Professional Documents

Culture Documents

Fund Switch - New

Uploaded by

Muthu Kumar HOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fund Switch - New

Uploaded by

Muthu Kumar HCopyright:

Available Formats

The Life of Your Policy

(Policy Servicing Form for SBI Life Unit Linked Products)

Customer ID: Policy No.: Name of the Life Assured:.. ... Name of the Policy Holder(If different from Life Assured) ... Product Name: Guidelines for filling in the form:

(for office use only) CIF Code/IA Code:.. Branch Code Date & Time Stamp

1.

2.

This form is to be filled by the Life Assured/ Policy Holder himself in BLOCK LETTERS. Please tick the check boxes wherever required. The Life Assured/ Policy Holder must authenticate any cancellation or alterations in this form. Please refer to the General Information provided on page 2 of this form for details regarding the Sections in this form. Percentage To Equity Fund [N.A. for Unit Plus Elite] Equity Optimiser Fund [N.A. for Unit Plus RP & SP, Unit Plus Elite] Growth Fund Balanced Fund Bond Fund Equity Elite Fund [Available only Unit Plus Elite] Total: Percentage

1. SWITCHING FACILITY(Not available for Horizon/ Horizon II and Horizon II Pension)

3.

From Equity Fund [N.A. for Unit Plus Elite] Equity Optimiser Fund [N.A. for Unit Plus RP & SP, Unit Plus Elite] Growth Fund Balanced Fund Bond Fund Equity Elite Fund [Available only Unit Plus Elite] N.A Not Available For Unit Plus II Pension From Equity Pension Fund Equity Optimiser Fund Growth Pension Fund Balanced Pension Fund Bond Pension Fund

100%

Percentage

To Equity Pension Fund Equity Optimiser Fund Growth Pension Fund Balanced Pension Fund Bond Pension Fund Total:

Percentage

100%

PLEASE REFER TO THE LAST COLUMN OF THE TABLE GIVEN IN PARA 1 OF THE GENERAL INFORMATION SECTION ON PAGE 2

2. REDIRECTION FACILITY(2

nd Policy Year Onwards. Should be in multiples of 10% for Unit Plus RP, Unit Plus II RP and in multiples of 5% for Unit Plus Child and Unit Plus Elite. Not available for Horizon/ Horizon II and Horizon II Pension. Please refer Section 3 of the General In formation on page 2)

Percentage Equity Fund [N.A. for Unit Plus Elite] Equity Optimiser Fund [N.A. for Unit Plus RP & SP, Unit Plus Elite] Growth Fund Balanced Fund Bond Fund Equity Elite Fund [Available only Unit Plus Elite] N.A Not Available

For Unit Plus II Pension Equity Pension Fund Equity Optimiser Fund [N.A. for Unit Plus RP & SP, Unit Plus Elite] Growth Pension Fund Balanced Pension Fund Bond Pension Fund Equity Elite Fund [Available only Unit Plus Elite] Total

Percentage

100%

3. PARTIAL WITHDRAWAL FACILITY

Withdrawal Amount (in Rs.): Declaration/ Authorization:

(4th policy year onwards) Not available for Pension Plans i.e. Horizon II Pension & Unit Plus II Pension and for Unit Plus II RP, Horizon II, Unit Plus Child and Unit Plus Elite when there are unpaid premiums pertaining to the first 3 policy year.

/-

I, ; the Life Assured/ Policy Holder, hereby request SBI Life Insurance Co.Ltd.[SBI Life] to make necessary changes to my Policy in accordance with the information furnished above. I hereby accept and agree to be bound to such changes. I agree and accept that no request is valid until SBI Life receives ( receipt of this form by an Agent does not construe as receipt by SBI Life ) the request during the life time of the Life Assured and provided such request is accepted by SBI Life. Signature of the Policy Holder: __________________________________________ Date: _________ / __________ / _____________

For Office Use Only

Signature of the person attending the request: Name : Designation: Date:

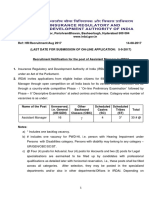

Unit Plus RP Unit Plus SP Unit Plus II RP Unit Plus II SP Unit Plus Child Unit Plus Elite Horizon Horizon II Horizon II Pension

Signature of the person approving the request:

Growth Fund Balanced Bond Designation: Fund Fund

Equity Fund

Available Available Available Available Available Not Available

Equity Optimiser Fund

Not Available Not Available Available Available Available Not Available

Name : Date:

Equity Elite Fund

Percentage in multiples of

Available Available Available Not Available X 10% Available Available Available Not Available X 10% Available Available Available Not Available X 10% Available Available Available Not Available X 10% Available Available Available Not Available X 5% Available Available Available Available X 5% No switching and redirection facilities for these products. Automatic Asset Allocation with Automatic Rebalancing will apply according to the plan option and remaining term to maturity/vesting age.

Equity Pension Fund Unit Plus II Pension

[

Available

Equity Optimiser Fund Available

Growth Pension Fund Available

Balanced Pension Fund Available

Bond Pension Fund Available

Equity Elite Fund Not Available

Minimum percentage X 10%

GENERAL INSTRUCTIONS

1. Fund option and Minimum Percentage Available under each SBI Life Unit Linked product 2. Switching Facility (Not available for Horizon/Horizon II / Horizon II Pension):

[i] Minimum Switch amount in respect of Unit Plus Regular & Single, Unit Plus-II Regular & Single Unit Plus-II Pension Regular & Single and Unit Plus Child is Rs.10,000 [ii] No minimum switch amount for Unit Plus Elite Switch To Percentage should be in multiples of 10 or 5 as stated in the last column of the table in Para 1 above. d. 4 Switches are free per Policy Year. Additional charged at Rs.100/- per Switching Request. An unused free switch can not be carried forward to the next policy year e. Total of Switch To percentage must be equal to 100%

a. b.

Available at any point of time for Inforce policies only.

c.

f.

g.

The Switch From & Switch To column should not have same funds. For ex. Request such as Switch from 100% Equity to 50% Equity & 50% Growth shall be considered invalid

Illustration: You want to switch 50% of your investment in Equity Fund and 60% of your investment in Bond Fund into Growth Fund and Balanced Fund in the percentage 60% and 40% respectively. Thus you will enter the values as:

From

Equity Fund [N.A. for Unit Plus Elite] Equity Optimiser Fund [N.A. for Unit Plus Elite] Growth Fund Balanced Fund Bond Fund Equity Elite Fund [Available only Unit Plus Elite]

Percentage 50%

To

Equity Fund [N.A. for Unit Plus Elite] Equity Optimiser Fund [N.A. for Unit Plus Elite] Growth Fund Balanced Fund Bond Fund Equity Elite Fund [Available only Unit Plus Elite]

Percentage

60% 40%

60%

N.A.- Not Available

3.

Total:

100%

Redirection Facility(Not

available for Unit Plus Single, Unit Plus II Single, Unit Plus II Pension Single Premium, Horizon, Horizon II & Horizon II Pension) Available from 2nd Policy Year Onwards. Free of cost but limited to ONE per Policy Year. The percentage mentioned for redirection, must be in multiples as stated in the last column of the table given in Para 1 above Is subject to 2 months prior notice to the receipt of next Regular Premium. Confirmation of such Redirection will be communicated to you. If Total of New Allocation Percentage specified is less than 100%, the balance will be invested into Bond Fund by default. If Total is more than 100%, the request will not be processed.

a. b.

c. d.

e.

4. Partial

Withdrawal Facility (not applicable for Pension plans):

Available from 4th Policy Year onwards (for Horizon, Unit Plus & Unit Plus Child Plans ) and from 4th Policy Year or attainment of 18 years of age in case of minor life assured, whichever is later (Horizon II, Unit Plus II & Unit Plus Elite) In case of Unit Plus II plans, it is available only if first 3 full years premiums are paid 4 Withdrawals are free per Policy Year for Unit Plus & Unit Plus II Plans, Unit Plus Child and Unit Plus Elite and 2 per policy year for Horizon and Horizon II Should be in multiples of Rs.1,000 Minimum & Maximum Withdrawal amount differs for each product. For details, please refer to the policy conditions contained in the Schedule-II of each product.

a. b. c.

d.

e. a.

b.

5. Common Conditions:

NAV used for liquidation / investment of Units i. If request is received before 3.00 p.m. : Closing NAV of the day ii. If request is received after 3.00 p.m. : Closing NAV of the next business day Invalid Request i. If the signature of the policyholder on the request differs from the one as per our records OR ii. If the request is not filled as per the conditions/guidelines mentioned in the foregoing paragraphs it will be treated as an invalid request. In such case , a fresh valid request complete in all respects will be processed on the date of receipt and the existing NAV as on the date of such receipt will be applicable.

SBI Life Insurance Co. Ltd. Registered Office: State Bank Bhavan, Madam Cama Road, Nariman Point, Mumbai - 400021 Corporate Office: Turner Morrison Bldg, GN Vaidya Marg, Fort, Mumbai 400023 Central Processing Centre: Kapas Bhavan, Plot No. 3A, Sec 10, CBD Belapur, Navi Mumbai. Regn No. 111 Call Toll Free No: 1800 22 9090 To download this form visit us at www.sbilife.co.in

Insurance is the subject matter of solicitation.

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Swaminathan PublicationDocument4 pagesSwaminathan PublicationRishabh DevNo ratings yet

- Economic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesDocument52 pagesEconomic, Demographic, and Institutional Determinants of Life Insurance Consumption Across CountriesAchmad McFauzanNo ratings yet

- NOTIFICATION CT TM 2019 English PDFDocument40 pagesNOTIFICATION CT TM 2019 English PDFNarender GillNo ratings yet

- In Re Atty Bernardo ZialcitaDocument3 pagesIn Re Atty Bernardo ZialcitaMCNo ratings yet

- 2010 Top 500 New Hampshire Retirement System PensionsDocument11 pages2010 Top 500 New Hampshire Retirement System Pensionsrush-sergesNo ratings yet

- RSA Rules-Annex 1Document6 pagesRSA Rules-Annex 1Shaju Ponnarath100% (1)

- Blackbook Project On Consumer Perception About Life Insurance PoliciesDocument80 pagesBlackbook Project On Consumer Perception About Life Insurance PoliciesMohit Kumar89% (28)

- Payslip - 2023 01 31Document1 pagePayslip - 2023 01 31mateivalentin94No ratings yet

- Proforma For Calculation of Income Tax For Tax DeductionDocument1 pageProforma For Calculation of Income Tax For Tax DeductionManchala Devika100% (1)

- Practical Accounting 1Document13 pagesPractical Accounting 1Sherrizah Ferrer MaribbayNo ratings yet

- Marriage of Grove, Matter Of, 571 P.2d 477, 280 Or. 341 (Or., 1977)Document11 pagesMarriage of Grove, Matter Of, 571 P.2d 477, 280 Or. 341 (Or., 1977)attilzmaxNo ratings yet

- 13 Month Pay - Central Azucarera Vs Central Azucarera UnionDocument2 pages13 Month Pay - Central Azucarera Vs Central Azucarera UnionJolet Paulo Dela CruzNo ratings yet

- Aafr Ias 19 Icap Past Papers With SolutionDocument12 pagesAafr Ias 19 Icap Past Papers With SolutionTsegay ArayaNo ratings yet

- Rbi 8 % Bond TdsDocument3 pagesRbi 8 % Bond TdssunnycccccNo ratings yet

- QDRO ArticleDocument19 pagesQDRO ArticlestitesattorneyNo ratings yet

- Form CSRF Subscriber Registration FormDocument7 pagesForm CSRF Subscriber Registration FormPranab Kumar DasNo ratings yet

- IRDA Recruitment Assistant Managers 2017 - Official NotificationDocument28 pagesIRDA Recruitment Assistant Managers 2017 - Official NotificationKshitija100% (1)

- Form 1040-ES: Purpose of This PackageDocument12 pagesForm 1040-ES: Purpose of This Packagetarles666No ratings yet

- Css ProfileDocument28 pagesCss ProfilejjajjNo ratings yet

- SAP HR Stepwise Screen ShotsDocument41 pagesSAP HR Stepwise Screen ShotsVIN_J50% (2)

- FINAL Wilshire TRSL SFP ResponseDocument129 pagesFINAL Wilshire TRSL SFP ResponseAlexNo ratings yet

- 2022 T1 Form - CompletedDocument8 pages2022 T1 Form - CompletedARSH GROVERNo ratings yet

- CPS Missing Credit FormatDocument6 pagesCPS Missing Credit FormatArumugam KrishnanNo ratings yet

- Agreements and Disclosures UbsDocument88 pagesAgreements and Disclosures UbsAxeliiNilssonNo ratings yet

- Appendix Chapter IIDocument57 pagesAppendix Chapter IItridibmtNo ratings yet

- Letter of Offer Template - DooDocument4 pagesLetter of Offer Template - DooShabarish RajuNo ratings yet

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonNo ratings yet

- October 28, 2013Document12 pagesOctober 28, 2013The Delphos HeraldNo ratings yet

- CircularDocument5 pagesCircularrajuNo ratings yet

- Informe Revisión de Eventos y Decisiones Que Provocaron La Crisis Fiscal en La Administración de Sistemas de RetiroDocument52 pagesInforme Revisión de Eventos y Decisiones Que Provocaron La Crisis Fiscal en La Administración de Sistemas de RetiroEmily RamosNo ratings yet