Professional Documents

Culture Documents

Price-Book Value Ratio: Definition

Uploaded by

Rajvachan ManiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Price-Book Value Ratio: Definition

Uploaded by

Rajvachan ManiCopyright:

Available Formats

Price-Book Value Ratio: Definition Price-Book Value Ratio: Definition

l The price/book value ratio is the ratio of the market value of equity to

the book value of equity, i.e., the measure of shareholders equity in

the balance sheet.

l Price/Book Value = Market Value of Equity

Book Value of Equity

l Consistency Tests:

If the market value of equity refers to the market value of equity of

common stock outstanding, the book value of common equity should be

used in the denominator.

If there is more that one class of common stock outstanding, the market

values of all classes (even the non-traded classes) needs to be factored in.

PBV Ratio: September 1997 PBV Ratio: September 1997

St d. Dev = 6.19

Mean = 3.3

N = 4750.00

Price t o Book Value

P/ BV Rat ios: Sept ember 1997

1200

1000

800

600

400

200

0

Price Book Value Ratio: Stable Growth Firm Price Book Value Ratio: Stable Growth Firm

l Going back to a simple dividend discount model,

l Defining the return on equity (ROE) = EPS

0

/ Book Value of Equity,

the value of equity can be written as:

l If the return on equity is based upon expected earnings in the next time

period, this can be simplified to,

P

0

DPS

1

r g

n

P

0

BV

0

*ROE*Payout Ratio *(1 + g

n

)

r-g

n

P

0

BV

0

PBV =

ROE*Payout Ratio *(1 + g

n

)

r-g

n

P

0

BV

0

PBV =

ROE*Payout Ratio

r-g

n

Price Book Value Ratio: Stable Growth Firm Price Book Value Ratio: Stable Growth Firm

Another Presentation Another Presentation

l This formulation can be simplified even further by relating growth to

the return on equity:

g = (1 - Payout ratio) * ROE

l Substituting back into the P/BV equation,

l The price-book value ratio of a stable firm is determined by the

differential between the return on equity and the required rate of return

on its projects.

P

0

BV

0

PBV =

ROE - g

n

r-g

n

Price Book Value Ratio for a Stable Growth Price Book Value Ratio for a Stable Growth

Firm: Example Firm: Example

l Jenapharm was the most respected pharmaceutical manufacturer in

East Germany.

l Jenapharm, which was expected to have revenues of 230 million DM

and earnings before interest and taxes of 30 million DM in 1991.

l The firm had a book value of assets of 110 million DM, and a book

value of equity of 58 million DM. The interest expenses in 1991 is

expected to be 15 million DM. The corporate tax rate is 40%.

l The firm was expected to maintain sales in its niche product, a

contraceptive pill, and grow at 5% a year in the long term, primarily by

expanding into the generic drug market.

l The average beta of pharmaceutical firms traded on the Frankfurt

Stock exchange was 1.05.

l The ten-year bond rate in Germany at the time of this valuation was

7%; the risk premium for stocks over bonds is assumed to be 5.5%.

Estimating a Price/Book Ratio for Jenapharm Estimating a Price/Book Ratio for Jenapharm

l Expected Net Income = (EBIT - Interest Expense)*(1-t) = (30 - 15) *

(1-0.4) = 9 mil DM

l Return on Equity = Expected Net Income / Book Value of Equity = 9 /

58 = 15.52%

l Cost on Equity = 7% + 1.05 (5.5%) = 12.775%

l Price/Book Value Ratio = (ROE - g) / (r - g) = (.1552 - .05) / (.12775 -

.05) = 1.35

l Estimated MV of equity = BV of Equity * Price/BV ratio = 58 * 1.35

= $78.3 mil DM

Price Book Value Ratio for High Growth Firm Price Book Value Ratio for High Growth Firm

l The Price-book ratio for a high-growth firm can be estimated

beginning with a 2-stage discounted cash flow model:

l Dividing both sides of the equation by the book value of equity:

where ROE = Return on Equity in high-growth period

ROE

n

= Return on Equity in stable growth period

P

0

=

EPS

0

*Payout Ratio *(1+g)* 1

(1+g)

n

(1+r)

n

_

,

r -g

+

EPS

0

*Payout Ratio

n

*(1+g)

n

*(1+g

n

)

( r - g

n

)(1+r)

n

P

0

BV

0

=

ROE*Payout Ratio*(1+g)* 1

(1+g)

n

(1+ r)

n

_

,

r - g

+

ROE

n

*Payout Ratio

n

*(1+g)

n

*(1+g

n

)

(r-g

n

)(1+r)

n

1

]

1

1

1

PBV Ratio for High Growth Firm: Example PBV Ratio for High Growth Firm: Example

l Assume that you have been asked to estimate the PBV ratio for a firm

which has the following characteristics:

High Growth Phase Stable Growth Phase

Length of Period 5 years Forever after year 5

Return on Equity 25% 15%

Payout Ratio 20% 60%

Growth Rate .80*.25=.20 .4*.15=.06

Beta 1.25 1.00

Cost of Equity 12.875% 11.50%

The riskfree rate is 6%.

Estimating Price/Book Value Ratio Estimating Price/Book Value Ratio

l The price/book value ratio for this firm is:

PBV =

0.25 * 0.2 * (1.20) * 1

(1.20)

5

(1.12875)

5

_

,

(.12875 - .20)

+

0.15 *0.6 * (1.20)

5

*(1.06)

(.115 - .06) (1.12875)

5

1

]

1

1

1

= 2.66

PBV and ROE: The Key PBV and ROE: The Key

PBV and ROE: Risk Scenarios

0

0.5

1

1.5

2

2.5

3

3.5

4

10% 15% 20% 25% 30%

ROE

P

r

i

c

e

/

B

o

o

k

V

a

l

u

e

R

a

t

i

o

s

Bet a=0.5

Bet a=1

Bet a=1.5

PBV/ROE: Oil Companies: 1996 PBV/ROE: Oil Companies: 1996

Company Name P/ BV ROE

Tot al ADR B 0.90 4.10

Giant Indust ries 1.10 7.20

Royal Dut ch Pet roleum ADR 1.10 12.30

Tesoro Pet roleum 1.10 5.20

Pet robras 1.15 3.37

YPF ADR 1.60 13.40

Ashland 1.70 10.60

Quaker St at e 1.70 4.40

Coast al 1.80 9.40

Elf Aquit aine ADR 1.90 6.20

Holly 2.00 20.00

Ult ramar Diamond Shamrock 2.00 9.90

Wit co 2.00 10.40

World Fuel Services 2.00 17.20

Elcor 2.10 10.10

Imper i al Oi l 2.20 8.60

Repsol ADR 2.20 17.40

Shell Transport & Trading ADR 2.40 10.50

Amoco 2.60 17.30

Phi l l i ps Pet r ol eum 2.60 14.70

ENI SpA ADR 2.80 18.30

Mapco 2.80 16.20

Texaco 2.90 15.70

Brit ish Pet roleum ADR 3.20 19.60

Tosco 3.50 13.70

Average 2.05 11.83

PBV versus ROE regression PBV versus ROE regression

l Regressing PBV ratios against ROE for oil companies yields the

following regression:

PBV = 0.96 + 9.28 (ROE) R

2

= 46.67%

l For every 1% increase in ROE, the PBV ratio should increase by

0.0928.

Valuing Pemex Valuing Pemex

l Assume that you have been asked to value a PEMEX for the Mexican

Government; All you know is that it has earned a return on equity of

14% last year. The appropriate P/BV ratio can be estimated in one of

two ways

Beta based upon international oil companies = 0.70

Cost of Equity = 7.50% + 0.70 (5.50%) = 11.35%

l P/BV Ratio (based upon regression) = 0.96 + 9.28 * 0.14 = 2.26

Looking for undervalued securities - PBV Looking for undervalued securities - PBV

Ratios and ROE Ratios and ROE

l Given the relationship between price-book value ratios and returns on

equity, it is not surprising to see firms which have high returns on

equity selling for well above book value and firms which have low

returns on equity selling at or below book value.

l The firms which should draw attention from investors are those which

provide mismatches of price-book value ratios and returns on equity -

low P/BV ratios and high ROE or high P/BV ratios and low ROE.

The Valuation Matrix The Valuation Matrix

MV/BV

ROE-r

High ROE

High MV/BV

Low ROE

Low MV/BV

Overvalued

Low ROE

High MV/BV

Undervalued

High ROE

Low MV/BV

IBM: The Rise and Fall IBM: The Rise and Fall

IBM: PBV and ROE

0.00

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

1

9

8

3

1

9

8

4

1

9

8

5

1

9

8

6

1

9

8

7

1

9

8

8

1

9

8

9

1

9

9

0

1

9

9

1

1

9

9

2

1

9

9

3

1

9

9

4

1

9

9

5

1

9

9

6

1

9

9

7

Year

P

/

B

V

R

a

t

i

o

0.00%

5.00%

10.00%

15.00%

20.00%

25.00%

30.00%

R

O

E

PBV

ROE

Estimating price-book value ratios from Estimating price-book value ratios from

comparables comparables

Year Regression R squared

1987 PBV = 0.1841 + .00200 - 0.3940 + 1.3389 EGR + 9.35 ROE 0.8617

1988 PBV = 0.7113 + 0.00007 - 0.5082 + 0.4605 EGR + 6.94 ROE 0.8405

1989 PBV = 0.4119 + 0.0063 - 0.6406 + 1.0038 EGR+ 9.55 ROE 0.8851

1990 PBV = 0.8124 + 0.0099 - 0.1857 + 1.1130 EGR+ 6.61 ROE 0.8846

1991 PBV = 1.1065 + 0.3505 - 0.6471 + 1.0087 EGR + 10.51 ROE 0.8601

PBV = Price / Book Value Ratio at the end of the year

= Dividend Payout ratio at the end of the year = Beta of the stock

EGR = Growth rate in earnings over prior five years

ROE = Return on Equity = Net Income / Book Value of Equity

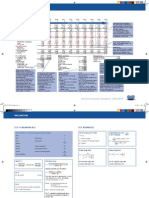

Price/BV Ratio Regression: September 1997 Price/BV Ratio Regression: September 1997

Mul t i pl e R . 82230

R Squa r e . 67618

Adj us t e d R Squa r e . 67519

St a nda r d Er r or 2. 26067

Ana l ys i s of Va r i a nc e

DF Sum of Squa r e s Me a n Squa r e

Re gr e s s i on 4 13873. 43418 3468. 35855

Re s i dua l 1300 6643. 79915 5. 11061

F = 678. 65780 Si gni f F = . 0000

- - - - - - - - - - - - - - - - - - Va r i a bl e s i n t he Equa t i on - - - - - - - - - - - - - - - - - -

Va r i a bl e B SE B Be t a T Si g T

PROJ GR 2. 9995 0. 6546 . 076348 4. 582 . 0000

PAYOUT - . 002588 . 016361 - . 002502 - . 158 . 8743

BETA 1. 599903 . 237074 . 112513 6. 749 . 0000

ROE 4. 823908 . 095323 . 800078 50. 606 . 0000

( Cons t a nt ) - . 062492 . 228514 - . 273 . 7845

Cross Sectional Regression for Brazil in 1997 Cross Sectional Regression for Brazil in 1997

l Using data obtained from Bloomberg for 137 Brazilian companies, we

ran the regression of PBV ratios against returns on equity and obtained

the following:

PBV = 1.06 + 2.16 ROE R

2

= 15.49%

(11.30) (4.84)

l For instance, the predicted PBV ratios for Aracruz, Telebras, Bradesco

and Petrobras would be as follows:

Company Actual PBV ROE Predicted PBV

Aracruz 0.66 15.44% 1.06 + 2.16(.1544)=1.39

Bradesco 1.56 16.01% 1.06 + 2.16(.1601)=1.41

Petrobras 1.27 3.37% 1.06 + 2.16 (.0337)=1.13

Telebras 1.48 9.97% 1.06 + 2.16(.0997)=1.28

Cross Sectional Regression for India: Cross Sectional Regression for India:

November 1997 November 1997

l Using data from November 1997 for the Indian companies which have

GDRs listed on them, and regressing PBV against ROE for these firms

yields:

PBV = -1.68 + 24.03 ROE ( R squared=51%)

l Reliance, Indias largest firm in terms of market value of equity, has a

return on equity of 15.86%. Plugging in Reliances ROE into this

equation would yield:

Predicted PBV for Reliance= -1.68 + 24.04 (.1568) = 2.09

On a relative basis, Reliance is under valued with a price/book value ratio of

1.80.

Value/Book Value Ratio: Definition Value/Book Value Ratio: Definition

l While the price to book ratio is a equity multiple, both the market

value and the book value can be stated in terms of the firm.

l Value/Book Value = Market Value of Equity + Market Value of Debt

Book Value of Equity + Book Value of Debt

Value/Book Ratio: Description Value/Book Ratio: Description

Value/ BV Rat ios: December 1997

0

200

400

600

800

1000

1200

<

0.5

0.5

-

1.00

1.00

-

1.50

1.50

-

2.00

2.00

-

2.50

2.5

- 3 . 0

3.0

- 4 . 0

4.0

- 5 . 0

> 5.0

Value/ BV

N

u

m

b

e

r

o

f

F

i

r

m

s

Determinants of Value/Book Ratios Determinants of Value/Book Ratios

l To see the determinants of the value/book ratio, consider the simple

free cash flow to the firm model:

l Dividing both sides by the book value, we get:

l If we replace, FCFF = EBIT(1-t) - (g/ROC) EBIT(1-t),we get

V

0

=

FCFF

1

WACC- g

V

0

BV

=

FCFF

1

/BV

WACC- g

V

0

=

ROC - g

WACC- g

Value/Book Ratio: An Example Value/Book Ratio: An Example

l Consider a stable growth firm with the following characteristics:

Return on Capital = 12%

Cost of Capital = 10%

Expected Growth = 5%

l The value/FCFF ratio for this firm can be estimated as follows:

Value/FCFF = (.12 - .05)/(.10 - .05) = 1.40

l The effects of ROC on growth will increase if the firm has a high

growth phase, but the basic determinants will remain unchanged.

Value/Book and the Return Spread Value/Book and the Return Spread

Value/ BV Rat ios and Ret urn Spreads

-

0.50

1.00

1.50

2.00

2.50

3.00

3.50

4.00

4.50

-

2

%

-

1

%

0

%

1

%

2

%

3

%

4

%

5

%

6

%

7

%

8

%

9

%

1

0

%

ROC - WACC

V

a

l

u

e

/

B

V

R

a

t

i

o

WACC=8%

WACC=10%

WACC=12%

You might also like

- Chapter 13 Equity ValuationDocument33 pagesChapter 13 Equity Valuationsharktale2828No ratings yet

- Chapter 13 Equity ValuationDocument28 pagesChapter 13 Equity ValuationSakthi PriyadharshiniNo ratings yet

- Relative Valuation Guide for Telecom CompanyDocument22 pagesRelative Valuation Guide for Telecom Companysanket patilNo ratings yet

- VebitdaDocument24 pagesVebitdaAndr EiNo ratings yet

- 1.1 What Is Their Profit Margin? Profit MarginDocument16 pages1.1 What Is Their Profit Margin? Profit MarginVenay SahadeoNo ratings yet

- PS RatioDocument28 pagesPS RatioTomislav MatoševićNo ratings yet

- Chapter 19: Financial Statement AnalysisDocument11 pagesChapter 19: Financial Statement AnalysisSilviu TrebuianNo ratings yet

- Discounted Cash Flow ValuationDocument45 pagesDiscounted Cash Flow Valuationnotes 1No ratings yet

- Forecasting - Penilaian BisnisDocument63 pagesForecasting - Penilaian BisnisyuliyastutiannaNo ratings yet

- Financial Management - Kendle QuesuestionsDocument4 pagesFinancial Management - Kendle QuesuestionsDr Rushen SinghNo ratings yet

- Price-Book Value Ratio: Definition and DeterminantsDocument27 pagesPrice-Book Value Ratio: Definition and DeterminantsRoyLadiasanNo ratings yet

- Residual Income Valuation - UrpDocument18 pagesResidual Income Valuation - Urparmando.chappell1005100% (1)

- Analyze Financial Statements and RatiosDocument11 pagesAnalyze Financial Statements and Ratiosnpiper29100% (1)

- FIN 213 Review Questions: Question OneDocument16 pagesFIN 213 Review Questions: Question OneJustus MusilaNo ratings yet

- Running Head: Woolworths Financial AnalysisDocument13 pagesRunning Head: Woolworths Financial AnalysisPrinciNo ratings yet

- F&C International Outline Answers ValuationDocument6 pagesF&C International Outline Answers ValuationnurNo ratings yet

- American Vanguard Corporation (Security AnaylisisDocument18 pagesAmerican Vanguard Corporation (Security AnaylisisMehmet SahinNo ratings yet

- Hewlett Packard (HPQ) Equity ValuationDocument10 pagesHewlett Packard (HPQ) Equity ValuationMada ArslanNo ratings yet

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- COMM 324 A4 SolutionsDocument6 pagesCOMM 324 A4 SolutionsdorianNo ratings yet

- Understanding the Value of Common StocksDocument12 pagesUnderstanding the Value of Common StocksMonalisa SethiNo ratings yet

- FM FormulasDocument13 pagesFM Formulassudhir.kochhar3530No ratings yet

- Full-Information Forecasting, Valuation, and Business Strategy AnalysisDocument56 pagesFull-Information Forecasting, Valuation, and Business Strategy AnalysisRitesh Batra100% (4)

- PE Ratio: Understanding Price-Earnings RatiosDocument35 pagesPE Ratio: Understanding Price-Earnings RatiosTanmay GuptaNo ratings yet

- PE Ratios PDFDocument40 pagesPE Ratios PDFRoyLadiasanNo ratings yet

- Chapter Company AnalysisDocument30 pagesChapter Company Analysisranbirkapoor8597No ratings yet

- Modifying The Model To Include Stock BuybacksDocument14 pagesModifying The Model To Include Stock BuybacksJozefNo ratings yet

- Profitability AnalysisDocument9 pagesProfitability AnalysisAnkit TyagiNo ratings yet

- Cost of CapitalDocument19 pagesCost of CapitalChintan KeniaNo ratings yet

- Cost of Capital Components Debt Preferred Common Equity WaccDocument55 pagesCost of Capital Components Debt Preferred Common Equity Waccfaisal_stylishNo ratings yet

- Chapter3 ExercisesDocument6 pagesChapter3 ExercisesNguyễn PhươngNo ratings yet

- DCF TakeawaysDocument2 pagesDCF TakeawaysvrkasturiNo ratings yet

- EconomyDocument12 pagesEconomyRayZa Y MiralNo ratings yet

- Dividend Policy-1Document37 pagesDividend Policy-1Uma NNo ratings yet

- E V: A A P: Perceived MispricingDocument19 pagesE V: A A P: Perceived MispricingHeidi HCNo ratings yet

- Relative PeDocument16 pagesRelative PeDaddha ShreetiNo ratings yet

- Chapter 4 - Analysis of Financial StatementsDocument50 pagesChapter 4 - Analysis of Financial Statementsnoor_maalik100% (1)

- Valuation of Corporation: Drivers of Value CreationDocument60 pagesValuation of Corporation: Drivers of Value CreationUzzaam HaiderNo ratings yet

- Ratio of Price To Book 2.22Document14 pagesRatio of Price To Book 2.22Lê Hữu LựcNo ratings yet

- Ipm CH 1 AnswersDocument6 pagesIpm CH 1 AnswersShakiul RanaNo ratings yet

- Valuation: Future Growth and Cash FlowsDocument12 pagesValuation: Future Growth and Cash FlowsAnshik BansalNo ratings yet

- Financial Analysis - Sony and Apple - PT2Document16 pagesFinancial Analysis - Sony and Apple - PT2chuck martinNo ratings yet

- Solution To Average and Difficult QuestionsDocument7 pagesSolution To Average and Difficult QuestionsDanielleNo ratings yet

- Cost of Equity: DR (CA) Anil AroraDocument41 pagesCost of Equity: DR (CA) Anil AroraladosehrawatNo ratings yet

- Chap 18Document16 pagesChap 18n_kurniatiNo ratings yet

- Analyze Portfolio PerformanceDocument48 pagesAnalyze Portfolio PerformanceMd Zainuddin IbrahimNo ratings yet

- READING 10 Industry and Company AnalysisDocument26 pagesREADING 10 Industry and Company AnalysisDandyNo ratings yet

- Chapter 10: Equity Valuation & AnalysisDocument22 pagesChapter 10: Equity Valuation & AnalysisMumbo JumboNo ratings yet

- Addl Notes - FCFF Model PDFDocument17 pagesAddl Notes - FCFF Model PDFRoyLadiasanNo ratings yet

- Chap 4 - Other DCF ModelsDocument35 pagesChap 4 - Other DCF Modelsrafat.jalladNo ratings yet

- DuPont AnalysisDocument15 pagesDuPont Analysisgarconfrancais06No ratings yet

- K12Document31 pagesK12AakashNo ratings yet

- Financial Analysis of Dabur Industries PVTDocument20 pagesFinancial Analysis of Dabur Industries PVTRahul BattooNo ratings yet

- Cuyix RevisedDocument6 pagesCuyix RevisedMaryam KhanNo ratings yet

- Soln CH 18 Equity ValDocument13 pagesSoln CH 18 Equity ValSilviu TrebuianNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Fuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryFrom EverandFuel Pumps & Fuel Tanks (C.V. OE & Aftermarket) World Summary: Market Values & Financials by CountryNo ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Piping Engineer ResponsibilitiesDocument1 pagePiping Engineer ResponsibilitiesRajvachan ManiNo ratings yet

- Febuary 01, 2000 05:25:41 Information Handling Services, 2000Document128 pagesFebuary 01, 2000 05:25:41 Information Handling Services, 2000Rajvachan ManiNo ratings yet

- 400 702Document18 pages400 702Rajvachan ManiNo ratings yet

- As4331 Iso7005Document2 pagesAs4331 Iso7005Rajvachan ManiNo ratings yet

- Knownmoney + Statement 2019,2020,2021,2022 (28.7.23)Document4 pagesKnownmoney + Statement 2019,2020,2021,2022 (28.7.23)nurulazuantyNo ratings yet

- AP 5902 LiabilitiesDocument11 pagesAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- Understanding Macro Economics PerformanceDocument118 pagesUnderstanding Macro Economics PerformanceViral SavlaNo ratings yet

- Lecture 19Document103 pagesLecture 19billyNo ratings yet

- Apayao Glassworks BusinessDocument4 pagesApayao Glassworks BusinessvicentaNo ratings yet

- Systems Design: Job-Order CostingDocument60 pagesSystems Design: Job-Order Costingrachim04No ratings yet

- Attributed Profitability Segments in Copa For SfinDocument9 pagesAttributed Profitability Segments in Copa For SfinMOORTHYNo ratings yet

- Pathways To Entrepreneurial GrowthDocument11 pagesPathways To Entrepreneurial GrowthHòa Âu DươngNo ratings yet

- Lecture 8Document46 pagesLecture 8api-3767414No ratings yet

- Eco Assignment OligopolyDocument8 pagesEco Assignment OligopolyRR1814B29100% (1)

- Seminar 8 QuestionsDocument3 pagesSeminar 8 Questionsnandan27100% (1)

- Auditing Revenue Process & Accounts ReceivableDocument17 pagesAuditing Revenue Process & Accounts ReceivableDaniel TadejaNo ratings yet

- Understanding Markets, Market Demand, and The Marketing EnvironmentDocument2 pagesUnderstanding Markets, Market Demand, and The Marketing EnvironmentSubbaiyar SivapathasekaranNo ratings yet

- Microsoft's Brand Image Marketing StrategyDocument4 pagesMicrosoft's Brand Image Marketing StrategyFTU.CS2 Đinh Bảo TrâmNo ratings yet

- Interim Financial Reporting - v.21Document2 pagesInterim Financial Reporting - v.21Rajesh KumarNo ratings yet

- Valuation-Methods and ParametersDocument15 pagesValuation-Methods and ParametersPranav Chaudhari100% (2)

- Cost Accounting Final ReportDocument15 pagesCost Accounting Final ReportMurtaza MoizNo ratings yet

- Moha Business PlanDocument10 pagesMoha Business Planmohammednur gudetaNo ratings yet

- Business Plan: Mapua UniversityDocument9 pagesBusiness Plan: Mapua UniversityKryzha RemojoNo ratings yet

- IB Economics PEQ Paper 1 Grid by Grid March 2021Document5 pagesIB Economics PEQ Paper 1 Grid by Grid March 2021MrsalemNo ratings yet

- Eloiza Heart Trading Company Financial StatementsDocument2 pagesEloiza Heart Trading Company Financial StatementsAr JayNo ratings yet

- Chief Financial Officer CFO in Midwest USA Resume David LindstaedtDocument4 pagesChief Financial Officer CFO in Midwest USA Resume David LindstaedtDavidLindstaedtNo ratings yet

- Ebook PDF College Accounting A Career Approach 13th Edition PDFDocument41 pagesEbook PDF College Accounting A Career Approach 13th Edition PDFdavid.roberts311100% (33)

- HR Compliance TrainingDocument10 pagesHR Compliance TrainingRaghubar JhaNo ratings yet

- Capstone ProjectDocument19 pagesCapstone ProjectRenu GuptaNo ratings yet

- True or False Conceptual Framework Set 2Document2 pagesTrue or False Conceptual Framework Set 2Demi Pardillo100% (1)

- Calculate Customer Lifetime Value for SaaS BusinessDocument20 pagesCalculate Customer Lifetime Value for SaaS Businesskamalapati tiwariNo ratings yet

- Learning Skills Assg 2Document11 pagesLearning Skills Assg 2BETTY WEE CHONG TIAN STUDENTNo ratings yet

- StocksDocument9 pagesStocksHassan Tahir SialNo ratings yet

- Types of Internal ControlsDocument12 pagesTypes of Internal Controlsshazana_ak100% (5)