Professional Documents

Culture Documents

Absolute Vs Conjugal Leg Research

Uploaded by

Jeric ReiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Absolute Vs Conjugal Leg Research

Uploaded by

Jeric ReiCopyright:

Available Formats

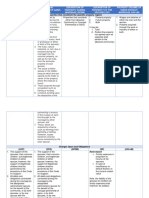

ABSOLUTE COMMUNITY PROPERTY

CONJUGAL PROPERTY OF GAINS

REGIME OF SEPARATION OF PROPERTY When future spouses agree in the marriage settlements that their property relations during marriage. (Art 143)

When will it commence /When is it applicable?

It shall commence at the precise moment that the marriage is celebrated. Any stipulation, express or implied, for the commencement of the commencement of the community regime at any other time shall be void. (Art. 88, 107)

PROPERTY REGIME OF UNIONS WITHOUT MARRIAGE (Without any legal impediment) Art. 147 When a man and a woman capacitated to marry each other, live exclusively with each other as husband and wife without the benefit of marriage or under a void marriage.

PROPERTY REGIME OF UNIONS WITHOUT MARRIAGE (With legal impediments) Art 148 When parties involved are not capacitated to marry each other live exclusively together.

Waiver of Rights In absence of Marriage settlement, which regime shall govern?

No waiver of rights, interests, shares and effects, except in case of judicial separation of property (Art. 89, 107) General Rule. Under Civil Code (Established before the Family Code) Property acquired by either or both of them through their work or industry and their wages and salaries are governed by the rules of coownership. Only properties acquired by both of the parties through their actual joint contribution of money, property, or industry shall be owned by them in common in proportion to their respective contributions.

General rule. Under Family Code.

Governing Rules

Marriage Settlement; Family Code; in case of conflict, rules of Coownership. All the property owned by the spouses at the time of the celebration of the marriage or acquired thereafter.

Family Code; in case of conflict, rules of Copartnership (Art. 108)

The provisions of the Family Code apply suppletorily to the provisions of the marriage settlement (Article 143). May refer to present or future property or both. It may be total or partial. In the latter case, property not agreed upon as separate shall pertain to the absolute community.

Properties constituting the property regime

1. Those acquired during the marriage with conjugal funds 2. Those obtained from labor, industry, work or profession of either or both spouse 3. Fruits of conjugal property due or received during the marriage and net fruits of separate property 4. Share in the hidden

treasure 5. Those acquired through occupation. 6. Livestock in excess of what was brought to the marriage 7. Those acquired by chance. Property acquired during the marriage is presumed to belong to the community, unless it is proved that it is one of those excluded therefrom. To invoke the presumption, the property must be shown to have been acquired during the marriage. It is not necessary to prove that the property was acquired by the funds of the community. Registered name generally not indicative, except if you cannot prove that the property was acquired during the marriage. 1. Property acquired during the marriage by gratuitous title and its fruits except if its expressly provided by the donor, testator or grantor that they shall form part of the community property 2. Property for personal and exclusive use of either spouse (jewelry forms part of the ACP) All property acquired during the marriage, whether the acquisition appears to have been made, contracted or registered in the name of one or both spouses, is presumed to be conjugal unless the contrary is proved. Properties acquired while they lived together shall be presumed to have been obtained by their joint efforts, work or industry. A party who did not participate in the acquisition by the other party who did not participate in the acquisition by the other party of any property shall be deemed to have contributed jointly in the acquisition thereof if the former's efforts consisted in the care and maintenance of the family and of the household. To each spouse shall belong all earnings from his or her profession, business or industry and all fruits, natural, industrial or civil, due to received during the marriage from his or her separate property. All which are agreed in the marriage settlement. 1. Salaries and wages shall be owned by them in equal shares; 2. Property acquired by either of the parties exclusively by his or her own fund belongs to such party, provided that there is proof that he or she acquired it by exclusive funds; 3. Property acquired while Their contributions and corresponding shares are presumed equal.

Presumption, in the absence of proof to the contrary

Exclusions from the property regime (Exclusive property of each spouse)

1) That which is brought to the marriage as his or her own; 2) That which each acquires during the marriage by gratuitous title; 3) That which is acquired by right of redemption, by barter or by exchange with property belonging to only one of the spouses; and 4) That which is purchased

3. Property acquired before the marriage by one with legitimate descendants by former marriage and its fruits and income

with exclusive money of the wife or of the husband.

Future or present property or both.

they live together shall be presumed to have been obtained by their joint efforts, work or industry and shall be owned by them in equal shares. A party who did not participate in the acquisition by the other party of any property shall be deemed to have contributed jointly in the acquisition thereof if the formers efforts consisted in the care and maintenance of the family and of the household. 4. The fruits of the couples separate property are not included in the coownership. 5. Property acquired by any of the parties after separation shall be exclusively owned by the party who acquired it.

Charges upon the Regime

1. Debts and obligations contracted by either spouse without the consent of the other to the extent it benefited the family. 2. Debts and obligations contracted during the marriage by designated administrator-spouse, both spouses, or by one with the consent of the other. 3. Taxes, liens, charges and expenses upon community property. 4. Support of spouses, their

1. Debts and obligations contracted by either spouse without the consent of the other to the extent it benefited the family. 2. Debts and obligations contracted during the marriage by designated administrator-spouse, both spouses, or by one with the consent of the other. 3. Taxes, liens, charges and expenses upon community property. 4. Support of spouses, their

Both shall bear the family expenses in proportionate to their income.

common children and legitimate children of either spouse. 5. Expenses of litigation between spouses unless the suit is found to be groundless. 6. Ante-nuptial debts which redounded to the benefit of the family. 7. Taxes and expenses for mere preservation made during the marriage upon the separate property of either spouse used by the family. 8. Expenses for professional or vocational course. 9. Other ante-nuptial debts, support of illegitimate child, and liabilities for crime or quasi-delicts in absence of separate property 10. Donated or promised to common legitimate children for profession, vocational course or self improvement. (Art 94)

common children and legitimate children of either spouse. 5. Expenses of litigation between spouses unless the suit is found to be groundless. 6. Ante-nuptial debts which redounded to the benefit of the family. 7. Taxes and expenses for mere preservation of separate property 8. Expenses for professional, vocational or selfimprovement courses of either spouse. 9. Value of what is donated or promised to common legit children for professional, vocation or self improvement courses. 10. Other ante-nuptial debts, support of illegitimate child, and liabilities for crime or quasi-delicts in absence of separate property. (Art 121) If the donations are onerous, the amount of the charges shall be borne by the exclusive property of the donee spouse, whenever they have been advance by the conjugal partnership of gains. (Art 114) Current market value of their separate properties

Liability if property is not enough for the charges

If the community property is insufficient to cover the foregoing liabilities, except those falling under paragraph (9), the spouses shall be solidarily liable for the unpaid balance with their separate properties.

The payment of personal debts contracted by the husband or the wife before or during the marriage shall not be charged to the conjugal properties partnership except insofar as they redounded to the benefit of the family. Neither shall the fines and pecuniary indemnities imposed upon them be charged to the partnership. However, the payment of personal debts contracted by either spouse before the marriage, that of fines and indemnities imposed upon them, as well as the support of illegitimate children of either spouse, may be enforced against the partnership assets after the responsibilities enumerated in the preceding Article have been covered, if the spouse who is bound should have no exclusive property or if it should be insufficient; but at the time of the liquidation of the partnership, such spouse shall be charged for what has been paid for the purpose above-mentioned.

Payment of personal obligations

Losses/Winnings in any game of chance, betting, sweepstakes, or any other kind of gambling (permitted or not)

Losses shall be borne by the loser and shall not be charged to the community but any winnings there from shall form part of the community property. (Art 117, 123)

Both spouses jointly enjoy the administration and enjoyment of the community property/ conjugal partnership. In case of disagreement, however, the husbands decision shall prevail, subject to recourse to the court by the wife for proper remedy, which must be availed of within five years from the date of the contract implementing such decision. In the event that one spouse is incapacitated or otherwise unable to participate in the administration of the common properties, the other spouse may assume sole powers of administration. Administration These powers do not include disposition or encumbrance without authority of the court or the written consent of the other spouse. In the absence of such authority or consent, the disposition or encumbrance shall be void. However, the transaction shall be construed as a continuing offer on the part of the consenting spouse and the third person, and may be perfected as a binding contract upon the acceptance by the other spouse or authorization by the court before the offer is withdrawn by either or both offerors. Neither spouse may donate any community/conjugal property without the consent of the other. Consent is not needed when donations are moderate and in favor of charity or on occasions of family rejoicing or family distress. (Art 98)

Each spouse shall own, dispose of, posses, administer and enjoy his or her separate estate, without need of the consent of the other.

Consent in Donation of Spouses

Neither party can encumber or disose by acts inver vivos of his or her share in the property acquired during cohabitation and owned in common, without the consent of the other, until after the termination of their cohabitation. (Art 147)

When is the regime terminated?

1) Upon the death of either spouse 2) When there is a decree of legal separation 3) When the marriage is annulled or declared void 4) In case of judicial separation of property during the marriage under Article 134 to 138. Dissolution must be registered in the registry of property to affect 3rd persons in good faith.

Filing a Decree reviving the former property regime that existed between the spouses (governed by Art 67)

Marriage without marriage settlement or as arranged in the marriage settlement. Executing a Deed of Extrajudicial Partition. Such agreement is perfectly legal and is a valid way of dividing up their properties. (Art 496)

Forfeiture of a share in the ownership.

Requirements in Dissolution 1. Inventory of all properties 2. Payments of Debts and obligation of ACP 3. Remains at the separate properties of the spouses are returned to the owner. 4. Net remainder of ACP is divided equally. 5. Delivery of presumptive legitimes. (Art 102) 1. Inventory of all property 2. Amounts advanced by the conjugal partnership in payment of personal debts of either spouse 3. Reimbursement for use of exclusive funds of either spouses 4. Payments of obligations to third parties 5. Delivery of the remains of exclusive funds to each spouse 6. Payment of losses of movables 7. Division of net profits 8. Delivery of presumptive legitimes. (Art. 129) 1) Same proceeding for settlement of estate; or 2) Judicially or extrajudicially within six months from the death of spouse

Procedure of Dissolution / Liquidation

Dissolution upon death of a spouse

1) Same proceeding for settlement of estate; or 2) Judicially or extrajudicially within one year from the death of spouse

Rule if there is subsequent marriage without the liquidation required by law

A mandatory regime of complete separation of property shall govern the property relations of the subsequent marriage.

Rules on Disposition of properties of the spouses

Either spouse may dispose by will of his or her interest in the community property. This is possible because the will takes effect only upon the death. However, neither spouse may donate any community property without the consent of the other. However, either spouse may, without the consent of the other, make moderate donations from the community property for charity or on occasions of family rejoicing or family distress.

The separation in fact or separation de facto (as opposed to legal separation), between husband and wife shall not affect the regime of absolute community, except that: (1) The spouse who leaves the conjugal home or refuses to live therein, without just cause, shall not have the right to be supported; Effects if the spouses separate in fact (2) When the consent of one spouse to any transaction of the other is required by law, judicial authorization shall be obtained in a summary proceeding; (3) In the absence of sufficient community property, the separate property of both spouses shall be solidarily liable for the support of the family. The spouse present shall, upon proper petition in a summary proceeding, be given judicial authority to administer or encumber any specific separate property of the other spouse and use the fruits or proceeds thereof to satisfy the latters share.

Procedures in case of abandonment

If a spouse without just cause abandons the other or fails to comply with his or her obligations to the family (obligations to the family refer to marital, parental or property relations), the aggrieved spouse may petition the court for receivership, for judicial separation of property or for authority to be the sole administrator of the absolute community, subject to such precautionary conditions as the court may impose. A spouse is deemed to have abandoned the other when her or she has left the conjugal dwelling without intention of returning. The spouse who has left the conjugal dwelling for a period of three months or has failed within the same period to give any information as to his or her whereabouts shall be prima facie presumed to have no intention of returning to the conjugal dwelling.

Procedures in case of death of a spouse

Upon the termination of the marriage by death, the community property shall be liquidated in the same proceeding for the settlement of the estate of the deceased. If no judicial settlement proceeding is instituted, the surviving spouse shall liquidate the community property either judicially or extra-judicially within six months from the death of the deceased spouse. If the procedure on liquidation, as outlined above, is not followed: (a) any disposition or encumbrance involving community property by the surviving spouse shall be void; and (b) any subsequent marriage shall be governed by the mandatory regime of complete separation of property. When only one of the parties is in good faith, the share of the party in bad faith shall be forfeited: 1. In favor of their common children 2. In case of default of or waiver by any or all of the common children or their descendants, each vacant share shall belong to the respective surviving descendants 3. In the absence of such descendants, such share belongs to the innocent party If one party is validly married to another: - His or her share in the co-owned properties will accrue to the ACP/CPG of his/her existing valid marriage If the party who acted in bad faith is not validly married to another, his/her share shall be forfeited in the same manner as that provided in Art 147. The same rules on forfeiture shall apply if both parties are in bad faith.

Forfeiture in case one party is in bad faith

10

You might also like

- ABSOLUTE COMMUNITY, CONJUGAL PARTNERSHIP, SEPARATION OF PROPERTYDocument7 pagesABSOLUTE COMMUNITY, CONJUGAL PARTNERSHIP, SEPARATION OF PROPERTYMarella GarciaNo ratings yet

- Property RegimeDocument13 pagesProperty RegimeVenus-Dominic CuetoandUntalascoNo ratings yet

- Matrix of Property RegimeDocument10 pagesMatrix of Property Regimealyssamaesana100% (4)

- Property Relations Bet Hus&Wife - Aug2015Document15 pagesProperty Relations Bet Hus&Wife - Aug2015Krissa Jennesca TulloNo ratings yet

- Property RegimesDocument105 pagesProperty RegimesJet Ortiz100% (1)

- Absolute Community - Conjugal Partnership of GainsDocument7 pagesAbsolute Community - Conjugal Partnership of GainsCris CalumbaNo ratings yet

- Absolute Community and Conjugal Partnership Property RegimesDocument8 pagesAbsolute Community and Conjugal Partnership Property Regimesadrixulet100% (1)

- Property Regimes in the PhilippinesDocument9 pagesProperty Regimes in the PhilippinesKyle DionisioNo ratings yet

- Questions For Civil Law 1Document8 pagesQuestions For Civil Law 1Tollie Mar GarciaNo ratings yet

- Matrix Fam CodeDocument3 pagesMatrix Fam CodeAngelo C. Decena100% (1)

- Persons and Family Relations: San Beda College of LawDocument3 pagesPersons and Family Relations: San Beda College of LawstrgrlNo ratings yet

- Lontoc-Cruz V Santos CruzDocument16 pagesLontoc-Cruz V Santos CruzJed MacaibayNo ratings yet

- Everything you need to know about Philippine property regimesDocument2 pagesEverything you need to know about Philippine property regimesjade123_129No ratings yet

- Legal ResearchDocument6 pagesLegal ResearchKate MontenegroNo ratings yet

- Accountability of Public OfficersDocument42 pagesAccountability of Public OfficersChristian TajarrosNo ratings yet

- Family CODE 96. Mercado Vs TanDocument2 pagesFamily CODE 96. Mercado Vs TanAgatha Bernice MacalaladNo ratings yet

- Abra Valley College Inc Vs Aquino (SUMMARY)Document2 pagesAbra Valley College Inc Vs Aquino (SUMMARY)ian clark MarinduqueNo ratings yet

- Step by Step Guide To Inheriting in The PhilippinesDocument3 pagesStep by Step Guide To Inheriting in The PhilippinesJean PradoNo ratings yet

- PERSONS AND FAMILY RELATIONS FinalsDocument5 pagesPERSONS AND FAMILY RELATIONS FinalsAnaSolitoNo ratings yet

- PFR ReviewerDocument22 pagesPFR ReviewerFuture AvocadoNo ratings yet

- Republic Vs Legaspi 670 Scra 110Document6 pagesRepublic Vs Legaspi 670 Scra 110RyoNo ratings yet

- Criminal Law DLSu Part (1) - 21-30Document10 pagesCriminal Law DLSu Part (1) - 21-30Jose Jarlath0% (1)

- Persons and Family Relations Review QuestionsDocument9 pagesPersons and Family Relations Review QuestionsNikita DaceraNo ratings yet

- SPS. CARLOS S. ROMUALDEZ AND ERLINDA R. ROMUALDEZ, Petitioners, v. COMMISSION ON ELECTIONS AND DENNIS GARAY, Respondents.Document16 pagesSPS. CARLOS S. ROMUALDEZ AND ERLINDA R. ROMUALDEZ, Petitioners, v. COMMISSION ON ELECTIONS AND DENNIS GARAY, Respondents.ZACH MATTHEW GALENDEZNo ratings yet

- People v. Lagman: Treachery Qualifies Stabbing to MurderDocument42 pagesPeople v. Lagman: Treachery Qualifies Stabbing to MurderFrancis FlorentinNo ratings yet

- Mock Bar QuestionnaireDocument2 pagesMock Bar Questionnairekrypna100% (1)

- Edward Kenneth Ngo Te V Rowena Ong Guttierez YuDocument2 pagesEdward Kenneth Ngo Te V Rowena Ong Guttierez YuSheree TampusNo ratings yet

- Conjugal Partnership of Gains and Absolute Community of PropertyDocument1 pageConjugal Partnership of Gains and Absolute Community of PropertyRence Santos DabuNo ratings yet

- Ayala Investment and Devt Corp Vs CADocument1 pageAyala Investment and Devt Corp Vs CAFrancise Mae Montilla MordenoNo ratings yet

- Civ Rev - Alcazar V AlcazarDocument1 pageCiv Rev - Alcazar V Alcazartin_m_sNo ratings yet

- Garcia V Recio - October 2, 2001 - G.R. No. 138322 PDFDocument11 pagesGarcia V Recio - October 2, 2001 - G.R. No. 138322 PDFJayMichaelAquinoMarquezNo ratings yet

- Rights of Illegitimate Children to Support and SurnameDocument14 pagesRights of Illegitimate Children to Support and SurnamePinky De Castro AbarquezNo ratings yet

- Book Philippine Political Law Isagani Cruz 2014 PDF Docx 1Document1,047 pagesBook Philippine Political Law Isagani Cruz 2014 PDF Docx 1lawnotesnijanNo ratings yet

- Family Home Article 152Document8 pagesFamily Home Article 152Da JeNo ratings yet

- Grace PoeDocument7 pagesGrace PoeDanny CastilloNo ratings yet

- Citizenship NotesDocument3 pagesCitizenship NotesShinji NishikawaNo ratings yet

- I. Essay Questions. Do Not Repeat The Facts. A Yes or No Answer Without A Legal Basis Will Not Be Given Any PointDocument3 pagesI. Essay Questions. Do Not Repeat The Facts. A Yes or No Answer Without A Legal Basis Will Not Be Given Any PointLeonor LeonorNo ratings yet

- SYSTEM OF PROPERTY REGIMES DURING MARRIAGEDocument10 pagesSYSTEM OF PROPERTY REGIMES DURING MARRIAGEYubert ViosNo ratings yet

- Illegitimate Children ReportDocument15 pagesIllegitimate Children ReportMarvin CustodioNo ratings yet

- Tani-De La Fuente Vs de La Fuente, GR No. 188400, March 8, 2017Document14 pagesTani-De La Fuente Vs de La Fuente, GR No. 188400, March 8, 2017Britt John BallentesNo ratings yet

- Family Code of The PhilippinesDocument14 pagesFamily Code of The PhilippinesYvette TevesNo ratings yet

- Family Code ModuleDocument65 pagesFamily Code ModuleGLai DrDelgadoNo ratings yet

- Ra 9048Document4 pagesRa 9048Jm OlfindoNo ratings yet

- Persons and Family RelationsDocument7 pagesPersons and Family RelationsLing EscalanteNo ratings yet

- Civil Law LMT.2Document63 pagesCivil Law LMT.2Erikha AranetaNo ratings yet

- Reflection Paper On The 3 Contemporary Styles of TheologyDocument2 pagesReflection Paper On The 3 Contemporary Styles of TheologyDorisseNo ratings yet

- PFR Notes PART 2Document11 pagesPFR Notes PART 2Hemsley Battikin Gup-ayNo ratings yet

- Nullity of marriage petition grantedDocument3 pagesNullity of marriage petition grantedblue_blue_blue_blue_blueNo ratings yet

- US Vs EnduaveDocument1 pageUS Vs Enduavepoppy2890No ratings yet

- Cuba v. CuencoDocument2 pagesCuba v. CuencoKing BadongNo ratings yet

- 43 Manacop Vs CADocument5 pages43 Manacop Vs CAFredamoraNo ratings yet

- Atilano V Chua Ching BengDocument3 pagesAtilano V Chua Ching Bengherbs22221473No ratings yet

- Persons and Family Relations Reviewer (2nd Exam CoverageDocument46 pagesPersons and Family Relations Reviewer (2nd Exam CoverageRikka ReyesNo ratings yet

- PD 1445Document30 pagesPD 1445gred05No ratings yet

- Article Ix Constitutional Commissions: I. Section 5 Commissions ShallDocument4 pagesArticle Ix Constitutional Commissions: I. Section 5 Commissions ShallPAOLO ANTONIO MACALINONo ratings yet

- Distinction Between Absolute Community Property (Acp) and Conjugal Property of Gains (CPG)Document6 pagesDistinction Between Absolute Community Property (Acp) and Conjugal Property of Gains (CPG)Danielle Gumpad DolipasNo ratings yet

- Regime of Separation of PropertyDocument4 pagesRegime of Separation of PropertyNoreen DelizoNo ratings yet

- The Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisDocument6 pagesThe Law On CONJUGAL PARTNERSHIP of GAINS of Properties in Simple Terms Shall Be Like ThisfirstNo ratings yet

- Conjugal Partnership of GainsDocument7 pagesConjugal Partnership of Gainssheshe gamiaoNo ratings yet

- Research Work 2Document8 pagesResearch Work 2Marc CosepNo ratings yet

- Accfa Vs CugcoDocument5 pagesAccfa Vs CugcoJeric ReiNo ratings yet

- Lopez Vs Commissioner of CustomsDocument1 pageLopez Vs Commissioner of CustomsJeric Rei50% (2)

- Case Digest On Complex CrimeDocument2 pagesCase Digest On Complex CrimeJeric Rei0% (1)

- CitizenshipDocument36 pagesCitizenshipJeric ReiNo ratings yet

- VA Response On Home Loans For Veterans Working in Marijuana IndustryDocument1 pageVA Response On Home Loans For Veterans Working in Marijuana IndustryMarijuana MomentNo ratings yet

- Aznar V CitibankDocument3 pagesAznar V CitibankDani LynneNo ratings yet

- STP Analysis of ICICI BANK vs SBI for Savings AccountsDocument28 pagesSTP Analysis of ICICI BANK vs SBI for Savings AccountsUmang Jain0% (1)

- SFL - Voucher - MOHAMMED IBRAHIM SARWAR SHAIKHDocument1 pageSFL - Voucher - MOHAMMED IBRAHIM SARWAR SHAIKHArbaz KhanNo ratings yet

- Edit 610 Lesson Plan RedesignDocument3 pagesEdit 610 Lesson Plan Redesignapi-644204248No ratings yet

- Adventures in Antarctica: 12 Days / 9 Nights On BoardDocument2 pagesAdventures in Antarctica: 12 Days / 9 Nights On BoardVALENCIA TORENTHANo ratings yet

- Volume 42, Issue 52 - December 30, 2011Document44 pagesVolume 42, Issue 52 - December 30, 2011BladeNo ratings yet

- Cross Culture Management & Negotiation IBC201 Essay TestDocument2 pagesCross Culture Management & Negotiation IBC201 Essay TestVu Thi Thanh Tam (K16HL)No ratings yet

- Joint Admissions and Matriculation Board: Candidate DetailsDocument1 pageJoint Admissions and Matriculation Board: Candidate DetailsShalom UtuvahweNo ratings yet

- Management: Standard XIIDocument178 pagesManagement: Standard XIIRohit Vishwakarma0% (1)

- Variety July 19 2017Document130 pagesVariety July 19 2017jcramirezfigueroaNo ratings yet

- ThesisDocument310 pagesThesisricobana dimaraNo ratings yet

- The Paombong Public MarketDocument2 pagesThe Paombong Public MarketJeonAsistin100% (1)

- 2003 Patriot Act Certification For Bank of AmericaDocument10 pages2003 Patriot Act Certification For Bank of AmericaTim BryantNo ratings yet

- Restoration of All Things - Siegfried J. Widmar 1990Document10 pagesRestoration of All Things - Siegfried J. Widmar 1990zdfhsdfhdsNo ratings yet

- Compounding & Reduplication: Forms and Analysis Across LanguagesDocument23 pagesCompounding & Reduplication: Forms and Analysis Across LanguagesUtari ListiyaniNo ratings yet

- PharmacopoeiaDocument6 pagesPharmacopoeiaPushap BadyalNo ratings yet

- API Technical Document 10656Document19 pagesAPI Technical Document 10656NazmulNo ratings yet

- Noli Me TangereDocument26 pagesNoli Me TangereJocelyn GrandezNo ratings yet

- Finals ReviewerDocument4 pagesFinals ReviewerElmer Dela CruzNo ratings yet

- Human Rights Violations in North KoreaDocument340 pagesHuman Rights Violations in North KoreaKorea Pscore100% (3)

- Allotment Order 2022-23 - FIRST Round Arts - 52212302 - KARUNRAJ MDocument2 pagesAllotment Order 2022-23 - FIRST Round Arts - 52212302 - KARUNRAJ MKarun RajNo ratings yet

- Turnabout AirportDocument100 pagesTurnabout AirportBogdan ProfirNo ratings yet

- Form No. 32: Medical Examination Results Therefore If Declared Unfit For WorkDocument1 pageForm No. 32: Medical Examination Results Therefore If Declared Unfit For WorkchintanNo ratings yet

- Dean Divina J Del Castillo and OtherDocument113 pagesDean Divina J Del Castillo and OtheracolumnofsmokeNo ratings yet

- Đa S A The PESTEL Analysis of VinamilkDocument2 pagesĐa S A The PESTEL Analysis of VinamilkHiền ThảoNo ratings yet

- B001 Postal Manual PDFDocument282 pagesB001 Postal Manual PDFlyndengeorge100% (1)

- Selected Candidates For The Post of Stenotypist (BS-14), Open Merit QuotaDocument6 pagesSelected Candidates For The Post of Stenotypist (BS-14), Open Merit Quotaامین ثانیNo ratings yet

- Hydrography: The Key To Well-Managed Seas and WaterwaysDocument69 pagesHydrography: The Key To Well-Managed Seas and Waterwayscharles IkeNo ratings yet

- Supply Chain Management PepsiDocument25 pagesSupply Chain Management PepsivenkateshNo ratings yet