadro 1. Isotermas de Adsorción-GAB: #AW % Humedad DireccionDocument18 pagesCuadro 1. Isotermas de Adsorción-GAB: #AW % Humedad DireccionJarise Laban CastilloNo ratings yet

- N XN Yn 0.1 (Tn-Yn) SOL. ANALITICA ERRORDocument9 pagesN XN Yn 0.1 (Tn-Yn) SOL. ANALITICA ERRORRamiro HuacalloNo ratings yet

- FsDocument5 pagesFsPhellypeNo ratings yet

- Reinforcement Brs TablesDocument5 pagesReinforcement Brs TablesPhanendra Kumar AttadaNo ratings yet

- Area Final2Document1 pageArea Final2Nadikak KomangodageNo ratings yet

- X (M Cell/l) vs. Time (S) : Column BDocument3 pagesX (M Cell/l) vs. Time (S) : Column BHeather FongNo ratings yet

- Mayli Econometria Exa FinalDocument13 pagesMayli Econometria Exa Finalzenia mayli coras de la cruzNo ratings yet

- 1 Entrega ComentadaDocument17 pages1 Entrega ComentadaÁlvaro Amitai Livramento SantosNo ratings yet

- Observations and CalculationsDocument14 pagesObservations and Calculationssagarchawla13No ratings yet

- Assignment 3 Machine DesignDocument3 pagesAssignment 3 Machine DesignMuhammad FarhalNo ratings yet

- KuisDocument4 pagesKuisRima RasidaNo ratings yet

- CalculationsDocument7 pagesCalculationsVivek SinghNo ratings yet

- Bending LabDocument17 pagesBending LabAshley BillNo ratings yet

- Safawat Gani ID 22305012 ECO 303 AssignmentDocument5 pagesSafawat Gani ID 22305012 ECO 303 AssignmentSafawat GaniNo ratings yet

- PT Bank Mitraniaga TBKDocument35 pagesPT Bank Mitraniaga TBKannisa mNo ratings yet

- Concept of SamplingDocument20 pagesConcept of SamplingVishnupriyaNo ratings yet

- The Student T Distribution and Its Use: James H. SteigerDocument36 pagesThe Student T Distribution and Its Use: James H. SteigerZvonko TNo ratings yet

- Chapter 7. Sampling Distributions and Point Estimation of ParamatersDocument75 pagesChapter 7. Sampling Distributions and Point Estimation of ParamatersNguyen Tuan Hiep (K14HL)No ratings yet

- 4.06 Z - TestDocument2 pages4.06 Z - Testsumit6singhNo ratings yet

- Statistics and Probability: Senior High SchoolDocument43 pagesStatistics and Probability: Senior High SchoolRegie CarinoNo ratings yet

- 3 - Principles of Data ReductionDocument14 pages3 - Principles of Data Reductionlucy heartfiliaNo ratings yet

- Stat - Inference IIDocument28 pagesStat - Inference IIhello everyoneNo ratings yet

- Statistic and Probability - q4 - Amor, Andrei B. - F. BaltazarDocument19 pagesStatistic and Probability - q4 - Amor, Andrei B. - F. BaltazarMa. Salvacion AbellaNo ratings yet

- LESSON 7 Parameter and StatisticDocument34 pagesLESSON 7 Parameter and StatisticlagunzadjidNo ratings yet

- SAS Chapter 10Document5 pagesSAS Chapter 10mihirhotaNo ratings yet

- Test Bank For Statistics For Managers Using Microsoft Excel 7 e 7th Edition David M Levine David F Stephan Kathryn A SzabatDocument24 pagesTest Bank For Statistics For Managers Using Microsoft Excel 7 e 7th Edition David M Levine David F Stephan Kathryn A Szabatvickiemartinezxqwpdcybji100% (32)

- Introduction of StatisticsDocument81 pagesIntroduction of StatisticsMidhat SaleemNo ratings yet

- Chapter 9 Tools: Z Test Statistic for a Hypothesis Test of the Population Mean (when σ is known)Document5 pagesChapter 9 Tools: Z Test Statistic for a Hypothesis Test of the Population Mean (when σ is known)Sean CallahanNo ratings yet

- Module 5 Random Sampling For StudentsDocument21 pagesModule 5 Random Sampling For StudentsJohn Marvin D AmilNo ratings yet

- Sheet 1Document3 pagesSheet 1Menna Elsaoudy100% (1)

- Chapter-04: Measures of Central TendencyDocument71 pagesChapter-04: Measures of Central TendencySamir SiddiqueNo ratings yet

- BS Chap 1 MCQDocument29 pagesBS Chap 1 MCQChinmay Sirasiya (che3kuu)No ratings yet

- Descriptive Statistics & DataDocument215 pagesDescriptive Statistics & DataVicky GuptaNo ratings yet

- ParameterDocument3 pagesParameterRahul RajNo ratings yet

- Bsafc6 Tif Ch01 Q1-38Document10 pagesBsafc6 Tif Ch01 Q1-38Katrina Lei100% (1)

- Sample VS. Population: in Statistics We Commonly Use The Terms Population and SampleDocument6 pagesSample VS. Population: in Statistics We Commonly Use The Terms Population and SampleLots KieNo ratings yet

- An Analysis of The Java RatioDocument3 pagesAn Analysis of The Java RatioJOSE TORINNo ratings yet

- UNIT 1-Module 1-TeachingDocument26 pagesUNIT 1-Module 1-TeachingMachel AlexanderNo ratings yet

- J. K. Shah Classes Sampling Theory and Theory of EstimationDocument37 pagesJ. K. Shah Classes Sampling Theory and Theory of EstimationGautamNo ratings yet

- UNIT 1-Module 1Document39 pagesUNIT 1-Module 1Machel AlexanderNo ratings yet

- Sampling Notes Part 01Document13 pagesSampling Notes Part 01rahulNo ratings yet

- Statistics & Probability Q3 - Week 5-6Document16 pagesStatistics & Probability Q3 - Week 5-6Rayezeus Jaiden Del RosarioNo ratings yet

- CHAPTER III Sampling and Sampling DistributionDocument51 pagesCHAPTER III Sampling and Sampling DistributionMaricris Jagto-calixtoNo ratings yet

- Chapter 3Document16 pagesChapter 3Dayanat Aliyev50% (2)