Professional Documents

Culture Documents

Dealogic Project Finance Review: First Nine Months 2011

Uploaded by

raghul_sudheeshOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dealogic Project Finance Review: First Nine Months 2011

Uploaded by

raghul_sudheeshCopyright:

Available Formats

Dealogic Project Finance Review | First Nine Months 2011

Global Project Finance Volume On Par With First Nine Months of 2010 PFI/PPP Volume At Record High State Bank of India Led the Global Mandated Arranger Ranking

Project Finance Volume Global project finance volume reached $277.2bn in the first nine months of 2011, on par with the $227.3bn recorded during the same 2010 period A record 654 projects were completed during the first none months of 2011, up from the previous record of 631 during the comparable 2010 period Loan financing accounted for 80% of project finance volume in the first nine months of 2011, on par with that seen in the same 2010 period. Bond financing, which stood at $14.7bn, was the highest first nine month volume since 2006 ($17.2bn) Project Finance by Region India, with volume of $72.8bn, reached a first nine month record and represented 26% of the global project finance market. Volume increased 12% from the first nine months of 2010 ($65.0bn) Australasia saw one of the largest increases in volume with $25.4bn recorded in the first nine months of 2011, up from $13.8bn during the comparable 2010 period. Volume was boosted by Wiggins Island Coal Export Terminals $3.0bn project

Refinancing Volume from the refinancing of projects stood at a record $49.8bn in the first nine months of 2011, up 38% on the $36.1bn reached in the comparable 2010 period Project Finance by Sector Energy became the leading sector for project finance volume in the first nine months of 2011 and accounted for 36% of total volume. Infrastructure, with $90.9bn, increased 8% on the first nine months of 2010 PFI/PPP Global PFI and PPP volume reached a record $69.9bn in the first nine months of 2011, up 28% on the $54.7bn recorded during the same 2010 period Western Europe accounted for 32% of all PFI/PPP projects with volume of $22.7bn in the first nine months of 2011, down 13% compared with $26.1bn in the comparable 2010 period. The Indian SubContinent followed the opposite trend with volume almost doubling to $19.0bn from $9.8bn in 2010 Project Finance Rankings State Bank of India topped the global mandated arranger ranking with a 13.1% share followed by IDBI Bank with 3.8%

$bn 120 100 80 60 40 20 0 1Q 2Q 3Q 4Q Volume

Project Finance Volume Deals

Deals 300 250 200 150 100 50 0

1Q

2Q

3Q

4Q

1Q

2Q 2011

3Q

2009

2010

$bn 60 50 40 30 20 10 0 2006 2007

Refinanancing Volume First Nine Months Volume Deals

Deals 120 100 80 60 40 20 0

2008

2009

2010

2011

Dealogic Project Finance Review

Dealogic Project Finance Review | First Nine Months 2011

Press Release | Final Results For immediate release October 10, 2011

Global Volume Analysis Regional Analysis Sector Analysis Private Finance Initiatives / Public Private Partnerships Top Ten Deals Project Finance Rankings

3 4 5 6 7 8

Coverage & Criteria About Dealogic

12 13

Media Contacts

New York Edward Jones +1 212 577 4511 Edward.jones@dealogic.com London Nandeep Roopray +44 20 7440 6163 Nandeep.roopray@dealogic.com Hong Kong Terry Wong +852 3698 4745 Terry.wong@dealogic.com

Project Finance Contacts

New York Douglas Campbell +1 212 577 4435 Douglas.campbell@dealogic.com London Amy Williams +44 207 440 6368 Amy.williams@dealogic.com Hong Kong Anthony Castillo +852 3698 4816 Anthony.castillo@dealogic.com

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 2

Dealogic Project Finance Review

Global Volume Analysis

Global Project Finance volume reached $277.2bn in the first nine months of 2011, on par with the $277.3bn recorded during the same 2010 period. 3Q 2011 volume of $78.9bn was down 13% on 3Q 2010 ($90.5bn) and was the lowest third quarter volume since 2009 ($72.1bn) A record number of projects (654) reached financial close in the first nine months of 2011, up from the previous record high of 631 projects in the comparable 2010 period Asia Pacific accounted for 48% of project finance volume in the first nine months of 2011, up from 43% during the same 2010 period. EMEA accounted for 35%, down from 41% while the Americas captured 17% of the market, the same proportion as in the first nine months of 2010 Project finance loan volume reached $220.4bn in the first nine months of 2011 and was on par with the record $219.7bn recorded in the first nine months of 2010 Bond financing in the first nine months of 2011 totaled $14.7bn, the highest first nine month volume since 2006 ($17.2bn) and has already surpassed the full year volume of $14.3bn reached in 2010 Equity financing dropped to $42.1bn in the first nine months of 2011, down 12% on the $48.0bn reached in the same 2010 period and was down 35% on the first nine month record of $65.2bn recorded in 2008 Global PPP/PFI volume reached a record $69.9bn in the first nine months of 2011, up 28% compared with the $54.7bn reached in the comparable 2010 period. PPP/PFI accounted for 25% of total project finance volume in the first nine months of 2011, the highest proportion since 2006 (28%)

$bn 300 250 200 150 100 50 0 2006 2007 2008 2009 2010 2011 Non-PFI Volume PFI Volume PFI as % of Total Volume $bn 300 250 200 150 100 50 0 2006 2007 Loan 2008 Bond 2009 Equity 2010 % of Bonds 2011 First Nine Months

Global Volume

% 12 10 8 6 4 2 0

Global PFI Project Finance

First Nine Months

% 30 25 20 15 10 5 0

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 3

Dealogic Project Finance Review

Regional Analysis

Europe project volume stood at $78.1bn in the first nine months of 2011, up 6% on the same period in 2010. Western European volume was up 8% to $58.2bn, while Eastern European volume stayed on par with the $19.8bn reached in the first nine months last year Asia project finance volume reached a first nine month record of $109.0bn and accounted for 39% of total project finance volume in 2011 o India was the leading nation globally with $72.8bn via 163 projects and reached a first nine months record for volume and activity

$bn 300 250 200 150 100 50 0 2006 2007 2008 2009 2010 Europe Americas 2011 Asia Pacific Middle East & Africa Global Year-on-Year Growth

Project Finance Volume by Region First Nine Months

% 50 40 30 20 10 0 -10 -20 -30

Australasia accounted for 9% of global project finance volume and experienced the largest increase (84%) of all regions. Volume reached $25.4bn in the first nine months of 2011, up from $13.8bn in the comparable 2010 period Middle East & Africa project finance volume experienced the largest volume decline among all regions, down 53% to $18.0bn in the first nine months of 2011 from $38.6bn in the same period last year

North America $30.4bn (72 deals) -4%

Western Europe $58.2bn (182 deals) 8%

Eastern Europe $19.8bn (22 deals) 0%

Asia (Ex India) $36.2bn (71 deals) -10%

First Nine Months 2011 Project Finance Volume by Top 15 Nations Rank 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 Nationality India Australia United States France Spain Russian Federation United Kingdom Canada Singapore China Brazil Germany Italy Turkey Turkmenistan Totals Value (US $m) 72,850 25,390 20,187 15,902 15,648 13,285 10,673 10,186 7,957 7,066 6,274 6,206 5,270 4,214 4,100 277,197 Deals 163 61 57 19 52 7 44 15 6 5 12 10 39 17 1 654

Latin Am/Caribbean $16.3bn (73 deals) 16%

Middle East/Africa $18.0bn (47 deals) -53%

Indian SubContinent $72.8bn (163 deals) 12%

Australasia $25.4bn (62 deals) 84%

% Change (First 9M 2010) 29% 84% -16% 154% -22% 59% 59% 32% 510% -21% 105% 209% 11% 116% 0%

Page | 4

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Dealogic Project Finance Review

Sector Analysis

Energy, the leading sector in the first nine months of 2011, accounted for 36% of global project finance, up from a 32% share in the same 2010 period. Volume increased 15% to reach $101.0bn in the first nine months of 2011, up from $87.8bn in comparable 2010 o The Power sub-sector led Energy volume with $61.5bn in the first nine months of 2011, up 11% on the 2010 comparable period ($55.2bn). The Renewable Fuel and Wind Farm sub-sectors followed with $25.2bn and $14.2bn, respectively India led the Energy sector nationality ranking in the first nine months of 2011 with 73 deals totaling $38.5bn. The US and Spain followed with $17.1bn and $10.2bn, respectively

Sector Breakdown 2011 (2010)

Industrial 5% (4%) Oil & Gas 12% (21%) Mining 6% (3%) Telecom Petrochemical 3% (6%) 6% (3%) Energy/Power 36% (32%)

Infrastructure 33% (30%)

The Infrastructure sector ranked second with volume of $90.9bn and accounted for 33% of global project finance in the first nine months of 2011, up from a 30% share in the same period of 2010 ($84.2bn) o o Chinas Macau Venetian Hotel Refinancing $3.7bn project, that signed in September 2011, was the largest Infrastructure project of 3Q 2011 The Road sub-sector accounted for 23% ($20.5bn) of Infrastructure volume in the first nine months of 2011, while Urban railway volume accounted for 13% at $11.6bn PFI/PPP accounted for 61% ($55.5bn) of Infrastructure sector volume in the first nine months of 2011, up from a 55% ($46.5bn) share in the comparable 2010 period

$bn 110 100 90 80 70 60 50 40 30 20 10 0 2006 Petrochemical Industrial 2007 Mining

Sector Volume First Nine Months

The Petrochemical sector saw the largest volume increase in the first nine months of 2010 (73%) followed by the Mining sector (62%)

2008 Energy/Power

2009 Infrastructure Telecom

2010

2011 Oil & Gas

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 5

Dealogic Project Finance Review

Private Finance Initiatives / Public Private Partnerships

PFI/PPP volume reached a record $69.9bn in the first nine months of 2011, up 28% on the $54.7bn reached in the comparable 2010 period. Despite this, activity decreased to 139 closed projects in 2011 from 157 in comparable 2010 o Western Europe continued to dominate the PFI/PPP market in the first nine months of 2011 with $22.7bn, down 13% from the same 2010 period. Of this, France accounted for a record 66% ($15.0bn), up from 10% ($2.6bn) in the first nine months of 2010 Eastern Europe saw the largest volume decrease of all regions, down o $404m from $3.9bn in the first nine months of 2010 The Indian Sub-Continent saw PFI/PPP volume double in the first nine months of 2011, dominated by India's record volume of $19.0bn which accounted for just over a quarter of global PFI/PPP volume, up from 18% in the same 2010 period

$bn 80 70 60 50 40 30 20 10 0 Others 2007 2006 North America Asia 2008 2009 2010 Indian Sub-Continent Eastern Europe 2011 Western Europe

PFI / PPP Regional Breakdown First Nine Months

o o

PFI/PPP volume in the second quarter reached $29.8bn and accounted for 43% of all volume in the first nine months of 2011. Each quarter of 2011 was up on the respective quarter in 2010 although the increase in 3Q 2011 was only marginal, reaching $18.0bn Road led all sub-sectors by both volume and deal count with $17.0bn via 55 deals in the first nine months of 2011 although volume was down 21% from $21.5bn via 41 deals in the same 2010 period. Road accounted for almost a quarter of all PPP/PFI volume in the first nine months of 2011, down from 39% in 2010 Telecom PFI/PPP totaled $3.4bn in the first nine months of 2011, up 58% on the $2.1bn recorded in the same 2010 period. The only Telecom project to complete so far this year was the Aircel 2G and 3G Network Expansion The $3.6bn Newcastle Third Coal Export Terminal PPP Project, which completed in Australia during 3Q 2011, was the first closed PFI/PPP mining project on record

Defence Mining Power Hospital Urban railway Rail Road 0 5

PFI / PPP Sub-Sector Breakdown First Nine Months

2011 2010

10

15

20

25 $bn

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 6

Dealogic Project Finance Review

Top Ten Global Project Finance Deals First Nine Months 2011

Financial Close Date 14-Jun-11 04-Mar-11 17-Jun-11 07-Jan-11 26-Apr-11 20-Sep-11 05-Apr-11 29-Mar-11 01-Feb-11 19-May-11 Borrower LISEA Nord Stream Vedanta Aluminium Hong Kong-Zhuhai-Macao Bridge Authority Turkmengaz VML US Finance L&T Metro Rail (Hyderabad) Aircel Resorts World at Sentosa SA Health Partnership Securitisation Project Name Tours-Bordeaux High Speed Rail PPP Nord Stream Gas Pipeline Phase 2 Vedanta Aluminium Refinery Refinancing Hong Kong-Zhuhai-Macao Bridge Project South Lolotan Gas Field Second Phase Development Macau Venetian Hotel Refinancing Hyderabad Metro Rail PPP Project Aircel 2G and 3G Network Expansion PPP Project Resorts World at Sentosa Refinancing New Royal Adelaide Hospital PPP Country France Russia India China Turkmenistan Macau India India Singapore Australia Sector Urban railway/LRT/MRT Gas pipeline Power Bridge Gasfield exploration and development Hotel/resort/casino Rail - Infrastructure Telecom Hotel/resort/casino Hospital Value ($m) 9,141 4,860 4,683 4,435 4,100 3,700 3,646 3,367 3,268 3,057

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 7

Dealogic Project Finance Review

Project Finance Rankings

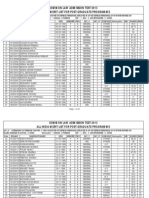

Global Project Finance Loans Ranking First Nine Months 2011 Rank 1 2 3 4 5 6 7 8 9 10 Mandated Lead Arranger State Bank of India IDBI Bank China Development Bank Corp Mitsubishi UFJ Financial Group Sumitomo Mitsui Financial Group Credit Agricole CIB Axis Bank Santander BNP Paribas ICICI Bank Value $m 27,093 7,872 7,495 7,294 6,495 6,124 5,456 5,144 5,009 4,838 Deals 66 15 7 63 54 55 21 62 49 15 % Share 13.1 3.8 3.6 3.5 3.1 3.0 2.6 2.5 2.4 2.3 Rank 1 2 3 4 5 6 7 8 9 10 Global PFI/PPP Project Finance Loans Ranking - First Nine Months 2011 Mandated Lead Arranger State Bank of India BBVA Sumitomo Mitsui Financial Group Axis Bank SG CIB Santander Credit Agricole CIB ANZ Dexia Natixis Value $m 7,935 2,620 2,332 2,125 1,751 1,700 1,622 1,468 1,287 1,214 Deals 19 16 17 8 13 13 14 4 10 8 % Share 17.1 5.7 5.0 4.6 3.8 3.7 3.5 3.2 2.8 2.6

North American Project Finance Loans Ranking - First Nine Months 2011 Rank 1 2 3 4 5 6 7 8 9 10 Mandated Lead Arranger Mitsubishi UFJ Financial Group Bank of Montreal Credit Agricole CIB ING Credit Suisse Barclays Sumitomo Mitsui Financial Group Canadian Imperial Bank of Commerce CIBC RBS Royal Bank of Canada Value $m 2,919 1,158 1,111 984 960 938 820 612 585 560 Deals 25 6 13 11 7 4 10 5 6 5 % Share 15.4 6.1 5.9 5.2 5.1 5.0 4.3 3.2 3.1 3.0 Rank 1 2 3 4 5 6 7 8 9 10

European Project Finance Loans Ranking - First Nine Months 2011 Mandated Lead Arranger China Development Bank Corp Santander BBVA UniCredit BNP Paribas Credit Agricole CIB SG CIB Mitsubishi UFJ Financial Group Dexia ING Value $m 4,100 3,513 3,332 2,897 2,813 2,632 2,578 1,898 1,781 1,646 Deals 1 45 36 34 21 18 27 14 21 18 % Share 7.2 6.2 5.9 5.1 4.9 4.6 4.5 3.3 3.1 2.9

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 8

Dealogic Project Finance Review

Regional Project Finance Rankings

Asian Project Finance Loans Ranking First Nine Months 2011 Rank 1 2 3 4 5 6 7 8 9 10 Mandated Lead Arranger State Bank of India IDBI Bank Axis Bank ICICI Bank China Development Bank Corp Korea Development Corp Sumitomo Mitsui Financial Group Standard Chartered Infrastructure Development Finance Co Ltd - IDFC Bank of China Value $m 26,075 7,872 5,456 4,588 2,551 1,988 1,881 1,447 1,417 1,373 Deals 64 15 21 14 3 11 20 16 15 2 % Share 31.0 9.4 6.5 5.5 3.0 2.4 2.2 1.7 1.7 1.6 Rank 1 2 3 4 5 6 7 8 9 10 ANZ Commonwealth Bank of Australia National Australia Bank Sumitomo Mitsui Financial Group Westpac Banking Corp Standard Chartered State Bank of India China Development Bank Corp Lloyds Banking Group Mitsubishi UFJ Financial Group Australasian Project Finance Loans Ranking First Nine Months 2011 Mandated Lead Arranger Value $m 3,413 2,579 2,044 1,573 1,455 1,000 1,000 768 759 698 Deals 25 18 22 6 19 1 1 2 6 9 % Share 14.9 11.2 8.9 6.9 6.3 4.4 4.4 3.3 3.3 3.0

Middle East & African Project Finance Loans Ranking - First Nine Months 2011 Rank 1 2 3 4 5 6 7 8 9 =10 =10 Mandated Lead Arranger Turkiye Garanti Bankasi Banque Saudi Fransi - BSF Deutsche Bank Standard Bank Group SG CIB Samba Financial Group HSBC BNP Paribas Standard Chartered Yapi Kredi Invest Turkiye Is Bankasi AS - Isbank Value $m 1,170 1,010 843 653 645 630 606 578 538 438 438 Deals 13 3 2 6 6 4 4 6 6 4 4 % Share 7.5 6.5 5.4 4.2 4.2 4.1 3.9 3.7 3.5 2.8 2.8 Rank 1 2 3 4 5 6 7 8 9 10

Latin American & Caribbean Project Finance Loans Ranking - First Nine Months 2011 Mandated Lead Arranger Mizuho Financial Group BBVA Santander Mitsubishi UFJ Financial Group ING Sumitomo Mitsui Financial Group Credit Agricole CIB Fondo Nacional de Infraestructura FONADIN HSBC SG CIB Value $m 743 731 690 628 510 466 459 312 288 284 Deals 7 5 7 5 7 5 6 1 2 4 % Share 8.4 8.3 7.8 7.1 5.8 5.3 5.2 3.5 3.3 3.2

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 9

Dealogic Project Finance Review

Project Finance Rankings

Arranger of Global Project Finance Loans Ranking First Nine Months 2011 Rank 1 2 3 4 5 6 7 8 9 10 Arranger State Bank of India IDBI Bank China Development Bank Corp Mitsubishi UFJ Financial Group Credit Agricole CIB Sumitomo Mitsui Financial Group Axis Bank BNP Paribas Santander ICICI Bank Value $m 26,994 7,872 7,380 7,298 6,237 5,745 5,356 5,214 5,052 4,838 Deals 66 15 7 66 58 57 21 53 63 15 % Share 13.0 3.8 3.6 3.5 3.0 2.8 2.6 2.5 2.4 2.3 Rank 1 2 3 4 5 6 7 8 9 10 Provider of Global Project Finance Loans Ranking - First Nine Months 2011 Provider State Bank of India Mitsubishi UFJ Financial Group China Development Bank Corp Credit Agricole CIB Sumitomo Mitsui Financial Group Santander ING SG CIB BNP Paribas Bank of China Value $m 13,740 6,467 6,269 5,412 5,178 4,791 4,414 4,162 4,038 3,869 Deals 85 74 9 64 62 68 53 56 54 8 % Share 6.9 3.2 3.1 2.7 2.6 2.4 2.2 2.1 2.0 1.9

Bookrunner of Global Project Finance Bonds Ranking - First Nine Months 2011 Rank 1 2 3 4 5 6 7 8 9 10 Bookrunner Royal Bank of Canada Citigroup Credit Suisse JPMorgan Goldman Sachs BNP Paribas RBS HSBC Bank of Nova Scotia Credit Agricole CIB Value $m 3,498 1,905 1,187 825 790 744 713 538 518 475 Deals 4 5 5 3 2 4 4 3 2 2 % Share 23.8 13.0 8.1 5.6 5.4 5.1 4.9 3.7 3.5 3.2 Rank 1 2 3 4 5 6 7 8 9 10

Sponsor of Global Project Finance Deals- First Nine Months 2011 Sponsor Adani Group Vedanta Resources Larsen & Toubro Turkmengaz Las Vegas Sands Corp Maxis Communications Genting International Plenary Group eAccess Caisse des Depots et Consignations CDC Value $m 6,256 6,060 5,737 4,100 3,700 3,367 3,269 2,778 2,742 2,700 Deals 7 2 2 1 1 1 1 6 2 4 % Share 2.3 2.2 2.1 1.5 1.4 1.2 1.2 1.0 1.0 1.0

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 10

Dealogic Project Finance Review

Project Finance Advisor Rankings

Financial Adviser of Global PFI/PPP Project Finance Deals First Nine Months 2011 Rank 1 1 3 4 5 6 7 8 9 10 Financial Advisor Deloitte & Touche State Bank of India HSBC Holdings Natixis SG CIB Axis Bank Credit Agricole CIB Ernst & Young Royal Bank of Canada Macquarie Value $m 5,869 5,440 4,584 3,602 3,476 3,411 3,047 2,923 1,873 1,791 Deals 6 13 6 2 2 7 1 9 7 3 % Share 10.4 9.6 8.1 6.4 6.1 6.0 5.4 5.2 3.3 3.2 Rank 1 2 3 4 5 6 7 8 9 10 Financial Adviser of Global Project Finance Deals - First Nine Months 2011 Financial Advisor State Bank of India HSBC Holdings Axis Bank IDBI Bank Deloitte & Touche PricewaterhouseCoopers SG CIB RBS Macquarie Ernst & Young Value $m 30,799 9,419 9,080 8,322 7,357 7,107 6,945 6,672 4,103 3,976 Deals 47 16 16 12 10 13 4 7 8 13 % Share 20.3 6.2 6.0 5.5 4.9 4.7 4.6 4.4 2.7 2.6

Legal Adviser of Global PFI/PPP Project Finance Deals First Nine Months 2011 Rank 1 2 3 4 5 6 7 8 8 10 Legal Advisor Amarchand & Mangaldas & Suresh A Shroff & Co Allen & Overy Linklaters White & Case Luthra & Luthra Hogan Lovells International Trilegal Clifford Chance India Law Services Freehills Value $m 3,725 3,535 3,379 3,263 3,044 2,825 2,772 2,376 2,350 2,249 Deals 3 9 6 4 5 4 3 10 5 5 % Share 5.6 5.3 5.1 4.9 4.6 4.2 4.2 3.6 3.5 3.4 Rank 1 2 3 4 5 6 7 8 9 10

Legal Adviser of Global Project Finance Deals - First Nine Months 2011 Legal Advisor Amarchand & Mangaldas & Suresh A Shroff & Co Clifford Chance White & Case Latham & Watkins Allen & Overy SJ Law Advocates & Solicitors Linklaters Luthra & Luthra Allens Arthur Robinson Milbank Tweed Hadley & McCloy Value $m 14,765 12,751 12,008 10,644 10,191 9,227 9,160 8,847 7,593 7,374 Deals 25 64 27 35 38 17 34 18 34 25 % Share 5.9 5.1 4.8 4.3 4.1 3.7 3.7 3.6 3.1 3.0

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 11

Dealogic Project Finance Review

Dealogic Project Finance Coverage & Criteria

The following is an Executive Summary of the coverage & criteria used to produce this document. To obtain a comprehensive document detailing Dealogics precise scope, policies and methodologies, please contact one of the analysts listed on the second page of this release.

GENERAL

Tables are complete and current to the best of our knowledge. While an official snapshot of the project finance landscape as of the date of publication, rankings are subject to retroactive change due to a variety of factors. Eligibility is defined by the involvement of infrastructure specific sectors, both economic and social There must be a clearly defined project or portfolio of projects, long term assets, dependency on cash flows and commercial bank lending All PPPs/PFIs (excluding service contracts) are included. Tables cover privately (co-) funded projects. Transactions not denominated in US dollars are converted to a US dollar equivalent at loan agreement signing date.

ELIGIBILITY

Mandated Arrangers: mandated arranger status is assigned to the banks awarded the mandate by the borrower or banks given the title by the mandated arranger group Refinancings and restructurings are eligible for tables. Acquisitions of projects are eligible for tables as long as repayment of the debt is based on cash-flows of the assets. Amendments and amended and restated loans are eligible if there is a change to pricing, tenor or loan amount, which require a 100% lender vote. Cancelled loans are eligible provided that the loan agreement has been signed, and fees have been paid. A sole lender on a loan greater than $100m must submit documentation for the deal to be eligible.

RANKING

All financier tables are based on equal apportionment apart from the provider ranking where final takes are used (when disclosed). Financier tables will exclude projects with no commercial bank lending Non-financier tables include; legal advisor, financial advisor and sponsor Legal and financial advisors are eligible for non-commercial bank lending projects

EXCLUSIONS

We cover only infrastructure project financing and therefore exclude the following: o o o o o Real Estate (Except PFI / PPP deals); Shipping or Aircraft financing where not tied to a specific project; Equipment financing (when not related to a specific project); Agriculture; Manufacturing.

Dealogic reserves the right to challenge any transaction submitted for inclusion and may request supporting documentation.

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 12

Dealogic Project Finance Review

Notes to Editors

About Dealogic Dealogic is a platform used by global and regional Investment Banks worldwide to help optimize their performance and improve competitiveness. Dealogic consists of sophisticated technology, unique content, consulting and support that enables Investment Banks to better manage the critical components of their business including, strategy, coverage, origination, execution, sales and compliance. Implemented across the organization, Dealogic connects the components of an Investment Bank together more effectively, helping banks to identify opportunities, cover the right clients, evaluate investor appetite, execute deals reliably and ultimately win more business. Dealogic has over 25 years experience and a deep knowledge of the Investment Banking and Capital Markets space with every one of the top 50 banks in the world utilizing the Dealogic platform. Dealogic Publishing The Project Finance Review is a quarterly compilation of global and regional project finance activity and participant rankings. Data, research and rankings used within these reports are produced via Projectware, a component of the Dealogic Platform.

Dealogic Project Finance Review | First Nine Months 2011 Final Results | October 2011

Page | 13

You might also like

- Global Project Finance Review 2009Document12 pagesGlobal Project Finance Review 2009rorourkeNo ratings yet

- Global IB Revenue Falls 14% to $47.5bn in 2012Document10 pagesGlobal IB Revenue Falls 14% to $47.5bn in 2012asdfaNo ratings yet

- CHINA'S CLEAN REVOLUTION FINANCING REPORTDocument8 pagesCHINA'S CLEAN REVOLUTION FINANCING REPORTDima MostovoyNo ratings yet

- Conomic: The Impending Signs of Global UncertaintyDocument16 pagesConomic: The Impending Signs of Global UncertaintyS GNo ratings yet

- Recent Developments in PPP Models in ASEAN and East AsiaDocument27 pagesRecent Developments in PPP Models in ASEAN and East AsiaFauziah Zen100% (1)

- 2 Ibp EcoLetter January 13, 2012Document2 pages2 Ibp EcoLetter January 13, 2012Chinkoz SagaNo ratings yet

- BTG Pactual XII CEO Conference: February 2011Document38 pagesBTG Pactual XII CEO Conference: February 2011MillsRINo ratings yet

- Boom of Project Financing in IndiaDocument3 pagesBoom of Project Financing in IndiaDaksh TayalNo ratings yet

- Briefing 67 China Economic Review 2010Document30 pagesBriefing 67 China Economic Review 2010Jocel M. SinguaNo ratings yet

- Highlight of Economy 2009-10-2Document18 pagesHighlight of Economy 2009-10-2Mateen SajidNo ratings yet

- Bank of Kigali Announces Q2 2011 & 1H 2011 ResultsDocument9 pagesBank of Kigali Announces Q2 2011 & 1H 2011 ResultsBank of KigaliNo ratings yet

- Investment Market Update: Asia Pacific Q2 2011Document4 pagesInvestment Market Update: Asia Pacific Q2 2011Cam AnhNo ratings yet

- US Research Quarterly 2012-05-22 SIFMADocument20 pagesUS Research Quarterly 2012-05-22 SIFMAAnirudh SinghNo ratings yet

- PR913g Rio Tinto Announces Record First Half EarningsDocument52 pagesPR913g Rio Tinto Announces Record First Half EarningskhotarisNo ratings yet

- Economic Analysis of Infrastructure: - Macro Analysis - Industry Analysis - Micro AnalysisDocument22 pagesEconomic Analysis of Infrastructure: - Macro Analysis - Industry Analysis - Micro AnalysisNikhilNo ratings yet

- National Profile of China: Major Cities, Population, Economy and TradeDocument6 pagesNational Profile of China: Major Cities, Population, Economy and TradeSupra_Singh_2147No ratings yet

- China's Fiscal Policy in The Post-Crisis PeriodDocument16 pagesChina's Fiscal Policy in The Post-Crisis PeriodJenNo ratings yet

- 2011Q4 Earnings GoogleDocument12 pages2011Q4 Earnings GoogleVentureBreakNo ratings yet

- Dialog Consolidates Growth Momentum With Strong Q2 Results: 04 August, 2011. ColomboDocument2 pagesDialog Consolidates Growth Momentum With Strong Q2 Results: 04 August, 2011. ColomboYasasi JayawardanaNo ratings yet

- 2011 Q2 Central London Offices JLLDocument16 pages2011 Q2 Central London Offices JLLpcharrisonNo ratings yet

- Public Debt Management: Quarterly Report Apr-Jun 2010Document27 pagesPublic Debt Management: Quarterly Report Apr-Jun 2010rachitganatraNo ratings yet

- China Inside Out: China Going Global: Key TrendsDocument40 pagesChina Inside Out: China Going Global: Key TrendsTon ChockNo ratings yet

- Economic Indicators For FII'sDocument16 pagesEconomic Indicators For FII'sSubodh MallyaNo ratings yet

- Global MA Financial ReviewDocument24 pagesGlobal MA Financial ReviewSteven HunterNo ratings yet

- Asia-Pacific Quarterly M&A Spotlight – December 2011Document4 pagesAsia-Pacific Quarterly M&A Spotlight – December 2011Mike WilliamsNo ratings yet

- Mills: EBITDA Margin Reaches 43.3%, With Strong Growth: Bm&Fbovespa: Mils3 Mills 1Q12 ResultsDocument15 pagesMills: EBITDA Margin Reaches 43.3%, With Strong Growth: Bm&Fbovespa: Mils3 Mills 1Q12 ResultsMillsRINo ratings yet

- Economic Growth of India and ChinaDocument4 pagesEconomic Growth of India and Chinaswatiram_622012No ratings yet

- Deallogic Global M&a ReviewDocument19 pagesDeallogic Global M&a ReviewDisel VinNo ratings yet

- LG Announces 2010 Financial ResultsDocument4 pagesLG Announces 2010 Financial ResultsAmit Kumar SinghNo ratings yet

- Thomson Reuters M&a Review (2015)Document24 pagesThomson Reuters M&a Review (2015)Carlos MartinsNo ratings yet

- Global PPP-PFI Outlook - H2 2011 - Infra Journal - IJDocument14 pagesGlobal PPP-PFI Outlook - H2 2011 - Infra Journal - IJpranavpNo ratings yet

- China's Growing Economy: Market Socialism, Exports, and FDIDocument17 pagesChina's Growing Economy: Market Socialism, Exports, and FDIsn07860No ratings yet

- The Edge: Articles On Selected Singapore DevelopersDocument13 pagesThe Edge: Articles On Selected Singapore DevelopersThe PariahNo ratings yet

- Global Legal Advisory Mergers & Acquisitions Rankings 2010Document48 pagesGlobal Legal Advisory Mergers & Acquisitions Rankings 2010pal2789No ratings yet

- Sustained Economic Growth: Economic Development: Good Governance Is Good EconomicsDocument18 pagesSustained Economic Growth: Economic Development: Good Governance Is Good EconomicsJaycil GaaNo ratings yet

- Org Study Canara Bank 150904183048 Lva1 App6892Document81 pagesOrg Study Canara Bank 150904183048 Lva1 App6892shivaraj p yNo ratings yet

- Data Alert 140328 Australia Among Chinas Top Three DestinationsDocument1 pageData Alert 140328 Australia Among Chinas Top Three DestinationspeipeiNo ratings yet

- Philippines ODA REVIEW 2010Document88 pagesPhilippines ODA REVIEW 2010naknNo ratings yet

- Global Financial Advisory Mergers & Acquisitions Rankings 2013Document40 pagesGlobal Financial Advisory Mergers & Acquisitions Rankings 2013Ajay SamuelNo ratings yet

- Deal Tracker Annual Edition 2010 - Test VersionDocument116 pagesDeal Tracker Annual Edition 2010 - Test Versionraghu552012No ratings yet

- Deal Tracker Annual Edition 2010 Test VersionDocument116 pagesDeal Tracker Annual Edition 2010 Test VersiondidwaniasNo ratings yet

- CAFTA and AIIB: Comparing Trade and Infrastructure InitiativesDocument8 pagesCAFTA and AIIB: Comparing Trade and Infrastructure Initiativesanon_497907791No ratings yet

- China's Policy Responses To The Global Financial Crisis - Efficacy and Risks 1 Liqing ZhangDocument6 pagesChina's Policy Responses To The Global Financial Crisis - Efficacy and Risks 1 Liqing ZhangTatit KurniasihNo ratings yet

- Gagbm2023 308 315Document8 pagesGagbm2023 308 315MarkWeberNo ratings yet

- Group4 IVM Project FinalDocument60 pagesGroup4 IVM Project FinalVaibhav GargNo ratings yet

- Mills 3Q12 Results Show Record Revenue and EBITDADocument14 pagesMills 3Q12 Results Show Record Revenue and EBITDAMillsRINo ratings yet

- Malaysia's Petrochemical Zones For Location PDFDocument41 pagesMalaysia's Petrochemical Zones For Location PDFWan Faiz50% (2)

- JLJKJHDocument12 pagesJLJKJHSandeep MadivalNo ratings yet

- United Bank Limited: Unconsolidated Condensed Interim Financial StatementsDocument20 pagesUnited Bank Limited: Unconsolidated Condensed Interim Financial StatementsYasir SheikhNo ratings yet

- Q4 2012 EarningsRelease FINALDocument17 pagesQ4 2012 EarningsRelease FINALAnonymous Feglbx5No ratings yet

- 1141 24053 1 10 20180630 PDFDocument10 pages1141 24053 1 10 20180630 PDFrobert jnr MartinNo ratings yet

- ChinaWatch 12th 5yplan BbvaDocument7 pagesChinaWatch 12th 5yplan BbvaLola MentoNo ratings yet

- Winds of Change Halcyon Days Back Again!!: A Comprehensive Assessment (Q1 March 2010)Document36 pagesWinds of Change Halcyon Days Back Again!!: A Comprehensive Assessment (Q1 March 2010)Parul KshatriyaNo ratings yet

- PF I League Tables 2016Document40 pagesPF I League Tables 2016SuperstarVirgoNo ratings yet

- Economic Survey 2012Document4 pagesEconomic Survey 2012NavinkiranNo ratings yet

- Business Environment and Policy: Dr. V L Rao Professor Dr. Radha Raghuramapatruni Assistant ProfessorDocument41 pagesBusiness Environment and Policy: Dr. V L Rao Professor Dr. Radha Raghuramapatruni Assistant ProfessorRajeshwari RosyNo ratings yet

- NILS Law Review Vol. 1Document4 pagesNILS Law Review Vol. 1raghul_sudheeshNo ratings yet

- Cochin University Law Review: Vol: Xxxviii Issue No.1Document3 pagesCochin University Law Review: Vol: Xxxviii Issue No.1raghul_sudheeshNo ratings yet

- Cochin University Law Review: Vol: Xxxviii Issue No.1Document3 pagesCochin University Law Review: Vol: Xxxviii Issue No.1raghul_sudheeshNo ratings yet

- JudgmentDocument35 pagesJudgmentraghul_sudheeshNo ratings yet

- Jan 14 OrderDocument4 pagesJan 14 Orderraghul_sudheeshNo ratings yet

- Leaflet HiiL IJ Awards 2014Document2 pagesLeaflet HiiL IJ Awards 2014raghul_sudheeshNo ratings yet

- Poster Giri 2013-14Document1 pagePoster Giri 2013-14raghul_sudheeshNo ratings yet

- D D Basu Memorial Lecture - Speech Delivered by Shri K K VenugopalDocument39 pagesD D Basu Memorial Lecture - Speech Delivered by Shri K K Venugopalraghul_sudheeshNo ratings yet

- CLAT 2013 PG ResultsDocument41 pagesCLAT 2013 PG Resultsraghul_sudheeshNo ratings yet

- GNLU Review Commission ReportDocument41 pagesGNLU Review Commission Reportraghul_sudheesh100% (1)

- Novartis Patent JudgementDocument112 pagesNovartis Patent JudgementFirstpost100% (1)

- JudgmentDocument54 pagesJudgmentraghul_sudheeshNo ratings yet

- Shamnad Basheer's Written SubmissionsDocument46 pagesShamnad Basheer's Written Submissionsraghul_sudheeshNo ratings yet

- Sangma Case JudgmentDocument52 pagesSangma Case Judgmentraghul_sudheeshNo ratings yet

- Letter To NLSIU Communtiy by SidharthDocument3 pagesLetter To NLSIU Communtiy by Sidharthraghul_sudheeshNo ratings yet

- Resonse From BCI ChairmanDocument7 pagesResonse From BCI Chairmanraghul_sudheeshNo ratings yet

- Fourth AIBE Question PaperDocument9 pagesFourth AIBE Question Paperraghul_sudheesh67% (3)

- Sangma Case JudgmentDocument52 pagesSangma Case Judgmentraghul_sudheeshNo ratings yet

- BCI Rainmaker ContractDocument6 pagesBCI Rainmaker Contractraghul_sudheeshNo ratings yet

- Shreya Singhal v. Union of India WP FINALDocument26 pagesShreya Singhal v. Union of India WP FINALraghul_sudheesh50% (6)

- Per R. Prasad, Member (Minority)Document93 pagesPer R. Prasad, Member (Minority)raghul_sudheeshNo ratings yet

- Shreya Singhal v. Union of India WP FINALDocument26 pagesShreya Singhal v. Union of India WP FINALraghul_sudheesh50% (6)

- Case No. 20 0f 2008 Main OrderDocument126 pagesCase No. 20 0f 2008 Main Orderraghul_sudheeshNo ratings yet

- Order of The Delhi High CourtDocument7 pagesOrder of The Delhi High CourtRaghul SudheeshNo ratings yet

- Petition To NUALS ChancellorDocument11 pagesPetition To NUALS Chancellorraghul_sudheesh100% (1)

- Financial Assistance Application For BerlinDocument7 pagesFinancial Assistance Application For Berlinraghul_sudheeshNo ratings yet

- GNLU Detention Case JudgementDocument46 pagesGNLU Detention Case Judgementraghul_sudheeshNo ratings yet

- NLUJ Law Review PosterDocument1 pageNLUJ Law Review Posterraghul_sudheeshNo ratings yet

- Petition To BCIDocument14 pagesPetition To BCIraghul_sudheeshNo ratings yet

- Full Text of SC Judgment On Ajmal KasabDocument398 pagesFull Text of SC Judgment On Ajmal Kasabraghul_sudheeshNo ratings yet

- Chapter 3 Auditors ResponsibilityDocument17 pagesChapter 3 Auditors ResponsibilityJay LloydNo ratings yet

- Abhilash SynopsisDocument7 pagesAbhilash SynopsisMoin KhanNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/23Document20 pagesCambridge International AS & A Level: ACCOUNTING 9706/23tarunyadavfutureNo ratings yet

- Project Fin323Document22 pagesProject Fin323Alwasat ComputerNo ratings yet

- Rahul Publications Invoice NumberDocument1 pageRahul Publications Invoice Numberdhruvslg86No ratings yet

- Sample Question BBI-mergedDocument67 pagesSample Question BBI-mergedankit chauhanNo ratings yet

- Fortune TellerDocument3 pagesFortune TellerbharatNo ratings yet

- OBC Post Matric Tenta 2018-19Document274 pagesOBC Post Matric Tenta 2018-19Mansoor AhmedNo ratings yet

- Micro FinanceDocument17 pagesMicro FinanceAbhishek ThakurNo ratings yet

- Ey Aarsrapport 2021 22 5Document1 pageEy Aarsrapport 2021 22 5Ronald RunruilNo ratings yet

- NHB Vishal GoyalDocument24 pagesNHB Vishal GoyalSky walkingNo ratings yet

- Fannie Mae - 2012 Servicing GuideDocument1,178 pagesFannie Mae - 2012 Servicing GuideudhayaisroNo ratings yet

- CB Insights 2020 Fintech 250: Company Sector CategoryDocument3 pagesCB Insights 2020 Fintech 250: Company Sector CategoryBánh NgôNo ratings yet

- Fa2 Ch-1 Inventory. Special Valeation FDocument60 pagesFa2 Ch-1 Inventory. Special Valeation FTsi AwekeNo ratings yet

- Amazing RaceDocument6 pagesAmazing RaceHanns Lexter PadillaNo ratings yet

- Brochure - FDP On Financial ServicesDocument2 pagesBrochure - FDP On Financial Servicesamitnpatel1No ratings yet

- SDR FinalDocument17 pagesSDR FinalAiswarya VijayanNo ratings yet

- ch04 Completing The Accounting Cycle - StudentDocument13 pagesch04 Completing The Accounting Cycle - StudentTâm Vũ NhậtNo ratings yet

- Implement Business Plan & RecordsDocument101 pagesImplement Business Plan & RecordsParon MarNo ratings yet

- Statement NOV2023 233609538-1Document25 pagesStatement NOV2023 233609538-1Rmillionsque FinserveNo ratings yet

- PR Amundi Results 2020Document15 pagesPR Amundi Results 2020dorgNo ratings yet

- Chapter 3 To LastDocument126 pagesChapter 3 To LastASHU KNo ratings yet

- CPA REVIEW SCHOOL OF THE PHILIPPINES AUDITING PROBLEMSDocument6 pagesCPA REVIEW SCHOOL OF THE PHILIPPINES AUDITING PROBLEMSchibbs1324No ratings yet

- BIP 390 Investment Banking RegulationsDocument38 pagesBIP 390 Investment Banking RegulationsDuc Bui100% (2)

- Technical English - Banking and FinanceDocument3 pagesTechnical English - Banking and FinanceBernat Urbano CabreraNo ratings yet

- BonusHistory2020 21Document3 pagesBonusHistory2020 21sunil CNo ratings yet

- Learning ROE and Finance Practice ProblemsDocument10 pagesLearning ROE and Finance Practice ProblemsMore EssentialsNo ratings yet

- Save with Capital One 360 Bank in JanuaryDocument5 pagesSave with Capital One 360 Bank in JanuaryAluvya AdamsNo ratings yet

- Bab 23 Audit KasDocument47 pagesBab 23 Audit KasAyakaNo ratings yet

- CA Ramakrishna CVDocument2 pagesCA Ramakrishna CVCA Madhu Sudhan ReddyNo ratings yet