Professional Documents

Culture Documents

Personal Finance Management and Workplace Productivity

Uploaded by

Kelechi UlohOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Personal Finance Management and Workplace Productivity

Uploaded by

Kelechi UlohCopyright:

Available Formats

Personal Finance Management and Workplace Productivity

Personal finance is a very critical issue in promoting workplace productivity. However, this is often overlooked by both employees and employers alike. Employees are often concerned about their income, pay increases, favourable work environment and other benefits, while the employer is often concerned about overheads, employee contributions, loyalty and the likes. Financial education for employees will definitely improve workplace productivity as stress is reduced, man-hours loss due to time spent in resolving financial crises is minimized and theft by employees could be alleviated.

An understanding of financial basics would promote employee personal financial wellness, increased employee loyalty & morale and a good feeling of control over their personal finances. Personal Finance Basics:

Networth: This is fundamentally a subtraction of what is Owed from what is Owned. This could be said to be Assets minus Liabilities; Networth = Assets Liabilities. However, the constituents of Assets and Liabilities could defer for individuals. For instance, a vehicle can be an asset to an individual while it is a liability to another. Assets are often defined as items which produce income. A hypothetical Networth analysis can be shown as: ASSETS (A) LIABILITIES (L) S/N DESCRIPTION N DESCRIPTION N 1. Shares 450,000:00 Mortgage 18,456,750:00 2. Cash 123,500:00 Car Loan 1,230,000:00 3. *Personal Belongings 3,425,000:00 Personal 85,000:00 Loans 4. Mutual Funds 75,000:00 Credit Card 5. Pension Fund Contribution 278,900:00 6. 7. Real Estate/Rent Prepaid Notes Receivables 26,457,500:00 115,000:00 30,924,900:00

19,771,750:00

Networth = Assets (A) Liabilities (L) = N11, 153,150:00 Some schools of thought, opines that only Liquid Assets (easily convertible to cash) should be captured, personal belongings (Cars, Household equipments, e.t.c) were adjudged as highly depreciable and most often worthless at points of resale. However, other schools not only uphold that personal effects be included (at depreciated values), but also propose the inclusion of Intangible assets (Education, Work experience, Competences, e.t.c) in anyway quantifiable. Whichever approach we adopt will depend on the objective we intend to achieve. Age and income are also key factors in determining Networth of individuals. How much should you be worth at your present age? Every individual has his or her own unique lifestyle, so there is no one-sizefits-all, universally agreed-upon number. However, Thomas Stanley and William Danko, authors of "The Millionaire Next Door" (1998), provide a general formula: Net worth = Age * Pretax income 10

A negative Networth should enable you strive on taking it to the positive, while a low income makes it harder to build your net worth, multiply streams of income is usually encouraged. If the numbers come up negative, spending is most likely the culprit. Cutting your spending is the first step towards turning your situation around. Paying off debts is the next. If your net worth is low, strive to build it through saving and investing. Our focus should be on maximizing the amount we save and minimizing the amount we spend. David John Marotta, a widely-quoted financial advisor, recommends instituting a savings plan that results in building net worth to the point where it reaches 20-times annual spending by the time a person reaches age 72 and retires. The voluntary contribution under the Pensions scheme is one good avenue to achieving this. Hourly/Daily Pay An understanding of your hourly/daily pay helps build your work efficiency, keeping close watch on time wasters and the financial implication. This will enable you value your time and assiduously work towards improving the value of your hourly pay. Hourly pay = Daily pay No. of work hours Daily pay = Gross Monthly Nominal Pay No. of Days in a Month Recurrent Expenses The same way we complain of the high cost of government expenditures, especially with the kind of democracy we practice and the huge number of unproductive workers, so do our personal spending witness repeated expenditures that are highly wasteful and unnecessary. In improving our savings magnitude, our expenditures must be thorough and slim. PI C = S Hence, the lower the Consumption (C), the higher the Savings (S) arising from our Personal Income (PI). Unfortunately our savings culture is very poor because of our spending culture characterized by sentiments, peer influences and short term perspectives. Overall, we should be very skillful in recognizing daily or monthly repeated expenditures to manage our income. These recurrent expenses could pose great danger if not sufficiently minimized or grossly eradicated. Cost items such as transport, feeding, entertainments, telephone, gratification tips, domestic staff, gas/petrol/diesel/kerosene, e.t.c must be minimized as possible. Once this is achieved, savings is improved which can promote investment, self esteem and employee loyalty.

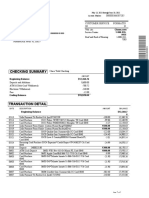

Cashflow Analysis Most often than not, our monthly expenditure outweighs monthly income. Where are the extra bucks coming from? A spreadsheet that clearly shows the daily incomes and expenditure would display the flow of cash. A simple cashflow template for January February, 2011 will be as shown below (please note this is not an exhaustive list of items):

JAN. Description INCOME (I): Bal. B/F Salary Others TOTAL: EXPENDITURE(E): Tithe/Zakat Offerings/Gifts Transport Feeding Entertainment Rent Education Others TOTAL: CLOSING BAL. (I-E):

Amount (N) 15,000 135,000 34,500 184,500 18,450 14,000 12,500 35,000 21,000 10,000 23,500 7,500 141,750 42,550

FEB. Description INCOME (I): Bal. B/F Salary Others TOTAL: EXPENDITURE(E): Tithe/Zakat Offerings/Gifts Transport Feeding Entertainment Rent Education Others TOTAL: CLOSING BAL. (I-E):

Amount (N) 42,550 135,000 27,450 205,000 20,500 14,000 12,500 45,000 10,000 10,000 15,500 5,500 133,000 72,000

The above analysis shows that additional income has enhanced the closing balances. Otherwise the expenditure profile is higher or quite close to the monthly salary. Daily Expense Notepad Using a notepad, either through mobile phones or small pieces of paper neatly placed in our wallets/handbags, can be a sure way to capture daily expenses as they occur. The total expense per day can then be aggregated monthly. This personal finance practice will ensure all expenses are traceable, because surprisingly small sums of expenses add up, little drops of water we say, makes an ocean. Savings Strategy We must adopt a savings method akin to our lifestyle and easy to implement. Daily/Monthly contributions engaged in by group of individuals are one of such methods. This could now be channeled for investment purposes. The voluntary pension contribution scheme is another great way of savings for retirement. Personal Finance Tips The following tips could help in achieving personal finance wellness: 1. Ensure to live within your means 2. Distinguish Assets from Liability items, and purchase more of the Assets. 3. Set aside funds for savings, pay yourself first (at least 10% of your income) 4. Build up emergency funds (at least three months accumulated gross salaries).

5. Plan a Budget; be careful not to expend much on unplanned items. 6. Take at least 24-48 hours before embarking on any huge purchase. Prices could fall and gives you an advantage; inflation could also reduce the purchasing power of the available funds. However, the timeframe helps for proper decision making. 7. Dont purchase a car valued more than your Annual pay package, except a very long lease with favourable interest rates. 8. Ensure your debt is continually minimized. 9. Embrace Insurance covers 10. Maximize Employment benefits; staff bus, free/subsidized breakfast and lunch, staff loans, e.t.c 11. Be careful about borrowings. 12. Dont give what you dont have 13. Ensure efficient spending culture Benefits of Personal Finance Education on Employees and the Employer. 1. We should always ask the questions: - Am I underpaid, well paid or overpaid? - Using the *ELTV and *EVP models employees should strive to be at the underpaid level, so as to proceed to well paid and then overpaid level. We should always add more value than we receive. 2. Personal finance and customer relation; wrong attitude to work and customers could be as a result of personal finance problems. 3. Develop your career; get education and training to improve your throughput. 4. Increasing personal bankruptcy, heavy debt, shortage of income, and inability to save are dare financial problems which can damage workplace morale and diminish productivity. 5. Personal financial wellness affects absenteeism and work time used for personal financial matters. ELTV & EVP MODELS *ELTV Employee Life-Time Value: a quantitative measure of the long term financial contribution an employee makes to an organization. Hence the tilt of info gathering from employees age, sex, salary, bonuses, etc, to critical info on performance, workplace behavior, attitudes, loyalty, Financial in flows per employee, cost of maintaining an employee, etc. These will help build an ELTV. *EVP Employee Value Proposition; value of the organization to the employee, which contributes directly to the employees ability to contribute to the firm. These are more intrinsic values; satisfaction of work, the environment, leadership, colleagues, compensation, how well the company fulfills peoples needs, expectations and dreams, etc. Conclusion Employee financial education will promote: 1. Awareness about the need to plan and save for retirement. 2. knowledge of personal finances.

3. 4. 5. 6. 7. 8. 9. 10. 11. 12.

Feelings of control over their personal finances. Confidence in managing money to achieve personal financial goals. The number who reduced some personal debts. Confidence in making investment decisions, improvement in their personal financial situation. Development of plans for their financial future. Employee personal financial wellness. Increased employee loyalty and morale. Reduced workers stress. Increased workplace productivity. Reduced incidence of employee theft.

Uloh Kelechi Remmy (Formerly Oulo kenechukwu Remigius)

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Account Statement 12-10-2023T22 26 37Document1 pageAccount Statement 12-10-2023T22 26 37muawiyakhanaNo ratings yet

- Material Requirements PlanningDocument38 pagesMaterial Requirements PlanningSatya BobbaNo ratings yet

- A Globalization and Public AdministrationDocument15 pagesA Globalization and Public AdministrationsemarangNo ratings yet

- ReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDocument21 pagesReSA B45 AUD First PB Exam - Questions, Answers - SolutionsDhainne Enriquez100% (1)

- Derivatives As Hedging Intrument in Managing Foreign Currency Exposures TheoriesDocument10 pagesDerivatives As Hedging Intrument in Managing Foreign Currency Exposures TheoriesJulie annNo ratings yet

- UntitledDocument986 pagesUntitledJindalNo ratings yet

- Going: ForwrdDocument340 pagesGoing: ForwrdAngel MaNo ratings yet

- Top Companies in Vapi GujaratDocument9 pagesTop Companies in Vapi GujaratNimesh C VarmaNo ratings yet

- Labour Law Notes GeneralDocument55 pagesLabour Law Notes GeneralPrince MwendwaNo ratings yet

- Mean Vs Median Vs ModeDocument12 pagesMean Vs Median Vs ModekomalmongaNo ratings yet

- Public Limited CompaniesDocument2 pagesPublic Limited CompaniesGaurav AgarwalNo ratings yet

- Basel 1 NormsDocument12 pagesBasel 1 NormsamolreddiwarNo ratings yet

- Impact of Microfinance Services On Rural Women Empowerment: An Empirical StudyDocument8 pagesImpact of Microfinance Services On Rural Women Empowerment: An Empirical Studymohan ksNo ratings yet

- of OlayDocument14 pagesof OlaySneha KhapardeNo ratings yet

- How Monetary Policy Impacts Inflation in KenyaDocument46 pagesHow Monetary Policy Impacts Inflation in KenyaNjoguNo ratings yet

- Capital Intensive Labor Intensive: Required: Determine The FollowingDocument2 pagesCapital Intensive Labor Intensive: Required: Determine The FollowingMahediNo ratings yet

- Estado Bancario ChaseDocument2 pagesEstado Bancario ChasePedro Ant. Núñez Ulloa100% (1)

- Portfoli o Management: A Project OnDocument48 pagesPortfoli o Management: A Project OnChinmoy DasNo ratings yet

- Bài Tập Và Đáp Án Chương 1Document9 pagesBài Tập Và Đáp Án Chương 1nguyenductaiNo ratings yet

- Cash Receipt Cycle: Step Business Activity Embedded Control Forms Risk InformationDocument10 pagesCash Receipt Cycle: Step Business Activity Embedded Control Forms Risk InformationJudy Ann EstradaNo ratings yet

- Lec 6 QuizDocument3 pagesLec 6 QuizWennie NgNo ratings yet

- Summary of Newell'S Corporate AdvantageDocument3 pagesSummary of Newell'S Corporate AdvantageMay Angeline CurbiNo ratings yet

- E-Business Adaptation and Financial Performance of Merchandising Business in General Santos CityDocument9 pagesE-Business Adaptation and Financial Performance of Merchandising Business in General Santos CityTesia MandaloNo ratings yet

- MCQ Corporate FinanceDocument13 pagesMCQ Corporate FinancesubyraoNo ratings yet

- Introduction to Accounting EquationDocument1 pageIntroduction to Accounting Equationcons theNo ratings yet

- Alliancing Best Practice PDFDocument48 pagesAlliancing Best Practice PDFgimasaviNo ratings yet

- Rajiv Awas Yojana GuidelinesDocument24 pagesRajiv Awas Yojana GuidelinesSherine David SANo ratings yet

- Human Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofDocument44 pagesHuman Resource Management Process in Big Bazaar: in Partial Fulfillment of The Requirements For The Degree ofDHARMENDER YADAVNo ratings yet

- PPCFDocument4 pagesPPCFAbdulkerim kedirNo ratings yet

- An Evaluation of The Customers' Satisfaction of Social Islami Bank Limited: A Study On Savar Branch Submitted ToDocument44 pagesAn Evaluation of The Customers' Satisfaction of Social Islami Bank Limited: A Study On Savar Branch Submitted ToHafiz Al AsadNo ratings yet