Professional Documents

Culture Documents

Basel Accord Portfolio Management Case Study

Uploaded by

Jelena PavlovicOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basel Accord Portfolio Management Case Study

Uploaded by

Jelena PavlovicCopyright:

Available Formats

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.

com

CASE STUDY: Portfolio Management with Basel Accord (var_dev, cvar_dev) Background This case study demonstrates an optimization setup for credit portfolio management. It is based on papers by Theiler, et al. (2003) and Theiler (2004). Similar optimization models for credit risk were considered in Andersson, et al. (2001). This model maximizes the expected returns of the credit portfolio under internal and regulatory loss risk limits. From the banks internal perspective, credit risks are limited by the economic capital, i.e., the capital resources available to the bank to cover credit losses. The economic capital usually is defined as a subset of the banks equity. At the same time, the bank needs to limit its credit risk from a regulatory perspective. We consider the loss risk limitation rules set by the Basel Committee on Banking Supervision. We are considering the prevailing rules of Basel I, Basel (1988, 1996). However, credit risk weights of the Basel II rules, Basel (2001), can be easily incorporated in similar way. Banks are charged capital to cover credit risks of their bank book which are limited by the maximum amount of regulatory capital applicable to cover these risks. We concentrate on a credit portfolio of the bank book. The credit risk of the bank book is limited by the tier_1, i.e. the core capital, and the tier_2, i.e. the supplementary capital. The tier_1 capital mainly consists of the core capital of the bank, plus some other components. The tier_2 capital includes supplementary capital elements, such as the allowance for loan loss reserves and various long-term debt instruments, such as subordinated debt, see, Basel (1988), and also United (1998), p. 119. This model integrates assets involving both market and credit risk under internal and regulatory loss risk limitations. The capital constraints limit the expected profits of the bank in the planning period. The less economic and regulatory capital are available, the less risk a bank is able to take, and the more limited the achievable expected profits are in a business period. We assume a planning horizon of one year for expected returns, one year for credit risk, and one day for market risk. We combine different horizons for credit and market risks under the assumption that portfolio positions are constant for the year and the market risk is the same (is constant) for every day of this year. To provide background on risk-based regulations we extracted from United (1998) several relevant citations: Credit risk Banks are required to meet a total risk-based capital requirement equal to 8 percent of riskweighted assets. At a minimum, a banks capital must consist of core capital, also called tier 1 capital, of at least 4 percent of risk-weighted assets. Core capital includes common stockholders equity, noncumulative perpetual preferred stock, and minority equity investments in consolidated subsidiaries. The remainder of a banks total capital can also consist of supplementary capital, known as tier 2 capital. This can include items such as general loan and lease loss allowances, cumulative preferred stock, certain hybrid (debt/equity) instruments, and subordinated debt with a maturity of 5 years or more. The regulation limits the amount of various items included in tier 1 and tier 2 capital. For example, the amount of supplementary (tier 2) capital that is recognized for purposes of the risk-based capital calculation cannot exceed 100 percent of tier 1 capital. ... Under the credit risk rules, the adjustments of asset values to account for the relative riskiness of a counterparty involve multiplying the asset values by certain risk weights, which are percentages ranging from 0 to 100 percent. A zero risk-weight reflects little or no credit risk. For example, if a

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

bank holds a claim on the U.S. Treasury, a Federal Reserve Bank, or the central government or central bank of another qualifying Organization for Economic Cooperation and Development (OECD) country, this asset is multiplied by a factor of 0 percent, which results in no capital being required against the credit risk from this transaction. ... For an obligation owed by another commercial bank in an OECD country, a bank must multiply the amount of this obligation by 20 percent, which has the effect of requiring the bank to hold capital equal to 1.6 percent of the value of the claim on the other bank. Loans fully secured by a mortgage on a 1-4 family residential property carry a risk weight of 50 percent, thus requiring the bank to hold capital equal to 4 percent of the value of the mortgage. For an unsecured obligation owed by a private corporation or individual, such as a loan without collateral, a bank must multiply the amount of the unsecured obligation by 100 percent, which requires the bank to hold capital equal to a full 8 percent of the value of the unsecured obligation. ... To adjust for credit risks created by financial positions not reported on the balance sheet, the regulations provide conversion factors to express off-balance sheet items as an equivalent onbalance sheet item, as well as rules for incorporating the credit risk of interest-rate, exchange-rate, and other off-balance sheet derivatives. These positions are converted into a credit equivalent amount, and then the standard loan risk-weight for the type of customer is applied. The riskweight is applied according to the type of obligor, except that in the case of derivatives the maximum risk-weight is 50 percent. ... In both the banking and securities/futures sectors, capital regulations contain formulas that apply single risk-weightings to a broad range of riskiness within a single category. For example, in banking, the same 8 percent capital requirement is imposed on all unsecured loans to private commercial borrowers regardless of individual creditworthiness, with the result that a highrisk/high-return loan carries no more regulatory capital than a low-risk/low-return loan. As a result, the regulation might give firms an incentive to seek the highest returns within a broad class regardless of underlying risk; or to adjust activities (e.g, develop new products and/or change operations or corporate structures) in a way that reduces or escapes capital requirements. In other words, firms may adjust business to achieve the lowest regulatory capital cost rather than an optimal balance of risk and capital. Also, the securities net capital rule requires registered broker-dealers to apply a 100-percent haircut to any portion of the trading profits, to the extent the profits are unsecured, reflecting SECs emphasis on liquidity in its net capital rule. ... All banks are required to calculate their credit risk for assets, such as loans and securities; and off-balance sheet items, such as derivatives or letters of credit. The credit risk calculation assigns all assets and off-balance sheet items to one of four broad categories of relative riskiness (0, 20, 50, or 100 percent) according to type of borrower/obligor and, where relevant, the nature of any qualifying collateral or guarantee. Off-balance sheet items are converted into credit equivalent amounts. The assets and credit equivalent amount of off-balance sheet items in each category are multiplied by their appropriate risk-weight and then summed to obtain the total riskweighted assets for the denominator of the credit risk-based capital ratio. Capital, the numerator of the capital ratio, is long-term funding sources for the bank that are specified in the regulations. A bank is to maintain a total risk-based capital ratio (total capital/risk-weighted assets) of at least 8 percent. ...

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The credit risk regulation requires the use of two sets of multipliers. One set of multipliers places each off-balance sheet item into one of four categories and converts items in each category into asset equivalents. These conversion factors are multiplied by the face or notional amount of the off-balance sheet items to determine the credit equivalent amounts. In addition, for derivatives, these credit equivalent amounts are the value of the banks claims on the counterparties plus add-on factors to cover the potential future value of the derivative contracts. Then the other set of multipliers applies the risk-weights to assets and off-balance sheet credit equivalent amounts according to the type of borrower/obligor (and, where relevant, the nature of any qualifying collateral or guarantee). The sum of the risk-weighted assets in all categories is the credit risk-weighted assets for the bank. ... Market risk. Market risk consists of general market and specific risk components. To determine the market risk-equivalent assets, the risk or capital charges must be calculated for both components. Market risk capital charges are based on general market and specific risks. Examples of general market risk factors are interest rate movements and other general price movements. Capital charges for general market risks are to be based on internal models developed by each bank to calculate a VAR estimate, i.e., potential loss that capital will need to absorb. The internal VAR estimate for general market risks is to be based on statistical analyses that determine the probability of a given loss, based on at least 1 year of historical data. This VAR estimate is to be calculated daily using a 99 percent one-tailed confidence interval with a price shock equivalent to a 10-business day movement in rates and prices; i.e., 99 percent of the time the calculated VAR would not be exceeded in a 10-day period. ... Specific risk arises from factors relating to the characteristics of specific issuers of instruments. Specific risk factors reflect both idiosyncratic price movements of individual securities and event risk from incidents, such as defaults or credit downgrades, which are unique to the issuer and not related to market factors. If a banks internal model does not capture all aspects of specific risk, an add-on to the capital charge is required for specific risk. Specific risk estimates based on internal models are subject to adjustments based on the precision of the model. The total market risk capital charge is the sum of the capital charges for general market and specific risk. The total market risk capital charge is based on the larger of the previous days VAR estimate and the average of the daily VAR estimates for the past 60 days times the multiplier. The multiplier ranges from 3 up to a maximum of 4 depending on the results of backtesting.17 Market risk-equivalent assets are the total market risk capital charges multiplied by 12.5. ... Application of the market risk capital ratio requires the use of a two-part test. The sum of tiers 1, 2, and 3 capital must equal at least 8 percent of total adjusted risk-weighted assets. The tier 3 capital in this sum is only to be allocated to cover market risk. In addition, the sum of tier 2 and tier 3 capital for market risk may not exceed 250 percent of tier 1 capital allocated for market risk. The regulation includes other restrictions on the use of tier 2 and 3 capital.

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

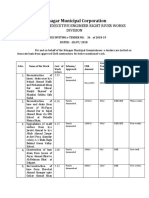

Regulatory capital

Credit risk of bank book

Market risk of trading book

Tier 1 and tier 2 capital used for credit risk

Tier 1 and tier 2 capital used for market risk

Figure 1. Regulatory Capital.

Tier 3 capital

References Andersson, F., Mausser , H., Rosen, D., and S. Uryasev (2001): Credit Risk Optimization with Conditional Value-At-Risk Criterion. Mathematical Programming, Series B 89, 273-291.

T T

Basel committee on Banking Supervision (1988): International convergence of capital measurement and capital standards, Basel, July 1988. Basel committee on Banking Supervision committee (1996): Amendment to the capital accord to incorporate market risks, Basel, January 1996.

Basel Committee on Banking Supervision (2001): Consultative Document. The New Basel Capital Accord, January 2001, Basel, January 2001. Theiler, U., Bugera, V., Revenko, A., and S. Uryasev (2003): Regulatory Impacts on Credit Portfolio Management. Leopold-Wildburger, U. et al. (Eds.), Operations Research Proceedings 2002, Springer, Berlin, 335-340. Theiler, U. (2004): Risk Return Management Approach for the Bank Portfolio in: Szego, G. (Ed.), Risk Measures for 21st Century, John Wiley & Sons, Chichester, 403-430. United States Accounting Office (1998): Risk-Based Capital - Regulatory and Industry Approaches to Capital and Risk, Washington, July 1998.

Several papers in this list can be downloaded from: http://www.ise.ufl.edu/uryasev/pubs.html#b http://www.ursula-theiler.de/publications.htm http://www.gloriamundi.org/

TU UT

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Notations

I = number of instruments (bonds) in the portfolio; i={1,,I} index of instruments in the

portfolio;

J = number of scenarios; j={1,,J} index of scenarios;

x = (x1 , ... , x I ) = vector of exposures (in currency) to instruments i=1,I ;

li = lower bound on exposure to instrument i ; ui = upper bound on exposure to instrument i ; qi = present value (price) of i-th instrument;

ri = rate of return (per year) of i-th instrument in the absence of risk (for instance, yield of the

bond);

ijbb = future value (in one year) of i-th instrument in the bank book under the credit risk scenario j

accounting for credit migration and default;

rijbb =

ijbb

qi

1 = rate of return (per year) of i-th instrument in the bank book under the credit risk

scenario j accounting for credit migration and default.

bb bb r jbb = r1j , ..., rIj = vector of rates of return (per year) of instrument i=1,I in the bank book

under the credit risk scenario j ;

rijtb ( t ) = rate of return (per 10 trading days) of i-th instrument in the trading book under the

market risk scenario j ;

tb tb r jtb = r1j ,..., rIj = vector of rates of return (per 10 trading) of instrument i=1,I in the trading

book under the credit risk scenario j ;

I

L(x, rjbb ) = rijbb xi = bank book loss under the credit risk scenario j;

i =0 I

L x, r

tb j

) = r

i =0

tb ij

xi = trading book loss (per 10 trading days) under the market risk scenario j ;

tb = confidence level for VaR deviation for trading book;

5

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

bb = confidence level for CVaR deviation for bank book;

CTier k = available Tier- k capital, k=1, 2,3;

a xk = used for risk management purposes Tier- k capital, k=1,, 3 (free additional variables);

wicr = regulatory credit risk capital weight for security i; wisp = regulatory specific market risk weight for security i; w mr = regulatory weight for market risk;

C econ = maximum amount of economic capital available to cover internal loss risk

(measured by CVaR deviation CVaR _ DEV ( L(x, r bb ) ) ) .

Simulation of Scenarios Yearly credit risk scenarios of bond returns, rijbb , accounting for credit migration and default can be simulated using standard methodologies, including CreditMetrics. 10-day market risk scenarios, rijtb , can be calculated with historical Monte Carlo simulations.

Optimization Problem maximizing estimated return (without risk)

I

max ri xi

i =1

(CS.1)

subject to internal constraint on credit risk

CVaR _ DEV ( L(x,r bb ) ) C econ

(CS.2)

regulatory constraint on capital covering credit risk

I

w

i =1

cr i

a a xi = x1 + x2

(CS.3)

regulatory constraint on capital covering market risk

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

w

i =0

sp i

a a xi + w mr VaR _ DEV ( L(x,r tb ) ) x3 + (CTier 1 x1a ) + (CTier 2 x2 )

(CS.4)

constraint limiting unused Tier-2 + used Tier-3 capital vs. unused Tier-1 capital

a a a x3 + (CTier 2 x2 ) 2.5 (CTier 1 x1 )

(CS.5)

constraint limiting Tier-2 vs. Tier-1 capital

a a x2 x1

(CS.6)

upper/lower bounds on exposures

l i xi ui , i = 1,K I ;

bounds on used Tier- k capital

a 0 xk CTier k , k=1,,3 .

(CS.7)

(CS.8)

Comment According to the Basel accord, see, United (1998), The total market risk capital charge is based on the larger of the previous days VaR estimate and the average of the daily VaR estimates for the past 60 days of the minimal return over 10 trading days. As a proxy for this VaR estimate, we considered in the model the VaR estimate of 10 trading days returns. This is an optimistic estimate of the value which should be included in the model. After solving the optimization problem the actual risk constraints can be verified for the optimal portfolio. If the actual VaR constraint included in regulations is not satisfied, then the coefficient w mr can be increased and the optimization problem can be solved with a higher weight for the market risk. Implementation within Portfolio Safeguard Initial Data Number of instruments in the portfolio, I = 6.

Number of scenarios for internal risk = 10000. Number of scenarios for regulatory risk = 2500.

Expected_returns are in the matrix matrix_returns.

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Scenarios for internal risk are in the matrix matrix_bank_book_scenarios.

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Scenarios for regulatory risk are in the matrix matrix_trading_book_scenarios.

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

10

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Regulatory credit risk capital weights, wicr , are in the matrix matrix_credit_risk_capital_weights.

Regulatory specific market risk weight, wisp , are in the matrix

matrix_specific_market_risk_weights.

Regulatory weight for market risk, w mr = 3.

Lower bounds on exposures in the constraint (CS.7) are in the point point_basle_accord_lb.

11

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Upper bounds on exposures in the constraint (CS.7) are in the point point_basle_accord_ub.

12

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

a Lower and Upper bounds on additional variables, xk , k=1,,3, in the constraint (CS.8) as well as Lower and Upper bounds on exposures in the constraint (CS.7) are in the Box of Variables variables_1 in the columns LB and UB respectively.

You can view initial data in the File and Data modes. You can find the Box of Variables in the Problems mode.

Functions

The matrix matrix_returns is used for building the Linear function linear_return_without_risk incorporated in objective function (CS.1).

13

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The matrix matrix_bank_book_scenarios is used for building CVaR Deviation for Loss function cvar_dev_internal_constraint_credit_risk incorporated in constraint (CS.2).

T T

The matrix matrix_trading_book_scenarios is used for building VaR Deviation for Loss function var_dev_trading_book incorporated in constraint (CS.4).

T T

14

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The matrix matrix_credit_risk_capital_weights is used for building the Linear function linear_capital_covering_credit_risk incorporated in constraint (CS.3).

15

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The matrix matrix_specific_market_risk_weights is used for building the Linear function linear_specific_market_risk incorporated in constraint (CS.4).

16

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Variable functions variable_x1a and variable_x2a are used for modeling Tier-1 and Tier-2 capitals respectively incorporated in constraints (CS.3)-(CS.6), and (CS.8). Variable function variable_x3a is used for modeling Tier-3 capital incorporated in constraints (CS.4) - (CS.5), and (CS.8).

17

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

You can view information about functions in the File, Functions, and Problems modes.

Problem and Elements of Problem You can see the structure of the problem (CS.1) - (CS.8) in the Problems mode.

18

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Name of the problem begins with the string problem_Basle_Accord_C_econ and terminates by the value of the C econ in the right-hand side of the constraint (CS.2) (in the picture C econ = 65).

The problem consists of the following Elements of Problem: Objective objective_Basle_Accord_return corresponding to (CS.1) Constraint constraint_internal_credit_risk corresponding to (CS.2) Constraint constraint_capital_covering_credit_risk corresponding to (CS.3) Constraint constraint_capital_covering_market_risk corresponding to (CS.4) Constraint constraint_Tier1_Tier2_Tier3 corresponding to (CS.5) Constraint constraint_Tier1_Tier2 corresponding to (CS.6) Box of Variables corresponding to (CS.7) - (CS.8)

The icon means that the problem is of maximization type.

T

The Objective objective_Basle_Accord_return (CS.1) includes the Linear function linear_return_without_risk.

19

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The Constraint constraint_internal_credit_risk (CS.2) includes CVaR Deviation for Loss (Cvar_Dev) function cvar_dev_internal_constraint_credit_risk.

The lower bound in constraint_internal_credit_risk (CS.2) is -Infinity (see the third row in the right-hand side of the Problems screen) and the upper bound in this constraint, C econ , is set

to 65 (see the first row in the right-hand side of the Problems screen). This value is used as the

suffix in the name of the problem. The Constraint constraint_capital_covering_credit_risk (CS.3) is modeled in the following modification:

20

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

w

i =1

cr i

a a xi x1 x2 = 0 .

(CS.3)

The left-hand side of (CS.3) is a linear combination of the following three functions:

Linear function linear_capital_covering_credit_risk included into

constraint_capital_covering_credit_risk with the coefficient 1 Variable function variable_x1a included into constraint_capital_covering_credit_risk with the coefficient -1 Variable function variable_x2a included into constraint_capital_covering_credit_risk with the coefficient -1

The equality to zero in (CS.3) is set by the zero lower bound (see the fifth row in the right-hand side of the Problems screen) and the zero upper bound (see the first row in the right-hand side of the Problems screen).

The Constraint constraint_capital_covering_market_risk (CS.4) is modeled in the

following modification

I

w

i =0

sp i

a a a xi + x1 + x2 x3 + w mr VaR _ DEV ( L(x,r tb ) ) CTier 1 + CTier 2 .

(CS.4)

The left-hand side of (CS.4) is a linear combination of the following five functions:

21

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Linear function linear_specific_market_risk included into constraint_capital_covering_market_risk with the coefficient 1

Variable function variable_x1a included into

constraint_capital_covering_market_risk with the coefficient 1

Variable function variable_x2a included into

constraint_capital_covering_market_risk with the coefficient 1

Variable function variable_x3a included into

constraint_capital_covering_market_risk with the coefficient -1

VaR Deviation for Loss function var_dev_trading_book included into

constraint_capital_covering_market_risk with the coefficient w mr = 3

The lower bound in the constraint_capital_covering_market_risk (CS.4) is -Infinity (see the seventh row in the right-hand side of the Problems screen) and the upper bound in this constraint, CTier 1 + CTier 2 , is set to 10 ( CTier 1 = 10, CTier 2 = 0) ) (see the first row in the right-hand side of the Problems screen). The Constraint constraint_Tier1_Tier2_Tier3 (CS.5) is modeled in the following modification

a a a 2.5 x1 x2 + x3 2.5 CTier 1 CTier 2 .

(CS.5)

22

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The left-hand side of (CS.5) is a linear combination of the following three functions: Variable function variable_x1a included into constraint_Tier1_Tier2_Tier3 with the coefficient 2.5 Variable function variable_x2a included into constraint_Tier1_Tier2_Tier3 with the coefficient -1 Variable function variable_x3a included into constraint_Tier1_Tier2_Tier3 with the coefficient 1

The lower bound in constraint_Tier1_Tier2_Tier3 (CS.5) is -Infinity (see the fifth row in the right-hand side of the Problems screen) and the upper bound in this constraint, 2.5 CTier 1 CTier 2 , is set to 25 ( CTier 1 = 10, CTier 2 = 0) ) (see the first row in the right-hand side of the Problems screen).

The Constraint constraint_Tier1_Tier2 (CS.6) is modeled in the following modification a a x2 x1 0 (CS.6) The left-hand side of (CS.6) is a linear combination of the following two functions: Variable function variable_x2a included into constraint_Tier1_Tier2 with the coefficient 1 Variable function variable_x1a included into constraint_Tier1_Tier2 with the coefficient -1

23

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The lower bound in constraint_Tier1_Tier2 (CS.6) is -Infinity (see the fourth row in the right-hand side of the Problems screen) and the upper bound in this constraint is set to 0 (see the first row in the right-hand side of the Problems screen). Constraints (CS.7) - (CS.8) are modeled in the Box of Variables (see the table in the right-

hand side of the Problems screen).

24

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The table consists of five columns: Id of variable Name of variable Lower Bound (LB) on variable (Constrants (CS.7) - (CS.8)) Value of variable Upper Bound (UB) on variable (Constrants (CS.7) - (CS.8)) If the problem was not optimized, the column Value is empty, otherwise it contains optimal solution of the problem. Generation of Optimal Solutions of the Problem The problem was run with several values of C econ = 35, 40, 45, 50, 55, 60, 65 in the

constraint (CS.2). For every value of C econ we set as the upper bound of the constraint_internal_credit_risk and we rename the last two digits in the name of the

problem in the Problems mode. Then, we run the modified problem in the Optimization mode.

Correspondingly, seven optimal points were generated. Name optimal points are labeled by the values of C econ : point_problem_Basle_Accord_C_econ_35, point_problem_Basle_Accord_C_econ_40, point_problem_Basle_Accord_C_econ_45, 25

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

point_problem_Basle_Accord_C_econ_50, point_problem_Basle_Accord_C_econ_55, point_problem_Basle_Accord_C_econ_60, point_problem_Basle_Accord_C_econ_65. Components of these points are expressed in currency. You can view these points in the File or Data modes.

Analyses Functions and generated optimal solutions are embedded in the analysis under the Analysis mode.

26

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

All functions included in the analysis were evaluated on all included points (see column

Value in the table at the right-hand side of the Analyses screen built for one selected point point_problem_Basle_Accord_C_econ_35).

Graphs Graphs mode presents nine charts: Graph graph_efficient_frontier shows dependence of the portfolio return vs. CVaR Deviation of credit risk (see constraint (CS.2))

27

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Graph graph_portfolio_RORAC shows dependence of the portfolio Return on Risk Adjusted Capital (RORAC) as defined in Theiler (2004) vs. bound C econ in constraint (CS.2); bound values C econ are reflected in the names of the points.

28

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Graph graph_portfolio_ROE shows dependence of the portfolio Return

as defined in Theiler (2004) vs. bound C econ

are reflected in the names of the points.

on Equity (ROE) in the constraint (CS.2); bound values C econ

29

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The portfolio Return on Equity (ROE) is calculated as the ratio of the function

linear_return_without_risk to the sum (x1a+x2a+x3a). The first function is available in the problem formulation, while the sum is not available. To calculate the sum (x1a+x2a+x3a) we defined the constraint constraint_sum_Tier in the Function mode.

30

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The Constraint constraint_sum_Tier is a linear combination of the following three functions: Variable function variable_x1a included into constraint_sum_Tier with the coefficient 1 Variable function variable_x2a included into constraint_sum_Tier with the coefficient 1 Variable function variable_x3a included into constraint_sum_Tier with the coefficient 1 The lower bound in the constraintconstraint_sum_Tier is -Infinity (see the first row in the right-hand side of the Functions screen), and the upper bound in this constraint is set to

Infinity (see the fifth row in the right-hand side of the Functions screen). This constraint is not used in the problem formulation.

Graph graph_marginal_vs_exposure shows marginal and exposures for the four assets with non-zero exposures in the optimal point point_problem_Basle_Accord_C_econ_40 (similar graphs can be found in Andersson, et al. (2001)). To get the exact numerical information about the point coordinates in the graph, left-click on a point in the graph.

31

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Graphgraph_asset_ROE shows the dependence of the Return on Equity (ROE) of a single asset as defined in Theiler, et al. (2003) and Theiler (2004) vs. components of the point

point_problem_Basle_Accord_C_econ_40.

32

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Graph graph_asset_RORAC shows dependence of the Return on Risk Adjusted Capital (RORAC) of a single asset as defined in Theiler, et al. (2003) and Theiler (2004) vs. components of the point point_problem_Basle_Accord_C_econ_40.

33

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

Graph graph_exposures shows the structure of several of the optimal points (with C econ =35, 45, 65).

34

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The histogram histogram_bank_book_loss" shows the histogram of the credit risk for the selected optimal points with C econ =40.

35

5214 SW 91st Way, #130, Gainesville, FL 32608 Tel.: (352) 505-5632, (352) 213-3457 uryasev@aorda.com, www.aorda.com

The histogram histogram_trading_book_loss" shows the histogram of the market risk for the selected optimal points with C econ =40.

36

You might also like

- BCMT Module 3 - Tech4ED Center ManagementDocument46 pagesBCMT Module 3 - Tech4ED Center ManagementCabaluay NHSNo ratings yet

- Capital Adequacy Ratios For BanksDocument36 pagesCapital Adequacy Ratios For BanksRezaDennyzaSatriawanNo ratings yet

- Capital Adequacy Ratio: FormulaDocument7 pagesCapital Adequacy Ratio: FormulasauravNo ratings yet

- Capital Adequacy CalculationDocument9 pagesCapital Adequacy CalculationSyed Ameer HayderNo ratings yet

- Var, CaR, CAR, Basel 1 and 2Document7 pagesVar, CaR, CAR, Basel 1 and 2ChartSniperNo ratings yet

- Banking RatiosDocument7 pagesBanking Ratioszhalak04No ratings yet

- Components of Assets & Liabilities in Bank's Balance SheetDocument7 pagesComponents of Assets & Liabilities in Bank's Balance SheetAnonymous nx6TUjNP4No ratings yet

- Basel II Capital Adequacy Norms OverviewDocument13 pagesBasel II Capital Adequacy Norms OverviewicdawarNo ratings yet

- Theory of Risk Capital in Financial FirmsDocument58 pagesTheory of Risk Capital in Financial FirmsIsabel BNo ratings yet

- Modelling credit risk under Basel frameworksDocument27 pagesModelling credit risk under Basel frameworksPuneet SawhneyNo ratings yet

- Capital Adequacy RatioDocument4 pagesCapital Adequacy RatiobharatNo ratings yet

- Basel NormsDocument33 pagesBasel NormsPaavni SharmaNo ratings yet

- Risk Management in Banking CompaniesDocument2 pagesRisk Management in Banking CompaniesPrashanth NaraenNo ratings yet

- Capital Adequacy RatioDocument7 pagesCapital Adequacy Ratiokumar_rajeshNo ratings yet

- Importance of Basel 1 & 2Document25 pagesImportance of Basel 1 & 2anand_lamani880% (1)

- Basel III Capital Regulations and Liquidity StandardsDocument40 pagesBasel III Capital Regulations and Liquidity Standardsrodney101No ratings yet

- What Is Leverage in Financial Management?Document13 pagesWhat Is Leverage in Financial Management?majidNo ratings yet

- What Is Leverage in Financial Management?Document13 pagesWhat Is Leverage in Financial Management?majidNo ratings yet

- Capital Adequacy: Ensuring Financial StabilityDocument4 pagesCapital Adequacy: Ensuring Financial StabilityHryshikesh DihingiaNo ratings yet

- Capital Adequacy Ratio For Banks - 1Document9 pagesCapital Adequacy Ratio For Banks - 1Jignesh NayakNo ratings yet

- The Treatment of Large Exposures in The Basel Capital Standards - Executive SummaryDocument2 pagesThe Treatment of Large Exposures in The Basel Capital Standards - Executive SummaryrakhalbanglaNo ratings yet

- Tier 1 CapitalDocument5 pagesTier 1 CapitalsmaarNo ratings yet

- Components and Calculation of Regulatory CapitalDocument13 pagesComponents and Calculation of Regulatory CapitalMuhammad ZulkifulNo ratings yet

- Tier 1 Capital RatioDocument23 pagesTier 1 Capital RatiokapilchandanNo ratings yet

- What Is Leverage in Financial Management?Document12 pagesWhat Is Leverage in Financial Management?majid aliNo ratings yet

- Points CaiibDocument7 pagesPoints CaiibbinalamitNo ratings yet

- Asset and Liability Management WIKIPEDIADocument18 pagesAsset and Liability Management WIKIPEDIAHAN SUKARMANNo ratings yet

- CAMELS' financial health frameworkDocument4 pagesCAMELS' financial health frameworkWaseem KhanNo ratings yet

- What is RBC and how does it protect firmsDocument3 pagesWhat is RBC and how does it protect firmsDilawar Kamran-17No ratings yet

- What Is Capital Adequacy of Banks and Financial Institutions?Document5 pagesWhat Is Capital Adequacy of Banks and Financial Institutions?Raymond mmuNo ratings yet

- Week 8 Capital Adequacy Sounders1871Document36 pagesWeek 8 Capital Adequacy Sounders1871Nguyen Hoang ThaoNo ratings yet

- Capital Adequacy & Capital PlanningDocument21 pagesCapital Adequacy & Capital PlanningAdityaNo ratings yet

- Camel 1Document7 pagesCamel 1Papa PappaNo ratings yet

- Financial Risks and The Pension Protection Fund: Can It Survive Them?Document32 pagesFinancial Risks and The Pension Protection Fund: Can It Survive Them?Frederick Ofori-MensahNo ratings yet

- The New Basel Capital Accord: Glossary of TermsDocument6 pagesThe New Basel Capital Accord: Glossary of TermsNevena BebićNo ratings yet

- Weaknesses in Regulatory Capital Models and Their ImplicationsDocument10 pagesWeaknesses in Regulatory Capital Models and Their Implicationshemstone mgendyNo ratings yet

- Risk-Based Capital Definition and CalculationDocument6 pagesRisk-Based Capital Definition and CalculationMuhamad HelmiNo ratings yet

- Commercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Document8 pagesCommercial Banking Assignment: Dhruti Bhatia Roll No: 062 Specialization-Finance MMS - 2020Dhruti BhatiaNo ratings yet

- WACC Computation: Is The Cost of Equity, KDocument4 pagesWACC Computation: Is The Cost of Equity, Kderek_lee_34No ratings yet

- Basel I Basel II Basel III Basel Committee On Banking SupervisionDocument5 pagesBasel I Basel II Basel III Basel Committee On Banking Supervisionsrabon baruaNo ratings yet

- Risk Management Framework: by Prof Santosh KumarDocument30 pagesRisk Management Framework: by Prof Santosh KumarAYUSH RAVINo ratings yet

- The Basel Capital Accord: An Evolving International Framework for Bank Capital StandardsDocument11 pagesThe Basel Capital Accord: An Evolving International Framework for Bank Capital StandardsRashidAliNo ratings yet

- Accounting For Economic and Regulatory Capital in RAROC AnalysisDocument11 pagesAccounting For Economic and Regulatory Capital in RAROC AnalysisCarla PiresNo ratings yet

- Financial Management PaperDocument11 pagesFinancial Management PaperSankar RajagopalNo ratings yet

- Topic 4 RecapDocument8 pagesTopic 4 RecapEcho YangNo ratings yet

- Determinants of Capital Adequacy Ratio: A Case of Nepalese Commercial Banks. - Deepa AryalDocument19 pagesDeterminants of Capital Adequacy Ratio: A Case of Nepalese Commercial Banks. - Deepa AryalRitesh shresthaNo ratings yet

- Financial Risk ManagementDocument6 pagesFinancial Risk ManagementMohammadAhmadNo ratings yet

- The Significance of Basel 1 and Basel 2 For The Future of The Banking Industry With Special Emphasis On Credit InformationDocument21 pagesThe Significance of Basel 1 and Basel 2 For The Future of The Banking Industry With Special Emphasis On Credit InformationSohaib ButtNo ratings yet

- Capital Adequacy RatiosDocument3 pagesCapital Adequacy RatiosPropertywizzNo ratings yet

- Dodd Frank and Its Implications On FSP'sDocument7 pagesDodd Frank and Its Implications On FSP'sRakshit Raj SinghNo ratings yet

- Extract From The Article Catering Your Question About Basel I and IIDocument6 pagesExtract From The Article Catering Your Question About Basel I and IISayma Ul Husna HimuNo ratings yet

- CB AssignmentDocument6 pagesCB AssignmentVaishnavi khotNo ratings yet

- Chapter 7 - Risks of Financial Inter MediationDocument69 pagesChapter 7 - Risks of Financial Inter MediationVu Duy AnhNo ratings yet

- Capital Adequacy Ratio: Improve It Talk Page References or Sources Confusing or UnclearDocument4 pagesCapital Adequacy Ratio: Improve It Talk Page References or Sources Confusing or Unclearanandu3636No ratings yet

- Capital Adequacy Ratio - Wikipedia, The Free EncyclopediaDocument4 pagesCapital Adequacy Ratio - Wikipedia, The Free EncyclopediaTrần Kim ChungNo ratings yet

- Capital Adequacy: Credit ExposureDocument10 pagesCapital Adequacy: Credit ExposureHimani DhingraNo ratings yet

- Crr&BaselaccordsDocument4 pagesCrr&BaselaccordsFarah KhanNo ratings yet

- RAROCDocument22 pagesRAROCchelsea1989No ratings yet

- SSRN Id1645946Document8 pagesSSRN Id1645946Konstantin DanilovNo ratings yet

- Ch2-Iso QMSDocument10 pagesCh2-Iso QMSSubramanian RamakrishnanNo ratings yet

- TQM DEFINITION AND PRINCIPLESDocument6 pagesTQM DEFINITION AND PRINCIPLESIsabel Victoria GarciaNo ratings yet

- Sample MidTerm Multiple Choice Spring 2018Document3 pagesSample MidTerm Multiple Choice Spring 2018Barbie LCNo ratings yet

- Material Handling and ManagementDocument45 pagesMaterial Handling and ManagementGamme AbdataaNo ratings yet

- Business Management, Ethics and Entrepreneurship All DefinitionDocument23 pagesBusiness Management, Ethics and Entrepreneurship All DefinitionShrikant Rathod33% (3)

- CV2Document6 pagesCV2teclarteeNo ratings yet

- Chase Lesson 3 PDFDocument4 pagesChase Lesson 3 PDFstraywolf0No ratings yet

- Case StudyDocument21 pagesCase StudyVinu Thomas0% (1)

- 18MEC207T - Unit 5 - Rev - W13Document52 pages18MEC207T - Unit 5 - Rev - W13Asvath GuruNo ratings yet

- Technology Start Ups Jun 15 FinalDocument86 pagesTechnology Start Ups Jun 15 FinalAlberto LoddoNo ratings yet

- 2011 Aring Sup1 Acute CFA Auml Cedil Ccedil Ordm Sect Aring Ccedil Auml Sup1 BrvbarDocument17 pages2011 Aring Sup1 Acute CFA Auml Cedil Ccedil Ordm Sect Aring Ccedil Auml Sup1 BrvbarBethuel KamauNo ratings yet

- Mps international Class 11 business studies CASE STUDIESDocument7 pagesMps international Class 11 business studies CASE STUDIESRaghav Kanoongo100% (1)

- Conflicts Over Privacy in The WorkplaceDocument2 pagesConflicts Over Privacy in The WorkplaceHaris MunirNo ratings yet

- Company Profile Law Firm Getri, Fatahul & Co. English VersionDocument9 pagesCompany Profile Law Firm Getri, Fatahul & Co. English VersionArip IDNo ratings yet

- India's Leading Infrastructure Services CompanyDocument25 pagesIndia's Leading Infrastructure Services CompanyArdhendu ShekharNo ratings yet

- Lion Dates PDFDocument20 pagesLion Dates PDFIKRAMULLAHNo ratings yet

- Srinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionDocument7 pagesSrinagar Municipal Corporation: Office of The Executive Engineer Right River Works DivisionBeigh Umair ZahoorNo ratings yet

- REVIEWER UFRS (Finals)Document5 pagesREVIEWER UFRS (Finals)cynthia karylle natividadNo ratings yet

- Larsen Toubro Infotech Limited 2015 DRHP PDFDocument472 pagesLarsen Toubro Infotech Limited 2015 DRHP PDFviswanath_manjula100% (1)

- PRTC-FINAL PB - Answer Key 10.21 PDFDocument38 pagesPRTC-FINAL PB - Answer Key 10.21 PDFLuna VNo ratings yet

- Technology AnnualDocument84 pagesTechnology AnnualSecurities Lending TimesNo ratings yet

- TPM Event CalenderDocument3 pagesTPM Event Calenderamarpal07No ratings yet

- 01 Chapter 1 Joint Venture and Public EnterpriseDocument11 pages01 Chapter 1 Joint Venture and Public EnterpriseTemesgen LealemNo ratings yet

- Analyzing Financial Performance with Profit & Loss and Balance SheetsDocument27 pagesAnalyzing Financial Performance with Profit & Loss and Balance SheetssheeluNo ratings yet

- Sana HNMDocument12 pagesSana HNMSana MirNo ratings yet

- The Importance of Reverse Logistics (#274692) - 255912Document11 pagesThe Importance of Reverse Logistics (#274692) - 255912I'malookIubeNo ratings yet

- CaseDocument2 pagesCaseAman Dheer KapoorNo ratings yet

- Traditional VS Modern MarketingDocument17 pagesTraditional VS Modern Marketingneha palkarNo ratings yet

- FREIGHT ChargesDocument36 pagesFREIGHT Chargesmayankpant1No ratings yet