Professional Documents

Culture Documents

Vikram Rathi - Depreciation at Delta Air and Singapore Airlines

Uploaded by

Vikram RathiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vikram Rathi - Depreciation at Delta Air and Singapore Airlines

Uploaded by

Vikram RathiCopyright:

Available Formats

Vikram Rathi

Section B Depreciation at Delta Air Lines and Singapore AirLines

PGP2011939

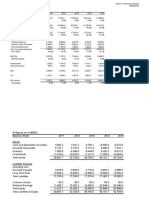

Q1. A) Delta Air Lines: Prior to 1986 100 10 90 10 9 1986-1993 100 10 90 15 6 1993-later 100 5 95 20 4.75

Cost of Aircraft Less: Estimated Salvage Value Depreciable Cost Depreciable Life Annual Depreciation

B)

Singapore Airlines Prior to 1989 100 10 90 8 11.25 1989-later 100 20 80 10 8

Cost of Aircraft Less: Estimated Salvage Value Depreciable Cost Depreciable Life Annual Depreciation

Q2: We can see from above that Delta Air Lines is depreciating its aircrafts at a lower rate whereas Singapore Airlines is depreciating its assets at 68% higher rate. This difference is very significant since each of the airline has fixed asset in billions of dollars. Factors affecting depreciable life and salvage value: 1. Advanced technology aircrafts: Latest state-of-the-art technology air crafts have higher salvage value and higher life. We can also see that Singapore AL has more percentage share of A310-300 and B747 in its fleet whereas Delta AL has more % share of B727, B757 and L1011-1 in its fleet. 2. Aircraft Usage: Singapore AL was using its carriers for mostly international flights. Comfort and technology were the key points. Avg. Passenger trip length was 2720 miles. Hence, it was using its aircrafts more excessively. Hence depreciable life was less. Delta AL had only 21% of its revenues from international flights. For domestic flights, cost is more important issue than comfort. Avg. Passenger trip length was 969 miles only. Since it was not using its aircrafts very rigorously, depreciable life was more. 3. Maintenance: Some airlines spend more on maintenance and increase useful life and salvage value of their air crafts. This different treatment is proper because useful life and salvage value is subject to above mentioned parameters. Flexibility and judgement is required to account for these issues. Q3: Deltas avg. fixed assets in 1993: (9043+173+8354+173)/2 = 8872 ($ million)

Vikram Rathi

Section B

PGP2011939

Difference: if used prior depreciation assumptions: 8872 *(0.06-0.0475) = 111 ($ million) Difference: if used prior depreciation assumptions: 8872 *(0.08-0.0475) = 288 ($ million) Q4: Singapore AL is making continuous profit for past five years. In the same period Delta AL lost money in its operations. With its aggressive depreciation strategy, Singapore AL can manage its accounting profit to be in the constant range and can go for less depreciation during low revenue times. We can also see that since Singapore AL keeps its carriers at a new state, its earnings from Sale of Flight equipment is a significant part of its net profit. Newer aircrafts have become a part of Singapore ALs strategy which makes it much more comfortable and hence, it might be preferred by customers for international flights. Q5: It can be seen that higher age will lead to lower depreciation expense since depreciable value is divided into more number of periods. In case of Delta, life is higher which will lead to lower depreciation expense each year. From question 1, we can see that its 40% lower than that of Singapore ALs.

You might also like

- Delta Singapore Airlines Case SolutionDocument7 pagesDelta Singapore Airlines Case SolutionSamaresh Paikara100% (1)

- Delta and Singapore Airlines Case Study - UpdatedDocument9 pagesDelta and Singapore Airlines Case Study - Updatedabhishek choudhary0% (1)

- Chapter 7-1 SternDocument7 pagesChapter 7-1 SternPatrick HariramaniNo ratings yet

- Case Analysis Ibm.Document8 pagesCase Analysis Ibm.Leyya VivoNo ratings yet

- Case Analysis - Carnival Cruise LinesDocument14 pagesCase Analysis - Carnival Cruise LinesArjun ManoharanNo ratings yet

- EDS Case Study AnalysisDocument2 pagesEDS Case Study Analysissabey22991No ratings yet

- Termination Case Study Presentation Group6Document10 pagesTermination Case Study Presentation Group6KrishnanandShenaiNo ratings yet

- Sample Quiz Operations ManagementDocument25 pagesSample Quiz Operations Managementakamalapuri388100% (2)

- Group 1 - Agile Electric Case AnalysisDocument12 pagesGroup 1 - Agile Electric Case AnalysisNiyati AggarwalNo ratings yet

- Mueller Lehmkuhl Case Write UpDocument2 pagesMueller Lehmkuhl Case Write UpPauline AndrieNo ratings yet

- Group 3 FM Project IT IndustryDocument13 pagesGroup 3 FM Project IT IndustryPS KannanNo ratings yet

- Globalization of Indian Automobile IndustryDocument25 pagesGlobalization of Indian Automobile IndustryAjay Singla100% (2)

- Ford Auto CollectionDocument10 pagesFord Auto Collectionkarishma_sehgal50% (4)

- Southwest Study Case PresentationDocument11 pagesSouthwest Study Case PresentationQurratu Ayun AmranNo ratings yet

- Discussion QuestionsDocument3 pagesDiscussion Questionsmehar noor100% (1)

- NTT Docomo Case StudyDocument4 pagesNTT Docomo Case StudyLy Nguyen LeNo ratings yet

- Avellin's Marketing Strategy for New Eco7 Motor OilDocument2 pagesAvellin's Marketing Strategy for New Eco7 Motor OilRahul AgarwalNo ratings yet

- Sai CoatingDocument13 pagesSai CoatingUday Deogam100% (1)

- How Hard Should You Push DiversityDocument7 pagesHow Hard Should You Push DiversitySanjana Ramavarapu100% (1)

- Finnish Fur Sales Co., Ltd. v. Juliette Shulof Furs, Inc.Document4 pagesFinnish Fur Sales Co., Ltd. v. Juliette Shulof Furs, Inc.Ngỗng Ngáo NgácNo ratings yet

- Marsh & McLennan GuidelinesDocument1 pageMarsh & McLennan GuidelineseanshNo ratings yet

- Strategic Outsourcing at Bharti Airtel LimitedDocument10 pagesStrategic Outsourcing at Bharti Airtel LimitedKunal DelwadiaNo ratings yet

- The Fashion Channel: Section-A Group - 6Document4 pagesThe Fashion Channel: Section-A Group - 6Aviral SankhyadharNo ratings yet

- Greenville PPT Group 1Document22 pagesGreenville PPT Group 1Anushree GawadNo ratings yet

- DocxDocument4 pagesDocxAdityaHridayNo ratings yet

- EasyJet Marketing Case StudyDocument9 pagesEasyJet Marketing Case StudySourav JainNo ratings yet

- Tyler Abrasives Global Pricing Case StudyDocument7 pagesTyler Abrasives Global Pricing Case StudyTejas ShahNo ratings yet

- Parts 1-3: Three Corporations ComparedDocument4 pagesParts 1-3: Three Corporations ComparedMohsin JalilNo ratings yet

- Barila Spa - Ans-1 & Ans-3Document2 pagesBarila Spa - Ans-1 & Ans-3SiddharthNo ratings yet

- Case External Analysis The Us Airline IndustryDocument2 pagesCase External Analysis The Us Airline IndustryPenujakIPJB0% (1)

- CPL Case Analysis SolutionDocument5 pagesCPL Case Analysis SolutionKshitij MaheshwaryNo ratings yet

- Organizational Behavior-Ii Assignment: Case Study On Appex CorporationDocument5 pagesOrganizational Behavior-Ii Assignment: Case Study On Appex CorporationRishabhGuptaNo ratings yet

- B2B Marketing - Jyoti - Sagar - P19052Document5 pagesB2B Marketing - Jyoti - Sagar - P19052JYOTI TALUKDARNo ratings yet

- The Effect of Global Crisis Into Euro Region: A Case Study of Greek CrisisDocument6 pagesThe Effect of Global Crisis Into Euro Region: A Case Study of Greek CrisisujjwalenigmaNo ratings yet

- Channel Conflict at Samsung IndiaDocument14 pagesChannel Conflict at Samsung IndiaAkash RanjanNo ratings yet

- Case Analysis-American Airlines Revenue ManagementDocument2 pagesCase Analysis-American Airlines Revenue ManagementElizabeth MathewNo ratings yet

- Case Study: Tata Motors JLR - A Two-Edged SwordDocument12 pagesCase Study: Tata Motors JLR - A Two-Edged SwordVidushi ThapliyalNo ratings yet

- JetBlue SASB Sustainability LeadershipDocument1 pageJetBlue SASB Sustainability LeadershipShivani KarkeraNo ratings yet

- Case Analysis 1 (Part2)Document3 pagesCase Analysis 1 (Part2)api-4444878100% (1)

- SAP Electric - Charges Group 4Document7 pagesSAP Electric - Charges Group 4Saunak SaikiaNo ratings yet

- Destin Brass Products Co. ABC Costing Case StudyDocument15 pagesDestin Brass Products Co. ABC Costing Case Studywrite2som67% (3)

- Assignment: Littlefield Simulation - Game 2Document8 pagesAssignment: Littlefield Simulation - Game 2Sumit SinghNo ratings yet

- Scotts Miracle-Gro Spreader Sourcing DecisionDocument10 pagesScotts Miracle-Gro Spreader Sourcing DecisionmsarojiniNo ratings yet

- Ford Motor Company - PrateekDocument7 pagesFord Motor Company - Prateekprakhar guptaNo ratings yet

- Case Study #3 - Gulf Real Estate (Q 1-3)Document1 pageCase Study #3 - Gulf Real Estate (Q 1-3)rascal1331100% (1)

- MashaweerDocument3 pagesMashaweerCleo VanNo ratings yet

- MacroeconomicsDocument2 pagesMacroeconomicsmonikam meshramNo ratings yet

- Chandragupt Institute of Management Patna: Will Not Be Considered For EvaluationDocument3 pagesChandragupt Institute of Management Patna: Will Not Be Considered For EvaluationAYUSH RAVINo ratings yet

- Strategic Analysis of Allegiant Airlines' Cost Leadership StrategyDocument23 pagesStrategic Analysis of Allegiant Airlines' Cost Leadership StrategyEduard Hoffmann0% (1)

- Country Hill CaseDocument2 pagesCountry Hill CaseAlisha Anand [JKBS]No ratings yet

- California Choppers 1Document3 pagesCalifornia Choppers 11z2x3c4vNo ratings yet

- American ConnectorDocument4 pagesAmerican ConnectorChihab EL AlaouiNo ratings yet

- 17020841116Document13 pages17020841116Khushboo RajNo ratings yet

- Product Proliferation and Preemption Strategy SupplementsDocument22 pagesProduct Proliferation and Preemption Strategy SupplementstantanwyNo ratings yet

- Samantha Seetaram IENG3003 Assignment1Document15 pagesSamantha Seetaram IENG3003 Assignment1Samantha SeetaramNo ratings yet

- Ben & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisDocument5 pagesBen & Jerry's Homemade Ice Cream Inc: A Period of Transition Case AnalysisSaad JavedNo ratings yet

- Garanti Payment Systems:: Digital Transformation StrategyDocument12 pagesGaranti Payment Systems:: Digital Transformation StrategySwarnajit SahaNo ratings yet

- Business Strategy Using Financial Statements: Depreciation at Delta Air Lines and Singapore Airlines (A) Case AnalysisDocument10 pagesBusiness Strategy Using Financial Statements: Depreciation at Delta Air Lines and Singapore Airlines (A) Case AnalysisLuo YanhanNo ratings yet

- Depreciation at Delta Air Lines and Singapore Airlines (A)Document3 pagesDepreciation at Delta Air Lines and Singapore Airlines (A)Aadit AggarwalNo ratings yet

- Acn 301Document4 pagesAcn 301Fahim IslamNo ratings yet

- Nokia Distribution Network: Submitted By: Submitted ToDocument20 pagesNokia Distribution Network: Submitted By: Submitted ToAshutoshJhaNikhilNo ratings yet

- Netscape CaseDocument6 pagesNetscape CaseVikram RathiNo ratings yet

- Al Gore BplanDocument4 pagesAl Gore BplanVikram RathiNo ratings yet

- Vikram Rathi - Taxing SituationsDocument2 pagesVikram Rathi - Taxing SituationsVikram RathiNo ratings yet

- Multiple Choice: Quiz - LeasesDocument7 pagesMultiple Choice: Quiz - LeasesJulius Lester AbieraNo ratings yet

- Sample Business Plan No Part of This Proposal May Be CopiedDocument18 pagesSample Business Plan No Part of This Proposal May Be CopiedJoy A. VisitacionNo ratings yet

- Accounting Problem Book 2011Document103 pagesAccounting Problem Book 2011Sveta Chernica100% (1)

- DERIVATIVES AND PPEDocument7 pagesDERIVATIVES AND PPEblackphoenix303No ratings yet

- Georgia Tech FRSDocument79 pagesGeorgia Tech FRSMatt BrownNo ratings yet

- Capital Budgeting 2Document4 pagesCapital Budgeting 2Nicole Daphne FigueroaNo ratings yet

- Brewer 8e PPT Ch01 TDocument54 pagesBrewer 8e PPT Ch01 TJuan Camilo IdarragaNo ratings yet

- Financial Analysis of Hindustan Uniliver LimitedDocument37 pagesFinancial Analysis of Hindustan Uniliver Limitedambi07No ratings yet

- 704Document8 pages704Bhoomi GhariwalaNo ratings yet

- SCDL Managerial AccountingDocument552 pagesSCDL Managerial Accountingkuldeep528271% (7)

- Test Bank For Taxation of Individuals and Business Entities 2012 3rd Edition SpilkerDocument65 pagesTest Bank For Taxation of Individuals and Business Entities 2012 3rd Edition SpilkerLindaEvansizgo100% (36)

- Railway Project Assessment for Duranto ExpressDocument2 pagesRailway Project Assessment for Duranto Expresskeyurpatel1993No ratings yet

- Questions - Income Tax Divyastra CH 7 - PGBPDocument19 pagesQuestions - Income Tax Divyastra CH 7 - PGBPArjun ThawaniNo ratings yet

- Project ReportDocument26 pagesProject ReportSHRUTI AGRAWALNo ratings yet

- Calculate the room rent to be charged per day to earn a profit of 25% on cost excluding interestDocument5 pagesCalculate the room rent to be charged per day to earn a profit of 25% on cost excluding interestchirag shah100% (1)

- Vamshi Rubber Project Finance CaseDocument2 pagesVamshi Rubber Project Finance CaseRajesh GoelNo ratings yet

- Review Session 3 Conceptual FrameworkDocument16 pagesReview Session 3 Conceptual Frameworkalyanna alanoNo ratings yet

- Operating or Service CostingDocument6 pagesOperating or Service Costingkrunalpunjani07No ratings yet

- DA Examination September 2020 Q ADocument219 pagesDA Examination September 2020 Q AMosesNo ratings yet

- Adjustment Depreciation MCQ SDocument5 pagesAdjustment Depreciation MCQ SAtiq43% (7)

- Product Method, Income Method, Expenditure MethodDocument10 pagesProduct Method, Income Method, Expenditure MethodShivansh ChauhanNo ratings yet

- OVERHEADS - Topic 7Document21 pagesOVERHEADS - Topic 7Alepha TemboNo ratings yet

- Solutions To Selected End-Of-Chapter 6 Problem Solving QuestionsDocument9 pagesSolutions To Selected End-Of-Chapter 6 Problem Solving QuestionsVân Anh Đỗ LêNo ratings yet

- Chapter 8Document38 pagesChapter 8Taurai Mamire100% (2)

- CALCULATE ACCOUNTING RATE OF RETURN (ARRDocument5 pagesCALCULATE ACCOUNTING RATE OF RETURN (ARRRohit GandhiNo ratings yet

- LEASE ACCOUNTING ESSENTIALSDocument6 pagesLEASE ACCOUNTING ESSENTIALSIts meh SushiNo ratings yet

- Econ PE ProblemBkDocument19 pagesEcon PE ProblemBkMustafa OmarNo ratings yet

- Quiz 2 SpreadsheetDocument3 pagesQuiz 2 SpreadsheetAnesNo ratings yet

- Journal ProblemsDocument2 pagesJournal ProblemsAccounting Files100% (1)

- Ms Comprehesive Exam Cart - October, 2015Document4 pagesMs Comprehesive Exam Cart - October, 2015Vel JuneNo ratings yet