Professional Documents

Culture Documents

Laxman Behra DefenceProcurement

Uploaded by

Yash NaudiyalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Laxman Behra DefenceProcurement

Uploaded by

Yash NaudiyalCopyright:

Available Formats

IDSA Issue Brief

A Critical Review of Defence Procurement Procedure 2011

Laxman Kumar Behera

IDSA ISSUE BRIEF

1

Laxman Kumar Behera is Research Fellow at the Institute for Defence Studies and Analyses, New Delhi

January 25, 2011

Summary

The Defence Procurement Procedure-2011 (DPP-2011) which came into force on January 1, 2011, incorporates important changes aimed at simplifying procedures, speeding up procurement and enhancing benefits for the Indian defence industry. New guidelines for shipbuilding by private shipyards on competitive basis have been included. New categories have been added to the product list for offsets, namely, Civil Aerospace, Internal Security and Training. Other changes have been incorporated with respect to the validity of Request for Proposal (RFP), post accord of Acceptance of Necessity (AON), Exchange Rate Variation (ERV), the constitution of a Technical Oversight Committee (TOC), Transfer of Technology (ToT) for Maintenance Infrastructure, Trial Evaluations, Performance and Warranty Bond, and Fast Track Procedure. Notwithstanding these changes, DPP-2011 has failed to usher in reforms in some critical areas. Despite recommendations by the Group of Ministers and the Comptroller and Auditor General of India, the new document, like its previous versions, has not focussed on strengthening the acquisition structure and enhancing the quantity and quality of acquisition functionaries. DPP-2011 does not focus enough attention on bringing about parity in the categorisation process, adopting a more dynamic offset policy, enhancing foreign direct investment in defence, and eliminating the practice of discrimination between the public and the private sectors. In the absence of reforms in these areas, DPP-2011 may not be able to achieve its stated objectives of expeditious procurement and greater involvement of domestic industry in defence production.

A Critical Review of Defence Procurement Procedure 2011

Introduction

On January 06, 2011 the Ministry of Defence (MoD) released the Defence Procurement Procedure 2011 (DPP-2011), which formally supersedes DPP-2008 and its 2009 amended version. Based on experience and feedback of these earlier DPPs, DPP-2011 has refined some earlier provisions and also added a few new ones. Defence Minister A.K. Antony, e in his foreword to the new document, has stated that the revised provisions are aimed at expediting decision making, simplification of contractual and financial provisions and also to establish a level playing field for the Indian defence industry, both public sector and private sector.

Highlights of DPP-2011

The major refinements of DPP-2011 relate to two issues, one pertaining to naval shipbuilding, and the other to offsets. As regards naval shipbuilding, Chapter III of DPP-2011 now contains two sets of guidelines as compared to the single set of guidelines in DPP-2008. Section A of Chapter III of DPP-2011 incorporates provisions that would be applicable exclusively for government-owned shipyards on nomination basis, while provisions in Section B are meant primarily for private shipyards although they apply equally to stateowned shipyards on a competitive basis. The Defence Ministry hopes that Section B would encourage participation of the private shipyards and promote indigenisation and self-reliance in warship construction. The modifications to the offset provisions relate to expansion of the list of products which could be utilised by the foreign companies for discharging their offset obligations. The earlier List of Defence Products has been expanded under the new name List of Products Eligible for Discharge of Offset Obligations and includes two new categories: Products for Internal Security and Civil Aerospace Products. The DPP-2011 now has 27 categories of products (in comparison to 13 categories in DPP-2008), which could be used for offsets (see Annexure-I). It is noteworthy that the revised product list in DPP-2011 is exclusive of certain services which could also be resorted to by the foreign companies to discharge their mandatory offset obligations. According to the revised guidelines, for the purpose of discharge of offsets, services will mean maintenance, overhaul, upgradation, life extension, engineering, design, testing of eligible products as indicated in [the expanded eligible product list] and training. Training may include training services and training equipment (e.g. simulators) but excludes civil infrastructure. The MoD is optimistic that the expanded

IDSA Issue Brief

product list and inclusion of services and training in the offset ambit will provide a wider range of offset opportunities to vendors participating in defence procurements and encourage building up of indigenous manufacturing in crucial areas. The DPP-2011 has also brought about several other changes, pertaining to Request for Proposal (RFP), Transfer of Technology (ToT) for Maintenance Infrastructure, Technical Oversight Committee (TOC), Trial Evaluation, Exchange Rate Variation (ERV), Performance and Warranty Bond, and Fast Track Procedure among others. The changes to provisions in DPP-2008 and the comments thereof are summarised in the Table at Annexure-II.

Critique of DPP-2011

Weaknesses Related to Institutional and Human Resource (HR) Aspects Like in previous DPPs, the major weakness of the DPP-2011 is its lack of focus on institutional and human resource aspects, which are crucial for efficient acquisition. Institutionally, the importance of a strong acquisition body was advocated by the Group of Ministers (GoM) in 2001 in its Report on Reforming the National Security System. The GoM had recommended creation of a separate and dedicated institutional structure to undertake the entire gamut of procurement functions to facilitate a higher degree of professionalism and cost-effectiveness in the process. However this vital recommendation has been only partially implemented, by setting up an Acquisition Wing. Vital acquisition functions such as formulation of Qualitative Requirements (QRs), and trial and test evaluations are not part of its functions, resulting in diffusion of accountability and its attendant weaknesses. This has been highlighted by the Comptroller and Auditor General of India (CAG), who in a 2007 report pointed out systemic weaknesses in Armys acquisitions which included inter alia, delays in acquisition; lack of effective coordination among the services in procurement of common items/capabilities; major drawbacks in the formulation of QRs; deficiencies in the process of technical and trial evaluations. Reiterating the GoMs recommendation, the CAG has suggested an integrated defence acquisition organisation incorporating all the functional elements and specialisation involved in defence acquisition under one head. Although nearly a decade has passed since the GoM made its recommendation and four years since the CAG made its observations, the successive DPPs, including the 2011 version, have failed to act upon them.

A Critical Review of Defence Procurement Procedure 2011

MoDs procurement budget, which is Rs. 43,800 crore for 2010-11, is expected to grow in double digits every year in the coming decade and beyond. It is, therefore, important that this huge sum of tax payers money is spent efficiently. This would require setting up of a strong acquisition wing and providing adequate number of functionaries for acquisitions who possess the required domain knowledge in their respective fields. The DPPs of e successive years have not paid adequate attention to these vital aspects. As it currently stands, the numbers of functionaries responsible for acquisitions in both the MoD and the Services are not only grossly inadequate but also perform their duty on tenure posting which does not extend for more than three years. Moreover, with no prior training they are left to learn on the job because of which the majority find it difficult to do justice to the task that lies before them. Considering that apart from the rules and guidelines, it is the people who make a huge difference in any transaction, the DPP needs to focus on this vital aspect too. Too Many Procurement Categories Although not a new provision, the DPP-2011 has formally included one more procurement category Buy and Make (Indian) - which was announced in the 2009 Amendments to DPP-2008. With the new category formally incorporated in DPP-2011, there are now four broad categories the other three being Buy, Buy and Make, and Make. The subcategories under Buy are Buy (Global) and Buy (Indian); and Strategic, Complex and Security Sensitive Systems, Buy Indian (Low technology mature systems), and Make under Make procedure (see Annexure-III for various aspects of Indias defence procurement categories). In other words, in DPP-2011, there are seven categories or sub-categories that have to be evaluated by the categorisation committee of the MoD, before zeroing in on a particular category through which a weapon system would be procured. However, what makes the whole process of categorisation an uphill task, are the distinct conditions and processes under each of the categories/sub-categories. As a result, the relatively easier options such as Buy and Buy and Make are often preferred over the more complex categories, Make or Buy and Make (Indian), which are critical for the development of the indigenous defence industry. Since one of the objectives of the DPP-2011 is to promote domestic industry though a greater share in procurement, the categorisation process should take this into account, and orient itself towards development of the domestic industry. Liberal yet Conservative Offset Policy The expansion of the eligible product list for offsets in the DPP-2011 has further liberalised the offsets provisions which include features such as complete freedom to the foreign original equipment manufacturers (OEMs) to (1) choose their Indian partners, (2) change

IDSA Issue Brief

them in exceptional cases (3) choose any combination of methods for discharging their offset obligations (the foreign OEMs are allowed to discharge their offset obligations by either direct and/ or indirect purchase of defence products and services produced by Indian defence industry or by way of direct investment in Indias defence industrial infrastructure, including R&D). However this liberal face of the offset policy is still marked with some degree of conservatism, especially with regard to provisions such as multipliers, technology transfer and banking period. In contrast to acceptable global practices, the offset guidelines in DPP-2011 do not allow the provisions of multiplier and technology transfer through offset route. The conservatism is partly driven by the fear of being dumped with redundant technologies and partly because of lack of a strong monitoring system. However, these obstacles need to be overcome to get the maximum benefit out of the offset route. For example, multipliers could be given on a select list of technologies, so as to infuse greater interest among the foreign companies to transfer such technologies which they are otherwise reluctant to pass on. As regards banking of offsets, which could be utilised for discharging future obligations, the present validity period (two-and-a-half years) is too less to attract prior investment. Considering that the banking provision is meant for engaging foreign companies in India for a long time, the time period may be suitably extended. Confusion over DPPs Version In addition to the changes in the product list, the DPP-2011 has also made a minor but significant alteration in its introductory language pertaining to the offset procedure. In contrast DPP-2008, which made a clear statement that the procedures contained in the document are binding on all resultant offsets, the DPP-2011 does not mention such binding provisions. Rather it states that the provisions in the DPP concerning offsets will be implemented ... in the manner elaborated in the new document. The key omission of the term 2011 from the introductory part which seems to be deliberate may however carry a different meaning for different people. For some, it could mean that the offset proposals made before the commencement of DPP-2011 (i.e., January 01, 2011) could be considered for revision to take into account the expanded list of defence products eligible for discharge of offset obligations. For others, there may be no need to revise the offsets because Paragraph 77 of Chapter I of DPP-2011 states that those cases in which RFPs have been issued before the start of DPP-2011 would be processed as per the guidelines of DPP-2008. Given the above situation, the MoD may like to clarify which interpretation is correct.

A Critical Review of Defence Procurement Procedure 2011

Limited FDI Provision Although a decision to change the FDI policy is beyond the purview of the DPP, provisions such as Buy and Make (Indian) and offsets, which are intended to promote the domestic industry through active collaboration with foreign companies, are unlikely to work optimally unless the present FDI policy is reviewed. Evidence shows that the current e defence FDI policy, which allows up to 26 per cent equity stake in any Indian defence industrial venture, has failed to bring in any meaningful financial and technological dividends. The failure is primarily because of the reluctance of the foreign players to commit anything to a joint venture (JV) in India in which they have little control. Considering that collaboration with foreign companies in the defence industrial sector is one of the objectives of the DPP, a suitable revision of the FDI cap is necessary to meet the stated objectives. Discrimination between Private and Public Sectors Historically, the Indian private sector has been subject to discrimination vis--vis the defence public sector undertakings (DPSUs) and ordnance factories (OFs) for a variety of reasons. The reforms to this effect, which started with the 2001 decision to open up the defence industry to the private sector, and subsequently, through a variety of DPP-led measures, have not been able to eliminate this weakness. The private companies apprehend that their counterparts under the administrative control of the MoD still enjoy an unfair advantage over them. To some extent, this apprehension is driven by the MoDs right to nominate its own enterprises for supply orders in certain cases. The DPP-2011, which has taken bold initiatives in broadening the level playing field between private and public sector companies, has not completely done away with the nomination rights. This is evident from the provisions relating to ToT for maintenance infrastructure and the new shipbuilding guidelines. Between these two, the latter is more serious, given its larger impact on private shipbuilders. By separating the shipbuilding guidelines into two sections - one for government owned entities and the other for the private sector - the DPP-2011 has created a situation whereby whatever cannot be nominated to government shipyards would be offloaded to the private sector on competitive basis. In other words, while private sector is subject to competition for the residual orders, their public sector counterpart shipyards are to be awarded the prime contracts on the basis of their capacity, so that their order book remains full all the times. However, what is unclear behind such perceived favouritism is the MoDs larger objective. If the objective is to develop a strong and selfreliant domestic defence industry, the DPP should enunciate a uniform set of guidelines, which are applicable equally to both the private and public sectors purely on the basis of merit.

IDSA Issue Brief

Conclusion

The DPP-2011, which supersedes its earlier versions and amendments with effect from January 01, 2011, has incorporated several new provisions and revised some. The revised provisions, especially those related to validity of RFPs, offsets, ToT for Maintenance Infrastructure, Technical Oversight Committee, Performance and Warranty Bond, Fast Track Procedure, Exchange Rate Variation, Trial Evaluation, are welcome changes that would together help expedite defence acquisition, and push for higher defence industrialisation in India. The positive changes notwithstanding, the latest DPP falls short of several accounts. As is the case with its previous versions, the new document has focussed only on the procedural issues, without any attention to the institutional aspects. As has been pointed out by the CAG, the present acquisition structure is not geared for greater efficiency. The weakness of the structure is further compounded by lack of adequate and trained manpower. The MoD needs to factor in these issues in the DPP-2013 to ensure greater efficiency in acquisition. The DPP-2011 has also not paid enough attention to bring parity in the procurement categorisation process, adopt a more dynamic offset policy, indicate any change in the current FDI policy in the defence sector and eliminate completely the discrimination between the private and public sector enterprises. Since these weaknesses have a bearing upon different facets of acquisition, they also need to be addressed.

A Critical Review of Defence Procurement Procedure 2011

Annexure-I

List of Products Eligible for Discharge of Offset Obligations Defence Products e 1. Small arms, mortars, cannons, guns, howitzers, anti-tank weapons and their ammunition including fuses. 2. Bombs, torpedoes, rockets, missiles, other explosive devices and charges, related equipment and accessories specially designed for military use, equipment specially designed for handling, control, operation, jamming and detection. 3. Energetic materials, explosives, propellants and pyrotechnics. 4. Tracked and wheeled armoured vehicles, ves and aircraft equipment, related equipment specially designed or modified for military use, parachutes and related equipment. 7. Electronics and communication equipment specially designed for military use such as electronic counter measure and counter counter measure equipment, surveillance and monitoring, data processing and signalling, guidance and navigation equipment, imaging equipment and night vision devices, sensors. 8. Specialized equipment for military training or for simulating military scenarios, specially designed simulators for use of armaments and trainers. 9. Forgings, castings and other unfinished products which are specially designed for products for military applications and troop comfort equipment. 10. Miscellaneous equipment and materials designed for military applications, specially designed environmental test facilities and equipment for the certification, qualification, testing or production of the above products. 11. Software specially designed or modified for the development, production or use of above items. This includes software specially designed for modelling, simulation or evaluation of military weapon systems, modelling or simulating military operation scenarios and Command, Communications, Control, Computer and Intelligence (C4I) applications. 12. High velocity kinetic energy weapon systems and related equipment. 13. Direct energy weapon systems, related or countermeasure equipment, super conductive equipment and specially designed for components and accessories.

IDSA Issue Brief

Products for Internal Security 1. Arms and their ammunition including all types of close quarter weapons. 2. Protective Equipment for Security personnel including body armour and helmets. 3. Vehicles for internal security purposes including armoured vehicles, bullet proof vehicles and mine protected vehicles. 4. Riot control equipment and protective as well as riot control vehicles. 5. Specialized equipment for surveillance including hand held devices and unmanned aerial vehicles. 6. Equipment and devices for night fighting capability including night vision devices. 7. Navigational and communications equipment including for secure communications. 8. Specialized counter terrorism equipment and gear, assault platforms, detection devices, breaching gear, etc. 9. Training aids including simulators and simulation equipment. Civil Aerospace Products 1. All types of fixed wing as well as rotary aircraft including their air frames, aero engines, aircraft components and avionics. 2. Aircraft design and engineering services. 3. Technical publications 4. Raw material and semi-finished goods. 5. Flying training institutions and technical training institutions (excluding civil infrastructure).

A Critical Review of Defence Procurement Procedure 2011

10

Annexure-II

Some Other Changes in DPP-2011

e

DPP-2008 Paragraph 20 of Chapter I: Acceptance of Necessity (AON) would lapse where the RFP for approved quantity is not issued within two years from accord of AON Changes in DPP-2011 Paragraph 20 of Chapter I: For cases where the original RFP has been issued within two years from accord of AON and later retracted for any reason, the AON would continue to remain valid, as long as the original decision and categorisation remain unchanged, provided the subsequent RFP is issued within one year from the date of retraction of original RFP Paragraph 28 of Chapter I: The Indian entity could be a company incorporated under The Companies Act 1956, including DPSUs or entities like OFB/Army Base Workshops/Naval Dockyards/Base Repair Depots of Air Force. Comments The extension of validity would save processing time, which is quite significant given the file movements across cross sections of decision/approval points within the Armed Forces and MoD. For the private sector, the deletion of the term RURs in the revised paragraph leaves the chance of getting in to maintenance business to those companies who are registered under the Companies Act. The nomination approach could be a hindrance in the getting. It is to be noted the MoD has so far not announced the RURs since the DPP-2006 announced detailed guidelines first reference to it. The DPP-2011 has retained these guidelines The extension of grace period may retain participation of some companies who have genuine difficultly in fielding their equipments in the originally stipulated time period

Paragraph 28 of Chapter I: For transfer of technology (ToT) from foreign companies to Indian companies for maintenance infrastructure, the Indian firms would be DPSUs/OFB/Raksha Udyog Ratnas (RUR) or any other firms as selected by the Department of Defence Production

Paragraph 41 of Chapter I: Any vendor failing to produce equipment for trials by due date would normally be given a grace period of 15 days to produce the equipment for trials. However, if the equipment is not evaluated in the initial trials then the vendor/equipment would not be considered at a later point of time. Paragraph 46 of Chapter I:

Paragraph 41 of Chapter I: Any vendor failing to produce equipment for trials by due date would normally be given a grace period of 15 days to produce the equipment for trials. An additional grace period of up to 30 days may be obtained by Service Headquarters from their respective Vice Chief keeping in view the practical time period necessary for trials

Paragraph 46 of Chapter I: A TOC

Senior and experienced

IDSA Issue Brief

11

Paragraph 41 of Chapter I: Any vendor failing to produce equipment for trials by due date would normally be given a grace period of 15 days to produce the equipment for trials. However, if the equipment is not evaluated in the initial trials then the vendor/equipment would not be considered at a later point of time. Paragraph 46 of Chapter I: The Technical Oversight Committee (TOC) will comprise of 3 members, one Service Officer, one DRDO scientist and one representative of DPSU not involved with that acquisition Annexure III to Appendix F (Guidelines of protection of Exchange Rate Variation (ERV) in Contracts with Defence PSUs): Defence PSUs are allowed to insert ERV clause in both Buy (Global) and Buy (Indian) contracts

Paragraph 41 of Chapter I: Any vendor failing to produce equipment for trials by due date would normally be given a grace period of 15 days to produce the equipment for trials. An additional grace period of up to 30 days may be obtained by Service Headquarters from their respective Vice Chief keeping in view the practical time period necessary for trials

The extension of grace period may retain participation of some companies who have genuine difficultly in fielding their equipments in the originally stipulated time period

Paragraph 46 of Chapter I: A TOC will comprise three members- one Service Officer, one DRDO scientist and one representative of DPSU. Members nominated should have adequate seniority and experience and should not be involved with that acquisition case. Annexure III to Appendix F (Guidelines of Protection of Exchange Rate Variation in Contracts): Indian vendors are allowed to insert ERV clause in Buy (Global) cases. They are not allowed to insert the clause in Buy (Indian) contracts, unless the supplier is a defence PSU in abinitio single vendor cases or when nominated as production agency Paragraph 7 of Appendix F to Schedule I (Payment Terms): The seller is required to give only one Performance cum Warranty Body of five per cent of the value of the contract

Senior and experienced members in TOC would provide better oversight. However ambiguity lies in what constitutes seniority and experience.

The new ERV guidelines are a step towards creating level playing filed between Indian private and public sector companies

Paragraphs 7 and 8 of Appendix F to Schedule I (Payment Terms): Separate Performance and Warranty Bonds, each amounting to five per cent of value of the contract to be submitted by the seller

This would halve financial burden on seller, which may reflected in commercial quote

the the be its

Appendix

(Refers

to

Paragraph 3 (p) Timeline for Procurement (Security Classification): In case of deviations to the timelines given at Appendix C to Chapter 1 of DPP, such deviations and week-wise targets to be proposed by SHQ with justification in a new format Appendix C (Refers to Paragraph 74

The insertion of new paragraph will bring higher accountability among acquisition functionaries

The

week-wise

A Critical Review of Defence Procurement Procedure 2011

12

Appendix C (Refers to Paragraph 74 (a) of Chapter I): Month-wise broad timeframe for completion difference procurement activities.

Appendix C (Refers to Paragraph 74 (a) of Chapter I): Week-wise broad timeframe for completion difference procurement activities.

e Paragraph 27 of Chapter IV Paragraph

(Liquidated Damages Fast Track Procedure): In case of delay of supplies, the vendor will run the risk of imposition of LD (Liquidated Damages) @ 1% per week subject to maximum of 10% of value of delayed store apart from the getting blacklisted and debarred from future dealing with Govt of India.

27 of Chapter IV (Liquidated Damages): In case of delay of supplies, the vendor will run the risk of imposition of LD @ 1.5% per week subject to maximum of 15% of value of delayed store.

The week-wise timeframe provides a better picture of time taken by various procurement agencies. It would help bring more accountability. The omission of reference to blacklisting is a tacit understanding of MoD that such option does not bring higher accountability on the part of vendors. The increase of value of LD as an alternative to blacklisting is more pragmatic

IDSA Issue Brief

13

Annexure-III

Aspects of Indias Defence Procurement Categories

Indigenous Requirement (%) 30 Outright purchase Buy Global Not Applicable Supposed to increase to 100 as indigenous production matures 50 Nature of Involvement of Domestic Industry 100 per cent-owned Indian company, majority-holding Indian JV A majority holding Indian company can participate in global tender A nominated Indian company

Procurement (Sub-) Category

Meaning

Buy Indian Buy

Buy & Make

Import followed by indigenous production through ToT Indigenous production with partnership with foreign company Indigenous R&D, design and development Outright purchase Indigenous R&D, design, development and production

Buy & Make (Indian) Strategic, complex and security sensitive systems Buy Indian (Low technology mature systems) Make (High technology complex systems and upgrades)

majority-holding Indian JV

Supposed to be 100

DRDO, Academia, and Indian company

Make

50

Indian Company

Supposed to be 100

Indian Company

You might also like

- Firming Up The "Buy", "Buy & Make", and "Make" Decision and Relevance of Pre-Feasibility StudyDocument18 pagesFirming Up The "Buy", "Buy & Make", and "Make" Decision and Relevance of Pre-Feasibility StudyAjitesh KumarNo ratings yet

- Eye On Defense - January 2012 PDFDocument32 pagesEye On Defense - January 2012 PDFsaileshNo ratings yet

- Press Information Bureau Government of India: Salient Features of Defence Procurement Procedure-2013Document2 pagesPress Information Bureau Government of India: Salient Features of Defence Procurement Procedure-2013Arun ChopraNo ratings yet

- Enterprise Email Army Service Acquisition Report To CongressDocument46 pagesEnterprise Email Army Service Acquisition Report To CongressFedScoopNo ratings yet

- Chap 8Document58 pagesChap 8Chaman AbhishekNo ratings yet

- DPP 2013Document361 pagesDPP 2013kailashbansalNo ratings yet

- DPP 2016 PDFDocument100 pagesDPP 2016 PDFAnonymous OiZTWwANo ratings yet

- Question Paper Integrated Case Studies - II (352) : July 2006Document27 pagesQuestion Paper Integrated Case Studies - II (352) : July 2006Wise MoonNo ratings yet

- Army Local Audit Manual (Part I & II)Document561 pagesArmy Local Audit Manual (Part I & II)Varma Mks83% (6)

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementFrom EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementNo ratings yet

- Defence Audit Manual Vol ADocument291 pagesDefence Audit Manual Vol AHarishSharmaNo ratings yet

- April 2018 IDSA ArticlesDocument56 pagesApril 2018 IDSA ArticleslovehackinggalsNo ratings yet

- Paper19 3Document27 pagesPaper19 30No ratings yet

- SIDM SAfricaDocument26 pagesSIDM SAfricasandeepdevathiNo ratings yet

- EthiopiaDocument11 pagesEthiopiabruk100% (1)

- OS Construction MGT L5Document69 pagesOS Construction MGT L5Fenta DejeneNo ratings yet

- BSNL PDFDocument42 pagesBSNL PDFRAVI KUMARNo ratings yet

- PB FDIDefenceIndustryDocument16 pagesPB FDIDefenceIndustryManish JaiswalNo ratings yet

- C & AG Report No. 17Document73 pagesC & AG Report No. 17Kumud KishorNo ratings yet

- FI Alpha-BELDocument7 pagesFI Alpha-BELRohit TalpadeNo ratings yet

- Opportunities in The Indian Defence SectorDocument78 pagesOpportunities in The Indian Defence SectorPratip BhattacharyyaNo ratings yet

- Market Survey Amendment 1 For S3 PDFDocument12 pagesMarket Survey Amendment 1 For S3 PDFPetar PetrovicNo ratings yet

- Claim MethodsDocument20 pagesClaim MethodsYasir AhmadNo ratings yet

- IB DefenceOffsetGuidelines 050813Document6 pagesIB DefenceOffsetGuidelines 050813Sreekanth ReddyNo ratings yet

- Supplement2010 To DPM 2009Document152 pagesSupplement2010 To DPM 2009sunshine_avenueNo ratings yet

- Appendix BDocument42 pagesAppendix Bpranab.gupta.kwicNo ratings yet

- Second Phase of XBRL ImplementationDocument14 pagesSecond Phase of XBRL ImplementationNihjas KallarathodikaNo ratings yet

- EITF - Issue16C - Summary1 - 12september2016 EyDocument35 pagesEITF - Issue16C - Summary1 - 12september2016 EyŞtefan AlinNo ratings yet

- CIO-SP3 - NITAAC Statement of Work (SOW) Template: As of Mm/Dd/Yyyy Agency NameDocument6 pagesCIO-SP3 - NITAAC Statement of Work (SOW) Template: As of Mm/Dd/Yyyy Agency NameJessica PetersonNo ratings yet

- Union Compliance Defence Army and Ordnance Factories 30 2013 Chap 6Document24 pagesUnion Compliance Defence Army and Ordnance Factories 30 2013 Chap 6ravi chandranNo ratings yet

- Running Head: Acquisition Process 1Document10 pagesRunning Head: Acquisition Process 1JOSEPHNo ratings yet

- Book Indian Defence Industry 0Document222 pagesBook Indian Defence Industry 0azamericaNo ratings yet

- The Government Manager's Guide to The Statement of WorkFrom EverandThe Government Manager's Guide to The Statement of WorkNo ratings yet

- FY12 Top Ops Webinar Talking Points 100411Document6 pagesFY12 Top Ops Webinar Talking Points 100411Elliot S VolkmanNo ratings yet

- Description: Tags: By08addevDocument16 pagesDescription: Tags: By08addevanon-574266No ratings yet

- Executive SummaryDocument7 pagesExecutive SummaryJustus EstherNo ratings yet

- Coal SectorDocument70 pagesCoal SectorArun HariharanNo ratings yet

- DPP 2013Document428 pagesDPP 2013Jayapal HariNo ratings yet

- LEGACY - JSP886 V7P08.09 HumanFactorsIntegration FINAL ODocument5 pagesLEGACY - JSP886 V7P08.09 HumanFactorsIntegration FINAL OLaura Encinas EscobarNo ratings yet

- Description: Tags: By08cpssDocument25 pagesDescription: Tags: By08cpssanon-176751No ratings yet

- SWOT AnalysisDocument3 pagesSWOT Analysissidlbsim100% (1)

- OS Barbeding and Concreting Level II - IIIDocument164 pagesOS Barbeding and Concreting Level II - IIIGudeta Jifara0% (1)

- GP 00-05 Engineering Technical Practice (ETP) Subject Matter Expert (SME) Roles, Responsibilities, and Expectations 6.5.2009 PDFDocument6 pagesGP 00-05 Engineering Technical Practice (ETP) Subject Matter Expert (SME) Roles, Responsibilities, and Expectations 6.5.2009 PDFAnonymous r7iCXPzINo ratings yet

- Fdi in Indian Defence SectorDocument18 pagesFdi in Indian Defence SectorAnonymous Y0M10GZVNo ratings yet

- 6 3 20112 VenuGopalDocument23 pages6 3 20112 VenuGopalJoeprem KhumarNo ratings yet

- COSO Internal Control - Integrated Framework Update Project Frequently Asked QuestionsDocument5 pagesCOSO Internal Control - Integrated Framework Update Project Frequently Asked QuestionsRossi XavierNo ratings yet

- Revisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ADocument54 pagesRevisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ANagendra KrishnamurthyNo ratings yet

- D PR Template 29072020Document40 pagesD PR Template 29072020Sarthak KarandeNo ratings yet

- Eye On Defense - March 2013Document46 pagesEye On Defense - March 2013saileshNo ratings yet

- Draft Stories On CLC Replies - Sept 22Document3 pagesDraft Stories On CLC Replies - Sept 22Manish GuptaNo ratings yet

- Agency PerformanceDocument27 pagesAgency PerformanceBahram NajedyNo ratings yet

- RA 9184 Written ReportDocument14 pagesRA 9184 Written ReportAllen DelaCruz LeonsandaNo ratings yet

- Benefits of EvmDocument12 pagesBenefits of EvmMiraj ShahidNo ratings yet

- R 26Document3 pagesR 26shrimsnegiNo ratings yet

- L4M1 Sample Answer Guidance FVDocument12 pagesL4M1 Sample Answer Guidance FVAkash Poudel100% (3)

- Revisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ADocument54 pagesRevisionary Test Paper - Final - Syllabus 2012 - Dec2013: Group - IV Paper 19 - Cost and Management Audit Section - ANagendra KrishnamurthyNo ratings yet

- Bhel Divestment Strategy AnalysisDocument9 pagesBhel Divestment Strategy AnalysisHimanshu JoshiNo ratings yet

- Description: Tags: By08idacsDocument20 pagesDescription: Tags: By08idacsanon-277832No ratings yet

- The Partition of IndiaDocument20 pagesThe Partition of IndiaSourabh Menon100% (1)

- The East India CompanyDocument4 pagesThe East India CompanyEkta KhatriNo ratings yet

- Medieval History 02 - Daily Class Harsha, Chalukyas and PallavasDocument20 pagesMedieval History 02 - Daily Class Harsha, Chalukyas and PallavasAryavart ChaudharyNo ratings yet

- India Society and CultureDocument15 pagesIndia Society and Cultureshivam satyamNo ratings yet

- 11 Conclusion PDFDocument4 pages11 Conclusion PDFSunny TuvarNo ratings yet

- 2020 SX GenDocument39 pages2020 SX GenHemendra PrasannaNo ratings yet

- Airlines Sector in India and Its Contribution in Indian GDPDocument11 pagesAirlines Sector in India and Its Contribution in Indian GDPAnshuman UpadhyayNo ratings yet

- Amsec 24052019Document740 pagesAmsec 24052019Bhavin Sagar0% (1)

- SelectionList R1-Web AHU ExDocument754 pagesSelectionList R1-Web AHU Exasifsheril143No ratings yet

- SST and Eng Previous Years Class 10 Cbse Solved Question PapersDocument763 pagesSST and Eng Previous Years Class 10 Cbse Solved Question PapersDeepayan PaikNo ratings yet

- IPL New Microsoft Office Word DocumentDocument4 pagesIPL New Microsoft Office Word Documentanon_136728171No ratings yet

- 7 AshokaDocument11 pages7 AshokaAmartya Srivastava75% (4)

- Important History Questions For Upcoming Exams - History Questions MCQs at SmartkeedaDocument2 pagesImportant History Questions For Upcoming Exams - History Questions MCQs at SmartkeedasmartkeedaNo ratings yet

- Trust Deregistration List - AurangabadDocument91 pagesTrust Deregistration List - AurangabadAmit SangewarNo ratings yet

- Ahmednagar (Maharashtra) Tuition Contact NumbersDocument9 pagesAhmednagar (Maharashtra) Tuition Contact NumbersSai KiranNo ratings yet

- Modern Indian History A Primer - OrGOS IASDocument73 pagesModern Indian History A Primer - OrGOS IASD100% (2)

- Marxit Aproach NotesDocument6 pagesMarxit Aproach NotestareshNo ratings yet

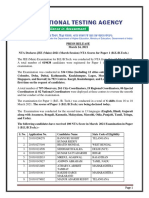

- Press Release NtaDocument6 pagesPress Release NtaAnkitaNo ratings yet

- B. R. Ambedkar: Vinoba BhaveDocument1 pageB. R. Ambedkar: Vinoba BhaveAravindNo ratings yet

- Gayatri Aur Uski Praan Prakriya PDFDocument35 pagesGayatri Aur Uski Praan Prakriya PDFvivek DwivediNo ratings yet

- 300 Best Mcqs September Set 1: Dr. Gaurav GargDocument6 pages300 Best Mcqs September Set 1: Dr. Gaurav GargMohd YounusNo ratings yet

- All India Hospital ListDocument530 pagesAll India Hospital ListtexmoNo ratings yet

- Time Line Between 1857 To 1947Document8 pagesTime Line Between 1857 To 1947Safdar Hayat KhaksarNo ratings yet

- Review of Article: How Operation Blue Star Changed The History of India PDFDocument5 pagesReview of Article: How Operation Blue Star Changed The History of India PDFHarpreet SinghNo ratings yet

- F.3 Beneficiary Registered Account Frozen & Verified Report As On: 10/08/2020 08:34:59Document2 pagesF.3 Beneficiary Registered Account Frozen & Verified Report As On: 10/08/2020 08:34:59Debajit BorahNo ratings yet

- 17th March: Dr. Gaurav GargDocument2 pages17th March: Dr. Gaurav Gargआई सी एस इंस्टीट्यूटNo ratings yet

- Kiran Singh: 22 Years New DelhiDocument2 pagesKiran Singh: 22 Years New DelhinitsabhiNo ratings yet

- Answer Key To WBCS Preliminary Examination 2015 PDFDocument6 pagesAnswer Key To WBCS Preliminary Examination 2015 PDFLive OnceNo ratings yet

- Photo's - Sai Baba's First Silver Rath Yatra To ShirdiDocument8 pagesPhoto's - Sai Baba's First Silver Rath Yatra To ShirdirOhit beHaLNo ratings yet

- Cultural Diversity in IndiaDocument6 pagesCultural Diversity in IndiaKishor Kumar Jha100% (1)