Professional Documents

Culture Documents

SIBL Assignment

Uploaded by

Dipayan_luOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SIBL Assignment

Uploaded by

Dipayan_luCopyright:

Available Formats

ABSTRACT Social Islami Bank Limited (SIBL) is a banking company registered under the companies Act 1994with its

head office 15 Dilkusha C/A, Dhaka-1000. The bank operates as a scheduled bank under abanking license issued by the Bangladesh Bank. The Bank started its operation from 22, November 1995. SIBL is a capitalized new generating Bank with an authorized capital of Taka 4000 Million in2008 and paid up capital of Taka 585 million in 2008 and also 585 million respectively as of December 2007. In the formal corporate sector, this Bank would, among others, offer the most up-todate banking services through opening of various types of deposit and investment accounts, financingtrade, providing letters of guarantee, opening letters of credit, collection of bills effecting domesticand international transfer, leasing of equipment and consumer durables, hire purchase and installment sale for capital goods, investment in low-cost housing and management of real estates, participatory investment in various industrial, agricultural , transport, educational and health projects and so on. In the Non-formal noncorporate sector, it would, among others, involve in cashWaqf Certificate and development and management of WAQF and MOSQUE properties, and Trust funds. For coordinating my internship I have been placed in Social Islami Bank Limited, IDB Bhaban Branch, and Dhaka. There are 03 sections in IDB Bhaban Branch. They are: 1) General Banking .2) Investment Department 3) Foreign Exchange Department. Accordingly I shall work all of thesections. I shall devote my utmost effort and attention to learn bankers functions. After completion of the internship, I will render my all knowledge to present the report on Overall banking System of Social Islami Bank Limited- A Special Focus on Fund Management.The report is divided into SevenChapters. 1) Introduction 2) Organization 3) Branch operation 4) Online banking 5) Performance, Ratio and SWOT Analysis 6) Project Analysis Fund Management 7) Concluding Remarks. In theorganizational part will briefly describe overview of the organizations historical background, functions, business philosophy, ownership pattern, foreign correspondents and overseas operationsand benefits provided to customers by the organization. Branch operation part will describe the product and service provided to the customers by a branch.

INTRODUCTION Since the establishment of Social Islami Bank Limited has come forward as a private commercial bank and very encourage has come forward as the stimulator of economic activities in the country. The bank has been entrusted with the responsibility of undertaking various steps related to the development of the countrys commercial ,industrial and agricultural sectors. The banking sector of a country is called the economic barometer of the country. As a pioneer commercial bank in the private sector in Bangladesh, Social Islami Bank provides considerable financial helps to the business sector that imports industrial goods and/or exports excess production outside the country for profit. Thus for imports the Social Islami Bank provides LIM (Loan against Import Merchandise) and LTR (Loan against Trust Receipt) facility and for exports provides both pre shipment and post shipment finances. Thus with these bank helps the prospect sin the business sector has increased more than ever before. HISTORICAL BACKGROUND OF SIBL Social Islami Bank Limited (SIBL) is a banking company registered under the companies Act 1994 with its head office in 15 Dilkusha C/A, Dhaka-1000. The bank operates as a scheduled bank under a banking license issued by the Bangladesh Bank, Central Bank of the country. The Bank started its operation from 22, November 1995. SIBL is a capitalized new generating Bank with an authorized capital and paid up capital of Taka585 million in 2007 and also. 585 million respectively as of December 2006.Currently the bank has 24 branches of which 12 in Dhaka, 4 in Chittagong, 1 in Sylhet, 2 in Narayanganj, 1 in Bogra, 1 in Khulna, 1 in Rajsahi, 1 in Sirajgonj. The bank undertakes all types of banking transaction to support the development of trade and commerce in the country. SIBL services are also available for the entrepreneurs to set up new venture and BMRE of industrial units. To provide clientele services in respect of international trade ithas established wide corresponded banking relationship with local and foreign banks trade and financial interest home and abroad. Since the very inception, Social Islami Bank Ltd. is working with the philosophy of serving the nationals as an

ideal and unique financial house. Every organization has some objectives of its own. The prime objective of Social Islami Bank Ltd. is to earn profit throw undertaking the responsibility of providing financial help for the development of the countrys commercial and industrial sector. EVOLUTION OF ISLAMIC BANKING:In Muslim communities limited banking activity, such as acceptance of deposits, goes back to the time when the Prophet Muhammad was still alive. At that time, people deposited money with the Prophet or with Abu Bakr Siddique, the First Khalif of Islam. The first modern Islamic bank, established in Egypt in1972, was called Nasser's Social Bank. Islamic accounting, an essential tool for the success of Islamic banks, is said to have been developed contemporaneously at the University of Cairo. Islamic banking operations are not limited to Arab soil, or Islamic countries, but are Spreading throughout the world. One reason is the "growing trend toward transcending national boundaries, and unifying Muslims into a political and economic entity that could have a significant impact on the pattern of world trade. ...Since Muslims are inclined to follow Islamic traditions, there is a tendency to establish an Islamic economic system in every Islamic nation. .. and to restore Shariah Law as the basic source for legislation" Islamic banking is no longer confined to concepts and ideas only. The Islamic banking and financial framework has developed into a full-fledged system and discipline. The concept has become clear to a great extent by now as to what are its basic requirements for compliance with Shariah. The earliest Islamic bank raced serious challenges ranging from general suspicions about their viability to a common mistrust about their intentions. Since then, the Islamic banks have been steadily growing to a remarkable level at this stage. During the last decades, financial instruments used by Islamic banks have developed significantly, both on assets and liability sides. Many instruments have been developed to mobilize financial surpluses. A number or Islamic banks have launched investment instruments in the form of certificates with short-term maturities or have established funds earmarked for certain investments. Accordingly, Islamic financial

institutions are operating at present in one former the other, in around70 countries of the world. SALIENT CHARACTERISTICS OF ISLAMIC BANKING;An Islamic bank is a full service intermediary financial institution that abides by the Islamic law. However, some writers like to see in Islamic banks more than a financial institution. This is not true. In a paper, Kuran (1997) said,"Islamic banking defies the separation between economics and religion. It invokes religious authority in a domain that modem civilization has secularized One must know the difference between Shariah, as a law, and religion. The only authority exercised on Islamic banks is that of their respective boards of directors and the supervision of central banks. The commitment of Islamic finance to abide by the Islamic law determines its main characteristics. This commitment is manifested is redefining its modes of operation and relationships between the financial intermediary on one hand, and the suppliers and users of funds on the other hand, in order to make them compatible with Shariah. The actual practice of Islamic banking over the past three decades and the rise of Islamic banks as a new species of banks reveal three innovations in the banking traditions. 1. New kind of relationship between banks and depositors, 2. Integration of financial and real market in financing, 3. Incorporation of ethics and moral values in investment and financing decisions. Islamic Banking brings economic empowerment to Muslims in the areas of operation. It helps Muslim businesspersons, through financial aid, to remain competitive. It also leads towards the creation of job opportunities for Muslims as well as Non-Muslims.

It is a basis for expansion into the Islamic Economic System since the establishment of each Islamic Bank is also the creation of another bank to co-operate with others in the International web of Islamic Banks. Thus also creating a link for international interests. It provides investors with flexibility in the types of accounts within which they could channel their investment. It thus links capital to labor and reduces expenditure, to levels, related with the type of investment, the value thereof and its period. Islamic Banks enable the saving of monetary resources for the future as shown by the Yusuf (A.S.) and in a methodology approved by Allah. This thus leads to the protection of wealth. Sponsoring Islamic activity & the mobilization of resources for International Islamic Support not only investment, but moral as well, i.e. relief towards Muslim refugees and victims of war, etc.

Islamic Banks facilitate international and local trade, provide foreign exchange services and profitably invest the Muslim fraternity's surplus wealth in conformity to Islamic principles through economically acceptable development and social projects indispensable for the Muslim Ummah. ISLAMIC MODES OF FINANCING:The important modes of financing are 1. Musharakah 2. Mudarabah 3. Murabaha 4. Salam 5. Istisna 6.Ijaraha

Musharakah Musharakah means a relationship established under a contract by the mutual consent of the parties for sharing of profits and losses in the joint business. It is an agreement under which the Islamic bank provides funds, which are mixed with the funds of the business enterprise and others. All providers of capital are entitled to participate in management, but not necessarily required to do so. The profit is distributed among the partners in preagreed ratios, while the loss is borne by each partner strictly in proportion to respective capital contributions.

Mudarabah A form of partnership where one party provides as the funds while the other provides expertise and management. The latter is referred to as the Mudarib. Any profits accrued are shared between the two parties on a pre-agreed basis, while loss is borne by the provider of the capital. Murabaha Literally it means a sale on mutually agreed profit. Technically, it is a contract of sale inwhich the seller declares his cost and profit. Islamic banks have adopted this as a mode offinancing. As a financing technique, it involves a request by the client to the bank to purchasea certain item for him. The bank does that for a definite profit over the cost, which is settledin advance. Salam Salam means a contract in which advance payment is made for goods to be delivered later on. The seller undertakes to supply some specific goods to the buyer at a future date in exchange of an advance price fully paid at the time of contract. It is necessary that the

quality of the commodity intended to be purchased is fully specified leaving no ambiguity leading to dispute. The objects of this sale are goods and cannot be gold, silver or currencies. Barring this, Salam covers almost everything, which is capable of being definitely described as to quantity, quality and workmanship. Istisna It is a contractual agreement for manufacturing goods and commodities, allowing cash payment in advance and future delivery or a future payment and future delivery. Istisna can be used for providing the facility of financing the manufacture or construction of houses, plants, projects, building of bridges, roads and highways. Ijaraha A contract under which an Islamic bank finances equipment, building or other facilities for the client against an agreed rental together with a unilateral undertaking by the bank or the client that at the end of the lease period, the ownership in the asset would be transferred to the lessee. The undertaking or the promise does not become an integral part of the lease contract to make it conditional. The rental as well as the purchase price are fixed in such manner that the bank gets back its principal sum along with profit, which is usually determined in advance.

FORMATION OF SOCIAL ISLAMI BANK The Bank was incorporated in Bangladesh in the year 1995 as a banking company under the companies Act, 1994, all types of commercial banking services as provided by the Bank from time to time besides as a matter of policy the Bank conducts its Business on the principles of Mushataka, Murabaha, Bai-Muazzal and Hire Purchase transaction approved by Bangladesh Bank.

Products & Services Mudaraba Term Deposit. Mudaraba Savings Deposit. Al-Wadia Current Account. Mudaraba Notice Deposit. Mudaraba Scheme Deposit. Cash Waqf. Mudaraba Hajj Savings Deposit. Mudaraba Monthly Savings Scheme.

Mudaraba Special Deposit Pension Scheme (5 Years).

Mudaraba Monthly Profit Deposit Scheme. Mudaraba Education Deposit Scheme. Mudaraba Home Saving Scheme. Mudaraba Millinery Deposit Scheme.

ATM Service. Locker Service. One Line Banking

Deposits Accepted by SIBL Mudaraba saving Deposit (MSD) These are profit bearing deposit accounts. The drawings are restricted in respect of both the amount of withdrawal and the frequency thereof so that the payment of interest does not become any compensating for the banker. Some time the restrictions are ignored against the depositors written confirmation to forgo his claim for interest on the total balance for the whole month of withdrawal. Special Saving Scheme Mudaraba Hajj Saving Scheme Hajj is one of the basic pillars of Islam- the complete code of life. SIBL has introduced a scheme in the name & style Mudaraba Hajj Saving Scheme to facilitate the intending Muslims to perform Hajj properly at appropriate age. This is purely a saving scheme for Hajj. Any Muslim intending in perform Hajj by building up deposit required for meeting Hajj expenses will select one of the 20 alternative choices based on duration of period from 1 year to 20 years for building- up savings by monthly installments under this scheme.

Mudaraba Education Scheme SIBL being encouraged by the success of the Mudaraba deposit accounts, has introduced another savings scheme namely Mudaraba Education Scheme

Mudaraba Millionaire Scheme People of Bangladesh are the followers of Islam. They are mostly interested to make interest free deposits. Taking these facts into consideration SIBL a joint venture Islamic bank introduced a monthly installment based "Mudaraba Millionaire Scheme" Rules and regulations of this scheme: Tk. 550/-, Tk. 1050/- or Tk. 2050/- is taken as monthly installment under Mudaraba principles of Islamic Shariah.

Mudaraba Special Savings (Pension) Scheme Any Bangladeshi person aged above 18 yrs and having sound mental condition can may open this scheme. To open this account there must be a signature of a valued introducer. Parents or legal guardians can open this scheme in the name of their underage children. Mudaraba Monthly Profit Deposit Scheme The features of this scheme are as follows: 1.Tk. 1, 00,000/-, 1, 10,000/-, 1, 20,000/- or 1, 25,000/- or any amount multiple canbe deposited under this scheme.2. 2.The duration of the amount should be for Five years.

3.Profits shall be distributed under this scheme as follows: a. 1,00,000/- Tk. 900 (net)b. 1,10,000/- Tk. 1000 (net)a. 1,20,000/- Tk. 1,100 (net)b. 1,25,000/- Tk. 1150 (net)4. 4.The payable profit will become due after 1 month of deposit. But the amount will be deposited to account in the last week of the month.5. 5.Generally, a depositor cannot withdraw the amount before 5 years. But, in unavoidable circumstances the depositor can withdraw the amount and in that case the depositor will have to submit the duly filled application form of the scheme.

Mudaraba Term Deposit Mudaraba Term Deposit is one, which is repayable after the expiry of a predetermined period fixed by him. The period varies from 1 month to 1 year or above. These deposits are not repayable on demand but they are withdrawing able subject to a period of notice. Hence, it is popularly known as Mudaraba Time Deposit or Time Liabilities. Normally the money on a fixed deposit is not repayable before the expiry of a fixed period. In case of MTDR Account the Bank needs to maintain a cash reserve. So SIB offers a high interest rate in MTDR accounts. The Interest rates followed by SIBL Al Wadiah Current Deposit 1.ALWADIAH Current Deposit A/cs are opened proper introduction with minimum initial deposit fixed by the Bank.2.

2.ALWADIAH Deposit is accepted on ALWADIAH principles which mean alAmanah with permission to use. According to this principle Bank can use the fund of the account along with other funds as per Shariah at bank's own risk. Accountholder(s) will not share any profit/loss.3. 3.The Law and regulation of Bangladesh, usual customs and procedures common tobanks in Bangladesh including Islamic Banking Principles shall apply to and govern the conduct of account opened with the Bank.

You might also like

- Principles of Islamic Finance: New Issues and Steps ForwardFrom EverandPrinciples of Islamic Finance: New Issues and Steps ForwardNo ratings yet

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word DocumentAmina AsimNo ratings yet

- Islamic BankingDocument11 pagesIslamic BankingAmara Ajmal100% (5)

- The Banking System in MalaysiaDocument6 pagesThe Banking System in MalaysiaHong Tat HengNo ratings yet

- Case Study IMU150 (Wakalah)Document16 pagesCase Study IMU150 (Wakalah)Adam BukhariNo ratings yet

- Al BarskhaDocument86 pagesAl BarskhaMian MohsinNo ratings yet

- Islamic Banking in Bangladesh Progress and PotentialsDocument25 pagesIslamic Banking in Bangladesh Progress and PotentialsRaihan MahmoodNo ratings yet

- Islamic Banking in Pakistan Cooperation With Central Bank and Conventioanl BanksDocument14 pagesIslamic Banking in Pakistan Cooperation With Central Bank and Conventioanl BanksM.Majid ShaikhNo ratings yet

- Tawkir Term PaperDocument18 pagesTawkir Term PaperSoniya ZamanNo ratings yet

- Bank ManagementDocument20 pagesBank Managementamirahhani najmaNo ratings yet

- Definition of Investment and Investment MechanismDocument12 pagesDefinition of Investment and Investment MechanismShaheen Mahmud50% (2)

- PGDIFP - Unit 3 Class 2Document93 pagesPGDIFP - Unit 3 Class 2Shadman ShakibNo ratings yet

- Chapter 1: Introduction: Shariah Principles and Avoid Prohibited Activities Such As Gharar (Excessive Uncertainty)Document76 pagesChapter 1: Introduction: Shariah Principles and Avoid Prohibited Activities Such As Gharar (Excessive Uncertainty)Vki BffNo ratings yet

- Chap 10Document2 pagesChap 10MuhammadWaseemNo ratings yet

- Project ReportDocument9 pagesProject ReportZameer AbbasiNo ratings yet

- Islamic Banking Vs Conventional BankingDocument17 pagesIslamic Banking Vs Conventional BankingFarrukh Ahmed Qureshi100% (19)

- Regulation and Performance of Islamic Banking in Bangladesh: Abu Umar Faruq Ahmad M. Kabir HassanDocument27 pagesRegulation and Performance of Islamic Banking in Bangladesh: Abu Umar Faruq Ahmad M. Kabir HassandurporbashiNo ratings yet

- Islamic BankingDocument25 pagesIslamic Bankingmojoo2003No ratings yet

- Final ReportDocument10 pagesFinal ReportMuhammad AliNo ratings yet

- Formate - IJHSS - Historical Background of Islamic Banking in NigeriaDocument8 pagesFormate - IJHSS - Historical Background of Islamic Banking in Nigeriaiaset123No ratings yet

- CandyDocument3 pagesCandyMuhammad Khuram ShahzadNo ratings yet

- Summary Chapter 3 - 237177 - BWFS3093Document2 pagesSummary Chapter 3 - 237177 - BWFS3093AbdiKarem JamalNo ratings yet

- Research MethodologyDocument14 pagesResearch MethodologySounds You WantNo ratings yet

- Principle of Islamic Business and FinanceDocument13 pagesPrinciple of Islamic Business and FinanceHaiderNo ratings yet

- Essentials of Islamic Finance ReportDocument22 pagesEssentials of Islamic Finance ReportFirdous SaeedNo ratings yet

- Islamic Banking in PakistanDocument72 pagesIslamic Banking in PakistanRida ZehraNo ratings yet

- General Banking Activities (CBS)Document15 pagesGeneral Banking Activities (CBS)Ifrat SnigdhaNo ratings yet

- Historical Background of IBBLDocument5 pagesHistorical Background of IBBLSISkobirNo ratings yet

- Islamic Banking PPT - 1Document25 pagesIslamic Banking PPT - 1Govinda ChhanganiNo ratings yet

- The Need For Regulatory ..Awwal Sarker Held On 20-02-2007Document6 pagesThe Need For Regulatory ..Awwal Sarker Held On 20-02-2007turjo987No ratings yet

- Islamic Banking in Bangladesh Progress and PotentialsDocument23 pagesIslamic Banking in Bangladesh Progress and Potentialssumaiya sumaNo ratings yet

- DUBAIISLAMICBANKDocument31 pagesDUBAIISLAMICBANKMubashir Hassan KhanNo ratings yet

- Executive Summary: The Caring BankDocument85 pagesExecutive Summary: The Caring BankKashif AwanNo ratings yet

- AIBL Background of The CompanyDocument6 pagesAIBL Background of The CompanySISkobir100% (1)

- Islamic Money MarketDocument3 pagesIslamic Money MarketALINo ratings yet

- Write A Report On Islamic Banking and Their Profit Sharing Methods Critically Analyzing-2Document18 pagesWrite A Report On Islamic Banking and Their Profit Sharing Methods Critically Analyzing-2Ellis AdaNo ratings yet

- Impact of Traditional Economic On Banking SectorDocument4 pagesImpact of Traditional Economic On Banking SectorKASHMALAFAROOQNo ratings yet

- Assignment of Islamic BankingDocument6 pagesAssignment of Islamic BankingFarjad AliNo ratings yet

- First Security Islami Bank Internship ReportDocument65 pagesFirst Security Islami Bank Internship ReportDurantoDx100% (2)

- Introduction To Islamic BankingDocument3 pagesIntroduction To Islamic BankingEhsan QadirNo ratings yet

- Askari Islamic (Hamza)Document16 pagesAskari Islamic (Hamza)HaiderNo ratings yet

- An Internship Report Final On Shahjalal Islami Bank Limited. BangladeshDocument42 pagesAn Internship Report Final On Shahjalal Islami Bank Limited. BangladeshSanjanMahmood75% (4)

- Investment Performance of Al-Arafah Islami BankDocument64 pagesInvestment Performance of Al-Arafah Islami BankSharifMahmud100% (2)

- Islamic Banking OverviewDocument21 pagesIslamic Banking OverviewmudasirNo ratings yet

- In Partial Fulfilment of The Requirements For: "Islamic Banking"Document50 pagesIn Partial Fulfilment of The Requirements For: "Islamic Banking"rk1510No ratings yet

- Types of Banks: Central BankDocument12 pagesTypes of Banks: Central BankRohit PanjwaniNo ratings yet

- Islamic Banking: Malaysia'S PerspectiveDocument15 pagesIslamic Banking: Malaysia'S PerspectivejawadNo ratings yet

- Internship Report On Bank Islami by Owais ShafiqueDocument300 pagesInternship Report On Bank Islami by Owais ShafiqueOwais ShafiqueNo ratings yet

- Fixe ReportDocument50 pagesFixe Reportrehan mughalNo ratings yet

- 3-Regulation of Islamic Banking in Bangladesh, Role of Bangadesh Bank (Abdul Awwal Sarker)Document5 pages3-Regulation of Islamic Banking in Bangladesh, Role of Bangadesh Bank (Abdul Awwal Sarker)ikutmilisNo ratings yet

- Islamic Treasury IMALDocument11 pagesIslamic Treasury IMALPrashant VishwakarmaNo ratings yet

- Assignment On of Islamic BankingDocument14 pagesAssignment On of Islamic BankingSanjani80% (5)

- Basics of Islamic BankingDocument6 pagesBasics of Islamic BankingMnk BhkNo ratings yet

- Musharakah Securitization Ijarah Securitization Sukuk Types of SukukDocument10 pagesMusharakah Securitization Ijarah Securitization Sukuk Types of Sukukabubakar70No ratings yet

- Ibbl PDFDocument3 pagesIbbl PDFKanij FatemaNo ratings yet

- Law of Banking and Security: Dr. Zulkifli HasanDocument25 pagesLaw of Banking and Security: Dr. Zulkifli HasanQuofi SeliNo ratings yet

- Why Study Islamic Banking and Finance?Document28 pagesWhy Study Islamic Banking and Finance?Princess IntanNo ratings yet

- Business CommunicationDocument56 pagesBusiness CommunicationDipayan_luNo ratings yet

- FX Theory QestionDocument5 pagesFX Theory QestionDipayan_luNo ratings yet

- MKT NewDocument14 pagesMKT NewDipayan_luNo ratings yet

- Central Banking-1Document15 pagesCentral Banking-1Dipayan_luNo ratings yet

- CENTRAL BANKING & MONETARY POLICY Short NoteDocument11 pagesCENTRAL BANKING & MONETARY POLICY Short NoteDipayan_luNo ratings yet

- Fin 219Document3 pagesFin 219Dipayan_luNo ratings yet

- Six Point FormulaDocument2 pagesSix Point FormulaDipayan_luNo ratings yet

- A Case Study On Final)Document1 pageA Case Study On Final)Dipayan_luNo ratings yet

- RBI GUIDELINES ON Working CapitalDocument57 pagesRBI GUIDELINES ON Working Capitalashwini.krs80No ratings yet

- Perfomance BTW NBC and CRDB 2010Document7 pagesPerfomance BTW NBC and CRDB 2010Moud KhalfaniNo ratings yet

- Important: Compound Interest QuestionsDocument12 pagesImportant: Compound Interest QuestionsShraiya ManhasNo ratings yet

- ITC Corporate ValuationDocument6 pagesITC Corporate ValuationSakshi Jain Jaipuria JaipurNo ratings yet

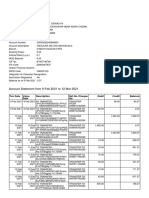

- Account Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 9 Feb 2021 To 12 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceABHINAV DEWALIYANo ratings yet

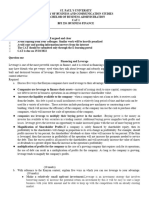

- FABM2 12 Quarter1 Week7Document10 pagesFABM2 12 Quarter1 Week7Princess DuquezaNo ratings yet

- BFI 220 CAT AnswersDocument2 pagesBFI 220 CAT Answerssamkimari5No ratings yet

- Types of Insurance Essentials PowerPointDocument27 pagesTypes of Insurance Essentials PowerPointVinodKumarMNo ratings yet

- 0 - Accounting For Income Tax SummaryDocument7 pages0 - Accounting For Income Tax SummaryJaneNo ratings yet

- Final Report KasbDocument70 pagesFinal Report KasbtrueliarerNo ratings yet

- UNSW FINS1612 Chapter01 - TestBankDocument24 pagesUNSW FINS1612 Chapter01 - TestBankelkieNo ratings yet

- Hedge Fund BackersDocument6 pagesHedge Fund Backers1c796e65b8a4c8No ratings yet

- Act130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Document15 pagesAct130: Accounting For Special Transactions Prelim Exam S.Y 2020-2021Nhel AlvaroNo ratings yet

- Brand Finance Banking 500 2022 PreviewDocument48 pagesBrand Finance Banking 500 2022 Previewstart-up.ro100% (1)

- A Summer Training Report On HDFC LifeDocument30 pagesA Summer Training Report On HDFC LifeOwais LatiefNo ratings yet

- Account PayableDocument6 pagesAccount PayablenaysarNo ratings yet

- Suncoast Bank StatementDocument3 pagesSuncoast Bank StatementolaNo ratings yet

- Comparative Study Between Two BanksDocument26 pagesComparative Study Between Two BanksAnupam SinghNo ratings yet

- DR Manfred Knof: Curriculum VitaeDocument2 pagesDR Manfred Knof: Curriculum VitaeFernandoNo ratings yet

- Disbursement Voucher: Department of EducationDocument3 pagesDisbursement Voucher: Department of EducationMaria Kristel L PascualNo ratings yet

- Foundations of Financial Management 15Th Edition Block Test Bank Full Chapter PDFDocument67 pagesFoundations of Financial Management 15Th Edition Block Test Bank Full Chapter PDFjavierwarrenqswgiefjyn100% (7)

- 5.3 Income StatementDocument4 pages5.3 Income StatementHiNo ratings yet

- 中英文对照版财务报表及专业名词Document6 pages中英文对照版财务报表及专业名词sandywhgNo ratings yet

- Peer-Review Assessment Course 1aDocument5 pagesPeer-Review Assessment Course 1aSamael LightbringerNo ratings yet

- Westpac Feb4Document2 pagesWestpac Feb4რაქსშ საჰა100% (1)

- Mbaf 605 Lecture Week 10Document71 pagesMbaf 605 Lecture Week 10Gen AbulkhairNo ratings yet

- Sanulac Nutricion Colombia S.A.S. (Colombia) : SourceDocument2 pagesSanulac Nutricion Colombia S.A.S. (Colombia) : SourceCatalina Echeverry AldanaNo ratings yet

- Compound IntrestDocument5 pagesCompound Intrestvenkata sureshNo ratings yet

- Student Information: Check Centre Lot S.NO. Student NameDocument232 pagesStudent Information: Check Centre Lot S.NO. Student NameVijayant GautamNo ratings yet

- Adjusting Accounts and Preparing Financial Statements: We Have Learned - .Document23 pagesAdjusting Accounts and Preparing Financial Statements: We Have Learned - .Đàm Quang Thanh TúNo ratings yet