Professional Documents

Culture Documents

Indo 2008 07 BTN

Uploaded by

Arsitek Tropis0 ratings0% found this document useful (0 votes)

12 views14 pagesOriginal Title

indo_2008_07_btn

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

DOC, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

12 views14 pagesIndo 2008 07 BTN

Uploaded by

Arsitek TropisCopyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as DOC, PDF, TXT or read online from Scribd

You are on page 1of 14

Dubai International Award

for Best Practices

to Improve the Living Environment

NARATIVE REPORTING FORMAT

7

th

CYCLE - YEAR 2008

PT BANK TABUNGAN NEGARA (PERSERO)

Jl. Gadjahmada No.1 Harmoni

Jakarta Pusat, 10130

Indonesia

Page 1

Annex I: BEST PRACTICES REPORTING FORMAT

1. a) Name of the Best Practice : Affordable Housing for Middle to Lower

Income Group In Indonesia

b) City/Town : Nation Wide

c) Country : Indonesia

d) Region : Asia & Pacific

e) Has this initiative been submitted previously? NO

2. Address of the Best Practice

Name oI the Organization : PT Bank Tabungan Negara (Persero)

Street : 1l. Gadjahmada No.1 Harmoni

P.O. Box : --

City/Town : 1akarta Pusat

Postal Code : 10130

Country : Indonesia

Telephone number : +62216336789

Fax number : +62216346704

Email addresses : webadminbtn.co.id

3. Contact Person : Iqbal Latanro (Direktur Utama / CEO)

4. Type oI Organisation: Others, Commercial Banking

5. The Nominating Organisation (only iI diIIerent Irom above).

---

6. The Partners

Partner 1

a) Name oI Organisation : PT CAHAYA BUMI PRATAMA

b) Address oI the Organisation : 1l. Industri Raya Cikarang No.2

Cikarang Utara, 1awa Barat, Indonesia

Postal Code : 17530

Telephone : +622170219902-03

c) Contact Person : H. DASUKI RAHMAN

d) Type oI Organisation : Others, Developer

e) Type oI Support : Financial Support

Partner 2

a) Name oI Organisation : PT. PERSADA 1AYA ARTHA

b) Address oI the Organisation : 1l. Mandar XIX Blok DF6 No.7

Bintaro, 1akarta Selatan, Indonesia

Telephone : +62217376568, +622159450666

Facsimile : +62217372888

c) Contact Person : IR. HARI1ONO HINDRAD1A1A / TOMI / NANA

d) Type oI Organisation : Others, Developer

e) Type oI Support : Financial Support

Page 2

Partner 3

a) Name oI Organisation : PT KARYA GRAHA CEMERLANG

b) Address oI the Organisation : 1l. Tanjung Duren Selatan No.1

Gedung Tomang Tol Lantai 2

1akarta Barat, Indonesia

Telephone : +62215636913 / +622156942191

c) Contact Person : ERNA

d) Type oI Organisation : Others, Developer

e) Type oI Support : Financial Support

Partner 4

a) Name oI Organisation : PT ISPI PRATAMA LESTARI PERKASA

b) Address oI the Organisation : 1l. Boulevard Artha Gading Blok C15-16

1akarta Utara

Telephone : +62214527777

c) Contact Person : REMMY KOHAR

d) Type oI Organisation : Others, Developer

e) Type oI Support : Financial Support

Partner 5

a) Name oI Organisation : PT BEKASI ASRI PEMULA

b) Address oI the Organisation : 1l. Duren Tiga No.18

1akarta Selatan

Telephone : +62217975955

c) Contact Person : AGUSTINUS ATMADI

d) Type oI Organisation : Others, Developer

e) Type oI Support : Financial Support

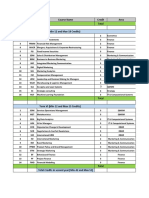

7. Financial Profile

(in million $)

No Partner Year 2004 Year 2005 Year 2006 Year 2007 TOTAL

1 PT Cahaya Bumi Pratama 33.71% 6.01

2 Persada Jaya Artha, PT 42.62% 48.39% 39.29% 15.99

3 Karya Graha Cemerlang, PT 27.74% 13.04% 4.78

4 spi Pratamalestari Perkasa, PT 43.14% 23.86% 13.96% 9.36

5 Bekasi Asri Pemula, PT 100% 14.24% 4.92

TOTAL 3.35 11.02 8.85 17.82 41

Note: USD 1 approx. to IDR 9200

8. Category of the Best Practice:

Housing

O Affordable housing production O Homelessness

O Access to housing finance and

improvement

O Slum and settlement upgrading

O onstruction industry O Building materials and construction technology

O 6ual access to housing resources

and ownership

O Rental housing

O By-laws and standards

Page 3

Land Use Management

O and use planning O Geographical inIormation systems

O Development incentives O Open space conservation

O and development O Urban/suburban renewal

O state management O Equal rights to ownership and inheritance

(especially by women)

Housing and Human Rights

O Implementation oI the right to

adequate housing

O Prevention oI Iorced eviction

O Security oI tenure O Secure tenancy

O Provision oI public inIrastructure Ior

adequate housing

O ousing accessibility

O Housing habitability and cultural

adequacy

O ousing affordability

O Equal rights to ownership and

inheritance (by women)

9. Level of Activity

Select one oI the Iollowing that best describes the usual level oI activity:

O Global O Regional (international) O ational

O Provincial/State O etropolitan O City/Town

O Neighbourhood O 'illage O International

10. Eco-System

Select the eco-system in which your initiative usually operates:

O Arid/Semi-Arid O Coastal O Continental

O High Plateau O Island O ountain

O River Basin O %ropical/Sub-%ropical

11. Summary

n 1974, ndonesian government launched its residential development plan. n

order to support its policy, as State Owned orporations, Bank %abungan egara

(or Bank B% was appointed as residential funding institution for middle-lower

income people. Based on the decree from Minister of Financial home ownership

loan was launched. Since that day, Bank B% provide subsidized home ownership

loan for all ndonesian middle lower income community and also middle up home

ownership. At present day Bank B% has formulated main objective to give

outstanding services in housing finance and its related industry, and also

providing other products and banking services. ome loan becoming the core

business of Bank B%, by the end of 2 it's reached by 91" of oan portfolio,

and the rest are located as different types of loan. By the end of 27 Bank B%

have been financing subsidized home loan more than 1.939.537 units (Retail

customer and disbursing for about Rp.2.78,48 million (e6uals to USD 2.248

million.

Page 4

12. Key Dates

%here are no particular dates for such main mission to be conducted. n order to

conduct all corporate objection and initiatives, the home loan was disbursed all the

time during office hours. Any customer may come to the Branch Office to consult

with the customer service concerning their needs about housing finance at any

time. %he customer may also come to our partners (housing developer who

provide the housing project. Our partners will direct them to Bank %abungan

egara branch office and give the customer with supported document or

information that may needed in home loan application documentation. But the key

dates for national housing movement started since

O 1974 when the government assigned Bank as residential funding institution

for middle-lower income people

O 27 When the Bank initiates the 27 Annual orporate planning and

develop Strategic orporate Planning 28-212.

13. Narrative

SITUATION BEFORE THE INITIATIVE BEGAN

Prior to 1974, there was no home loan for ndonesian people. ndonesian people

who wish to build a residential house, must take consumption loan from the bank

or saving some money. %here was no special loan addressed for home ownership

even a subsidized credit scheme/home loan for middle to lower income group.

%here was also no housing/property developers established to provide affordable

housing project. Only people who have a good financial condition can build an

affordable house.

ESTABLISHMENT OF PRIORITIES

Based on the year 27 Bank %abungan egara orporate Planning, with regard

to corporate main objections in housing loan, the top list priorities formulated

need to be conducted as follows:

O ew credit line Rp.7.43, billion.

O ntegrate marketing program campaign to improve prospect customer

awareness towards Bank %abungan egara existing as a Bank who serves the

customer with the needs for housing by applying one stop banking strategy in

housing program.

O mproving the loan delivery service processes.

O mproving human resources 6uality in loan services delivery.

O mproving the competitive advantage of the loan product line.

O mproving loan documentation administration.

Page 5

FORMULATION OF OB1ECTIVES AND STRATEGIES

Based on the year 27 orporate Planning the management has formulated the

main objectives for loan activities as follows:

O mproving loan services

O Maintain the loan 6uality

O valuating and develop the line of loan product

O Promoting the loan products

Based on the Bank %abungan egara 28-212 orporate Planning, there are

five main strategies formulated by the Management as follows:

O %o give outstanding services in housing finance and its related industry,

consumption loan, and Small and Medium enterprise

O mproving competitive advantage by product development innovation, services

and strategic network based on ultimate technology.

O Develop a 6uality human capital, a professional and with high integrity

O onducting banking management based on prudential banking principle and

good orporate Covernance to improve shareholder value

O orporate social responsibility for the rest of people and surrounding

environment.

MOBILISATION OF RESOURCES

n order to support corporate operation and to achieve financial objective while

still providing subsidized home loan for middle to lower income people, Bank

%abungan egara continue to raise fund surplus and exploring all possibilities to

mobilize low cost fresh fund resources as follows:

O Developing low cost retail product feature

reating a new product feature can be very useful to preserve the customer

retention. %his is very important and become one factor to keep the customer

loyalty.

O ow cost fund surplus

ow cost fund surplus is very important in order to keep the cost loan able fund

low

O mitting A new Obligation

ew Obligation emission very useful to keep the corporate operation and

financial leverage stays on its track, while the other type of retail product must

be maintained carefully

O orporate Privatization

Privatization is a way to leverage Bank %abungan egara its capability to

disburse home loan and getting a fresh fund to support the corporate

operation.

O Mortgage Securitization

Mortgage Securitization will provide a fresh fund through intensive assets turn

over.

%he Covernment as the subsidy provider for healthy and simple housing (RS

also encourages all of Banking/on Bank institution in ndonesia to serve RS

Page 6

loan disbursement. %he Covernment negotiates with %he entral Bank to create

incentive for banking institution who serves RS loan disbursement for Middle to

ower ncome Croup.

PROCESS

Bank B% corporate objection is to give outstanding services in housing finance

and its related industry and also providing other products and banking services. n

parallel, Bank B% must support the ndonesian Covernment in ational ousing

Policy to Provide Subsidized oan for Middle to lower ncome people e.g. Cerakan

asional Pembangunan Sejuta Rumah (Developing a million affordable house

ational Movement and developing rental and owned low cost apartment. %he

Covernment Policy seems to be not successfully implemented because the national

movement did not get fully supported by ade6uate national budget. ven %hough

Bank B% keeps on trying to help the ndonesia Covernment by raising a new credit

line for middle to lower income group.

Bank B% had made some financial projection for five years to come in order to

meets the needs for affordable housing. Bank B% has initiate an option needs to be

done in order to meets such need for affordable housing through Privatization and

Mortgage Securitization. An ndependent consultant also invited to do some study to

review and to develop visible options for Bank B% with regards to financial

projection result. %he privatization through nitial Public Offering right now is

waiting for the government approval, meanwhile the mortgage securitization will be

launched as soon as all supporting regulation clearly set up. Privatization and

Mortgage Securitization will leverage Bank B% financial capability to provide low

cost fresh fund and will make the home loan disbursement through the Bank's

partner (ousing Developer more affordable.

Another problem for Bank B% to support the outlet expansion is limited amount of

human resources. ew employee need to be recruited to fill the position on a new

outlet. %his problem gradually alleviated, and the outlet opening launched as

scheduled as soon as the Bank ndonesia granted the outlet opening licensed.

nternal resources of low cost fresh fund are limited. %o deal with this problem Bank

B% continue to improve its marketing campaign and creating a new product

feature to preserve the customer loyalty.

Page 7

ealthy and Simple ousing (RS oan Disbursement Flow hart

%he flow chart shows how Affordable housing delivered to Middle to ower ncome

Croups. Bank %abungan egara disburse construction loan to ousing developer.

ousing developer build the housing project. %he customers buy the house with

ousing loan facilities from Bank %abungan egara. %he Covernment plays role as

the ational housing program regulator and providing an interest subsidy.

Bank B%

Partner/

Developer

iddle to ower

Income

Customer

Government

( Regulator &

Interest subsidy

)provider

RSH Housing

Project

Page 8

RESULTS ACHIEVED

(Rp. miliar)

NPL KPR NASIONAL NationaI Market Share

Non Subsidy Subsidy TotaI Non Susbsidy &KPA KPR TotaI Bank BTN NationaI

ec-02 3,779 5,430 9,209 4.76% 21,773 27,203 33.85% 14.38% #V/0!

ec-03 5,102 5,376 10,478 3.80% 30,108 35,484 29.53% 13.78% 30.44%

ec-04 6,010 5,833 11,843 3.21% 42,099 47,932 24.71% 13.02% 35.08%

ec-05 7,340 6,742 14,082 4.04% 56,034 62,776 22.43% 18.91% 30.97%

ec-06 8,081 8,264 16,345 3.91% 72,713 80,977 20.18% 16.07% 28.99%

ec-07 9,095 10,847 19,942 3.88% 94,253 105,100 18.97% 22.01% 29.79%

rowth Bank BTN

MARKET SHARE KPR BANK BTN

Note: KPR means home mortgage

Bank B% is a market leader in ousing oan in ndonesia. %he table above

shown Bank %abungan egara market share in 22 - 27 periods. At the end of

year 27, Bank B% had been disbursed Rp. 9.95 million ommercials ousing

oan and Rp.1.847 million subsidized ousing oan for Middle to ower ncome

Croup (Unaudited, Market share for total reach about 18.97". Bank %abungan

egara manages to keep the on Performing oan ratio below 5". %he P

Ratio for 27 reaches 3.88" (Unaudited.

oan Disbursement Achievement in more detail can be seen on the table attached

to this arrative Formatting Report. By the end of 27 Bank %abungan egara

disburse not less than 1.939.537 unit (Retail customer and disbursing for about

Rp.2.78,48 million (e6uals to USD 2.248 million.

SUSTAINABILITY

A critical point about the affordable housing program in ndonesia is limitation of

low cost fresh fund. %here are some ways to minimize the limitation.

a. %his kind of great work has been established since 1974. %he Covernment

ousing Agency realize that Bank %abungan egara resources is limited and

realize that must be way out to support government policy provide affordable

housing for all ndonesian people. n 24 %he Covernment ousing

Department initiate Memorandum of Understanding with 33 Banking

nstitution in ndonesia to distribute or disburse KPR RS (home mortgage for

affordable housing for Middle to ower ncome Croup with nterest Rate

subsidy mechanism.

%he table below shows the target and realization KPR RS disbursement in

2 as the MOU result.

Page 9

aIam Jutaan Rupiah, kecuaIi unit

No. Bank Name TARET AdditionaI

Unit share (%) Loan

1 BTN 100,000 83,273 97.21 2,735,093 MOU

2 BTN SYARIAH 200 195 0.23 5,279 MOU

3 BNI 2,906 621 0.72 2,321 MOU

4 BRI 3,000 107 0.12 343 MOU

5 BANK BUMI PUTERA 0 8 0.01 40 MOU

6 BANK PERSYARIKATAN 2,000 0 0.00 0 MOU

7 BANK KESE1AHTERAAN EKONOMI 300 0.00 MOU

8 BANK BUKOPIN 1,000 0.00 MOU

9 BANK DANAMON 4,500 0.00 MOU

10 BMT MARDLATILLAH, MA1U 1AYA, AN NA1AH 400 49 0.06 MOU

11 BANK SYARIAH MANDIRI 200 0.00 MOU

12 BPD NANGGRO ACEH D 1,500 0.00 MOU

13 BPD SUMUT 1,663 0.00 MOU

14 BPD SUMSEL 400 94 0.11 226 MOU

15 BPD RIAU 725 0.00 MOU

16 BPD 1AMBI 500 0.00 MOU

17 BPD BENGKULU 450 0.00 MOU

18 BPD SUMBAR (BANK NAGARI) 1,200 0.00 MOU

19 BPD LAMPUNG 0.00 MOU

20 BPD DKI 1akarta 1,500 114 0.13 442 MOU

21 BPD 1ABAR 2,900 48 0.06 240 MOU

22 BPD 1ATENG 350 20 0.02 100 MOU

23 BPD DIY 64 10 0.01 50 MOU

24 BPD 1ATIM 2,500 0.00 MOU

25 BPD KALSEL 1,000 152 0.18 551 MOU

26 BPD KALTIM 2,900 739 0.86 3,956 MOU

27 BPD KALBAR 500 112 0.13 305 MOU

28 BPD KALTENG 100 0.00 MOU

29 BPD SULAWESI TENGGARA 3,000 0.00 MOU

30 BPD SULAWESI TENGAH 170 0.00 MOU

31 BPD SULAWESI SELATAN 750 68 0.08 213 MOU

32 BPD NTB 120 51 0.06 191 MOU

33 BPD NTT, MALUKU, PAPUA 3,750 0.00 MOU

T O T A L 140,548 85,661 100.00 2,749,348

ReaIized KPR

2006

RSH MOU MEMBER

As result many of ndonesia people especially those who live as middle to lower

income group can take benefit from the government policy in affordable

housing program

b. Bank %abungan egara Privatization

Privatization is a way to leverage Bank %abungan egara its capability to

disburse home loan, and getting a fresh fund to support the corporate operation.

But this is has not been done yet even though its get fully supported by the

ndonesian ouse Representative.

LESSONS LEARNED

O n order to fulfil the needs of affordable housing for middle to lower income

people an ade6uate low cost fresh fund need to be mobilized. %he Covernment and

the private sector should have to work together to create a conducive economic

condition where as the low cost fresh fund mobilization will prevail intensively.

ow cost Fresh Fund can be mobilized easily through stock market. ong term

government obligation can be used as subsidized home loan resources. %he

mortgage securitization will receive fresh fund if supporting regulation was set up

already.

O ousing/property market should be deregulated by government to minimize the

housing demand gap. %he government should also give the incentive for subsidized

home loan developer. Unnecessary regulations sometimes discourage developer to

develop a housing project, and this situation will lead to higher price/unit of the

house.

Page 10

O A Creat support for Bank %abungan egara for privatization to provide

commercial and subsidized home loan. ndonesian ouse representative fully

support the government and the Bank %abungan egara management policy to

conduct the privatization via initial public offering. nitial Public offering will

leverage the Bank %abungan egara loan disbursement capability. %he higher

amount loan would be disbursed the greater amount of middle to lower income

people will be served.

O Bank %abungan egara as state owned enterprise, with developer as partner and

Covernment Agency have worked together to provide affordable housing for

middle to lower income groups. ven though the lack of supply Affordable

ousing still hard to meet the housing demands. All of support still needed to

mobilize all resources to provide affordable housing for middle to lower income

groups.

TRANSFERSABILITY

Bank %abungan egara as state owned enterprise, with developer as partner and

Covernment Agency have worked together to provide affordable housing for middle

to lower income groups. ven though there still a lot of lack of Affordable ousing

market supply it is still hard to meet the housing demands. We still need a big

support to mobilize all resources to provide affordable housing for middle to lower

income groups.

%his kind of great work has been established since 1974. %he Covernment ousing

Agency realize that Bank %abungan egara resources is limited and realize that

must be way out to support government policy provide affordable housing for all

ndonesian people. n 24 %he Covernment ousing Department initiate

Memorandum of Understanding with 33 Banking nstitution in ndonesia to

distribute or disburse KPR RS (affordable ousing for Middle to ower ncome

Croup with nterest Rate subsidy mechanism.

RELATED POLICY/IES OR LEGISLATION

%his practice had been getting fully supported from the Covernment ousing

Department and ndonesian ouse of representative. Recent government policy on

ational affordable ousing program is:

a. Ministry of ousing Regulation o. 5/PRM/M/27 regulate subsidy

facility for Middle to lower income group who wish to build their own house

to get support from subsidy housing loan from the bank institution.

b. Ministry of ousing Regulation o. /PRM/M/27 regulate subsidy

facility for Middle to lower income group who wish to build their own house

to get support from subsidy housing loan with syaria institution principle.

c. Ministry of Finance Regulation o. 3/PMK.3/27 regulate about value

added tax which exclude on purchasing RS below Rp. 49 milion.

Page 11

Bank %abungan egara had been fully support by ndonesian ouse of representative to

do the privatization option to leverage Bank %abungan egara loan disbursement

capability to provide affordable housing loan for middle to lower income group.

14. References

Title oI Article: Source (include author, publication title, volume/number, date, and page

number(s) :

1. InIobank agazine (InIobank, 'angkah Mantap Bank B% dengan Kendali

Manajemen Baru, No.347, Februari 2008, Page 34-36).

2. InIobank agazine (InIobank, '6bal atanro: B% %idak Bisa agi idup di Menara

Cading, InIobank No.347, Februari 2008, Page 34-36).

3. Berita Bank BTN (Bank BTN, website www.btn.co.id,Pemohon Kredit Rusunami

Antri di B%, Bank BTN Website, arch, 13, 2008).

4. Berita Bank BTN (Bank BTN, website www.btn.co.id, Bank nggan Bangun

Perumahan Rakyat?", Bank BTN Website, January , 28, 2008).

5. Berita Bank BTN (Bank BTN, website www.btn.co.id, KPR B% Siap Bersaing,

Bank BTN Website, January , 04, 2008).

6. Berita Bank BTN (Bank BTN, website www.btn.co.id, Fokus Pembiayaan

Perumahan, Bank BTN Website, January , 02, 2008).

7. Berita Bank BTN (Bank BTN, website www.btn.co.id, Segera %erbitkan Oblgasi Rp.1

%riliun, Bank BTN Website, January , 02, 2008).

8. Banjarmasin Post (Banjarmasin Post, website www.banjarmasinpost.co.id, 'Subsidi

RS jadi 8 miliar, September 06, 2007).

Description of Articles

1. InIobank agazine (InIobank, 'Bank B% onfident Step ontrolled by ew

Management, No.347, February 2008, Page 34-36)

Bank BTN role which become dominant Iactor in helping the Indonesia government

providing the need Ior housing Ior Indonesia people has made Bank BTN existence can

not be put aside. Bank BTN perIormance getting better day by day, Iully service all oI

the Indonesian people to have their own home. With its new Board oI director has made

Bank BTN contribution in home owner Iinancing can not be replace by another

institution.

There are some Bank BTN conIident steps in providing loan housing as Iollow:

Improving corporate perIormance

arket leader in loan housing

Improving service quality

Generate a new outlet

Corporate business development

Supporting Indonesian government national housing program

Page 12

2. InIobank agazine (InIobank, 6bal atanro : B% an not live in vory %ower

Anymore", InIobank No.347, February 2008, Page 34-36)

Bank BTN has been playing a big role in supporting aIIordable housing Ior all oI

Indonesian people through out the country and about 97 housing program Ior middle

to lower income group Iinanced by Bank BTN. But now Bank BTN has to change. The

change must support Bank BTN perIormance in the Iuture. Furthermore loan growth

target in 2008 must be raised by 26. The change must be done as quickly as possible,

Iail to do so, Bank BTN will surely out oI business. The Bank BTN new CEO, Iqbal

atanro said Bank BTN Can not live in Ivory Tower anymore. Bank BTN wants to

change the paradigm. To achieve the main corporate mission, Bank BTN corporate

image will have to be transIorming Iorm Bureaucratic to business environment.

3. Bank BTN News (Bank BTN, website www.btn.co.id, Rusunami Applicator are

Queue n ine, Bank BTN Website, arch, 13, 2008)

Rusunami Applicators are Queue in ine. Bank BTN loan director, Purwadi said that is

up Ior now there has been 4000 unit application processed, meanwhile its still 1600-

1700 unit to go Irom Cengkareng, odern land Tangerang, Cawang and 1800 unit to go

Irom up coming rusunami project. Purwadi also mention the loan that had been

disbursed Rp. 800 billion Ior Rusunami and RSH Irom the target Rp.10.043 trillion.

4. Bank BTN News (Bank BTN, website www.btn.co.id, %he Bank nstitution

Reluctant to Support Affordable ousing Program?", Bank BTN Website, January ,

28, 2008)

Recently the Banks Institutions in Indonesia tends to reIuse to disburse a micro loan Ior

small business enterprise. Commercials banking presume disbursing a loan Ior small

business enterprise has a higher risk than a big commercial corporation. The same thing

happens with aIIordable housing loan Ior middle to lower income group. The

commercial bank presume the loan Ior middle to lower income group to get an

aIIordable housing loan has a lot higher risk than iI its disbursed Ior upper income

group to get commercial housing loan. Among 132 Commercial Bank in Indonesia,

practically only Bank BTN constantly disburse a subsidy housing loan Ior middle to

lower income group. Bank BTN has a capital limitation. The demand Ior aIIordable

housing is nearly 600.000 units/annum, but Bank BTN can only support subsidy loan

housing Ior about 100.000 unit/annum. According to Ryan Kiryanto, in order to

stimulate all oI the commercial bank to support Indonesia government in housing policy

is to reduce the risk level oI subsidy housing loan by reducing ATR rate by 15 Irom

40 to 25. This option will enable all oI the Commercial Bank to have a higher

lending capability to disburse the loan especially in subsidy housing loan.

5. Bank BTN News (Bank BTN, website www.btn.co.id, KPR B% ready to compete,

Bank BTN Website, January , 04, 2008)

Bank BTN management realize that the business competition between Bank Institutions

is remain tough and getting harder everyday, especially in aIIordable loan housing. In

order to deal with other competitor, as a breakthrough Bank BTN had launched KPR

platinum with two alternative loan interest rate instalment option. First option is Iix

instalment with interest rate 10.75 just Ior one year instalment and 10.95 interest

Page 13

rate Ior the Iirst Iive year instalment. KPR Platinum is intended targeted Ior lower to

upper income group with loan value above Rp.150 million.

6. Bank BTN News (Bank BTN, website www.btn.co.id, Focusing On oan ousing

(Mortgage", Bank BTN Website, January, 02, 2008).

The Ultimate challenge Ior the new Bank BTN`s Board OI Director Ior the near Iuture

is remain tough because Bank BTN have to conduct its main mission which Iocusing on

oan Housing (mortgage) Ior middle to lower income people.

Bank BTN Iormer CEO, Kodradi said, economically speaking, the Iuture challenge is

remain tough especially when Bank BTN engage in Indonesian Banking architecture

Iramework concerning the single presence policy issue held by Bank Indonesia.

Politically speaking, whether the challenge is remain tough or less is depend on

Indonesian government political will as the owner. Should the government still concern

with its housing program Ior the sake oI Indonesia people, Bank BTN will still survive.

AIter all have been through with all oI economic turbulence in late 1999, Bank BTN

still survive and continuing providing aIIordable housing loan Ior middle to lower

income group in Indonesia.

7. Bank BTN News (Bank BTN, website www.btn.co.id, Bank B% announce to

launch Rp 1. %rillion Debts, Bank BTN Website, January, 02, 2008).

In 2008 Bank BTN initiate to make housing loan growth raised by 28 or about

Rp.10.03 trillion higher than in 2007 which about Rp.8 trillion. In order to support that

loan growth Bank BTN intend to issue Rp.1 trillion debts to anticipate previous debts

that due Ior Rp. 800 billion in 2008. In Parallel, Bank BTN also had planned to launch

privatization trough initial public oIIering (IPO) 30 oI its capital. Bank BTN new

CEO, Iqbal atanro said that Bank BTN will stay Iocus on Housing loan Ior middle to

lower income group and yet still continue to Iine tune the marketing campaign policy

and loan pricing including the interest rate to keep Bank BTN competitive toward the

main competitor.

8. Banjarmasin Post (Banjarmasin Post, website www.banjarmasinpost.co.id, 'ealthy

Decent ousing Subsidy Become 8 Billion Rupiahs, September 06, 2007)

Bank BTN CEO Kodradi said that Bank BTN had lowered the loan interest rates which

becoming 13.5/annum. The policy being taken as responded to Bank oI Indonesia

policy that keep lowered the BI rate which stay on single digit level 8,25. He also

mentions the bank institution business competition especially in housing loan gradually

tougher recently. Customer purchasing power getting better and they want to take a

bigger amount oI loan. To deal with this Bank BTN had launched KPR platinum with

two alternative loan interest rate instalment options. First option is Iix instalment with

interest rate 10.75 just Ior one year instalment and 10.95 interest rate Ior the Iirst

Iive year instalment. KPR Platinum is intended targeted Ior lower to upper income

group with loan value above Rp.150 million.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Planner Approval For Move Order RequisitionsDocument7 pagesPlanner Approval For Move Order RequisitionsSrimannarayana KasthalaNo ratings yet

- Develop Business in Rural Areas With The Help of Digital PlatformsDocument30 pagesDevelop Business in Rural Areas With The Help of Digital PlatformsMd Tasnim FerdousNo ratings yet

- Engineering Marketing and EntrepreneurshipDocument41 pagesEngineering Marketing and Entrepreneurshipimma coverNo ratings yet

- Project Report On Birla Sun LifeDocument62 pagesProject Report On Birla Sun Lifeeshaneeraj94% (34)

- Module 8-MRP and ErpDocument25 pagesModule 8-MRP and ErpDeryl GalveNo ratings yet

- NEC Contracts - One Stop ShopDocument3 pagesNEC Contracts - One Stop ShopHarish NeelakantanNo ratings yet

- HTTP WWW - Valueresearchonline.com Funds DefaultDocument2 pagesHTTP WWW - Valueresearchonline.com Funds DefaultAnanth PuthucodeNo ratings yet

- Continuing Certification Requirements: (CCR) HandbookDocument19 pagesContinuing Certification Requirements: (CCR) HandbookLip Min KhorNo ratings yet

- Market Mix Analysis - Manisha - 083Document31 pagesMarket Mix Analysis - Manisha - 083Manisha MittimaniNo ratings yet

- Sustainable Supply Chain Evolution and FutureDocument42 pagesSustainable Supply Chain Evolution and Futureatiqa tanveerNo ratings yet

- Avon-Strategic Management CaseDocument56 pagesAvon-Strategic Management Casebrownshuga100% (2)

- Buku2 Ref Ujian WMIDocument3 pagesBuku2 Ref Ujian WMIEndy JupriansyahNo ratings yet

- McKinsey 7s Framework Final (Draft 2)Document2 pagesMcKinsey 7s Framework Final (Draft 2)Anshul Gautampurkar0% (1)

- # An - Je - 100k - 2-0 - 3-29-19 - v2Document5 pages# An - Je - 100k - 2-0 - 3-29-19 - v2Collblanc Seatours Srl Jose LahozNo ratings yet

- Bahan Lain KokokrunchDocument7 pagesBahan Lain KokokrunchsurianimerhalimNo ratings yet

- Investment Practice ProblemsDocument14 pagesInvestment Practice ProblemsmikeNo ratings yet

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- Quality Management System Part 4Document26 pagesQuality Management System Part 4Bo DoNo ratings yet

- LAW OF CONTRACT ESSENTIALSDocument18 pagesLAW OF CONTRACT ESSENTIALSLegnaNo ratings yet

- EFFECTS OF ECONOMIC GROWTH AND GST RISEDocument41 pagesEFFECTS OF ECONOMIC GROWTH AND GST RISESebastian ZhangNo ratings yet

- Dissolution QuestionsDocument5 pagesDissolution Questionsstudyystuff7No ratings yet

- Introduction To Fintech: Igor PesinDocument56 pagesIntroduction To Fintech: Igor PesinLittle NerdNo ratings yet

- Business DiversificationDocument20 pagesBusiness DiversificationRajat MishraNo ratings yet

- Freedom Baromoter Asia 2010Document82 pagesFreedom Baromoter Asia 2010Friedrich Naumann-Stiftung Untuk Kebebasan (FNF)No ratings yet

- Hippo Case StudyDocument3 pagesHippo Case StudyAditya Pawar 100100% (1)

- Ethic in Business ResearchDocument8 pagesEthic in Business ResearchHoma MilaniNo ratings yet

- Kavanagh4e PPT01Document24 pagesKavanagh4e PPT01colin0% (1)

- A Rib A Supplier EnablementDocument2 pagesA Rib A Supplier Enablementeternal_rhymes6972No ratings yet

- Balancing Cash HoldingsDocument14 pagesBalancing Cash HoldingsMelese AberaNo ratings yet

- Inventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Document9 pagesInventory Valuation: First in First Out (FIFO) Last in First Out (LIFO) Average Cost Method (AVCO)Abhilash JhaNo ratings yet