Professional Documents

Culture Documents

A Compendium and Comparison of 25 Project Evaluation Techniques. Part 2 Ratio, Payback, and Accounting Methods

Uploaded by

Rama RenspandyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Compendium and Comparison of 25 Project Evaluation Techniques. Part 2 Ratio, Payback, and Accounting Methods

Uploaded by

Rama RenspandyCopyright:

Available Formats

ELSEVIER

Int. J. Production

Economics 42 (1995) lOlL129

produ&ion economics

A compendium and comparison of 25 project evaluation techniques. Part 2: Ratio, payback, and accounting methods

Donald S. Remer*, Armando P. Nieto

Harvey Mudd College of Engineering and Science, Claremont, CA 91711, USA

Received August 1994; accepted for publication August 1995

Abstract This two-part paper presents 25 different methods and techniques used to evaluate the economic desirability of projects. We categorized these 25 methods into 5 types: net present value methods, rate of return methods, ratio methods, payback methods, and accounting methods. We provide insight into the advantages and limitations of these project evaluation methods by comparing and contrasting them. Many examples are included to illustrate the use of these methods. In Part 1, we examine net present value and rate of return methods. In Part 2, we examine ratio, payback, and accounting methods. A recap, comparison, and full summary of all 25 methods is included at the end of Part 2.

Keywords:

Project

evaluation

techniques;

Ratio methods;

Payback

methods;

Accounting

methods

3. Introduction This is Part 2 of a two-part paper. The primary purpose of this two-part paper is to discuss, summarize, and compare 25 project evaluation methods in one central source. This paper will help the reader understand the advantages and disadvantages of these methods, as well as which to use in various applications. In Part 1, we briefly introduced 25 different project evaluation techniques. Then, we examined net present value and rate of return methods. We now continue in Part 2 with a description of ratio methods, payback methods, and accounting methods. Several examples are included. Next, we apply almost every technique to one comparative example. Finally, we summarize, compare and contrast all 25 different methods.

4. Project evaluation

techniques

solving always,

As described in Part 1 of this two-part paper, the rate of return methods calculate the rate of return by for i. The ratio methods calculate the rate of return from ratios which are based, usually, but not

upon net present

author.

value

techniques.

* Corresponding

0925.5273/95/$09.50 0 1995 Elsevier Science B.V. All rights reserved SSDl 0925-5273(95)00105-O

102

D.S. Remer, A.P. Nieto,lInt. .I Production

Economics

42 (1995) IO-129

III. Ratio methods A. Premium worth percentage The premium worth percentage method (PWP) is a variation of the internal rate of return method. This method is also known as the explicit reinvestment rate of return method and the discounted profit-toinvestment ratio method [ll, 341. See Table 11. This method determines the net profit percentage of a project by dividing the present worth of the net profit by the present worth of the initial investment. Here, initial investment refers to the total investment of a project and net profit refers to all positive cash flows. The MARR used to calculate the present worth of the cash flows is compared with the net profit percentage. If this percentage is greater than the reinvestment rate, the project is favorable. If the rates are equal (which is the result of the internal rate of return method), the investor is indifferent to the project. Otherwise, the project is rejected. Again, as with any rate of return method discussed in Part 1 of this two-part paper, the figures used in the calculations must all be of the same equivalence method (i.e., all present worths, all future worths or all annual worths) [ 11,341. Example 8 illustrates the uses of the premium worth percentage method. Example 8. Premium worth percentage analysis of two projects with equal lives The cash flows for two proposed Projects A and B are shown below (Note: These cash flows will be frequently referred to throughout this paper.) Year Investment (S) Income (S) Operating and maintenance costs ($) Misc. costs (S) Salvage value ($) Net cash flow (S)

Project 0 1 2 3 4 5

A 1000 0 0 0 0 0

0 0 0

375 375 375 375 325

0

40 40 40 40 40

35 35 35 35 35

0

0 0

0

0 0

50

0 0 0 0 0

1000 300 300 300 300 300

Project B: 1000 0 0 1 0 2 0 3 0 4 0 5

475 475 375 325 125

30 30 30 30 30

45 45 45 45 45

50

1000 400 400 300 250 100

Each of these projects has been proposed to accomplish the same purpose. The MARR for both projects is 10%. The present worth of the net profit is equal to the net present worth of the cash flows. In Example 1, the present worth of Project A (PW,) was calculated to be $137. The premium worth percentage can then be expressed as Premium worth percentage of Project A: PWPA = PWA/ZA, where IA equals the initial investment of Project A, $1000. Solving PWP* = (137/1000) = 13.7%.

D.S. Remer, A.P. Nietollnt.

J. Production

Economics

42 (1995) 101-129

103

Table 11 Terms used to describe Ratio method Premium worth

ratio methods Also known as discounted

percentage

Return on investment Benefit/cost Profit-to-investment Savings-to-investment Cost effectiveness

Explicit reinvestment rate of return, discounted profit to investment ratio, return on original Investment Engineers method, DuPonts method Benefits/costs ratio method, benefits/costs analysis. Also see Table 13 Net income-to-investment method No other names found No other names found

Similarly, the present worth of Project B, PWB, was found to be $152. Its premium then be expressed as Premium worth percentage of Project B: PWP, = PWB/IB, where In equals the initial investment of Project B, $1000. Solving PWPB = (152/1000) = 15.2%.

worth percentage

can

Since both projects have premium worth percentages greater than the MARR, able. However, since PWPa > PWPA, Project B should be chosen.

both projects

are accept-

The results given by the premium percentage worth method can be misleading because the present worths of the projects are never actually compared. For example, the present value of one project may be twice the present value of another. However, premium percentage worth method does not recognize this and may indicate that the project with the lesser present worth is more desirable simply because it has a higher PWP ratio [12]. For this reason, the premium worth percentage method should never be used as the lone criteria for project evaluation. B. Return on investment There are two variations of the return on investment (ROI) Method. The first is the return on original investment method. The second is the return on average investment method. The return on original investment method measures a percentage relationship between the average yearly profit and the initial investment. The return on average investment method measures the percentage relationship between the average yearly profit and the average yearly investment. The amounts used to calculate the averages are not discounted (i.e., they do not consider the time value of money) [13, 183. This, in our opinion, is a major disadvantage of this method. Unlike other methods, the return on investment method has no set criteria for project profitability. Example 9 shows how the return on investment calculations are made. Example 9a. Return on original investment analysis of two projects with equal lives Using the same cash flows as given in Example 1 (see Part 1) or Example 8, the average Project A can be expressed as follows: Average yearly profit of Project A: AYP

A

yearly profit of

= $300 + $300 + $300 + $300 + $300

5

years

= $300/year. on original

The initial investment for both Project A (IA) and Project B (I,) is equal to $1000. The return investment can then be expressed as Return on original investment of Project A: ROIA = AYPJIA = (300/1000) = 30%

104

D.S. Renter, A.P Nietollnt. .J. Production Economics42 (1995) 101-129 B can be expressed as

Similarly, the average yearly profit of Project Average yearly profit of Project B: AYP

B

= $400 + $400 + $300 + $250 + $100

5

years

= $290/year

The return on original investment can then be expressed as Return on original investment of Project B: ROIB = AYPB/ZB = (290/1000) = 29% This method does not have a set criteria for project profitability, however, since ROIA > ROIB, Project A should be chosen. For thefirst time in this paper, Project A isfounll to he morefuvorable than Prqject B. However, this is wrong and illustrates the consequences of not considering the time value of money! It also demonstrates why one method should not be used as the sole criteria for evaluating projects. The discounted return on original investment method, also known as the premium worth percentage method, does include the time value of money. This method was demonstrated in Example 8 and found Project B to be more favorable than Project A. The second variation of return on investment is illustrated in Example 9b. Example 9b. Return on average investment analJeis on two projects with equal lives The average yearly profit for each of the projects was calculated in Example 9a. Now, the calculations for the average yearly investment must be made. To do this, the concept of depreciation must be introduced. Depreciation represents an accounting method for reducing the value of assets [4]. More on depreciation will be discussed later in Subsection V: Accounting methods. For now, the depreciation values will just be given. The yearly depreciation (straight line) for both projects is assumed to be $190. Therefore, the yearly investments can be shown as follows: Year Initial investment ($) Total depreciation ($) Yearly investment investment) ($) 1000 810 620 430 240 50 (total net

1 2 3 4 5

1000 0 0 0 0 0

0 190 380 570 760 950

The values listed under yearly investment are also known as book values. For more information on the calculation of these values, see Example 15, or see references [4,52] From the figures listed above, the average yearly investment (or average yearly book value) can be calculated as: Average yearly investment of Projects A and B: AYI = $1000 + $810 + $620 + $430 + $240 + $50 = $525,vear, ,_ 6 years

D.S. Remet-, A.P. Nietojht.

J. Production

Economics

42 (1995) 101-129

105

The denominator Therefore, the return Return Return on average on average

is six because there are six different investment totals on average investment can be expressed as follows: investment investment of Project of Project A = RAIA = AYP,JAYIA B = RAIB = AYP,/AYIB

over

the five-year

period.

= (300/525) = 57%, = (290/525) = 55%.

Again, this method does not have a set criteria for project acceptance. However, since RAIA > RAIB, Project A is found to be more favorable than Project B, which is incorrect! This further illustrates the need to always consider the time value of money, as well as the use of more than just one project evaluation technique. According to surveys conducted in 1978 and 1991 (see Part l), the use of the Return on investment method has increased from 30% to 39% [22,23]. It should also be noted that of the companies surveyed in 1991, none used the return on investment method without the use of the either the internal rate of return method or net present value methods. In general, other terms for the return on investment method include the Engineers method or DuPonts method [18]. See Table 11. C. Benefit/cost ratio The benefit/cost ratio method (B/C) was introduced primarily as a result of the US Governments need to evaluate project proposals submitted to Congress. In the 1930s Congress established the criterion for the acceptance of a project, which stated that the benefits of a project must outweigh the costs. Thus, the benefit/cost ratio method developed out of Congressional legislation. For this reason, local, state and federal government agencies usually use the benefit/cost ratio method to allocate their resources [l, 121. In this case, incurs the costs. However, the benefits and costs the public receives the benefits, while the government are generally received by the same individual or corporation when this method is used to evaluate projects in the private sector. Although a monetary value cannot be easily attached to many benefits, as long as there is no ambiguity, the benefit/cost ratio method provides simple results. These results should be very similar to those given by the net present value criterion method [4,38,53]. Commonly written as benefit(s)/cost(s) or benefit(s) - cost(s), in its most general form, the ratio can be represented as

or

B/C

or

B-C,

where B represents the benefits and C represents the costs [1,4,12]. The criteria for acceptance and rejection of a project can be judged according to Table 12 provided that the benefits and costs of a project are each represented by the same discount method type (i.e., both are present worth values or both are future worth values) [12]. In Table 12, a benefit is defined to be negative if the proposed project results in a reduction of benefits. Similarly, a negative cost arises when there is a reduction in the costs of a proposed project [12]. There are several variations of the benefit/cost ratio method. One commonly used variation is the conventional benefit/cost ratio method. Here, B represents the total net benefits (benefits - disbenefits) while C is just the initial cost involved (minus any salvage value). From here on, the initial cost C will be assumed to have already been adjusted for any salvage value. Using this method, it is important to note that disbenefits are subtracted from benefits and not added to costs [4]. Another term used to describe the conventional benefit/cost ratio method is the aggregate benefit/cost ratio method or the Eckstein benefit/cost ratio method

c311.

106 Table 12 Acceptance

D.S. Remer, A.P. Nietolht.

J. Production Economics

42 (1995) 101-129

criteria

for the benefit/cost

ratio method

1123 Ratio (B/C) Decision Accept Indifferent Reject Accept Reject Reject Indifferent Accept

Benefit (numerator) Positive Positive Positive Positive Negative Negative Negative Negative

Cost (denominator) Positive Positive Positive Negative Positive Negative Negative Negative

> 1.0

= 1.0 < 1.0 Any Any > 1.0 = 1.0 < 1.0

Table 13 Summary of benefit/cost Benefit/cost method

ratio method

variations Also known Denominator C C c Aggregate B/C ratio and Eckstein Netted B/C ratio No other names found B/C ratio as

Ratio formula Numerator

Conventional B/C Modified B/C Lorie-Savage B/C

B B-O&M B-O&M-C

B = Benefits - disbenefits. 0 & A4 = Operating and maintenance costs. C = Initial cost - salvage value (if any).

Another variation [4, 311. This method

B = benefits

of the benefit/cost ratio method defines B and C as - operating

is the modified

or netted

benefit/cost

ratio method

- disbenefits

and maintenance

costs,

and C = initial cost.

Thus, instead of including all future costs incurred as part of C in the denominator, they are added to and included as a part of B in the numerator. Although this method yields a different numerical result, it does not change the decision to accept or reject a project [1,4]. Therefore, the choice to represent operating and maintenance costs as an incurred cost (conventional method) or as a disbenefit (modified method) will not affect the desirability of a project [12]. A third variation of the benefit/cost ratio method is the Lorie-Savage benefit/cost ratio method [31]. This method is similar to the modified benefit/cost ratio method except that it includes the initial investment as both a cost (or disbenefit) in the numerator and as a cost in the denominator [31]. Therefore, B and C are defined as B = benefits C = initial - disbenefits cost. - O&M costs - initial cost,

D.S. Remer, A.P. Nietollnt.

J Production

Economics 42 (1995) 101-129

107

This methods criteria for determining the desirability of a project are different from the previous two methods. Whereas before, a project was acceptable if the B/C ratio was greater than one, the Lorie-Savage B/C ratio method accepts a project if the B/C ratio is greater than zero. An analogous set of criteria can be determined for this method if the ratio column in Table 12 is changed to read 0.0 instead of 1.0. This method is sometimes understood as a B/C analysis involving no ratio. This is because dividing by the initial cost will not change the sign of the B/C ratio. Therefore, simply evaluating B, as defined for the Lorie-Savage B/C ratio method, will determine the acceptance or rejection of a project based on the same criteria. Depending on whether the benefit/cost ratio method is applied to independent projects or mutually exclusive projects, the manner in which the B/C ratio method is applied may vary. In other words, for independent projects, the B/C ratio method can be applied without the need for more information. However, when evaluating and comparing mutually exclusive projects, an incremental analysis should be used. This simply implies that each project must first be considered on an independent basis. Those that are deemed acceptable are then ranked according to their B/C ratios. Finally, the difference between ratios on an incremental basis is applied [4,12]. Example 10 shows the uses of each of the three variations of the B/C ratio method. The procedure for performing incremental analysis will not be discussed. For information on this type of analysis see refs. [4,11,12,27,32,33,503. Example 10a. Conventional B/C analysis of two projects with equal lives Using the benefit/cost ratio method on a project which does not have any benefits other than dollar profits and does not have any disbenefits other than the initial investment is not very common. For this reason, B/C analysis would normally not be performed on Projects A and B. However, to illustrate how to use these methods, it will be assumed that bene&s refers to all positive cash flows after the initial investment and disbenefts will refer to all negative cash _/lows after the initial investment. Given these assumptions, and using the cash flows from Example 1 or Example 8, the present worth of the benefits of Project A can be expressed as Present worth of the benefits of Project A: PWAr+,,rit, = 375(P/A, i, 4) + 325(P/F, i, 5), where i = MARR = 10%. Solving: PW*B,,ri& = $1391. Present worth of the disbenefits of Project A: PWAui,b,,rit, = 75(P/A, i, 5) Solving: PWA Disbenefits= $284 The initial investment of Project A, IA, equals $1000. The present worth of the salvage value of Project A can be expressed as Present worth of the salvage value of Project A: PWAsalvage = 50(P/F, i, 5) Solving: PWASalvage = $31. According to Table 13, the conventional method defines the B/C ratio as

B C = PWBenefits PWDisbenefits

Initial

Cost - PWSalvage.

Solving: BA: PWAB,,,rit, - PWADi,b,,,fit, = 1391 - 284 = $1107, CA: I, - PWASalvage = 1000 - 31 = $969 The conventional ratio for Project A is then (BA/CA) = (1107/969) = 1.14. is favorable.

Since (BA/CA) > 1, the project

108

D.S. Remer. A.P. Nietollnt.

J. Production

Economics

42 (1995) 101-129

Similarly,

the present

worth

of the benefits

and disbenefits

of Project

B can be expressed

as i, 5)

PW BBenefils= 475(P/F, = $1406

i, 1) + 47_5(P/F, i, 2) + 375(P/F,

i, 3) + 325(P/F,

i, 4) + 125(P/F,

i, 5) = $284 PWBDisbenefits = 75(P/A, Since the salvage values and initial investments Project B can be expressed as BB cg= PWaaenerils - PWBnisbenerifs

fB PWBSalvage

are equal for both projects,

the conventional

B/C ratio for

The conventional

BB

ratio for Project =1122 969

B is then

1406 - 284 1000 - 31

c=

= 1.16.

Again, since BB/Cs > 1, Project B is favorable. However, since BB/CB > BA/CA, Project B should be chosen over Project A. It should be noted that usually when comparing two or more projects, an incremental analysis may be performed. However, this is only useful when the initial investments of each project are different. In this example, the initial investments were identical and, therefore, no incremental analysis was performed. For more information on incremental analysis, see Refs. [4,11,12,27,32,33, SO] or any other engineering economics text book. Although the modified method is different from the conventional method, based on the assumptions made in Example lOa, the numerator of the modified ratio, B, will be exactly the same as that calculated for the conventional B/C ratio method. For this reason, there will be no example of the modified benefit/cost ratio method. However, it is important to recognize that when evaluating projects that have benefits and disbenefits other than just costs and profits, the modified method will provide different ratios, although the same result will be given as to which project is best. An example for the Lorie-Savage benefit/cost ratio method will now be given in Example lob. Example lob. Lorie-Savage B/C analysis of two projects with equal lives Based on the assumptions given in Example lOa, if present worth values Lorie-Savage B/C ratio can be defined as

B -= PWBenefits PWDistxnefits 1

are chosen

for analysis,

the

1 - PWSalvage

Using the results given in Example IOa, it should be clear that, for Project A: BA = 1107 - 1000 = $107, and CA = 1000 - 31 = $969 Therefore, the Lorie-Savage B/C ratio for Project A is BA/CA = (107/969) = 0.11. Similarly, for Project B: BB = 1122 - 1000 = $122, and Ca = 1000 - 31 = $969. Therefore, the Lorie-Savage ratio for Project B is BB/Cs = (122/969) = 0.13. Both Projects A and B are deemed favorable because their ratios are greater than zero. However, B,/CB > BA/CA, Project B should be chosen.

since

D.S. Remer, A.P. Nietolht.

J. Production

Economics

42 (1995) 101-129

109

Depending on the goal of the project, the benefit/cost ratio method yields different results. For example, one goal may be to maximize the B/C ratio and the other may be to maximize the benefits of a project. Therefore, it is important that the goals be well defined to eliminate any unnecessary confusion. One of the difficulties encountered in the benefit/cost ratio method, as well as any other public project evaluation technique, is identifying all the users of the projects. Another problem is identifying all the benefits and disbenefits of the project. Although it was assumed, for simplicity, that the B/C values for benefit/costs analysis were not ambiguous, it is not always easy to quantify all the benefits and disbenefits into dollars or some other unit of measure [27]. D. Profit-to-investment ratio The profit-to-investment ratio method (PIR) measures the total profitability relationship between the total of undiscounted profit to the initial investment. PIR =y, where PIR is the amount of profit per dollar invested, I is the initial investment and p is the resulting profit from I. Another name for this technique is the net income-to-investment method [34]. There is no strict set of criteria for this method. However, as a screening criterion, if the PIR is substituted for i*, then a project may be considered for investment according to Table 10 (see Part 1) [34]. Example 11 shows how to apply the method and criteria. Example 11. Profit-to-investment ratio analysis of two projects with equal lives Using the same cash flows presented in Example 1 or Example 8, the profits (p) for Projects A and B can be expressed as Profit from Project A: pA = 5(300) = $1500, Profit from Project B: &, = 2(400) + 300 + 250 + 100 = $1450. Since the initial investments (I) for both projects equals $1000, their respective PIRs can be expressed as

PIR

of a project by examining Thus, the ratio

the

A. ~

PA IA

4 = B =

(1500 - 1000)/1000

= 50%)

PIR

B. ~

PBIB

(1450 - 1000)/1000

= 45%.

As a screening criterion, both projects have PIRs greater than the MARR (10%). However, since PIRA > PIRB, Project A should be chosen. In addition, this method may prove to be more useful if some minimum PIR criterion is established and/or a minimum number of years to meet this criterion (see payback methods). One of the advantages of this method is that it is easy to calculate and provides of a project. However, a large weakness of this method is that it does not consider E. Savings-to-investment ratio The savings-to-investment ratio method earlier. The ratio can be expressed as an idea of the profitability time value of money [34].

(SIR) is a variation

of the benefit/cost

ratio method

discussed

S1RP(Z) =

P(E)

P(S)

110

D.S. Remer, A.P. Nietolht.

J. Production

Economics

42 (1995) 101-129

where P(I) represents the present worth of the initial investment, P(S) represents the present worth of the projects salvage value (if any), and P(E) represents the present worth of all other project cash flows. This method is used primarily in the public sector, such as the US Department of Defense [ 123. The criteria for accepting or rejecting a project are analogous to that shown for the benefit/cost ratio method in Table 12. Due to the similarity between the savings-to-investment ratio method and the conventional B/C ratio method, no example is presented. However, the SIR method is recognized as a different method for use by government projects which do not necessarily contain benefits, but do incur costs. Thus, the term savings is used because government projects are not expected to produce income the way it is produced in the private sector [12]. The results of the savings-to-investment ratio method can be misleading if they are not used properly. For proper use, the same procedure described for the benefit/cost ratio method should be followed [12].

F. Cost efectiveness In general, cost effectiveness refers to economic efficiency [SO]. The cost effectiveness method (CE) is really a concept for handling projects whose outputs cannot necessarily be understood in terms of monetary units. Although often used in the space and defense industries, or in environmental areas, the cost effectiveness method can be applied in any sector provided the following three conditions apply: (1) Common goals or purposes must be identifiable and attainable. (2) There must be an alternative means of meeting the goals. (3) There must be perceptible constraints for bounding the problem. Perceptible constraints include time, cost effectiveness and anything else which better defines the project [9,54,55]. The steps which define a standardized way for correctly approaching the cost effectiveness method are outlined in Table 14 [9,54,55]. These steps are similar to those outlined in Table 2 (see Part l), except more detailed. The fixed effectiveness approach examines the incurred cost to achieve a certain level of benefit. The fixedcost approach uses the amount of effectiveness at a given cost as a basis for selection. Here, cost usually refers to an amount derived through the net present value criterion method or the life cycle costing method. Example 12 demonstrates the use of the cost effectiveness method [9,54,55]. Although the same example has been applied to each of the previous methods, a different example will be presented for the cost effectiveness method because of its unique application to projects whose values cannot be understood in terms of monetary units.

Table 14 Cost effectiveness (1) (2) (3) (4) (5) (6) (7) (8) (9) (10)

steps [9]

Define the goals State the requirements necessary for attainment of goals Develop at least one alternative which achieves the goals Establish evaluation measures which relate capabilities of alternatives to requirements, such as performance, reliability Select the fixed-effectiveness approach or the fixed-cost approach Determine the capabilities of the alternatives in terms of the evaluation measures Express the alternatives and their capabilities in a suitable manner Analyze the various alternatives based upon the effectiveness criteria and the cost considerations Conduct sensitivity analysis Document all considerations, analyses and decisions from the above nine steps

availability

and

D.S. Renter, A.P. NietoJInt.

J. Production

Economics

42 (1995) 101-129

111

Example 12. Cost effectiveness method Consider the four mutually exclusive Improvement

for four traffic safety improvements [12,56]. highway safety projects shown below: Effectiveness (accidents reduced per year) 32 22 10 16 Cost/Effctiveness (per accident reduced) 848 675 915 762 ($)

cost ($) (equivalent uniform annual cost) 27 150 14 850 9150 12200

L M N 0

Here, cost effectiveness is described as the equivalent annual cost per accident reduced (i.e., the ratio of cost (monetary) to effectiveness (nonmonetary). If we accept the premise that the objective is to maximize cost effectiveness - that is, if we want to select the alternative that minimizes the ratio C/E or maximizes E/C ~ it follows that the preference order for these four alternatives is M > 0 > L > N. The E/C formulation is sometimes known as bang for the buck, especially with respect to military systems. The results given by this method are based upon the goal or objective of the investor. For more information about the application of the cost effectiveness method, see Refs. [9,12,50,54-571.

The methods discussed so far have examined equivalent worths, rates of return, and ratios. The next section describes methods which use the length of time required to achieve certain goals as the determining factor for project evaluation.

ZV. Payback

methods

A. Payback period The payback period method (PP) examines the number of years required for a projects earnings to equal the initial investment. In other words, it is the amount of time required for the project to pay for itself. Thus, the name payback period method [4,49]. The procedure for applying the payback period method is analogous to the procedure for applying the internal rate of return method. The only differences are that: (1) the unknown variable is n and not i, and (2) not all future cash flows need be considered. According to the same two surveys mentioned earlier, the use of the payback period method has decreased from 78% in 1978 to 64% in 1991 [22,23]. Also, most of the companies surveyed reported that they usually use either the net present value criterion method or the internal rate of return method in conjunction with the payback period method. There are two commonly used types of the payback period method. They are the conventional payback period method and the discounted payback period method. We recommend the discounted payback period method. However, the conventional or undiscounted payback period method is sometimes easier to explain to people unfamiliar with project evaluation techniques. The conventional payback period method assumes an interest of O%, while the discounted payback period method usually uses the MARR. The acceptance criterion for this method is usually, but not always, based upon a minimum required payback period. However, in the case of two or more projects, the project with the lowest payback period is usually preferred [l]. The calculation involved when using these methods is shown in Example 13.

112

D.S. Remer, A.P. Nietollnt.

J. Production

Economics

42 (1995) 101-129

Example 13a. Conventional payback period analysis on two projects with equal lives Using the same cash flows given in Example 1 or Example 8, the conventional payback periods for Projects A and B can be calculated by summing their undiscounted cash flows. By examining the undiscounted cash flows at the end of each year for Project A, it is clear that at the end of year 3, an undiscounted total of $900 has been paid back to the project. At the end of year 4, a total of $1200 has been paid back. Therefore, the conventional payback period lies between 3 and 4 years. Since the annual cash flows are equal to $300, the exact payback period can be expressed as follows: 0 = - 1000 + 300nA, where nA is the payback period. Solving, nA is found to be 3.3 years. Similarly, the conventional payback period for Project B can be found to be between 2 years ($800) and 3 years ($1100). Since $800 has been paid back after two years, the additional time to recover the remaining $200 can be expressed as follows: 0 = - 1000 + 800 + 300n, where n represents the additional number of years required to recover the remaining $200. Solving, n is found to be 0.7 years. The total undiscounted payback period, nB, for Project B can then be expressed as 2 + n = 2 + 0.7 = 2.7 years. Therefore, nB = 2.7 years. Since nB < nA, Project B should be chosen. However, any project some established minimum payback period is usually rejected.

whose payback

period

is longer

than

Example 13b. Discounted payback period ana1Jl.G of two projects with equal lives Again, using the same cash flows and 10% MARR given in Example 1 or Example payback period for Project A can be expressed as 0 = - 1000 + 300(P/A, lo%, nA).

8, the discounted

The procedure used to find n, is analogous to that explained under the internal rate of return method. Solving, nA is found to be 4.3 years. Since the annual cash flows for Project B are not equal, the calculation for the discounted payback period of Project B is more complicated than that for Project A. One equation cannot be written and immediately solved. Instead, one equation must be written for each year and then solved. If the project has not been paid back, then a new equation must be written for the next year and so on. For Project B, this can be expressed as follows: Year 1: - 1000 + 400(P/F, The project lo%, 1) = - 1000 + 364 = - $636. 2 years must be examined:

has not been paid back after 1 year. Therefore, lo%,

Year 2: - 636 + 400(P/F, The project

2) = - 636 + 331 = - $305. 3 years must be considered:

has still not been paid back after 2 years, therefore, lo%, 3) = - 305 + 225 = - $80,

Year 3: - 305 + 300(P/F, Year 4: - 80 + 250(P/F, Now, the project discounted payback

lo%, 4) = - 80 + 171 = $91.

has been fully paid back and has even produced an additional $91. Therefore, the period lies between 3 and 4 years. The procedure to find the exact number of years, nB, is

D.S. Remer, A.P. NietoJInt. J. Production Economics 42 (1995) 101-129

113

the same as that used to find the undiscounted 3 years:

number

of years. Summing

the discounted

values over the first

Year 1 + Year 2 + Year 3 = 364 + 331 + 225 = $920. The present worth of the amount earned at the end of the fourth year was found to be $171. Therefore, additional number of years required for Project B to be paid back can be expressed as - 1000 + 920 = - n(171). Solving, n = 0.5 years. Therefore, expressed as

ng =

the

the total

number

of years required

to pay back

Project

B can be

3 + n = 3 + 0.5 = 3.5 years.

Since ?rg < nA, Project B should be chosen. However, as stated in Example 13a, both Projects A and B must have payback periods shorter than some established minimum number of years to be acceptable. Clearly, discounted payback period analysis for projects with equal annual payments is much easier to perform than for projects with unequal annual cash flows. The cash flows of Project B, for example, could not have been annualized using the annual equivalence analysis because only those cash flows before the payback period are to be considered. Thus, the need for tedious and strict year-by-year examination is necessary. However, if the original cash flows are already equal, such as those of Project A, discounted payback analysis becomes much easier to use. One of the disadvantages of this method is that it does not look at cash flows after the payback period. The cash flows after the payback period determine the projects rate of return. Two projects which have the same payback period, but different cash flows after the payback period, may be rated as equally favorable by this method [4,18,32]. To illustrate this point, consider the following two cash flows: Year 0 1 2 3 4 5 Project - $100 S 60 $ 60 $ 0 S 0 S 0 Y Project - $100 S 40 S 40 S 40 S 40 $ 40 Z

Clearly, whether the conventional or modified payback period method is used, Project Y will be selected because it has a shorter payback period than Project Z. However, this is wrong! When the cash flows after the payback period are considered, Project Z obviously becomes recognizable as the better project. For these reasons, the payback period method should be used in conjunction with other methods, such as the internal rate of return method or net present value criterion method. An advantage of this method is that it sometimes provides a quick way of determining the risk of a project based upon the length of the payback period. Also, as with the annual worth method, this method is often easier understood by people without an economics background [18,30,32]. The payback period method is also referred to as the payback time method, the recovery period method, payout period method and the payoff period method [12,13,27,33,37,49]. See Table 15.

114

D.S. Remer, A.P. Nieto Jht. J. Production

Economics

42 (1995) 101-129

Table 15 Terms used to describe Payback method

payback

methods Also known as payout period method, payoff period method

Payback period Project balance

Payback time method, recovery period method, Areas of negative and positive balances

B. Project balance The project balance (PB) method is similar to the payback period method. Instead of computing the number of years until the present worth of future cash flows equals zero, the project balance method calculates the future worth of cash flows at every time period using an investment rate equal to the MARR. Therefore, this method allows the investor to determine the amount of positive or negative total receipts at the end of each time period. When applied to the end of the project, this method is equivalent to the future worth method. The criteria for the project balance method are equal to the net present value criterion listed in Table 5 (see Part 1) [31]. The procedure for computing the project balance of a project is outlined in Example 14.

Example 14. Project balance analysis of two projects with equal lives

Using the same cash flows and 10% MARR Project A can be expressed as: PBA,: - $1000, the project balance at the end of year 1. Similarly, as given in Example 1 or Example 8, the project balance for

where PBAo equals PB*,: PBAZ:

- lOOO(F/P, lo%,

1) + 300 = - $800, lo%, 1) + 300 = - $580, or

- lOOO(F/P, lo%, 2) + 300(F/P, - lOOO(F/P, lo%, 2) + 300(F/A, 3) + 300(F/A,

10%. 2) = - $580, lo%, 3) = - $338,

PB*,: PBA4: PB,,: Similarly,

- lOOO(F/P, lo%,

- lOOO(F/P, lo%, 4) + 300(F/A, - lOOO(F/P, lO%, 5) + 300(F/A,

lo%, 4) = - $72, lO%, 5) = $221, can be expressed as

for Project - $1000,

B, the project

balance

PBBo: PBB1: PB,,:

- lOOO(F/P, lO%, 1) + 400 = - $700, - lOOO(F/P, lo%, - 700(F/P, 2) + 400(F/P, lo%, 1) + 400 = - $370, or,

lO%, 1) + 400 = - $370, lo%, lo%, 1) + 300 = - $107, 1) + 250 = $132,

PBB3: PBB4: PB,,:

- 370(F/P, - 107(F/P, 132(F/P,

lo%,

1) + 100 = $246.

This can be represented graphically as shown in Figs. 3 and 4. Provided that the projects continue throughout their 5-year lives, both projects are favorable according to the net present value criterion listed in Table 5 (see Part 1). Also, the exact number of years in which the

D.S. Remer, A.P. Nietollnt.

J. Production

Economics

42 (1995) 101-129

115

2 Years

Fig. 3. Project

balance

for project

A.

Fig. 4. Project

balance

for project

B.

project balance becomes positive is equal to the discounted payback period. Depending on additional criteria, such as a minimum payback period or a minimum project balance within a certain number of years, the favorableness of these projects may change. However, assuming no additional criteria has been established, since the payback period for Project B, n, is less than the payback period for Project A, nA, Project B should be chosen. While it may seem as though the project balance method offers the exact information as the discounted payback period method, this is not the case. In the project balance method, the net amounts calculated at the end of each period enable the investor to easily observe the annual financial status of the project, whether it is before or after the payback period. Consider the following two cash flows: Year 0 1 2 3 4 5 Project - $75 $35 $35 $35 $0 $0 J Project - $75 $35 $35 $35 $35 $35 K

116

D.S. Remer, A.P. Nieto/Int.

J. Production

Economics

42 (1995) 101-129

Both projects have the same payback period, but different project balances. Therefore, by considering all cash flows, the project balance method provides added insight to the payback period method. Furthermore, this allows the investor to obtain a rough estimation of the amount of risk presented by undertaking a project. The project balance method is also known as areas of negative and positive balances [31]. See Table 15. In each of the four previous sections, the net cash flows used to make the calculations were assumed to have already included depreciation and taxes (i.e., they were after-tax calculations). However, there are some methods which examine the cash flows before taxes have been considered. These are the accounting methods of project evaluation and are presented in the next section.

V. Accounting

methods

There are several accounting or book methods which are primarily accounting concepts of a projects profitability. Among some of the additional items that have not specifically been included are accounting profit, book value, average book value and depreciation. A brief description of these terms is given below. For more descriptive definitions, see Ref. [52]. Accounting profit represents the same amount as the term net profit described in previous methods. It is simply the difference between positive and negative cash flows. Depreciation describes the decline in value of a companys physical assets, such as buildings and equipment, over their useful lives. It is a method of capital recovery for accounting and bookkeeping purposes. Book value represents the initial cost of a project less any accumulated depreciation. Average book value is simply the sum of the annual book values divided by the number of years of the projects useful life [12]. There are several methods for computing the depreciation of a project and thus, different book method results may occur depending on the depreciation method selected. A recent summary of current depreciation rules in the US and the 7 countries with the largest investment from the US and the NAFTA and EC countries is found in Refs. [SS, 591. (NAFTA represents the North American Free Trade Area and EC represents the European Community.) The first of these methods is known as the original book method. It provides a projects rate of return based on the ratio of average annual accounting profit to the original book value of the asset, or project. Another name for this method is the accounting rate of return method [32]. See Table 16. A variation of this method is known as the average book method which obtains a ratio by dividing the average annual accounting profit by the average book value. A second variation of the original book method is known as the year-by-year book method which examines the ratio of the yearly accounting profit to the yearly book value [12]. Each of these methods needs a basis for comparison. Therefore, as a screening technique, if the rate determined is greater than the MARR, the project is accepted. If the rate equals the MARR, the investor is indifferent to the project. Otherwise, the project is rejected [32]. However, as demonstrated in Example 15, the interpretation of these rates of return may not always be clear.

Table 16 Terms used to describe Accounting method

accounting

methods Also known as

Original book method Average book method Year-by-year method Hoskolds method

Accounting rate of return method Average accounting rate of return method Year-by-year accounting rate of return method No other names found

D.S. Remer, A.P. Nietojht.

J. Production

Economics

42 (1995) 101-129

117

Another accounting method is known as Hoskolds method for computing the rate of return. Traditionally used in the mining industry, this method assumes that uniform annual deposits taken from a projects revenues will be invested into a sinking fund at a relatively low rate of return. The value of the fund at the end of an assets useful life should be just enough to replace the asset. Hoskolds rate of return is the ratio of the amount remaining after the sinking fund deposit to the initial investment [12]. Example 15 demonstrates the use of these methods using the original, unadjusted cash flows of projects. Example 15a. Original book method Although the cash flows given in Example 1 or Example 8 did not explicitly include depreciation and tax considerations, it was assumed that they were already adjusted to account for such items. However, when applying these accounting methods, it is necessary to examine the unadjusted cash flows, along with depreciation and tax values. The unadjusted cash flows for both Projects A and B are presented below. For simplicity, a tax rate of 50% will be used. Yr. Project CI GI EXP. CFBT D,(SL) TI Taxes= CFAT NCF

A

(1000) 485 485 485 485 485 (1000) 2425 685 685 485 385 175 (1000) 2415 (75) (75) (75) (75) (75) (375)

610

0

1 2 3 4 5 Total Project

(75) (75) (75) (75) (75) (375)

410 410 410 410 410 2050

(1G) (190) (190) (190) (190) (950)

220 220 220 220 220 1100

(110) (110) (110) (110) (110) (550)

(1000) 300 300 300 300 300 500

(1000) 300 300 300 300 300 500

B

(1000) (190) (190) (190) (190) (190) (950) 420 420 220 120 0 1180 (210) (210) (110) (60) 0 (590) (1000) 400 400 300 250 100 450 (1000) 400 400 300 250 100 450

0

1 2 3 4 5 Total

610 410 310 100 2040

a Assumed

tax rate of 50%. EXP = expenditures; TI = taxable income;

GI = gross income; () denotes negative cash flow; CI = capital investment; CFBT = cash flow before taxes; D, = depreciation; SL = straight-line depreciation; CFAT = cash flow after taxes; NCF = net cash flow. The amount in each column can be calculated as follows: CFBT = GI - EXP, - D,, where tr represents - taxes, the tax rate,

TI = CFBT

Taxes = (TI)(tr), CFAT NCF = CFBT = CFAT.

118

D.S. Remer, A.P. Nieto/lnt.

J. Production

Economics

42 (1995) 101-129

The depreciation amount expressed as follows: D, = BV, - sv n

(DJ in this example

is calculated

using the straight-line

(SL) method.

It can be

where BV, represents the original book value (or initial cost), SV represents the salvage value (if any) and II represents the number of years in the projects life. Other depreciation methods may be used. Also, note that the annual net cash flow (NCF) for each project is equal to the net cashjows given in Example 1 or Example 8. The ratio or rate of return given by the original book method can generally be expressed as OB=AAP BV, ! 9a, the average

where AAP represents the average accounting profit of the project. From Example accounting profit (or average yearly profit, AYP) for Project A was found to be AAPA = $300/year. The original book value of the project is equal to the initial investment. Solving for OBA:

OBA: ~

Therefore,

BV,* is equal to $1000.

AAPA BV,A

= ~

300

1000

30%. given by the original book method can be expressed as

Similarly, OB,=$.

for Project

B, the rate of return

OB

From Example Solving for OBs:

9a, AAPB was found = 29%.

to be $290/year.

BV,B is equal

to the initial

investment

of $1000.

OBB = (290/1000)

Both of these projects have original book rate of returns OBA > OBB, Project A should be chosen. Example 15b. Average book method The average book rate of return (AB) can be expressed AB=AAP ABV

greater

than the MARR

(10%). However,

since

as

where ABV equals the average book value. The average book value depends on the depreciation expressed as follows: ABV = BVO + BVi + BV;! + ... + BV, n+l

method

used. However,

in general,

it can be

where n equals the number of years in the projects life. The formula for finding the book value of a project at some time t is BV, = I - D,, where I equals the initial investment and D, equals the total depreciation accumulated at time t.

D.S. Remet-, A.P. Nietojlnt.

J. Production

Economics 42 (1995) 101-129

119

Example 9b listed the book values for Projects A and B. Since the initial investments methods are equal for both projects, each has the same annual book values. Therefore, A and B, the annual book values are: BVO: I - D,, = 1000 - 0 = $1000, BVr: I - D1 = 1000 - 190 = $810, BV1: I - D2 = 1000 - 380 = $620, BV3: I - D3 = 1000 - 570 = $430, BV4: Z - D4 = 1000 - 760 = $240, BVS: Z - D5 = 1000 - 950 = $50.

and depreciation for both Projects

As calculated in Example 9b, the average book value (ABV) for Projects A and B equals $525. Using the average yearly profit values calculated in Example 15a and solving for the average book rate of return for Project A: ABA: (AAPJABVJ Similarly, AB,: for Project B: = (300/525) = 57%.

(AAPB/ABVB) = (290/525) = 55%. of returns greater than the MARR (10%). However, since

Both projects have average book rate ABA > ABB, Project A should be chosen.

Although the procedures and calculations for the original and average book methods are the same as those presented for the return on original and average investment methods, separate examples were included to illustrate better the concepts of depreciation and book value. Also, the information given in Examples 15a and 15b will be used in Example 15~. Example 1%. Year-by-year method Examples 15a and 15b have presented the yearly accounting profits and book values for Projects A and B. Based upon these yearly values, the year-by-year rate of return (YY) can be expressed by the general formula: YY, = (APJBV,), where, for some time t, AP, represents For Project A, these values are: the accounting profit and BV, represents the book value.

YY,,: (APO/BVO) = (O/1000) = O%, YYr: (APJBVJ YY2: (AP2/BV2) YY,: (AP3/BV3) = (300/810) = 37%, = (300/620) = 48%, = (300/430) = 70%, = (300/240) = 125%,

YY4: (APJBVa)

YYs: (APS/BVS) = (300/50) = 600%.

120

D.S. Remer. A.P. Nietojht.

J. Production

Economics

42 (1995) 101-129

Similarly, YY,:

for Project

B, the year-by-year

rates of return

are

(APO/BVO) = (O/1000) = O%, = (400/810) = 49%, = (400/620) = 65%, = (300/430) = 70%, = (250/240) = 104%, = (100/50) = 200%,

YYr: (AP,/BVr) YY,: YY,: (AP2/BV2) (AP,/BV,)

YY4: (AP,/BV,) YYs: (AP5/BV5)

Clearly, both projects have year-by-year rates of return greater than the MARR (10%). However, there is no strict criteria for judging a profit. Just as with the benefit/cost method discussed earlier, depending on the goals of the project, one project may be more favorable than the other. If the project goal is to maximize the end-year rate of return, then Project A should be chosen since YYSA > YYsB. However, if the goal is to maximize the first-year rate of return, then Project B should be chosen since YYIB > YYIA. Example 15d. Hoskolds method The formula for computing Hoskolds

HRR =

rate of return

(HRR) can be written

as

AW- dp

RV

where AW represents the annual worth of a project (not including initial investment), dp represents the required annual deposit to a sinking fund, and RV represents the replacement value of a project at the end of n years. Here, II represents the number of years in projects life. For simplicity, it will be assumed that the sinking fund offers a rate of return equal to the MARR (10%) and that the replacement value of the project after n years is unchanged. Given these assumptions, it follows that, in order for the sinking fund to return an amount equal to the initial investment after II years, dp can be calculated in the following way: dp = I(FIA, L n),

where I equals the initial investment and i, represents the rate of return offered by the sinking fund. For Project A, the annual worth (AW is equal to $300 and the initial investment, IA, is $1000. The annual required deposit to the sinking fund, dp,, can be calculated as follows: dp,: Therefore, HHR

A.

I,(A/F,

i,, n) = lOOO(A/F, lo%, rate of return

5) = $164. A, HRR*, is

Hoskolds

for Project = 13.6%.

. AWL - dp, RVA Hoskolds B

=

300 - 164 = 1000

Similarly,

HRR

rate of return

for Project

B, HRR,,

can be expressed

as

A% - dp,

RVB initial investments of $1000, equal service lives of 5 years, and equal 10%

Both projects have equal MARRs. Therefore, RVB = RVA = $1000, dp, = dp, = $164.

D.S. Remer, A.P. Nietollnt.

J. Production

Economics

42 (1995) 101-129

121

One way to find the annual the initial investment.

worth, AW; is to first calculate

the present

worth, PWL of all cash flows after

PWB: 4OO(P/F, lo%, 1) + 4OO(P/F, lo%, 2) + 300(P/F, = $1152 Annualizing AW*: Hoskolds PWg over the life of the project: 1152(,4/P, lo%, 5) = $304. for Project = 14%. greater B is then

lo%, 3) + 25O(P/F, lo%, 4) + lOO(P/F, lo%, 5)

rate of return 304 - 164 1000

HRRB =

Both projects have rates of return B should be chosen.

than the 10% MARR, however,

since HRRB > HRRA, Project

Now that each of the different methods for evaluating of the different techniques will be presented.

projects has been explained,

a comparative

example

5. Recap of comparative

example of project evaluation techniques

In this two-part paper, several examples have been presented to help provide a better understanding of the application of each project evaluation method. When combined, these examples serve as one comparative example. This section summarizes their results. There were many assumptions and simplifications made to reduce the complexity of the examples. Therefore, this comparative example serves only as minimal guideline for the basic use of each technique. For a more detailed explanation of projects with more realistic and complicated cash flows, interest rates, etc., see the references at the end of this paper. The comparative example used throughout this paper contained only two projects: Project A and Project B. The purpose for choosing to use the same projects (as well as same cash flows) on every example presented was to provide a consistent means for comparing how each of the methods would determine which (if any) project(s) should be accepted. Also, by choosing not to use a different set of cash flows for every example, more insight can be gained by comparing and contrasting project evaluation methods. Let us recap our comparative example. First, we assumed that the company conducting the project evaluation analysis was interested in purchasing a new system for the price of $1000. Second, we assumed that were only two systems of interest: Project A and Project B. Third, we assumed a MARR of 10%. Finally, we assumed that the company was interested in using every technique presented in this paper, whenever possible, to evaluate Projects A and B. Table 17 summarizes the results of each of the project evaluation methods used. No examples for the life cycle costing, maximum prospective value criterion, modified benefit/cost ratio, or savings-to-investment ratio method were presented because of their great similarities to other techniques when considering the assumptions made above (see earlier discussion). (Note: The cost effectiveness method could not be applied to Projects A and B. However, a short discussion of the cost effectiveness method was presented in Example 12.) From Table 17, it is clear that each of the net present value methods yielded the same result: They all selected Project B over Project A. Also, note that all four methods used the time value of money (TVM) and the minimum attractive rate of return (MARR). Although examples for the life cycle costing method and

122

D.S. Remer, A.P. NietoJInt. J Production Economics 42 (1995) 101-129

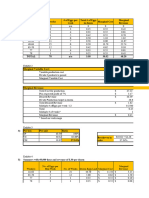

Table 17 Summary of comparative Project 1 2 3 4 5 6 I 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 evaluation method

example Example la 2 3 4 None None 5 6 7 8 9a 9b 10a None lob 11 None 12 13a 13b 14 15a 15b 1% 15d Use TVM? Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No No Yes Yes Yes

No

Use MARR Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes Yes No Yes Yes Yes Yes Yes Yes

Project B B B B N/A N/A B B B B A A B N/A B A N/A N/A B B B A A A B

selected

Present worth Future worth Annual worth Capitalized worth Life cycle costing Maximum prospective value criterion Internal rate of return External rate of return Growth rate of return Premium worth percentage Return on original investment Return on average investment Conventional benefit/cost ratio Modified benefit/cost ratio Lorie-Savage benefit/cost ratio Profit-to investment ratio Savings-to-investment ratio Cost effectiveness Conventional payback period Discounted payback period Project balance Original book method Average book method Year-by-year book method Hoskolds rate of return making criteria.

Yes Yes No Yes Yes No No No Yes

a used only for decision

maximum prospective value criterion method were not presented, because of their close similarity to NPV, the results would have been identical to those given by present worth, future worth, annual worth and capitalized worth method. By examining the rate of return methods, we find that once again, Project B is favored. Also, as with NPV, each of the rate of return methods used TVM and the MARR. By looking at the ratio methods, we see that the premium worth percentage method has also selected Project B. Notice that it also considers TVM and uses the MARR. However, in examining the return on original and average methods, we see that, for the first time, Project A was favored over Project B. Notice that, unlike the other methods covered thus far, the return on investment method does not use TVM and uses the MARR only for decision making purposes. By observing the results for the benefit/cost ratio method, we find that both the conventional benefit/cost ratio method and the Lorie-Savage benefit/cost ratio method have also chosen Project B. Both methods use TVM and the MARR. Although examples for the modified benefit/cost ratio method and the savings-toinvestment ratio method were not presented, their results would have also favored Project B, due to their similarity to the conventional benefit/cost ratio method. Just as with the return on investment method, the profit-to-investment ratio method, does not use TVM and only incorporates the MARR as part of its decision making criteria. Consequently, it chose Project A over Project B. In examining the conventional payback period method, we find that just as with the profit-to-investment ratio method, it neither considers TVM, nor does it use the MARR. Yet, it correctly chose Project B (more on

D.S. Remer, A.P. Nietollnt.

J. Production

Economics

42 (1995) 101-129

123

this later). The discounted payback period method, which does include the use of TVM and the MARR, also chose Project B. The same is true of the project balance method. Finally, in examining the accounting methods, we see that the original book, average book and year-byyear methods do not use TVM and only use the MARR for decision-making criteria purposes. Consequently, all three methods favored Project A. Hoskolds rate of return method, which uses both TVM and the MARR, correctly selected Project B over Project A. From Table 17, it is clear that most of the project evaluation techniques, including the net present value methods and the internal rate of return method, correctly selected Project B over Project A. The only project evaluation techniques which selected Project A over Project B were the return on investment (both original and average) method, the profit-to-investment ratio method and the book methods (original, average and year-by-year). Also, note than none of these methods consider TVM and none incorporate the MARR in its calculations. The error in choosing Project A can therefore be attributed to the lack of TVM and the MARR considerations in their calculations. Generally, project evaluation methods which do not consider these two important factors in their calculations should always be used in conjunction with other techniques. Sometimes, however, projects which do not consider TVM or incorporate the MARR in either its calculations or its decision-making criteria can, fortunately, yield the same results as NPV or the internal rate of return method. Consider the conventional payback period method (Example 13a). This technique ignores both TVM and the MARR, yet it correctly selects Project B over Project A. To explain this, we must recall the limitations of the payback period methods. One disadvantage of this method is that it does not consider any cash flows after the payback period. When examining the cash flows of these two projects, we see that Project B earns most of its revenue in the first 3 years. Therefore, it makes sense that the payback period, as calculated by this method will be short in comparison to the projects full life. If Project B earned most of its revenue in the last 3 years instead of the first three, Project A would have clearly been preferred by this method. This illustrates the drawbacks of using the payback period method. In actual practice, the results of this method should be compared with those of NPV or the internal rate of return method. Many of the project evaluation methods correctly selected Project B over Project A. Most of these methods, such as NPV, internal rate of return method and the benefit/cost ratio method, give independent results which do not usually need other methods to verify their results. In other words, as described in Table 18, these methods can be used alone. However, it is usually desirable to use more than one technique when evaluating any project.

6. Comparison

and summary of project evaluation

techniques

In this two-part paper, 25 different methods and techniques used to evaluate the economic desirability of projects were divided into 5 types: net present value methods, rate of return methods, ratio methods, payback period methods, and accounting methods. Table 18 shows some of the basic differences and similarities among each of the project evaluation methods discussed in this paper. The highlights of this comparison are: Net present value methods (NPV) and the internal rate of return method provide the essential analysis techniques used by most all other methods. NPV ignores sizes of projects. Only NPV, life cycle costing, maximum prospective value criterion, internal rate of return, external rate of return, benefit/cost ratio, savings-to-investment ratio, and cost effectiveness method are considered to yield independent results (i.e., these methods usually do not need to be used in conjunction with other methods). However, it is usually desirable to use two or more methods for analyzing a project. Life cycle costing, benefit/cost ratio, savings-to-investment ratio and cost effectiveness are methods used primarily in the public sector.

l l l l

Table 18 techniques Use MARR? Can be used alone? Used mostly by Uses Advantages Disadvantages

Comparison Use TVM?

of project evaluation

Project evaluation method Yes Yes Yes Private sector Discounts all cash flows to present date Shows present consequence of the project

Type

Present

worth

NPV

(PW)

Ignores size of project repeated projects assumption; usually not understood by people unfamiliar with engineering economics Same as above

Future

worth

NPV

Yes Private sector Private sector Compounds all cash flows to a future date

Yes

Yes

(FW) Yes Converts all cash flows to a series of equal, usually annual cash flows Yes Yes

Shows future consequence of the project

Annual

worth

NPV

(AW)

Shows yearly consequence of the project; easily understood by people unfamiliar with engineering economics Shows yearly consequence of infinite-lived project

Ignores size of project; repeated project assumption

Capitalized worth

NPV

Yes Private sector

Yes

Yes

Ignores

size of project

(CW) Yes Public sector Yes Yes

Determines equal, usually annual, cash flows equivalent of an infinite lived project Like PW, but more detailed

Life cycle costing

NPV

Considers more costs and is more thorough than PW

Same as listed in PW above

(LCC) Yes Private sector Yes Yes Like PW, but uses an intermediary i-rate Additional i-rate maximizes capital growth rate more than PW Many short-term investments must be considered; determination of additional cash flows is complex Private sector Finds rate of return for which PW equals zero No external considered factors are Assumption of reinvesting at IRR may be unrealistic; multiple roots Yes Private sector Like IRR, except assumes cash flows are reinvested at MARR Often calculates a more realistic rate of return than IRR More conservative IRR. than

Maximum prospective value criterion (MPVC)

NPV

Internal rate of return (IRR)

RR

Yes

Yesa

Yes

External rate of return

RR

Yes Yes

(ERR)

Growth rate of return (GRR)

No Yes Yes No

RR

Yes

Yes Private sector Private sector Private sector Private and public sectors Like PWP, but PW of benefits to cost or initial investment Easy to calculate Like PWP, but averaged and no TVM Gives averaged results Ignores TVM Determines net profit percentage ratio of PW to initial investment Simple to calculate Never really compares the present worths of projects.

Like IRR, but finds rate of return for which the FW equals zero Depends solely upon the time period chosen for analysis

Gives a rate of return a project promises to yield at a future date

Premium worth Ratio percentage (PWP)

No Yes No

Return on investment (ROB

Yes Yes Yes

Ratio

Benefit/cost (B/Cl

Ratio

Sometimes difficult to identify and quantify all benefits and disbenefits into dollar amounts; also difficult to identify all users of the project. Ignores TVM; no strict set of criteria

Profit-toinvestment ratio (PIR) Yes Yes

Yes

Ratio

No Yes No

Private sector

Like PWP, but not discounted

Provides easy idea of profitability

Savings-toinvestment ratio (SIR) Yes

Yes Yes

Ratio

Public sector

Like B/C, but used mainly by the government

Concept for projects which do not necessarily contain benefits, but do incur costs. Serves as alternative to finding monetary equivalent of products Offers quick determination of risk; easily understood by people unfamiliar with engineering economics

Results misleading if not used properly

cost effectiveness (CE)

YeP No Yesb

Ratio

Public sector

Concept for projects whose products or results can not be put in monetary terms Finds number of years for projects earnings to equal its investment Like PP, but gives a year-by-year analysis

There must be an alternative means of meeting the goal Ignores cash flows after the payback period; may yield mis-leading results Allows easy observation of annual financial status; gives rough estimation of risk involved No strict set of criteria

Payback period (PP)

Yes No Yes

Payback

Private sector

Project balance (PBJ

No No

Payback

Private sector

Original book COB)

Acct.

Private

Like ROI, but uses concepts of book value and depreciation

Considers depreciation and book values

Ignores TVM; calculations can be long and tedious; results may be mis-leading.

Table 18 (continued) Use TVM? Advantages Use MARR? Can be used alone? Used mostly by Uses Disadvantages

!z

Project evaluation method No Same as above Yes No Same as above Same as above Private sector Private sector Like OB and AB, but gives year-by-year analysis Same as above Considers profit after the project has been replaced

Type

Average book (AB) No Yes No

Acct.

Year-by-year

Acct.

Same as above.

(YY) Yes Yes No Private sector Determines rate of return of revenue (minus sinking fund deposit) to replacement cost

Hoskolds rate of return

Acct.

Repeated projects assumption

(HRR)

a MARR used in decision-making criteria only. b Applies only to modified method, not conventional.

D.S. Remer, A.P. Nietollnt.

J. Production

Economics

42 (1995) 101-129

127

Return on investment, profit-to-investment ratio, payback period (conventional only), original book, average book and year-by-year method ignore time value of money (TVM). Only the conventional payback period method does not incorporate the minimum attractive rate of return (MARR) in either its calculations or its decision criteria. The internal rate of return method sometimes yields multiple root solutions. For small companies with high calculated internal rates of return, the external rate of return method offers a better, more realistic result than the internal rate of return method. The results of the annual worth and payback period method are easily understood by people who are unfamiliar with engineering economics. . Profit-to-investment ratio, payback period and project balance method all offer quick analysis and rough estimations of the amount of risk and profitability of a project. A major disadvantage of the payback period method is that it ignores all cash flows after the payback period. Also, only the modified method uses the MARR (i.e., it uses TVM). Original book, average book and year-by-year methods explicitly incorporate the use of depreciation, book values, and other accounting concepts. Only the payback period and project balance method use the length of time after a projects start as a main consideration in decision making criteria. The benefit/cost ratio method requires the sometimes difficult task of quantifying all costs into monetary terms, while cost effectiveness provides an alternative method for those projects that cannot be quantified into monetary terms. The savings-to-investment ratio method is used almost exclusively in the public sector for those projects which do not necessarily contain benefits, but do incur costs. According to both the 1978 and 1991 surveys described in Part 1 of this two-part paper, the two most commonly used and relied upon methods are the net present value methods (NPV) and the internal rate of return method. These two methods provide the backbone for most all other project evaluation techniques. The results given by NPV or the internal rate of return method (or a slight variation of those results) are used by all the other methods discussed in this paper. Also, each of these other methods offer some additional insight through unique advantages, as well as disadvantages, when used in conjunction with either NPV or the internal rate of return method. A comparative example of two projects was also presented to illustrate the effects of the varying techniques and their applications. The results of the comparison showed that most of the project evaluation techniques, including the net present value criterion method and the internal rate of return method, correctly selected Project B over Project A. The only project evaluation techniques which incorrectly selected Project A over Project B neither considered TVM nor the MARR in their calculations. In general, techniques which do not consider these two important factors in their calculations should be used in conjunction with other techniques which do use TVM and the MARR.

l l l l l l l l l l

References

[l] Au, T. and Au, T.P., 1992. Engineering Economics for Capital Investment Analysis, 2nd ed. Prentice-Hall, Englewood Cliffs, NJ. [2] Almond, B. and Remer, D.S., 1979. Models for present worth analysis of selected industrial cash flow patterns. Eng. Process Econ., 4: 455. [3] Almond, B. and Remer, D.S., 1980. Present worth analysis of capital projects using a polynomial cash flow model. Eng. Process Econ., 5: 33. [4] Blank, L.T. and Tarquin, A.J., 1989. Engineering Economy, 3rd. ed. McGraw-Hill, New York. [S] Grant, E.L., Ireson, W.G. and Leavenworth, RX, 1990. Principles of Engineering Economy, 8th ed. Wiley, New York. [6] Newman, D.G., 1991. Engineering Economic Analysis, 4th ed. Engineering Press, San Jose, CA. [7] Remer, D.S., Tu, J.C., Carson, D.E. and Ganiy, S.A., 1984. The state of the art of present worth analyses of cash flow distributions. Eng. Costs Prod. Econ., 7: 257.

128

D.S. Renter, A.P. Nietollnt.

J. Production

Economics

42 (1995) ICI-129