Professional Documents

Culture Documents

3

Uploaded by

Ana-Maria OlteanuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3

Uploaded by

Ana-Maria OlteanuCopyright:

Available Formats

JOURNAL OF PREVENTIVE MEDICINE 2008; 16(1-2): 24-37

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMNIA

Anca Vitcu1, Elena Lungu2, Luminia Vitcu3

1. University Al. I. Cuza, Faculty of Computer Science, Iai, Romnia 2. Institute of Public Health, Iai, Romnia 3. Institute of Public Health, Bucureti, Romnia Abstract. Aim. The present survey was aimed at finding a statistical relationship between life expectancy at birth and Gross Domestic Products (GDP) per capita among a number of European countries and at national level, among Romanian counties. In the context of these models, the study tried to find the efficiency of policy plans which stimulate this connection. Material and method. The methods employed to find this connection between the two variables included multivariate statistical analysis. The efficiency was studied based on a common used method: ratios. Results. Regarding the analysis involving the European countries, there can be concluded that, the relationship between life expectancy at birth and GDP per capita can be defined by a linear regression model. Thus, higher levels of GDP per capita have been associated with high life expectancy at birth. Regarding efficiency of policy plans there can be noticed that the countries which explored in the best way the human capital in terms of life expectancy at birth vs GDP per capita, are countries with strong institutions. On the other hand, the analysis employed at Romanian national level, provides a model which envisages that there are other factors that boost or cripple its economic growth. In terms of policy plans there can be remarked that the Romanian counties which explored less the relationship between life expectancy at birth and GDP per capita, are counties which confronted with factors of a malfunction market. Conclusions. The analysis undertaken in this study proves that at European level there is a strong positive correlation between life expectancy at birth and economic development, and countries that can successfully manage this relationship possess a distinct advantage in front of economic and social challenges. For Romnia the model developed is strongly influenced by complementary factors. Key words: life expectancy at birth, GDP per capita, simple regression model, cluster analysis Rezumat. Scop. Obiectivul studiului a fost determinarea unei legturi statistice ntre sperana de via la natere i Produsul Intern Brut (PIB) pe locuitor. Modelarea relaiei dintre cele dou variabile a fost realizat att le nivel European ct i la nivel naional, ntre judeele Romniei. In contextul acestor modele, studiul a definit eficiena politicilor care stimuleaz aceast conexiune. Material si metod. Metodele utilizate pentru construirea modelelor au inclus elemente de statistic multivariat, iar studierea eficienei a avut la baza o metod frecvent utilizat n econometrie pentru Data Envelopment Analysis (DEA): metoda proporiilor. Rezultate. In ceea ce privete rezultatul analizelor la nivelul rilor europene se poate afirma faptul c ntre sperana de via la natere i PIB pe locuitor poate fi definit un model liniar, bazat pe o corelaie pozitiv ntre cele dou variabile. Pe de alt parte, analiza eficienei politicilor dezvoltate la nivel naional este regsit n modul n care aceste ri tiu s exploateze relaia dintre sperana de via la natere i PIB per capita. In ceea ce privete Romnia, corelaia dintre cele dou variabile a fost foarte mic, iar modelul a artat implicarea

24

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMANIA altor factori care influeneaz creterea economic. De asemenea, n termeni de eficien, se poate observa c judeele care nu tiu s exploateze corect relaia dintre cele dou variabile se confrunt cu disfuncionaliti ale pieei. Concluzie. Studiul arat c la nivel european exist o puternic corelaie pozitiv ntre sperana de via la natere i dezvoltarea economic, iar rile care dezvolt un management adecvat al acesteia identific soluii care rspund cu succes provocrilor economice i sociale. In cazul Romniei, relaia dintre cele dou variabile este puternic influenat de factori complementari. Cuvinte cheie: speraa de via la natere, PIB pe locuitor, modelul liniar, analiza cluster

INTRODUCTION The economic performance depends on several factors which vary across countries and in countries across areas. Long-run growth is the most important aspect of how the economy of a country functions. The disparities among countries are due to differences in growth policies regarding technology and human investment both influencing the efficiency of labor. In this context better technology produces a higher efficiency of labor and the more capital the worker has at the disposal to amplify productivity, the more prosperous the economy can be. In turn, the two principal determinants of capital intensity are: the investment effort made by economy (the share of real GDP saved and invested to increase the capital stock) and the requirements of economy (how much new investment is needed to equip new workers with the standard level of capital, to keep up with new technologies and replace damages). Good and bad policies can accelerate or slow all this growth. Countries with high per capita GDP may have stronger institutions with a greater control over the resources and a greater capacity to change the flow of policy. We focused on GDP per

capita to catch the effect of a countrys wealth on policy volatility. Life expectancy at birth is a weighted average of mortality rates at all ages, strongly influenced by infant and child mortality rates. Its value gives a great part of the picture describing community wellbeing (health and socioeconomic conditions). We focused on life expectancy at birth to capture the effect of a countrys health on policy volatility. The connection between these two variables can theoretical be explained by the fact that a population experiencing a rapid increase in life expectancy is likely to have more savings and contribute more to investments. The quantitative impact of life expectancy on economic growth is estimated to have an important magnitude. MATERIAL AND METHODS The present paper is based on the data provided by National Institute of Statistics Romnia and WHO database for the years 2005 and 2006 (1, 2). The purpose of the study was to characterize the relationship between two important variables, GDP per capita and life expectancy at birth employing components of multivariate

25

Anca Vitcu, Elena Lungu, Luminia Vitcu

statistical analysis, as well as some basic econometric elements. The statistical analysis included a simple regression model to sense problem, and a cluster analysis to organize data into meaningful clusters and help select effective actions. The model is specified by the equation: ln( y i ) = 0i + 1i xi + i , where i =1, 2,, N is the number of countries, y i is GDP per capita for country i , xi is life expectancy at birth for country i , 0i and 1i are parameters to be estimated, and i is a random error term associated with observation y i . For statistical reasons the dependent variable, GDP per capita entered in the analysis as natural logarithm. The econometric element incorporated into the analysis refers to the calculation of a performance ratio, more specific, the efficiency in converting the input (life expectancy at birth) into output (GDP per capita). This ratio is defined simply as:

Efficency =

output , input

under the hypothesis that between these two variables there is some connection. We applied these methods to study the relationship between GDP per capita and life expectancy at birth for a number of countries in Europe and than for the Romanian counties looking for similarities between the variables behavior (3, 4).

RESULTS AND DISCUSSION In the following lines we explore the statistical relationship between life expectancy at birth and GDP per capita in two study cases: 1) analysis among some European countries, and 2) analysis at national level among Romanian counties. Hypothesis: Higher levels of GDP per capita are associated with high life expectancy at birth. The case of European countries The sample was composed of 29 European countries. The variables involved in the analysis are GDP per capita and life expectancy at birth. The data are valid for 2006. Before accepting or rejecting the formulated hypothesis we have to study the relationship between ln(GDP per capita) and life expectancy at birth. We will try to answer the following issues: Is GDP per capita related to life expectancy at birth? If so, how are they related? Firstly we generated the correlation matrix which enables us to test for a statistical relationship between the two variables. The outcome shows a value of 0.828 for the Pearson correlation coefficient, significant at 0.01 level. In other words, this means that GDP per capita appeared to have a positive correlation with life expectancy at birth. Plotting the independent variable (life expectancy at birth) against the dependent variable [ln(GDP per capita)], the scatter diagram indicates that these variables are linearly related (fig. 1).

26

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMANIA

11.5 11.0 10.5

LN(GDP per capita) (Euro)

10.0 9.5 9.0 8.5 8.0 70

72

74

76

78

80

82

Life expectancy at birth (years)

Fig 1. Scatter diagram of ln(GDP per capita) and life expectancy at birth, 2006

Considering the above information, we built a good linear regression model between the response variable ln(GDP per capita) and the independent variable (life expectancy at birth). The summary of the model is presented in table 1. According to this model, R-square, the percent of the GDP per capita, explained by life expectancy at birth is 0.686. This means that other variables, not included in the model, explain the rest of the variance. In other words, the one-independent model explains

68.6% of the variance. An important information presented in table 1 refers to the adjusted R-square, which value is 0.674, meaning that the penalty for the possibility that some of the variance may be due to chance is small. On the other hand, the calculated standard error is about 0.47 units, which means that we could be 95% confident that the actual value would be in the interval determined by the predicted value 1.96 * 0.47 (tab. 1).

Table 1. Model summary for the European countries R Model summary 0.828 R Square 0.686 Adjusted R Square Std. Error of the Estimate 0.674 0.4658

27

Anca Vitcu, Elena Lungu, Luminia Vitcu

In the ANOVA table we can see that the significance of the F value is below 0.05, so we can affirm that the model is significant (tab. 2).

The information regarding model coefficients, B and Beta, as well as the constant are presented in table 3.

Table 2. ANOVA table Model Regression Residual Total Sum of Squares 12.789 5.859 18.647 df 1 27 28 Mean Square 12.789 0.217 F 58.937 Sig. 0.000

Table 3. Model Coefficients Model Unstandardized Standardized Coefficients Coefficients B Std. Error Beta -6.404 0.209 2.107 0.027 .828 t Sig. IC95% for B

(Constant) Life expectancy at birth

Lower Upper Bound Bound -3.040 0.005 -10.726 -2.082 7.677 0.000 0.153 0.265

According to these values the prediction (regression) equation can be written in the following way: predicted ln(GDP per capita)= 0.209 * (life expectancy at birth) 6.404. More precisely, reminding that the standard error of estimate is 0.47, this means that at the 0.05 significance level the estimate is the value given by this formula plus or minus 1.96*0.47. Other important values mentioned in table 3 are: the value of Beta, the standardized regression coefficient (0.828), and the levels of significance of the t-test which show a significant B coefficient and also a significant constant.

The model described above is valid only if the framework of the following assumptions: the relationships between the independent and dependent variables is linear (which we already proved) the errors are normally distributed technically normality is necessary only for the t-tests to be valid, estimation of the coefficients only requires that the errors be identically and independently distributed the error variance is constant (homogeneity of variance) the errors associated with one observation are not correlated with the errors of any other observation the model is properly specified 28

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMANIA

So, to answer to these issues we performed a residual analysis which

summary is presented in table 4.

Table 4. Residuals Statistics Minimum Predicted Value 8.4687 Std. Predicted Value -1.902 Standard Error of 8.964E-02 Predicted Value Adjusted Predicted 8.3933 Value Residual -.9285 Std. Residual -1.993 Stud. Residual -2.059 Deleted Residual -.9905 Stud. Deleted -2.200 Residual Mahal. Distance .071 Cook's Distance .000 Centered Leverage .003 Value Maximum 10.5634 1.197 .1885 10.6039 1.2439 2.670 2.721 1.2917 3.134 3.619 .161 .129 Mean 9.7544 .000 .1193 9.7563 1.041E-15 .000 -.002 -1.9307E-03 .008 .966 .032 .034 Std. Deviation .6758 1.000 2.773E-02 .6796 .4574 .982 1.013 .4870 1.072 .934 .045 .033 N 29 29 29 29 29 29 29 29 29 29 29 29

Studying the values of Mahalanobis distance and Cooks distance as well as the centered leverage value we can conclude that it does not appear there are problem cases.

10

The regression standardized residual histogram provides a visual way of assessing if the assumption of normally distributed residual error is met (fig. 2).

4 F uen req cy Std. D ev = .98 Mean = 0.00 0

-2.00 -1.00 -1.50 -.50 0.00 .50 1.00 1.50 2.00 2.50

N = 29.00

Regre ssion Standardized Res idual

Fig. 2. The regression standardized residual histogram

29

Anca Vitcu, Elena Lungu, Luminia Vitcu

When the sample size is small, the histogram, in general, shows irregularities from a normal curve. Studying Normal P P Plot of Regression Standardized Residual we can notice that the plots have the trend of the 45-degree line, and they are close to it. The normality of the residuals can also be checked based on the tests of normality, in our case Shapiro-Wilk statistic is not significant (sig. =0.568).

1.00

Based on these results, the residuals from this regression appear to conform to the assumption of being normally distributed. The scatterplot of studentized deleted residuals vs standardized predicted values shows that the residuals fall between -2 and +2. Also, it reveals that all the points are positioned in a constant horizontal band (fig. 4).

.75

.50 Expected Cum Prob

.25

0.00 0.00

.25

.50

.75

1.00

Observed Cum P rob

Fig. 3. Normal P P Plot of Regression Standardized Residual

Regression Studentized Deleted (Press) Residual 4 3 2 1 0 -1 -2 -3 -2.0

-1.5

-1.0

-.5

0.0

.5

1.0

1.5

Regression Standardized Predicted Value

Fig. 4. The scatterplot of studentized deleted residuals vs standardized predicted values

30

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMANIA

In the scatterplot of standardized predicted values against observed values if 100% of the variance is explained in a linear relationship the

1.5 Regression Standardized Predicted Value 1.0 .5 0.0 -.5 -1.0 -1.5 -2.0 8.0

points form a straight line. In our case the points are dispersed around a straight line (the trend) due to the standard error of estimate (fig. 5).

8.5

9.0

9.5

10.0

10.5

11.0

11.5

LN(GDP per capita)

Fig. 5. The scatterplot of standardized predicted value against dependent variable

This reflects the fact that the model explains only 68.6% of the variance. As we well know a model specification error can occur when one or more relevant variables are omitted from the model or one or more irrelevant variables are included in the model. If relevant variables are omitted from our model, the common variance they share with included variable may be wrongly attributed to this variable, and the error term can be inflated. Model specification errors can substantially affect the estimate of regression coefficients. To check if the model is properly specified we used the predicted value and the predicted value squared as predictors of the dependent variable. In this new 31

approach, if the model is specified correctly the predicted value should be significant while the predicted value squared shouldnt be significant. The results of this analysis are presented in table 5 and we can see that the t-test envisages that the standardized predicted value square is not significant (the significance level is 0.411>0.05). Thus, we can conclude that, the linear model is valid from statistical point of view, so we can accept the hypothesis that higher levels of GDP per capita are associated with high life expectancy at birth. In this context we can say that health is an important determinant of economic growth.

Anca Vitcu, Elena Lungu, Luminia Vitcu Table 5. Model coefficients (Standardized predicted value squared included) Model Unstandardized Coefficients B (Constant) Standardized Predicted Value Squared Standardized Predicted Value 9.855 -0.104 0.613 Std. Error 0.148 0.124 0.116 Standardized Coefficients Beta -0.119 0.752 95% Confidence Interval for B Lower Upper Bound Bound 66.566 0.000 9.550 10.159 -0.836 0.411 -0.359 0.151 5.293 0.000 0.375 0.851 T Sig.

Performing a cluster analysis based on to which components we associated GDP per capita and life expectancy at the corresponding efficiency percentage: birth we found the following clusters Luxembourg (100%); Cluster 1: Norway (78%); Cluster 2: Denmark (57%), Ireland (57%), Switzerland (55%); Cluster 3: Netherlands (45%), Finland (44%), UK (43%), Austria (41%), Cluster 4: Belgium (41%), Germany (39%), France (38%); Italy (34%), Spain (30%), Greece (27%), Cyprus (26%); Cluster 5: Portugal (21%), Slovenia (21%), Malta (17%), Czech Republic Cluster 6: (16%), Estonia (15%); Hungary (13%), Slovakia (12%), Latvia (11%), Lithuania (11%), Cluster 7: Poland (10%), Romnia (7%), Turkey (7%), Bulgaria (5%). To calculate the relative efficiency scores (percentages) we used a classical econometric method. We considered the model in which the key performance outcome is GDP per capita (output variable), and one of the factors that can lead to this outcome, life expectancy at birth (input variable). For each country, we divided the output measure by the input measure; we selected the highest ratio and compare all other to it calculating their relative efficiency with respect to the best value. Then we 32 converted the scores to percentages multiplying by 100. This simple method was chosen as the analysis technique because variables can be measured in different units and it measure technical efficiency defined as the successful implementation of a policy plan, deviations from the plan being perceptible. Studying the distribution of relative efficiency percentages among clusters, we can remark that the countries which explored in the best way the human capital in terms of life expectancy

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMANIA

at birth vs GDP per capita, are countries with strong institutions. The case of Romnia Preparing a similar model for Romanian counties we achieved that at the national level the outcomes are very different regarding the connection between the two variables (GDP per capita and life expectation at birth). For statistical reasons we excluded from the analysis Bucureti and Satu

10.0

Mare counties. The study uses the data available for 2005. The correlation matrix shows for the Pearson correlation coefficient a low value (0.331) significant at 0.05 level. Plotting the independent variable (life expectancy at birth) against the dependent variable [ln(GDP per capita)], the scatter diagram indicates that these variables can be linearly related (fig 6.).

9.5

9.0

LN(GDP per capita)

8.5

8.0 7.5 70.0

70.5

71.0

71.5

72.0

72.5

73.0

Life expectancy at birth (years)

Fig 6. Scatter diagram of ln(GDP per capita) and life expectancy at birth, 2006

The R-square, the percent of the GDP per capita explained by life expectancy at birth has a very small value 0.110 (tab. 6). This means that other variables, not included in the model, explain the bulk of the variance. In other words, this oneindependent model explains only 11% of the variance.

The adjusted R-square, calculated considering the variance due to chance is 0.086 (tab. 6). The calculated standard error is about 0.48 units, which means that we could be 95% confident that the actual value would be in the interval determined by the predicted value 1.96 * 0.48 (tab. 6).

33

Anca Vitcu, Elena Lungu, Luminia Vitcu Table 6. Model Summary for Romnia R Model summery 0.331 R Square 0.110 Adjusted R Square 0.086 Std. Error of the Estimate 0.4783

In the ANOVA table we can notice that the significance of the F value is 0.037 (less than 0.05), so we can affirm that the model is significant (tab. 7).

The coefficients table envisaged that the independent value included in the model is significant (sig = 0.037) (tab. 8).

Table 7. ANOVA table Model Regression Residual Total Sum of Squares 1.072 8.694 9.766 df 1 38 39 Mean Square 1.072 .229 F 4.687 Sig. .037

Table 8. Model Coefficients Unstandardized Coefficients B Std. Error (Constant) -6.016 6.865 Life expectancy 0.208 0.096 at birth Model Standardized Coefficients Beta 0.331 t Sig. IC95% for B Upper Bound 7.881 0.402

Lower Bound -0.876 0.386 -19.912 2.165 0.037 0.013

The scatterplot of studentized deleted residuals vs standardized predicted values visualizes the fact that the residuals fall between -2 and +2 and that the all the points are positioned in a constant horizontal band (fig. 7). The

test of normality, Shapiro-Wilk, is not significant (sig.=0.130), from which we can conclude, that the residuals from this regression appear to conform to the assumption of being normally distributed.

34

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMANIA

1.5

1.0 Regression Deleted (Press) Residual

.5

0.0

-.5 -1.0 -2.0

-1.5

-1.0

-.5

0.0

.5

1.0

1.5

2.0

Regression Standardized Predicted Value

Fig. 7. The scatterplot of studentized deleted residuals vs standardized predicted values

In the scatter diagram of standardized predicted value against dependent variable the points are very spread

2.0 Regression Standardized Predicted Value 1.5 1.0 .5 0.0 -.5 -1.0 -1.5 -2.0 7.5 8.0 8.5

around the trend, situation explicated by the fact that the model explains only 11% of the variance (fig.8).

9.0

9.5

10.0

LN(GDP per capita)

Fig. 8. The scatterplot of standardized predicted value against dependent variable

35

Anca Vitcu, Elena Lungu, Luminia Vitcu

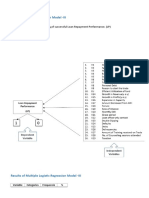

paper, that higher levels of GDP per To verify if the model is correctly capita are associated with high life specified we computed the squared of expectancy at birth. The model shows predicted value and then included it in that there are other factors that boost the model. The results show that the or cripple the economic growth. squared of predicted value is Performing a cluster analysis based on significant (sig.=0.306), suggesting GDP per capita and life expectancy at that we have omitted important birth we found the following clusters variables in our regression. to which components we associated In this case, we dont have enough the corresponding efficiency percentage: evidence to accept the hypothesis formulated at the beginning of this Constana (100%), Timi (96%), Cluj (88%); Cluster 1: Prahova (84%), Arge (75%), Braov (74%); Cluster 2: Iai (69%), Bihor (66%), Bacu (64%), Mure (60%), Dolj (58%); Cluster 3: Arad (56%), Galai (51%), Sibiu (50%), Suceava (49%), Hunedoara Cluster 4: (47%), Ilfov (45%); Dmbovia (43%), Gorj (41%), Mure (40%), Neam (39%), Vlcea Cluster 5: (38%), Alba (37%), Buzu (36%); Olt (32%), Cara-Severin (31%), Harghita (29%), Brila (29%), Cluster 6: Bistria-Nsud (27%), Teleorman (27%), Vrancea (26%), Botoani (25%); Cluster 7: Ialomia (24%), Vaslui (23%), Mehedini (22%), Slaj (21%), Tulcea (21%), Covasna (20%), Clrai (18%), Giurgiu (17%). Studying the distribution of relative efficiency percentages among these clusters, we can remark that the counties which explored less the relationship between life expectancy at birth and GDP per capita are counties which confronted with factors of a malfunction market. CONCLUSIONS International literature proved that investment in public health produces enormous economic benefits both for the people and countries as a whole, being an important determinant of economic growth. The analysis undertaken in this study proves that at international level there is a strong positive correlation between life 36 expectancy at birth and economic development, and countries that can successfully manage this relationship possess a distinct advantage in front of economic and social challenges. The analysis provided at country level, for Romnia envisaged a different model in terms of connection between life expectancy at birth and GDP per capita. The model developed is strongly influenced by complementary factors.

LIFE EXPECTANCY IMPACT ON GDP PER CAPITA IN ROMANIA

REFERENCES

1. WHO/Europe: Europe health for all database (HFA DB), July, 2008, http://www.euro.who.int/hfadb. 2. National Institute of Statistics: Romanian Statistical Yearbook 2007, Bucureti.

3. Tandon Ajay: Attaining Millennium Development Goals in Health: Itst Economic Growth Enough?, March, 2005. 4. WHO, The Council of Europe Development Bank: Health and Economic Development in SouthEastern Europe, 2006.

37

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Predicting Flight Delays With Error Calculation Using Machine Learned ClassifiersDocument6 pagesPredicting Flight Delays With Error Calculation Using Machine Learned Classifiersnikhil vardhanNo ratings yet

- Case 01 CompleteDocument12 pagesCase 01 Completeertizashuvo100% (1)

- Chapter 2-Simple Regression ModelDocument25 pagesChapter 2-Simple Regression ModelMuliana SamsiNo ratings yet

- Multiple Linear Regression and Checking For Collinearity Using SASDocument18 pagesMultiple Linear Regression and Checking For Collinearity Using SASRobin0% (1)

- Current Ratio, Return on Equity, Debt to Equity Ratio, Asset Growth, and Dividend Payout Ratio of CompaniesDocument11 pagesCurrent Ratio, Return on Equity, Debt to Equity Ratio, Asset Growth, and Dividend Payout Ratio of CompaniesPande GunawanNo ratings yet

- PreviewpdfDocument31 pagesPreviewpdfRisma RahayuNo ratings yet

- MBA-EX 8102-Quantative Methods For Management Assignment-7, Class-7 Submitted by - Navneet Singh Roll No. S037Document4 pagesMBA-EX 8102-Quantative Methods For Management Assignment-7, Class-7 Submitted by - Navneet Singh Roll No. S037navneet26101988No ratings yet

- Ritel ModernDocument15 pagesRitel ModernLanang TanuNo ratings yet

- Emperical Measurement of PriceDocument5 pagesEmperical Measurement of PriceRica Joy CuraNo ratings yet

- Prediction of Permeability and Porosity From Well Log Data Using The Nonparametric Regression With Multivariate Analysis and Neural Network, Hassi R'Mel Field, AlgeriaDocument16 pagesPrediction of Permeability and Porosity From Well Log Data Using The Nonparametric Regression With Multivariate Analysis and Neural Network, Hassi R'Mel Field, Algeriajhon berez223344No ratings yet

- Beck and Katz 2011Document28 pagesBeck and Katz 2011Tamas GodoNo ratings yet

- Pengaruh Kompetensi Dan Profesionalisme Auditor Internal Tehadap Kinerja Karyawan Dengan Internar KontrolDocument13 pagesPengaruh Kompetensi Dan Profesionalisme Auditor Internal Tehadap Kinerja Karyawan Dengan Internar Kontroliadi putroNo ratings yet

- Statistics SummaryDocument10 pagesStatistics SummaryAhmed Kadem ArabNo ratings yet

- Text List of MiniTab CommandsDocument9 pagesText List of MiniTab CommandsFaizargarNo ratings yet

- Regression AnalysisDocument11 pagesRegression AnalysisAvanija100% (2)

- FHMM1034 Chapter 5 Correlation and Regression (Student Version)Document49 pagesFHMM1034 Chapter 5 Correlation and Regression (Student Version)Allen Fourever100% (2)

- BDA Quiz 2 HelpDocument4 pagesBDA Quiz 2 HelpSpiderNo ratings yet

- Chapter 11Document22 pagesChapter 11anggiNo ratings yet

- Multiple Logistic Regression Model-LPDocument7 pagesMultiple Logistic Regression Model-LPmanjushreeNo ratings yet

- Assignment_3 Linear Regression and Correlation AnalysisDocument12 pagesAssignment_3 Linear Regression and Correlation AnalysisHarshith HirisaveNo ratings yet

- Statistical Tests For Comparative StudiesDocument7 pagesStatistical Tests For Comparative StudiesalohaNo ratings yet

- Simple LR LectureDocument60 pagesSimple LR LectureJanine CayabyabNo ratings yet

- 2010 AP Statistics Free Response SolutionsDocument3 pages2010 AP Statistics Free Response Solutionsvamsi_kcNo ratings yet

- Credit Card Fraud DetectionDocument14 pagesCredit Card Fraud DetectionSnehal Jain100% (1)

- EwanDocument144 pagesEwanChristian AquinoNo ratings yet

- Unit 4 Tutorial Problems UpdatedDocument2 pagesUnit 4 Tutorial Problems UpdatedDeepak ChaudharyNo ratings yet

- Weekly Wages in Rs. No. of Persons Weekly Wages in Rs. No of PersonsDocument15 pagesWeekly Wages in Rs. No. of Persons Weekly Wages in Rs. No of PersonsDarshit PatelNo ratings yet

- Curve FittingDocument28 pagesCurve FittingCillalois Marie FameroNo ratings yet

- Time Management During Covid-19 Pandemic The EffecDocument4 pagesTime Management During Covid-19 Pandemic The EffecHanny Joy Teves ArdabaNo ratings yet

- Statistics Sample ProblemDocument2 pagesStatistics Sample Problemlucas0% (1)