Professional Documents

Culture Documents

Fitch Ratings - Press Release

Uploaded by

Alfonso RobinsonOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fitch Ratings - Press Release

Uploaded by

Alfonso RobinsonCopyright:

Available Formats

Fitch Ratings | Press Release

11/7/11 1:22 PM

Fitch Rates Danbury, CT Refunding GOs 'AAA'; Outlook Stable

04 Oct 2011 3:34 PM (EDT)

Ratings

Fitch Ratings-New York-04 October 2011: Fitch Ratings has assigned the following rating to the City of Danbury, CT's (the city) general obligation (GO) bonds: --$14.84 million GO refunding bonds, issue of 2011, at 'AAA'. The bonds are scheduled to price this week via negotiation. In addition, Fitch affirms the city's following ratings: --Approximately $166 million outstanding GO bonds at 'AAA'; --$2 million outstanding GO notes, series 2011, at 'F1+'. The Rating Outlook is Stable. SECURITY The bonds and notes are a full faith and credit obligation of the city backed by its unlimited taxing power. KEY RATING DRIVERS Above-Average Socioeconomic Indicators: The city's economic profile is strong with a broad economic base, continued economic development, above average wealth levels and low unemployment. Strong Financial Flexibility: Despite moderate draws on reserves in recent years, Danbury has consistently maintained strong fund balance levels. Low Debt Levels: The debt burden is low and is expected to remain so given the rapid amortization of existing debt and the city's manageable debt plans. Above-Average Pension Funding: Pension and other post employment benefits (OPEB) are well managed as illustrated by the city's high pension funding levels. CREDIT PROFILE Danbury is the largest city in northern Fairfield County and is easily accessible to New York City, Hartford and Norwalk, all of which are within 60 miles. The city benefits from continued economic development and 8% population growth over the prior decade to 80,893, enhancing its role as an important regional employment and retail center. The city's tax base, with a current $11 billion market value, has benefited from several significant economic development projects in the health care and pharmaceutical manufacturing sectors, including the recent expansions of Boehringer-Ingelheim and MannKind Bio Pharmaceuticals Corporation. Danbury Hospital has completed its merger with the New Milford Hospital and has been undertaking expansion efforts. The retail sector is also well-represented as the city is home to the Danbury Fair Mall, the largest retail mall in New England. The city's unemployment rate has declined to 7.6% for July 2011 from 8.1% the year prior and compares favorably with the state (9.2%) and national (9.3%) averages. Income levels register comfortably above the national average and have strengthened in recent years relative to those of wealthy Fairfield County and the state of Connecticut. The city maintains a healthy level of financial flexibility with consistently sound reserves, despite a moderate use of fund balance for the past three audited years. Danbury's stable revenue base includes a high proportion of property taxes, which make up 71% of general fund revenues. Fiscal 2010 ended with a $1.17 million draw on fund balance, lowering the unreserved fund balance to $23.8 million or 9.6% of spending, well within its policy limit of 5%-10%. Estimated fiscal 2011 results indicate a small estimated use of $122,000 in reserves, much less than the $2.5 million appropriated, because of the successful sale of a city asset and tight spending controls. The unreserved fund balance is expected to remain sound at $23.6 million, remaining within 9%-10% of expenditures due to a decrease in spending. The fiscal 2012 budget includes $2.9 million of one-time revenues from a planned asset sale of vacant land, and the use of $2.4

http://www.fitchratings.com/creditdesk/press_releases/detail.cfm?print=1&pr_id=729941 Page 1 of 3

Fitch Ratings | Press Release

11/7/11 1:22 PM

million of fund balance. If fully drawn upon, this would result in a still healthy unreserved fund balance of 9.8% of budgeted spending. The adopted budget for fiscal 2012 includes a 3.5% mill rate increase which will generate an additional $6.7 million to support expenditure increases in education ($1.1 million), pension costs ($2.4 million), debt service ($3.1 million) and employee benefits ($0.4 million). The budget also includes $1.1 million for capital improvements and $450,000 for contingencies. Debt levels are low and are expected to remain so given the city's conservative debt policies, limited bonding plans and manageable capital needs. Amortization is strong with nearly 70% of principal retired in 10 years. The city's fiscal 2012-2016 capital plan totals $270 million, although the city expects actual capital spending to be lower as some projects will be scaled down or cancelled. The city has $18.6 million of authorized/unissued debt remaining as well as its annual $3 million allowance for nonreferendum approved debt. The city plans on issuing approximately $40-$50 million of bonds over the next five years for city and school projects and plans to go out for referendum in March 2012 for an initial $10-15 million issue. The city's pension funding levels remain strong. On an aggregate basis, the city's six pension plans are 94% funded, using the city's 8% assumed investment rate. Adjusting for Fitch's more conservative 7% discount rate assumption, funding remains high at 85%. For fiscal 2012, the city's contribution for its pension plans increased to $7.8 million, up $2.4 million from $5.3 million in fiscal 2011, but still represents a low 3.6% of budgeted spending. Other post employment benefit (OPEB) liabilities are manageable. The city has prudently set aside $1.2 million in a reserve in anticipation of establishing a trust in the future. Contact: Primary Analyst Kevin Dolan Director +1-212-908-0538 Fitch, Inc. One State Street Plaza New York, NY 10004 Secondary Analyst Stephen Friday Analyst +1-212-908-0384 Committee Chairperson Steve Murray Senior Director +1-512-215-3729 Media Relations: Cindy Stoller, New York, Tel: +1 212 908 0526, Email: cindy.stoller@fitchratings.com. Additional information is available at 'www.fitchratings.com'. The ratings above were solicited by, or on behalf of, the issuer, and therefore, Fitch has been compensated for the provision of the ratings. In addition to the sources of information identified in Fitch's Tax-Supported Rating Criteria, this action was additionally informed by information from Creditscope, University Financial Associates, S&P/Case-Shiller Home Price Index, IHS Global Insight, Zillow.com, and National Association of Realtors. Applicable Criteria and Related Research: --'Tax-Supported Rating Criteria', dated Aug. 15, 2011; --'U.S. Local Government Tax-Supported Rating Criteria', dated Aug. 15, 2011. Applicable Criteria and Related Research: Tax-Supported Rating Criteria U.S. Local Government Tax-Supported Rating Criteria ALL FITCH CREDIT RATINGS ARE SUBJECT TO CERTAIN LIMITATIONS AND DISCLAIMERS. PLEASE READ THESE LIMITATIONS AND DISCLAIMERS BY FOLLOWING THIS LINK: HTTP://FITCHRATINGS.COM/UNDERSTANDINGCREDITRATINGS. IN ADDITION, RATING DEFINITIONS AND THE TERMS OF USE OF SUCH RATINGS ARE AVAILABLE ON THE AGENCY'S PUBLIC WEBSITE 'WWW.FITCHRATINGS.COM'. PUBLISHED RATINGS, CRITERIA AND METHODOLOGIES ARE AVAILABLE FROM THIS SITE AT ALL TIMES. FITCH'S CODE OF CONDUCT, CONFIDENTIALITY, CONFLICTS OF INTEREST, AFFILIATE FIREWALL, COMPLIANCE AND OTHER RELEVANT

http://www.fitchratings.com/creditdesk/press_releases/detail.cfm?print=1&pr_id=729941 Page 2 of 3

Fitch Ratings | Press Release

11/7/11 1:22 PM

POLICIES AND PROCEDURES ARE ALSO AVAILABLE FROM THE 'CODE OF CONDUCT' SECTION OF THIS SITE.

Copyright 2011 by Fitch, Inc., Fitch Ratings Ltd. and its subsidiaries.

http://www.fitchratings.com/creditdesk/press_releases/detail.cfm?print=1&pr_id=729941

Page 3 of 3

You might also like

- 3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementDocument36 pages3 Lake Ave Extension LLC V City of Danbury Zoning Commission JudgementAlfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 January 10Document29 pagesRe-Elect Mayor Esposito SEEC 20 January 10Alfonso RobinsonNo ratings yet

- St. Hiliare v City of Danbury (complaint)Document91 pagesSt. Hiliare v City of Danbury (complaint)Alfonso RobinsonNo ratings yet

- Roberto Alves SEEC 20 January 10 (Termination)Document31 pagesRoberto Alves SEEC 20 January 10 (Termination)Alfonso RobinsonNo ratings yet

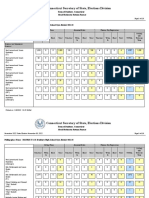

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- Danbury November 2023 Municipal Election Returns (Amended)Document91 pagesDanbury November 2023 Municipal Election Returns (Amended)Alfonso RobinsonNo ratings yet

- Governor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtDocument5 pagesGovernor Lamont Nominates 20 Jurists To Serve As Judges of The Connecticut Superior CourtAlfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 January 10Document37 pagesAlves For Danbury Form 20 January 10Alfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 April 10 2023Document201 pagesAlves For Danbury SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 April 10 2023Document88 pagesRe-Elect Mayor Esposito SEEC 20 April 10 2023Alfonso RobinsonNo ratings yet

- Alves For Danbury SEEC 20 July 10 2023Document102 pagesAlves For Danbury SEEC 20 July 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC 20 October 10 2023Document75 pagesRe-Elect Mayor Esposito SEEC 20 October 10 2023Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 October 10 2022Document32 pagesRe-Elect Mayor Esposito SEEC Form 20 October 10 2022Alfonso RobinsonNo ratings yet

- Re-Elect Mayor Esposito SEEC Form 20 January 10 2023Document54 pagesRe-Elect Mayor Esposito SEEC Form 20 January 10 2023Alfonso RobinsonNo ratings yet

- Danbury Democrats Ward Reappointment Proposal (Plan A)Document6 pagesDanbury Democrats Ward Reappointment Proposal (Plan A)Alfonso RobinsonNo ratings yet

- To City of Danbury Election WardsDocument13 pagesTo City of Danbury Election WardsAlfonso RobinsonNo ratings yet

- Danbury 2022 Head Moderators ReturnsDocument7 pagesDanbury 2022 Head Moderators ReturnsAlfonso RobinsonNo ratings yet

- Danbury Republican Party Ward Reapportionment Proposal (Plan B)Document8 pagesDanbury Republican Party Ward Reapportionment Proposal (Plan B)Alfonso RobinsonNo ratings yet

- 2021 Danbury Election Finals (Per Ward)Document2 pages2021 Danbury Election Finals (Per Ward)Alfonso RobinsonNo ratings yet

- Joe DaSilva For Judge of Probate, Danbury CT 2022Document2 pagesJoe DaSilva For Judge of Probate, Danbury CT 2022Alfonso RobinsonNo ratings yet

- 2022 Danbury Head Moderators Return DataDocument118 pages2022 Danbury Head Moderators Return DataAlfonso RobinsonNo ratings yet

- 2021 Danbury Head Moderator Return DataDocument136 pages2021 Danbury Head Moderator Return DataAlfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 October 26 (7 Days Until Election)Document35 pagesAlves For Danbury Form 20 October 26 (7 Days Until Election)Alfonso RobinsonNo ratings yet

- Alves For Danbury Form 20 October 12 Amendment (7 Days Until Election)Document4 pagesAlves For Danbury Form 20 October 12 Amendment (7 Days Until Election)Alfonso RobinsonNo ratings yet

- Summary Ballots by Party 2021Document6 pagesSummary Ballots by Party 2021Alfonso RobinsonNo ratings yet

- Danbury 2021 Election TotalsDocument9 pagesDanbury 2021 Election TotalsAlfonso RobinsonNo ratings yet

- Summary Ballots by Party 2021Document6 pagesSummary Ballots by Party 2021Alfonso RobinsonNo ratings yet

- Dean Esposito Form 20 October 26 (7 Days Until Election)Document40 pagesDean Esposito Form 20 October 26 (7 Days Until Election)Alfonso RobinsonNo ratings yet

- Frank Salvatore City Council at Large MailerDocument2 pagesFrank Salvatore City Council at Large MailerAlfonso RobinsonNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- En Banc G.R. No. 97419, July 03, 1992: Supreme Court of The PhilippinesDocument15 pagesEn Banc G.R. No. 97419, July 03, 1992: Supreme Court of The PhilippinesJoe RealNo ratings yet

- CSR 25 1Document8 pagesCSR 25 1anon_146186758No ratings yet

- Jan Issue2021Document8 pagesJan Issue2021Nayan BhowmickNo ratings yet

- Comparative Study of Retail Banking Strategies Adopted by Various Private Sector Banks Such As HDFC Bank, Icici Bank and Axix Bank.Document31 pagesComparative Study of Retail Banking Strategies Adopted by Various Private Sector Banks Such As HDFC Bank, Icici Bank and Axix Bank.asutoshNo ratings yet

- Holt Accounting & Tax: Poor Accounting Quality, Debt & Intangibles, and PensionsDocument4 pagesHolt Accounting & Tax: Poor Accounting Quality, Debt & Intangibles, and PensionsWira WijayaNo ratings yet

- Allah'S Name We Begin With The Most Beneficial and The Most MercifulDocument44 pagesAllah'S Name We Begin With The Most Beneficial and The Most MercifulFarhan Rajput100% (5)

- Pages from 29. ĐỀ 29 (Hằng 13) - Theo đề MH lần 1.Image.MarkedDocument6 pagesPages from 29. ĐỀ 29 (Hằng 13) - Theo đề MH lần 1.Image.Markedthuy tongNo ratings yet

- Notice of Assessment 2023 04 11 11 51 12 947361Document4 pagesNotice of Assessment 2023 04 11 11 51 12 947361Amelia D. LopezNo ratings yet

- Chapter-3 On Pension, Gratuity, BSNL GSLIDocument69 pagesChapter-3 On Pension, Gratuity, BSNL GSLIc2anNo ratings yet

- Credito Edwin GuzmanDocument2 pagesCredito Edwin GuzmanCarol Milena Arias MontoyaNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Piyush PatelNo ratings yet

- Mercer IndiaDocument60 pagesMercer Indiarajenrao51777564No ratings yet

- HR - Switzerland FinalDocument25 pagesHR - Switzerland FinalMikmikNo ratings yet

- March (00000002)Document35 pagesMarch (00000002)Jonathan GuignardNo ratings yet

- Conplete Text - Constitutional Law II LB401 CK 15-2-2019 PDFDocument389 pagesConplete Text - Constitutional Law II LB401 CK 15-2-2019 PDFabhijeet raiNo ratings yet

- 2Document16 pages2RaviKiran AvulaNo ratings yet

- jurnAL KESOSDocument11 pagesjurnAL KESOSAkinori TazumeNo ratings yet

- Bye-Laws of Krishak Bharati Cooperative LimitedDocument26 pagesBye-Laws of Krishak Bharati Cooperative LimitedMadhav VayedaNo ratings yet

- Kkku Karak PDFDocument268 pagesKkku Karak PDFNido SantosNo ratings yet

- Types of Employment ContractDocument2 pagesTypes of Employment ContractSyazwani OmarNo ratings yet

- An Integrated Model of Financial Well BeDocument10 pagesAn Integrated Model of Financial Well BeMohammad Adnan RummanNo ratings yet

- SIP - Awareness of Financial Planning in Emerging Indian Market On HDFC LifeDocument74 pagesSIP - Awareness of Financial Planning in Emerging Indian Market On HDFC LifeManish SharmaNo ratings yet

- Practical Issues in TDSDocument21 pagesPractical Issues in TDShrushikesh0501No ratings yet

- Da KeralaDocument4 pagesDa KeralaVishwas ShindeNo ratings yet

- Alex Frey, Ivy Bytes-A Beginner's Guide To Investing How To Grow Your Money The Smart and Easy Way - Ivy Bytes (2011)Document53 pagesAlex Frey, Ivy Bytes-A Beginner's Guide To Investing How To Grow Your Money The Smart and Easy Way - Ivy Bytes (2011)miche345100% (1)

- Accessibility Assignment 1 1Document7 pagesAccessibility Assignment 1 1api-301140443No ratings yet

- To, The Zonal Manager Bank of India Indore ZoneDocument3 pagesTo, The Zonal Manager Bank of India Indore ZoneKrishna MyakalaNo ratings yet

- Financial Institution and MarketDocument52 pagesFinancial Institution and Marketsabit hussenNo ratings yet

- Prosper Chapter6v2 PDFDocument28 pagesProsper Chapter6v2 PDFAdam Taggart100% (2)

- Compassionate Appointment Approved Merit Point System and FormsDocument10 pagesCompassionate Appointment Approved Merit Point System and FormssoorayshNo ratings yet