Professional Documents

Culture Documents

Core Inflation Primer - June 2010

Uploaded by

Arnold OsioOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Core Inflation Primer - June 2010

Uploaded by

Arnold OsioCopyright:

Available Formats

Core Inflation June 2010

CORE INFLATION AND THE ESTIMATION OF CORE INFLATION 1. What is core inflation? Core inflation is a widely used measure of the underlying trend or movement in the average consumer prices. It is often used as a complementary indicator to what is known as headline or Consumer Price Index (CPI) inflation. 2. How is core inflation different from CPI or headline inflation? Headline inflation refers to the rate of change in the CPI, a measure of the average price of a standard basket of goods and services consumed by a typical family. In the Philippines, the CPI basket is composed of various consumer items as determined by the nationwide Family Income and Expenditure Survey (FIES) conducted every three years by the National Statistics Office (NSO). Headline inflation thus captures the changes in the cost of living based on the movements of the prices of items in the basket of commodities and services consumed by the typical Filipino household. On the other hand, core inflation measures the change in average consumer prices after excluding from the CPI certain items with volatile price movements. By stripping out the volatile components of the CPI, core inflation allows us to see the broad underlying trend in consumer prices. Core inflation is often used as an indicator of the long-term inflation trend and as an indicator of future inflation. It is usually affected by the amount of money in the economy relative to production, or by monetary policy.

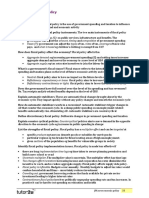

Headline and Core Inflation

Year-on-Year Change in Percent (2000=100)

14.0 12.0 10.0 8.0 6.0 4.0

3.7

June 2010 Year-on-Year Core Year-on-Year Headline

3.9

2.0 0.0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

3. Why do we need to measure core inflation? In many countries, CPI inflation is often influenced by factors beyond the control of economic policy and has tended to be historically volatile. Shocks or disturbances in

Department of Economic Research

Core Inflation June 2010

certain areas of the economy may cause it to temporarily move away from its long-term trend. In the Philippines, the volatility of inflation has been caused by factors such as disturbances in agricultural food supply or movements in international oil prices. As a result, the headline inflation rate may reach double-digit levels, even though the prices of other CPI components show only mild increases. Core inflation is an indicator of the underlying movement in consumer prices since it takes out the effect of temporary disturbances and shocks that cause prices to surge or decline, independent of economic and monetary policy. Measuring core inflation helps policymakers determine whether current movements in consumer prices represent shortlived disturbances or are part of a permanent trend. Such knowledge is important to the formulation of economic policy, particularly monetary policy. 4. How is core inflation measured or computed? There are several methods used to compute core inflation. The most common approach used in many countries is the exclusion method, which computes core inflation by taking out the prices of a fixed, pre-specified set of items from the CPI basket. The excluded components are considered to be either volatile or susceptible to supply disturbances and typically consist of food and energy items. This is based on the notion that the markets related to these goods are prone to supply shocks. Some economists advocate the use of statistically-based methods that remove extreme or outlier price changes (both positive and negative) from the overall inflation rate. The set of excluded items changes each month, depending on which particular items exhibit extreme price movements. The most common statistical measures of core inflation are the trimmed mean and weighted median. Both measures are derived from a highest-to-lowest (or positive to negative) ranking of individual price changes for each given month. The trimmed mean measure takes the average inflation rate after excluding a specified percentage of extreme positive and negative price changes, while the weighted median simply takes the median inflation rate which corresponds to a cumulative CPI weight of 50 percent from the highest-to-lowest ranking. It is also possible to use econometric techniques to estimate core inflation by estimating or calculating a statistical relationship between inflation and other relevant economic variables. The estimated regression model is then used to generate monthly estimates of core inflation using actual data for the other variables in the model. In the Philippines, the official core inflation measure is computed using the exclusion method. This approach was chosen for the following reasons: ease of construction; understandability by the general public; easy replication and verification by others; increased accountability and transparency of measurement; and timeliness. Answers to question nos. 9-10 provide a more detailed explanation on the choice of core inflation measures. Answer to question no. 12 provides a numerical example.

Department of Economic Research

Core Inflation June 2010

CROSS-COUNTRY EXPERIENCES ON CORE INFLATION 5. Do other countries monitor core inflation? Yes, most statistical authorities in other countries publish a measure of core inflation. Among central banks, it has become a common practice to monitor core inflation, irrespective of the monetary policy framework being used. For example, non-inflation targeting central banks such as the US Federal Reserve, the Bank of Japan and the Monetary Authority of Singapore also monitor core inflation.

6. How do other countries measure core inflation? The majority of countries employ the exclusion method and define core inflation as the overall price index net of the effects of shocks such as policy changes (involving taxes for instance), exchange rate, interest rate, and items which exhibit seasonal patterns. The most common items excluded are food and energy since these items are considered traditionally as volatile components of the overall CPI basket. Canada, for example, excludes food, energy and the effects of indirect taxes, while the US excludes food and energy. Thailands core inflation measure excludes raw food and energy prices, while the United Kingdom and New Zealand exclude only interest charges. Peru excludes 9 volatile itemsincluding food, fruits and vegetables, and urban transportcomprising about 21.2 percent of the CPI basket. Meanwhile, Chile uses a statistical-based approach and estimates its core measure by excluding both the largest 20 percent of negative price changes and the largest 8 percent of positive price changes. The table below summarizes the official core inflation measures adopted by other countries as well as the other core inflation measures used internally by their central banks. Country Official Core Measure Other Measures Used Internally by Central Banks CPI excluding 8 most volatile items (16%) Weighted Median Trimmed Mean (15%) Trimmed Mean (10%) Trimmed mean Weighted Median CPI excluding volatile items (30%) Weighted Median Trimmed Mean (15%) Structural Vector Autoregression (VAR) model estimate

Canada

CPI excluding Food, Energy and Indirect Taxes

Thailand Australia New Zealand Singapore

CPI excluding Fresh Food and Energy (23%) Treasury underlying CPI CPI excluding interest charges CPI excluding costs of private road transport and costs of accommodation

Japan Peru

CPI excluding Fresh Food CPI excluding 9 volatile items (food, fruits and vegetables, and urban transport, about 21.2 %)

Department of Economic Research

Core Inflation June 2010

Country

Official Core Measure

Other Measures Used Internally by Central Banks Weighted median Trimmed mean (15%)

United States United Kingdom Chile

CPI excluding food and energy Retail price index excluding mortgage interest Rates (RPIX) CPI excluding 20% with higher (-) variations and 8% with higher (+) variations CPI excluding agricultural food, public services, and transport CPI excluding indirect taxes CPI excluding energy and unprocessed food (IPSEBENE) ULI minus fruits, vegetables, and energy CPI (ULI 1) less mortgage interest payments (MIPS) CPI (ULI 2) excluding MIPS and food and energy CPI (ULI) less unprocessed food and energy

Colombia Germany Spain Netherlands Ireland

Portugal

7. How do policymakers use core inflation in other countries? Most statistical agencies in other countries use core inflation as a supplementary indicator to headline inflation and publish it alongside the headline rate. Some inflation targeting central bankssuch as the central banks from Canada, Czech Republic, Finland, Thailand and South Africause core inflation as the operating target for monetary policy. TOWARDS AN OFFICIAL DEFINITION OF CORE INFLATION IN THE PHILIPPINES 8. Is there an official definition of core inflation in the Philippines? Yes, there is an official definition of core inflation in the Philippines. The National Statistical Coordination Board (NSCB) through NSCB Resolution No. 6 Series of 2003 adopted an official definition and methodology for computing core inflation in the Philippines based on the exclusion method. Thus, while headline inflation is calculated as the year-on-year change in the overall CPI compiled by the NSO, the official core inflation measure is defined as the rate of change of headline CPI after excluding selected food and energy items.

9. How was the official definition of core inflation determined? The official definition is the result of inter-agency technical discussions among the NSO, the NSCB, the National Economic Development Authority (NEDA), the Statistical Research and Training Center (SRTC), the National Wage and Productivity Commission (NWPC), the Department of Trade and Industry (DTI), and the Bangko Sentral ng Pilipinas (BSP).

Department of Economic Research

Core Inflation June 2010

10. Why was the exclusion method chosen for the official definition? The exclusion method was chosen because: (a) it is easier to understand compared to the other methodologies; (b) it is more transparent and can be easily computed by anyone from CPI data; (c) it can be produced by the NSO at the same time as the headline inflation rate; and (d) it is in accordance with the common international practice of excluding food- and energy-related components of the CPI. Given that core inflation is a relatively new concept for the Filipino public in general, policymakers believed that the simplicity of the exclusion method can facilitate greater understanding by the public and consequently, help build credibility in the use of core inflation.

11. What specific items were excluded in order to compute for core inflation? The items in the CPI that were excluded in the definition of core inflation components and their corresponding CPI weights (2000=100) are as follows: Rice (9.4 percent) Corn (0.9 percent) Fruits & Vegetables (5.3 percent) LPG (1.3 percent) Kerosene (0.3 percent) Oil, Gasoline and Diesel (1.3 percent)

Together, the above excluded items account for 18.4 percent of the CPI. The list of excluded items shall be reviewed by the NSCB Board and the Technical Committee on Price Statistics (TCPS) whenever the CPI is rebased. 12. Is it possible to cite an example of the numerical computation of core inflation based on the official definition? For illustration purposes, the following table presents a sample computation of core inflation for December 2007. The core inflation rate for a given month (in this case December 2007) is the sum of core items inflation adjusted by the re-calibrated weights of these core items.

Department of Economic Research

Core Inflation June 2010

CONSUMER PRICE INDEX, PHILIPPINES (2000=100)

December 2007

in percent

HEADLINE Commodity Inflation Rate

(1)

Weights

(2)

Weights of Non-Core Items

(3)

CPI Weights Excluding Non-Core Items

(4)=(2) - (3)

CORE Weights in Core CPI

(5)=(4) / 81.6

Core CPI Dec 2007

(6)

Dec 2006

(7)

Core Inflation

(8) = ((6/7)1)*100

All Items A. All Food Items B. Clothing C. Housing and Repairs D. Fuel, Light and Water E. Services F. Miscellaneous

1

3.9 4.8 1.6 1.1 5.3 4.9 1.3

100.0 50.0 3.0 16.8 6.9 15.9 7.3

18.4 15.5 0.0 0.0 1.5 1.3 0.0

a

81.6 34.5 3.0 16.8 5.4 14.6 7.3

a

100.0 42.3 3.7 20.6 6.6 17.9 9.0

142.9 141.8 125.6 134.5 165.7 160.1 123.2

139.3 136.4 123.6 133.0 167.1 155.0 121.6

2.6 3.9 1.6 1.1 -0.8 3.3 1.3

b c

b c

The CPI weights are derived from each components' percentage share to the total personal consumption expenditure of a typical family, based on data from the NSO's FIES.

(See Question No. 2) n.b. - Figures may not add-up due to rounding off a Non-core items are rice, corn, fruits and vegetables

b c

excluding LPG and kerosene excluding oil, gasoline and diesel

13.

Which government agency generates the official core inflation data? In February 2004, the NSO began publishing the official rate of core inflation, alongside the headline inflation rate.

14.

Will core inflation replace the current CPI or headline inflation published by the NSO? No. Core inflation is not intended as a replacement for headline inflation, but as a complementary indicator of the general movement in prices of goods and services.

15.

Where does core inflation fit into the BSPs inflation targeting framework? Under the BSPs inflation targeting framework, the annual inflation target is still defined in terms of the headline inflation rate. The BSP uses the official measure of core inflation as a complementary indicator of consumer price movements. Thus, it would serve as an additional input to monetary policy analysis.

16.

As a consideration in adjusting the minimum wages in the country, should Regional Wage Boards use core inflation rather than headline inflation?

No. Core inflation should not be used to represent the price developments variable, among others, as basis for adjusting wages in the country. Since the intention is to factor into the wage-fixing and adjustment decisions the general increases in the cost of living and losses in purchasing power, the Regional Wage Boards should still use headline inflation. Wage adjustments must consider the price changes in all the items in the CPI basket, including rice, corn and fuel-related items which are excluded in the computation of core inflation.

Department of Economic Research

Core Inflation June 2010

NOTES

Department of Economic Research

Core Inflation June 2010

NOTES

Department of Economic Research

Core Inflation June 2010

CORE INFLATION AND THE ESTIMATION OF CORE INFLATION 1. What is core inflation? Core inflation is a widely used measure of the underlying trend or movement in the average consumer prices. It is often used as a complementary indicator to what is known as headline or Consumer Price Index (CPI) inflation. 2. How is core inflation different from CPI or headline inflation? Headline inflation refers to the rate of change in the CPI, a measure of the average price of a standard basket of goods and services consumed by a typical family. In the Philippines, the CPI basket is composed of various consumer items as determined by the nationwide Family Income and Expenditure Survey (FIES) conducted every three years by the National Statistics Office (NSO). Headline inflation thus captures the changes in the cost of living based on the movements of the prices of items in the basket of commodities and services consumed by the typical Filipino household. On the other hand, core inflation measures the change in average consumer prices after excluding from the CPI certain items with volatile price movements. By stripping out the volatile components of the CPI, core inflation allows us to see the broad underlying trend in consumer prices. Core inflation is often used as an indicator of the long-term inflation trend and as an indicator of future inflation. It is usually affected by the amount of money in the economy relative to production, or by monetary policy.

Headline and Core Inflation

Year-on-Year Change in Percent (2000=100)

14.0 12.0 10.0 8.0 6.0 4.0

3.7

June 2010 Year-on-Year Core Year-on-Year Headline

3.9

2.0 0.0

2001 2002 2003 2004 2005 2006 2007 2008 2009 2010

3. Why do we need to measure core inflation? In many countries, CPI inflation is often influenced by factors beyond the control of economic policy and has tended to be historically volatile. Shocks or disturbances in

Department of Economic Research

Core Inflation June 2010

certain areas of the economy may cause it to temporarily move away from its long-term trend. In the Philippines, the volatility of inflation has been caused by factors such as disturbances in agricultural food supply or movements in international oil prices. As a result, the headline inflation rate may reach double-digit levels, even though the prices of other CPI components show only mild increases. Core inflation is an indicator of the underlying movement in consumer prices since it takes out the effect of temporary disturbances and shocks that cause prices to surge or decline, independent of economic and monetary policy. Measuring core inflation helps policymakers determine whether current movements in consumer prices represent shortlived disturbances or are part of a permanent trend. Such knowledge is important to the formulation of economic policy, particularly monetary policy. 4. How is core inflation measured or computed? There are several methods used to compute core inflation. The most common approach used in many countries is the exclusion method, which computes core inflation by taking out the prices of a fixed, pre-specified set of items from the CPI basket. The excluded components are considered to be either volatile or susceptible to supply disturbances and typically consist of food and energy items. This is based on the notion that the markets related to these goods are prone to supply shocks. Some economists advocate the use of statistically-based methods that remove extreme or outlier price changes (both positive and negative) from the overall inflation rate. The set of excluded items changes each month, depending on which particular items exhibit extreme price movements. The most common statistical measures of core inflation are the trimmed mean and weighted median. Both measures are derived from a highest-to-lowest (or positive to negative) ranking of individual price changes for each given month. The trimmed mean measure takes the average inflation rate after excluding a specified percentage of extreme positive and negative price changes, while the weighted median simply takes the median inflation rate which corresponds to a cumulative CPI weight of 50 percent from the highest-to-lowest ranking. It is also possible to use econometric techniques to estimate core inflation by estimating or calculating a statistical relationship between inflation and other relevant economic variables. The estimated regression model is then used to generate monthly estimates of core inflation using actual data for the other variables in the model. In the Philippines, the official core inflation measure is computed using the exclusion method. This approach was chosen for the following reasons: ease of construction; understandability by the general public; easy replication and verification by others; increased accountability and transparency of measurement; and timeliness. Answers to question nos. 9-10 provide a more detailed explanation on the choice of core inflation measures. Answer to question no. 12 provides a numerical example.

Department of Economic Research

Core Inflation June 2010

CROSS-COUNTRY EXPERIENCES ON CORE INFLATION 5. Do other countries monitor core inflation? Yes, most statistical authorities in other countries publish a measure of core inflation. Among central banks, it has become a common practice to monitor core inflation, irrespective of the monetary policy framework being used. For example, non-inflation targeting central banks such as the US Federal Reserve, the Bank of Japan and the Monetary Authority of Singapore also monitor core inflation.

6. How do other countries measure core inflation? The majority of countries employ the exclusion method and define core inflation as the overall price index net of the effects of shocks such as policy changes (involving taxes for instance), exchange rate, interest rate, and items which exhibit seasonal patterns. The most common items excluded are food and energy since these items are considered traditionally as volatile components of the overall CPI basket. Canada, for example, excludes food, energy and the effects of indirect taxes, while the US excludes food and energy. Thailands core inflation measure excludes raw food and energy prices, while the United Kingdom and New Zealand exclude only interest charges. Peru excludes 9 volatile itemsincluding food, fruits and vegetables, and urban transportcomprising about 21.2 percent of the CPI basket. Meanwhile, Chile uses a statistical-based approach and estimates its core measure by excluding both the largest 20 percent of negative price changes and the largest 8 percent of positive price changes. The table below summarizes the official core inflation measures adopted by other countries as well as the other core inflation measures used internally by their central banks. Country Official Core Measure Other Measures Used Internally by Central Banks CPI excluding 8 most volatile items (16%) Weighted Median Trimmed Mean (15%) Trimmed Mean (10%) Trimmed mean Weighted Median CPI excluding volatile items (30%) Weighted Median Trimmed Mean (15%) Structural Vector Autoregression (VAR) model estimate

Canada

CPI excluding Food, Energy and Indirect Taxes

Thailand Australia New Zealand Singapore

CPI excluding Fresh Food and Energy (23%) Treasury underlying CPI CPI excluding interest charges CPI excluding costs of private road transport and costs of accommodation

Japan Peru

CPI excluding Fresh Food CPI excluding 9 volatile items (food, fruits and vegetables, and urban transport, about 21.2 %)

Department of Economic Research

Core Inflation June 2010

Country

Official Core Measure

Other Measures Used Internally by Central Banks Weighted median Trimmed mean (15%)

United States United Kingdom Chile

CPI excluding food and energy Retail price index excluding mortgage interest Rates (RPIX) CPI excluding 20% with higher (-) variations and 8% with higher (+) variations CPI excluding agricultural food, public services, and transport CPI excluding indirect taxes CPI excluding energy and unprocessed food (IPSEBENE) ULI minus fruits, vegetables, and energy CPI (ULI 1) less mortgage interest payments (MIPS) CPI (ULI 2) excluding MIPS and food and energy CPI (ULI) less unprocessed food and energy

Colombia Germany Spain Netherlands Ireland

Portugal

7. How do policymakers use core inflation in other countries? Most statistical agencies in other countries use core inflation as a supplementary indicator to headline inflation and publish it alongside the headline rate. Some inflation targeting central bankssuch as the central banks from Canada, Czech Republic, Finland, Thailand and South Africause core inflation as the operating target for monetary policy. TOWARDS AN OFFICIAL DEFINITION OF CORE INFLATION IN THE PHILIPPINES 8. Is there an official definition of core inflation in the Philippines? Yes, there is an official definition of core inflation in the Philippines. The National Statistical Coordination Board (NSCB) through NSCB Resolution No. 6 Series of 2003 adopted an official definition and methodology for computing core inflation in the Philippines based on the exclusion method. Thus, while headline inflation is calculated as the year-on-year change in the overall CPI compiled by the NSO, the official core inflation measure is defined as the rate of change of headline CPI after excluding selected food and energy items.

9. How was the official definition of core inflation determined? The official definition is the result of inter-agency technical discussions among the NSO, the NSCB, the National Economic Development Authority (NEDA), the Statistical Research and Training Center (SRTC), the National Wage and Productivity Commission (NWPC), the Department of Trade and Industry (DTI), and the Bangko Sentral ng Pilipinas (BSP).

Department of Economic Research

Core Inflation June 2010

10. Why was the exclusion method chosen for the official definition? The exclusion method was chosen because: (a) it is easier to understand compared to the other methodologies; (b) it is more transparent and can be easily computed by anyone from CPI data; (c) it can be produced by the NSO at the same time as the headline inflation rate; and (d) it is in accordance with the common international practice of excluding food- and energy-related components of the CPI. Given that core inflation is a relatively new concept for the Filipino public in general, policymakers believed that the simplicity of the exclusion method can facilitate greater understanding by the public and consequently, help build credibility in the use of core inflation.

11. What specific items were excluded in order to compute for core inflation? The items in the CPI that were excluded in the definition of core inflation components and their corresponding CPI weights (2000=100) are as follows: Rice (9.4 percent) Corn (0.9 percent) Fruits & Vegetables (5.3 percent) LPG (1.3 percent) Kerosene (0.3 percent) Oil, Gasoline and Diesel (1.3 percent)

Together, the above excluded items account for 18.4 percent of the CPI. The list of excluded items shall be reviewed by the NSCB Board and the Technical Committee on Price Statistics (TCPS) whenever the CPI is rebased. 12. Is it possible to cite an example of the numerical computation of core inflation based on the official definition? For illustration purposes, the following table presents a sample computation of core inflation for December 2007. The core inflation rate for a given month (in this case December 2007) is the sum of core items inflation adjusted by the re-calibrated weights of these core items.

Department of Economic Research

Core Inflation June 2010

CONSUMER PRICE INDEX, PHILIPPINES (2000=100)

December 2007

in percent

HEADLINE Commodity Inflation Rate

(1)

Weights

(2)

Weights of Non-Core Items

(3)

CPI Weights Excluding Non-Core Items

(4)=(2) - (3)

CORE Weights in Core CPI

(5)=(4) / 81.6

Core CPI Dec 2007

(6)

Dec 2006

(7)

Core Inflation

(8) = ((6/7)1)*100

All Items A. All Food Items B. Clothing C. Housing and Repairs D. Fuel, Light and Water E. Services F. Miscellaneous

1

3.9 4.8 1.6 1.1 5.3 4.9 1.3

100.0 50.0 3.0 16.8 6.9 15.9 7.3

18.4 15.5 0.0 0.0 1.5 1.3 0.0

a

81.6 34.5 3.0 16.8 5.4 14.6 7.3

a

100.0 42.3 3.7 20.6 6.6 17.9 9.0

142.9 141.8 125.6 134.5 165.7 160.1 123.2

139.3 136.4 123.6 133.0 167.1 155.0 121.6

2.6 3.9 1.6 1.1 -0.8 3.3 1.3

b c

b c

The CPI weights are derived from each components' percentage share to the total personal consumption expenditure of a typical family, based on data from the NSO's FIES.

(See Question No. 2) n.b. - Figures may not add-up due to rounding off a Non-core items are rice, corn, fruits and vegetables

b c

excluding LPG and kerosene excluding oil, gasoline and diesel

13.

Which government agency generates the official core inflation data? In February 2004, the NSO began publishing the official rate of core inflation, alongside the headline inflation rate.

14.

Will core inflation replace the current CPI or headline inflation published by the NSO? No. Core inflation is not intended as a replacement for headline inflation, but as a complementary indicator of the general movement in prices of goods and services.

15.

Where does core inflation fit into the BSPs inflation targeting framework? Under the BSPs inflation targeting framework, the annual inflation target is still defined in terms of the headline inflation rate. The BSP uses the official measure of core inflation as a complementary indicator of consumer price movements. Thus, it would serve as an additional input to monetary policy analysis.

16.

As a consideration in adjusting the minimum wages in the country, should Regional Wage Boards use core inflation rather than headline inflation?

No. Core inflation should not be used to represent the price developments variable, among others, as basis for adjusting wages in the country. Since the intention is to factor into the wage-fixing and adjustment decisions the general increases in the cost of living and losses in purchasing power, the Regional Wage Boards should still use headline inflation. Wage adjustments must consider the price changes in all the items in the CPI basket, including rice, corn and fuel-related items which are excluded in the computation of core inflation.

Department of Economic Research

Core Inflation June 2010

NOTES

Department of Economic Research

Core Inflation June 2010

NOTES

Department of Economic Research

You might also like

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Inflation Hacking: Inflation Investing Techniques to Benefit from High InflationFrom EverandInflation Hacking: Inflation Investing Techniques to Benefit from High InflationNo ratings yet

- C I E C I 1 - What Is Core Inflation?Document7 pagesC I E C I 1 - What Is Core Inflation?Nherwin OstiaNo ratings yet

- Core InflationDocument5 pagesCore InflationMuhammad Umar IqbalNo ratings yet

- How Is Core Inflation Different From CPI or "Headline" Inflation?Document7 pagesHow Is Core Inflation Different From CPI or "Headline" Inflation?Du Baladad Andrew MichaelNo ratings yet

- Eco ResearchDocument5 pagesEco ResearchArdays BalagtasNo ratings yet

- Inflation Targeting December 2011: T BSP P S 1. What Is Inflation?Document14 pagesInflation Targeting December 2011: T BSP P S 1. What Is Inflation?Jasmine LustadoNo ratings yet

- Econ DevDocument2 pagesEcon DevKristine ChavezNo ratings yet

- Economic Development: Prepared By: Cristeta A. Baysa, DBA Oct 2020Document4 pagesEconomic Development: Prepared By: Cristeta A. Baysa, DBA Oct 2020Cristeta BaysaNo ratings yet

- Measurement of Inflation and The Philippine Monetary Policy FrameworkDocument11 pagesMeasurement of Inflation and The Philippine Monetary Policy FrameworkChaiiNo ratings yet

- Metadata Core InflationDocument3 pagesMetadata Core InflationQuinselle Suayan CaspilloNo ratings yet

- CD TC TT2Document26 pagesCD TC TT2Xuanhoa TdNo ratings yet

- Inflation UIGDocument43 pagesInflation UIGzerdnaNo ratings yet

- Definition of Terms: Basket of Goods: Consumer Price IndexDocument6 pagesDefinition of Terms: Basket of Goods: Consumer Price IndexstudentoneNo ratings yet

- Definition of InflationDocument28 pagesDefinition of InflationRanjeet RanjanNo ratings yet

- Core Inflation ConceptDocument30 pagesCore Inflation ConceptBhairavi UvachaNo ratings yet

- Economic Performance IndexDocument16 pagesEconomic Performance IndexMonika ThakranNo ratings yet

- Inflation Targeting Framework: Indonesia in ComparisonDocument25 pagesInflation Targeting Framework: Indonesia in ComparisonPrasya AnindityaNo ratings yet

- Rme 2Q 2013Document4 pagesRme 2Q 2013caitlynharveyNo ratings yet

- Economic IndicatorsDocument4 pagesEconomic IndicatorsAbdullah Al FayazNo ratings yet

- Monetary & Fiscal PolicyDocument20 pagesMonetary & Fiscal PolicyMadhupriya DugarNo ratings yet

- The Instruments of Macroeconomic Policy.Document10 pagesThe Instruments of Macroeconomic Policy.Haisam Abbas IINo ratings yet

- Cef2009 Adb EngDocument20 pagesCef2009 Adb EngOeng Siev TongNo ratings yet

- 2013 - RanchhodDocument9 pages2013 - RanchhodMsus HughesNo ratings yet

- - Nguyễn Đức Thành - Vĩ MôDocument2 pages- Nguyễn Đức Thành - Vĩ MôThành VirtueNo ratings yet

- Econ ReportDocument5 pagesEcon ReportChrissa Marie VienteNo ratings yet

- Inflation TargetingDocument16 pagesInflation TargetingKathryn PuyatNo ratings yet

- Macro Remaning Pastpaper AnsDocument27 pagesMacro Remaning Pastpaper AnsSaif ali KhanNo ratings yet

- Inflation Targeting For Discussion v2.0Document18 pagesInflation Targeting For Discussion v2.0Zace RuruNo ratings yet

- Seid Final Report March 2022Document17 pagesSeid Final Report March 2022Run FastNo ratings yet

- Macro AssignmentDocument8 pagesMacro Assignmentfahad nstuNo ratings yet

- A: Consumer Price Index (Cpi) I: DefinitionDocument5 pagesA: Consumer Price Index (Cpi) I: DefinitionEdward RaymondNo ratings yet

- InflationDocument3 pagesInflationbrazzaq_2No ratings yet

- Article 3.0Document9 pagesArticle 3.0Vinish ChandraNo ratings yet

- The TermDocument9 pagesThe Termkrishna2007_jaiNo ratings yet

- What Is It?: Importance of Inflation and GDP.)Document3 pagesWhat Is It?: Importance of Inflation and GDP.)Arun_Prasath_1679No ratings yet

- Qa edexcel6EC02Document7 pagesQa edexcel6EC02SaChibvuri JeremiahNo ratings yet

- Food Inflation in Pakistan Literature ReviewDocument28 pagesFood Inflation in Pakistan Literature ReviewMukhtar Gichki50% (2)

- ME AssignmentDocument23 pagesME AssignmentAshutosh AshishNo ratings yet

- Compensation AssignmentDocument4 pagesCompensation Assignmentsalzadjali15No ratings yet

- Monetary Policy NewDocument12 pagesMonetary Policy NewAbdul Kader MandolNo ratings yet

- Economic Analysis and SolutionsDocument6 pagesEconomic Analysis and SolutionsJAMES ROLDAN HUMANGITNo ratings yet

- Food Prices and in Ation in Tanzania: Working Paper 12/0459Document49 pagesFood Prices and in Ation in Tanzania: Working Paper 12/0459Khuslen AmgalanNo ratings yet

- Analysis About Economic Indicators in IndonesiaDocument7 pagesAnalysis About Economic Indicators in IndonesiaAndalira Zagita PutriNo ratings yet

- Bus Final ProjectDocument24 pagesBus Final ProjectSausanNo ratings yet

- MEDIUMDocument19 pagesMEDIUMMarielle CatiisNo ratings yet

- Factors Influencing The Inflation in The UAE: - Zarah JiyavudeenDocument7 pagesFactors Influencing The Inflation in The UAE: - Zarah Jiyavudeenzarah jiyavudeenNo ratings yet

- Inflation in Singapore and ChinaDocument5 pagesInflation in Singapore and ChinaNursyafiza Binti RazaliNo ratings yet

- Module 5 ACED1 LUCIA LAZODocument7 pagesModule 5 ACED1 LUCIA LAZOmaelyn calindongNo ratings yet

- Measures of Inflation: Long-Term Trends: Figure 1 Shows Overall Inflation Trends Have DeclinedDocument14 pagesMeasures of Inflation: Long-Term Trends: Figure 1 Shows Overall Inflation Trends Have DeclinedpreethianujoseNo ratings yet

- Economic Theory Paper Assignment FinalDocument22 pagesEconomic Theory Paper Assignment Finalolawuyi adedayoNo ratings yet

- L8B Introduction To MacroeconomicsDocument19 pagesL8B Introduction To Macroeconomicskurumitokisaki967No ratings yet

- Targeting PDFDocument19 pagesTargeting PDFMia Siong CatubigNo ratings yet

- T BSP P S 1. What Is Inflation?Document18 pagesT BSP P S 1. What Is Inflation?gladys manaliliNo ratings yet

- CPI WPI IndiaDocument3 pagesCPI WPI IndiaAnand DeshmaneNo ratings yet

- InflationDocument7 pagesInflationNarsayya RajannaNo ratings yet

- Monetary Policy and Its Influence On Aggregate Demand.Document16 pagesMonetary Policy and Its Influence On Aggregate Demand.Anonymous KNo ratings yet

- Making Sense of Inflation Figures: FE Editorial: Understanding InflationDocument5 pagesMaking Sense of Inflation Figures: FE Editorial: Understanding InflationashishprrinNo ratings yet

- MPRA Paper 68704Document31 pagesMPRA Paper 68704TBP_Think_TankNo ratings yet

- MR Hayami: Price Stability and Monetary PolicyDocument8 pagesMR Hayami: Price Stability and Monetary PolicyRaegharp ConstantioulNo ratings yet

- Smart Home Lista de ProduseDocument292 pagesSmart Home Lista de ProduseNicolae Chiriac0% (1)

- RMC 46-99Document7 pagesRMC 46-99mnyng100% (1)

- PaySlip 05 201911 5552Document1 pagePaySlip 05 201911 5552KumarNo ratings yet

- Bahasa Inggris IIDocument15 pagesBahasa Inggris IIMuhammad Hasby AsshiddiqyNo ratings yet

- Seller Commission AgreementDocument2 pagesSeller Commission AgreementDavid Pylyp67% (3)

- Technical Question Overview (Tuesday May 29, 7pm)Document2 pagesTechnical Question Overview (Tuesday May 29, 7pm)Anna AkopianNo ratings yet

- Industry Analysis: Liquidity RatioDocument10 pagesIndustry Analysis: Liquidity RatioTayyaub khalidNo ratings yet

- Posting Journal - 1-5 - 1-5Document5 pagesPosting Journal - 1-5 - 1-5Shagi FastNo ratings yet

- The Relevance of Sales Promotion To Business OrganizationsDocument40 pagesThe Relevance of Sales Promotion To Business OrganizationsJeremiah LukiyusNo ratings yet

- P1 Ii2005Document3 pagesP1 Ii2005Boris YanguezNo ratings yet

- Evolution of Taxation in The PhilippinesDocument16 pagesEvolution of Taxation in The Philippineshadji montanoNo ratings yet

- BAIN REPORT Global Private Equity Report 2017Document76 pagesBAIN REPORT Global Private Equity Report 2017baashii4No ratings yet

- Design Analysis of The Lotus Seven S4 (Type 60) PDFDocument18 pagesDesign Analysis of The Lotus Seven S4 (Type 60) PDFChristian Villa100% (4)

- Ahmed BashaDocument1 pageAhmed BashaYASHNo ratings yet

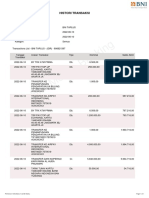

- BNI Mobile Banking: Histori TransaksiDocument1 pageBNI Mobile Banking: Histori TransaksiWebi SuprayogiNo ratings yet

- The Making of A Global World 1Document6 pagesThe Making of A Global World 1SujitnkbpsNo ratings yet

- ENG Merchant 4275Document7 pagesENG Merchant 4275thirdNo ratings yet

- Indian Contract ActDocument8 pagesIndian Contract ActManish SinghNo ratings yet

- Kennedy 11 Day Pre GeneralDocument16 pagesKennedy 11 Day Pre GeneralRiverheadLOCALNo ratings yet

- Chennai - Purchase Heads New ListDocument298 pagesChennai - Purchase Heads New Listconsol100% (1)

- Manufactures Near byDocument28 pagesManufactures Near bykomal LPS0% (1)

- The System of Government Budgeting Bangladesh: Motahar HussainDocument9 pagesThe System of Government Budgeting Bangladesh: Motahar HussainManjare Hassin RaadNo ratings yet

- Guide To Accounting For Income Taxes NewDocument620 pagesGuide To Accounting For Income Taxes NewRahul Modi100% (1)

- Year 2016Document15 pagesYear 2016fahadullahNo ratings yet

- Aptdc Tirupati Tour PDFDocument1 pageAptdc Tirupati Tour PDFAfrid Afrid ShaikNo ratings yet

- A Glossary of Macroeconomics TermsDocument5 pagesA Glossary of Macroeconomics TermsGanga BasinNo ratings yet

- VENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Document1 pageVENDOR TBE RESPONSE OF HELIMESH FROM HELITECNICA (Update 11-2)Riandi HartartoNo ratings yet

- Independent Power Producer (IPP) Debacle in Indonesia and The PhilippinesDocument19 pagesIndependent Power Producer (IPP) Debacle in Indonesia and The Philippinesmidon64No ratings yet

- PDC Yanque FinalDocument106 pagesPDC Yanque FinalNilo Cruz Cuentas100% (3)

- Deductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDocument12 pagesDeductions From Gross Income: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersMichael Reyes75% (4)