Professional Documents

Culture Documents

Labor Standards

Uploaded by

liboaninoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Labor Standards

Uploaded by

liboaninoCopyright:

Available Formats

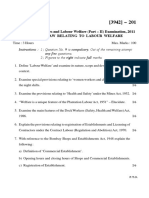

LABOR STANDARDS ( 2007 EDITION ) 10 Principles in Labor: 1.not all labor for another is compensable 2.

not all compensable labor is demandable 3.labor is a property right (except government employment) 4.prohibition vs involuntary servitude 5.living wage 6.state intervention in labor 7.validity of labor legislation cannot be challenge as unjust legislation or cla ssification 8.waiver of labor rights can be effected by government intervention 9.interpretation of labor contracts in favor of labor (except: union security cl ause and strikes) 10.prohibition vs diminution of benefits.

Policy Declaration Art. 3: The State shall 1.Afford protection to labor 2.Promote full employment 3.Ensure equal work opportunities regardless of sex, race or creed 4.Regulate the relations between workers and ER s. 5.Assure the rights of workers to self-organization, collective bargaining, secu rity of tenure, and just humane conditions of work. 6.Art 12,Sec 1 1987 Constitution states the Equitable distribution of opportunit ies and wealth and increase in amount of goods and services provided by nation f or people s benefit and expanding productivity. 2006 notes: principle of protection extends to EEs who is abused by ER or Union leadership or their respective representatives. 2005 notes:Rule on construction in favor of labor applies only in case there is doubt. 2006 notes: in private entity, labor is a property right; while in government ,l abor is not property right since public office is a public trust, so it must be traceable to a law, if you cannot trace it ,then no employment in government ev en if how long (ex: if you have been mixing coffee in office of mayor for 10 yrs , it will not prescribe)

Law Classification 1. Labor Standards Law That which sets out the minimum terms, conditions and ben efits of employment that ER s must provide or comply with and to which EE s are enti tled as a matter of legal right. Ex. 8-hour labor law 2. Labor Relations Law That which defines * the status, rights and duties * and the institutional mechanisms that govern the individual and collective interaction of ER s and EE s or their repr esentatives. Ex. Book V of Labor Code 3. Welfare Legislation designed to take care of contingencies which may affect w orkers, e.g. where there is loss of income for research beyond the worker s contro l. BENEFITS * Social Security Law.

Basis for Enactment 1. Art. II, Sec.5, Const. : The maintenance of peace and order, the protection of life, liberty, and property, and the promotion of general welfare are essenti al for the enjoyment by all the people of the blessing of democracy. 2. Art. II, Sec. 18, Const. : The State affirms labor as a primary social econo mic force. It shall protect the rights of workers and promote their welfare. 3. Art. XIII, Sec. I, Const. : The Congress shall give highest priority to the enactment of measures that protect and enhance the right of all the people to hu man dignity, reduce social, economic and political inequalities, and remove cult ural inequities by equitably diffusing wealth and political power for the common good. To this end, the State shall regulate the acquisition, ownership, use, and dispo sition of property and its increments.

Labor and social legislation are enacted pursuant to the police power of the Sta te. This is its inherent power to enact wholesome and reasonable laws to promote order, safety, health, morals and general welfare of society. In its exercise t he state may interfere with personal liberty, with property and with business an d occupation. (Calalang vs. Williams). No longer may the due process clause and the freedom of contract be invoked to c hallenge labor and social legislation. This has long been discarded since the 19 37 case of West Coast Hotel vs. Parish (US) and the 1924 case of Pp. vs. Pomar ( RP).

Labor relation laws enable workers to obtain from their employers more than the minimum benefits set by labor standard laws EMPLOYER (ER) and EMPLOYEE(EE) RELATIONSHIP ER includes any person,natural or juridical, acting directly or indirectly in the interest of the ER in relation to an EE and shall include the Government and al l its branches, subdivisions and instrumentalities, all GOCC s and institutions, a s well as non-profit private institutions, or organizations. EE includes any person in the employ of an ER. The term shall not be limited to t he EE s of a particular ER, unless this Code explicitly states. It shall include a ny individual whose work has ceased as a result or in connection with any curren t labor dispute or because of unfair labor practice if he has not obtained any o ther substantially equivalent or regular employment. purchaser of the assets of an ER corporation is not considered a successor ER o f the latter s EE since Labor contracts are not enforceable against a transferee of an enterprise, labor contracts being in personam, thus binding only between p arties. The existence of ER-EE relationship is determined by the following elements name ly: The existence of an ER-EE relationship is a question of law and being such, it cannot be made the subject of an agreement. (Tabas vs. CMC) a. b. c. d. the the the the Selection and engagement of the EE s payment of Wages power of Dismissal; and power to control the EE s conduct

particular form of evidence is required to prove the existence of an ER-EE relat ionship. Any competent and relevant evidence to prove the relationship may be ad mitted (Opulencia vs. NLRC)

CONTROL TEST *** There is an ER-EE relationship where the ER controls or has reserved the rig ht to control the EE not only as the result of the work but also as to the means by which said work is to be accomplished (Paradise vs. Ng). The test merely cal ls for the existence of the right to control the manner of doing the work not th e actual exercise of the right. (Ruga vs. NLRC) The line should be drawn between rules that merely serve as guidelines towards the achievement of the mutually d esired results without dictating the means or methods employed in attaining it, and those that control or fix the methodology and bind or restrict the party hir ed to the use of such means. The first , which aim only to promote the result, c reate no ER-EE relationship unlike the second, which addresses both the result a nd the means to achieve it. (Insular Life vs. NLRC) The control test calls merel y for the existence of the right to control and manner of doing work, not the ac tual exercise of the right. (Dy Keh Beng) ECONOMIC TEST The absence of ER-EE relationship may be determined through economic tests like the inclusion of the EE in the payrolls, having irregular compensation and havin g a personal stake in the business. (Sevilla vs. NLRC)

2006 notes:ER-EE is a question of fact if no question as to indirect ER nor 105, 106 and 107 but it becomes a question of law if there s another party beyond ER-EE or there s indirect ER or 105,106, and 109. Way of answering--- law itself says it Is there an ER-EE relationship on the following? * Workers under a pakiao agreement arranged by G whom PRC considered as an indep endent contractor. ER gives orders to G, on where to store the copra, when to br ing out, how much to load and where, and what class of copra to handle. The equi pment used is owned by PRC. Yes. PRC has direct control over the handling of th e copra. The control test is satisfactorily met. * Piece workers subject to specifications. Yes. The fact that the making of the basket is subject to Dy s specifications indicates the existence of control. (Dy K oh Beng vs. ILMU) * Tailors, pressers, stitchers and similar workers employed by COD on a piece-wo rk basis. The EE s are governed by the company s regulations i.e. 8-hour workday, re cording of attendance etc Furthermore, a master cutter distributes job orders equ ally, supervises the work and sees to it that they were finished as soon as poss ible. Yes. The worker s conduct in the performance of their work was controlled by the company (Rosario vs. Ople) * Cargadores and pahinantes recruited by SMC through a labor contractor who are governed by the regulations of the SMC whose work consisted of loading, unloadin g, pilling or palleting empty bottles and wooden shells from company trucks and warehouses. Yes. The evidence firmly establishes the control exercised by the SM C. (BLUM vs. Zamora) * Shoe shiners who had their own customers but shared proceeds with company. No. The company does not exercise any degree of control or supervision over his wor k. The shoe shiner is a partner in trade. (Besa vs. Trajano)

* Vendees of cigarettes who are governed by the regulations of the vendor compan y i.e. definite sales territory, requirement to submit daily, weekly and monthly reports, etc. Yes. Vendor company had control over the vendee. (SSS vs. CA) 2006 notes: the moment there is a surety bond, ER-EE do not exist. *I. S, a prominent social figure, had an agreement with TWS to act as branch mana ger; The agreement provided that she would be entitled to a part of the commissi on on sale of tickets; and that she would share in the expenses of maintaining t he office. She was also a signatory to a lease agreement covering the branch s pre mises, holding herself solidarily liable for the prompt payment of rentals. No. I. S was not subject to the control by TWS. The services rendered by I.S must ha ve been done by her pursuant to a contract of agency. (Sevilla vs. CA)

* A plant manager hired by a marble company which was about to close in a few mo nth s time due to business losses. The company had no control over the former, eit her as to hours of work or method of accomplishing the work. The former was enti tled to a percentage of the net profits of the company for that period. No. Mana ger was merely a party to a joint venture. (CMC vs. NLRC)

* Fishermen-crew of a trawl fishing vessel subject to control and supervision of the owner of the vessel i.e. conduct of fishing operations; time to report to f ishing port, etc Yes. (Ruga vs. NLRC) * Tailors, seamstresses and other workers of a haberdashery who were paid on a p iece-rate basis. They were directed by the proprietor of the establishment as sp ecified by the customers. They were required to finish jobs orders in one day be fore due date. Yes. They did not exercise independence in their own methods, but on the contrary were subject to the control of the establishment from the begin ning of their task to their completion. They also had to rely on the tools and e quipment supplied by the haberdashery. (Makati Haberdashery vs. NLRC) * The power of control refers merely to the existence of the power and not the a ctual exercise thereof. * Caddles who are not under the control and supervision of the golf club as to w orking hours, manner of carrying out their services, etc. No. The club did not h ave the measure of control over the incidents of the caddy s work and compensation that the ER would possess. (Manila vs. IAC) * College teachers. Yes. The Court takes judicial notice that a university cont rols the work of the members of its faculty; that it prescribes the courses or s ubjects that they teach and the time and place for teaching. (Feati vs. Bautista ) * Jeepney drivers working under the boundary system. Yes. The driver does not ha ve any interest in the business because he did not invest anything in the acquis ition of jeeps and did not participate in the management thereof. (Citizen s Leagu e of Free Workers vs. Abbas)

In Agency, it is civil law, so regular courts has jurisdiction and not the labor arbiter In tenancy: 1.Farmworker(ER-EE): 1 enterprise and that is of the ER ,no right of possession of EE Tenancy: joint production agreement (so it is partnership), tenant has right of possession. 2.T:compensation is conditional(less harvest, no share) F: compensation is unconditional ,meron harvest or wala, may sweldo. 3.T: service is that entire family may help F:only hired EE is obliged to render service 4.T:landowner has little control since it is the tenant that decides how to plan t

2006 notes:Even if there s ER-EE rel, the ff are still immune from suit: embassy,c onsul and int organization.

INDEPENDENT CONTRACTOR AND LABOR CONTRACTOR 2006 notes: in legitimate contracting there exist a trilateral relationship unde r which there is a contract for a specific job between the principal and the con tractor/subcontractor and a contract of employment between contractor/subcontrac tor and its workers. 2006 notes:between principal and the contractor,the major applicable laws regard ing their work relationship are the Civil code and pertinent commercial laws. Be tween contractor and his employees ,the pertinent law is the Labor Code. Between the principal and contractor s ee,no er-ee relationship exist since contractor is a business man, an employer. 2006 notes:er-ee exist between principal and workers where the contracting arran gement is not legitimate ,as where is it a labor only contracting.

1.There is labor-only contracting where: a.the person supplying in workers to an ER does not have > substantial capital > [substantial] investment in the form of tools, equipment, machineries, work pr emises, among others b.and the workers recruited and placed by such persons are performing activities which are directly related to the principal business of such ER. In such cases, the person or intermediary shall be considered merely as an agent of the ER who shall be responsible to the workers in the same manner and extent as if the latter were directly employed by him. Labor-only contracting as defined herein is hereby prohibited and the person act ing as contractor shall be considered merely as an agent or intermediary of the ER who shall be responsible to the workers in the same manner and extent as if t he latter were directly employed by him.

2.There is job contracting where: 1. The contractor carries on an independent business and undertakes the contract work a. on his own account

b. under his own responsibility c. according to his own manner and method d. free from the control and direction of his ER or principal in all matters con nected with the performance of the work except as to the results thereof; and 2. The contractor has a. substantial capital or b. [substantial] investment in the form of tools, machineries, work premises, an d other materials which are necessary in the conduct of his business. when a contractor fails to pay the wages of his EE s, the ER who contracted out th e job to the contractor becomes jointly and severally liable with his contractor to the EE s of the latter to the extent of the work performed under the contract as if such ER were the ER of the contractor s EE s. (PBC vs. NLRC) Liability of ER, Independent Contractor and Subcontractor and Labor-Only Contrac ting General Rule : An ER who enters into a contract with a contractor to perform wor k for the ER, does not thereby create an ER-EE relationship between himself and the EE s of the contractor. Thus the EE s of the contractor remain the contractor s EE s and his alone. (PBC vs. NLRC) Nonetheless : When a contractor fails to pay the wages of his EE s in accordance w ith the Labor Code, the ER who contracted out the job to the contractor becomes jointly and severally liable with the contractor to the EE s of the latter to the e xtent of the work performed under the contract as if such ER were the ER of the c ontractor s EE. The law itself, established an ER-EE relationship between the ER and the job con tractor s EE s for a limited purpose i.e. in order to ensure that the latter get pai d for wages due them. 1. Indirect ER : These provisions shall likewise apply to any person, partnershi p , association or corporation which, not being an ER, contracts with an indepen dent contractor for the performance of any work, task, job or project. (Art. 107 ) 2. Labor-Only Contractor : The conclusion is different where there is labor-only c ontracting. The labor-only contractor i.e. person or intermediary, is considered m erely as an agent of the ER. The statute makes the ER directly responsible to the EE s of the labor-only contractor as if such EE s had been directly employed by the E R. The statute establishes an ER-EE relationship between the ER and the EE s of th e labor-only contractor, this time for a comprehensive purpose, to prevent any vio lation of this Code. (Broadway Motors vs. NLRC) > The legitimate job contractor provides services while the labor-only contracto r only provides manpower. > Job contractor undertakes to perform a specific job while labor-only contracto r merely provides personnel to work for the employer. Art. 108 : An ER or urnish a bond equal ond will answer for as the case may be indirect ER may require the contractor or subcontractor to f to the cost of labor under contract, on condition that the b the wages due the EE s should the contractor or subcontractor, fail to pay the same.

If an independent service contractor fails to pay the wages of the janitors its supplies to XYZ, is XYZ liable for the unpaid wages?Yes. According to Art. 106, the ER shall be jointly and severally liable to the EE s of the contractor or subc ontractor to the extent of the work performed under the contract. (Alcantara)

Would your answer change if XYZ already paid the independent contractor the cont ract price? No, XYZ will still be liable for the unpaid wages of the janitor sin ce the obligation is imposed by law. PTS, a government agency, entered into a service agreement with ABC or the suppl y of janitors to PTS. ABS failed to pay the wages of the janitors. PTS refused t o pay on the ground that it is a government agency. Is this claim valid?No. The janitors employed by ABC are considered indirect EE s and not to indirect EE s comin g from the private sector. (Rabago vs. NLRC) Examples of Independent Contractor: * Commission agent : IPC Company entered into agreement with registered represen tatives who worked on a commission basis. While the agents were subject to a set of rules and regulations governing the performance bond; the termination for ce rtain causes, however, the agents were not required to report to work; to devote their time exclusively for the company; to account for their time nor submit a record of their activities; and that they were paid on a commission based on a c ertain percentage of sales. The fact that for a certain specified causes (failur e to meet annual quota) the relationship may be terminated does not mean such co ntrol exists, for the causes of termination have no relation to the means and me thods of work. (IPC vs. SSS) * Dealership : A contract whereby one engages to purchase and sell soft drinks o n trucks supplied by the manufacturer but providing that the other party (peddl er) shall have the right to employ his own workers, shall post a bond to protect the manufacturer against losses shall be responsible for damages caused to thi rd person, shall obtain the necessary licenses and permits and bear the expenses incurred in the sale of the soft drinks. (Mafinco vs. NLRC) Another dealership agreement wherein the dealer: handles the products in accorda nce with existing laws and regulations; sends his orders to the factory plant; i s supplied by the factory with a delivery truck and all expenses for repairs are borne by the factory; receives no commission but given a discount for all sales ; is responsible alone for any violation of the law, sells the product at the pr ice agreed upon between the parties; and posts a surety bond of not less than P1 0,000.00. (La Suerte vs. Director of Labor Relations) * Security Agency : Shipping company entered into an agreement with a security a gency wherein the security agency was responsible for the hiring and assignment of the guards, the guards were not known to the shipping company for it dealt di rectly with the agency, and a payment of a lump sum to the agency who in turn pa id the compensation of the individual watchmen. Under the circumstances, the gua rds cannot be considered EE s of the shipping company. It is the security agency t hat recruits, hires and assigns the work of the watchmen. It is the wages to whi ch the watchman is entitled. The powers to dismiss lies with the agency. Lastly, since the company has to deal with the agency, and not with the individual watc hmen, on matters, pertaining to the contracted task, it stands to reason that th e company does not exercise any power or control over the watchmen s conduct. (APL vs. Clave) * Stevedoring Services : SHIPSIDE entered into a Contract for Services with La Un ion providing among others that the latter would furnish all labor needed for st evedoring work in piers controlled by the former. The net balance of the stevedo ring charges will be divided equally among the parties. The records do not show any participation on the part of SHIPSIDE with respect to the selection and enga gement of the individual stevedores. The terms and conditions of their services are matters determined not by SHIPSIDE but by La Union. It is also sufficiently established that La Union exercised supervision and control over its labor force

. While SHIPSIDE occasionally issued instructions to the stevedores, such instru ctions, in legal contemplation are mere requests since the privity of contract l ies between the workers and La Union. (SHIPSIDE vs. NLRC)

* Collection Agency : Singer entered into a collection agency agreement with colle ctors providing among others that the collector is to be considered at all times to be an independent contactor; he was required to comply with certain rules an d regulations (i.e. use of authorized receipts, monthly collection quota, cash b ond, and submission of report of all collections at least once a week); and his services can be terminated in case of failure to satisfy these regulations. Howe ver, the agent was not required to observe office hours or to report to Singer e xcept for remitting his collections. He did not have to devote his time exclusiv ely for Singer and the manner and method of collection were left solely to the d iscretion of the agent, and he shouldered his transaction services. ( * Messengerial/Janitorial Services : Janitors were hired by CSI and assigned to La Union Carbide. They drew their salaries from CSI. CSI exercised control over them through a SCI EE who gave orders and instructions. Moreover, CSI had the po wer to assign its janitors to various clients and pull them out. CSI was a regis tered service contractor and did business with a number of known companies in th e country. It maintains its own office and had its own office equipment. It furn ishes its janitors the cleaning equipment. (Rhone-Poulene vs. NLRC) BCC, capitalized at P1 million fully subscribed and paid for provided janitorial and other services to various firms. It hired A and B and assigned them to work for FEBTC. The two reported for work wearing the prescribed uniform of the BCC ; their leave of absences were filed directly with BCC; and their salaries drawn only from BCC. FEBTC however issued a job description which detailed the functi ons of two. Applying the control test, BCC is the ER of the two. Furthermore, it had substantial capital. The guidelines in the job description were laid down merely to ensure the desired result was achieved. It did not, however, tell how the work should be performed. (Neri vs. NLRC) * Repair and Maintenance Service : F doing business, was hired by Shell to con duct a hydro-pressure test. He was paid a lump sum for the work he and his men a ccomplished. He utilized his own tools and equipment. He accepted business from other companies. He was not controlled by Shell with regard to the manner in wh ich he conducted the test. (Pilipinas Shell vs. CA)

Examples of Labor-Only Contracting * Agency hiring : PBC and CESI entered into an agreement under which the latter undertook to supply the former with 11 messengers. The agreement provided that t he messengers would remain EE s of CESI; PBC remitted to CESI amount equivalent to the wages of the messengers; CESI in turn paid them and their names are not inc luded in the PBC s payroll; the bank, in cases of dismissal would request CESI, an d CESI would in fact withdraw such messenger, and the messengers performed their functions within the bank s premises. CESI cannot be considered a job contractor because its undertaking is not the performance of a specific job; it merely unde rtook to provide the bank with a certain number of persons able to carry out the work of messengers. (PBC vs. NLRC) Under the Work Contract between A and a motorshop, A undertook to supply labor a nd supervision in the performance of automotive body painting work. A and his me n were paid lump sum, the company supplied the tools, equipment, machineries and materials and moreover, the jobs were done in the premises of the motor shop. A side from the fact that the company exercised control and direction over the wor k done by A and his men, the line of work-automobile painting was directly relat ed to, if not an integral part of the regular business of the motor shop. (Broad way Motors vs. NLRC) LS provided helpers, janitors, mechanics to NP, a corporation engaged in garment manufacturing. The agreement between the two provided that LS shall provide NP with workers, NP shall pay LS a fee based on rates fixed by the agreement, there is no ER-EE relationship between the two and LS shall have exclusive direction in the selection, engagement and discharge of its personnel and the latter shall be within is full control. LS is a labor-only contractor since it is merely an ag ent to procure workers for the real ER. * Security Guard Hiring : Hyatt and VSS entered into a contract of services whe rein VSS agreed to protect the properties and premises of Hyatt by providing sec urity guards. The security guards filled up Hyatt employment application forms a nd submitted the forms to the Security Department of the hotel. Their wages were paid directly by Hyatt and their assignments, promotions, supervisions and dism issal were approved by the Chief Security Officer of Hyatt. (Vallum Security vs. NLRC) 2006 notes: since Hilton is the one doing the training ,assigning and hiring, so Vallum is only a labor only contractor. 2006 notes:liability of indirect ER under labor code cannot apply in causes of a ction arising from quasi-delict (ex: guard playing gun tapos nakabaril, the agen cy is liable but not the hotel)

Rights of Contractual Employees: 1.safe and healthful working conditions 2.labor standards such as service incentive leave, rest days.. 3.social security and welfare benefits 4.self-organization, collective bargaining and peaceful concerted action 5.security of tenure Summary of Prohibited Labor Contracting:

1.Labor Contracting 2.Contracting that terminates the employment of regular employees ,or reduces t heir work hours ,or reduces or splits a bargaining unit, if such contracting out is not done in good faith and not justified by business exigencies. 3.Contracting with a CABO It may also be a ground for cancellation of union registration.

4.Contracting with an in-house agency It is a variety of labor-only contracting disguised by the fiction of separate c orporate entity. 5.Contracting because of a strike or lock out It is prohibited since if allowed it would undermine the nature and purpose of s trike and could amount to a run-away shop. But it should be noted that under Art icle 264, the employer himself may directly hire replacements of strikers even w hile the strike is in progress.

6.Contracting that constitutes ULP

7.Exploits employee in need Taking undue advantage of economic situation or lack of bargaining strength of contractual employee or undermining his security of tenure or basic rights or ci rcumventing the provisions of regular employment.

EMPLOYMENT AGENCIES Worker any member of the labor force, whether employed or unemployed

Private fee-charging employment agency any person or entity engaged in the recruit ment or placement of workers for a fee which is charged directly or indirectly, from the workers or ER s or both. Private recruitment entity any person or association engaged in the recruitment an d placement of workers, locally or overseas, without charging, directly or indir ectly, any fee from the workers or the ER s or both.

Allowed Private Agencies and Entities Sec. 1, Rule III, Book I, IRR s No person or entity shall engage in the recruitmen t and placement of workers either for local or overseas employment except the fo llowing: [allowed agencies] 1. public employment agencies 2. POEA 3. private recruitment entities 4. private employment agencies 5. shipping or manning agents or representatives; and 6. such other persons or entities as may be authorized by the Secretary. *Art. 25 : . . . the private employment sector shall participate in the recruit ment and placement of workers, locally and overseas, under such guidelines, rule s and regulations as may be issued by the Secretary of Labor.

Prohibited Business Agencies and Entities 1. Art. 18 : Ban on Direct Hiring No ER may hire a Filipino worker for overseas employment except through the Boards and entities authorized by the Secretary of Labor. a. Direct hiring by members of the diplomatic corps; b. International organizations and such other ER s as may be; c. allowed by the Secretary of Labor is exempted from this provision. 2. Art. 26 : Travel agencies and sales agencies of airline companies are prohibi ted from engaging in the business of recruitment and placement of workers for ov erseas employment, whether for profit or not. Workers Fees Art. 32 : Any person applying with a private fee-charging employment agency for employment assistance shall not be charged any fee until 1. he has obtained employment through its efforts; or 2. he has actually commenced employment. Such fee shall be always covered with t he appropriate receipt clearly showing the amount paid. The Secretary of Labor s hall promulgate the schedule of allowable fees. Reports Submission

* Art. 33 : Whenever the public interest requires, the Secretary of Labor may di rect all persons or entities within the coverage of this Title to submit a repor t on the status of employment, including job vacancies, details of job requisiti ons, separation from job, wages, other terms and conditions, and other employmen t data. GOVERNMENT TECHNIQUES OF REGULATION PRIVATE RECRUITMENT AND PLACEMENT BUSINESS Licensing, Citizenship, Capitalization, Duration, Transferability and Fees Citizenship Requirement: A.Only Filipino citizens or B.Only corporations, partnerships or entities at least 75% of the authorized and voting capital stock of which is owned and controlled by Filipino citizens shal l be permitted to participate in the recruitment and placement of workers, local ly or overseas. Capitalization Substantial capitalization as determined by the Secretary of Labo r. (P2 M 2006 Revision) Dapat may license and authority from DOLE, if license only but no authority, th en they cannot hire workers for overseas employment. -- authority must be both authority to conduct and authority to operate and not one from the other, dapat both!! Non-transferability of License or Authority No license or authority shall be used directly or indirectly by any other person other than the one in whose favor it was issued; or at any place other than that stated in the license of authority nor such license or authority be transferred, conveyed or assigned to any other person or entity. Any transfer of business address, appointment or designation of any agent or rep resentative including the establishment of additional offices everywhere shall b e subject to the prior approval of the DOLE.

2006 Pointers: Agency may be allowed to conduct provin. Recruitment or job fa irs only upon written authority from POEA. Prior conduct of recruitment, a copy of authority shall be presented to DOLE/Regional Director concerned. Authority means a document issued by the Secretary of Labor and Employment author izing a person or association to engage in recruitment and placement activities as a private recruitment entity; while a license is the document issued to a perso n or entity to operate a private employment agency. A license is valid for a period of 2 years from the date of issuance unless soon er cancelled, revoked or suspended for violation of the Labor Code or its IRR s. Art. 31 : All applicants for license or authority shall post such cash and suret y bonds as determined by the Secretary of Labor to guarantee compliance with pre scribed recruitment procedures, rules and regulations, and terms and conditions of employment as appropriate.The purpose of bonds is to insure that if the right s of these overseas workers are violated by their ER s recourse would still be ava ilable to them against the local companies that recruited them for the foreign p rincipal. (Stronghold vs. CA) Percentage of salary remittance 1. seaman 80%

2. 3. 4. 5. 6.

construction worker 70% professional workers with free board and lodging professional without board and lodging 50% domestic helpers 50% other workers 50%

70%

Prohibited Practices Art. 34 : Prohibited Practices license or holder of authority: It shall be unlawful for any individual, entity

1. To charge or accept; directly or indirectly, any amount greater than that spe cified in the schedule of allowable fees, or make a worker pay any amount greate r than that actually received by him as a loan or advance; 2. To furnish or publish any false notice or information or document in relation to recruitment or employment; [includes the act of furnishing fake employment d ocuments to a worker. (Azucena) 3. To give any false notice, testimony, information or document or commit any Ac t of misrepresentation for the purpose of securing a license of authority under this Code; 4. To induce or attempt to induce a worker already employed to quit his employme nt in order to offer him to another unless the transfer is so designed to libera te the worker from oppressive terms and conditions of employment; 5. To influence or attempt to influence any person or entity not to employ any w orker who has not applied for employment through his agency; 6. To engage in the recruitment or placement of workers in jobs Harmful to publi c health or morality or to the dignity of the Republic of the Philippines; 7. To obstruct or attempt to obstruct inspection by the secretary of Labor or by his duly authorized representatives; 8. To Fail to file reports on the status of employment, placement vacancies, rem ittance of foreign exchange earnings, separation from jobs, departures and such other matters of information as may be required by the Secretary of Labor; 9. To substitute or alter employment contracts approved and verified by the DOLE from the time of actual signing thereof by the parties up to and including the period of expiration of the same without the approval of the Secretary of Labor Unless it is to improve the terms and conditions of employment. (Vir-Jen vs. NLR C); 10. To become an officer or member of any corporation engaged in Travel agency o r to be engaged directly or indirectly in the management of a travel agency; 11. To Withhold or deny travel documents from applicant workers before departure for monetary or financial consideration other than those authorized under this Code and its implementing rules and regulations.

(BAR), Filipina, was recruited by a local private employment agency for a tutori ng job abroad. Upon arrival in the place of employment, she was made to work as a housemaid. What advice will you give her? I will advice the Filipina to commen ce a criminal action against the employment agency for violation of Art. 34 of t he Labor Code. She was recruited under false pretense.

PHILIPPINE OVERSEAS EMPLOYMENT AGENCY (POEA): (such is appeallable to the office of the Secretary) 1.cancellation/suspension of license of authority to recruit of Recruitment ag encies (until phase out within 5 yrs) 2.Disciplinary actions towards Overseas Contract workers

2006 notes:Only jurisdiction left to POEA is administrative in character relati ng to licensing/regulating agencies and disciplinary action which are administra tive in character involving employer, principals and partners toward migrant workers. It also has liability under cash and surety bonds and power to refu nd of illegally collected fees. 2006 notes: An agreement that diminishes the employees pay and benefits as con tained in POEA approved contract is void unless such is approved by POEA.( if in crease,it is valid even if no further approval). 2006 notes: POEA has no jurisdiction to hear and decide claim for enforcement of a foreign judgment such, must be brought before regular courts. (POEA is an administrative agency exercising quasi-judicial functions)

RA 8042 (July 15,1995) not only transferred from POEA to the Labor Arbiter (appeallabe to the NLRC) the jurisdiction over money claims, but it also invo lved money claims for overseas deployment (period of deployment and before depa rture for abroad ) unlike in POEA where it covers only workers for overseas em ployment 2006 notes: POEA may hear ,but the decision part lies with the DOLE.

TERMS: Contract Worker - Any person working or who has worked overseas under a valid emp loyment contract. Manning agency Any person or entity recruiting seamen for vessels plying internati onal waters and fore related maritime activities. Name Hire Worker who is able to secure employment overseas on his own without the assistance or participation of an agency. Overseas employment Employment of a worker outside the Philippines, including empl oyment on hoard vessels plying international waters covered by a valid employmen t contract. Placement fee Amount charged by a private employment agency from a worker for its

services in securing employment. Service fee Amount charged by a license from its foreign ER as payment for actual services rendered in relation to the recruitment and employment of workers for s aid principal. SANCTIONS Suspension and/or Cancellation of License or Authority The Secretary of Labor sh all have the power to suspend or cancel any license or authority to recruit EE s f or overseas employment for violations of rules and regulations by the DOLE, the POEA, or for violation of the provisions of this, and other applicable laws . . Penalties Violations of any provisions of this Tile or IRR s by license or holder of authority : a. imprisonment of not less than 2 years nor more than 5 years b. or a fine of not less than P10,000.00 nor more than P50,000.00 c. or both such imprisonment and fine, at the discretion of the court. Violation of any of the provisions thereof or its implementing rules and regulat ions by a non-license or non-holder of authority a.imprisonment of not less than 4 years nor more than 8 years b.or a fine of not less than P20,000.00 nor more than P100,000.00 c.or both such imprisonment and fine, at the discretion of the court. If the offender is a corporation, partnership, association or entity, the penalt y shall be imposed upon the officer or officers of the corporation, partnership, association or entity responsible for violation; and if such officer is an alie n, he shall in addition to the penalties herein prescribed, be deported without further proceedings: Illegal recruitment: a.imprisonment of not less than 6 years and 1 day but not more than 12 years and b.a fine of not less than P200,000.00 nor more than P500,000.00. Illegal recruitment constituting Economic Sabotage: a.life imprisonment; and b.a fine of not less than P500,000.00 nor more than P1,000,000.00. The maximum penalty shall be imposed if: a . the person illegally recruited is less than 18 years of age; or b. committed by a non-license or non-holder of authority. * The Secretary of Labor or his duly authorized representative may order the clo sure of illegal recruitment establishments. Art. 38 (c) of the Labor Code granting the Secretary of Labor the power to issue search or arrest warrants is declared unconstitutional and null and void. (Sala zar vs. Achacoso) --money claims arising from ER-EE relationship prescribes in 3 years --strict rules of evidence are not applicable in claims for compensation and dis ability benefits In case of breach of the employment contract by a foreign-based ER, may the priv ate employment agency or recruitment entity be held liable? What is the nature o f the liability of the recruitment and placement agency and its principal? Yes. The agency or entity undertakes under oath to assume full and complete responsib ility for all claims and liabilities which may arise in connection with the use of the license or authority. The agency is jointly severally liable with the pri ncipal or foreign-based ER for any of the violations of recruitment agreement co

ntract of employment. (Ambraque vs. NLRC; Pp vs. Catan) ILLEGAL RECRUITMENT Recruitment and Placement - Act of a. Canvassing b. Enlisting c. Contracting d. Transporting e. Utilizing f. Hiring or g. Procuring workers and h. Includes referrals, contracts services, promising or advertising for employme nt, locally or abroad, whether for profit or not. Provided That any person or entity which, in any manner, offers or promises for a fee emp loyment to 2 or more persons shall be deemed engaged in recruitment or placement . [The number of persons dealt with is not, an essential ingredient of the act o f recruitment or placement. The provision merely lays down a rule of evidence th at where a fee is collected in consideration of a promise or offer of employment to 2 or more prospective workers, the individual or entity dealing with them sh all be deemed to be engaged in the act of recruitment or placement. (Pp vs. Pani s) 2006 Pointers: -even if a manning agent in Philippines is jointly and severally liable with principal-foreign corporation -A sister of a maltreated DH in Hongkong can file case here in the Philippines in behalf of the latter. -illegal recruitment prescribed in 5 years, but if with eco.sabotage, then 20 y ears -advertising already constitutes as illegal recruitment and falsity of notice is immaterial for prosecution of case Illegal termination w/o just and valid cause (2006 revision) - full reimbursement fees + 12% - salaries for unexpired portion or 3 mos. For every year of unexpired term hever is lower 2006 notes:in OCW, there is no backwages Liability of private employment agency employment contract - joint and solidary with employer - all claims and liabilities that may arise in connection with the implementatio n of the contracts Any recruitment activities, including the prohibited practices, enumerated under Art. 34 of this Code, to be undertaken by non-licensees or non-holders of autho rity shall be deemed illegal and punishable under Art. 39 of this Code. Art. 36 : The Secretary of Labor shall have the power to restrict and regulate t he recruitment and placement activities of all agencies within the coverage of t his Title and is hereby authorized to issue orders and promulgate rules and regu lations to carry out the objectives and implement the provisions of this Title. Sec. 2, Rule VI, Book I, IRR s : Pending investigation of the complaint or report, the Secretary may suspend the license of the private employment agency concerne d. . .

whic

Art. 37 : The Secretary or his duly authorized representatives may, at any time, inspect the premises, books of account and records of any person or entity cove red by this Title, require it to submit records regularly on prescribed forms, a nd act on violations of any provisions of any provisions of this Title. Illegal recruitment when committed by a: 1.Illegal recruitment by a syndicate Carried out by a group of 3 or more persons conspiring and/or confederating with one another in carrying out any unlawful o r illegal transaction, enterprise or scheme defined under the first paragraph he reof. 2.Illegal recruitment in large scale ually or as a group. Committed against 3 or more persons individ

2006 notes: When the Labor Code speaks of illegal recruitment, committed against 3 or more persons , it must be understood as referring to the number of complainan ts therein, otherwise, prosecutions for single crimes of illegal recruitment can be cumulated to make out a case of large scale illegal recruitment. In other wo rds, a conviction for large-scale illegal recruitment must be based on a finding in each case if illegal recruitment of 3 or more persons whether individually o r as a group. (Pp vs. Reyes) 2006 notes:in all instance of illegal recruitment, it shall be considered an off ense involving economic sabotage and shall be penalized which is non-bailable an d life imprisonment

Sec. 8, Migrant Workers Act : A criminal action arising from illegal recruitment as defined herein shall be filed with the RTC of the province or city where the offense was committed or where the offended party actually resides at the time of the commission of the offense: provided, That the court where the criminal ac tion is first filed shall acquire jurisdiction to the exclusion of other courts. The crime of illegal recruitment has 2 elements: i. That the offender is a non-license or non-holder of authority to lawfully eng age in the recruitment and placement of workers; and j. That the offender undertakes any of the recruitment activities defined under Art. 13 (b) of the Labor Code or any of the prohibited practices enumerated unde r Art. 34 of the same Code.

G convinced F and S, that they could be employed for France for a fee. G was als o able to persuade A that he could give A a working visa. Nothing happened to F, S and A. G did not have any license to recruit or authority to recruit? A may b e charged and convicted of a large-scale illegal recruitment since he did not ha ve the license or authority to recruit, and yet recruit at least 3 persons. (Pp vs. Turda) Furthermore, he can also be convicted and charged of estafa since the latter is a malum in se while the former is a malum prohibium NATO, a national union of teachers was able to find jobs abroad for its member b y directly contacting other teachers organizations in foreign countries, without charging additional fees. Is this legal? No. Only persons or entities with appr opriate license or authority can engage in recruitment and placement of workers. Contact services are activities that fall within the scope of recruitment and p lacement of workers. A paper manufacturing company in Cainta would like to know if it needs to obtain

a license authority before it can recruit workers for its plant. No license or authority is necessary. The company is not engaged in the business of recruitmen t and placement of workers, it is not recruiting workers to be employed by other s. It does not represent a principal. It is recruiting its own workers. ALIEN EMPLOYMENT Art. 40 : Employment Permit of Non-resident Aliens Any alien seeking admission t o the Philippines for employment purposes and any domestic or foreign ER who des ires to engage an alien for employment in the Philippines shall obtain an Alien Employment permit from the DOLE . For an enterprise registered in preferred areas of investments, said alien emplo yment permit must be issued upon recommendation of the government agency charged with the supervision of the registered enterprise. Sec. 7, Rule XIV, Book I, IRR s : The Alien Employment permit shall be valid for a minimum period of 1 year. Who are subjected to it: 1.ALL foreign nationals seeking admission to the Philippines for employment 2.Missionaries or religious workers who intend to engage in gainful employment 3.holder of special investors resident visa ,special retirees resident visa, tre aty trades visa or special non-immigrant visa who occupy an executive/technical position in any establishment. 4.agnencies whether public/private who secure service of foreign property to pra ctice their profession in Philippines under reciprocity and other international agreements 5.non-indo Chinese refugees who are asylum seekers and given refugee status by t he UN. 6.resident foreign nationals seeking employment in the Phil. Exempted are: Diplomatic officials, consular officials and national organization . Art. 41 : Prohibition Against Transfer of Employment (a) After the issuance of an employment permit, the alien shall not transfer to another job or change his ER without prior approval of the Secretary of Labor. Art. 288 : Any alien found guilty shall be summarily deported upon completion of service of sentence(other grounds are misrepresentation, failure to renew and p ersons non grata)

May an ER in the Philippines employ a worker who is not a Filipino citizen? Yes, except to nationalized activities such as: a. public utility to develop, exploit and utilize natural resources 60% Filipino ; b. Mass media 100% owned by Filipino citizens c. Advertising 70% Filipino owned d. Retail Business 100% Filipino owned e. Financing business 60% Filipino owned Are there exceptions to the prohibition against employment of aliens in entities engaged in nationalized activities? Yes, when (a) the Secretary of Justice spec ifically authorizes the employment of technical personnel; or (b) where aliens a

re elected members of Board of Directors in proportion to their allowable partic ipation in the capital; or (c) when allowed under certain special laws. 2006 notes: A resident alien need not obtain an employment permit in order to be employed in the Philippines. (Almodiel vs. NLRC) what they are required ,toget her with resident immigrants are Alien Employment registration certificate. Alien Employment Permit Conditions for Grant Art. 40 : The employment permit may be issued to a non-resident alien or to the applicant ER after a determination of -competent -able and -willing at the time of the application to perform the services for which the alien is de sired. [The DOLE is the agency vested with jurisdiction to determine the questio n of availability of the local workers. (General Milling vs. Torres) Sec. 5, Rule XIV, Book I, IRR s : Requirements for Employment Permit Applicants he applicant for an employment permit shall be accompanied by the following: a. Curriculum vitae signed by the applicant indicating the educational backgroun d, his work experience and other data showing that he possesses technical skills in his trade or profession. b. Contract of employment between the ER and the principal, which shall embody t he following, among others: > That the non-resident alien shall comply with all applicable laws and rules an d regulations; > That the non-resident alien worker and ER shall bind themselves to train at le ast 2 Filipino understudies; and > A designation by the ER of at least 2 understudies which must be the most rank ing regular EE s in the section or department for which the expatriates are being hired to ensure actual transfer of technology. ER s right to hire labor is not absolute since the legislature has power to make r egulation subject only to the condition that they pass the reasonableness and pu blic interest test. T

POEA (summary) Appeal to secretary of DOLE within 10 calendar days for cancellation/revocation/ supervision of license or authority Appeal to NLRC within 10 days for violation of overseas employment contracts,or disciplinary cases filed against overseas contract workers Original and exclusive jurisdiction over all claims arising out of an er-ee rela tionship by virtue of any law or contract involving including: -disciplinary cases

-pre-employment cases w/c are administrative in character -violations of conditions for issuance of license or authority to recruit worker s. DEVELOPMENT OF HUMAN RESOURCES Art. 58 : Apprenticeship oretical instruction. Practical training on the job supplemented by related the

Art. 73 : Learners Persons hired as trainees in semi-skilled and other industrial occupations which are non-apprenticeable and which may be learned through practi cal training on the job in a relatively short period of time which shall not exc eed 3 months. Art. 78 : Handicapped workers Those whose earning capacity is impaired by age or p hysical or mental deficiency or injury A. APPRENTICES must be approved by TESDA which is evidence by the apprenticeship agreement. 1. Period of apprenticeship shall not exceed 6 months. 2. Wages shall not start below 75% of the minimum wage.

Art. 60 : Only ER s in highly technical industries and only in apprenticeable occu pations may employ apprentices. Sec. 1, Rule IV, Book II, IRR s : Highly Technical Industries Trade, business, enter prise, industry or other activity which is engaged in the application of advance d technology. Art. 58 : Apprenticeship Occupation Requires more than 3 months of practical train ing supplemented by related theoretical instruction. - 1 month probation - prior approval by TESDA of the proposed apprenticeship program is a condition sine qua non before an apprenticeship can be validly entered into - employer is not obliged to employ the apprentice after the completion of his t raining Art. 70 : Apprenticeship programs shall be primarily voluntary except: a. When national security or particular requirements of economic development so demand, the President may require compulsory training where the shortage of trai ned manpower is deemed critical by the Secretary of Labor. b. Where services of foreign technicians are utilized by private companies in ap prenticeable trades. Qualifications of an Apprentice: A.At least 15 years of age: provided, those below 18 years of age shall not work in hazardous occupations; B.Be physically fit for the occupation. C.Possess vocational aptitude and capacity. D.Possess the ability to comprehend, and follow oral and written instructions. ( Sec. 11, Rule VI, Book III, IRR s) A 5-star hotel would like to have an apprentice program dishwashers? No. This is

not an apprenticeable program occupation because proficiency can be attained wi thin a very short period. Besides, the hotel industry is not highly technical. ( Alcantara) After working for 1 month may an apprentice be dismissed without cause? No. Afte r the probationary period of 1 month, the apprenticeship agreement may be termin ated only for cause. 2006 notes: but if it is less than 1 month, then the ER may terminate the appren tice at will or no cause.

Causes for termination of apprenticeship agreement BY a. b. c. ay d. APPRENTICE Repeated violation by ER of agreement Cruel or inhuman treatment Personal problems which prevents a satisfactory performance (bad health or aw sila ng misis nya) Substandard working conditions

EMPLOYER a. habitual absentism b. willful disobedience e.g. rules c. insubordination lawful order d. poor physical conditions apprentice e. theft or malicious destruction f. poor efficiency of performance g. engaging in violence h. gross misconduct i. bad health or continuing illness. (Sec. 25, Rule VI, Book II, IRR s) * employer must make a commitment to employ the business

B. LEARNERS - Learnership programs must be approved by TESDA * Art. 74 : Learners may be employed when: 1. no experienced worker is available 2. the employment of learners is necessary to prevent curtailment of employment opportunities 3. and the employment does not create unfair competition in terms of labor costs or impair or lower working standards. Art. 75 : 1. Duration of the learnership period shall be 3 months; 2. Wages and salary rates begin at not less than 75% minimum wage; and 3. A commitment to employ learners if they so desire, as regular EE s upon complet ion of the learnership. > All learners who have been allowed or suffered work during the first 2nd month s to be deemed EE s training is terminated by the ER before the end of the stipula ted period though no fault of the learner. Art. 76 : Learners employed in piece or incentive-rate jobs during training shal l be paid in full for the work done. J entered into a learnership agreement with employer A. Before the end of 2 mon ths, A terminated the agreement. When J requested for a chance to let him finish the 3 months period. At the end of 3 months, A refused to hire J. Is the stand of A sustainable? No. A has a commitment under the learnership agreement to empl oy J as a regular worker upon the completion of the learnership.

C. HANDICAPPED WORKERS Art. 79 : Handicapped workers may be employed when their employment 2. is necessary to prevent curtailment of employment opportunities; and 3. when it not create unfair competition in labor costs or lower working standar ds. Conditions of Employment - not exceed 8 hours - allowed overtime Art. 80 : Rates to be paid to handicapped workers shall not be less than 75% of the applicable minimum wage. Employment agreement must state the duration of the employment period and the wo rk to be performed. Art. 81 : Handicapped workers may be hired as apprentices or learners if their h andicap is not such as to effectively impede the performance of job operations i n the particular occupations for which they are hired. Ratio of theoretical vs. on the job training > 100: 2000 - may work overtime duly credited as his training time * Art. 72 : The Secretary of Labor may authorize the: 2. hiring of apprentices without compensation whose training on the job is requi red by the school or training program curriculum as a requisite for graduation o r board examination. There is no ER-EE relationship between students on one hand , and schools, where there is written agreement between them under which the fo rmer agree to work for the latter in exchange for the privilege to study free o f charge. (Sec. 14, Rule X, Book III, IRR s) 3. A clerk in the College of Law of a University worked without pay but was allo wed to take up no more than 3 units per semester free of charge. The clerk resig ned and demanded payment of unpaid wages. Is the clerk entitled to unpaid wages? Yes. Sec. 14, Rule X, Book III, IRR s : only applies in instances where the stude nts are given real opportunity, including such facilities as may be reasonably n ecessary to finish their chosen courses under such arrangement. In this problem, the clerk was not given any real opportunity to finish law as he was allowed to take up no more than 3 units per semester. There is therefore an ER-EE relation ship between the clerk and the university. (Alcantara) Enforcement 1. Art. 66 : Appeal to the Secretary of Labor - The decision of the authorized agency of the DOLE may be appealed to the Secretary of Labor within 5 days from

receipt of the decision. The decision of the Secretary of Labor shall be final a nd executory. 2. Art. 67 : Exhaustion of Administative Remedies No person shall institute any action for the enforcement of any apprenticeship agreement or damages for breach of any such agreement, unless he has exhausted all available administrative rem edies. CONDITIONS OF EMPLOYMENT HOURS OF WORK Normal Hours The 8-hour labor law was designed not only to safeguard the health and welfare o f the laborer but in a way to minimize unemployment by forcing ER s, in cases, whe re more than an 8-hour operations is necessary, to utilize different shifts of l aborers working only for 8 hours each. (Manila Terminal vs. CIR) 2006 notes: if agreed by parties, instead of 8 hrs pwede 7 hours ang duty. Art. 83 : The normal of hours of work of any EE shall not exceed 8 hours a day. Art. 84 : Hours worked shall include: A.all time during which an EE is required -to be on duty -to be at a prescribed workplace and B.all time during which an EE is suffered or permitted to work. Rest periods of short duration during working hours shall be counted as hours wo rked. Principles in Determining Hours Worked(2005 Revision) 1. All hours are hours worked which the EE is required to give to his ER regardl ess of whether or not such hours are spent in productive labor or involve physic al or mental exertion; 2. An EE need not leave the premises of the workplace in order that his rest per iod shall not be counted, it being enough that a. he stops working, b. may rest completely and c. may leave his workplace, to go elsewhere, whether within or outside the prem ises of the workplace; 3. If the work performed was necessary or it benefited the ER or the EE could no t abandon his work at the end of the normal working hours because he had no rep lacement, all the time spent for such work shall be considered as hours worked, if the work was with the knowledge of his ER or immediate supervisor; 4. The time during which an EE is inactive by reasons of interruptions in his wo rk beyond his control shall be considered working time either if the imminence o f the resumption of the work requires the EE s presence at the place of work or if the interval is too brief to be utilized effectively and gainfully in the EE s ow n interest. Jose works as a janitor. He continues sweeping the floors after 5:00 p.m The mana

ger is aware of this, but he does not stop Jose from doing work after 5:00 p.m. Is this hours of work? Yes. Although Jose was not instructed expressly to render work, he was impliedly allowed to do so by failure of the ER to warn him agains t rendering such work. Besides the work rendered by Jose benefited the ER. Waiting Time 1. Sec. 5, Rule I, Book III, IRR s : Waiting time spent by an EE shall be consider ed as working time if waiting is an a. integral part of his work, or b. the EE is required to engage by an ER to wait The controlling factor is whether waiting time spent in idleness is so spent pre dominantly for the ER s benefit or for the EE s. (Azucena) 2. S, a company driver has the following work schedule: 8:30 a.m. - fetches G.M .; 9:00 a.m. 12:00 noon does nothing on call for G.M. at the company premises ; 12 noon 1:00 p.m. lunch; 1:00 p.m. 5:00 p.m. drives the G.M. to conferences; 5:0 0 p.m. goes home. The company refuses to pay him for the 9:00 a.m. to 12:00 noon period. Is this valid? No. S is not free to make use of the period effectively and gainfully for his own purposes. He must remain in the premises as at any tim e he may be called to drive for the G.M. (Alcantara) 3. 30 minutes prior to the start of the scheduled working hours, the workers of an enterprise assembled at a designated area to answer roll call. As their house s are situated right where the farms are located, the workers can go back in the ir houses after roll call to do some chores. Is the assembly time working time? No. The works are not subject to the absolute control of the company during the period. The workers were not deprived of the time to attend to other personal pu rsuits. (Aria vs. NLRC) Idle Time 1. A laborer need not leave the premises of the factory, shop or boat in order t hat his period of rest shall not be counted, it being enough that he cease to wor k , may rest completely and leave or may leave at his will the spot where he actua lly stays while working, or go somewhere else, whether within or without the fac tory, shop or boat. (Luzon Stevedoring vs. Luzon Marine Dept. Union) 2. A, an accountant in the manufacturing firm, has idle time in her work schedul e, waiting for company papers to work on. She dovotes this time working on papers of other firms for which she receives remuneration. Is the firm obligated to pa y her for this time? Yes. Although she is working on the papers of other compani es, she has no absolute control over her time. Her ER may at any time require he r to do some work. She cannot furthermore leave the place of work during her wor k schedule. (Alcantara) 3. T, a machine operator was forced to stop operating his machine for 1 hour dur ing a brownout. Is this working time? Yes. The interruption was not due to the f ault of T. Besides 1 hour is too brief to be utilized effectively and gainfully for his own interest. 2006 notes: if made to work, example 8 am dapat magstart ang duty, pero 7 pa lan g ginapatrabaho na it is compensable. 2006 notes:for non-productive, like taking shower (which is integral to company s SOP) then it is compensable -- also, kahit dismissal na but cement mixer is still grinding cement, alangan n aman iwanan mo yan, so it is still compensable. --but if you are a carpenter and after work you have to baid your tools, it is n ot compensable coz its your own tools.

Meal Time Sec. 7, Rule I, Book III, IRR s : Every ER shall give his EE s not less than 1 hour time-off for regular meals, except in the following cases where a meal period of not less than 20 minutes may be given by the ER provided > Where work is Non-manual in nature or does not involve strenuous physical exer tion; > Where the establishment regularly Operates less than 16 hours a day; > In cases of actual or impending Emergency or there is urgent work to be perfor med on machineries and equipment to avoid serious loss which the ER would otherw ise suffer; and > Where the work is necessary to Prevent serious loss of perishable goods. That such shorter meal period (provided above) is credited as compensable hours worked of the EE But if it is the EE who requested for the shorter meal time, then such shortened meal period is not compensable. Rest periods or coffee breaks running from 5 to 20 minutes shall be considered a s compensable working time. Where during the so-called meal period, the laborers are required to stand by fo r emergency work, or where said meal hour is not one of complete rest, such peri od is considered overtime. (Pan Am vs. Pan Am EE s Association) Working While Sleeping * Sleeping time may be considered working time if it is subject to serious inter ruption or takes place under conditions substantially less desirable than would be likely to exist at the EE home i.e. firemen permitted to sleep a portion of t he time they are so on duty at the fire station.

On Call 1. Sec. 5, Rule I, Book III, IRR s : An EE while he is required in the ER s premises or so close thereto that he cannot use the nd gainfully for his own purpose shall be considered as working all. An EE who is not required to leave word at his own or with s where he may be reached is not working while on call. to remain on call time effectively a hours while on c company official

2. If an EE is kept within reach through a cellular phone. Is it on call? No. (A zucena) 3. GenRule: You are not compensable but the moment you are called then it is com pensable. In PanAM case, SC rules that even while waiting,it is compensable.

Travel Time Principles which determine whether or not time spent in travel is working time:

Travel from Home to Work Normal travel from home to work is no work time but an emergency call outside of regular working hours requiring him to go to his regul ar place of business is working time. Travel that is all in the day s work Time spent by an EE in traveling from one job site to another, during the workday, must be counted as hours worked. Travel away from home Travel away from home is clearly worktime when it cuts acr oss the EE s workday, except during meal period or when EE is permitted to sleep i n adequate facilities furnished by the ER. The time is not only hours worked on regular workdays but also during corresponding working hours on non-working days . Outside of these regular working hours, travel away from home is not considere d working time. (Azucena)

Lectures, Meetings, Training Programs Sec. 6, Rule I, Book III, IRR s : Attendance at lectures, meetings, training progr ams and other similar activities shall not be counted as working time if all of the following conditions are met: 1. Attendance is outside of the ER s regular working hours; 2. Attendance is in fact voluntary; and 3. The EE does not perform any productive work during such attendance. Semestral Break Regular full-time teachers are entitled to salary and COLA during semestral brea k. (U.Pang. Faculty Union vs. U. Pang.)

The following are not entitled to OVERTIME PAY, PREMIUM PAY FOR REST/HOLIDAYS, NIGHT SHIFT DIFFERENTIALS, HOLIDAY PAY,SERVICE INCENTIVE LEAVE, WEEKLY REST PER IODS and SERVICE CHARGE 1.Government EE s whether employed by the National Government or any of its political subdivisions , including those employed in GOCC s with original charters BUT IF GOVT EMPLOYEES A RE UNDER LABOR CODE(NOT UNDER CIVIL SERVICE since no original charter) THEN THEY A RE GOVERNED BY THIS TITLE. 2.Managerial (Power to hire and fire) Employees AND Other officers or members of the managerial staff if they perform the following duties and responsibilities 3.Field personnel Non-agricultural EE s who regularly perform their duties away from the principal place of business or branch office of the ER and whose actual hours of work in the field cannot be determined with reasonable cer tainty. 2006 notes: not field personnel are fishermen and linemen. 2006 notes:field personnel are sales rep and med rep 4.Members of the family of the ER who are dependent on him for support 5.Domestic helpers Minister to a natural family. So if it minister to a bachelor(binata) ,then that is not domestic helper but it is personal service of another like a bodyguard a nd a chauffer. 2006 notes: DH cannot self-organized and they cannot be assigned to commercial o r industrial area, coz if they will be, then it will be converted to industrial/ commercial worker (which includes the family driver)

6.persons in the personal service of another (like guards and private nurses). However, house personnel hired by a ranking company official, but paid for the c ompany itself, to maintain a staff house provided for the official, are not the latter s domestic helpers but regular EE s of the company. (Cadiz vs. Philippine Sin ter)

7.And workers who are paid by results. [Including those who are paid on piece-wo rk, takay , pakiao , or task basis if their output rates are in accordance with the st andards prescribed.] 2006 notes: pc rate workers are entitled to COLA and 13th month pay while task b asis workers are not entitled to COLA and 13th month pay. 1Foremen, inspectors and supervisors given the power to recommend hiring and fir ing of EE s but where ultimate power to hire or fire rested with personnel manager ? No. Where such recommendatory powers are subject to evaluation and review, the same are not effective and not an exercise of independent judgment as required by law. ( Franklin Baker Company vs. Trajano) 2.Cutter in tailoring shop was assigned chore of distributing work to shop s tailo rs when the shop s manager were absent. He saw to it that work conformed with patt ern he had prepared and if not, had them redone, repaired or sewn. No. He did no t participate in policy-making. It is true that in the absence of the manager an d assistant manager, he distributes and assigns work to EE s but such duty though involving discretion is occasional and not regular and customary. (Villuga vs. N LRC) 3.In TIMEX case, there is quota, but quota is purpose of discipline so it is sti ll considered pc rate ,however, if your given time ,then you are not a pc rate w orker.

8.Retail and Service Establishments Pearl(who owns the pearl in the food?) if retail, you buy the entire food then t ake out so you own the pearl, but if service: restaurant owns the inedible part (pearl)

9.Health Personnel Entitled to rest day after 5 working days, if you have him work on 6th day ,you have to pay him a premium. 10.Deep Sea Fishermen

OVERTIME WORK Art. 87 : Overtime Work regular work day plus 25% basic hourly rate (hourly rate= Wage per day/ 8) Special days, holiday or rest day plus 30% of the regular hourly rate on said da ys. Art. 89 : Emergency Overtime Work - Any EE may be required by the ER to perform overtime work in any of the following cases: a.When the country is at war b.When any other national or local emergency has been declared c.When it is necessary to prevent loss of life or property or in case of imminen t danger to the public safety due to an actual or impending emergency in the loc ality caused by serious accidents, fire, flood, typhoon, earthquake, epidemic or other Disaster or calamity. d.When there is Urgent work to be performed on machines and installations in ord er to avoid serious loss or damage to the ER or some other cause of similar natu re. e.When the work is necessary to prevent loss or damage to Perishable goods. f.Where the completion or continuation of the work started before the 8th hour i s necessary to prevent Serious obstruction or prejudice to the business operatio ns of the ER. The EE s refusal to obey the order of the EE constitutes insubordination for which he may be subjected to disciplinary action. (Alcantara) Art. 88 : Undertime work in any particular day shall not be offset by overtime w ork on another day BUT not on someday. ---Permission given to the EE to go on leave on some other day of the week shall not exempt the ER from paying the additional compensation required. Art. 90 : For purposes of computing overtime and other additional remuneration as required by this Chapter the regular wage of an EE shall include the cash wage only, without deduction on account of facilities provided by the ER. (2005 Pointers) Y, corporation, as a company policy, required its EE s to render o nly 6 hours of work daily but pays them the minimum wage corresponding to 8 hour s work. Later, the full 8-hours was required without any increase in wages. Are the EE s entitled to overtime pay? Yes. Though voluntary practice or policy, the c ompany has fixed the normal workday at 6 hours. It now constitute part of the te rms and conditions of employment and cannot be unilaterally withdrawn by the ER. ) Distinguish overtime pay from premium pay Overtime pay is additional compensation for work done beyond the normal work hou rs on ordinary working days. Premium pay is additional compensation for work rendered by the EE on days norma lly he should not be working. But additional compensation for work rendered in e xcess of 8 hours during these days is also considered overtime pay. A was late for work on a particular day. To offset for the time he was late, A w

orked on additional period equivalent to the period he was late for work. The pe riod was offset against A undertime. Is this valid? Yes. The prohibition to offse t overtime against undertime applies to undertime incurred and overtime rendered on different days. -Provisions for overtime covers both profit and non-profit establishment or unde rtaking For purposes of computing overtime EGULAR WAGE includes the cash wage only; without deduction of facilities provide d. Compressed Week voluntary basis

* While as a general rule, the right to overtime pay cannot be waived under exis ting laws, the EE s and ER can agree to a compressed workweek of 5 days of 9 hours each with no payment of overtime if this will redound to the benefit of the wor kers i.e. if the original workweek is reduced from Monday Saturday to Monday Fri day. (Azuzena) Conditions for Compressed Work Week 2. voluntary agreed upon 3. not to exceed 48 hours/ week 4. no diminution on take home pay or fringe benefits 5. waivers must be made 6. all hours exceeding 48 hours/week considered overtime 7. must submit report to DOLE Retail Establishment--sale of goods for personal or household use ex. grocery Service Establishment--sale of services to individuals for their own or househol d use ex. T.V. repair shop

No Formula Basic Contract When the contract of employment requires work for more than 8 hours at specific wages per day, without providing for a fixed hourly rate or that the daily wages include overtime pay, said wages cannot be considered as including overtime com pensation. (Manila Terminal vs. CIR)

Built-In Compensation The employment contract may provide for a built-in overtime pay. Because of this, non-payment of overtime pay by the ER is valid. (Engineering equipment vs. Minis ter of Labor)

2006 notes:if started undertime, kahit lampas na 5:00 if in total is not more th an 8 hrs, not entitled to overtime.

2006 notes: in shifts, the 1st day is included in your overtime since you count 24 hours (Phil based work on a 24 hour basis unlike in US whereby it is based on working hour.) 2006 notes:May the right to overtime pay be waived? As a general rule, the right cannot be waived. (Cruz vs. Yes Sing) However, when the waiver is exchange for certain benefits and privileges, which may be more than what will accrue to them in overtime pay, the waiver may be permitted. (MERALCO Workers Union vs. MERALC O)

WEEKLY REST PERIODS Art. 91 : It shall be for the duty of every ER, whether operating for profit or not, to provide EE a rest period of not less than 24 consecutive hours after eve ry 6 consecutive normal working days. The ER shall determine and schedule the weekly rest day of his EE s.However, the E R shall respect the preference of EE s as to their weekly rest day when such prefe rence is based on religion grounds. Sec. 4, Rule III, Book III, IRR s : Where however the choice of the EE s as to their rest day based on religious grounds will inevitably result in serious prejudi ce or obstruction to the operation of the undertaking, the ER may so schedule th e weekday rest day of their choice at least 2 days in a month. Art. 92 : When ER may require Work on rest day a. In case of actual or impending emergency caused by serious accident, fire, fl ood, typhoon, earthquake, epidemic, or other Disaster or calamity to prevent los s of life, or imminent danger to public safety. b. In case of Urgent work, to avoid serious loss which the ER would otherwise su ffer; c. In the event of Abnormal pressure of work due to special circumstances, where the ER cannot ordinarily be expected to resort to other measures; d. To prevent or damage to Perishable goods; e. Where the Nature of work requires continuous operations and stoppage of the w ork may result in irreparable injury or loss to the ER; and f. Analogous (avail of favorable weather) or similar circumstances

How much is a worker entitled if he works on a rest day Scheduled rest day additional compensation of at least 30% of his regular wage. entitled to additional compens

Scheduled rest day which is a non-working holiday ation of at least 50% of his regular wage.

Scheduled rest day which is a regular holiday entitled to additional compensatio n of at least 30% of his regular holiday rate of 200% based on his regular wage rate. (Sec. 4, Rule III, Book I, IRR s) V works on board the M/V Starfish. Sometimes, the boat remains at sea for 2 week