Professional Documents

Culture Documents

Efficiency - Essential Element of The Investment

Uploaded by

bahaman417Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Efficiency - Essential Element of The Investment

Uploaded by

bahaman417Copyright:

Available Formats

LUCRRI TIIN IFICE, SERIA I, VOL.

XI (2) EFFICIENCY - ESSENTIAL ELEMENT OF THE INVESTMENT DECISION EFICIEN A- ELEMENT ESEN IAL AL DECIZIEI DE INVESTI IE RAMONA LILE , V.V. PANTEA* , SUZANA MONICA BJA*

The objective of each domestic or foreign investor is to achieve profit and purpose of investment decision and particularly the foreign one is to get efficiency. In terms of competitiveness, propelled at extremely high levels of free market economy, investment decision may be adopted only based on an essential element - the efficient investment. In the context of the current crisis caused by the reduction in volume of energy resources, raw materials, degradation of environment and natural disasters multiplication is necessary to use the concept of efficiency to justifying any investment decisions overall, especially foreign investment, which require much greater efforts to achieve change of very ambitious objectives.

Key words: investment, decision, efficiency indicators. As the most general term, the economic efficiency is determined by a correlation between the economic process and the effort took place to obtain that effect (result). As it is measurable, this fraction (division) expresses the relationship between a size "result" (or output - in cz. English) size and a "consumption" (input). Measurable outcome of the effort, efficiency measure social effect of economic activity is materialized: 1. materialy - as quantitative, qualitative and structural point of view, in the newly created or added values. 2. expression in value as the value of assets created, etc. accumulation funds. 3. the social as raising the living standard, improvement of working conditions for the members of society, etc.. Depending on the goal, economic efficiency implies a dual sharing: first, to the effect of the effort and then to the determined results divided to the results from a previous period, which is the comparison basis, or divided to the best known worldwide performances.

Aurel Vlaicu Arad University, Faculty of Economic Science, Romania

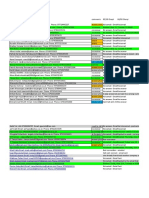

FACULTATEA DE MANAGEMENT AGRICOL The Economic Efficiency is calculated as a ratio between the effects size and the efforts size or the efforts size and their effects size. In the first case, the effect obtained for an effort unit, which have to be maximum, is determined; in the second case, the effort realized to obtain an effect unit, which have to be minimal, is calculated. Determination of the real effects and efforts, due to difficulties encountered in quantifying the elements that compose these two variables, is a complex problem. In order to achieve a correct calculation, the following conditions are necessary: 1) effect and effort elements have to be into a causal dependency, 2) to quantify the effects, both direct and indirect effects, related or involved effects, have to consider; 3) to quantifying the efforts, all direct and indirect costs related to results have to be reflected and as possible as can, they should be homogeneous, 4) the links between effects and efforts must match to their economic content and, in the same time, to consider their different dimensions. 5) indicators of the economic efficiency should allow the aggregation or disaggregation operations. 6) to calculate the indicators of economic efficiency, the influence of time factor and the increasing uncertainty in the assessment of future results, have to be considered. As term of efforts (consumed resources), the efficiency study must find answers to these questions: a) how to use the efforts (resources) b) how much of them is consumed (regarding to their savings and the degree of recovery, too ). Socio-economic efficiency of foreign investments in Romania Economic concept of foreign investments in Romania is based on the ground of specific socio-economic criteria. Using these criteria allows the conversion of overall efficiency investments indicators into specific indicators of the socio-economic efficiency of foreign investments in Romania.

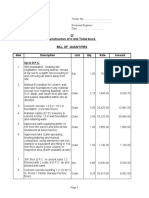

LUCRRI TIIN IFICE, SERIA I, VOL. XI (2) An important aspect are the requirements derived from socioeconomic efficiency, for foreign investments. Criteria are linked to results and resources used in foreign investments. By the influence of foreign investments, increasing socio-economic efficiency is able to determine capsizing paradoxical situation where inputs price exceeds outputs price and to transform this situation, which is find in the clothing industry, into one of acceptable yield. Thus, it can be obtain a reduction in costs of raw materials use to made products by a line of modern manufacturing that generate small losses, and consequently lower cost than today. Thus, by reducing the cost of raw material, an increased wage labor is provided, so consolidated budget has inputs generated by taxes. Default, revenue budget allocation to social areas ensures population welfare, increasing their living standard. In the field of improving infrastructure, foreign investment may be effective by public or private partnerships, where the direct beneficiaries are: host country population, local firms, foreign investors. A good infrastructure in the host country, ensures all its development opportunities, creating the premises of foreign investments in the areas excepted from the developed areas. A socio-economic effect will be to uniform all regions, so to standardize the structure. Moreover, it is a principle of the new global economic order. Due to the infrastructure development, people can travel by different high-speed transport ways, decreasing the travel time and, last but not least, reducing the number of traffic accidents. From an economic point of view, firms benefit by reducing time distribution of finished products, with great profit in less time and due to decreased costs to repair their own car park. In conclusion, by improving the business climate and the working conditions and population living., the foreign investments ensure improving of socio-economic life for both poor population and businessmen. Indicators used in the analysis of investment projects efficiency by BIRD methodology Indicators used in the analysis of investment projects efficiency by BIRD methodology are:

FACULTATEA DE MANAGEMENT AGRICOL 1. The ratio of updated total revenues and updated total costs which represents an indicator, part of the profitability of income, so it allows to characterize profitability and therefore, the coefficient will be named coefficient assessing profitability income (Carv). This indicator reflects the profitability of foreign investment flows and allows the managers involved in the investment of funds generated by these flows, to select, by using effective socio-economic criteria those targets capable to harmonize economic branches, such as there are no major contradictions between total optimum and partial optimum or between created system and its subsystems; 2. Updated net income (NPV) of the foreign investments cash flows is calculated as the difference between current value of revenues and that of the costs related to the foreign investments flow. In the BIRD methodology, there is still a version of using updated cash -flow to apreciate a foreign investments project. This version consists in determination of update rate that makes the NPV of foreign investments cash flow to be zero and revenues and costs ratio to have the same unit. 3. Internal rate of return (IRR) of foreign investments is the average return on invested funds for a project as long as it exists , so the duration to realise foreign investments and its productive activity period. In the methodology IBRD, internal rate of return is one of the most important indicators of investments economic efficiency because it reflects net income obtained for a monetary unit of total effort, effort made by investment and production, for a certain duration. Compared with the NPV, internal rate of financial return has certain limits, due to the fact that annual flows are updated to a rate which is not the expression of the opportunity cost capital. Therefore, in analyzing the economic efficiency of investment, IRR should have only a restraining role in the acceptance of projects, and the choosen method to be determined by NPV. In comparing several investment projects, characterized by closed NPV, approximately equal, the project with maximum IRR has priority . 4.Internal rate of exchange (CNRa). This indicator gives the designer the opportunity to assess the competitive products in the foreign investments on the international market. For the general case, it can be calculated using formulas. This indicator CNRa, reflects intake of construction industry over all other sectors, when entrepreneurs succeed through superior management to reduce implementing times for the

LUCRRI TIIN IFICE, SERIA I, VOL. XI (2) investment objectives, because they consider the duration of investment existence, which includes the duration of constructions execution. This has a social effect, by providing many and more comfortable jobs.The economic effect is that, giving the objective operation earlier in run, a better return and thus accelerate economic circuit obtained. In literature it is known as BRUNO test, which consists in estimating costs in national currency for a currency unit of the project designed, which is obtained either by export of products or it is saved by replacing imports of these products. An investment project is acceptable only if Bruno test reflects a smaller or equal value to that of the official rate of exchange. By Bruno test, a new indicator expressing CNRa of foreign investment obtained. This is particularly useful for environmental managers to assess business projects in order to increase exports / decrease imports. Following the determination of cost to obtain / saving an amount of currency, a direct comparison of the rate of return of the project with the official return of the course and various conventional rates is realized. Due to the used extension point, it allows to the assessment of the foreign exchange effectiveness to have a higher confidence level. 5. Threshold of profitability (PR) represents the minimum production capacity of foreign investment, at which the target may operate without losses, respectively that loading percentage of production designed capacity where profit is zero. Because a zero profit expresses undesirable situation, the profitability threshold is called critical point, too. This critical point stays at the intersection of total expenditure line with the revenues line of sale products obtained through the foreign investment objective. 6. In the framework of the analysis, the sensitivity is expressed by performing successive hypothetical modifications on costs and / or incomes for efficiency indicators, considered as background for applying the investment decision. The sensitivity of feasibility for an investment represents a variability of its efficiency conditions when main indicators revealing the investment changed: the investment value, update rate, operational receipts and payments generated by that. The purpose of sensitivity analysis is to select the critical variables of the model parameters, which have most influence effects on NPV or IRR. We suggest choosing as critical variables, those parameters which for a variation (positive or negative) causes the increase with 1% of the IRR or 5% of net present (updated) value. To determine the variation effect of these conditions, only

FACULTATEA DE MANAGEMENT AGRICOL that variable factor is considered, all other conditions remaining constant. Sensitivity analysis consists in comparing the size of change rates into NPV and NPV- percentage, with change occurring on IRR, on IRR decreasing reflected by IRR decreasing rate. The sensitivity analysis can be performed at all effective management indicators considered by the management team of the investment objective at the analysis time. Economic efficiency of lohn Lohn is a type of international agreement by which a manufacturer (performer) obliges himself to execute a product at the command of a beneficiary (order), in exchange for remuneration and on the background of technical documentation presented by order. In terms of foreign trade, lohn processing operations represent import-export labor, their subject consisting in raw materials, materials, pre-manufactured, which are the property of one of the parties (importer), processing by the other part (exporter). Customer provides materials and raw materials, execution documentation (models, designs, drawings, etc.) considered to realise final products, he or she establishes technical parameters and quality indicators of the final product. In return, the manufacturer promises to realize, according to the technical standards established by the beneficiary, the final product at specified date, written in the contract. To order to fulfilled these conditions, required technological equipment and know-how must be provided. The producer has the advantage that the beneficiary provides them, usually he is responsible to implement a new technology,offering training courses for the workers and providing specialized consultance. Producers investment is minimal, because the beneficiary bear the costs of supply, production costs, transportation and distribution. On the other hand, the producer has a small percentage of profit, insufficient to a development of business by own forces. In this way, he remains dependent to his customers, whose commands must be very high to provide a directly proportional growing income for producer. Lohn Processing System is preferred by entrepreneurs who have made investments: they created other small factories, they have acquired new technology etc.. and they are seeking for a quick recovery of costs in time, ensuring continuity of production. Among the advantages, lohn includes: - better use of production capacity

LUCRRI TIIN IFICE, SERIA I, VOL. XI (2) - enhancing import of technology - help expanding of the market - contributing to increase of qualification of labor force. Among the disadvantages could be considered: - in case of unfavorable situation, potential risk for the labor exporter - risk by delays in the supply with raw materials - price risk - providing a lower income than in case of own products export. Initiating, contracting and achievement of lohn operations have the following motivations: - the exporter has processing possibilities, but it lacks the raw materials and materials that meet the quality standads required by the importer who buy them - there are additional capacities (temporary or continuity) in manufacturing, compared to the extractive industry which provides the raw materials - material advantages by lohn processing operations in place to make new investments - exploiting differences between pay levels into different regions, countries. Lohn Processing Operations solves discrepancies that occur in terms of quality, quantity and assortment between domestic possibilities and foreign market requirements, encouraging optimal use of production capacity. BIBLIOGRAPHY 1.ABRUDAN IOAN, GABRIELA LOBON IU, MIRCEA LOBON IU, 2003, I.M.M.-urile i managementul lor specific, Ed. Dacia, ClujNapoca, 2.ABRUDAN IOAN, 1999, Premise i repere ale culturii manageriale romneti, Ed. Dacia, Cluj-Napoca, 3.BURDU EUGEN. (coord), 2000, Managementul schimbrii organiza ionale, Ed. Economic, Bucureti,. 4.BURDUS EUGEN., Management comparat, Ed. Economic, Bucureti, 1998.

FACULTATEA DE MANAGEMENT AGRICOL 5.IONESCU GH.GHEORGHE., ADINA LETI IA NEGRUA, ADAM CIPRIAN MIHAI, 2003, Considerations about the Business Values Evolution and the Christian Values, n The End of Transformation?, Tu Chemnitz-Zwickau, Chemnitz,. 6.IONESCU GH.GHEORGHE, ADINA LETI IA NEGRUA, 2004, Filosofia i cultura managementului japonez, Ed. Concordia, Arad,. 7.IONESCU GH. GHEORGHE, ADINA LETITIA NEGRUSA, 2000, L environment culturel et la gestion International, n vol. Dialogues Culturals et Development economique europene, Sedcom Libris, Iai i Grenoble,. 8.IONESCU GH. GHEORGHE, ADINA LETITIA NEGRUSA, 2000, L evolution des valeurs de l affaires et la religion, n vol. Dialogues Culturals et Development economique europene, Sedcom Libris, Iai i Grenoble,. 9.IONESCU GH. GHEORGHE , ANDREI TOMA, 2001, Cultura organiza ional i managementul tranzi iei, Ed. Tribuna Economic, Bucureti, 10.IONESCU GH. GHEORGHE., EMIL CAZAN, ADINA LETI IA NEGRUA, 1999, Modelarea i optimizarea deciziilor manageriale, Ed. Dacia, Cluj-Napoca,. 11.IONESCU GH. GHEORGHE., LILE RAMONAM, 2007, Management general, Ed UAV, Arad,.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Evaluation CriteriaDocument6 pagesEvaluation Criteriabahaman417No ratings yet

- Project Appraisal Using DisDocument26 pagesProject Appraisal Using DisNiranjan AbeyrathnaNo ratings yet

- Canada CbaDocument51 pagesCanada Cbaroberto3780No ratings yet

- 249 2009 enDocument1 page249 2009 enbahaman417No ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Step-7 Sample ProgramDocument6 pagesStep-7 Sample ProgramAmitabhaNo ratings yet

- Chapter 1.4Document11 pagesChapter 1.4Gie AndalNo ratings yet

- Mentorship ICT at A GlanceDocument5 pagesMentorship ICT at A GlanceTeachers Without Borders0% (1)

- I5386-Bulk SigmaDocument1 pageI5386-Bulk SigmaCleaver BrightNo ratings yet

- Opel GT Wiring DiagramDocument30 pagesOpel GT Wiring DiagramMassimiliano MarchiNo ratings yet

- A.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdDocument6 pagesA.2 de - La - Victoria - v. - Commission - On - Elections20210424-12-18iwrdCharisse SarateNo ratings yet

- Carelink Connect: User GuideDocument41 pagesCarelink Connect: User GuideMiha SoicaNo ratings yet

- Business Occupancy ChecklistDocument5 pagesBusiness Occupancy ChecklistRozel Laigo ReyesNo ratings yet

- Journalism Cover Letter TemplateDocument6 pagesJournalism Cover Letter Templateafaydebwo100% (2)

- TENDER DOSSIER - Odweyne Water PanDocument15 pagesTENDER DOSSIER - Odweyne Water PanMukhtar Case2022No ratings yet

- Type BOQ For Construction of 4 Units Toilet Drawing No.04Document6 pagesType BOQ For Construction of 4 Units Toilet Drawing No.04Yashika Bhathiya JayasingheNo ratings yet

- Minas-A6 Manu e PDFDocument560 pagesMinas-A6 Manu e PDFJecson OliveiraNo ratings yet

- National Senior Certificate: Grade 12Document13 pagesNational Senior Certificate: Grade 12Marco Carminé SpidalieriNo ratings yet

- D6a - D8a PDFDocument168 pagesD6a - D8a PDFduongpn63% (8)

- Rhino HammerDocument4 pagesRhino HammerMichael BNo ratings yet

- COVID Immunization Record Correction RequestDocument2 pagesCOVID Immunization Record Correction RequestNBC 10 WJARNo ratings yet

- The Website Design Partnership FranchiseDocument5 pagesThe Website Design Partnership FranchiseCheryl MountainclearNo ratings yet

- Financial StatementDocument8 pagesFinancial StatementDarwin Dionisio ClementeNo ratings yet

- MNO Manuale Centrifughe IngleseDocument52 pagesMNO Manuale Centrifughe IngleseChrist Rodney MAKANANo ratings yet

- Procurement Audit PlanDocument12 pagesProcurement Audit PlanMustafa Bilal100% (1)

- SyllabusDocument9 pagesSyllabusrr_rroyal550No ratings yet

- Land Degradetion NarmDocument15 pagesLand Degradetion NarmAbdikafar Adan AbdullahiNo ratings yet

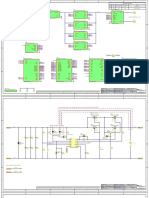

- Scheme Bidirectional DC-DC ConverterDocument16 pagesScheme Bidirectional DC-DC ConverterNguyễn Quang KhoaNo ratings yet

- Barangay Tanods and The Barangay Peace and OrderDocument25 pagesBarangay Tanods and The Barangay Peace and OrderKarla Mir74% (42)

- Sigma Valve 2-WayDocument2 pagesSigma Valve 2-WayRahimNo ratings yet

- How Can You Achieve Safety and Profitability ?Document32 pagesHow Can You Achieve Safety and Profitability ?Mohamed OmarNo ratings yet

- Computerized AccountingDocument14 pagesComputerized Accountinglayyah2013No ratings yet

- For Email Daily Thermetrics TSTC Product BrochureDocument5 pagesFor Email Daily Thermetrics TSTC Product BrochureIlkuNo ratings yet

- 2 and 3 Hinged Arch ReportDocument10 pages2 and 3 Hinged Arch ReportelhammeNo ratings yet

- 1.2 The Main Components of Computer SystemsDocument11 pages1.2 The Main Components of Computer SystemsAdithya ShettyNo ratings yet