Professional Documents

Culture Documents

Tax Alert - 2005 - Nov

Uploaded by

zhanleriOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Alert - 2005 - Nov

Uploaded by

zhanleriCopyright:

Available Formats

TAX ALERT

November 30, 2005 PETROLEUM PRODUCTS IMPORTED BY CEBU PACIFIC FOR USE IN ITS INTERNATIONAL FLIGHTS ARE EXEMPT FROM SPECIFIC OR AD VALOREM TAXES PURSUANT TO SECTION 135(a) OF THE 1997 NIRC. To be entitled to exemption from excise tax under Section 135(a) of the National Internal Revenue Code of 1997 (the Tax Code), the following must be present: (i) the petroleum products are sold to an international carrier for use and consumption outside the Philippines; (ii) the petroleum products sold to these international carriers shall be stored in a bonded storage tank and may be disposed of only in accordance with the rules and regulations to be prescribed by the Secretary of Finance, upon recommendation of the Commissioner of Internal Revenue; and (3) in the case of international carriers of foreign registry, the country of said foreign international carrier exempts from similar taxes petroleum products sold to Philippine carriers. The language of Section 135(a) of the Tax Code is broad enough to include petroleum products sold by nonresidents to an international carrier of Philippine registry for its international flights. The obvious intent of the law is to grant exemption to the international carrier and not to the seller of the petroleum products. Thus, to impose an excise tax on petroleum products directly imported from abroad by international carriers, such as Cebu Pacific, would render for naught the intention of Section 135(a) of the Tax Code exempting petroleum products purchased by international carriers from excise tax. BIR Ruling No. DA-438-2005 dated October 21, 2005. THERE IS NO STATUTE OR REGULATION THAT PROHIBITS THE USE OF FOREIGN CURRENCY IN FINANCIAL STATEMENTS OF TAXPAYERS. BIR Ruling No. DA-398-2005 dated September 26, 2005. LANDS THAT HAVE BEEN VACANT, IDLE, UNPRODUCTIVE AND UNIMPROVED SINCE THEIR ACQUISITION ARE CAPITAL ASSETS. Facts: The parcels of land were recorded in the taxpayers books as investments. They have been idle since their acquisition. No improvements have been introduced. The taxpayer did not include them in its inventory nor did these generate any rental income. Held: The parcels of land are capital assets. Their sale is subject to 6% capital gains tax (CGT) pursuant to Section 27(D)(5) of the Tax Code and to DST at the rate of P15.00 for each P1,000.00, or fractional part in excess of P1,000.00, of the consideration or fair market value of the property whichever is higher pursuant to Section 196 of the same Code. The sale of the property, not being used in the ordinary course of the taxpayers business, is not subject to 10% VAT. BIR Ruling No. DA-420-2005 dated October 10, 2005.

2 BIR REITERATES THE TAX CONSEQUENCES OF JOINT VENTURES. A joint venture is not subject to corporate income tax under Section 27 of the Tax Code. Gross payments received by the joint venture are not subject to the 2% expanded withholding tax prescribed under Section 57(B) of the Tax Code, as implemented by Revenue Regulations (Rev. Regs.) No. 6-85 and amended by Rev. Regs. No. 2-98. The allocation between the co-venturers of the projects saleable area in consideration of their respective contributions, as stipulated in the Joint Venture Agreement, is not a taxable event. It is not subject to income tax or withholding tax because the allocation is a mere return of capital that each party contributed. The Partition Agreement is not subject to DST. Upon the subsequent disposition by the co-venturers of the areas allocated to them, the gain that may be realized from such sale will be subject to the regular income tax rates under Sections 27, 27(A) or 27(E) of the Tax Code, as the case may be, and/or to the creditable withholding tax under Rev. Regs. No. 2-98. The sale shall be subject to DST imposed under Section 196 of the Tax Code based on the gross selling price or fair market value of the property, whichever is higher. Moreover, the sale shall also be subject to VAT. BIR Ruling No. DA-431-2005 dated October 20, 2005. See also BIR Ruling No. DA-397-2005 dated September 22, 2005. A JOINT VENTURE FOR A CONSTRUCTION PROJECT OF THE GOVERNMENT IS NOT SUBJECT TO INCOME TAX. Consequently, gross payments to said joint venture are not subject to withholding tax. The joint venture, being exempt from corporate income tax, is not required to file quarterly and final or adjusted income tax returns. BIR Ruling No. DA-415-2005 dated October 4, 2005. AN AGREEMENT, WHICH WAS EXECUTED WITHOUT CONSIDERATION AND NOT IN CONNECTION WITH A SALE, WHERE THE LOTS DEVELOPED UNDER A JOINT VENTURE ARE REGISTERED UNDER THE NAME OF ONLY ONE PARTY INSTEAD OF EXECUTING A PARTITION AGREEMENT, IS NOT SUBJECT TO DST UNDER SECTION 196 OF THE TAX CODE. BIR Ruling No. DA-430-2005 dated October 20, 2005. THE INFUSION OF ADDITIONAL PAID-IN CAPITAL, WITHOUT THE ISSUANCE OF ADDITIONAL SHARES OF STOCK, IS DEEMED A CAPITAL INVESTMENT. It is not subject to income tax, donors tax and DST under Section 174 of the Tax Code, as amended. BIR Ruling No. DA-432-2005 dated October 20, 2005. THE TRANSFER BY A FOREIGN CORPORATION OF ITS SHARES IN A DOMESTIC CORPORATION TO ANOTHER FOREIGN CORPORATION BY WAY OF STOCK DIVIDENDS PURSUANT TO A LEGITIMATE WORLDWIDE CORPORATE REORGANIZATION IS NOT SUBJECT TO PHILIPPINE INCOME TAX. In this case, there is no effective transfer of beneficial ownership since the transfer was from a subsidiary to a parent company. Moreover, no gain was realized by the transferor

3 foreign corporation for income tax purposes. September 26, 2005. BIR Ruling No. DA-400-2005 dated

CASH DIVIDENDS DECLARED BY A DOMESTIC CORPORATION TO A U.S. CORPORATION IS SUBJECT TO 15% PREFERENTIAL INCOME TAX. Facts: TIPI is a domestic corporation, while TI is a company organized and existing under the laws of the State of Delaware with a Philippine branch. Independently of the Philippine branch, TI owns 99.99% of the shares of stock of TIPI. TIPI intends to declare cash dividends in favor of TI. Issue: Whether the cash dividends to be declared by TIPI in favor of TI are subject to the preferential income tax rate of 15%, pursuant to Sec. 28(B)(5)(b) of the Tax Code. Ruling: The reduced 15% income tax on dividends is applicable if the United States shall allow TI a tax credit against U.S. taxes for taxes deemed paid in the Philippines. In previous rulings, the BIR recognized that U.S. tax laws allow a credit against the tax due from the U.S. taxes deemed to have been paid in the Philippines equivalent to at least 20%. Hence, the cash dividends to be declared by TIPI in favor of TI are subject to a preferential income tax rate of 15%. BIR Ruling No. DA-417-2005 dated October 7, 2005. INCOME NOT COVERED BY A SPECIFIC ARTICLE IN THE RP-KOREA TAX TREATY IS TAXABLE ONLY IN KOREA. A Korean resident is taxable only in Korea for its income arising in the Philippines when such income is not covered under any specific provision of the RP-Korea tax treaty but is considered Other Income under Article 22 of the said treaty. Guarantee fees paid to a Korean corporation for its guaranty of loans granted to a Philippine corporation are considered Other Income. BIR Ruling No. DA-ITAD-104-05 dated September 19, 2005. SERVICE COMMISSIONS PAID TO A KOREAN CORPORATION FOR SERVICES CARRIED OUT ENTIRELY IN KOREA, BEING INCOME NOT DERIVED FROM SOURCES WITHIN THE PHILIPPINES BY A FOREIGN CORPORATION, IS EXEMPT FROM PHILIPPINE INCOME TAX AND VAT. BIR Ruling No. DA-ITAD-105-05 dated August 24, 2005. EDUCATIONAL INSTITUTIONS ARE EXEMPT FROM 20% FINAL TAX ON INTEREST DERIVED FROM TIME DEPOSITS AND MONETARY PLACEMENTS WITH BANKS. Interest income from currency bank deposits and yield from deposit substitute instruments and under the expanded foreign currency deposit system derived by J School in pursuance of its purpose as an educational institution is exempt from the payment of the 20% and 7.5% final tax. Moreover, the school is likewise exempt from payment of the 20% final tax on interest earnings derived from time deposit accounts, treasury bonds, treasury bills and other bank notes. BIR Ruling No. DA-414-2005 dated October 4, 2005. PROFESSIONAL FEES PAID TO TECHNICAL CONSULTANCY FOR A CORPORATION PROVIDING THE CONSTRUCTION, REPAIR,

4 ALTERATION, RESTORATION, DEVELOPMENT, MANAGEMENT, SUPERVISION AND SPECIAL STUDIES OF ANY TECHNICAL WORK, PLAN OR PROJECT ARE SUBJECT TO 2% CREDITABLE WITHHOLDING TAX. A Specialty Contractor is defined as one whose operations pertain to the performance of construction work requiring special skill and whose principal contracting business involves the use of specialized building trades or crafts. [Section 3, Rev. Regs. No. 62001 amending Section 2.57.2(E)(3) of Rev. Regs. No. 2-98.] Although the corporation does not perform actual construction work, it is considered a specialty contractor because its principal contracting business involves the use of specialized building trades or crafts. BIR Ruling No. DA-439-2005 dated October 24, 2005. THE TRANSFER OF LAND TO A SPECIAL PURPOSE VEHICLE PURSUANT TO A DACION EN PAGO IS EXEMPT FROM DOCUMENTARY STAMP TAX AND CAPITAL GAINS TAX PURSUANT TO RA 9182, OTHERWISE KNOWN AS THE SPECIAL PURPOSE VEHICLE ACT OF 2002. While, ordinarily, the transfer of property by way of a dacion en pago is subject to DST and CGT or creditable withholding tax, as the case may be, the transfer of property to a Special Purpose Vehicle is exempt from the following taxes: (1) DST; (2) CGT on the transfer of land treated as capital asset; (3) creditable withholding tax on the transfer of land treated as ordinary asset; and (4) VAT. BIR Ruling No. DA- 407-2005 dated October 3, 2005. THE TRANSFER OF PROPERTY TO A TRUSTEE PURSUANT TO A REVOCABLE INTER VIVOS TRUST IS NOT SUBJECT TO INCOME OR DONORS TAX, VAT AND DST. The property transferred under the Revocable Inter Vivos Trust shall be subject to estate tax at the time of the transferors death. BIR Ruling No. DA-416-2005 dated October 6, 2005. COMMISSIONER FORGOES THE IMPOSITION OF SURCHARGE AND PENALTIES ON THE LATE PAYMENT OF ESTATE TAX ON ACCOUNT OF FAVORABLE ACTION ON THE REQUEST FOR EXTENSION OF TWO MORE YEARS TO PAY ESTATE TAX. However, pursuant to Section 249 of the Tax Code, the estate shall be liable for 20% interest from the time the estate tax accrued to the time of payment. BIR Ruling No. DA-437-2005 dated October 21, 2005. A NON-RESIDENT FOREIGN CORPORATION (TPI) MAINTAINING A TOLL PROCESSING AGREEMENT WITH A DOMESTIC CORPORATION (DPI) AND A COMMISSIONAIRE AGREEMENT WITH ANOTHER DOMESTIC CORPORATION (TWP) IS NOT DEEMED TO HAVE A PERMANENT ESTABLISHMENT IN THE PHILIPPINES PURSUANT TO ARTICLE 8 IN RELATION TO ARTICLE 5 OF THE RP-US TAX TREATY. Facts: TPI is a non-resident foreign corporation duly organized ad existing under the laws of the USA. DPI is a domestic corporation engaged in the manufacture and sale of plastic wares, kitchen and household effects. TWP is also a domestic corporation that

5 resulted from the spin-off of the marketing division of DPI and functions as the marketing entity and the commissionaire agent of TPI. Under the commissionaire agent structure, the mainstream transaction flow involves: (1) TWP receiving orders from the distributors of the products; (2) TWP forwards the orders to TPI for acceptance as TWP has no authority to conclude contracts on behalf of TPI; (3) once orders are accepted, TPI purchases ordered items from DPI, which manufactured the products; (4) upon purchase, title to the DPI goods is transferred from DPI to TPI the moment the goods leave DPIs premises; and (5) upon instructions of TPI to DPI, the finished goods are transported from the premises of DPI to unrelated distributors and upon delivery thereto, title of the goods passes from TPI to the distributor. As the commissionaire, TWP: (1) is of an independent status; (2) shall market and sell the goods purchased by TPI from DPI and deals with Philippine customers in its own name; (3) shall use its own invoice in billing customers for the goods sold by TPI; (4) files the VAT returns on behalf of TPI for goods sold within the Philippines; and (5) will charge an arms length commission fee to TPI. In the case of DPI, it owns and operates the facilities, plant and the machinery/equipment. TPI is the legal owner of all the imported and locally sourced raw materials being used in the production of the finished products which DPI sell to TPI. Held: TWP and DPI are not considered permanent establishments of TPI under paragraph 2 of Article 5 of the RP-US Tax Treaty and since they do not have the authority to conclude contracts with customers in the name or on behalf of TPI. Neither TWP nor TPI habitually maintain a stock of goods or merchandise from which either may regularly deliver goods or merchandise on behalf of TPI. While TPI will enter into a toll processing agreement with DPI and a commissionaire agreement wit TWP, they will not constitute permanent establishments since DPI and TWP will have separate and distinct personalities from TPI, their activities will not be devoted wholly or almost wholly to TPI, and will be done in the ordinary course of their business under arms length conditions. Consequently, TPI will not be subject to Philippine income tax on the business profits or income to be derived from the sale of goods to customers in the Philippines and that TPI will not be subject to the 1% creditable withholding tax on the sale of goods to customers in the Philippines and will also not be required to withhold the same tax on payments to local suppliers of raw and packing materials. BIR Ruling No. DA-ITAD-106-05 dated September 21,2005.

NOTE: The information provided herein is general and may not be applicable in all situations. It should not be acted upon without specific legal advice based on particular situations. If you have any questions, please feel free to contact any of the following at telephone number (632) 633-9418, facsimile number (632) 633-1911, or at the indicated e-mail address:

Atty. Carlos G. Baniqued Atty. Laura Victoria A.S. Yuson-Layug Atty. Terence Conrad H. Bello Atty. Ma. Carlota Christina G. Laio-Santiago Atty. Suzette A. Celicious Atty. Madeline L. Zialcita-Villapando Atty. Kathleen L. Saga

cgbaniqued@baniquedlaw.com lvyusonlayug@baniquedlaw.com thbello@baniquedlaw.com cglaino@baniquedlaw.com sacelicious@baniquedlaw.com mlzvillapando@baniquedlaw.com klsaga@baniquedlaw.com

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Implementing Rules of Republc Act 8972 - Solo Parent Welfare Act of 2000Document12 pagesImplementing Rules of Republc Act 8972 - Solo Parent Welfare Act of 2000pbasister100% (2)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Infor Mashup SDK Developers Guide Mashup SDKDocument51 pagesInfor Mashup SDK Developers Guide Mashup SDKGiovanni LeonardiNo ratings yet

- Integrated Project Management in SAP With Noveco EPMDocument34 pagesIntegrated Project Management in SAP With Noveco EPMrajesh_das3913No ratings yet

- MockupDocument1 pageMockupJonathan Parra100% (1)

- BP 344 Accessibility LawDocument22 pagesBP 344 Accessibility Lawmoonstardolphins100% (2)

- Ra 7279Document19 pagesRa 7279Babang100% (1)

- Math30.CA U1l1 PolynomialFunctionsDocument20 pagesMath30.CA U1l1 PolynomialFunctionsUnozxcv Doszxc100% (1)

- Variant Configuration Step by Step ConfigDocument18 pagesVariant Configuration Step by Step Configraghava_83100% (1)

- Philippines Clean Air Act of 1999Document29 pagesPhilippines Clean Air Act of 1999mcdale100% (4)

- MA5616 V800R311C01 Configuration Guide 02Document741 pagesMA5616 V800R311C01 Configuration Guide 02Mário Sapucaia NetoNo ratings yet

- Revised Implementing Rules and Reguiittions For BP 22ODocument66 pagesRevised Implementing Rules and Reguiittions For BP 22Oraegab100% (12)

- Road Signs 2006v enDocument226 pagesRoad Signs 2006v enzhanleriNo ratings yet

- Vienna Convention On Road Traffic (1968)Document78 pagesVienna Convention On Road Traffic (1968)Sana IkramNo ratings yet

- Republic Act No 6770 PDFDocument10 pagesRepublic Act No 6770 PDFisamokerNo ratings yet

- Pao Law IrrDocument10 pagesPao Law IrrzhanleriNo ratings yet

- Eo 841 - 2009Document4 pagesEo 841 - 2009zhanleriNo ratings yet

- Typeface ResourceDocument27 pagesTypeface ResourcezhanleriNo ratings yet

- PD - 1517 Urban Land ReformDocument9 pagesPD - 1517 Urban Land ReformNilo PajarellanoNo ratings yet

- PD 957Document16 pagesPD 957zhanleriNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledDocument16 pagesBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledzhanleriNo ratings yet

- Tax Alert - 2005 - FebDocument11 pagesTax Alert - 2005 - FebzhanleriNo ratings yet

- Commonwealth Act No 32Document1 pageCommonwealth Act No 32zhanleriNo ratings yet

- Nipas Act of 1992Document11 pagesNipas Act of 1992zhanleriNo ratings yet

- The Nipas ActDocument26 pagesThe Nipas ActAaron Julius M. LeccionesNo ratings yet

- Friar Lands Act 2007Document5 pagesFriar Lands Act 2007zhanleriNo ratings yet

- Republic Act No 8368Document1 pageRepublic Act No 8368zhanleriNo ratings yet

- A Primer To Understanding The P-REIT - Part 1Document2 pagesA Primer To Understanding The P-REIT - Part 1zhanleriNo ratings yet

- Nipas Act of 1992Document11 pagesNipas Act of 1992zhanleriNo ratings yet

- Commonwealth Act No 32Document1 pageCommonwealth Act No 32zhanleriNo ratings yet

- Heirs of Timoteo Moreno vs. Mactan - Cebu International Airport Authority, G.R. No. 156273, October 15, 2003Document8 pagesHeirs of Timoteo Moreno vs. Mactan - Cebu International Airport Authority, G.R. No. 156273, October 15, 2003Fides DamascoNo ratings yet

- Demecio Flores-Martinez Petition For Review of Enforcement of Removal OrderDocument9 pagesDemecio Flores-Martinez Petition For Review of Enforcement of Removal OrderBreitbart NewsNo ratings yet

- The General Agreement On Trade in Services An IntroductionDocument22 pagesThe General Agreement On Trade in Services An IntroductionakyregisterNo ratings yet

- HOS Dials in The Driver App - Samsara SupportDocument3 pagesHOS Dials in The Driver App - Samsara SupportMaryNo ratings yet

- IT ManagementDocument7 pagesIT ManagementRebaz Raouf Salih MohammedNo ratings yet

- Chapter 2 FlywheelDocument24 pagesChapter 2 Flywheelshazwani zamriNo ratings yet

- Manual Centrifugadora - Jouan B4i - 2Document6 pagesManual Centrifugadora - Jouan B4i - 2Rita RosadoNo ratings yet

- Secure Access Control and Browser Isolation PrinciplesDocument32 pagesSecure Access Control and Browser Isolation PrinciplesSushant Yadav100% (1)

- Ge Dir ReportsDocument1 pageGe Dir Reportsselvam chidambaramNo ratings yet

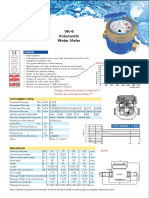

- Baylan: VK-6 Volumetric Water MeterDocument1 pageBaylan: VK-6 Volumetric Water MeterSanjeewa ChathurangaNo ratings yet

- Infineon ICE3BXX65J DS v02 - 09 en PDFDocument28 pagesInfineon ICE3BXX65J DS v02 - 09 en PDFcadizmabNo ratings yet

- Katie Todd Week 4 spd-320Document4 pagesKatie Todd Week 4 spd-320api-392254752No ratings yet

- Basic Concept of Process Validation in Solid Dosage Form (Tablet) : A ReviewDocument10 pagesBasic Concept of Process Validation in Solid Dosage Form (Tablet) : A Reviewqc jawaNo ratings yet

- BS en 12951-2004Document26 pagesBS en 12951-2004Mokhammad Fahmi IzdiharrudinNo ratings yet

- Zellner Bayesian AnalysisDocument4 pagesZellner Bayesian AnalysisfoopeeNo ratings yet

- G.R. No. L-54171 October 28, 1980 JEWEL VILLACORTA, Assisted by Her Husband, GUERRERO VILLACORTA, COMPANY, Respondents. TEEHANKEE, Acting C.J.Document6 pagesG.R. No. L-54171 October 28, 1980 JEWEL VILLACORTA, Assisted by Her Husband, GUERRERO VILLACORTA, COMPANY, Respondents. TEEHANKEE, Acting C.J.Lyra Cecille Vertudes AllasNo ratings yet

- T. Herndon, M. Asch, R. Pollin - Does High Public Debt Consistently Stifle Economic Growth. A Critique of Reinhart and RogoffDocument26 pagesT. Herndon, M. Asch, R. Pollin - Does High Public Debt Consistently Stifle Economic Growth. A Critique of Reinhart and RogoffDemocracia real YANo ratings yet

- AGE-WELL Annual Report 2021-2022Document31 pagesAGE-WELL Annual Report 2021-2022Alexandra DanielleNo ratings yet

- 028 Ptrs Modul Matematik t4 Sel-96-99Document4 pages028 Ptrs Modul Matematik t4 Sel-96-99mardhiah88No ratings yet

- Example Italy ItenararyDocument35 pagesExample Italy ItenararyHafshary D. ThanialNo ratings yet

- Private Copy of Vishwajit Mishra (Vishwajit - Mishra@hec - Edu) Copy and Sharing ProhibitedDocument8 pagesPrivate Copy of Vishwajit Mishra (Vishwajit - Mishra@hec - Edu) Copy and Sharing ProhibitedVISHWAJIT MISHRANo ratings yet

- Application For Freshman Admission - PDF UA & PDocument4 pagesApplication For Freshman Admission - PDF UA & PVanezza June DuranNo ratings yet

- Critical Aspects in Simulating Cold Working Processes For Screws and BoltsDocument4 pagesCritical Aspects in Simulating Cold Working Processes For Screws and BoltsstefanomazzalaiNo ratings yet

- How To Google Like A Pro-10 Tips For More Effective GooglingDocument10 pagesHow To Google Like A Pro-10 Tips For More Effective GooglingMinh Dang HoangNo ratings yet

- Appendix 9A: Standard Specifications For Electrical DesignDocument5 pagesAppendix 9A: Standard Specifications For Electrical Designzaheer ahamedNo ratings yet