Professional Documents

Culture Documents

China - It's Not The End of The World As We Know It 2011-10-03

Uploaded by

bwhalmrastOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

China - It's Not The End of The World As We Know It 2011-10-03

Uploaded by

bwhalmrastCopyright:

Available Formats

l Global Research l On the Ground | 07:15 GMT 03 October 2011

China Its not the end of the world as we know it

Markets are overestimating Chinas 2012 slowdown There is still room to stimulate through monetary and fiscal policy Loosening will first happen in credit controls loan growth numbers should be closely watched Extreme bearishness on China has broken out among global investors. The Hong Kong China Enterprise index was down 27% from 1 July to 1 October, and China credit default swaps (CDS) have risen to almost 200bps after being below 100bps in 2009-10. China fear has spread fast, even though the broad macro story has not changed much: the official manufacturing PMI is still above 50, consumer confidence is holding up, Beijings macro policy is still set at tight (meaning there is room to loosen), and no major real-estate developer has filed for bankruptcy yet. The big China sell-off, however, suggests that much worse news than this a sharp slowdown in Chinas real economy and ineffectual policy loosening is now being discounted. We recently witnessed China fear in full bloom during a two-week US roadshow with clients corporate, real and leveraged funds. This note outlines the arguments and attempts to show the sunlight shining through the end-of-the-world clouds. There was also an outbreak of investor fear about China in late 2008. China CDS rose to almost 300bps. The fear then took the form of panic triggered by the Lehman shock to Western economies and banking systems, along with deep scepticism about Beijings ability to cope. Chinas forceful policy reaction triggered a V-shaped recovery, and by end-2009, worries about inflation were taking hold. Today, China fear is more potent. It is not only mixed up with European and US concerns, but there is more reason to think Beijings stimulus policy tools are limited this time around. We still think that Beijing will muddle through, though.

Stephen Green, +852 3983 8556

Stephen.Green@sc.com

Wei Li, +86 21 6168 5017

Li.Wei@sc.com

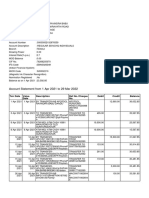

Chart 1: Monetary conditions are still tight and could be loosened in Q4 Our China Monetary Conditions Index

115 110 105 100 95 90 85 80 1999 2001 2003 2005 2007 2009 2011

Sources: CEIC, Standard Chartered Research

Important disclosures can be found in the Disclosures Appendix All rights reserved. Standard Chartered Bank 2011

research.standardchartered.com

On the Ground

Our view

We found two main views among investors in the last two weeks. Most are bearish on China in the short term (one to two months) given continued policy tightening and deteriorating external conditions, and accept the view that the authorities will loosen policy in Q4 (though some argue that inflation is still too high to allow that). The difference in thinking turns on the reaction to the policy shift: 1. The bears believe Chinas 2012 real GDP growth will be below 8% owing to weak external demand throughout the year and limited stimulus options onshore. Inflation is too high and local government debt too big to allow Beijing to loosen, the bears assert. A massive housing-market bubble is already bursting, they argue, and policy makers are nave to think they can manage a gradual deflation of residential housing prices. 2. Others including ourselves take the view that Beijing will react with loosening in Q4, policy will have an effect, and growth will be above 8% in 2012. Inflation is almost beaten, more infrastructure projects will be authorised, budgetary resources will be thrown at particularly hard-hit sectors, banks can leverage up more, budget spending can be boosted, and controls on residential housing will be loosened once developers have cut prices and eaten dirt for a few months. We look for a U-shaped recovery in H1-2012.

When will China shift policy?

The markets mood could begin to lighten when policy loosening begins. Monetary policy remains tight; this is the clear message of the latest Standard Chartered China Monetary Conditions Index (SCMCI), which we show in Chart 1. Many in the market (including us) had priced in mild monetary loosening starting in July/August 2011. In hindsight, the fact that this did not happen was probably a sell signal for China equities. Beijings reluctance to loosen was explained by high CPI inflation, as shown in Chart 7 (the market forecasts 6.0-6.2% y/y for September, still uncomfortably high) and a manageable slowdown in the real economy so far. The official PMI for September was 51.2, still expansionary; as Chart 2 shows, the slide in manufacturing PMIs in H1-2011 was much smoother than in H1-2008. The labour Chart 2: Growth has slowed but not reversed PMI index and electricity production (KWH bn, 3mma), seasonally adjusted (SA)

60 420 380 PMI index 50 300 45 260 40 Electricity production, SA, 3mma (RHS) 35 Jan-05 Jan-06 Jan-07 Jan-08 Jan-09 Jan-10 Jan-11 220 180 340

55

Sources: CEIC, Standard Chartered Research

GR11SE | 03 October 2011 2

On the Ground

market still appears pretty tight, and there have been no stories of significant layoffs so far. Despite some stress in the SME economy, we have not yet seen a verifiable wave of company closures or layoffs. We expect monetary loosening in Q4, starting with the loosening of the loan quota We expect loosening in Q4, but the timing is difficult to predict. Loosening is likely to begin with a quiet relaxation of the bank credit quota, so monthly credit growth needs to be watched carefully. If the Peoples Bank of China (PBoC) wanted to signal loosening, it would lower banks reserve ratio from the current 21.5%. We think the chances of a cut in the required reserve ratio (RRR) before year-end are now better than 50/50. The PBoC will resist cutting interest rates for as long as possible given its belief that they are still structurally too low. There are a few important dates to watch. In the second week of October, the State Council will meet to assess Q3 macro data and the global situation, and will release a short statement. This could signal a shift in how Beijing sees the balance of risks. In November, government officials from all the provinces will travel to Beijing for the National Economic Work Conference to hear about macro policy for 2012 and lobby for loosening. The balance of risks is clearly shifting as Charts 5 and 6 show, there is likely to be little good news for exports in the coming months. We look for export growth of around 5-10% in 2012 (we will address the importance of the sector to the overall economy in a subsequent note).

Still room for loosening

The bears argue that China cannot loosen much because of inflation and the bad debts generated by the previous round of stimulus. We expect y/y inflation to show clearer signs of moderation in Q4. Demand has slowed, as have import prices (particularly for oil, the biggest import). There is upside risk from another sharp increase in pork prices, as a clear supply response will probably take until Q1-2012. By November-December, we expect CPI inflation to fall to the 4.5-5.0% y/y range, which will allow for some loosening.

Chart 3: FAI project growth should rebound in 2012 % y/y, 3mma

35 30 25 20 15 10 5 0 -5 2005 2006 2007 2008 2009 2010 2011

Chart 4: Consumer markets look solid for now Measurements of consumer confidence and job market

120% Consumer confidence index (RHS) 115

110 100% Ratio of job offers/demand 80% 100 105

60% Mar-01 Mar-03 Mar-05 Mar-07 Mar-09 Mar-11

95

Sources: CEIC, Standard Chartered Research

GR11SE | 03 October 2011

Sources: CEIC, Standard Chartered Research

3

On the Ground

Problems at local government investment vehicles (LGIVs) are more of a challenge, given that LGIVs account for some 20% of outstanding bank credit and there are serious doubts about repayment (see Special Report, 18 July 2011, China Solving the local government debt problem). Beijings current plan for LGIV loans is to pressure local governments to ensure that interest payments are made. (If the central government wanted to embark on a significant restructuring of the economy and sort out local finances, a big, co-ordinated push to sell off local state-owned firms would be a thrilling option.) We have argued that it would be helpful to bring some of these projects onto the central governments books, and to finance more infrastructure through the budget rather than through the banks. Such a reform would clearly support confidence. In the meantime, we believe there is still room to stimulate by increasing infrastructure investment, allowing the banks to lend, and increasing fiscal expenditure. China still has many things to build including more infrastructure in the southern, central and western regions, irrigation projects, and social housing, among others. Chinas per-capita capital stock is likely still below 10% of the US level, while urbanisation, at 50%, has a long way to rise. China today is Japan circa 1970, not 1989. A review of the 12 Five Year Plan suggests that there is much more still to do and a recent visit to Beijing suggested that the National Development and Reform Commission (NDRC) has intentionally slowed down project approvals this year and could re-accelerate them if needed. Chart 3 shows that the fixed asset investment (FAI) cycle is ready to turn. Local government projects could get funding if bank lending was loosened. Clearly, though, there is less room for this kind of spending now than last time and we recommend the enforcement of a hard loan quota of CNY 9-10trn in 2012 to prevent another lending blow-out. In the housing market, there is clearly a problem of excessive inventory (Special Report, 4 July 2011, China Our big real estate survey, Part 3), and the September sales numbers were not as good as some had hoped flat on August, rather than up. The October sales numbers will be very important, as will be buyers reactions to price cuts. Little is currently known about the extent of price-cutting by developers and buyers reactions. The inventory problem is concentrated mostly in the Tier 2 cities; Chinas hundreds of Tier 3 and 4 cities are not over-built. If the Ministry of Finance can be persuaded to fund social housing properly, this will boost construction as real-estate developers pull back in 2012. The central government could loosen its current strict controls on property purchases if prices fall too much, but it is likely to wait awhile to ensure that the goal of inflicting some pain on the developers is achieved. At some point, though, worries about falling local government land sales and their impact on overall growth will kick in, and localities will start loosening controls.

th

GR11SE | 03 October 2011

On the Ground

Impact of the political cycle on policy

Clients in the US were interested in how the political cycle might impact policy. In the run-up to the 18

th

Congress of the Chinese Communist Party, thousands of party

posts including the top nine Politburo Standing Committee seats are up for grabs. We have little to say about how this political cycle will affect policy; Beijing is still a very black box. All central government leaders want to balance inflation and growth and as the balance of risks shifts from one to the other, policy will also shift. Leaders who need more support from the provinces (who are always more interested in growth than inflation) may well push for loosening earlier than central government technocrats. Future leaders will want to ensure that the economy is well positioned for sustainable growth from 2013-15, while the current leaders may focus more on making sure 2012 is a good year. So far, there are no identifiable splits within the central leadership over economic policy. Chart 5: External worries are building (I) Chinas export growth to the US and US PMI

40 30 20 10 0 -10 -20 -30 Jan-05 Jan-06 Jan-07 Exports to the US, y/y %, 3mma Jan-08 Jan-09 Jan-10 Jan-11 US PMI (RHS) 65 60 55 50 45 40 35 30 25 -40 Jan-05 Jan-06 Jan-07 0 -20 Exports to Euro-area, y/y %, 3mma Jan-08 Jan-09 Jan-10 Jan-11

Chart 6: External worries are building (II) Chinas export growth to the euro area and euro-area PMI

60 40 20 Euro-area PMI (RHS) 65 60 55 50 45 40 35 30 25

Sources: Bloomberg, Standard Chartered Research

Sources: Bloomberg, Standard Chartered Research

CNY policy, on both sides of the Pacific

On Chinese yuan (CNY) policy, there was broad agreement with our view of continued appreciation against the US dollar (USD). That said, appreciation is likely to slow from the 5-6% pace seen in 2011 so far unless there is an external shock; in that case, we think Beijing will re-peg the CNY to the USD. There was some discussion that now would be a good time to move to a basket exchange rate (which would allow some depreciation against the USD). We think the natural response to a weak global economy would be to re-peg. The policy focus would be on stimulating domestic demand. Exporters can be protected through subsidies or increases in VAT rebates, rather than by launching an overt currency war. Meanwhile, US Senator Charles Schumer and his colleagues have re-introduced the Currency Exchange Rate Oversight Reform Act of 2011 in the Senate. Given the current US political situation and the hurting job market, the bill is more likely than ever to be passed. The Democrat-controlled Senate could vote this week, which would leave the Republican-controlled House to decide whether to debate and table a vote, or to park the bill in committee. The Republican leadership may decide to push the bill through in order to dare the president to veto it, or it may determine that business opposition needs to be taken into account in an election season. The White House officially opposes the bill, but a veto would likely disappoint much of the Democratic base.

GR11SE | 03 October 2011

On the Ground

The bill is a reincarnation of previous drafts. Some effort has been made to make it WTO-compliant. (There is a hole in international trade law where currencies are concerned the US bill attempts to define undervalued currencies as subsidies, something trade law has been silent on. If China did bring a complaint, this would be a tricky call for the WTO dispute mechanism.) The bill allows CNY undervaluation to be considered as a subsidy, and would therefore allow US firms to file counterveiling duty (CVD) complaints against Chinas exports to the US. The number of CVD complaints filed by US businesses would certainly rise, but they take time to investigate, and the fallout would likely be limited. Beijing would file a WTO complaint against the bill, claiming it illegal, which would take two to three years to complete; in the meantime, a few US multinationals would find business conditions in China more challenging.

Summary

We believe the markets have panicked unjustifiably about China. Economic data remains constructive overall, and while exporters will suffer in 2012, domestic growth and the room for policy loosening is being underestimated. The real-estate and shadow banking sectors need to be monitored, but stories of distress are very limited in scale so far. Once loosening comes, we expect growth to reassert itself after a quarter or so. This will likely be a U-shaped recovery, in contrast to the V-shaped one we saw in late 2008 and early 2009. But our bet is that by Q2-2012, China will be proving itself more resilient than the markets are currently pricing in. Chart 7: Inflation has peaked (%)

14 12 10 8 6 4 2 0 -2 -4 -6 -8 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 CPI, y/y CPI, SAAR, 3mma

Sources: CEIC, Standard Chartered Research

GR11SE | 03 October 2011

On the Ground

Disclosures Appendix

Analyst Certification Disclosure: The research analyst or analysts responsible for the content of this research report certify that: (1) the views expressed and

attributed to the research analyst or analysts in the research report accurately reflect their personal opinion(s) about the subject securities and issuers and/or other subject matter as appropriate; and, (2) no part of his or her compensation was, is or will be directly or indirectly related to the specific recommendations or views contained in this research report. On a general basis, the efficacy of recommendations is a factor in the performance appraisals of analysts.

Global Disclaimer: Standard Chartered Bank and or its affiliates ("SCB) makes no representation or warranty of any kind, express, implied or statutory

regarding this document or any information contained or referred to on the document. The information in this document is provided for information purposes only. It does not constitute any offer, recommendation or solicitation to any person to enter into any transaction or adopt any hedging, trading or investment strategy, nor does it constitute any prediction of likely future movements in rates or prices, or represent that any such future movements will not exceed those shown in any illustration. The stated price of the securities mentioned herein, if any, is as of the date indicated and is not any representation that any transaction can be effected at this price. While all reasonable care has been taken in preparing this document, no responsibility or liability is accepted for errors of fact or for any opinion expressed herein. The contents of this document may not be suitable for all investors as it has not been prepared with regard to the specific investment objectives or financial situation of any particular person. Any investments discussed may not be suitable for all investors. Users of this document should seek professional advice regarding the appropriateness of investing in any securities, financial instruments or investment strategies referred to on this document and should understand that statements regarding future prospects may not be realised. Opinions, forecasts, assumptions, estimates, derived valuations, projections and price target(s), if any, contained in this document are as of the date indicated and are subject to change at any time without prior notice. Our recommendations are under constant review. The value and income of any of the securities or financial instruments mentioned in this document can fall as well as rise and an investor may get back less than invested. Future returns are not guaranteed, and a loss of original capital may be incurred. Foreign-currency denominated securities and financial instruments are subject to fluctuation in exchange rates that could have a positive or adverse effect on the value, price or income of such securities and financial instruments. Past performance is not indicative of comparable future results and no representation or warranty is made regarding future performance. While we endeavour to update on a reasonable basis the information and opinions contained herein, there may be regulatory, compliance or other reasons that prevent us from doing so. Accordingly, information may be available to us which is not reflected in this material, and we may have acted upon or used the information prior to or immediately following its publication. SCB is not a legal or tax adviser, and is not purporting to provide legal or tax advice. Independent legal and/or tax advice should be sought for any queries relating to the legal or tax implications of any investment. SCB, and/or a connected company, may have a position in any of the securities, instruments or currencies mentioned in this document. SCB and/or any member of the SCB group of companies or its respective officers, directors, employee benefit programmes or employees, including persons involved in the preparation or issuance of this document may at any time, to the extent permitted by applicable law and/or regulation, be long or short any securities or financial instruments referred to in this document and on the website or have a material interest in any such securities or related investment, or may be the only market maker in relation to such investments, or provide, or have provided advice, investment banking or other services, to issuers of such investments. SCB has in place policies and procedures and physical information walls between its Research Department and differing public and private business functions to help ensure confidential information, including inside information is not disclosed unless in line with its policies and procedures and the rules of its regulators. Data, opinions and other information appearing herein may have been obtained from public sources. SCB makes no representation or warranty as to the accuracy or completeness of such information obtained from public sources. You are advised to make your own independent judgment (with the advice of your professional advisers as necessary) with respect to any matter contained herein and not rely on this document as the basis for making any trading, hedging or investment decision. SCB accepts no liability and will not be liable for any loss or damage arising directly or indirectly (including special, incidental, consequential, punitive or exemplary damages) from use of this document, howsoever arising, and including any loss, damage or expense arising from, but not limited to, any defect, error, imperfection, fault, mistake or inaccuracy with this document, its contents or associated services, or due to any unavailability of the document or any part thereof or any contents or associated services. This material is for the use of intended recipients only and, in any jurisdiction in which distribution to private/retail customers would require registration or licensing of the distributor which the distributor does not currently have, this document is intended solely for distribution to professional and institutional investors. Country-Specific Disclosures - If you are receiving this document in any of the countries listed below, please note the following: United Kingdom and European Economic Area: SCB is authorised and regulated in the United Kingdom by the Financial Services Authority (FSA). This communication is not directed at Retail Clients in the European Economic Area as defined by Directive 2004/39/EC. Nothing in this document constitutes a personal recommendation or investment advice as defined by Directive 2004/39/EC. Australia: The Australian Financial Services License for SCB is License No: 246833 with the following Australian Registered Business Number (ARBN: 097571778). Australian investors should note that this document was prepared for wholesale investors only (as defined by Australian Corporations legislation). Brazil: SCB disclosures pursuant to the Securities Exchange Commission of Brazil (CVM) Instruction 483/10: This research has not been produced in Brazil. The report has been prepared by the research analyst(s) in an autonomous and independent way, including in relation to SCB. THE SECURITIES MENTIONED IN THIS REPORT HAVE NOT BEEN AND WILL NOT BE REGISTERED PURSUANT TO THE REQUIREMENTS OF THE SECURITIES AND EXCHANGE COMMISSION OF BRAZIL AND MAY NOT BE OFFERED OR SOLD IN BRAZIL EXCEPT PURSUANT TO AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS AND IN COMPLIANCE WITH THE SECURITIES LAWS OF BRAZIL. China: This document is being distributed in China by, and is attributable to, Standard Chartered Bank (China) Limited which is mainly regulated by China Banking Regulatory Commission (CBRC), State Administration of Foreign Exchange (SAFE), and Peoples Bank of China (PBoC). Hong Kong: This document is being distributed in Hong Kong by, and is attributable to, Standard Chartered Bank (Hong Kong) Limited which is regulated by the Hong Kong Monetary Authority. Japan: This document is being distributed to Specified Investors, as defined by the Financial Instruments and Exchange Law of Japan (FIEL), for information only and not for the purpose of soliciting any Financial Instruments Transactions as defined by the FIEL or any Specified Deposits, etc. as defined by the Banking Law of Japan. Singapore: This document is being distributed in Singapore by SCB Singapore branch, only to accredited investors, expert investors or institutional investors, as defined in the Securities and Futures Act, Chapter 289 of Singapore. Recipients in Singapore should contact SCB Singapore branch in relation to any matters arising from, or in connection with, this document. South Africa: SCB is licensed as a Financial Services Provider in terms of Section 8 of the Financial Advisory and Intermediary Services Act 37 of 2002. SCB is a Registered Credit Provider in terms of the National Credit Act 34 of 2005 under registration number NCRCP4. UAE (DIFC): SCB is regulated in the Dubai International Financial Centre by the Dubai Financial Services Authority. This document is intended for use only by Professional Clients and should not be relied upon by or be distributed to Retail Clients. United States: Except for any documents relating to foreign exchange, FX or global FX, Rates or Commodities, distribution of this document in the United States or to US persons is intended to be solely to major institutional investors as defined in Rule 15a-6(a)(2) under the US Securities Act of 1934. All US persons that receive this document by their acceptance thereof represent and agree that they are a major institutional investor and understand the risks involved in executing transactions in securities. Any US recipient of this document wanting additional information or to effect any transaction in any security or financial instrument mentioned herein, must do so by contacting a registered representative of Standard Chartered Securities (North America) Inc., 1095 Avenue of the Americas, New York, N.Y. 10036, US, tel + 1 212 667 0700. WE DO NOT OFFER OR SELL SECURITIES TO U.S. PERSONS UNLESS EITHER (A) THOSE SECURITIES ARE REGISTERED FOR SALE WITH THE U.S. SECURITIES AND EXCHANGE COMMISSION AND WITH ALL APPROPRIATE U.S. STATE AUTHORITIES; OR (B) THE SECURITIES OR THE SPECIFIC TRANSACTION QUALIFY FOR AN EXEMPTION UNDER THE U.S. FEDERAL AND STATE SECURITIES LAWS NOR DO WE OFFER OR SELL SECURITIES TO U.S. PERSONS UNLESS (i) WE, OUR AFFILIATED COMPANY AND THE APPROPRIATE PERSONNEL ARE PROPERLY REGISTERED OR LICENSED TO CONDUCT BUSINESS; OR (ii) WE, OUR AFFILIATED COMPANY AND THE APPROPRIATE PERSONNEL QUALIFY FOR EXEMPTIONS UNDER APPLICABLE U.S. FEDERAL AND STATE LAWS. Copyright 2011 Standard Chartered Bank and its affiliates. All rights reserved. All copyrights subsisting and arising out of all materials, text, articles and information contained herein is the property of Standard Chartered Bank and/or its affiliates, and may not be reproduced, redistributed, amended, modified, adapted, transmitted in any way without the prior written permission of Standard Chartered Bank.

Document approved by

Data available as of

Document is released at

Stephen Green Regional Head of Research, Greater China

GR11SE | 03 October 2011

07:15 GMT 03 October 2011

07:15 GMT 03 October 2011

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Valuation of StartupsDocument5 pagesValuation of Startupsomnifin.seoNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- PROJECT Management Practical Solution Tybscit Sem 6 STARUMLDocument4 pagesPROJECT Management Practical Solution Tybscit Sem 6 STARUMLSmart Boy Tushar54% (13)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Why Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabreraDocument2 pagesWhy Filipinos Don't Save: A Look at Factors That Impact Savings in The Philippines by Marishka CabrerathecenseireportNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- These Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NoDocument2 pagesThese Questions Help You Recognize Your Existing Background Knowledge On The Topic. Answer Honestly. Yes NocykenNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Firm's Sources of FinancingDocument19 pagesA Firm's Sources of FinancingisqmaNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Islami Bank Bangladesh LimitedDocument1 pageIslami Bank Bangladesh LimitedAbdur RahimNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Roaring Twenties DiagramsDocument15 pagesRoaring Twenties Diagramsapi-122009175No ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Commercial Bank of EthiopiaDocument3 pagesCommercial Bank of EthiopiaEmiru ayalew100% (1)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Balance SheetDocument39 pagesThe Balance SheetJUAN ANTONIO CERON CRUZNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Raising Capital PDFDocument10 pagesRaising Capital PDFSaurav SinghNo ratings yet

- Grade 5 English Module 1 FinalDocument19 pagesGrade 5 English Module 1 FinalAlicia Nhs100% (4)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Receivable FINANCING PDFDocument30 pagesReceivable FINANCING PDFChristian Blanza LlevaNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Chapter 6 - Money MarketsDocument47 pagesChapter 6 - Money MarketsBeah Toni PacundoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- A Century of Capital Structure: The Leveraging of Corporate AmericaDocument68 pagesA Century of Capital Structure: The Leveraging of Corporate AmericaMuhammad UsmanNo ratings yet

- Fin 105 SyllabusDocument5 pagesFin 105 SyllabusSamNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Cape Economics Past Paper Solutions June 2008Document11 pagesCape Economics Past Paper Solutions June 2008Akeemjoseph50% (2)

- MOCK P4 DecDocument5 pagesMOCK P4 DecHunainNo ratings yet

- Fina 004Document4 pagesFina 004Mike RajasNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Business Studies PamphletDocument28 pagesBusiness Studies PamphletSimushi SimushiNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- CPChap 1Document38 pagesCPChap 1Phương DaoNo ratings yet

- Discussion 4 FinanceDocument5 pagesDiscussion 4 Financepeter njovuNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- FINMAN1 FloatDocument1 pageFINMAN1 FloatJohn Vicente BalanquitNo ratings yet

- Trade and Other ReceivablesDocument21 pagesTrade and Other ReceivablesNoella Marie BaronNo ratings yet

- VPA Cheat SheetDocument5 pagesVPA Cheat SheetSharma comp71% (7)

- Task 1Document1 pageTask 1Robin ScherbatskyNo ratings yet

- Activity Sheet 3 Ordinary AnnuityDocument4 pagesActivity Sheet 3 Ordinary AnnuityFaith CalingoNo ratings yet

- The SIX SENSE (Karvy Demat Scam)Document12 pagesThe SIX SENSE (Karvy Demat Scam)Pranav TaleNo ratings yet

- Real Estate FundsDocument5 pagesReal Estate FundsDigito DunkeyNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Study On Equity Analysis With Respect To Banking Sector at INDIABULLSDocument20 pagesA Study On Equity Analysis With Respect To Banking Sector at INDIABULLSNationalinstituteDsnr0% (1)

- S Ep JFX 3 Wa El Al GS2Document8 pagesS Ep JFX 3 Wa El Al GS2Danda RavindraNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)