Professional Documents

Culture Documents

Foreclosure Avoidance Fact Sheet

Uploaded by

Ruthiness2012Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Foreclosure Avoidance Fact Sheet

Uploaded by

Ruthiness2012Copyright:

Available Formats

Veteran Borrowers in Delinquency Quick Reference Sheet

General Guidance

The US Department of Veterans Affairs urges all veterans who are encountering problems making their mortgage payments to speak with their servicers as soon as possible to explore options to avoid foreclosure. Contrary to popular opinion, servicers really do not want to foreclose because foreclosure costs a lot of money. Depending on a veterans specific situation, servicers may offer any of the following options to avoid foreclosure: o Repayment Plan The borrower makes regular installment each month plus part of the missed installments. o Special Forbearance The servicer agrees not to initiate foreclosure to allow time for borrowers to repay the missed installments. An example of when this would be likely is when a borrower is waiting for a tax refund. o Loan Modification - Provides the borrower a fresh start by adding the delinquency to the loan balance and establishing a new payment schedule. o Additional time to arrange a private sale The servicer agrees to delay foreclosure to allow a sale to close if the loan will be paid off. o Short Sale When the servicer agrees to allow a borrower to sell his/her home for a lesser amount than what is currently required to payoff the loan. o Deed-in-Lieu of Foreclosure - The borrower voluntarily agrees to deed the property to the servicer instead of going through a lengthy foreclosure process. Access our website at www.benefits.va.gov/homeloans/veteran.asp for additional information on VA loans and to watch videos of veterans who have completed the workout options listed above.

Servicemembers Civil Relief Act

Veteran borrowers may be able to request relief pursuant to the Servicemembers Civil Relief Act (SCRA). SCRA is intended to ease the economic and legal burdens on military personnel during their active service. In order to qualify for certain protections available under the Act, the borrower must request protection under the Act, and the loan must have originated prior to the current period of active military service. SCRA may provide for a lower interest rate, or prevent foreclosure or eviction up to nine months from period of military service.

Assistance to Veterans with VA-Guaranteed Home Loans

When a VA-guaranteed home loan becomes delinquent, VA provides supplemental servicing assistance to help cure the default. The servicer has the primary responsibility of servicing the loan to resolve the default. However, in cases where the servicer is unable to help the veteran borrower, Loan Guaranty has Loan Technicians in eight Regional Loan Centers and two special servicing centers who take an active role in interceding with the servicer to explore all options to avoid foreclosure. Veterans with VA-guaranteed home loans can call (877) 827-3702 to reach the nearest Loan Guaranty office where loan specialists are prepared to discuss potential ways to help save the loan. For more information go to www.benefits.va.gov/homeloans or call (877) 827-3702

Veteran Borrowers in Delinquency Quick Reference Sheet

(continued)

National Call Center for Homeless Veterans

Veterans who feel they may be facing homelessness as a result of losing their home can call (877) 4AID VET (877-424-3838) or go to www1.va.gov/HOMELESS/NationalCallCenter.asp to receive immediate assistance from VA.

Assistance to Veterans with non-VA Guaranteed Home Loans

For a veteran or service member who may have obtained a conventional or sub-prime loan, VA has a network of eight Regional Loan Centers and two special servicing centers that can offer advice and guidance. Borrowers may visit VAs website at www.benefits.va.gov/homeloans or call toll-free (877) 827-3702 to speak with a VA Loan Technician. However, unlike when a veteran has a VAguaranteed home loan, VA does not have the legal authority to intervene on the borrowers behalf. It is imperative that a borrower contacts his/her servicer as quickly as possible. VA Refinancing of a non-VA Guaranteed Home Loan Veterans with conventional home loans now have new options for refinancing to a VA-guaranteed home loan. These new options are available as a result of the Veterans Benefits Improvement Act of 2008. Veterans who wish to refinance their subprime or conventional mortgage may now do so for up to 100 pct of the value of the property, which is up from the previous limit of 90 pct. Additionally, Congress raised VAs maximum loan guaranty for these types of refinancing loans. Loan limits were effectively raised from $144,000 to $417,000. High cost counties have even higher maximum loan limits. VA County Loan Limits can be found at www.benefits.va.gov/homeloans. These changes will allow more qualified veterans to refinance through VA, allowing for savings on interest costs and avoiding foreclosure. A VA refinancing loan may help a veteran who is facing a big payment increase.

Other Assistance for Delinquent Veteran Borrowers

If VA is not able to help a veteran borrower retain his/her home (whether a VA-guaranteed loan or not), the HOPE NOW Alliance may be of assistance. HOPE NOW is a joint alliance consisting of servicers, counselors, and investors whose main goal is to assist distressed borrowers retain their homes and avoid foreclosure. They have expertise in financial counseling, as well as programs that take advantage of relief measures that VA cannot. HOPE Now provides outreach, counseling and assistance to homeowners who have the willingness and ability to keep their homes but are facing financial difficulty as a result of the crisis in the mortgage market. The HOPE NOW Alliance can be reached at (888) 995-HOPE (888-995-4673) or by visiting www.hopenow.com.

For more information go to www.benefits.va.gov/homeloans or call (877) 827-3702

You might also like

- Summary of Va Benefits For Disabled VeteransDocument8 pagesSummary of Va Benefits For Disabled Veteransjim912No ratings yet

- Personal Loan Products: New Car LoansDocument18 pagesPersonal Loan Products: New Car LoanssuvarnarathodNo ratings yet

- Foreclosure Alternatives ReportDocument3 pagesForeclosure Alternatives ReportCindy GrecoNo ratings yet

- Va HomeDocument17 pagesVa Homeapi-235677343No ratings yet

- WellsDocument3 pagesWellsForeclosure Fraud100% (1)

- 2016 Virginia Academy of Elder Law AttorneysDocument16 pages2016 Virginia Academy of Elder Law AttorneysMichael DuntzNo ratings yet

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- 7TH Loans PayableDocument4 pages7TH Loans PayableAnthony DyNo ratings yet

- FAC About Loans PDFDocument5 pagesFAC About Loans PDFDenzel BrownNo ratings yet

- Time Value of MoneyDocument30 pagesTime Value of MoneyAshia12No ratings yet

- RES 3200 Chapter 4 Fixed Interest Rate Mortgage LoansDocument11 pagesRES 3200 Chapter 4 Fixed Interest Rate Mortgage LoansbaorunchenNo ratings yet

- Foreclosure BrochureDocument6 pagesForeclosure BrochureAnnMarie BelairNo ratings yet

- Ecs2602 MCQ Testbank PDFDocument74 pagesEcs2602 MCQ Testbank PDFPaula kelly100% (1)

- Full Download Solution Manual For The Economics of Money Banking and Financial Markets 12th Edition Mishkin PDF Full ChapterDocument18 pagesFull Download Solution Manual For The Economics of Money Banking and Financial Markets 12th Edition Mishkin PDF Full Chaptergradientlactatemp44x100% (15)

- VA Loans Guidebook Ebook SummaryDocument8 pagesVA Loans Guidebook Ebook Summaryangel montanezNo ratings yet

- Mortgage Settlement FaqDocument4 pagesMortgage Settlement FaqAnonymous Feglbx5No ratings yet

- U. S. Small Business Administration Fact Sheet - Disaster Loans MISSISSIPPI Declaration 14738 & 14739Document2 pagesU. S. Small Business Administration Fact Sheet - Disaster Loans MISSISSIPPI Declaration 14738 & 14739rleeflowersNo ratings yet

- FCI Sheridan Shutdown ResourcesDocument6 pagesFCI Sheridan Shutdown ResourcesJeff HevenerNo ratings yet

- Research Papers On Reverse Mortgage LoanDocument5 pagesResearch Papers On Reverse Mortgage Loanafmcuafnh100% (1)

- Reverse Mortgage and HECM Purchase: Sponsored byDocument16 pagesReverse Mortgage and HECM Purchase: Sponsored byShibashish SahuNo ratings yet

- Disaster Loans Fact Sheet CT Irene 09-02-11Document2 pagesDisaster Loans Fact Sheet CT Irene 09-02-11BridgeportCTNo ratings yet

- NY 12776 Fact Sheet Hurricane Irene 08-31-11Document2 pagesNY 12776 Fact Sheet Hurricane Irene 08-31-11Watershed PostNo ratings yet

- Disaster Loan Program: Fact Sheet About U. S. Small Business Administration (Sba) Disaster LoansDocument2 pagesDisaster Loan Program: Fact Sheet About U. S. Small Business Administration (Sba) Disaster Loansmozart20No ratings yet

- Small Business Admin NY 13365 Fact Sheet 10-30-12Document2 pagesSmall Business Admin NY 13365 Fact Sheet 10-30-12awbmcNo ratings yet

- Just The Faqs:: Answers Common Questions About Reverse MortgagesDocument16 pagesJust The Faqs:: Answers Common Questions About Reverse MortgagesValerie VanBooven RN BSNNo ratings yet

- BankruptcyDocument44 pagesBankruptcysilentluciditysfNo ratings yet

- Types of Loans & Types of CreditDocument13 pagesTypes of Loans & Types of CreditRahul ParateNo ratings yet

- Farm Loans: VA Home LoansDocument2 pagesFarm Loans: VA Home LoansKuhnNo ratings yet

- FIMC RMBasicsFlyerDocument1 pageFIMC RMBasicsFlyerL.p. VogtmanNo ratings yet

- American Debt CouncilDocument2 pagesAmerican Debt Councilsamin mohsinNo ratings yet

- Acct 226Document4 pagesAcct 226freeNo ratings yet

- How to Win the Property War in Your Bankruptcy: Winning at Law, #4From EverandHow to Win the Property War in Your Bankruptcy: Winning at Law, #4No ratings yet

- RYPKEMA Quotes PDFDocument5 pagesRYPKEMA Quotes PDFNicholas BradleyNo ratings yet

- Sources of CreditDocument12 pagesSources of CreditMasud HassanNo ratings yet

- Save The Date: Attention Wells Fargo and Wachovia CustomersDocument2 pagesSave The Date: Attention Wells Fargo and Wachovia Customersapi-130786002No ratings yet

- 04 Veterans Pensions Protect Your Money From Poachers Pdf-0114-Poaching-Veterans-PensionsDocument12 pages04 Veterans Pensions Protect Your Money From Poachers Pdf-0114-Poaching-Veterans-Pensionsapi-309082881No ratings yet

- Equity Release United States Loan HUD: LenderDocument5 pagesEquity Release United States Loan HUD: Lender9870050214No ratings yet

- What Great For You Know About Mortgage Loans in Todays Lending EnvironmenttbxekDocument2 pagesWhat Great For You Know About Mortgage Loans in Todays Lending Environmenttbxekslimeblow82No ratings yet

- Understanding Personal LoansDocument10 pagesUnderstanding Personal Loansapi-255112727No ratings yet

- MATH +what Is Investment and LoanDocument11 pagesMATH +what Is Investment and LoanJhoana MaeNo ratings yet

- Gov Prev DefaultsDocument53 pagesGov Prev DefaultsvnsmechNo ratings yet

- Marketing of Financial Services AsignmentDocument11 pagesMarketing of Financial Services AsignmentMohit KumarNo ratings yet

- Affiliate LetterDocument7 pagesAffiliate LetterJohn ChauNo ratings yet

- Reverse Mortgage DissertationDocument7 pagesReverse Mortgage DissertationCustomPapersOnlineCanada100% (1)

- WI RHS Brochure Getting To Know Rural Development Financing FuturesDocument6 pagesWI RHS Brochure Getting To Know Rural Development Financing FuturesSarah CornNo ratings yet

- Mortgage Assistance ScamsDocument3 pagesMortgage Assistance Scamsdave1132No ratings yet

- Fsa BR 01 Web BookletDocument74 pagesFsa BR 01 Web BooklettomNo ratings yet

- Financial Literacy MaterialsDocument5 pagesFinancial Literacy MaterialsStanley JoeNo ratings yet

- Homeowner Foreclosure Help Protects and Defends Struggling Homeowners. New Consumer Defense Program Helps Homeowners Fight Back and Save Their Home From Foreclosure.Document4 pagesHomeowner Foreclosure Help Protects and Defends Struggling Homeowners. New Consumer Defense Program Helps Homeowners Fight Back and Save Their Home From Foreclosure.PR.comNo ratings yet

- SBA Veterans Advantage Guaranteed Loans: Veteran Small Business QualificationsDocument1 pageSBA Veterans Advantage Guaranteed Loans: Veteran Small Business Qualificationsmocon2008No ratings yet

- Capital MarketDocument19 pagesCapital MarketUrbano, Lourene Fe S. BSBA FM 2CNo ratings yet

- A Guide To Insurance ExcessesDocument10 pagesA Guide To Insurance ExcessesOsprey SkeerNo ratings yet

- HB Shap Program OverviewDocument3 pagesHB Shap Program OverviewSharonda Grove-WilliamsNo ratings yet

- Pandemic Financial Tool-KitDocument13 pagesPandemic Financial Tool-KitIndiana Family to FamilyNo ratings yet

- Abcd MasterRealtorPresentation4Document75 pagesAbcd MasterRealtorPresentation4etebark h/michaleNo ratings yet

- Eidl Faq 3.27.20Document6 pagesEidl Faq 3.27.20EddieNo ratings yet

- Sba Disaster Assistance Loans HomeownerDocument1 pageSba Disaster Assistance Loans HomeownerMelizanetteTexidorNo ratings yet

- 2019 JDC MarketingDocument13 pages2019 JDC Marketingharrystyling1No ratings yet

- Exempt Veterans Charged VA Home Loan Funding Fees: Office of Audits and EvaluationsDocument39 pagesExempt Veterans Charged VA Home Loan Funding Fees: Office of Audits and EvaluationsJustin RohrlichNo ratings yet

- NR Occ 2012 93aDocument2 pagesNR Occ 2012 93aForeclosure FraudNo ratings yet

- RRSP MortgagesDocument6 pagesRRSP Mortgagespkgarg_iitkgpNo ratings yet

- PDF 6176Document2 pagesPDF 6176api-309082881No ratings yet

- 2015 Overview of Va Benefit-Rev1Document1 page2015 Overview of Va Benefit-Rev1api-236451019No ratings yet

- What Are The Different Types of Interest and Why Do They MatterDocument6 pagesWhat Are The Different Types of Interest and Why Do They MatterRochelle Anne OpinaldoNo ratings yet

- Organizational Structure - Axis BankDocument3 pagesOrganizational Structure - Axis BankMohit Kumar100% (1)

- Types of Loans: Annuity LoanDocument2 pagesTypes of Loans: Annuity LoanEvelyne BujoreanNo ratings yet

- Mortgage Agent Level 1 ExamDocument10 pagesMortgage Agent Level 1 ExamShamsh KassamNo ratings yet

- Predatory Lending Sylacauga AlabamaDocument5 pagesPredatory Lending Sylacauga AlabamaRevRossReddickNo ratings yet

- Bridge Loan - InvestopediaDocument3 pagesBridge Loan - InvestopediaBob KaneNo ratings yet

- ROI Revision 260819 PDFDocument7 pagesROI Revision 260819 PDFDeepak Gowda SNo ratings yet

- Bank-DiscountDocument10 pagesBank-DiscountTeree ZuNo ratings yet

- Quiz 3Document2 pagesQuiz 3Joyce Anne SobremonteNo ratings yet

- Loan DocumentsDocument49 pagesLoan DocumentsBrendaNo ratings yet

- (AFFIN) - Form - Moratorium C19 - FINAL - 25 Feb2020Document2 pages(AFFIN) - Form - Moratorium C19 - FINAL - 25 Feb2020janicejongNo ratings yet

- Economics: The Institute of Bankers PakistanDocument29 pagesEconomics: The Institute of Bankers PakistanfafafaggggNo ratings yet

- Amortized Loan ExampleDocument8 pagesAmortized Loan ExampleEdward Raymund CuizonNo ratings yet

- CFPB Flyer Reverse-MortgageDocument4 pagesCFPB Flyer Reverse-MortgageoscarcaldeiraNo ratings yet

- RJSC Form XviiiDocument2 pagesRJSC Form XviiiMd. ZubaerNo ratings yet

- Classical Theory Demand For Money NallDocument15 pagesClassical Theory Demand For Money NallAchmad TriantoNo ratings yet

- FM213 - AT - Problem Set 2Document9 pagesFM213 - AT - Problem Set 2Guido MaiaNo ratings yet

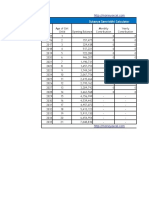

- Amortization Schedule With Extra PaymentsDocument28 pagesAmortization Schedule With Extra PaymentsJoseph PenningtonNo ratings yet

- Research 2Document33 pagesResearch 2ms.AhmedNo ratings yet

- 2023list - UPDATED LIST OF REGISTERED LC 30 SEPT 2023 1Document120 pages2023list - UPDATED LIST OF REGISTERED LC 30 SEPT 2023 1marsss lonsssNo ratings yet

- Sukanya Samriddhi Calculator VariableDocument38 pagesSukanya Samriddhi Calculator VariableRam SewakNo ratings yet

- Loan Amortization ScheduleDocument30 pagesLoan Amortization ScheduleMarc QuinamotNo ratings yet

- Genmath q2 Mod12 Solvingproblemsonbusinessandconsumerloans v2Document19 pagesGenmath q2 Mod12 Solvingproblemsonbusinessandconsumerloans v2Elyrb NevrijNo ratings yet

- SBA Loan Product MatrixDocument1 pageSBA Loan Product Matrixed_nycNo ratings yet