Professional Documents

Culture Documents

FNPF Annual Report 2011 Summary

Uploaded by

Intelligentsiya HqOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FNPF Annual Report 2011 Summary

Uploaded by

Intelligentsiya HqCopyright:

Available Formats

FNPF ANNUAL REPORT 2011 SUMMARY

protect our investments. The stability of the countrys foreign reserves has led to easing of the monetary policy. This has resulted in some relaxation of foreign exchange controls. While the Funds interest earnings grew in the year, the yield curve fell for the review period. There is no doubt that the domestic economy needs some impetus to revive investment and economic activity. Despite the relaxation of foreign exchange controls, 97 per cent of our investments are domiciled locally. This exposes FNPF to concentration risks with immense challenge of generating the appropriate return that is viable for Funds long-term sustainability. We will continue to work with the Reserve Bank of Fiji to find an acceptable level of offshore investments.

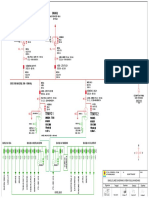

Fiji National Provident Fund and its Subsidiaries For the year ended 30 June 2011

Statements of Changes in Net Assets

Consolidated

2011 $000 228,791 10,865 3,192 - (1,385) 1,180 2,565 549 835 246,592 (2,288) 244,304 295,977 10,301 306,278 303,518 854,100 34,320 46 1,591 309,509 63,358 31,526 3,652 - 1,518 (30,166) - 2,502 6,466 62,660 96,857 583,839 270,261 17,791 252,470 (15,983) 236,487 3,551,495 (2,522) 311 (339) 424 3,785,856 2010 $000 206,912 8,262 2,510 - 103 (1,213) 2 (1,547) 267 215,296 (2,202) 213,094 282,909 13,436 296,345 292,267 801,706 40,380 322 5,152 277,486 53,673 30,750 1,330 - 2,067 - (6,386) 2,980 5,278 66,464 94,051 573,547 228,159 4,879 223,280 (17,802) 205,478 3,359,100 (12,000) (1,260) - 177 3,551,495

Investment Overview

MAJOR HIGHLIGHTS for FY11

Investment income grew steadily from $221.7 million in 2010 to $240.4 million in 2011, representing a 6.8 per cent Return on Investment (ROI). Members contributions grew by 3.8 per cent to a record of $303.5 million reflecting improved enforcement and compliance; however this was offset by total member withdrawals of $309.5 million, which led to a negative net contribution of $6.0 million. Investment rehabilitation resulted in the write-back of $30.4 million. The Fund increased its offshore investments to $114.2 million, aimed at diversifying the investment portfolio. Active members grew by 7.3 per cent to 302,729. Employers totalled 7,508 compared with 7,105 for 2010. Unpaid contribution decreased by 8.5 per cent from $9.0 million last year to $8.2 million. With the commencement of the 12 reform initiatives, wide public consultations on the key changes including the FNPF Act policy principles and the proposed actuarially-sound pension rates were conducted. 15,000 members are now receiving their monthly FNPF balances through the SUPERTxt Service a Short Messaging Service (SMS) that enables members to view their balances monthly as opposed to the six-monthly statements that the Fund issues bi-annually. The implementation of the Balance Scorecard that facilitates effective monitoring of the implementation of the Strategic Plan targets. The Memorandum of Administration (MOA), introduced in January 2011, allows relatives of deceased members to access $2,000 from the members Special Death Benefit payment. Members need to file their MOA which enables them to nominate a person to receive the $2000 for their funeral arrangements.

The Fund

2011 $000 221,903 7,800 3,168 8,506 (1,385) 1,227 (292) (511) - 240,416 (2,288) 238,128 - 2,407 2,407 303,518 544,053 - (23,823) 1,415 309,509 1,538 - - (6,529) - - - - - 10,251 9,080 301,441 242,612 - 242,612 - 242,612 3,525,771 - - - - 3,768,383 2010 $000 198,307 7,917 2,444 13,559 103 ( 911) 2 307 221,728 (2,202) 219,526 3,092 3,092 292,267 514,885 1,031 (668) 277,486 1,346 1,953 4,468 9,482 10,301 305,399 209,486 209,486 209,486 3,316,285 3,525,771

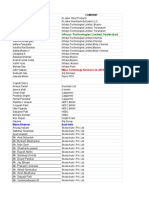

Asset Allocation for 2011

CHAIRMANS REPORT

Dear Member, It is with pleasure that I present the annual report for the financial year ending 30 June, 2011. In this report you will find key information of the operations of the Fund including highlights of major achievements. These include strong results in a net surplus of $242.6 million and asset write-back at an early stage of the Investment rehabilitation program. Whilst the Fund recognizes the urgency to complete the Reforms as scheduled, the need for members to understand the basis and implications of the reform has always been a priority to ensure it is done right the first time. Given the Funds size relative to Fijis financial system and Gross Domestic Product (GDP) it is important that corporate governance and appropriate technical policies are in place to safeguard members interest in ensuring the Fund is sustainable in the long-term. FNPF Reforms Reform measures adopted are aligned to the Funds corporate objectives of ensuring the financial security of members, sustaining growth and providing excellent standards of services. As such, the provision of pension needs to be on a sustainable and prudent financial basis. To achieve this, alternative products are being considered to give members more choices at retirement. Measures are also being proposed to ensure members accumulate a meaningful level of savings at retirement through preservation of a larger portion of members contributions. The FNPF also intends to cover as many workers as possible, especially those who are currently missing out. Significant changes are being considered to ensure that the Board acts first and foremost in the interest of members. Consultants were engaged to provide independent and technical expertise in the development of a modern and efficient legislative framework that provides for prudent and sustainable delivery of retirement savings and related services. Operating Environment The global economy, as it continues to emerge from recession, sees uneven and unstable progress. The rate of recovery is widely disparate across the Western and the Eastern economies. Economic growth has plummeted in the so-called developed Eurozone, Japan and USA, resulting in a new challenge of negative interest. Despite having to grapple with some global negatives, it is encouraging to note that the Fund recorded a surplus of $242.6 million. Record growth in tourist arrivals augurs well for our interest in the tourism sector. While we are aware that tourism is a fickle industry, its important for us to support the infrastructure development of this sector to

Financial Performance At a Group level, net surplus after tax came in at $236.5 million, up 15.1 per cent from 2010. The Fund Groups total assets as at 30 June, 2011 was $4.2 billion. FNPFs total assets increased to $3.8 billion from $3.5 billion in 2010. Net surplus increased by 16 per cent from $209.5 million in 2010. This is a 16 per cent improvement from last year and has been a result of increased Contributions and Investment Income. Contributions collected recorded $303.5 million, the highest in the Funds history. Investment income grew steadily from $221.7 million in 2010 to $240.4 million in 2011. This is a growth of 8.4 per cent resulting in a 6.8 per cent Return on Investment (ROI). Interest paid to Members The Board resolved and paid interest of 5.25 per cent to members for 2011, which is relatively better compared to last years payment. This saw the distribution of $133.2 million to members accounts. Way forward Long term sustainability is the most critical issue facing the Fund. Short-term pain would be a small price to pay to ensure that all workers in Fiji have a sustainable and stable retirement fund. Petty politics, self-interest and narrow-minded outlook by some members would not divert our attention from the core purpose of the Fund. Your Board will ensure that there is transparency in the way we conduct our business. We are guided by our vision to be Fijis corporate inspiration, and its the people at FNPF who will get us there. I am privileged to be at the helm of this organization during a period of change and reform. I am determined to see it through for the benefit of our working population to ensure that their life savings are safe, sound and invested wisely to ensure security in retirement. It is my view that the future holds many opportunities that will outweigh these challenges. Your Fund is well-positioned to embrace the future with confidence. Acknowledgement We are thankful to Government and other key stakeholders for their continued support during this challenging period. Your board and members of the board subcommittees have contributed their time and effort to ensure that we are on the path to sustainability. I would like to thank them for their support and guidance through the year. Lastly, I thank you, our members, for your steadfast support during this reporting period and we reiterate our commitment to you.

Investment income Interest income Net property income Dividends Dividends from subsidiaries Movement in net market value of investments: Unrealised gains/(losses) on revaluation of investment properties Unrealised gains/(losses) on other investments Realised gains/(losses) on investments Unrealised exchange gains/(losses) Realised exchange gains Direct investment expenses Net investment revenue Other revenue Sales revenue Other revenue Contributions revenue Contributions from employers and members Benefits paid and expenses incurred Airtime and PSTN charges Bad and doubtful debts loans and advances Bad and doubtful debts trade and other receivables Benefits paid Depreciation and amortisation Equipment and ancillary charges Impairment on equity investments Impairment on investment in subsidiary Impairment on property held for development Reversal of impairment on property, plant and equipment Reversal of cost to complete project Impairment on intangibles Interest expense Personnel expenses Other expenses Change in net assets for the year before income tax Income tax expense Change in net assets for the year after income tax Non controlling interest Change in net assets for the year after income tax Net assets available to pay benefits at the beginning of the year Acquisition/transfer of non controlling interest Increase/(decrease) in available for sale reserve Increase/(decrease) in asset revaluation reserve Others Net assets available to pay benefits at the end of the Year

The Funds investment objective is to maximize long term returns to grow members funds and sustain the pension requirement. Income Income for the year was $238.1 million compared with $219.5 million last year. The increase was a result of better yielding of the interest rates instrument. In particular, the full impact of our refocusing to longer term instruments in 2010 flowed through during the year. The return on investments was 6.8 per cent compared with 6.4 per cent in 2010. This enabled the Fund to credit 5.25 per cent interest to the members accounts, compared with 5 per cent last year. Interest Rates The yield curve fell sharply over the 12 months under review as excess liquidity more than doubled from $256 million as at 30 June, 2010 to $580 million as at 30 June, 2011. Lack of government appetite for domestic funds due to the successful float of their US denominated bonds, further dampened the interest rate market. Consequently, most of the public tenders were oversubscribed and the accepted yield for the 15-year bond fell by 195 basis points. Unfortunately, this trend is continuing and gives a precarious outlook for the next 12 months. Fixed Income The fixed income portfolio made up approximately 87 per cent of the portfolio in 2011. Total income from this portfolio was $222 million compared with $198 million last year. This equated to 93per cent of the total investment income for FY2011. Government Securities Investments in the Fijian Government securities remained the dominant asset class, making up approximately 59 per cent of the investment portfolio. Total portfolio closed at $2.1 billion compared with $2.0 billion in 2010. Investment in government bonds for the financial year was $237 million compared to $317 million the previous year. Quasi-Government Securities This portfolio consists of Government guaranteed securities in statutory bodies. The portfolio closed at $321 million compared with $348 million last year. Total investments in quasi-Government securities totaled $51 million compared with $70 million previous year. As indicated by the above figures, the decline was due to lack of floats due to high liquidity experienced in the financial system. Most statutory bodies were able to source cheaper short-term funding from the commercial banks. The portfolio also declined due to repayment of major investments upon maturity and through early redemptions of some securities. Local Term Deposits The local rates declined sharply during the financial year, mainly as a result of sharp increase in the financial liquidity. The portfolio closed at $173 million compared with $201.65 million last year. Offshore Investments The strengthening of its offshore portfolio was one of the key objectives of the Fund. This involved engagement of the Management and Board with the Government and the Reserve Bank on a regular basis,

which resulted in the RBF approving a total of $110 million for offshore investment for the calendar year 2011. This recent approval came after a period of 5 years and is supported by the strong Foreign Reserves levels. A total of $70 million was utilized in FY2011 for investment in foreign bonds and term deposits. Fiji Government US Denominated Bonds The Fund for the first time ventured into holding foreign currency denominated bonds, investing in Fiji Government US denominated bonds. These 5 year government guaranteed bonds offered a 9 per cent coupon return, making it a very attractive class of security to hold in terms of returns. Total holding as at 30 June, 2011 was US$20.246 million or $34.9 million. This investment was possible from the offshore allocation of $70 million approved by RBF for the FY2011 out of which $33.5 million was allocated towards purchase of the bonds. Foreign Term Deposits A total of $36.5 million was invested in foreign term deposits which offered higher rates compared to what is available locally. As a result the term deposit portfolio grew by 268% to close at $59 million. Equities Offshore equities The offshore equity portfolio grew by 18.6% to close at $19.2 million compared to $16.2 million last year. The growth was as a result of dividend reinvestment and gains in the market price of the portfolio. The Board started the process of seeking Expressions of Interest from suitable Fund Managers to actively manage the portfolio to enhance the returns. This process is expected to be completed in the first quarter of FY2012. Local Equities The Fund continued to focus on rehabilitation of non- performing companies and hence no major equity investments were undertaken. The market value of the Funds local equity portfolio at year-end was $320.5 million, compared with $312.0 million at 30 June 2010. The marginal growth resulted from some write back in the value of our investments with FNPF Investments Limited. Loans and Advances The Loans and Advances portfolio decreased from $466.4 million (net off write down) in FY2010 to $393.5 million this year. The reduction was due to implementation of rehabilitative measures to major loan accounts that were impaired last year. In particular, the foreclosure process for Momi Bay project was completed successfully and as a result the formerly impaired loan was reclassified as other non- financial assets. The Fund continued to focus on rehabilitation of its other loan accounts and through this mandate, Natadolas debt was restructured and the hotel has begun to repay its loans to the Fund, while foreclosure for Savusavu is underway. The Fund is finalizing options to develop both properties in order to create valuable assets that could generate returns to the Fund. The other achievement was processing of all loan accounts through the Loan Management System, thereby streamlining the internal processes for lending and the divestment of the staff loans scheme to HFC.

Summary of Key Indicators FY06-FY11

Annuity payments ($millions) Investment Portfolio ($billions) Interest rate credited to Members (%) Interest paid to members ($millions) Employers Inflation(%) Membership Contributions ($millions) Members Funds ($billions) Investment Income ($millions) Total Assets ($billions) Withdrawals - Benefits paid ($millions)

2006

37.4 3.1 6.5% 124.6 6,227 2.03 331,050 267.7 2.3 240.0 3.3 250.6

2007

38.3 3.0 6.3% 128.4 6,647 4.03 343,453 289.6 2.5 199. 3 3.4 292.3

2008

41.2 3.1 6% 131.1 6,701 5.08 352,358 281.7 2.6 194.0 3.5 297.7

2009

43.4 3.2 5% 113.6 6,944 3.22 357,662 288.5 2.7 227.4 3.3 352.3

2010

46.8 3.4 5% 121.2 7,105 6.83 364,717 292.3 2.9 219.5 3.5 254.9

2011

49.1 3.5 5.25% 133.6 7,508 5.55 368,186 303.5 3.0 238.1 3.8 309.5

Questions & Answers

1. How would you rate the Funds financial performance for the period under review? The Fund recorded an improved performance with a net surplus of $242.6 million compared with $209.5 million in 2010. Total members balance grew by $100 million; investment income increased from $221.7 million in 2010 to $240.4 million for this period; and total assets grew by $286 million to $3.8 billion compared with $3.5 billion in 2010. Contributions also increased by 3.8 per cent to $303.5 million. 2. The Fund recorded a negative net contribution of $6.0million, what do you attribute this to? Net contribution is calculated from total members contributions minus total members withdrawals. Contributions totaled $303.5 million, total withdrawals was $309.5 million. Therefore, the net contribution was negative $6.0 million. The increase in members withdrawals, despite the partial grounds being reviewed, is because of the increase in members over 55 years who exercised their retirement option for full withdrawal in anticipation of the Pension Reforms. 3. The Fund reviewed partial withdrawal grounds from 17 to 5 in the last financial year? What was the major reason for this? The major reason for this is to ensure the realignment of our service to our core role that of a retirement fund, tasked with ensuring members financial security in retirement. The reduction in grounds would mean less withdrawals by members, therefore allowing them to preserve their funds for retirement. 4. What does the Chairman mean by while the Funds interest earnings grew in the year, the yield curve fell for the review period? This means that income from all interest-earning products (bonds, deposits etc) increased in FY2011 despite the reduction in market rates for these products during this period. 5. In the last few years, the Fund had always maintained that one of its investment challenges was the restriction placed on foreign investment. Is this still a concern? The Reserve Bank of Fiji (RBF) relaxed its foreign exchange control policy last year, and this allowed the Fund to invest in foreign bonds and term deposits. This recent approval came after a period of 5 years and is supported by strong Foreign Reserves levels. The Fund will continue to work with Government and RBF to ensure that we are provided more opportunities to invest members funds for greater returns. 6. What is the Unclaimed Deposits Account (UDA) and what is its current status? The Unclaimed Deposits Account (UDA) is a requirement under the FNPF Act. It holds unclaimed funds held by the FNPF. This year the Fund transferred $3.3 million of unidentified contribution to this account. Another $6.1 million was transferred to the UDA for members over 65 years of age, who have not claimed their funds and whose accounts have not received any contributions for more than 10 years. 7. Will FNPF refund these funds to their rightful owners? If yes, what should these members do to reclaim their funds? Yes, these funds will be refunded to the rightful owners. Members need to verify their identity with us, and provide other supporting documents/evidence. Members over 65 years need to fill FNPF Form 9A and submit completed forms with certified documentations of their identity for verification purposes. For more information members can contact any of our branches or agencies or email us on information@fnpf.com.fj 8. What is the latest on the Pension Reforms? The Fund is now finalizing this and a formal announcement will be made at end of next month. 9. Are members funds safe? Yes, members funds are definitely safe. Net assets are still well in excess of members funds and the Reforms currently being undertaken is aimed at ensuring the Funds sustainability in the long-term.

Over half a million customers served in 2011

Grounds of Withdrawals

Grounds 55 years and over ($millions) Death ($millions) Disability ($millions) Migration ($millions) Marriage ($millions) Non-Citizens migrating ($millions) Partial ($millions) Housing transfers ($millions) Pension Annuity ($millions) Special Death Benefit costs ($millions) 2006 46.8 9.3 3.4 33.0 14.0 7.5 73.1 35.2 37.4 4.8 2007 58.3 12.0 3.5 33.1 14.0 6.7 99.7 37.1 38.3 3.7 2008 58.0 12.3 4.3 33.3 1.0 7.4 97.0 36.1 41.2 8.1 2009 75.4 12.4 2.3 39.8 2.0 6.3 135.7 30.6 43.4 6.3 2010 86.9 11.6 2.4 24.7 1.0 5.6 61.7 29.1 46.8 8.7 2011 120.7 10.7 3.6 31.9 0.0 5.1 45.2 33.3 49.1 9.8

Customer Service Total number of customers served during this period was 539,628. Of these, 493,757 (91 per cent) visited the Funds branches and agencies. The remaining 9 per cent were served by our Agents and Operators in the Tele-Information Centre. Pension Centre Total number of customers served at the Pension Centre was 25,835. Of those that came for pension services, 31 per cent were for pension orders, 21

per cent partial withdrawals assistance for over 55 years, and 8 per cent sought pension advice. Information Centre 49,531 telephone calls were received at Information Centre as opposed to 62,085 the previous year. The 20 per cent reduction in calls is attributed to changes made to our housing and partial withdrawal policies which restricted members from taking advantage of some of the withdrawal benefits that FNPF used to offer before.

AJITH KODAGODA Chairman

Private Mail, Bag, Suva. Telephone: 330 7811, Fax: 330 7611 Website: www.myfnpf.com.fj All correspondence to be addressed to the General Manager & Chief Executive

You might also like

- Peoples Merchant Annual Report 2010-11Document98 pagesPeoples Merchant Annual Report 2010-11jkdjfaljdkjfkdsjfdNo ratings yet

- Ing Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)Document1 pageIng Philippine Equity Fund A Unit Investment Trust Fund of ING Bank N.V. Philippine Branch (Trust Department)sunjun79No ratings yet

- Jep Ar 2010Document112 pagesJep Ar 2010Wee Seong SeowNo ratings yet

- Jaya Holdings Annual Report 2010Document112 pagesJaya Holdings Annual Report 2010wctimNo ratings yet

- Hemas Annual Report 2010 - 11Document110 pagesHemas Annual Report 2010 - 11sam713No ratings yet

- Butterfield Reports 2011 Net Income of $40.5 Million: For Immediate ReleaseDocument10 pagesButterfield Reports 2011 Net Income of $40.5 Million: For Immediate Releasepatburchall6278No ratings yet

- PFL Media Release Platform Wrap 312Document2 pagesPFL Media Release Platform Wrap 312Tuan Pham Heyts-YuNo ratings yet

- Bao Viet Annual ReportDocument87 pagesBao Viet Annual ReportLỳ KjmjNo ratings yet

- Platinum 2004 ASX Release FFH Short PositionDocument36 pagesPlatinum 2004 ASX Release FFH Short PositionGeronimo BobNo ratings yet

- MFC 4Q15 PRDocument48 pagesMFC 4Q15 PRÁi PhươngNo ratings yet

- EEA Fact Sheet April 2010Document2 pagesEEA Fact Sheet April 2010maxamsterNo ratings yet

- Pma FacsDocument27 pagesPma FacsGopi NathanNo ratings yet

- SPL Annual Report 2010 FinancialDocument65 pagesSPL Annual Report 2010 FinancialHAFIZJEE9041No ratings yet

- Ig Group Annualres - Jul12Document39 pagesIg Group Annualres - Jul12forexmagnatesNo ratings yet

- June 2011 Results PresentationDocument17 pagesJune 2011 Results PresentationOladipupo Mayowa PaulNo ratings yet

- Peso Balanced Fund: Investment ObjectiveDocument10 pagesPeso Balanced Fund: Investment ObjectiveErwin Dela CruzNo ratings yet

- Fortress Annual Report 2011 - FINALDocument193 pagesFortress Annual Report 2011 - FINALrajscribdNo ratings yet

- Financials and Projects: International Finance CorporationDocument118 pagesFinancials and Projects: International Finance CorporationMonishaNo ratings yet

- RPC Annual Report 2009-2010Document124 pagesRPC Annual Report 2009-2010Prabhath KatawalaNo ratings yet

- MAN Annual Report 2011Document138 pagesMAN Annual Report 2011Daniele Del MonteNo ratings yet

- ABF Aug2011Document1 pageABF Aug2011Charlene TrillesNo ratings yet

- Pfi Annual Report 2011Document232 pagesPfi Annual Report 2011sojol747412No ratings yet

- The Monks Investment Trust PLCDocument52 pagesThe Monks Investment Trust PLCArvinLedesmaChiongNo ratings yet

- KeppelT&T - 2010 Annual ReportDocument144 pagesKeppelT&T - 2010 Annual ReportDaxx83No ratings yet

- AIMCo 2010-11 Annual ReportDocument67 pagesAIMCo 2010-11 Annual ReportElias LadopoulosNo ratings yet

- Annual Report 2011Document56 pagesAnnual Report 2011Mark EpersonNo ratings yet

- Qbe 10-KDocument183 pagesQbe 10-Kftsmall0% (1)

- The Indian Employee PF Black BoxDocument9 pagesThe Indian Employee PF Black BoxdhanasekarenNo ratings yet

- Kingdom Annual Audited Results Dec 2009Document11 pagesKingdom Annual Audited Results Dec 2009Kristi DuranNo ratings yet

- Strategic Analysis of SBIMFDocument19 pagesStrategic Analysis of SBIMF26amitNo ratings yet

- Kotak Securities Limited 0Document34 pagesKotak Securities Limited 0Basith BaderiNo ratings yet

- Data1203 All PDFDocument288 pagesData1203 All PDFlehoangthuchienNo ratings yet

- Anglo Preliminary Results 2008Document28 pagesAnglo Preliminary Results 2008grumpyfeckerNo ratings yet

- 3Q 2010 GRSPX LetterDocument6 pages3Q 2010 GRSPX Lettercitybizlist11No ratings yet

- Pimco Corp. Opp Fund (Pty)Document46 pagesPimco Corp. Opp Fund (Pty)ArvinLedesmaChiongNo ratings yet

- Toyota Financial 2011Document19 pagesToyota Financial 2011Lioubov BodnyaNo ratings yet

- Black Diamond Global Enhanced Income Fund MRFP 2022-12-31Document8 pagesBlack Diamond Global Enhanced Income Fund MRFP 2022-12-31T.A.P.ExE.CEONo ratings yet

- 2010 FirstRand Annual Report 1Document450 pages2010 FirstRand Annual Report 1Sathya SeelanNo ratings yet

- Soya 2010Document108 pagesSoya 2010FatimahMohamadNo ratings yet

- 2011 ANZ Annual ResultsDocument132 pages2011 ANZ Annual ResultsArvind BhisikarNo ratings yet

- InnoTek Limited 2010 Annual ReportDocument139 pagesInnoTek Limited 2010 Annual ReportWeR1 Consultants Pte LtdNo ratings yet

- MAN GROUP (Done by Ummal)Document17 pagesMAN GROUP (Done by Ummal)sunnymanoNo ratings yet

- Knowledge Initiative - July 2014Document10 pagesKnowledge Initiative - July 2014Gursimran SinghNo ratings yet

- Mutual Fund Review: UTI Master Value FundDocument3 pagesMutual Fund Review: UTI Master Value FundAvinash SinghNo ratings yet

- CI Signature Dividend FundDocument2 pagesCI Signature Dividend Fundkirby333No ratings yet

- Exhibit C: Base Operations Earned RevenueDocument5 pagesExhibit C: Base Operations Earned RevenueCOASTNo ratings yet

- ADIB Investor Presentation FY 2011Document38 pagesADIB Investor Presentation FY 2011sunilkpareekNo ratings yet

- 14-NURFC Revised Business Plan Analysis IIDocument5 pages14-NURFC Revised Business Plan Analysis IICOASTNo ratings yet

- CapitaMall Trust (CMT) Annual Report 2011Document228 pagesCapitaMall Trust (CMT) Annual Report 2011dr_twiggyNo ratings yet

- Financial StatementsDocument108 pagesFinancial StatementsKumanan MunusamyNo ratings yet

- GOZ 1H11 ResultDocument7 pagesGOZ 1H11 ResultMaryna BolotskaNo ratings yet

- Full Temasek Review 2011Document96 pagesFull Temasek Review 2011Siddharth PisharodyNo ratings yet

- IFP - Aug and Sep 2012Document13 pagesIFP - Aug and Sep 2012Shakil KhanNo ratings yet

- Jaya Holdings Annual Report 2011Document100 pagesJaya Holdings Annual Report 2011wctimNo ratings yet

- University of Wales and Mdis: Introduction To Accounting (Hk004)Document11 pagesUniversity of Wales and Mdis: Introduction To Accounting (Hk004)Muhd RizdwanNo ratings yet

- As Traze NecaDocument216 pagesAs Traze NecasaandeepchandraNo ratings yet

- Aviva Financial Results 2010 - 030311Document190 pagesAviva Financial Results 2010 - 030311Rob TyrieNo ratings yet

- Rwanda's Application For Membership of The Commonwealth: Report and Recommendations of The Commonwealth Human Rights Initiative - Yash GhaiDocument81 pagesRwanda's Application For Membership of The Commonwealth: Report and Recommendations of The Commonwealth Human Rights Initiative - Yash GhaiIntelligentsiya HqNo ratings yet

- IN THE EYE OF THE STORM - Jai Ram Reddy and The Politics of Postcolonial Fiji - Brij Lal ANUDocument762 pagesIN THE EYE OF THE STORM - Jai Ram Reddy and The Politics of Postcolonial Fiji - Brij Lal ANUIntelligentsiya HqNo ratings yet

- Biman Mauritius Sept 2012Document26 pagesBiman Mauritius Sept 2012Crosbie WalshNo ratings yet

- The Causes of Fiji's 5 December 2006 Coup - Thesis - Brett A. Woods University of Canterbury 2008Document204 pagesThe Causes of Fiji's 5 December 2006 Coup - Thesis - Brett A. Woods University of Canterbury 2008Intelligentsiya HqNo ratings yet

- Fiji's High Court Judgment: Determining The Independence of The Fijian Judiciary - Lucy Anna MathiesonDocument5 pagesFiji's High Court Judgment: Determining The Independence of The Fijian Judiciary - Lucy Anna MathiesonIntelligentsiya HqNo ratings yet

- THE CASE THAT STOPPED A COUP? THE RULE OF LAW IN FIJI - University of New South Wales - Faculty of Law - 27 Nov 2003Document17 pagesTHE CASE THAT STOPPED A COUP? THE RULE OF LAW IN FIJI - University of New South Wales - Faculty of Law - 27 Nov 2003Intelligentsiya HqNo ratings yet

- A Study of Civil Liberties in Fiji - Shane SvobodaDocument28 pagesA Study of Civil Liberties in Fiji - Shane SvobodaIntelligentsiya HqNo ratings yet

- Destruction of Democracy in Fiji - Sanjay RameshDocument19 pagesDestruction of Democracy in Fiji - Sanjay RameshIntelligentsiya HqNo ratings yet

- Biography - Aiyaz Sayed-KhaiyumDocument1 pageBiography - Aiyaz Sayed-KhaiyumIntelligentsiya HqNo ratings yet

- A Legal Response to the Shameem Report: Fiji Human Rights Commission Director’s Report on the Assumption of Executive Authority by Commodore J V Bainimarama, Commander of the Republic of Fiji Military ForcesDocument8 pagesA Legal Response to the Shameem Report: Fiji Human Rights Commission Director’s Report on the Assumption of Executive Authority by Commodore J V Bainimarama, Commander of the Republic of Fiji Military ForcesIntelligentsiya HqNo ratings yet

- Human Rights Commission - Shaista Shameem - OpinionDocument32 pagesHuman Rights Commission - Shaista Shameem - OpinionIntelligentsiya HqNo ratings yet

- Sne A4Document387 pagesSne A4Intelligentsiya HqNo ratings yet

- Final CCF SubmissionDocument24 pagesFinal CCF SubmissionIntelligentsiya HqNo ratings yet

- Bank Chapter OneDocument8 pagesBank Chapter OnebikilahussenNo ratings yet

- Committee/Commission Head ObjectiveDocument5 pagesCommittee/Commission Head ObjectiveadmNo ratings yet

- Lalaine Espina - Business Finance-Interest RateDocument2 pagesLalaine Espina - Business Finance-Interest RateLalaine EspinaNo ratings yet

- A History of AgbonmagbeDocument201 pagesA History of AgbonmagbeDara afolabiNo ratings yet

- W1L3 - Lecture 3 - The Global North and The Global SouthDocument12 pagesW1L3 - Lecture 3 - The Global North and The Global Southaakriti VermaNo ratings yet

- Anand SirDocument19 pagesAnand SirSatishNo ratings yet

- S.No. ATM Center LocationDocument6 pagesS.No. ATM Center Locationask__hereNo ratings yet

- Globalization WebquestDocument3 pagesGlobalization WebquestRafael AraqueNo ratings yet

- Financial Forecasting Planning 1226943025978198 9Document20 pagesFinancial Forecasting Planning 1226943025978198 9Surya PratapNo ratings yet

- Renders Chapter Six HomeworkDocument8 pagesRenders Chapter Six HomeworkAsad Ehsan Warraich0% (1)

- Latest GST Changes 28-5-21Document5 pagesLatest GST Changes 28-5-21phani raja kumarNo ratings yet

- SR 2022 MT103Document80 pagesSR 2022 MT103Dandy ArifiyantoNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAlliah Mae ArbastoNo ratings yet

- Tally AssingmentDocument19 pagesTally AssingmentTaranNo ratings yet

- Topic 3: Assesment ACTIVITY 1: Answer Problems 2 and 3 of The Chapter 13 of Your Book Intermediate Accounting 1 A. Problem 2Document6 pagesTopic 3: Assesment ACTIVITY 1: Answer Problems 2 and 3 of The Chapter 13 of Your Book Intermediate Accounting 1 A. Problem 2Rey HandumonNo ratings yet

- Incc-M Maio 2011Document1 pageIncc-M Maio 2011Ney Taffari VazNo ratings yet

- Phurpa WangmoDocument38 pagesPhurpa WangmoJanina Kirsten DevezaNo ratings yet

- Chapter 3: International Financial Markets Book: Madura, Jeff. International Financial Management, India Edition, 2008 South-WesternDocument2 pagesChapter 3: International Financial Markets Book: Madura, Jeff. International Financial Management, India Edition, 2008 South-WesternChristian PiguerraNo ratings yet

- BSP Properties For SaleDocument9 pagesBSP Properties For Saleapi-384748172No ratings yet

- An Easy Way To Compute For Your Income Tax - JobStreetDocument3 pagesAn Easy Way To Compute For Your Income Tax - JobStreetVincent SuNo ratings yet

- GSM CalculatorDocument10 pagesGSM CalculatorDhanraj KannanNo ratings yet

- Dominus Brochure v1Document8 pagesDominus Brochure v1leila lolita leila lilasNo ratings yet

- Trading Marksheet SwingDocument76 pagesTrading Marksheet SwingKunal RawalNo ratings yet

- Hamachandru S Infosys Technologies Limited, Hyderabad: Name CompanyDocument6 pagesHamachandru S Infosys Technologies Limited, Hyderabad: Name CompanyreenajoseNo ratings yet

- Egypt Country Risk: Executive SummaryDocument6 pagesEgypt Country Risk: Executive SummarySawa SportNo ratings yet

- Medplus Health Services Limited DRHPDocument355 pagesMedplus Health Services Limited DRHPYash GuptaNo ratings yet

- SLD BulukandangDocument1 pageSLD BulukandangirfanNo ratings yet

- NYSF Walmart Solutionv2Document41 pagesNYSF Walmart Solutionv2Vianna NgNo ratings yet

- 2018 Spa AcacioDocument2 pages2018 Spa AcacioRussell Galvez HufanoNo ratings yet

- Garment SpecDocument2 pagesGarment SpecMohamed MokhtarNo ratings yet