Professional Documents

Culture Documents

Development Commissioner Handloom

Uploaded by

Sunil PurohitOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Development Commissioner Handloom

Uploaded by

Sunil PurohitCopyright:

Available Formats

Office of the Development Commissioner for Handlooms, Ministry of Textiles, Udyog Bhavan, New Delhi 110011

Dated: 29th April, 2009.

INVITATION OF TECHNICAL & FINANCIAL BIDS FOR HEALTH INSURANCE SCHEME FOR HANDLOOM WEAVERS

The Office of the Development Commissioner for Handlooms, Ministry of Textiles invites technical and financial bids from reputed insurance companies for implementation of Health Insurance Scheme for Handloom weavers throughout the country during 2009-10. The details of eligibility criteria and terms and conditions for the bid can be obtained from the website www.handlooms.nic.in. This can also be collected from Smt. Charumathi Krishnan, Assistant Director, O/o D.C. Handlooms, Room No. 51-A, Ministry of Textiles, Udyog Bhavan, New Delhi-110011 phone No. 23063973 from 11.00 a.m. to 5.00 p.m. on working days. The eligible companies may submit their bid in sealed envelopes latest by 18th May, 2009 by 12.00 Noon in the chamber of Smt. Meenu S. Kumar, Chief Enforcement Officer, Room No.55-B, Udyog Bhawan, New Delhi.

( B K Sinha) Development Commissioner (Handlooms) Telephone No. 23063684, 23062945 (Office)

No.1/2/2009-DCH/Proj.I Government of India Ministry of Textiles Office of the Development Commissioner for Handlooms Udyog Bhawan, New Delhi th Dated 29 April, 2009.

Invitation of technical & financial bids for Health Insurance Scheme for Handloom Weavers During the 11th Plan, the Health Insurance Scheme is a component of the Handloom Weavers Comprehensive Welfare Scheme. Under the Health Insurance Scheme 17.74 lakh weavers have been covered during 2007-08 and more than 18.00 lakh weavers have been covered during 2008-09. The Health Insurance Scheme is proposed to be continued during 2009-10 for covering handloom weavers and other ancillary handloom workers and their families over a period of 01 year. During 2009-10 approximately 18 lakh handloom weavers and ancillary workers are likely to be covered under the scheme (at the current rate of premium). This bid will be operational for 01 year during the financial year 2009-10. Health care facilities are extended to handloom weavers through this scheme where approximately 80% of the premium shall be borne by the Central Government and almost 20% by the weavers. With this background, financial bids are invited from all insurance companies dealing with health insurance and registered with IRDA for implementation of the Health Insurance Scheme for handloom weavers. The main features of the scheme are as follows:1 Objective of the scheme:1.1 All Handloom weavers whether male or female, are eligible to be covered under the Health Insurance Scheme. The scheme will cover the weavers family of four i.e. self, spouse and two children. The scheme is to cover persons between the age group of 01 day to 80 years. In case there is only one child in a family then one of the parents of the primary beneficiary of his/her choice can be covered under the scheme. In case there are no children in a family then both the parents of the primary beneficiary can be covered under HIS. In all, only four members in a family must be covered to avail the benefits under this scheme. In no case, wife/husband of same family shall be given separate cards.

1.2

The ancillary handloom workers like those engaged in warping, winding, dyeing, printing, finishing, sizing, Jhala making, Jacquard cutting etc. are also eligible to be covered. (Amt. in Rs.)

15,000/15,000/2,500/250/250/250/4,000/4,000/15,000/500/7,500/-

2. Benefits Eligible benefits will be as follows Annual Limit per family (1+3) Sub Limits per Family: All pre-existing Diseases + New Diseases Maternity Benefits (per child for the first two) Dental treatment Eye treatment Spectacles Domiciliary Hospitalization Ayurvedic/Unani/Homeopathic/Siddha Hospitalisation (Pre& Post Hospitalisation) Baby coverage OPD Exclusions:

Corrective cosmetic surgery or treatment, HIV, AIDS, Sterility, Venereal diseases, Intentional self-injury, use of intoxicating drug or alcohol, War, Riot, Strike, Terrorism acts & nuclear risks. 3. Eligibility (To be submitted As per Proforma in Annexure-I) 3.1 The insurance company must have a valid license from IRDA to deal in health insurance. Please attach copy along with the bid. 3.2 The insurance company should have Health Insurance business of at least Rs.100 crores in any of the following years i.e. 2005-06, 2006-07 and 2007-08. The company must also give details of Gross Premium Income of three years i.e. 2005-06, 2006-07 and 2007-08. Please attach copy of Audited Balance Sheet/Annual Report and any other proof showing details of Gross Premium Income and Health Insurance Business along with bid. The company should have its presence either through its own offices/representatives/TPAs in at least 250 handloom clusters out of 470 handloom clusters, which can be seen on the official website at www.handlooms.nic.in and can also be obtained from the Office of the Development Commissioner for Handlooms. The insurance company must give documentary proof thereof. In case, this is not so, this should be organised within one month of the award of the work order and documentary proof be submitted thereof immediately. The insurance company must give the details of the office network in India.

3.3 The insurance company must have tie-ups with hospitals and nursing homes in or around at least 250 handloom clusters in the country for the OPD/IPD cashless facilities. If current coverage in handloom clusters is not available, then they will have to establish presence in at least 250 handloom clusters within one month of the award of the work order and a documentary proof be submitted thereof immediately. It is expected that the number of such cashless empanelled hospitals will be increased over a period of time and all the handloom clusters will be covered by the end of the financial year. 4. Other conditions 4.1 After the work order is awarded to the Company, an amount equivalent to the Governments contribution of the premium amount and service tax to the extent of 30% of the premium of the total number of weavers to be covered will be released to the Company. At any point of time when 66% of the above mentioned amount is utilised towards enrolment of the weavers, the company shall send a progress report to the Office of the Development Commissioner for Handlooms indicating the number of people enrolled and funds utilised for the same. On receipt of progress report, which will be corroborated further by a certificate from the State Government, Office of the Development Commissioner for Handlooms will take steps to release the next instalment of 30% of the premium. Further releases will be made in the same proportion till the figure of 90% is reached. Once UCs have been received for 90% then only the remaining amount of 10% will be released. However, insurance company shall not stop or delay enrolment of weavers for insurance for delay in release of funds, subject to the provisions of Section 64 VB of Insurance Act, 1938. 4.2 One weaver family would normally receive the benefit for one year on payment of his/her share of premium. For the financial year 2009-10, the budgetary allocation is of Rs.115 crores. During this year, 18 lakh weavers (appx.) are expected to be covered all over the country out of which 33% should be from the NER (i.e. Assam, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura and Sikkim). 4.3 Primacy should be given for renewals as far as possible. 4.4 The minimum contribution by the weaver should be Rs.50/- per family even in cases where State Governments are making contribution on his behalf. GOI contribution towards premium shall continue at 80% plus service tax. 4.5 The insurance company shall pay/reimburse expenses incurred by the weavers in course of medical treatment availed of in any hospital or nursing home which are not empanelled by the company within the country, subject to limits/sub-limits. In such a case, the weaver may submit the prescription and the vouchers for the medicines to the insurance company or TPA who will ensure that full payment is made within Fifteen days after receipt of all the requisite documents and information. 4.6 The insurance company or its authorized representatives have to provide a cashless facility in nursing homes/hospitals empanelled by the Insurance Company/TPA in various States all over the country. This would mean that a patient can avail of treatment in any one of the empanelled hospitals without actually having to pay the bills. However, in the event of treatment in a non-

4.7 4.8

4.9 4.10

4.11

4.12 4.13

4.14 4.15

4.16

network hospital the insured claimant shall be reimbursed directly by the insurance company. The Policy shall be valid for a period of 12 months, from the date of receipt of premium by the insurer. The insurance company will prepare information related to this scheme/beneficiary in vernacular languages in different States. Insurance company shall give full publicity to the scheme so that large number of handloom weavers can benefit from this scheme. Besides giving advertisements in newspapers including in the concerned vernacular language other means such as TV interviews/Radio/local fairs/meetings and workshops shall also be used for creating awareness and for facilitating enrolments. The insurance company shall provide enrollment forms to the Director of Handlooms and the responsibility to enroll the weavers shall rest with the State Government. Before submission of UCs, the insurance company shall provide a list (hard and soft copy) of the beneficiaries to whom cards have been distributed containing full details such as father/husbands name and full residential address indicating house number and street number so that the person can be easily located for verification, to the D.C. Handlooms and the State Directors of Handlooms, to enable release of next installment of Central Govt. share of premium. The lists will be checked randomly by the State Governments. If any discrepancy is found in the number of weavers enrolled during the inspection on a random basis at various centres, the premium shall be refunded by the insurance company on a proportionate basis for that whole State. These random inspections will be done at least every three months by the State Government and a report sent to D.C. Handlooms. The Insurance Company shall submit a monthly report of total number of persons enrolled. State Director/Commissioner Incharge of Handlooms shall certify the number of such enrollments and issuance of health cards after due verification. The insurance company will send the monthly progress report as per the prescribed format along with the above mentioned certificates of the previous month by 20th of every month to the Office of the Development Commissioner for Handlooms indicating number of people insured, funds utilized and the claims settled as well as claims pending for more than fifteen days with reasons thereof in the prescribed format. The insurance company will hold meetings with the State Director incharge of Handlooms every month to review the implementation of the Health Insurance Scheme and take suitable steps to resolve all issues. The insurance company shall provide grievance/redressal centres in all four regions including NER in at least 250 clusters within one month from the date of finalization of the bid. It is expected that number of such centres shall increase over a period of time and all handloom clusters will be covered by the end of the financial year. The insurance agency and the Assistant Director (HL & Tex) of the district shall be equally responsible for timely settlement of the claims, distribution of reimbursement cheques to the beneficiaries and maintain detailed record thereof.

4.17 Arbitration clause i) In case of any dispute or difference, the matter shall be referred for Arbitration to the Secretary (Textiles), Ministry of Textiles which shall be final. ii) The Courts at New Delhi shall have jurisdiction for the purposes of the Arbitration and Conciliation Act, 1996. 5. 5.1 5.2 5.3 Financial bids (As per Annexure-II) The Insurance company should quote annual premium per family as per AnnexureII. Premium quoted should be valid for 01 year without any increase. The insurance company should ensure that the claims ratio to accrued premium is not less than 70% of the annual premium accrued. If so, the surplus amount will be refunded by insurance company to the Government of India. The claims ratio will include claims paid, claims in process including IBNR and TPA charges. DC(HL) may at any time discontinue the scheme by public notice and notice to the insurance company wherefore no new insurance shall be made but all earlier insurance undertaken shall be serviced during respective period of validity. A final account of Central Government share of premium and Service Tax and advance made shall be taken and cleared between the parties. In case the contract is terminated with the Company for any reason and if the ratio of claims paid, claims in process including IBNR and TPA charges is less than 70% of the annual premium accrued, then the balance amount would be refunded to the Government of India. The responsibility for collection of weavers share of premium will lie with State Government and the insurance company. The technical bid and financial bid should be sealed by the bidder in separate covers duly superscribed and both these sealed covers are to be put in a bigger cover which should also be sealed and duly superscribed. The bids in sealed envelopes should be sent to the following address (in the format enclosed in Annexure I & II) latest by 12.00 Noon on 18th May, 2009 to:Chief Enforcement Officer, Office of the Development Commissioner for Handlooms Room No.55-B, Udyog Bhawan, New Delhi-110011.

5.4

5.5

5.6 5.7

5.8 5.9

5.10

Conditional bids will not be considered. Office of the Development Commissioner for Handlooms reserves the right to accept or reject any or all bids without assigning any reason. Bids will be opened at 12.30 p.m. on 18.5.2009 (Monday) in the chamber of D.C.Handlooms, Room No.56, Udyog Bhawan, New Delhi-110011. The bidders should submit the information in Annexure.I and II in two separate envelopes. On the envelope containing Annexure.I, Technical Bid should be written and on the envelope containing Annexure.II, Financial Bid should be written. The Technical bid shall be opened first and the financial bid of only those will be opened who fulfill the eligibility criteria. For any further clarification, the Mrs. Charumathi Krishnan, Assistant Director, O/o D.C. Handlooms, Ministry of Textiles, Room No.51-A, Udyog Bhawan, New Delhi can be contacted, on any working day between 11.00 am. To 5.00 p.m. (Tele: 23063973).

(B.K. Sinha) Development Commissioner (Handlooms) Encl: Annexure I & II

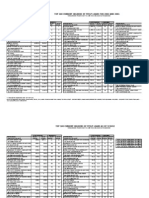

ANNEXURE- I FORMAT FOR TECHNICAL PROPOSAL 3.1 COMPANY PROFILE Name of the Insurance Company Registered Office of the Insurance Company IRDA License Number and validity (Please attach a photo copy) 3.2 FINANCIAL STANDING OF THE COMPANY FOR THE FOLLOWING THREE YEARS ( Rs. in crores) Gross Net Profit Year* premium Paid up Capital Net Worth Before Tax income 2007-08 2006-07 2005-06 * A copy of the audited balance sheet/ Annual Report and any other proof showing the details for each year may be enclosed 3.2 OFFICE NETWORK IN INDIA (Address proof / Contact details to be provided herewith) Region North South East West Total Number of offices of the Insurance Company

3.2

HEALTH INSURANCE EXPERIENCE (Please attach photo copies of work orders) Year No of individuals covered Nature of Policy Total Premium collected

Name of the Insurance Scheme

EXPERIENCE OF HANDLING OPD CLAIMS, (Please attach photocopies of the work-orders) Name of the Number of Insurance Year individuals Nature of the Policy Scheme covered

ANNEXURE II FORMAT FOR FINANCIAL PROPOSAL From --------------------------------------------------------------------------------------------------------------------Sir, Sub: Appointment of General Insurance Company for providing Health Insurance Cover to Handlooms Weavers To Development Commissioner for Handlooms Office of the D.C. Handlooms Ministry of Textiles NEW DELHI

We have read and understood all the terms and conditions of your Health Insurance Scheme and agree to abide the same. We _______________________ (insurance company) herewith give our price proposal for selection of our company for the above mentioned project for a period of 1 year. We will be paid a rate of Rs. _____________(Rupees .....) per family as per the details worked out below. Premium Rs. ___________________ Service Tax Rs. ___________________ Total Rs. ___________________ We will give primacy to renewals as far as possible. Yours faithfully Date______________ Place______________ Signature_______________ Full Name______________ Designation_____________ Address________________ (Name of the Company)

10

You might also like

- How to Uplift the Uae Economy Without Oil RevenueFrom EverandHow to Uplift the Uae Economy Without Oil RevenueNo ratings yet

- How to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysFrom EverandHow to Reverse Recession and Remove Poverty in India: Prove Me Wrong & Win 10 Million Dollar Challenge Within 60 DaysNo ratings yet

- Cope Rat IvesDocument5 pagesCope Rat IvesAniketh AnchanNo ratings yet

- Esi Act 1948Document11 pagesEsi Act 1948vinodkumarsajjanNo ratings yet

- Handicrafts Artisans Comprehensive Welfare Scheme Rajiv Gandhi Shipi Swasthya Bima YojnaDocument8 pagesHandicrafts Artisans Comprehensive Welfare Scheme Rajiv Gandhi Shipi Swasthya Bima YojnatajenderNo ratings yet

- Act Labour Employees StateinsuranceDocument15 pagesAct Labour Employees StateinsuranceShivam KumarNo ratings yet

- Livestock Insurance SchemeDocument7 pagesLivestock Insurance SchemeDhanushNo ratings yet

- Employees State InsuranceDocument19 pagesEmployees State InsurancerajanrengarNo ratings yet

- Employees' State Insurance Act, 1948Document6 pagesEmployees' State Insurance Act, 1948Ronan GomezNo ratings yet

- Employee State Insurance Act, 1948Document32 pagesEmployee State Insurance Act, 1948snigdha_tripathiNo ratings yet

- On "Employee's State Insurance Act 1948" of India.Document20 pagesOn "Employee's State Insurance Act 1948" of India.Anshu Shekhar SinghNo ratings yet

- ESI Scheme Salient Features of ESI SchemeDocument8 pagesESI Scheme Salient Features of ESI SchemeanjumanNo ratings yet

- Ah - RoyalDocument12 pagesAh - RoyalAnonymous FyZk2nShNo ratings yet

- Insurance SchemeDocument8 pagesInsurance SchemeBhargav KumarNo ratings yet

- RSBY Hospital Manual 28072010Document44 pagesRSBY Hospital Manual 28072010chimera03No ratings yet

- Seminar Report-EsiDocument17 pagesSeminar Report-EsiDilpreet kaurNo ratings yet

- Employee State Insurance Act 1948Document17 pagesEmployee State Insurance Act 1948Aquib KhanNo ratings yet

- ESICDocument23 pagesESICHarini Saripella100% (1)

- Lecture 3 - The Employee's State Insurance Act, 1948Document8 pagesLecture 3 - The Employee's State Insurance Act, 1948rishapNo ratings yet

- GO 406-FD of 2018 Dated 20.09.2018 Mediclaim InsuranceDocument6 pagesGO 406-FD of 2018 Dated 20.09.2018 Mediclaim InsuranceRAGHVENDRA PRATAP SINGHNo ratings yet

- Directorate of Employees' State Insurance (Medical Benefit) SchemeDocument75 pagesDirectorate of Employees' State Insurance (Medical Benefit) SchemeSumit ChauhanNo ratings yet

- Arogyadhan ApplicationDocument6 pagesArogyadhan Applicationksantarao9700No ratings yet

- Governt Health Insurance SchemeDocument62 pagesGovernt Health Insurance Schemesasmita nayakNo ratings yet

- Open PDFDocument9 pagesOpen PDFVinita KulakarniNo ratings yet

- New Health Insurance SchemeDocument36 pagesNew Health Insurance Schemevadivel.km1527No ratings yet

- Weavers HealthDocument25 pagesWeavers HealthHuidrom SharatNo ratings yet

- Nhis 2Document36 pagesNhis 2Saravanakumar RajaramNo ratings yet

- Benefits of EPFDocument6 pagesBenefits of EPFsiuyeelim100% (1)

- Star Health and Allied Insurance Co. LTD: IRDA Registration No: 129 Corporate Identity Number: U66010TN2005PLC056649Document1 pageStar Health and Allied Insurance Co. LTD: IRDA Registration No: 129 Corporate Identity Number: U66010TN2005PLC056649acrajeshNo ratings yet

- Healthcare ServiceDocument17 pagesHealthcare ServiceDea AlzenaNo ratings yet

- G.O 160Document170 pagesG.O 160kirubaNo ratings yet

- Medical Coverage PlanDocument30 pagesMedical Coverage PlanjnaguNo ratings yet

- The Employee's State Insurance Act, 1948Document27 pagesThe Employee's State Insurance Act, 1948Abhi RoyNo ratings yet

- Tender For Insurance Company 2019Document15 pagesTender For Insurance Company 2019amit_264No ratings yet

- Standard Note On ESI SchemeDocument82 pagesStandard Note On ESI Schemerudradeep duttaNo ratings yet

- Rashtriya Swasthya Bima Yojna (RSBY) : Is It Being Implemented All Over The Country?Document6 pagesRashtriya Swasthya Bima Yojna (RSBY) : Is It Being Implemented All Over The Country?DevendraNo ratings yet

- TMB UNI Family Health Care PolicyDocument24 pagesTMB UNI Family Health Care Policysubu_devasena6782100% (1)

- 070123-PAI & AAI General Guidelines PDFDocument4 pages070123-PAI & AAI General Guidelines PDFKishore KNo ratings yet

- Workers Compensation and RehabilitationDocument13 pagesWorkers Compensation and RehabilitationTedd HaidarNo ratings yet

- Health Insurance Scheme For Cbec Employees: BackgroundDocument7 pagesHealth Insurance Scheme For Cbec Employees: BackgroundhydexcustNo ratings yet

- Group Floater Mediclaim Policy (Cashless and Reimbursement)Document83 pagesGroup Floater Mediclaim Policy (Cashless and Reimbursement)Raju MathangiNo ratings yet

- Project Report of Labour Laws On Benefits of The Employees' State Insurance Act, 1948Document10 pagesProject Report of Labour Laws On Benefits of The Employees' State Insurance Act, 1948aggarwalbhaveshNo ratings yet

- Esi Act 1948-1Document53 pagesEsi Act 1948-1Takshi BatraNo ratings yet

- Obligation of The Employer: E) Obligation of Employee & Employers Under Employment State Insurance Act, 1948Document4 pagesObligation of The Employer: E) Obligation of Employee & Employers Under Employment State Insurance Act, 1948Sujay Vikram SinghNo ratings yet

- Esi Act 1948Document16 pagesEsi Act 1948Ravi NarayanaNo ratings yet

- Assignment On LL IDocument8 pagesAssignment On LL Itanmaya_purohitNo ratings yet

- Health Suraksha - Ind BrochureDocument2 pagesHealth Suraksha - Ind BrochureSumit BhandariNo ratings yet

- The Employees State Insurance Act, 1948Document24 pagesThe Employees State Insurance Act, 1948Pawan KumarNo ratings yet

- Guideline On ITDocument19 pagesGuideline On ITmikekikNo ratings yet

- Provident Fund FAQDocument4 pagesProvident Fund FAQgodsthomachayanNo ratings yet

- Harsh BB - 6semDocument52 pagesHarsh BB - 6semPaul MeshramNo ratings yet

- What Is E.S.I. Scheme ?Document23 pagesWhat Is E.S.I. Scheme ?pashya_hrNo ratings yet

- CM Dr. Kalaignar Insurance SchemeDocument12 pagesCM Dr. Kalaignar Insurance SchemeMeenakshi KhuranaNo ratings yet

- ESIC IntroductionDocument10 pagesESIC IntroductionBHAVIK MODINo ratings yet

- Mediclassic NewDocument2 pagesMediclassic NewPiyush KantNo ratings yet

- ESICDocument24 pagesESICIsha Sushil Bhambi100% (1)

- AcknowledgementDocument59 pagesAcknowledgementKomal ChimnaniNo ratings yet

- Letter of Demand Outstanding PaymentDocument12 pagesLetter of Demand Outstanding PaymentKushagra GuptaNo ratings yet

- The Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsFrom EverandThe Book of the Morris Minor and the Morris Eight - A Complete Guide for Owners and Prospective Purchasers of All Morris Minors and Morris EightsNo ratings yet

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- Koshal Katha Sept 2012Document20 pagesKoshal Katha Sept 2012Sunil PurohitNo ratings yet

- Sirpur Stone Inscription of Mahasivagupta's TimeDocument20 pagesSirpur Stone Inscription of Mahasivagupta's TimeSunil PurohitNo ratings yet

- The Folk Element in Hindu CultureDocument348 pagesThe Folk Element in Hindu CultureSunil PurohitNo ratings yet

- Politics of Sambalpuri or Kosali As A Dialect of Oriya in OrissaDocument10 pagesPolitics of Sambalpuri or Kosali As A Dialect of Oriya in OrissaSunil PurohitNo ratings yet

- Memorendum Submitted To Collector Cum President Virat Dhanuyatra Mahotsav BargarhDocument3 pagesMemorendum Submitted To Collector Cum President Virat Dhanuyatra Mahotsav BargarhSunil PurohitNo ratings yet

- JF) E Ûm: Qñûufû Kaòzû (Bûm-2)Document11 pagesJF) E Ûm: Qñûufû Kaòzû (Bûm-2)Sunil PurohitNo ratings yet

- A Viable State of KoshalDocument20 pagesA Viable State of KoshalSunil PurohitNo ratings yet

- Self DeterminationDocument58 pagesSelf DeterminationSunil PurohitNo ratings yet

- Citibank: Launching The Credit Card in Asia Pacific (A)Document1 pageCitibank: Launching The Credit Card in Asia Pacific (A)BishnuNo ratings yet

- Application AmexDocument8 pagesApplication AmexAkash HimuNo ratings yet

- Kuwait - Mohamed IqbalDocument18 pagesKuwait - Mohamed IqbalAsian Development Bank50% (2)

- Creating A Central Bank For The PhilippinesDocument5 pagesCreating A Central Bank For The PhilippinesAbegailTrinidadNo ratings yet

- DSRD Ar05Document132 pagesDSRD Ar05djon888No ratings yet

- SF 8.10A Audit Certificate For The Month of - (1st Month), 2020Document1 pageSF 8.10A Audit Certificate For The Month of - (1st Month), 2020praveenitplNo ratings yet

- ICAEW Advanced Level Strategic Business Management Study Manual Fifth Edition 2017Document1,457 pagesICAEW Advanced Level Strategic Business Management Study Manual Fifth Edition 2017Optimal Management Solution100% (5)

- Saudi Insurance Brochure Draft5Document6 pagesSaudi Insurance Brochure Draft5josephb100% (5)

- Oceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Document1 pageOceanic Bank International PLC - Revised Financial Statement For The 15 Month Period Ended December 31, 2008Oceanic Bank International PLC50% (2)

- Executive Order No 172Document9 pagesExecutive Order No 172Merceditas PlamerasNo ratings yet

- Sa 510Document14 pagesSa 510Narasimha Akash100% (1)

- Apni Shakhsiyat Ki Tameer Kaise Ki JaeDocument99 pagesApni Shakhsiyat Ki Tameer Kaise Ki JaeMansoorNo ratings yet

- Audit For Purchase CycleDocument2 pagesAudit For Purchase CycleSarlamSaleh100% (1)

- Mitc For Amazon Pay Credit CardDocument7 pagesMitc For Amazon Pay Credit CardBlain Santhosh FernandesNo ratings yet

- Submitted To:-Ms - Priya Singh Chauhan: Topic: - Analysis On Administrative Regulation On Corporate Finance in IndiaDocument10 pagesSubmitted To:-Ms - Priya Singh Chauhan: Topic: - Analysis On Administrative Regulation On Corporate Finance in IndiaharshNo ratings yet

- A01 Summer Training Project Report: Marketing MixDocument56 pagesA01 Summer Training Project Report: Marketing MixJaiHanumankiNo ratings yet

- GK Bullet - SBI PO (Mains) II PDFDocument33 pagesGK Bullet - SBI PO (Mains) II PDFgaurav singhNo ratings yet

- A Cheque Is A DocumentDocument15 pagesA Cheque Is A Documentmi06bba030No ratings yet

- Mortgages 2019Document60 pagesMortgages 2019Ivana JayNo ratings yet

- Rmo 21-2000Document15 pagesRmo 21-2000jef comendadorNo ratings yet

- Online Payment SystemDocument27 pagesOnline Payment SystemVijetha bhat100% (1)

- Camel Rating ModalDocument114 pagesCamel Rating Modalaparnaankit100% (2)

- UkccDocument10 pagesUkccFaiz Pecinta Reb0% (1)

- Letter To All Member Banks of SLBC (UP)Document1 pageLetter To All Member Banks of SLBC (UP)dadan vishwakarmaNo ratings yet

- Description: Tags: Top 100 Current Holders Cor Vers1Document4 pagesDescription: Tags: Top 100 Current Holders Cor Vers1anon-20972No ratings yet

- Darvas Box SummaryDocument7 pagesDarvas Box SummaryVijayNo ratings yet

- CA2 Group Assignment CompleteDocument14 pagesCA2 Group Assignment CompleteCatherine Yapp100% (1)

- Semester: B. Com - V Semester Name of The Subject: Financial Market & Institutions Unit-1Document61 pagesSemester: B. Com - V Semester Name of The Subject: Financial Market & Institutions Unit-1Sparsh JainNo ratings yet

- Local Case: MGT - 489 Sec: 07 Submitted To S.S.M Sadrul Huda (SSH2) Associate Professor Dept. of ManagementDocument7 pagesLocal Case: MGT - 489 Sec: 07 Submitted To S.S.M Sadrul Huda (SSH2) Associate Professor Dept. of ManagementThe TopTeN CircleNo ratings yet

- FYP Risk Management HDFC SecuritiesDocument82 pagesFYP Risk Management HDFC Securitiespadmakar_rajNo ratings yet