Professional Documents

Culture Documents

31 Social Welfare Venture HOPE IRDS

Uploaded by

Apar SinghCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

31 Social Welfare Venture HOPE IRDS

Uploaded by

Apar SinghCopyright:

Available Formats

A.

ORGANIZATION PROFILE Name of the Organization Year of Establishment Head Office HOPE INTEGRATED RURAL DEVELOPMENT SOCIETY December -2004. D.No.45/142/8,up Stairs, Road No-2, Venkataramana Colony, Kurnool. 518003 (A.P), South India L.Jayakumar Organization has been legal structure of society Registered Under Societies Act XXXV of 2001 with No. 901 / 2004. Hope has been operating in Kurnool, Yemmiganur, Mantralayam, Kodumur and Gudur mandals of Kurnool District, AndhraPradesh.

The Founder and The Secretary cum CEO Legal & Functional Status Geographic Area of Operation

B. GENESIS The chief founder Mr.L.Jayakumar had been in the field of marketing for more than two decades and during his journey he has noticed that many urban and rural poor women are struggling hard for earning their minimum income and it has motivated him to give the birth of Hope in the year of 2004 and render services to the poor women just to increase their minimum stranded by increasing their lively income. With the strong ambition to reduce the poverty level and to support the poor women, small and petty traders from the clutches of money lenders, he has resigned for the job and dedicated himself to support the urban and

rural poor women and today it is proudly seen with a clients of 5000 and looking forward to increase the clients of 54,390 by 2015.

Chief founder Mr.L.Jayakumar C. OUR REACH AS ON MAY 2010 No of units No. of Centers No of Groups No of Members Active Members Total Loan Disbursement Gross Loan Outstanding 2 171 457 4570 3410 101525500 15494600

D. VISION-MISSION AND GENERAL OBJECTIVES OF THE ORGANIZATION

1. VISION To create sustainable livelihoods for the poor and disadvantaged women. 2. MISSION

To reduce poverty and improve the quality life of the poor women in urban and rural areas of the Andhra Pradesh through the provision of Qualitative and responsive financial services in an innovative and Sustainable ways. 3. STRATEGY Hope strategy for intervention is organizing women into Groups, promoting micro economic enterprises for their socio economic development, peoples participation in community development activities, enabling them to have social security. 4. CORE VALUES Social Commitment. Dedication. Performing better than the Best. Self Reliance. Integrity.

5. OBJECTIVES (A) To promote productivity and thereby increase the income of the rural/urban poor women through micro finance. (B) To promote income generating activities of poor people through micro credit micro finance. 1. To achieve an appreciable raise in the standard of living of the poorest women section of the population. 2. To train them in learning income generation program to enhance their incomes and to improve their livelihood. 3. Enhancing the present levels of financial self-sufficiency and profitability. 4. To promote comprehensive Health Programme for the well being of the Rural Community and care or relief of the sick, the helpless and Indigent Persons. 5. HOPE plan in the near future to initiate free education to slum dwellers children, health services to clients and rehabilitation services to senior citizens. 6. To do all such other lawful things for the advancement and implementation of the Aims and objectives of the Society to be exclusively utilized for the advancement of the aims and objects of the Society. 6. QUALITY OF OPERATIONS a) Organizational capabilities It is operating in the area where the organization has been known to the public and it has been involved in peoples development initiatives.

Organization has eminent and experienced personnel in the Governing body as well as in the managerial side. Committed staff for the cause of poverty alleviation. Well trained staff in the field of Book-keeping, Accounting, Finance, and Human Resource Management. The MIS has been fully computerised at both in branch level and HO, at present HOPE is using FIMO software professionally developed by Jayam Solutions, Hyderabad. b) Infrastructural Capabilities

Hope is having infrastructural capabilities which are being used for the promotion of the operations. It is having vehicles, computers and furniture in all its branches. c) Existing customer base

Hopes existing customer base is 5865 as on 31-03-2010. There is a tremendous potentiality in the same area for the expansion of operations. Due to shortage of funding requirements, Hope could not expand its operations as per the projections.

E. STRONG AND WEAK POINTS (SWOT) OF HOPE

1. 2.

STRENGTHS Hope has clear focus on micro finance. It has cost effective and steadily expansion policy. It has developed good credit discipline among the members. It has stable and committed staff. It has reliable and good MIS and Accounting systems. Strong Internal and financial control and planning systems. Good reputation as a local NGO-MFI for these two districts. WEAKNESSES / CHALLENGES Despite of above strengths, it is having some challenges. Loan size is low.

3. 4.

Insufficient Funds for operations. Slow growth due to insufficient funds Opportunities Very good potentiality for expansion. Committed staff willing to maintain high staff and client retention rate. Manual MIS and Accounting systems for tracking and retrieving data. Good systems and procedures are in place. Good credit discipline cultivated among the members. Threats Working along with the Big Players in the Sector. Unethical practices of Moneylenders and pawnbrokers.

F. HOPE IRD SOCIETYS GOVERNANCE A seven member executive board from diverse professional backgrounds governs HOPE INTEGRATED RURAL DEVELOPMENT SOCIETY, KURNOOL. The diversity of technical expertise on the board includes Marketing, teaching, medical, and social works. The vast experience and commitment of the board paved the way towards realizing the organizations true potential and its active involvement catalyzed the endeavour of the organization to render sustainable financial services to the poor women retaining its ethical fiber.

1. THE EXECUTIVE BOARD MEMBERS NAME Sri. A.D.Jaya Prabhakar Sri. K. Seshagiri Sri. L. Jayakumar Sri. M. Raja Rao Smt. M. Ratna Kumari Smt.J. Subhashini Sri. A. Emmanuel DESIGNATION IN THE BOARD President Vice-President Secretary Joint Secretary Treasurer Executive member Executive member

2. HOPE IRD SOCIETY ADVISORY COMMITTEE A three member advisory committee from MFI professional backgrounds acts as Advisory Committee for HOPE INTEGRATED RURAL DEVELOPMENT SOCIETY, KURNOOL.

THE ADVISORY COMMITTEE MEMBERS

NAME Sri.L. Jaya Kumar Sri. K.V.Krishaiah Sri.S.Vijaya Bhaskar Sri. Sheshagiri Sri. Samuel Sujan Kalyan

DESIGNATION IN THE COMMITTEE Convener Member Member Member Member

3. STAFF PROFILE Sl.No Name of the Employee 1. L.Jayakumar 2. 3. 4. 5. 6. 7. 8. 9. 10. 11. 12. 13. 14. 15. K.E.Devadanam A. Rajesh Babu V.Ravikumar G.Sunder M.Michael M.Benjamin S.Veeresh Babu P.Rajasekhar Y.Srinivasulu G.Basha K.Ramakrishna B.Shaiksha Vali H.M.Ravi Kumar Educational Qualification B.Com B.Com M.Com B.A B.Com D.C.E B.Sc B.A B.A B.com B.A PUC B.A B.B.M Experience Date of Joining 24 Years 17th Dec 04 20 Years 1st Jan 05 6 Years 4 Years 3 Years 10 Years 6 Years 3 Years 3 Years 3 Years 6 Years 3 Years 2 Year 1 Year 5 Years 2 Years Fresher 01st Dec 09 15th Aug 06 4th Dec 06 1st July 07 7th Nov 07 17th Jan 08 1st April 08 17th Jan 08 18th Jan 08 18th Jan 08 4th Sep 09 1st Oct 09 8th Nov 09 1st Dec 09 10th May 10 Designation Secretary & CEO Accountants Manager Incharge Operations Branch Incharge MIS Officer HR Incharge Audit Officer. Sr.Credit officer Sr.Credit officer Sr.Credit officer Sr.Credit officer Sr.Credit officer Credit officer Account Assistant MIS Asst. Credit officer MIS Asst.

S.Vijaya Bhaskar B.Com Reddy 16. D.Abdul Gafoor Inter 17. M.L.P. Prem M.Sc IS Kumar G. OPERATIONAL STRUCTURE

1. OPERATIONAL STRUCTURE

2. SOCIETY METHODOLOGY HOPE IRD Society methodology is a Joint Liability Group (JLG) methodology.

3. AREA OFFICE STRUCTURE

4. ORGANOGRAM

H. PRODUCTS & SERVICES Hope is offering three types of products. These are Loan Products Insurance Product Employment Programme.

PRODUCTS General Loans

SERVICE CHARGES Int Rate: 12.5% p.a Documentation Rs. 50/L P F: 1%(Upfront) Client Enrolment fee Rs.100/-

FEATURES 1. 50 weeks 2. Weekly Instalments 3. Size of the loan vary by cycle 4. Collateralgroup guarantee

TARGET CLIENTS All Borrowers

DELIVERY 1. size of the loan Vary by cycle from Rs.5000/to Rs.18000/ 2. One Time Disburse ment to the Entire group (10 members) 1. Size of the loan Rs.5000/only

RangDe Loan

Int Rate: 8.5% p.a Documentation Rs. 50/L P F: 1%(Upfront) Int Rate: 8.75% p.a Documentation Rs. 50/L P F: 1%(Upfront) Int Rate: 8.5% p.a

1. 50 weeks 2. Weekly Instalments 3. Size of the loan vary by cycle 1. 50 weeks 2. Weekly Instalments 3. Size of the loan vary by cycle 1. 8 Months 2. Monthly Instalment

New Members

R M K Loan

All Borrowers

1. size of the loan Vary by cycle from Rs.8000/-

Employment Program (Tri Partnership with Pan iit & Rangde.org) Insurance

New Members

Size of the loan Rs.5,500/- only

Collection Rs.150/-

1. Covering the Life of the spouse &

All Borrowers & Spouse Compulsory

Through Birla Sun Life Insurance.

client 2. Natural & Accidental Death. 3. Male: 10000/4. Client Cover with loan Amount

I. A BRIEF NOTE ON HOPE SOCIAL DEVELOPMENT INITIATIVES FOR THE YEAR 2010 2011 HOPE set the following social objectives and committed to implement the below proposed new initiatives during the year 2010 2011. The following Social Objectives were framed in line with the vision and mission of HOPE. 1. To render responsive financial services for the underserved poorest of the Poor 2. To improve access to alternative livelihood opportunities for the client community 3. To respond to natural calamities 1. PROPOSED CLIENT PROTECTION INITIATIVES AT HOPE 2. Systematic loan appraisal mechanism will be introduced with a focus on assessment of current cash flows and willingness of the client. 3. Create awareness on the ill effects of multiple borrowings for clients 4. All the pricing, fees and terms and conditions will be shared in local language with the clients and ensured their proper understanding during group orientations 5. Credit Officers will be oriented and sensitized on appropriate collection Practices 6. Written code conduct will be introduced in the organizations to ensure ethical staff behaviour. 2. COMMUNITY DEVELOPMENT INITIATIVES HOPE has been continuously involved in various community development initiatives since inception. An overview of HOPE community development initiatives is hereunder depicted HOPE provided blankets and steel buckets for prisoners at Nandyal sub jail on 5th June 2005. HOPE provided lunch for 150 members for leprosy colony people and books and college fee for their children at adarsha nagar - Kurnool on 22nd January 2006 on the occasion of HOPE 1st anniversary. Conducted free medical camp for poor people at Ponnpuram colony Nandyal who are suffering with viral fever and chikungunya on 5th August of 2006 with three govt.

doctors and nurses. The camp was inaugurated and attended by Nandyal municipal Commissioner and area municipal corporators.500 People attended this medical camp. HOPE provided medicines and lunch for all the poor families at medical camp. On 26th January of 2007 HOPE provided lunch to eighty (80) old age mentally retarded and physically handicapped people at MISSIONARIES OF CHARITY old age home, somisetty nagar, B Camp Kurnool On the occasion of HOPE 2nd anniversary. On 21st July 2007 Hope provided sweets and snacks to mentally retarded and physically handicapped people at Care Land, Gooty road - Kurnool. Conducted flood relief activities in Kurnool and Mantralayam in Nov 2009 and provided relief kits to the recent flood victims. Proposal under process with the District Collector to conduct free Eye camps (for screening and surgeries) in tribal areas and schools in Kurnool district.

With the above inspiration, HOPE decided to continue other need based community development initiatives in future. 3. Proposed Feedback Mechanism at HOPE Establishing client grievance cell with a dedicated phone line. The number will be communicated to all members and printed on their repayment cards. A written feedback form will be made available for all staff during staff reviews.

J. 1. 2. 3. 4.

EXTERNAL RELATIONSHIPS HOPE HAS MEMBERSHIP WITH THE FOLLOWING NETWORKS. Sa-Dhan. Access Network promoted by CARE INDIA. HOPE HAS PARTNERSHIP WITH THE FOLLOWING FINANCIAL INSTITUTIONS. FWWB, India. SAADHANA I F P & Services, Kurnool. Rang De.Org, Chennai. R M K, New Delhi. Maanaveeya Holdings & Investment Private Ltd., HOPE PROPOSALS UNDER PROCESS WITH THE FOLLOWING FUNDING AGENCIES. Karur Vysya Bank. Indian Overseas Bank. Punjab National Bank. SIDBI. CONSULTANCY SERVICES

Mr.Vijaya Bhaskar of M/s Mitra Consultancy Services, Hyderabad accordingly entered an MOU on 22.05.2009 to undertake and implement the procedures and systems, internal controls, fund management and capacity building Etc.

5. STRATEGIC GROWTH PLAN Current activities with reference to the reach and its depth HOPEs current activities are closely related to its products. HOPE is now operating its operations in Yemmiganur, Mantrlayam,Kodumur & Gudur mandals with 5865 members in Kurnool district. K. PERFORMANCE 1. PROGRESS REPORT COMPARATIVE PROGRESS REPORT FOR LAST THREE YEARS As on 31.03.08 Operational Highlights No. of Centers No. of Groups No. of Members No. of Active Loans No. of Active Clients Total No. of loans disbursed Value of loans disbursed Gross Loan Outstanding Staff Strength Incharge Operations Unit Manager Credit Officer Tr.Credit Officer Support Services Admin Staff CEO Total Staff No. of Units Portfolio Quality Repayment Rate Portfolio At Risk (PAR) Average Loan Size Average loan Outstanding Debt Outstanding Efficiency Ratios Administrative Efficiency Operational Efficiency Personnel costs as a percent of adm. Number of active clients per staff As on 31.03.09 110 286 3,170 2,801 2,811 5,432 3,55,42,500 1,15,31,260 1 1 3 2 4 1 1 13 2 100.00% 0.00% 6,543 4,117 1,18,80,211 14.53 31.16 44.6 216.23 As on 31.03.10 143 342 3,910 2,824 3,396 8,522 6,55,45,500 1,36,18,560 Column1

152 334 4,390 3,069 3,225 11,672 9,70,13,500 1,62,64,460 1 1 7 5 1 1 16 2 100.00% 0.00% 8,312 5,300 1,55,39,811 17.24 30.87 43.58 201.56

1 6 3 1 1 12 2 100.00% 0.00% 7,691 4,822 1,33,96,413 15.14 32.38 48.89 283

member Number of active clients per Credit Officer Outstanding portfolio per loan officer Number of clients per branch office Profitability Ratios Return on Assets Return on Equity Yield on Portfolio Operational Self Sufficiency Financial Self Sufficiency

937 38,43,753.33 1,405.50 8.64 196.64 37.1 120.25 137.7

566 22,69,760.00 2,171.36 10.05 106.16 42.45 132.41 138.4

460.71 23,23,494.2 9 1,836.56 5.6 37.59 37.3 122.08 121.32

2. CASH FLOWS STATEMENT COMPARATIVE CASH IN FLOWS STATEMENT Apr'07 - Mar '08 INFLOWS Opening Cash / Bank External Borrowings Loan recovered Interest & Fee Income Other Income Advance recovery Staff Loan Recovery Sundry Receivables Insurance Mobilised from Mem Total Inflow Apr'08 - Mar '09 4,44,954 1,57,38,980 1,52,47,840 29,57,153 2,01,201 47,000 23,000 70,000 3,63,69,705 Apr'09 - Mar '10 Column1 6,02,069 3,80,332

1,92,50,000 1,70,50,000 2,79,15,700 2,88,22,100 51,20,427 51,21,500 1,60,099 1,67,696 19,300 69,000 51,865 1,27,935 6,400 5,200 2,28,000 3,89,500 5,37,33,683 5,29,28,419

COMPARATIVE CASH OUT FLOWS STATEMENT Apr'07 - Mar '08 OUTFLOWS Disbursements Loan repayments Interest on Borrowings Staff Salaries Travel Apr'08 - Mar '09 2,12,85,000 95,54,415 14,01,925 5,19,200 1,47,608 Apr'09 - Mar '10 Column1 3,00,03,000 3,14,68,000 1,77,33,798 1,50,90,110 21,46,325 20,15,990 7,34,870 10,11,157 3,43,466 5,47,826

Administrative expenses Insurance Amt paid to Birla Audit Fee Income Tax Paid TDS Vehicle Loans and Computer loans Fixed Deposits Staff Loans Fixed Assets Total Outflow Net Cash /Bank Balances

4,97,298

5,54,637 1,70,714 2,50,000 1,67,586 17,500 83,000 1,79,651 5,33,53,351 3,80,332

7,61,316 2,64,826 50,000 2,65,279 2,02,312 2,200 2,12,500 1,76,474 5,27,01,826 2,26,593

22,734 1,98,322 9,500 40,000 9,27,918 3,57,67,636 6,02,069

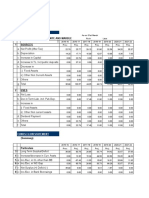

3. COMPARATIVE INCOME STATEMENT As on 31.03.08 Income Financial Income Interest Income on Loans Other Financial Income Service Charges from Insurance Total Income Financial costs Interest and fee on borrowings Gross Financial Margin Provision for loan losses Depreciation Net Financial Margin Operating costs Salaries Travel Administrative/office expenses Other Expenses Total Operating costs Net Surplus/deficit Non-operational Income/Exp Add: Grants Less: Income Tax Provision @ 30% Total consolidated surplus/deficit As on 31.03.09 Audited 29,57,153 2,01,201 31,58,354 As on 31.03.10 Column1 Audited Audited 51,20,427 1,60,099 57,286 53,37,812 51,21,500 3,27,696 1,24,674 55,73,870

14,01,925 17,56,429 60,372 60,372 16,96,057 5,19,200 1,47,608 4,97,298 11,64,106 5,31,951 5,31,951

21,46,325 31,91,487 20,872 2,13,574 2,34,446 29,57,041 7,34,870 3,43,466 5,54,637 17,424 16,50,397 13,06,644 72,000 13,78,644

20,15,990 35,57,880 26,460 2,03,171 2,29,631 33,28,249 10,11,157 5,47,826 7,61,316 23,20,299 10,07,950 10,07,950

4. COMPARATIVE BALANCE SHEET COMPARATIVE BALANCE SHEET As on 31.03.08 ASSETS Current Assets Cash in hand and bank Loans outstanding Gross Loans outstanding (Loan loss reserve) Net loans outstanding Rent Advance Telephone Deposit Advances Advance for Land Staff Loans Advance Tax Paid Sundry Receivables Total Current Assets Long term Assets Net property and equipment Total Long term Assets TOTAL ASSETS LIABILITIES AND NET WORTH Current Liabilities Short-term Liabilities : Advance from Members TDS Payble Grant Total Current Liabilities Long term Liabilities Individuals & Others FWWB Saadhana I F P & S Ltd RANG DE As on 31.03.09 Audited As on 31.03.10 Column1 Audited Audited

6,02,069 1,15,31,260 -1,15,313 1,14,15,947 5,000 6,000 1,12,500 33,200 30,609 1,22,05,325

3,80,332 1,36,18,560 -1,36,185 1,34,82,375 21,500 7,000 1,81,200 1,90,000 64,335 2,50,000 24,209 1,46,00,951

2,26,593 1,62,64,460 -1,62,645 1,61,01,815 21,500 9,200 2,23,700 4,60,000 1,48,900 3,00,000 2,71,345 1,77,63,053

13,51,171 13,51,171 1,35,56,496

13,17,248 13,17,248 1,59,18,200

12,90,552 12,90,552 1,90,53,605

6,73,380 6,73,380

2,65,279 35,000 3,00,279

24,99,996 91,11,124

78,33,296 49,44,443 1,72,000

93,05,537 38,00,924 8,38,500

RMK New Delhi Others Provision for audit fee Total Long term debt Other Liabilities: Ashok Leyland Finance Mahindra & Mahindra Death Claim TDS Payble Total Other Liabilities TOTAL LIABILITIES NET WORTH Donated Equity Capital for On lending Cumulative Grants for Operations Retained net surplus Current net surplus TOTAL NET WORTH TOTAL LIABILITIES + NET WORTH

2,69,091 1,18,80,211 22,906 2,74,292

4,46,674 1,33,96,413 1,37,156

10,00,000 5,94,850 1,55,39,811 2,09,844 14,896 1,61,752 3,86,492 1,59,26,303 -

2,97,198 1,28,50,789

1,37,156 1,38,33,848

1,73,757 5,31,951 7,05,707 1,35,56,496

72,000 7,05,707 13,06,644 20,84,352 1,59,18,200

1,07,000 20,12,352 10,07,950 31,27,302 1,90,53,605

L. BUSINESS PLAN 1. PROGRESS REPORT PROJECTED COMPARATIVE PROGRESS REPORT FOR THE NEXT 5 YEARS Column1 Operational Highlights No. of Centers No. of Groups No. of Members No. of Active Loans No. of Active Clients Total No. of loans disbursed Value of loans disbursed As on 31.03.11 As on 31.03.12 As on 31.03.13 As on 31.03.14 As on 31.03.15

Gross Loan Outstanding Members Savings

308 588 957 1,450 2,002 770 1,469 2,393 3,624 5,004 9,390 16,890 26,890 39,390 54,390 7,512 14,357 23,394 35,451 48,951 7,700 14,694 23,932 36,239 50,039 19,522 35,242 60,962 99,592 1,53,472 168,098,5 549,188,5 929,983,5 1,491,148 00 310,048,5 00 00 ,500 00 37,902,66 77,509,80 132,384,5 208,621,8 303,586,8 0 0 80 80 20

Outstanding Staff Strength Incharge Operations Unit Manager Credit Officer Tr.Credit Officer Support Services Admin Staff CEO Total Staff No. of Units Portfolio Quality Repayment Rate Portfolio At Risk (PAR) Average Loan Size Average loan Outstanding Debt Outstanding

1 4 12 2 7 2 1 29 4

1 7 18 4 10 4 1 45 7

1 11 28 4 13 7 1 65 11

1 16 45 4 17 7 1 91 16

1 22 62 4 17 7 1 114 22

100.00% 100.00% 100.00% 100.00% 100.00% 0.00% 0.00% 0.00% 0.00% 0.00% 8,611 8,798 9,009 9,338 9,716 5,046 5,399 5,659 5,885 6,202 43,671,17 82,344,80 131,573,0 202,523,4 277,904,7 8 3 39 97 16

Efficiency Ratios Administrative Efficiency 15.98 13.09 11.48 10.75 10.39 Operational Efficiency 30.16 27.43 24.97 23.86 22.98 Personnel costs as a percent 50 50 50 50 51.28 of adm. Number of active clients per 265.51 326.54 368.19 398.23 438.94 staff member Number of active clients per 641.65 816.35 854.72 805.31 807.08 Credit Officer Outstanding portfolio per 3,158,555 4,306,100 4,728,020 4,636,041 4,896,561 loan officer .00 .00 .71 .78 .61 Number of clients per branch 2,050.00 2,175.00 2,225.00 2,300.00 2,300.00 office Profitability Ratios Return on Assets 3.24 3.06 4.44 5.42 6.25 Return on Equity 28.24 35.36 49.71 51.73 48.52 Yield on Portfolio 35.28 31.94 30.71 30.54 30.59 Operational Self Sufficiency 118.14 117.63 124.23 129.32 134.51 Financial Self Sufficiency 112.88 112.95 119.33 124.1 128.18 2. CASH FLOWS STATEMENT COMPARATIVE CASH IN FLOWS STATEMENT Column1 Apr'10 Mar '11 Apr'11 Mar '12 Apr'12 Mar '13 Apr'13 Mar '14 Apr'14 Mar '15

INFLOWS Opening Cash / Bank External Borrowings

2,26,593 5,10,00,00 0 4,94,46,80 0 87,20,012 6,38,701 2,23,700 2,49,340 19,009 11,77,500

82,09,601 8,50,00,00 0 10,23,42,8 60 1,70,51,35 8 9,87,467 4,99,560 23,58,000

78,70,853 12,50,00,0 00 18,42,65,2 20 3,02,07,35 3 13,75,000 6,00,000 38,58,000

57,33,706 18,50,00,0 00 30,45,57,7 00 4,94,93,56 3 16,16,250 7,50,000 57,94,500

92,68,315 24,00,00,0 00 46,62,00,0 60 7,51,09,95 8 18,96,250 7,50,000 80,82,000

Loan recovered

Interest & Fee Income Other Income Advance recovery Staff Loan Recovery Sundry Receivables Insurance Mobilised from Mem Death Cliams Total Inflow

11,17,01,6 54

21,64,48,8 45

35,31,76,4 26

55,29,45,7 19

80,13,06,5 82

COMPARATIVE CASH OUT FLOWS STATEMENT Apr'10 - Mar '11 OUTFLOWS Disbursements Apr'11 Mar '12 7,10,85,00 0 2,28,68,63 3 38,02,790 15,22,000 5,32,700 9,89,300 14,896 9,81,250 Apr'12 Mar '13 14,19,50,0 00 4,63,26,37 4 81,89,587 27,34,000 9,56,900 17,77,100 Apr'13 Mar '14 23,91,40,0 00 7,57,71,76 4 1,40,16,15 6 40,93,000 14,32,550 26,60,450 Apr'14 Mar '15 Column1

38,07,95,0 56,11,65,0 00 00 11,40,49,5 16,46,18,7 42 80 2,21,18,54 3,19,17,68 7 7 58,90,000 82,84,000 20,61,500 27,54,430 38,28,500 51,15,370

Loan repayments Interest on Borrowings Staff Salaries Travel Administrative expenses Death Cliam Paid Insurance Amt paid to Birla Audit Fee Income Tax Paid TDS

19,65,000 50,000

32,15,000 75,000 26,93,800

48,28,750 1,00,000 50,60,564

67,35,000 1,00,000 86,14,559

6,28,888 1,61,752

11,84,031

Vehicle Loans and Computer loans Fixed Deposits Staff Loans Advance for Land Advances Fixed Assets Total Outflow

2,09,844 45,000 4,00,000 25,45,000 5,00,000 30,45,000 7,50,000 35,45,000 7,50,000 35,45,000 7,50,000

2,50,000 10,34,92,0 53 82,09,601

4,00,000 20,85,77,9 92 78,70,853

5,50,000 34,74,42,7 20 57,33,706

6,50,000 8,00,000 54,36,77,4 79,43,99,8 04 26 92,68,315 69,06,756

Net Cash /Bank Balances

3. INCOME STATEMENT COMPARATIVE INCOME STATEMENT Column1 Income Financial Income Interest Income on Loans Other Financial Income Service Charges from Insurance Total Income As on 31.03.11 Projected 87,20,012 6,38,701 1,96,250 95,54,962 As on 31.03.12 Projected 1,70,51,35 8 9,87,467 3,93,000 1,84,31,82 5 As on 31.03.13 Projected 3,02,07,35 3 13,75,000 6,43,000 3,22,25,35 3 As on 31.03.14 Projected 4,94,93,56 3 16,16,250 9,65,750 5,20,75,56 3 As on 31.03.15 Projected 7,51,09,95 8 18,96,250 13,47,000 7,83,53,20 8

Financial costs Interest and fee on borrowings Gross Financial Margin

38,02,790 57,52,172

81,89,587 1,02,42,23 8 3,96,071 3,56,397 75,000 8,27,468 94,14,769

1,40,16,15 6 1,82,09,19 7 5,48,748 3,95,117 1,00,000 10,43,865 1,71,65,33 2

2,21,18,54 7 2,99,57,01 5 7,62,373 4,46,094 1,00,000 13,08,467 2,86,48,54 8

3,19,17,68 7 4,64,35,52 0 9,49,649 5,16,875 1,00,000 15,66,524 4,48,68,99 6

Provision for loan losses Depreciation Provision for Audit Fee Net Financial Margin

2,16,382 3,45,496 50,000 6,11,878 51,40,295

Operating costs Salaries Travel Administrative/office expenses Other Expenses Total Operating costs

15,22,000 5,32,700 9,89,300

27,34,000 9,56,900 17,77,100

40,93,000 14,32,550 26,60,450

58,90,000 20,61,500 38,28,500

82,84,000 27,54,430 51,15,370

30,44,000 54,68,000

81,86,000 1,17,80,00 1,61,53,80 0 0 89,79,332 1,68,68,54 8 2,87,15,19 6

Net Surplus/deficit

20,96,295

39,46,769

Non-operational Income/Exp Add: Grants Less: Income Tax Provision @ 30% Total consolidated surplus/deficit 6,28,888 14,67,406 11,84,031 27,62,739 26,93,800 62,85,532 50,60,564 1,18,07,98 4 86,14,559 2,01,00,63 7

4. COMPARATIVE BALANCE SHEET COMPARATIVE BALANCE SHEET As on 31.03.11 As on 31.03.12 Projected As on 31.03.13 Projected As on 31.03.14 Projected As on 31.03.15 Projected Column1 Projected

ASSETS Current Assets Cash in hand and bank Loans outstanding Gross Loans outstanding (Loan loss reserve) Net loans outstanding Fixed Deposits Computer Advance Other Deposits Rent Advance Telephone Deposit Advances

82,09,601 3,79,02,66 0 -3,79,027 3,75,23,63 3

78,70,853 7,75,09,80 0 -7,75,098 7,67,34,70 2 25,00,000

57,33,706 13,23,84,5 80 -13,23,846 13,10,60,7 34 55,00,000

92,68,315 20,86,21,8 80 -20,86,219 20,65,35,6 61 90,00,000

69,06,756 30,35,86,8 20 -30,35,868 30,05,50,9 52 1,25,00,00 0

61,500 14,200

1,01,500 19,200

1,41,500 24,200

1,81,500 29,200

2,21,500 34,200

Advance for Land Staff Loans Advance Tax Paid Sundry Receivables Total Current Assets 4,60,000 2,99,560 3,00,000 2,52,336 4,71,20,83 0

4,60,000 3,00,000 3,00,000 2,52,336 8,85,38,59 1

4,60,000 4,50,000 3,00,000 2,52,336 14,39,22,4 76

4,60,000 4,60,000 4,50,000 4,50,000 3,00,000 3,00,000 2,52,336 2,52,336 22,64,77,0 32,16,75,7 12 44

Long term Assets Net property and equipment Total Long term Assets TOTAL ASSETS

11,95,056

12,38,659

13,93,542

15,97,448

18,80,573

11,95,056 4,83,15,88 6

12,38,659 8,97,77,25 0

13,93,542 14,53,16,0 18

15,97,448

18,80,573

22,80,74,4 32,35,56,3 59 16

LIABILITIES AND NET WORTH Current Liabilities Short-term Liabilities : Advance from Members Interest payable on Advance TDS Payble Grant Death Cliam Loan Protection Fee Total Current Liabilities Long term Liabilities Long term debt : Individuals & Others FWWB Saadhana I F P & S Ltd RANG DE RMK New Delhi Maanaveeya H &I P Ltd -

1,22,77,79 1 41,94,438 36,47,857 17,85,368 1,00,00,00 0

2,01,11,11 1 44,16,667 67,85,714 13,58,842 2,76,66,66 7

2,50,27,77 8 42,22,222 67,85,714 9,32,316 5,19,44,44 4

3,64,16,66 4,92,50,00 7 0 79,16,667 85,00,000 99,64,286 1,00,71,42 9 5,05,789 1,05,263 8,50,00,00 12,38,33,3 0 33

SIDBI AXIS Karur Vysya Bank Others Provision for audit fee Total Long term debt Other Liabilities: Ashok Leyland Finance Mahindra & Mahindra Death Claim TDS Payble R.K.Solutions Total Other Liabilities TOTAL LIABILITIES

42,50,000

98,75,000

1,93,75,00 0 1,17,85,71 4 1,14,99,85 0 1,00,000 13,16,73,0 39 13,16,73,0 39

3,06,25,00 4,18,75,00 0 0 2,42,14,28 6 2,00,55,40 6 1,00,000 27,80,04,7 16 20,26,23,4 27,80,04,7 97 16

35,71,429 39,44,294 50,000 4,37,21,17 8 4,37,21,17 8 8,24,19,80 3 77,14,286 44,16,517 75,000 8,24,19,80 3

1,94,28,57 1 1,26,66,51 7 1,00,000 20,26,23,4 97

NET WORTH Donated Equity Capital for On lending Cumulative Grants for Operations Retained net surplus Current net surplus TOTAL NET WORTH

1,07,000 30,20,302 14,67,406 45,94,708

1,07,000 44,87,708 27,62,739 73,57,447

1,07,000 72,50,447 62,85,532 1,36,42,97 9 14,53,16,0 18

1,07,000

1,07,000

1,35,35,97 2,53,43,96 9 3 1,18,07,98 2,01,00,63 4 7 2,54,50,96 4,55,51,60 3 0 22,80,74,4 32,35,56,3 59 16

TOTAL LIABILITIES + NET WORTH

4,83,15,88 6

8,97,77,25 0

BIBLIOGRAPHY http://hopeap.org http://www.rangde.org/ http://www.google.co.in/

You might also like

- 47 ERP HR ModuleDocument19 pages47 ERP HR ModuleApar SinghNo ratings yet

- Turnaround Venture - Playboy EnterprisesDocument5 pagesTurnaround Venture - Playboy EnterprisesApar SinghNo ratings yet

- Project - Dominance of Foreign Brands & Lessons For New Entrants in Indian Sportswear Organized Retail Sector1.Document138 pagesProject - Dominance of Foreign Brands & Lessons For New Entrants in Indian Sportswear Organized Retail Sector1.Apar SinghNo ratings yet

- 45 MIS Case 1 Contd...Document3 pages45 MIS Case 1 Contd...Apar SinghNo ratings yet

- 32 (01) Failed VentureDocument4 pages32 (01) Failed VentureApar SinghNo ratings yet

- 36 Finishing Parameters and Controlling FactorsDocument48 pages36 Finishing Parameters and Controlling FactorsApar Singh100% (1)

- 41 HRMDocument5 pages41 HRMApar Singh100% (1)

- 44 MIS Case 1Document1 page44 MIS Case 1Apar SinghNo ratings yet

- 42 Intellectual Property RightsDocument19 pages42 Intellectual Property RightsApar SinghNo ratings yet

- 35 Spotting and Stain Removal TechniquesDocument38 pages35 Spotting and Stain Removal TechniquesApar Singh100% (9)

- 38 TechpackDocument9 pages38 TechpackApar Singh100% (7)

- 18 IeDocument7 pages18 IeApar SinghNo ratings yet

- 37 T&A CalendarDocument1 page37 T&A CalendarApar SinghNo ratings yet

- 33 Eco Friendly Garment VentureDocument22 pages33 Eco Friendly Garment VentureApar SinghNo ratings yet

- 28 CSR Case Study 2Document3 pages28 CSR Case Study 2Apar SinghNo ratings yet

- 27 CSR Case Study 1Document6 pages27 CSR Case Study 1Apar SinghNo ratings yet

- 11 Coloured Stitch Designs in KnittingDocument40 pages11 Coloured Stitch Designs in KnittingApar Singh50% (2)

- 15 D&P 2Document2 pages15 D&P 2Apar SinghNo ratings yet

- 13 Garment Defect AnalysisDocument31 pages13 Garment Defect AnalysisApar Singh97% (29)

- 14 D&P 1Document2 pages14 D&P 1Apar SinghNo ratings yet

- 16 Dyeing and Printing DefectsDocument11 pages16 Dyeing and Printing DefectsApar Singh91% (11)

- 08 Case Study OBDocument6 pages08 Case Study OBApar Singh75% (4)

- 03 CapacitorsDocument1 page03 CapacitorsApar SinghNo ratings yet

- 01 MicrosoftDocument25 pages01 MicrosoftApar SinghNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Investment Office ANRS: Project Profile On The Establishment of Carpet Making PlantDocument25 pagesInvestment Office ANRS: Project Profile On The Establishment of Carpet Making Plantabel_kayel100% (2)

- MCQ's On EconomicsDocument42 pagesMCQ's On EconomicsDHARMA DAZZLENo ratings yet

- Block L - Salary-Based Budgeting Worksheet 8 - Sheet1Document2 pagesBlock L - Salary-Based Budgeting Worksheet 8 - Sheet1api-49586045967% (3)

- Albania: World Bank Group Partnership Program SnapshotDocument34 pagesAlbania: World Bank Group Partnership Program SnapshotHallidayMatthewNo ratings yet

- Chapter 5 - Student Lecture Notes - Nominal Interest Rates 2022fDocument42 pagesChapter 5 - Student Lecture Notes - Nominal Interest Rates 2022fLuqmaan KhanNo ratings yet

- Ajanta & ElloraDocument150 pagesAjanta & ElloraSuvithaNo ratings yet

- International Economics Revision NotesDocument28 pagesInternational Economics Revision NotesDaksh JainNo ratings yet

- Alternative Guide Full PDFDocument161 pagesAlternative Guide Full PDFaadeshy39No ratings yet

- MOE - Annual Economic Report - 2019Document88 pagesMOE - Annual Economic Report - 2019Yousuf MarzookNo ratings yet

- Non Profit Questions EdexcelDocument35 pagesNon Profit Questions EdexcelNipuni PereraNo ratings yet

- Lecture 9 Fiscal PolicyDocument53 pagesLecture 9 Fiscal PolicyAmjid HussainNo ratings yet

- Ilovepdf MergedDocument117 pagesIlovepdf Mergedbekiyob495No ratings yet

- Shree Shyam Granite Cma Data - Xls FINALDocument45 pagesShree Shyam Granite Cma Data - Xls FINALSURANA1973100% (1)

- A Sample CH 03Document17 pagesA Sample CH 03ishasahaiNo ratings yet

- 2011 EUA Crise Teto Da DívidaDocument12 pages2011 EUA Crise Teto Da DívidaGabriel LaguerraNo ratings yet

- Fundamentals November 2019 PDFDocument84 pagesFundamentals November 2019 PDFJubil RoxNo ratings yet

- The State of Major Macroeconomic Indicators in Ethiopia and Proposed DirectionsDocument11 pagesThe State of Major Macroeconomic Indicators in Ethiopia and Proposed DirectionsBisrat TeferiNo ratings yet

- Theory and Applications of MacroeconomicsDocument869 pagesTheory and Applications of MacroeconomicsJACK WEBB100% (1)

- AFAR 1.2 - Partnership Accounting (Partnership Dissolution and Liquidation)Document8 pagesAFAR 1.2 - Partnership Accounting (Partnership Dissolution and Liquidation)Kile Rien MonsadaNo ratings yet

- Pre-Feasibility Study for a Private Hospital in BalqaDocument63 pagesPre-Feasibility Study for a Private Hospital in BalqaFarhadNo ratings yet

- Ela Career Development Unit 3-Module 1 - Resource 2 Analyze A Salary-Based Budget 1Document3 pagesEla Career Development Unit 3-Module 1 - Resource 2 Analyze A Salary-Based Budget 1api-542822113No ratings yet

- Oman Vision 2040 VTHRRZDocument24 pagesOman Vision 2040 VTHRRZAnak Agung Bagus WirayudaNo ratings yet

- Fiscal Deficit in India By: Dr. Neelam Tandon PGDM Ii A, B and IbDocument1 pageFiscal Deficit in India By: Dr. Neelam Tandon PGDM Ii A, B and IbAnkit ChawlaNo ratings yet

- 2017G - 06392-171Gbl - Nigeria Presents 2018 BudgetDocument5 pages2017G - 06392-171Gbl - Nigeria Presents 2018 BudgetGeorge AniborNo ratings yet

- Cambridge IGCSE: ECONOMICS 0455/21Document8 pagesCambridge IGCSE: ECONOMICS 0455/21Sylwia SdiriNo ratings yet

- Economics Crisis of PakistanDocument6 pagesEconomics Crisis of PakistanHassam MalhiNo ratings yet

- DPNC Budget 2014 15 HighlightsDocument40 pagesDPNC Budget 2014 15 HighlightsSandeep GuptaNo ratings yet

- Canada Telecommunication SWOT AnalysisDocument3 pagesCanada Telecommunication SWOT AnalysisTheonlyone01No ratings yet

- Crisil Sme Connect Apr12Document56 pagesCrisil Sme Connect Apr12Vidya AdsuleNo ratings yet

- Assessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in Rs. LacsDocument20 pagesAssessment of Working Capital Requirements Form Ii - Operating Statement M/S Amounts in Rs. LacsAnuj NijhonNo ratings yet