Professional Documents

Culture Documents

Law Cases (26-2-2011)

Uploaded by

Deborah JacobOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Law Cases (26-2-2011)

Uploaded by

Deborah JacobCopyright:

Available Formats

POSITION OF DIRECTORS UNDER COMPANIES ACT 1956 1 2 3 4 TRUSTEE EMPLOYEE AGENT MEMBER

Lee v/s Lees Air Farming Ltd.

Subject Matter: This case relates to the position of directors. The directors are the brain of the company. They are professional men, who have been hired by the company to carry on its affairs. They cannot be called servants of the company. They occupy a very important position in the company. Brief Facts: In the company, the principal controller and director of the company was employed in this company as a pilot, and was engaged in his duties as a pilot. When he was carrying on his duty as a pilot, he met with an accident and died while on duty. Consequent upon his died, while on duty as a pilot his widow claimed the compensation under the Workers Compensation Act. She recovered the compensation. Principal laid down: Director as a person would work as an employee in a different capacity. He cannot be described as a servant but as an officer of the company.

DOCTRINE OF INDOOR MANAGEMENT

Royal British Bank v/s Turquand company Subject Matter: This refers to Doctrine of Indoor Management. An outsider who deals with the is entitled to assume that as far as the internal proceedings of the company is considered, everything is being regularly done. This protects the outsider against the company. Brief Facts: The AOA of the company provided that the directors of the company might borrow money on bonds. The directors borrowed money and issued bonds to the plaintiff. It was stated that provided the resolution was passed in the general meeting. It was held that, the plaintiff could recover the amount of bonds from the company. Because he was entitled to assume that the resolution has been passed in the general meeting Principal Laid Down: This is regarded as DIM that the persons dealing with limited liability companies are not required to inquire into the indoor management of such companies and therefore they will not be affected by any irregularity.

MISTATEMENT IN PROSPECTUS DOCTRINE OF ULTRA VIRES DERRY V/S PEEK

Subject Matter: Any person who has been induced to subscribe for shares or debentures of the company on the basis of misrepresentation, misstatement or untrue and fraudulent statement in the prospectus of the company can sue the person responsible for issuing it, provided that he proves that there was fraudulent misstatement in prospectus. Brief Facts: A special act of the parliament made a provision that the tramway companys carriage must be driven by animal power and with the permission of the board of trade be driven by steam power. The directors included a statement in the prospectus that by virtue of this special act, the company would have a right to use steam power instead of animal power. However, no reference was made to the board of trades concern. Subsequently, when the board of trade refused permission, the company was not allowed to drive the carriage by steam power. It had to be wound up. The plaintiff brought an action of deceit against the directors. Principle Laid Down: An innocent misstatement is not a fraud. Fraud may be committed by making a false statement knowingly and recklessly whether true or false. If the person making the false statement honestly believes it to be true, then such a person is not guilty of fraud. SHANTIPRASAD JAIN V.S KALINGA TUBES ------------------------------------------------------------Subject Matter: Sec 81 of the Indian Companies Act. If a company decides to increase its share capital, it is required to offer new shares to its existing shareholders first and then to the outsiders, by passing a resolution to that effect. Brief Facts: Two groups equally held the private company shares. In order to provide financial and admin assistance, the petitioner was made the chairman of the BOD. This private company was converted into a public company with a view to take advantage of the loan facility provided by the Orissa govt. These 2 groups who had majority in the BOD as well as in the general meeting resolved to offer shares to the outsiders to the total exclusion of the existing shareholders. The question came up for determination for the court as to whether the exercise of majority power was in good faith or to deprive the plaintiff of his right under Sec. 81. Principle Laid Down: It was observed in the case that operation of Sec. 81 could be excluded and new shares could be offered to outsiders to the total exclusion of the existing shareholders only in the following 2 cases: 1. The company must pass a special resolution for allotting of new shares. 2. The company must pass an ordinary resolution and the central govt. must be satisfied on application made by the BOD.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- History Nicula Monastery Wonderworking Icon of The Mother of GodDocument2 pagesHistory Nicula Monastery Wonderworking Icon of The Mother of Godlilianciachir7496No ratings yet

- Chaplet of St. Padre Pio-1Document2 pagesChaplet of St. Padre Pio-1Mateus SandersonNo ratings yet

- DocumentDocument2 pagesDocumentamine1331No ratings yet

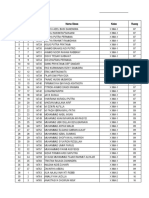

- Nilai Praktik Baca KitabDocument61 pagesNilai Praktik Baca KitabAhmad alamul hudaNo ratings yet

- Viva! Cristo Rey!: Solemnity of Christ The KingDocument132 pagesViva! Cristo Rey!: Solemnity of Christ The KingKristel Arceo SungaNo ratings yet

- Inside Bnei Akiva SchoolsDocument20 pagesInside Bnei Akiva SchoolsRobert ShurNo ratings yet

- Irosun Ofun-1Document22 pagesIrosun Ofun-1Ojubona Aremu Omotiayebi Ifamoriyo100% (1)

- The 52 Key Chapters of The Bible FellowshipDocument2 pagesThe 52 Key Chapters of The Bible FellowshipSilent BeastNo ratings yet

- SDM OnlyLove BabajiDocument8 pagesSDM OnlyLove Babajiலோகேஷ் கிருஷ்ணமூர்த்திNo ratings yet

- Module 1 The Rizal Law, Theory of Nationalism, The 19th Century PhilippinesDocument6 pagesModule 1 The Rizal Law, Theory of Nationalism, The 19th Century PhilippinesJohn Carlo QuianeNo ratings yet

- Swami Paramarthananda SaraswatiDocument180 pagesSwami Paramarthananda Saraswatiitineo2012No ratings yet

- Islam Dan Modernisme Di Indonesia: Kontribusi Pemikiran Mohamad Rasjidi (1915-2001) Mohammad Zakki AzaniDocument36 pagesIslam Dan Modernisme Di Indonesia: Kontribusi Pemikiran Mohamad Rasjidi (1915-2001) Mohammad Zakki Azanicep dudNo ratings yet

- Marriage Preparation Course, Lesson 3Document25 pagesMarriage Preparation Course, Lesson 3Quo Primum100% (1)

- Swami VivekanandasayingsDocument22 pagesSwami VivekanandasayingshemantisnegiNo ratings yet

- ArrrtttDocument4 pagesArrrtttLavenzel YbanezNo ratings yet

- The Time Two-Spirits: in ofDocument4 pagesThe Time Two-Spirits: in ofNicholas Breeze Wood100% (1)

- Diocesan Youth Days 9: Objective(s) For The DayDocument4 pagesDiocesan Youth Days 9: Objective(s) For The DayRaffy RoncalesNo ratings yet

- Ferraris and His WORKDocument8 pagesFerraris and His WORKeric parlNo ratings yet

- Dr. Subramanian Swamy Vs State of Tamil Nadu & Ors On 6 December, 2014Document20 pagesDr. Subramanian Swamy Vs State of Tamil Nadu & Ors On 6 December, 2014sreevarshaNo ratings yet

- Spiritual Practices of The Elders of Tableegh2Document90 pagesSpiritual Practices of The Elders of Tableegh2Mohammed SeedatNo ratings yet

- BOOK REVIEW On Akhuwat Ka Safar by DR - Mohammad Amjad SaqibDocument3 pagesBOOK REVIEW On Akhuwat Ka Safar by DR - Mohammad Amjad SaqibMERITEHREER786No ratings yet

- Islam and Sacred SexualityDocument17 pagesIslam and Sacred SexualityburiedcriesNo ratings yet

- Hinduastronomy00brenuoft PDFDocument364 pagesHinduastronomy00brenuoft PDFAlok Sharma100% (1)

- Hare, R M - Sorting Out EthicsDocument103 pagesHare, R M - Sorting Out EthicsJunior100% (1)

- Matecat Glossary DNDDocument135 pagesMatecat Glossary DNDQi GaoNo ratings yet

- Untitled2 PDFDocument12 pagesUntitled2 PDFkikaidanNo ratings yet

- SDMK Form A 1 - 5 Per AGUSTUS 2018 PontianakDocument559 pagesSDMK Form A 1 - 5 Per AGUSTUS 2018 PontianakMahmud AlhakeemNo ratings yet

- Complete Day 1 9 Novena To MHC 2023Document226 pagesComplete Day 1 9 Novena To MHC 2023Jasper A. SANTIAGONo ratings yet

- Sanketanidhi by Ramadayalu ChiDocument58 pagesSanketanidhi by Ramadayalu Chib_csr100% (2)

- As-Shahihah - Syaikh Al-AlbaniDocument120 pagesAs-Shahihah - Syaikh Al-AlbaniNur ShiyaamNo ratings yet