Professional Documents

Culture Documents

AC208

Uploaded by

Prox NitroOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AC208

Uploaded by

Prox NitroCopyright:

Available Formats

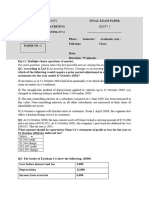

DEPARTMENT OF ACCOUNTANCY INTERMEDIATE FINANCIAL ACCOUNTING AC 208 FINAL EXAMINATION DATE: JUNE 2004 TIME ALLOWED: 4 HOURS TOTAL

MARKS: 100

INSTRUCTIONS Answer all the questions on this paper. QUESTION 1 2 3 4 5 TOPIC Issuing of Shares Partnership Leases Cash Flow Statement Definitions TOTAL MARKS MARKS 40 20 10 20 10 100

***THIS QUESTION PAPER HAS 4 PAGES***

QUESTION 1

(40 MARKS)

Chete Private Limited decided to issue 10 000 ordinary shares of $1 each to the Public on the 31 December 2000 as follows: On Application On Allotment On 1st Call On 2nd Call $ 0.25 0.30 0.30 0.15 1.00

The company received 30 000 share applicants with application money. The Directorate allotted one for every three shares received with all unsuccessful applicants being refunded their dues. All applicants paid their dues except for one who failed to pay the first and second installments on the 100 shares allotted to him. The shares were forfeited and reissued to Chido for $100. REQUIRED: (i) (ii) (iii) (iv) (v) (vi) (vii) Application and Allotment Account. 1st Call Account 2nd Call Account Bank Account Forfeiture and Reissue Account Chidos Account Balance sheet of Chete after the Issue (20 MARKS) (5 marks) (4 marks) (4 marks) (4 marks) (2 marks) (3 marks) (15 marks)

QUESTION 2

Partnership Dete and Rand was sold to a newly formed company called Lloyd Private Limited. The company took over the following assets and liabilities at 31 December 2000 at the following values: Freehold property Plant Fixtures Stocks Debtors Creditors $ 40 000 15 000 10 000 20 000 30 000 16 000

The company paid its purchase consideration of $150 000 by offering 150 000 ordinary shares of $1 each to Dete and Rand. The two parties were sharing profits equally.

REQUIRED: (i) (ii) (iii) Open Books of Lloyd in the Journal Book as at 31 December 2000. (5 marks) Show the essential Ledger Book records for the company (5 marks) Compile Lloyds Balance Sheet as at 31 December 2000 (10 marks)

QUESTION 3

(10 MARKS) (10 marks)

State any five differences between an operating lease and a Finance lease?

QUESTION 4

(20 MARKS)

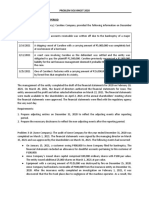

The following is the financial information of Chakupaidenga for the year ended 31 December 2001 Chakupaidenga Profit and Loss Account for Year Ended 31 December 2001 $ Turnover Raw materials consumed Staff costs Depreciation Loss on Disposal Operating profit Interest payable Profit before tax Taxation Dividend Profit retained for year Balance b/d Balance c/d 70 000 94 000 118 000 18 000 $ 720 000

300 000 420 000 28 000 392 000 124 000 268 000 72 000 196 000 490 000 686 000

Chakupaidenga Balance Sheet as at 31 December 2001 and 2000 31/12/2001 $ 1 596 000 318 000 1 278 000 ________ 24 000 76 000 48 000 148 000 1 426 000 Employed Capital Ordinary Share Capital Share premium Profit and Loss Long-term loans Current Liabilities Trade creditors Taxation Dividends 360 000 36 000 686 000 1 082 000 200 000 ________ 12 000 102 000 30 000 144 000 1 426 000 31/12/2000 $ 1 560 000 224 000 1 336 000 ________ 20 000 58 000 56 000 134 000 1 470 000 340 000 24 000 490 000 854 000 500 000 ________ 6 000 86 000 24 000 116 000 1 470 000

Fixed Assets (at cost) Depreciation Current Assets Stock Trade debtors Bank

During the year the company paid $90 000 for a new machinery. REQUIRED: Prepare a Cash Flow Statement for Chakupaidenga for the year ended 31 December 2001, using the Indirect Method, QUESTION 5 (a) (b) (10 MARKS) (5 marks) (5 marks)

What is a change in equity statement? Give five points. State five purposes of Compiling a Cash Flow Statement for an entity?

***END OF QUESTION PAPER***

You might also like

- Business Associations Attack OutlineDocument65 pagesBusiness Associations Attack OutlineWaylon Fields86% (7)

- Book-Keeping & Accounts/Series-2-2005 (Code2006)Document14 pagesBook-Keeping & Accounts/Series-2-2005 (Code2006)Hein Linn Kyaw100% (2)

- 8-1 Proxy For Annual Meeting of ShareholdersDocument1 page8-1 Proxy For Annual Meeting of ShareholdersDaniel100% (7)

- Poa May 2002 Paper 2Document12 pagesPoa May 2002 Paper 2Jerilee SoCute Watts50% (4)

- Vanguard Currency Hedging 0910Document24 pagesVanguard Currency Hedging 0910dave_cb123No ratings yet

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Financial Accounting and Reporting: Blank PageDocument28 pagesFinancial Accounting and Reporting: Blank PageMehtab NaqviNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Module 7 - Revenue Recognition - StudentsDocument10 pagesModule 7 - Revenue Recognition - StudentsLuisito CorreaNo ratings yet

- Financial Accounting11Document14 pagesFinancial Accounting11AleciafyNo ratings yet

- CPA Exam Financial Accounting Paper 1Document8 pagesCPA Exam Financial Accounting Paper 1Innocent Won Aber65% (34)

- ICMA Questions Dec 2012Document55 pagesICMA Questions Dec 2012Asadul HoqueNo ratings yet

- Statement of Cash Flows 3Document7 pagesStatement of Cash Flows 3Rashid W QureshiNo ratings yet

- Sun Life Final PaperDocument53 pagesSun Life Final PaperAnonymous OzWtUONo ratings yet

- Distressed Debt Investing - Trade Claims PrimerDocument7 pagesDistressed Debt Investing - Trade Claims Primer10Z2No ratings yet

- Financial Statement Analysis DR ReddyDocument84 pagesFinancial Statement Analysis DR Reddyarjunmba119624100% (1)

- Poa May 2001 Paper 2Document10 pagesPoa May 2001 Paper 2Jerilee SoCute WattsNo ratings yet

- Exam 1 5Document6 pagesExam 1 5Alex Schuldiner0% (1)

- 9706 June 2011 Paper 41Document8 pages9706 June 2011 Paper 41Diksha KoossoolNo ratings yet

- FfsDocument9 pagesFfsDivya PoornamNo ratings yet

- 6int 2004 Dec QDocument7 pages6int 2004 Dec QFloyd DaltonNo ratings yet

- Isc Specimen Question Paper Accounts 2014Document9 pagesIsc Specimen Question Paper Accounts 2014BIKASH166No ratings yet

- HKALE PACCT Question Book 2001 Paper 1Document15 pagesHKALE PACCT Question Book 2001 Paper 1Elien ZosNo ratings yet

- F7.2 - Mock Test 1Document5 pagesF7.2 - Mock Test 1huusinh2402No ratings yet

- Accounting Principles I Assessment TestDocument7 pagesAccounting Principles I Assessment TestNicolas ErnestoNo ratings yet

- Financial Reporting I - Final Exam 2Document2 pagesFinancial Reporting I - Final Exam 2MohammedBahgatNo ratings yet

- ACCT5101Pretest PDFDocument18 pagesACCT5101Pretest PDFArah OpalecNo ratings yet

- c6 Question BankDocument25 pagesc6 Question BankWaseem Ahmad QurashiNo ratings yet

- Lecture 4 & 5 - Preparing Financial Statements (XYZ LTD)Document1 pageLecture 4 & 5 - Preparing Financial Statements (XYZ LTD)Happy AdelaNo ratings yet

- HI5020 Final AssessmentDocument15 pagesHI5020 Final AssessmentTauseef AhmedNo ratings yet

- CA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelDocument18 pagesCA School of Accountancy's Mock Exam: PAPER: Financial Accounting (FA) TUTOR: Roshan BhujelMan Ish K DasNo ratings yet

- CMA April - 14 Exam Question - P-1Document12 pagesCMA April - 14 Exam Question - P-1MasumHasanNo ratings yet

- Essay A Essay B: Totals $569,000 $386,000Document4 pagesEssay A Essay B: Totals $569,000 $386,000Tosin YusufNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32muhammadxiaullahgNo ratings yet

- Accountancy - Paper-I - 2012Document3 pagesAccountancy - Paper-I - 2012MaryamQaaziNo ratings yet

- CT2-PX-0 - QP-x2-x3Document22 pagesCT2-PX-0 - QP-x2-x3AmitNo ratings yet

- 1992 Accounting Paper XiiDocument13 pages1992 Accounting Paper XiiMumtazAhmad100% (1)

- IF2 - Project 1 PDFDocument6 pagesIF2 - Project 1 PDFBillNo ratings yet

- P5 Syl2012 InterDocument27 pagesP5 Syl2012 InterViswanathan SrkNo ratings yet

- CA2A2Document5 pagesCA2A2Shanntha JoshittaNo ratings yet

- Accounting I.com 2Document4 pagesAccounting I.com 2Saqlain KazmiNo ratings yet

- Tee 1as Level QP Acc 2021Document10 pagesTee 1as Level QP Acc 2021Kalash JainNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/32Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/32shanti teckchandaniNo ratings yet

- Soal AkmDocument5 pagesSoal AkmCarvin HarisNo ratings yet

- Cambridge International AS & A Level: ACCOUNTING 9706/31Document12 pagesCambridge International AS & A Level: ACCOUNTING 9706/31SaiNo ratings yet

- Acc BetaDocument11 pagesAcc BetaHamiz AizuddinNo ratings yet

- Cuac208 Tests and AssignmentsDocument8 pagesCuac208 Tests and AssignmentsInnocent GwangwaraNo ratings yet

- 9706 31 Insert o N 20Document5 pages9706 31 Insert o N 20chirag mehtaNo ratings yet

- ACC121 FinalExamDocument13 pagesACC121 FinalExamTia1977No ratings yet

- Chapter 1 None CompressDocument9 pagesChapter 1 None CompressiadcNo ratings yet

- F3 MOCK EXAM: KEY ACCOUNTING CONCEPTSDocument21 pagesF3 MOCK EXAM: KEY ACCOUNTING CONCEPTSMaja Jareno GomezNo ratings yet

- 1 Af 101 Ffa Icmap 2013 PaperDocument4 pages1 Af 101 Ffa Icmap 2013 PaperZulfiqar AliNo ratings yet

- ÔN CUỐI KỲ CHUẨN MỰC BCTCQT 2Document8 pagesÔN CUỐI KỲ CHUẨN MỰC BCTCQT 2trantram130903No ratings yet

- Review Session 6 TEXTDocument6 pagesReview Session 6 TEXTAliBerradaNo ratings yet

- AE 221 Unit 3 Problems PDFDocument5 pagesAE 221 Unit 3 Problems PDFMae-shane SagayoNo ratings yet

- HKALE PACCT Question Book 2002 Paper 2Document10 pagesHKALE PACCT Question Book 2002 Paper 2Elien ZosNo ratings yet

- P5 Syl2012 InterDocument12 pagesP5 Syl2012 InterVimal ShuklaNo ratings yet

- ReceivablesDocument36 pagesReceivablesElla MalitNo ratings yet

- 001 1-1gbr 2002 Dec QDocument14 pages001 1-1gbr 2002 Dec QArun KarthikNo ratings yet

- Acct 2005 Practice Exam 2Document17 pagesAcct 2005 Practice Exam 2laujenny64No ratings yet

- 2022 FIA132 Term Test 1 FinalDocument9 pages2022 FIA132 Term Test 1 FinalkaityNo ratings yet

- Corporate Accounting I exam questions and solutionsDocument3 pagesCorporate Accounting I exam questions and solutionsRiteshHPatelNo ratings yet

- Acct 550 Final ExamDocument4 pagesAcct 550 Final ExamAlexis AhiagbeNo ratings yet

- ACC1006 EOY Essay DrillDocument13 pagesACC1006 EOY Essay DrillTiffany Tan Suet YiNo ratings yet

- IF2FInalExamSampleQuestions 1-12Document12 pagesIF2FInalExamSampleQuestions 1-12Percy IFNNo ratings yet

- Purchase Mock 1 PDFDocument14 pagesPurchase Mock 1 PDFSayed Zain Shah0% (1)

- Financial Accounting IFRS PresentationDocument10 pagesFinancial Accounting IFRS PresentationVaishnavi khotNo ratings yet

- Jzanzig - Acc 512 - Chapter 12Document27 pagesJzanzig - Acc 512 - Chapter 12lehvrhon100% (1)

- Madsen PedersenDocument23 pagesMadsen PedersenWong XianyangNo ratings yet

- 599327636153soa23032020193129 PDFDocument2 pages599327636153soa23032020193129 PDFSuresh DhanasekarNo ratings yet

- Industry Profile of ICICI SecuritiesDocument7 pagesIndustry Profile of ICICI SecuritiesRehna RinuNo ratings yet

- Business Innovation and Disruptive Technology (, Prentice Hall PTR, Financial Times)Document173 pagesBusiness Innovation and Disruptive Technology (, Prentice Hall PTR, Financial Times)Anonymous D0AX4fTAffNo ratings yet

- The Idea Compass From IdeablobDocument19 pagesThe Idea Compass From IdeablobideablobNo ratings yet

- Credit Management of PBLDocument53 pagesCredit Management of PBLIkramul HasanNo ratings yet

- RMIN 4000 Exam Study Guide Ch 2 & 9Document13 pagesRMIN 4000 Exam Study Guide Ch 2 & 9Brittany Danielle ThompsonNo ratings yet

- (Deutsche Bank) Depositary Receipts HandbookDocument22 pages(Deutsche Bank) Depositary Receipts Handbook00aaNo ratings yet

- Adjust trial balance and complete financial statementsDocument4 pagesAdjust trial balance and complete financial statementsAiman KhanNo ratings yet

- Salah Ezzedine FrauDDocument4 pagesSalah Ezzedine FrauDkksamahaNo ratings yet

- UD WIRASTRI GENERAL LEDGER REPORTDocument26 pagesUD WIRASTRI GENERAL LEDGER REPORTRay GhuNo ratings yet

- 8963 80Document16 pages8963 80OSDocs2012No ratings yet

- Fin 422 Case QuestionsDocument3 pagesFin 422 Case QuestionsoaklanduniversityNo ratings yet

- Report IFA For Norway On Interest DeductionDocument19 pagesReport IFA For Norway On Interest DeductionAnna ScaoaNo ratings yet

- EuroprisDocument3 pagesEuroprishiepsvgNo ratings yet

- Oriental Bank ProDocument113 pagesOriental Bank ProSubramanya DgNo ratings yet

- Case, The Crash That Shook The NationDocument3 pagesCase, The Crash That Shook The NationSamanBrarNo ratings yet

- India Chemicals Final ReportDocument281 pagesIndia Chemicals Final ReportGaurav MeshramNo ratings yet

- Welcome to Pass4Sure Mock TestDocument28 pagesWelcome to Pass4Sure Mock TestManan SharmaNo ratings yet