Professional Documents

Culture Documents

Q2FY12 Results Tracker 14.10.11

Uploaded by

Mansukh Investment & Trading SolutionsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Q2FY12 Results Tracker 14.10.11

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

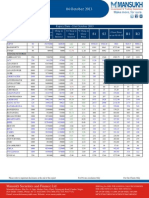

Results Tracker

Friday, 14 Oct 2011

make more, for sure.

Q2FY12

Results to be Declared on 14th Oct 2011

COMPANIES NAME

Asian Flora

Balaji Tele

Centrum Cap

Eskay Knit

Explicit Fin

Gateway Distr

KLIFESTYLE

Reliance Indl Infra

RS Software

Geojit Bnp

Heidelbergcement

Infomedia 18

Results Announced on 13th Oct 2011 (Rs Million)

Kajaria Ceramics

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

3167.6

0

468

106

362

88.2

273.8

84.8

0

189

2222.1

0

348.9

81.2

267.7

77.5

190.2

57

0

133.2

Equity

PBIDTM(%)

147.2

13.87

147.2

14.84

% Var

42.55

Year ended

201109

201009

0

34.14

30.54

35.23

13.81

43.95

48.77

0

41.89

5869.3

0

887.5

194.3

693.2

175.5

517.7

160.4

0

357.3

4177.1

0

661.9

158.9

503

151.1

351.9

105.5

0

246.4

0

-6.51

147.2

15.12

147.2

15.85

% Var

40.51

201103

201003

0

34.08

22.28

37.81

16.15

47.12

52.04

0

45.01

9534.2

0

1485.4

298.6

1186.8

295

891.8

285.2

0

606.6

7363.5

0

1156.7

375.2

781.5

267.1

514.4

155.9

0

358.5

0

-4.57

147.1

14.77

147.1

15.07

% Var

29.48

0

28.42

-20.42

51.86

10.45

73.37

82.94

0

69.21

0

-1.98

The sales moved up 42.55% to Rs. 3167.60 millions for the September 2011 quarter as compared to Rs. 2222.10 millions during the yearago period.An average growth of 41.89% was recorded for the quarter ended September 2011 to Rs. 189.00 millions from Rs. 133.20

illions.The company reported a good operating profit of 468.00 millions compared to 348.90 millions of corresponding previous quarter.

Praj Industries

Quarter ended

Year to Date

Year ended

201109

2289

201009

1087.7

% Var

110.44

201109

3936.1

201009

2024.4

% Var

94.43

201103

5553.8

201003

6031.2

% Var

-7.92

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

89.9

282.8

0

282.8

29.2

253.6

48.3

0

205.3

63.7

130.4

0

130.4

27.2

103.2

14.2

0

89

41.13

116.87

0

116.87

7.35

145.74

240.14

0

130.67

156.5

484.2

0

484.2

57.7

426.5

84.5

0

342

123.7

277.3

0

277.3

54

223.3

30.7

0

192.6

26.52

74.61

0

74.61

6.85

91

175.24

0

77.57

265.8

710.8

0.1

710.7

111.4

599.3

64.7

0

534.6

416.1

1398.6

3.3

1335.7

105.1

1230.6

91.8

0

1138.8

-36.12

-49.18

-96.97

-46.79

5.99

-51.3

-29.52

0

-53.06

Equity

PBIDTM(%)

369.6

12.35

369.5

11.99

0.03

3.05

369.6

12.3

369.5

13.7

0.03

-10.19

369.6

12.8

369.5

23.19

0.03

-44.81

Sales

The total revenue hovered 110.44% to Rs. 2289.00 millions for the September 2011 quarter as against Rs. 1087.70 millions during the

corresponding quarter last year.Net Profit for the quarter ended September 2011 zoomed to 130.67% from Rs. 89.00 millions to Rs. 205.30

millions.Operating profit surged to 282.80 millions from the corresponding previous quarter of 130.40 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

VST Industries

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

1647.6

72.3

544.5

0

544.5

49.5

495

159.1

0

335.9

1604

30.7

395.2

0

395.2

47.3

347.9

107.8

0

240.1

Equity

PBIDTM(%)

154.4

14.17

154.4

11.16

% Var

2.72

Year ended

201109

201009

135.5

37.78

0

37.78

4.65

42.28

47.59

0

39.9

3119.7

126.1

1092.3

0

1092.3

99.7

992.6

314.5

0

678.1

2875.3

103.6

670.8

0

670.8

93.2

577.6

157.3

0

420.3

0

27.05

154.4

35.01

154.4

23.33

% Var

8.5

201103

201003

21.72

62.84

0

62.84

6.97

71.85

99.94

0

61.34

5845.7

171.1

1596.8

0

1596.8

244.2

1352.6

402.5

0

950.1

4822.7

232.4

1158.2

0

1034.1

178.7

855.4

234.9

0

620.5

0

50.08

154.4

11.38

154.4

10.2

% Var

21.21

-26.38

37.87

0

54.41

36.65

58.12

71.35

0

53.12

0

11.61

The Total revenue for the quarter ended September 2011 of Rs. 1647.60 millions remain, more or less, the same.A comparatively good net

profit growth of 39.90% to Rs. 335.90 millions was reported for the quarter ended September 2011 compared to Rs. 240.10 millions of

previous same quarter.The company reported a good operating profit of 544.50 millions compared to 395.20 millions of corresponding

previous quarter.

Avantel Ltd

Quarter ended

Year to Date

201109

201009

Sales

52.87

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0.18

30.62

0.32

30.3

3

27.3

0

0

27.3

Equity

PBIDTM(%)

47.07

57.08

Year ended

201109

201009

32.68

% Var

61.78

201103

201003

58.62

% Var

63.22

222.61

215.44

% Var

3.33

95.68

0.52

5.68

0.44

5.24

2.8

2.44

0

0

2.44

-65.38

439.08

-27.27

478.24

7.14

1018.85

0

0

1018.85

0.52

35.59

0.66

34.93

5.56

29.37

0

0

29.37

1.05

9.68

0.68

9

5.53

3.47

0

0

3.47

-50.48

267.67

-2.94

288.11

0.54

746.4

0

0

746.4

0.85

46.82

4.06

42.76

11.47

31.29

6.24

0

25.05

1.11

26.85

2.82

24.03

12.34

11.69

1.06

0

10.64

-23.42

74.38

43.97

77.94

-7.05

167.66

488.68

0

135.43

47.07

16.44

0

247.13

47.07

37.2

47.07

16.51

0

125.26

47.07

19.45

47.07

11.83

0

64.41

The Turnover for the quarter ended September 2011 of Rs. 52.87 millions increase by 61.78% from Rs. 32.68 millions.The Net Profit of the

company vaulted to 1018.85% to Rs. 27.30 millions from Rs. 2.44 millions in the previous quarter.Operating profit for the quarter ended

September 2011 rose to 30.62 millions as compared to 5.68 millions of corresponding quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

You might also like

- Results Tracker 18 August 2011Document3 pagesResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 18 Oct 2011Document4 pagesResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 14 July 2012Document4 pagesResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 21.04.12Document3 pagesResults Tracker 21.04.12Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 19 July 2012Document4 pagesResults Tracker: Thursday, 19 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- BIMBSec - TM 1QFY12 Results Review - 20120531Document3 pagesBIMBSec - TM 1QFY12 Results Review - 20120531Bimb SecNo ratings yet

- Astra Agro Lestari: Strong Jan 11 ProductionDocument6 pagesAstra Agro Lestari: Strong Jan 11 ProductionerlanggaherpNo ratings yet

- Results Tracker 18.07.2012Document2 pagesResults Tracker 18.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 11.07.2012Document2 pagesResults Tracker 11.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- CESC Earnings In LineDocument3 pagesCESC Earnings In LinesanjeevpandaNo ratings yet

- Results Tracker: Wednesday, 19 Oct 2011Document6 pagesResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- TM 4QFY11 Results 20120227Document3 pagesTM 4QFY11 Results 20120227Bimb SecNo ratings yet

- Results Tracker 10.07.2012Document2 pagesResults Tracker 10.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Derivatives Report 31st DecDocument3 pagesDerivatives Report 31st DecAngel BrokingNo ratings yet

- Eq MIRCELECTR Upd1Document1 pageEq MIRCELECTR Upd1i2020No ratings yet

- BJE Q1 ResultsDocument4 pagesBJE Q1 ResultsTushar DasNo ratings yet

- Derivatives Report 15th September 2011Document3 pagesDerivatives Report 15th September 2011Angel BrokingNo ratings yet

- Results Tracker: Tuesday, 25 Oct 2011Document5 pagesResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Promoters Likely To Raise Stake: CMP '83 Target Price '104Document6 pagesPromoters Likely To Raise Stake: CMP '83 Target Price '104Angel BrokingNo ratings yet

- Derivatives Report 31 MAY 2012Document3 pagesDerivatives Report 31 MAY 2012Angel BrokingNo ratings yet

- Infosys Ltd-Q2 FY12Document4 pagesInfosys Ltd-Q2 FY12Seema GusainNo ratings yet

- Cebbco Spa 030412Document3 pagesCebbco Spa 030412RavenrageNo ratings yet

- BIMBSec - Digi Company Update - 20120502Document3 pagesBIMBSec - Digi Company Update - 20120502Bimb SecNo ratings yet

- Results Tracker: Friday, 03 Aug 2012Document4 pagesResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Astra International 1H11 Investor Summit Capital Market Expo 2011 PresentationDocument20 pagesAstra International 1H11 Investor Summit Capital Market Expo 2011 PresentationWibawo Huang Un UnNo ratings yet

- Results Tracker 17.07.2012Document2 pagesResults Tracker 17.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 12.07.2012Document2 pagesResults Tracker 12.07.2012Mansukh Investment & Trading SolutionsNo ratings yet

- Wah Seong 4QFY11 20120223Document3 pagesWah Seong 4QFY11 20120223Bimb SecNo ratings yet

- Results Tracker 12.01.12Document2 pagesResults Tracker 12.01.12Mansukh Investment & Trading SolutionsNo ratings yet

- INDIA Pharma Wyeth Q4FY12 Result updateDocument4 pagesINDIA Pharma Wyeth Q4FY12 Result updateSwamiNo ratings yet

- Rs 203 BUY: Key Take AwayDocument6 pagesRs 203 BUY: Key Take Awayabhi_003No ratings yet

- Titan Industries: Performance HighlightsDocument10 pagesTitan Industries: Performance HighlightsVishal AhujaNo ratings yet

- Analysis of Financial StatementDocument35 pagesAnalysis of Financial StatementSahir MoizNo ratings yet

- Derivatives Report 26th April 2012Document3 pagesDerivatives Report 26th April 2012Angel BrokingNo ratings yet

- Derivatives Report 11 JUNE 2012Document3 pagesDerivatives Report 11 JUNE 2012Angel BrokingNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Nifty Futures Turn To DiscountDocument3 pagesNifty Futures Turn To DiscountSakha SabkaNo ratings yet

- Abbott India: Performance HighlightsDocument11 pagesAbbott India: Performance HighlightsAngel BrokingNo ratings yet

- Derivatives Report 20 Jun 2012Document3 pagesDerivatives Report 20 Jun 2012Angel BrokingNo ratings yet

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Derivatives Report 10th August 2011Document3 pagesDerivatives Report 10th August 2011Angel BrokingNo ratings yet

- Suggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl2012 - Jun2014 - Paper - 20 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- Derivatives Report 15 JUNE 2012Document3 pagesDerivatives Report 15 JUNE 2012Angel BrokingNo ratings yet

- Derivatives Report 14 JUNE 2012Document3 pagesDerivatives Report 14 JUNE 2012Angel BrokingNo ratings yet

- SPH Reit - Hold: Upholding Its StrengthDocument5 pagesSPH Reit - Hold: Upholding Its StrengthventriaNo ratings yet

- Annual Report 2010 11Document80 pagesAnnual Report 2010 11infhraNo ratings yet

- Ings BHD RR 3Q FY2012Document6 pagesIngs BHD RR 3Q FY2012Lionel TanNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Kajaria Ceramics: Upgrade in Price TargetDocument4 pagesKajaria Ceramics: Upgrade in Price TargetSudipta BoseNo ratings yet

- Derivative Report: Nifty Vs OIDocument3 pagesDerivative Report: Nifty Vs OIAngel BrokingNo ratings yet

- Beta SecuritiesDocument5 pagesBeta SecuritiesZSNo ratings yet

- Mayur Uniquoters Q1 FY12 Results UpdateDocument18 pagesMayur Uniquoters Q1 FY12 Results UpdateChiragNo ratings yet

- Brs-Ipo Document Peoples Leasing Company LimitedDocument13 pagesBrs-Ipo Document Peoples Leasing Company LimitedLBTodayNo ratings yet

- BIMBSec-Digi 20120724 2QFY12 Results ReviewDocument3 pagesBIMBSec-Digi 20120724 2QFY12 Results ReviewBimb SecNo ratings yet

- Idea Cellular: Performance HighlightsDocument13 pagesIdea Cellular: Performance HighlightsAngel BrokingNo ratings yet

- Strategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Document40 pagesStrategic Financial Management: Presented By:-Rupesh Kadam (PG-11-084)Rupesh KadamNo ratings yet

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryFrom EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Finder's Fee Film Financing MemoDocument2 pagesFinder's Fee Film Financing MemoToussaintNo ratings yet

- 2Q 15 VcsurveyDocument11 pages2Q 15 VcsurveyBayAreaNewsGroupNo ratings yet

- Chapter 4Document83 pagesChapter 4anonimussttNo ratings yet

- TCS Balance SheetDocument3 pagesTCS Balance SheetdushyantkrNo ratings yet

- Accounting Changes-QUESTIONNAIRESDocument7 pagesAccounting Changes-QUESTIONNAIRESJennifer ArcadioNo ratings yet

- Sweat equity explainedDocument4 pagesSweat equity explainedkrishnithyanNo ratings yet

- Jollibee Foods Corp financial analysisDocument7 pagesJollibee Foods Corp financial analysisKathryn Bianca AcanceNo ratings yet

- Payback PeriodDocument14 pagesPayback PeriodiLoveMarshaNo ratings yet

- 5 Legal AspectsDocument27 pages5 Legal AspectskhldHANo ratings yet

- KSE RuleBook PDFDocument208 pagesKSE RuleBook PDFMuhammad HasnainNo ratings yet

- Al ArafahDocument10 pagesAl ArafahHasneen HasinNo ratings yet

- Department of Commerce BZU, Multan.: Nternship ONDocument36 pagesDepartment of Commerce BZU, Multan.: Nternship ONInnocent ZeeNo ratings yet

- Annual Report Fy 2018Document334 pagesAnnual Report Fy 2018Praneeth ThotaNo ratings yet

- CA Devendra Jain Sec 56 9-6-2018Document46 pagesCA Devendra Jain Sec 56 9-6-2018ShabarishNo ratings yet

- Viking Q2 LetterDocument13 pagesViking Q2 Lettermarketfolly.com100% (5)

- ArtiDocument3 pagesArtihardadi123No ratings yet

- 03 Stock Offerings and Monitoring InvestorDocument45 pages03 Stock Offerings and Monitoring InvestorMaulanaNo ratings yet

- Venture Capital 101Document4 pagesVenture Capital 101AsiakeiNo ratings yet

- Comparative Analysis of Mutual Fund SchemesDocument101 pagesComparative Analysis of Mutual Fund Schemesvipulgupta1988100% (4)

- Create A Debt Amortization Schedule For The Following Loan CaseDocument11 pagesCreate A Debt Amortization Schedule For The Following Loan CaseShivamKhareNo ratings yet

- The Cost and Equity Methods and Investment MethodsDocument13 pagesThe Cost and Equity Methods and Investment Methodsabirami manojNo ratings yet

- Options Pricing Using Binomial TreesDocument12 pagesOptions Pricing Using Binomial TreesGouthaman Balaraman100% (10)

- Portfolio Investment Management Specialist in Stamford CT Resume Michael BizzarioDocument1 pagePortfolio Investment Management Specialist in Stamford CT Resume Michael BizzarioMichaelBizzarioNo ratings yet

- 12Fall-PE Deal Summary-Mengyan WangDocument5 pages12Fall-PE Deal Summary-Mengyan WangMengyan WangNo ratings yet

- 12 Accountancy Accounting For Share Capital and Debenture Impq 1Document8 pages12 Accountancy Accounting For Share Capital and Debenture Impq 1Aejaz MohamedNo ratings yet

- 2015 Commentary NewDocument49 pages2015 Commentary NewHung Faat ChengNo ratings yet

- Ambuja - Holcim (Gaurav)Document18 pagesAmbuja - Holcim (Gaurav)Gaurav AgrawalNo ratings yet

- Chapter 7Document98 pagesChapter 7Arlien GerosanibNo ratings yet

- BKM Chapter 3 SlidesDocument41 pagesBKM Chapter 3 SlidesIshaNo ratings yet

- Case StudyDocument12 pagesCase StudyJerome MogaNo ratings yet