Professional Documents

Culture Documents

National Check Fraud Center Lock Box Banking

Uploaded by

asrinu88881125Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

National Check Fraud Center Lock Box Banking

Uploaded by

asrinu88881125Copyright:

Available Formats

National Check Fraud CenterLockBox Banking-Pro & Con Is Lockbox Banking right for You?

Do your customers mail payments to you? Are your customers dispersed across a region or the country? Do you hold checks over a day or two because your staff doesnt have the time to process them?

If so, you may want to consider the benefits of automated lockbox processing services.

Using lockbox banking is a cash flow improvement technique in which you have your customers' payments delivered to a special post office box instead of your business address. The difference between this special post office box and a regular post office box is that only your customers' payments are delivered to the box. Instead of you picking up the payments, your bank's couriers have a key to the post office box, and they remove its contents and deliver your customers' payments to your bank. Your bank opens the payments and then processes the payments for deposit directly into your bank account. Depending on the nature of your business, the contents of your lockbox can be removed and processed once a day, or more often if required. You can establish lockboxes in several different post offices or cities. A basic rule is that your lockboxes should be set up nearest to your customers to reduce the amount of time between your customers' mailing their payments and the deposit into your bank account. Lockbox banking accelerates the payment and deposit portion of your cash conversion period in two different ways. First, lockbox banking cuts down on any postal delays caused by having your customers' payments delivered to your business address. Mail delivered to your place of business entails some extra sorting so that your mail gets into the hands of the correct carrier, not to mention the added time it takes the carrier to actually deliver it to your address. Second, using a lockbox shortens the amount of time necessary to process your customers' payments, by having your bank open the payment envelopes and deposit them directly into your bank account. Since the payment processing is done at the bank, your customers' payments are received and deposited all within the same day. Doing this work yourself can delay the deposit of the payments anywhere from one to two days depending on how long it takes you to process your customers' payments for deposit, and to actually make the deposit at the bank. Lockbox banking is typically used by businesses that receive payments from numerous customers. Your utility companies and local cable TV franchises are two examples of businesses that are likely to be using lockbox banking. Even city and county governments are using Lockbox banking in the collections of taxes. Don't shy away from lockbox banking just because your business isn't as large as your local utility or cable TV franchise. Today's increased automation in payment processing has allowed banks to reduce the cost of their lockbox banking services enough to make it economical for businesses of any size. Since most banks will customize their lockbox banking services and costs to fit your specific needs, contact your bank for more information.

Sample of Lockbox process

Lockbox Problems:

In many financial institutions, the individuals in the lockbox area are the newest employees or are part-timers. Some of them are poorly supervised, poorly paid, not well-trained, and are vulnerable to temptation, and that has led to the latest fraud wave. Authorities have uncovered a large number of instances where employees working in lockbox areas have been paid a fee by criminals, typically $50 per copy, to turn over copies of the checks sent to the lockbox. The copies equip the thieves with everything they need to create counterfeit checks -- account holder's name, address, phone number, account number, bank name, bank routing number, check number and an example of an accepted signature on the account. This scenario radically improves the odds in favor of the counterfeiter and against the bank. By having access to a large number of accounts on which to counterfeit checks, the criminals are able to increase their chances of avoiding detection for a number of reasons. First of all, if they keep the amounts relatively small, their fraudulent activity probably will not be discovered until after the customer receives his next bank statement, plus the bank is not likely to spot the fakes because the amount will be below its cutoff for sight examination and, even if the bank examines the check, the signature might be identical to the legitimate one if the criminals use good scanning equipment. Second, many customers do not promptly examine their bank statements, so some counterfeits may go undetected for months. Third, even when the counterfeits are reported, it would take some real detective work to determine that the counterfeits on separate accounts are, in fact, related. Fourth, even when the pattern is spotted, there is no good way to identify future fakes. The only sure method for stopping the losses is to have customers whose accounts were compromised close the accounts and open new ones. Prior to this new twist on counterfeit check creation, thieves would customarily make several duplicates of a particular check, such as a payroll check on a major corporation. Once the activity was discovered, the authorities could put out a warning bulletin to let merchants and banks know that counterfeit checks on that company in a particular amount had been uncovered and everyone could watch out for those particular checks. With this new method of gathering information to produce counterfeits, thousands of unique items could be produced, leaving no pattern to follow.

How do you prevent this type of crime? Monitor lockbox operations more closely; Locate lockbox operations far from a photocopy machine; Make random, unexpected visits to the lockbox area; Be careful who you hire; Be alert to the possibility of fraud; such as when a customer notifies you that a counterfeit item has been paid on his account.

What can Lockbox Banking do for you? Faster access to your funds More timely receivables information Customized Remittance Processing Greater Remittance Processing More Efficient use of your office Staff

HIGHLIGHTS OF LOCKBOX BANKING:

Lockbox processing is a cash management service provided by banks to their corporate customers. Lockbox services are designed to accelerate the collection and deposit of check payments, sent with accompanying remittance document(s), through the mail. Lockbox services are provided almost exclusively by large banks. Of a total of 4.1 billion checks processed by U.S. banks in lockbox operations in 1994, 75 percent were processed by banks with over $5 billion in assets, and over 98 percent were processed by banks with over $1 billion in assets. Lockbox is a mature, consolidating banking business. Competitive break-even volumes are rising, and banks are being pressured to either increase their volumes, exit the business, or out source the function. For these reasons, image technology is being rapidly adopted in lockbox processing by banks that continue to provide the function, to achieve higher processing productivity (particularly in retail lockbox) and to provide new image-based services to customers (particularly in wholesale lockbox). Retail lockbox tends to involve higher processing volumes than wholesale lockbox. The leading retail lockbox bank processes about 27 million items per month, while the leading wholesale lockbox bank processes only about 4 million items per month. Intelligent character recognition (ICR), optical character recognition (OCR), and courtesy amount read (CAR) technology are being adopted rapidly for automating the amount entry and transaction balancing tasks in lockbox processing, thereby increasing processing efficiencies and productivity. High-volume retail lockbox systems tend to be tightly integrated, single-vendor solutions from industry providers of highspeed reader/sorter equipment (particularly BancTec and Unisys). Wholesale lockbox, with its lower processing volumes and greater requirement for customized features, is more frequently non-automated, or automated through software provided by independent third-party suppliers, particularly in lower-volume wholesale lockbox operations. don't simply credit the customer's account. Look for any clues about the source of the counterfeit. With the customer's permission, notify your state bankers association and your local clearinghouse and law enforcement authorities.

You might also like

- Instruction ManualDocument178 pagesInstruction ManualHarvey J91% (43)

- Us Online Bank Account Creation Guide!Document7 pagesUs Online Bank Account Creation Guide!matt93% (14)

- How To Print Checks With MICR FontsDocument65 pagesHow To Print Checks With MICR FontsSatya Raya0% (1)

- Check Cashing Toolkit FinalDocument49 pagesCheck Cashing Toolkit FinalREAL Solutions0% (1)

- Micr Basics Hand BookDocument21 pagesMicr Basics Hand BookManasib Ashraf100% (4)

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Cheque Fraud & CountermeasuresDocument5 pagesCheque Fraud & CountermeasuresHarish100% (3)

- Banking FraudsDocument38 pagesBanking Fraudssamfisher0528100% (1)

- R12 CheckPrintingDocument12 pagesR12 CheckPrintingNalamalpu Bhakthavatsala Reddy0% (1)

- A Collection of Fraud SchemesDocument54 pagesA Collection of Fraud SchemesJyoti Kumar67% (3)

- VCheckPrintFactory PDFDocument47 pagesVCheckPrintFactory PDFJackie Crisp100% (1)

- Credit Card FraudsDocument8 pagesCredit Card Fraudsalfregian11074819No ratings yet

- Bank, Check Cashing LessonDocument21 pagesBank, Check Cashing LessonShane Tate0% (1)

- Closing The Door and Leaving Open A Window: Closing The Check Cashing Money Laundering Regulatory GapDocument20 pagesClosing The Door and Leaving Open A Window: Closing The Check Cashing Money Laundering Regulatory GapNEJCCC100% (2)

- Credit FraudDocument67 pagesCredit Fraudrupa0% (1)

- ATM CircularDocument2 pagesATM CircularjabbanNo ratings yet

- CheckPlus - UserGuide 5.28Document91 pagesCheckPlus - UserGuide 5.28RyanRamroopNo ratings yet

- MGT417 Assignment PDFDocument26 pagesMGT417 Assignment PDFYanty Ibrahim86% (7)

- All You Need to Know About Payday LoansFrom EverandAll You Need to Know About Payday LoansRating: 5 out of 5 stars5/5 (1)

- Vehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDocument17 pagesVehicle Loans: List of Documents Required To Be Submitted For Hire Purchase LoanDr.K.PadmanabhanNo ratings yet

- Extracting Signatures From Bank Checks - 2003Document10 pagesExtracting Signatures From Bank Checks - 2003Tim BryantNo ratings yet

- FRBCheckFraud PDFDocument10 pagesFRBCheckFraud PDFTess AwasNo ratings yet

- Signature Verification Evolution To Exception Check ReviewDocument3 pagesSignature Verification Evolution To Exception Check Reviewpkaram12No ratings yet

- Fraud Alert On Card Trapping 2010 - 1Document2 pagesFraud Alert On Card Trapping 2010 - 1Rohit SinghNo ratings yet

- Fraud - Check Kiting in The Digital Age - White Paper - 4FEB20Document8 pagesFraud - Check Kiting in The Digital Age - White Paper - 4FEB20hbabtiwaNo ratings yet

- Acquiring FundsDocument3 pagesAcquiring FundsTruco El Martinez0% (1)

- Card ReaderDocument2 pagesCard ReaderWalter Dillenger100% (1)

- Bouncing ChecksDocument2 pagesBouncing ChecksBalbastre KristofferNo ratings yet

- Money 012Document3 pagesMoney 012nvisca100% (1)

- How To Authorize ACHDocument12 pagesHow To Authorize ACHPete NgNo ratings yet

- CitiBank ScamsDocument28 pagesCitiBank ScamsAeman WaghooNo ratings yet

- HackerDocument2 pagesHacker4gen_1No ratings yet

- Check Printing XM LPDocument15 pagesCheck Printing XM LPMuhammad Nadeem100% (3)

- Securing Credit Card Data Through SQL Server 2008Document9 pagesSecuring Credit Card Data Through SQL Server 2008Pravin118No ratings yet

- Bank Fraud InfoDocument7 pagesBank Fraud InfoturmekarsNo ratings yet

- Debit Card SkimmingDocument2 pagesDebit Card SkimmingBeldon GonsalvesNo ratings yet

- ACH Payment OptionsDocument1 pageACH Payment Optionsdouglas jonesNo ratings yet

- Check TamperingDocument28 pagesCheck TamperingandreasNo ratings yet

- CitiDirect Online Banking Bank Handlowy W Warszawie S.A.Document31 pagesCitiDirect Online Banking Bank Handlowy W Warszawie S.A.César OrellanaNo ratings yet

- Bouncing CheckDocument3 pagesBouncing CheckginalynNo ratings yet

- Checks: Naydud K. Cutipa Roiro Mg. Emerson Angel Espiritu Saenz Interpersonal Communication Accounting Day Iv-ADocument11 pagesChecks: Naydud K. Cutipa Roiro Mg. Emerson Angel Espiritu Saenz Interpersonal Communication Accounting Day Iv-AWilliam Paucar GarciaNo ratings yet

- Fraud Suspicion Procedure: If The Information Does MatchDocument2 pagesFraud Suspicion Procedure: If The Information Does MatchAbner James Yngente LagerfeldNo ratings yet

- Banking FraudDocument18 pagesBanking Fraudvandana_daki3941No ratings yet

- 25-Electronic Fund Peter)Document4 pages25-Electronic Fund Peter)Annonymous963258No ratings yet

- MTAP Bank Cheque Verification Using Image ProcessingDocument35 pagesMTAP Bank Cheque Verification Using Image Processingjasti chakradharNo ratings yet

- Mobile Remote Deposit Capture (Mobile Product)Document16 pagesMobile Remote Deposit Capture (Mobile Product)Kendra Shillington100% (1)

- Check Froad Abdulelah AlmasoudDocument14 pagesCheck Froad Abdulelah AlmasoudAbdulelahHouston0% (1)

- Cashing A Check PDFDocument2 pagesCashing A Check PDFOrig5No ratings yet

- Ict SystemsDocument12 pagesIct SystemsHaa'Meem Mohiyuddin100% (1)

- Wire FraudDocument49 pagesWire Fraudayleen arazaNo ratings yet

- CHeck Printing Industry Report - 20170223T090339.282018Z PDFDocument12 pagesCHeck Printing Industry Report - 20170223T090339.282018Z PDFblombardi8No ratings yet

- PDF 417 How ToDocument35 pagesPDF 417 How ToLiloit OsijekNo ratings yet

- Catch Me If You Can - Lakessica CarterDocument10 pagesCatch Me If You Can - Lakessica CarterLaKessica B. Kates-CarterNo ratings yet

- Merchant Manual (En)Document137 pagesMerchant Manual (En)Abu Rahma Sarip RamberNo ratings yet

- D.I.Y. Open Bank Account With No SSNDocument51 pagesD.I.Y. Open Bank Account With No SSNIvey50% (2)

- Fraud ATMsDocument15 pagesFraud ATMsAbdulrahman AbdulgNo ratings yet

- Fresh CardingtipsDocument1 pageFresh CardingtipsNeeraj GiriNo ratings yet

- Credit Card Fraud InvestigationsDocument1 pageCredit Card Fraud InvestigationsAlex AñascoNo ratings yet

- Personal Info SlavePaulDocument1 pagePersonal Info SlavePaulsluttyslavepaulNo ratings yet

- Bankten-Virtual Atm Machine ReportDocument74 pagesBankten-Virtual Atm Machine Reportapi-299315032No ratings yet

- Haslebacher ForumsDocument11 pagesHaslebacher ForumsPatrick PerezNo ratings yet

- Sap Hana TutorialDocument160 pagesSap Hana Tutorialandrefumian93% (14)

- Ibps RRB Po 2017 Capsule by Gopal Sir NewDocument83 pagesIbps RRB Po 2017 Capsule by Gopal Sir NewPraveen ChaudharyNo ratings yet

- Combined Graduate Level Examination-2017 Combined Graduate Level Examination-2017Document1 pageCombined Graduate Level Examination-2017 Combined Graduate Level Examination-2017asrinu88881125No ratings yet

- Sap Hana TutorialDocument160 pagesSap Hana Tutorialandrefumian93% (14)

- Sap MM TutorialDocument190 pagesSap MM TutorialRobraggamofNo ratings yet

- SAP FI - General LedgerDocument154 pagesSAP FI - General LedgersekhardattaNo ratings yet

- SAP FI - General LedgerDocument154 pagesSAP FI - General LedgersekhardattaNo ratings yet

- General AwarenessDocument106 pagesGeneral AwarenessMohan Chandra PothanaNo ratings yet

- Lockbox Power PointDocument19 pagesLockbox Power Pointasrinu88881125100% (1)

- Dist. Wise Outlets AreasDocument70 pagesDist. Wise Outlets Areasasrinu88881125No ratings yet

- Gopalakrishnapatro@Document2 pagesGopalakrishnapatro@asrinu88881125No ratings yet

- Sap Infosys FICODocument145 pagesSap Infosys FICOAdminnivas83% (6)

- Sap FicoDocument210 pagesSap Ficoasrinu88881125100% (1)

- SMDG Coarri213Document63 pagesSMDG Coarri213Hussain AijazNo ratings yet

- ITC ILO Turin Course - Application FormDocument6 pagesITC ILO Turin Course - Application FormMirza Muhammad Adnan0% (1)

- Form 3575Document1 pageForm 3575c100% (1)

- Rga 8872 Post-Elec 120414Document115 pagesRga 8872 Post-Elec 120414paul weichNo ratings yet

- Residents Air Objections Despite $76 Tax Cut: Salary Increases, Ipads in New Municipal BudgetDocument20 pagesResidents Air Objections Despite $76 Tax Cut: Salary Increases, Ipads in New Municipal BudgetelauwitNo ratings yet

- V3 Coffee CraftersDocument35 pagesV3 Coffee CraftersRich Dawson100% (1)

- Civil Engineering Consulting Companies in Kenya - Kenyan Student EngineerDocument69 pagesCivil Engineering Consulting Companies in Kenya - Kenyan Student EngineerDaniel Kariuki100% (1)

- Construction OrangebookDocument17 pagesConstruction OrangebookKien Trung NguyenNo ratings yet

- Certificate of Eligibility CaliforniaDocument3 pagesCertificate of Eligibility CaliforniaJojo Aboyme CorcillesNo ratings yet

- Republican State Leadership Committee - RSLC Post General Election - 8872Document114 pagesRepublican State Leadership Committee - RSLC Post General Election - 8872Progress MissouriNo ratings yet

- Haier Warranty CardDocument2 pagesHaier Warranty CardMani RichardNo ratings yet

- Cargo Manifest AnnabaDocument8 pagesCargo Manifest AnnabaMohamed ChelfatNo ratings yet

- CcardDocument62 pagesCcardPaul Cortez BlancarteNo ratings yet

- Perforated Plate PDFDocument6 pagesPerforated Plate PDFberylqzNo ratings yet

- MailingToSoverignStates PDFDocument238 pagesMailingToSoverignStates PDFnujahm1639100% (4)

- Application FormDocument2 pagesApplication FormbernardleloNo ratings yet

- Application To Register A CompanyDocument35 pagesApplication To Register A CompanyBrogan FoxNo ratings yet

- PO - Box (Countries Accepting)Document14 pagesPO - Box (Countries Accepting)Ana-Maria IordacheNo ratings yet

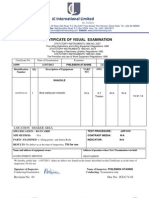

- International Limited: Certificate of Visual ExaminationDocument36 pagesInternational Limited: Certificate of Visual Examinationanon_656326693No ratings yet

- Phlpost Ciruclar No 15-69 A Re Updated Matrix of Postage Rates and Prices of Postal Products and Services Pursuant To Phlpost Circular No 15-69Document24 pagesPhlpost Ciruclar No 15-69 A Re Updated Matrix of Postage Rates and Prices of Postal Products and Services Pursuant To Phlpost Circular No 15-69Ja-Ne Victoria CudiaNo ratings yet

- Corp Npdiss PDFDocument10 pagesCorp Npdiss PDFSpiritually GiftedNo ratings yet

- Michelle Burgess OhioDocument27 pagesMichelle Burgess Ohiorob pennNo ratings yet

- CodesDocument20 pagesCodesVijay ReddyNo ratings yet

- Canadian Firearm Carrier License ApplicationDocument6 pagesCanadian Firearm Carrier License ApplicationDaveNo ratings yet

- Student Transcript RequestDocument1 pageStudent Transcript RequestLauren KirklandNo ratings yet

- PASS Application InstructionsDocument12 pagesPASS Application InstructionsH4LfAd1MENo ratings yet

- Republican State Leadership Committee Q2 Report To IRSDocument103 pagesRepublican State Leadership Committee Q2 Report To IRSSally Jo SorensenNo ratings yet

- 07R911036CDocument899 pages07R911036Cbreanna4teen9949No ratings yet