Professional Documents

Culture Documents

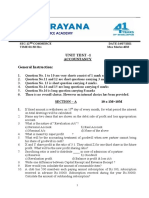

Accounts For Non-Trading Concerns Problem: 1

Uploaded by

KaliyapersrinivasanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Accounts For Non-Trading Concerns Problem: 1

Uploaded by

KaliyapersrinivasanCopyright:

Available Formats

ACCOUNTS FOR NON-TRADING CONCERNS Problem: 1 Show how you would deal with the following items of the

Cosmopolitian Club as on 31-3-2011 Particulars Tournament Fund Tournament Fund Investment Income from Tournament Tournament Expenses Problem: 2 The Madras Charity Hospital has paid Rs. 32,000 during 2010 under the head salaries. The salary paid includes Rs. 1,000 for 2009 and Rs. 200 for Rs. 2011. Salaries still payable for the year 2010 Rs. 2,000. Show how this item will appear in the Income & Expenditure Account of the Hospital for the year 2010. Problem: 3 In 2010 the subscriptions received were Rs. 40,000. These subscriptions include Rs. 1,500 received for the year 2009 and Rs. 2,400 for the year 2011. On 2010, the subscription due but not received were Rs. 1,200. What amount should be credited to the Income & Expenditure account in the books of Madras Library for the year ending 2010? Problem: 4 Prepare Receipts & payment Account of the Charity Eye Hospital for the year ending March 31st 2011. Particulars Opening Balances: Cash Bank Government Securities Subscription Interest Donations Miscellaneous Receipts Rs. 500 8,000 1,80,000 1,25,000 4,000 20,000 300 Particulars Furniture Purchased Salaries Investment Purchased Diet Expenses Surgical Instrument Purchased Rent & Taxes Insurance Premium Miscellaneous Expenses Closing Balances: Government Securities Cash Rs. 3,100 40,000 500 12,000 41,000 30,500 9,700 1,100 1,80,000 700 Debit 5,000 400 Credit 5,000 600 -

Problem: 5 The Cheran Sports Club seeks your help in preparing an Income & Expenditure Account for the year ended 31st December 2010 from and out of the details available below Particulars To Balance b/d To Entrance Fees To Subscription (including Rs. 50 for 2009) To Proceeds of Test Match To Interest on Investment (including Rs. 10 for 2009) Rs. Particulars 960 By Salary 200 By Maintenance of Grounds 3,480 (including Rs. 30 for 2009) By Wages of Grounds men 600 (including Rs. 15 for 2009) By Ground Rent 200 By Printing & Postage By Repairs By Balance c/d 5,440 Rs. 1,440 960 840 60 72 80 1,988 5,440

Problem: 6 From the following particulars of Chennai Club prepare Income & Expenditure Account for the year ended 30th June 2011 and the Balance Sheet as on that date. Depreciate Furniture by 10%; Billards table by 20%; Subscription amounting to Rs. 1,000 was still receivable. Rs. Credit Balances 10,000 Membership Subscription 9,680 Sundry Receipts 1,332 Sale of tickets 2,936 Entrance Fees 9,048 Capital Fund 19,200 696 12,776 6,472 8,760 6,400 3,040 90,340 Note: Treat Entrance Fees as Revenue Receipt. Debit Balances Furniture Billards table China Glass Cutlery Repairs Salaries & Wages Cash at Bank Cash in Hand Rent & Telephones Fuel & Light Entertainment Expenses Sundry Expenses Annual Dinner Rs. 42,240 6,972 12,936 1,792 26,400

90,340

Problem: 7 The Receipts & Payments Accounts of Friends Cricket Club for the year ended 30-061991 Particulars To Balance b/d To Subscription 1990 850 1991 40,000 1992 1,000 To Donations To Entrance Receipts To Interest from Bank Additional Information: a) b) c) d) e) f) Capital Fund Rs. 71,250 Fixed Assets Rs. 50,000 There are 450 members each paying Rs. 100 Annual Subscription. Half of the amount of Donations to be treated as capital receipts Wages Outstanding Rs. 200 Depreciate Fixed Assets by Rs. 2,000 Rs. Particulars 20,400 By Salaries & Wages By Entertainment Expenses By Electricity Charges By General Expenses 41,850 By Rent & Taxes 12,000 By Fixed Deposits 8,800 By Printing & Stationery 800 By Government Bonds By Balance c/d 83,850 Rs. 13,000 6,450 2,340 3,500 1,200 40,000 2,410 10,000 4,950 83,850

Prepare Income & Expenditure Account of the Club for the year ending 30th June 2091 and the Balance Sheet as on that date.

You might also like

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Technician Pilot Papers PDFDocument133 pagesTechnician Pilot Papers PDFCasius Mubamba100% (4)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Subquery ProblemDocument9 pagesSubquery ProblemAbhi RamNo ratings yet

- Poisoned NeedleDocument147 pagesPoisoned NeedleMark Cooper100% (3)

- Accountancy HOTSDocument47 pagesAccountancy HOTSYash LundiaNo ratings yet

- 01 Income and Expenditure AccountDocument4 pages01 Income and Expenditure AccountPrateek ⎝⏠⏝⏠⎠ Gupta ヅ0% (1)

- University of Vocational Technology: All Rights ReservedDocument5 pagesUniversity of Vocational Technology: All Rights ReservedMohamed ThabithNo ratings yet

- Capinew Account June13Document7 pagesCapinew Account June13ashwinNo ratings yet

- Accounts of Banking CompaniesDocument9 pagesAccounts of Banking Companieskunjap0% (1)

- 11 CaipccaccountsDocument19 pages11 Caipccaccountsapi-206947225No ratings yet

- PCC 2008 NPO QuestionDocument10 pagesPCC 2008 NPO QuestionVaibhav MaheshwariNo ratings yet

- Attention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Document17 pagesAttention C.A. PCC & Ipcc Students: (No.1 Institute of Jharkhand)Mahalaxmi RamasubramanianNo ratings yet

- 12 Accountancy SQP 4Document11 pages12 Accountancy SQP 4KandaroliNo ratings yet

- CBSE Class 11 Accountancy Question Paper SA 2 2013 PDFDocument6 pagesCBSE Class 11 Accountancy Question Paper SA 2 2013 PDFsivsyadavNo ratings yet

- 2011 JunDocument10 pages2011 JunShihan HaniffNo ratings yet

- Subscription (450 1000) 450000 Profit On Sale of Events Ticket 310000 Profit On Investments 200000 Total Income 960000Document2 pagesSubscription (450 1000) 450000 Profit On Sale of Events Ticket 310000 Profit On Investments 200000 Total Income 960000Alina RahimNo ratings yet

- Management Control SystemDocument11 pagesManagement Control SystemomkarsawantNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper3Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper3mansoorbariNo ratings yet

- PDFDocument3 pagesPDFPooja RanaNo ratings yet

- 35 Ipcc Accounting Practice ManualDocument218 pages35 Ipcc Accounting Practice ManualDeepal Dhameja100% (6)

- Review Questions On NPO SDocument4 pagesReview Questions On NPO Scoonyu1No ratings yet

- M Com Part I Accounts Question PDFDocument15 pagesM Com Part I Accounts Question PDFpink_key711No ratings yet

- Gujarat Technological University: InstructionsDocument4 pagesGujarat Technological University: InstructionsMuvin KoshtiNo ratings yet

- Accounts of Banking CompaniesDocument20 pagesAccounts of Banking CompaniesBasappaSarkar100% (1)

- Banking CompanyDocument5 pagesBanking CompanyPragathi PraNo ratings yet

- Problems On Cash Flow StatementsDocument12 pagesProblems On Cash Flow StatementsAnjali Mehta100% (1)

- Accountancy EngDocument8 pagesAccountancy EngBettappa Patil100% (1)

- Cat/fia (FTX)Document21 pagesCat/fia (FTX)theizzatirosliNo ratings yet

- Blue Print: Accounting: Class XI Weightage Difficulty Level of QuestionsDocument12 pagesBlue Print: Accounting: Class XI Weightage Difficulty Level of Questionssirsa11No ratings yet

- Accounts Paper Ii PDFDocument6 pagesAccounts Paper Ii PDFAMIN BUHARI ABDUL KHADERNo ratings yet

- T323 FA (Students)Document7 pagesT323 FA (Students)Cassandra AnneNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 (4) - 0 PDFsivsyadavNo ratings yet

- Narsee Monjee College of Comm. & Eco. Oct' 04: BMS (V) - Financial Management (Paper II)Document3 pagesNarsee Monjee College of Comm. & Eco. Oct' 04: BMS (V) - Financial Management (Paper II)Rutuja KhotNo ratings yet

- Accounts Paper I PDFDocument6 pagesAccounts Paper I PDFAMIN BUHARI ABDUL KHADERNo ratings yet

- Final Accounts Revision ProblemsDocument4 pagesFinal Accounts Revision Problemsblazingsun_11No ratings yet

- CS Exec - Prog - Paper-2 Company AC Cost & Management AccountingDocument25 pagesCS Exec - Prog - Paper-2 Company AC Cost & Management AccountingGautam SinghNo ratings yet

- 5Document8 pages5Sadhasivan SNo ratings yet

- 05mba14 July 07Document4 pages05mba14 July 07nitte5768No ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- Answers S3T1P1Document7 pagesAnswers S3T1P1mananleo88No ratings yet

- 08MBA14 May - June 2010Document3 pages08MBA14 May - June 2010nitte5768No ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNo ratings yet

- Test Series - Test No. - 5. Advanced Accounting120413115441Document5 pagesTest Series - Test No. - 5. Advanced Accounting120413115441Kansal AbhishekNo ratings yet

- CBSE Class 11 Accountancy Sample Paper 2013 PDFDocument12 pagesCBSE Class 11 Accountancy Sample Paper 2013 PDFsivsyadav100% (1)

- Study Note - 7: Accounting For Non-Profit Making OrganisationsDocument143 pagesStudy Note - 7: Accounting For Non-Profit Making OrganisationsharonsimithNo ratings yet

- The Figures in The Margin On The Right Side Indicate Full MarksDocument16 pagesThe Figures in The Margin On The Right Side Indicate Full MarksJatin GalaNo ratings yet

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- Final AccountsDocument5 pagesFinal AccountsGopal KrishnanNo ratings yet

- Non Trading ConcernsDocument27 pagesNon Trading ConcernsMuhammad Salim Ullah Khan0% (1)

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- Se 3Document4 pagesSe 3Azatbek ArystanNo ratings yet

- FA2 Midterm Test May 2012Document5 pagesFA2 Midterm Test May 2012LimShuLingNo ratings yet

- 11 Accountancy Notes Ch09 Financial Statement For Non Profit Organizations 02Document14 pages11 Accountancy Notes Ch09 Financial Statement For Non Profit Organizations 02Rishabh SethiaNo ratings yet

- CA Exam Preparatory Question AnswersDocument4 pagesCA Exam Preparatory Question AnswersBhavye GuptaNo ratings yet

- QB IiiDocument33 pagesQB IiisaketramaNo ratings yet

- Xii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021Document6 pagesXii Commerce Unit Test-1 Exam Accountancy Q.paper Dt.2021mekavinashNo ratings yet

- Important Questions For Accountancy 12th ComDocument17 pagesImportant Questions For Accountancy 12th ComAnkit RoyNo ratings yet

- Not Profit Ion 26-6-10Document1 pageNot Profit Ion 26-6-10najishjahangirNo ratings yet

- Economic & Budget Forecast Workbook: Economic workbook with worksheetFrom EverandEconomic & Budget Forecast Workbook: Economic workbook with worksheetNo ratings yet

- Commercial Bank Revenues World Summary: Market Values & Financials by CountryFrom EverandCommercial Bank Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- SET 2022 Gstr1Document1 pageSET 2022 Gstr1birpal singhNo ratings yet

- US Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistDocument114 pagesUS Army Medical Course MD0722-100 - Microbiology For The Veterinary SpecialistGeorges100% (2)

- Denagard-CTC US Knowledge ReportDocument4 pagesDenagard-CTC US Knowledge Reportnick224No ratings yet

- Readers Digest November 2021 PDF RD 2021 PDF EnglishDocument172 pagesReaders Digest November 2021 PDF RD 2021 PDF EnglishIslam Gold100% (1)

- To 33B-1-1 01jan2013Document856 pagesTo 33B-1-1 01jan2013izmitlimonNo ratings yet

- Arann Magazine, Issue 1-2-Online VersionDocument36 pagesArann Magazine, Issue 1-2-Online VersionmujismileNo ratings yet

- Grundfos Data Booklet MMSrewindablesubmersiblemotorsandaccessoriesDocument52 pagesGrundfos Data Booklet MMSrewindablesubmersiblemotorsandaccessoriesRashida MajeedNo ratings yet

- Consent CertificateDocument5 pagesConsent Certificatedhanu2399No ratings yet

- AppendicitisDocument7 pagesAppendicitisTim LuoNo ratings yet

- Editorship, Dr. S.A. OstroumovDocument4 pagesEditorship, Dr. S.A. OstroumovSergei OstroumovNo ratings yet

- UK FreshTECH Jammer RecipeBook 0Document24 pagesUK FreshTECH Jammer RecipeBook 0Temet NoscheNo ratings yet

- Assignment Nutrition and HydrationDocument17 pagesAssignment Nutrition and Hydrationmelencio olivasNo ratings yet

- Week 1 Seismic WavesDocument30 pagesWeek 1 Seismic WavesvriannaNo ratings yet

- Compensation ManagementDocument2 pagesCompensation Managementshreekumar_scdlNo ratings yet

- Studovaný Okruh: Physical Therapist Sample Test Questions (G5+)Document8 pagesStudovaný Okruh: Physical Therapist Sample Test Questions (G5+)AndreeaNo ratings yet

- Human Rights Law - Yasin vs. Hon. Judge Sharia CourtDocument7 pagesHuman Rights Law - Yasin vs. Hon. Judge Sharia CourtElixirLanganlanganNo ratings yet

- The Integration of Technology Into Pharmacy Education and PracticeDocument6 pagesThe Integration of Technology Into Pharmacy Education and PracticeAjit ThoratNo ratings yet

- AQ-101 Arc Flash ProtectionDocument4 pagesAQ-101 Arc Flash ProtectionYvesNo ratings yet

- Gintex DSDocument1 pageGintex DSRaihanulKabirNo ratings yet

- INTELLECTUAL DISABILITY NotesDocument6 pagesINTELLECTUAL DISABILITY Notesshai gestNo ratings yet

- Signage Method of Statement and Risk AssessmentDocument3 pagesSignage Method of Statement and Risk AssessmentNajmal AmanNo ratings yet

- Ecg Quick Guide PDFDocument7 pagesEcg Quick Guide PDFansarijavedNo ratings yet

- Assistive TechnologyDocument3 pagesAssistive Technologyapi-547693573No ratings yet

- Sesion 2 - Copia-1Document14 pagesSesion 2 - Copia-1Maeva FigueroaNo ratings yet

- RNP Rnav PDFDocument31 pagesRNP Rnav PDFhb2enbjxNo ratings yet

- #1 - The World'S Oldest First GraderDocument6 pages#1 - The World'S Oldest First GraderTran Van ThanhNo ratings yet

- Afforestation Powerpoint For NandniDocument9 pagesAfforestation Powerpoint For NandniFagun Sahni100% (1)

- Umur Ekonomis Mesin RevDocument3 pagesUmur Ekonomis Mesin Revrazali akhmadNo ratings yet