Professional Documents

Culture Documents

Application Form - Instructions - IFCI Bonds

Uploaded by

rahual_sOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Application Form - Instructions - IFCI Bonds

Uploaded by

rahual_sCopyright:

Available Formats

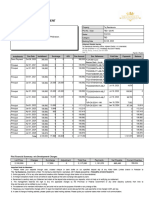

Basic Terms of Issue:

Options I Buyback / Non Cumulative Option 5,000/One Bond One Bond Yes Yearly 8% per annum January 31 every year II Buyback / Cumulative Option 5,000/One Bond One Bond Yes Not Applicable 8% p.a. annual compounding Not Applicable III Non Buyback / Non Cumulative Option 5,000/One Bond One Bond No Yearly 8.25% per annum January 31 every year Not Applicable January 31, 2021 January 31, 2021 IV Non Buyback / Cumulative Option 5,000/One Bond One Bond No Not Applicable 8.25% p.a. annual compounding Not Applicable

Face value (Rs.) Minimum Application In Multiples of Buy Back Option Interest Payment Coupon Coupon Payment Date Buyback Date Maturity Date Buy Back Intimation Period Maturity Amount (Rs.) Year 5 Year 6 Year 7 Year 8 Year 9

January 31 every year starting from year 2016 to year 2020 January 31, 2021 January 31, 2021 Every Year Between November 01 to November 30, starting from the Year 2015 till Year 2019 5,000 5,000 5,000 5,000 5,000 5,000 10,795 7,347 7,934 8,569 9,255 9,995

Not Applicable 5,000 11,047 (Rs.) -

Redemption Amount (in case the buyback option is exercised):

INSTRUCTIONS: Applicants are advised to read information memorandum carefully in order to satisfy themselves before making an application for subscription. For a copy of information memorandum, the applicant may request the issuer company/arrangers. 1) Application form must be completed in BLOCK LETTERS IN ENGLISH. A blank space must be left between two or more parts of the name. For example:A B C D W X Y Z 2) Signatures should be made in English / Hindi. Signatures made in any other Indian language must be attested by an authorised official of a Bank or by a Magistrate / Notary Public under his / her official seal. 3) Bonds will be issued only in demat form. 4) Application shall be for a minimum number of one Bond and multiples of one Bond thereafter.

5) 6)

7)

The benefit under section 80 CCF is limited to Rs 20,000 in a financial year, but there is no limit on investment. Applications can be made in single or joint names (not more than three); in case of joint names, all payments will be made out in favour the applicant whose name appears first in the application form; all notices, correspondence and communication will be addressed to the first applicant. The payment can be made either through Cheque/Demand Draft/Payorders. It has to be ensured that the application Forms accompanied by the Cheque/DD/Pay order, drawn and made payable in favour of IFCI Limited - Infra Bond and crossed Account Payee Only are deposited, directly with the designated branches of HDFC Bank (Collecting Banker) for crediting the amount to IFCI Limited -Infra Bond . The details of collection centres are available in information memorandum. The Cheque must be drawn on any bank including a Cooperative Bank, which is a member or a sub-member of the Bankers Clearing House, located at the place where the Application Form is submitted. Cash, Outstation Cheques, Money Orders or Postal Orders will NOT be accepted. As a matter of precaution against possible fraudulent encashment of interest warrants due to loss / misplacement, applicants are requested to mention the full particulars of their bank account, as specified in the Application Form (Bank detail should match the details provided in the Demat account). Interest warrants will then be made out in favour of the sole / first applicants account. Cheques will be issued as per the details in the register of Bondholders at the risk of the sole / first applicant at the address registered as per Demat Account. The PAN No of the Sole / First Applicant and all Joint Applicants(s) should be mentioned in the Application Form. As per the current income tax laws, there will not be any tax deduction at source (TDS) from the annual/cumulative interest, the bonds being listed and in dematerialised form. Receipt of application will be acknowledged by Bankers stamping the Acknowledgement Slip appearing below the Application Form. No separate receipt will be issued. The applications would be scrutinized and accepted as per the provisions of the terms and conditions of the Private Placement, and as prescribed under the other applicable Statutes/Guidelines etc. IFCI is entitled, at its sole and absolute discretion, to accept or reject any application, in part or in full, without assigning any reason whatsoever. An application form, which is not complete in any respect, is liable to be rejected All future communications should be addressed to the Registrar or to IFCI at their registered office mentioned below. The issue will open on November 16, 2010 and will remain open till December 31, 2010. However, the issuer would have an option to pre-close or extend the issue by a 1 day notice to arrangers.

8)

9)

10)

11) 12)

13)

14)

15) 16)

Registrar: - M/S Beetal Financial & Computer Services Pvt. Ltd, Beetal House, 3rd Floor, 99 Madangir, Behind Local Shopping Center, New Delhi 110062 Issuer: - IFCI LIMITED, Resources Department, IFCI Tower, 61, Nehru Place, New Delhi - 110019

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Acctax1 Chapter4 ReviewerDocument6 pagesAcctax1 Chapter4 ReviewerEirene Joy VillanuevaNo ratings yet

- E Newsletter September 2013Document13 pagesE Newsletter September 2013sd naikNo ratings yet

- Blocked LHVDocument1 pageBlocked LHVohotnikova0032No ratings yet

- Income From Other SourcesDocument16 pagesIncome From Other SourcesDipinderNo ratings yet

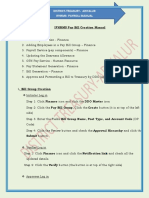

- Padasalai Ifhrms ManualDocument14 pagesPadasalai Ifhrms ManualSivakumar MurugesanNo ratings yet

- 8531Document9 pages8531Mudassar SaqiNo ratings yet

- Income Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersDocument27 pagesIncome Taxation 5Th Edition (By: Valencia & Roxas) Suggested AnswersLove FreddyNo ratings yet

- Mastering QuickBooks Payroll 2013Document105 pagesMastering QuickBooks Payroll 2013Chanty Sridhar100% (2)

- CO Form 104 InstructionsDocument24 pagesCO Form 104 Instructionskdavis9250No ratings yet

- 50-State Review of Cryptocurrency and Blockchain Regulation - Stevens Center For Innovation in FinanceDocument30 pages50-State Review of Cryptocurrency and Blockchain Regulation - Stevens Center For Innovation in FinanceellirafaeladvNo ratings yet

- Accounting For Labor Part 2Document11 pagesAccounting For Labor Part 2Ghillian Mae GuiangNo ratings yet

- Charitable Gift Annuities - Gift It and Earn BenefitDocument1 pageCharitable Gift Annuities - Gift It and Earn BenefitPerttoh MusyimiNo ratings yet

- 6 BudgetingDocument2 pages6 BudgetingClyette Anne Flores BorjaNo ratings yet

- Income Tax Department NoticeDocument6 pagesIncome Tax Department NoticeTaxRaahiNo ratings yet

- Gmak Engg Proforma InvoiceDocument1 pageGmak Engg Proforma Invoicegmak tvNo ratings yet

- Gcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceDocument3 pagesGcash Transaction History: Date and Time Description Reference No. Debit Credit BalanceJessica CraveNo ratings yet

- RR No. 1-2022Document3 pagesRR No. 1-2022try saguilotNo ratings yet

- Ayesha SajjadDocument1 pageAyesha SajjadPak FFNo ratings yet

- T24 TellerDocument57 pagesT24 TellerJaya NarasimhanNo ratings yet

- Taj Residencia: Customer Account StatementDocument1 pageTaj Residencia: Customer Account StatementGohar SaeedNo ratings yet

- AnswersDocument3 pagesAnswersYahya ZafarNo ratings yet

- Affidavit of Non Filing of Income TaxDocument2 pagesAffidavit of Non Filing of Income TaxMae Gnela50% (2)

- Copy B For Student 1098-T: Tuition StatementDocument1 pageCopy B For Student 1098-T: Tuition Statementqqvhc2x2prNo ratings yet

- PEAC Registration Confirmation Slip AJE210189Document1 pagePEAC Registration Confirmation Slip AJE210189Aspci Assumption PassiNo ratings yet

- Aie Credit WebquestDocument2 pagesAie Credit Webquestapi-267815068No ratings yet

- Costing - M3M Atrium 57Document2 pagesCosting - M3M Atrium 57Himanshu GodNo ratings yet

- All CCDocument66 pagesAll CCsukoymambo0% (1)

- Sworn Application For Tax Clearance: Annex CDocument1 pageSworn Application For Tax Clearance: Annex CpatrickkayeNo ratings yet

- Hrms General SetupsDocument30 pagesHrms General SetupsShyam GanugapatiNo ratings yet

- RMC No. 61-2016Document6 pagesRMC No. 61-2016sandraNo ratings yet