Professional Documents

Culture Documents

Entrepreneurship Report

Uploaded by

Suhani NagaliaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Entrepreneurship Report

Uploaded by

Suhani NagaliaCopyright:

Available Formats

ENTREPRENEURSHIP

LEVEL 1

FASHION BUSINESS MANAGEMENT Module teacher: ms. Priyanka aggarwal

Submitted by: Akansha Suhani nagalia

Table of contents 1. Entrepreneurship Executive summary 2. Location 3. Feasibility study 4. Market feasibility 5. Economic feasibility 6. Financial feasibility 7. Legal and administrative 8. Ecological feasibility: 9. Management model feasibility 10. Technical feasibility 11. Exit strategy feasibility 12. Vision and mission 13. Entry in the market 14. Promotion 15. Business operations 16. Management team profile 17. Financial plan 18. Break even point 19. Balance sheet 20. assets

Executive summary Our business plan is to set up a buying agency. A buying agency is one which works as an agent. It has contacts with both buyers and the manufacturers or exporters. Basically, it works for buyers and helps them in locating the right manufacturer for their order. We are a buying agency for fabric and home textiles. We will get our name registered as eagle eye ltd. Location: South City 2, Gurgaon, Haryana. This is 45 kms. From Delhi. View from outside- on 1st floor , clearly visible. Up: 24 hour service. Our vision and mission are: Mission: we want to provide excellent service to all the top most buyers . Prime values: Customers: finding the right customers. Serving them and keeping them guarantees our existence. Service: To provide quality service that meets or exceeds the customers requirements. Value: To price the services provided at such rates which are true value to our customers. Profit: To remain free and provide security for our company and associates, we must earn profits. Vission: We act as an agent between buyer and the factory and maintain a good relationship from buyer as well as factory which will help us to be the leading buying house.

Feasibility study Feasibility study can be defined as the process for identifying problems and opportunities, determining objectives, describing situations, defining successful outcomes and accessing the range of costs and benefits associated with several alternatives for solving a problem. It is used to support the decision-making process based on a cost benefit analysis of the actual project viability. It is conducted during the deliberation phase of a formal business plan. It is an analytical tool that includes recommendations and limitations. The findings of FS will be assessed by potential investors and stakeholders regarding their credibility and depth of argument.

There are different criteria on which the study has to be done is according to the types of feasibilities. They are:

3

1. Market feasibility: this area of study includes the Consumption trends, Past and present supply position, Production possibilities and constraints, Imports and Exports competition, the Cost Structure, Elasticity of Demand, Consumer Behavior, Distribution channels and marketing policies in use, Administrative and legal constraints related to the marketing of the product. The market that we are targeting to is the buyers. Its a business to business market. This means that no ultimate customer will be exposed to this idea of business. The manufacturer will make the garments/ whatever and will export it to the buyer as per the order and this function of locating a manufacturer is done by the buying agency. The competitors are: Dean Textile buying agency, Savvy sourcing, Tannvi Impex Private Limited, Trade winds services, Max India. The industry that this business falls under is fabric and textile industry. 2. Economic feasibility: this includes the Cost-benefit analysis, whether the project justified (i.e. will benefits outweigh costs), the minimal cost to attain a certain system, How soon will the benefits accrue, Which alternative offers the best return on investment, Examples of things to consider: Hardware/software selection, Selection among alternative financing arrangements (rent/lease/purchase), Difficulties, benefits and costs can both be intangible, hidden and/or hard to estimate, ranking multi-criteria alternatives Cost & benefit. Is the project justified (i.e. will benefits outweigh costs), What is the minimal cost to attain a certain system, How soon will the benefits accrue, Which alternative offers the best return on investment. How soon will the benefit come. Return on investments. Means of financing is that we are going to put in our own capital. (savings, reserves, etc.)

3. Financial feasibility: this is to ascertain whether the project will be financially viable enough for being able to meet the burden of serving debt and whether the proposed project will satisfy the return expectations of people who provide the capital. projected profitability- commission Break-even point- at what point are we going to cover the costs of the business. 4. Legal and administrative feasibility: the Form of Business organization, Registration, Clearances and Approvals from different authorities Form of business organization- partnership. Clearance & approval from different agencies. 5. Ecological feasibility: this includes What is the damage that can be caused by the project to the environment,the cost of restoration measures required to ensure that the damage to the environment is contained within acceptable limits.

4

6. Management model feasibility: this explains that how the business will generate revenue. Management personnel: Manager: Two managers: managing for different zones. Two Computer operators: for operating different designing softwares. 1 peon

7. Technical feasibility: this area of study includes whether The project is possible with current technology, the technical risks, Availability of the technology locally, Will it be compatible with other systems, Is the proposed technology or solution practical, Do we currently possess the necessary technology, Do we possess the necessary technical expertise, Is relevant technology mature enough to be easily applied to our problem,What kinds of technology will we need, the state-of-the-art technology or mature and proven technology. In our case as we are not into any business which would require a lot of machines since we are not manufacturing anything, what technology we would relate to is the latest type of computers, laptops, desktops, the updated and the newest fax machines, the internet facilities within the office, the telephones and the answering machines etc. 8. Exit strategy feasibility: it states the way by which we are going to take an exit from the market. There are various ways, which are IPOs, Merger/Acquisitions, Buyout by a partner in business, Franchise the business, Hand down the business to any other family member. Entry in the market: It is taken after analysing certain factors. We need to always keep eyes & ears open for a good opportunity. And it is also very important to keep a check on what is being currently demanded. Promotion: promotion and advertising is important for a new business. Through promotion it will come in the eyes of everybody. The ways of promotion are: Trade fairs By attractive schemes Special festive offers to Indian buyers

Business operations: Latest softwares : advanced versions of soft wares like coral draw, photo shop etc. for better understanding of the designs sent by the buyer with the latest technology applied to it. Provide great services. Trustful image by maintaining good and loyal relations with the buyers and the exporters.

5

The profit and loss account: PARTICULARS Travelling Expense Salaries Maintenance Electricity bills Internet Bills Printing & Stationery Advertisement Net profit AMOUNT(RS) Rs.4,00,000 Rs.5,40,000 Rs.60,000 Rs.1,20,000 Rs.12,000 Rs.20,000 Rs.10,00,000 Rs.7,48.000 Rs. 20,00,000 PARTICULARS By Commission AMOUNT(RS) Rs.20,00,000

Rs. 20,00,000

Management team profile: Hard working team With Work experience of at least 3 yrs. Should know different languages Must be a good representator and listener. Financial plan: our financial plan is that, we already have a land. Investment will take place in mending the interiors of the unit in registration of the company, buying computers, laptops, Buying other electronic gadgets, machines etc.

Breakeven point: Breakeven point is a point where the cost of the business is covered and hence forth the revenue starts. Breakeven point for our business is 6 months.

P R O F I T

6 M O N T H S

Balance Sheet:

liability Amount (Rs)

Assets

Amount (Rs)

Capital

1,02,70,000

1. Land 2. Computers 3. Laptops 4. A/c 5. Cabinets 6. Refrigerator

1,00,00,000 70,000 40,000 80,000 50,000 30,000 1,02,70,000

1,02,70,000

Assets: As we are not into any manufacturing or selling business. We do not have many assets like big machines for sewing or weaving the garment or any textile. We just need basic assets like land, for building up an office. Furniture, to sit onto and electrical appliances, like computers, laptops, latest printers, fax machines, internet facilities etc. Exit strategy: We can exit the market by the following ways: We can handover it to any other family member. We can sell it to the other partner. We can franchisee it if there are enough profits. We can come under any parent company.

You might also like

- Project Feasibility Study of ProjectDocument9 pagesProject Feasibility Study of ProjectMobasshera JahanNo ratings yet

- Feasibility StudyDocument16 pagesFeasibility StudyWaqar Asim100% (1)

- Unit 3 Enterprise Formation ProcessDocument11 pagesUnit 3 Enterprise Formation ProcessRupesh NewtonNo ratings yet

- Entrep Tos CoverageDocument4 pagesEntrep Tos CoverageSandro OpenioNo ratings yet

- Boe Unit 2Document42 pagesBoe Unit 2Harsh VermaNo ratings yet

- Uneeza Entreprenueship Past PaperDocument8 pagesUneeza Entreprenueship Past Paperali abbasNo ratings yet

- ED Module 2Document28 pagesED Module 2ನಂದನ್ ಎಂ ಗೌಡNo ratings yet

- Eng. Man. ReviewerDocument6 pagesEng. Man. ReviewerQuiane Jim ArenajoNo ratings yet

- MEI Mod5Document53 pagesMEI Mod5gomorrahNo ratings yet

- Ch. 3Document3 pagesCh. 3Bare SharmakeNo ratings yet

- Chapter 2-6Document110 pagesChapter 2-6Kena TeshomeNo ratings yet

- Business Idea, Business Plan and EnterpriseDocument36 pagesBusiness Idea, Business Plan and EnterpriseJohnny Come Lately100% (1)

- Bahir Dar Mechanical and Industrial EngineeringDocument67 pagesBahir Dar Mechanical and Industrial EngineeringGadisa AbrahimNo ratings yet

- Launching Enterprises 55Document21 pagesLaunching Enterprises 55John NasasiraNo ratings yet

- Chap 1112Document5 pagesChap 1112Jomer Tomale100% (2)

- Chapter 4 Oppotunity ScreeningDocument20 pagesChapter 4 Oppotunity ScreeningClarissNo ratings yet

- EM Final RequirementDocument4 pagesEM Final RequirementJoyce Abegail De PedroNo ratings yet

- Project Report, Business Plan, Feasibility ReportDocument15 pagesProject Report, Business Plan, Feasibility ReportPrakash Choudhary100% (2)

- Startup and New Venture ManagementDocument10 pagesStartup and New Venture ManagementVinod JakharNo ratings yet

- Role of An EntrepreneurDocument42 pagesRole of An EntrepreneurRohitkumariluNo ratings yet

- CHAPTER Six (Entre)Document28 pagesCHAPTER Six (Entre)Ayro Business CenterNo ratings yet

- ES Unit 3 NotesDocument12 pagesES Unit 3 NotesTejas GowdaNo ratings yet

- Economic Feasibility Study:: First: Goals and Personality of The Project OwnerDocument6 pagesEconomic Feasibility Study:: First: Goals and Personality of The Project OwnerPayal ChauhanNo ratings yet

- BUS 311 Recognising and Exploiting Business OpportunitiesDocument5 pagesBUS 311 Recognising and Exploiting Business OpportunitiesAdeleye AdetunjiNo ratings yet

- Ede Practical No 14 FinalDocument5 pagesEde Practical No 14 FinalDev PathakNo ratings yet

- BBBBBDocument8 pagesBBBBBmoonatyNo ratings yet

- Business Assign1 (Print)Document18 pagesBusiness Assign1 (Print)Maruf A SiddiqueNo ratings yet

- Entrep Reviewer Contents of Bus. PlanDocument17 pagesEntrep Reviewer Contents of Bus. Planrizalyn alegre100% (1)

- L.g-1 Business Practice - 2Document68 pagesL.g-1 Business Practice - 2Meseret SisayNo ratings yet

- Business Concept Unit 1Document16 pagesBusiness Concept Unit 1Soumendra RoyNo ratings yet

- Chapter 1Document22 pagesChapter 1omarel5ter2002No ratings yet

- Unit 3 Formation of Business EntityDocument10 pagesUnit 3 Formation of Business EntityMunni ChukkaNo ratings yet

- DocumentDocument15 pagesDocumentMark Jhon PausanosNo ratings yet

- Entrepreneruship (Unit 2)Document41 pagesEntrepreneruship (Unit 2)Yash KhandagreNo ratings yet

- SOLVED PAST PAPERS (Short Questions Only)Document5 pagesSOLVED PAST PAPERS (Short Questions Only)Zain LauNo ratings yet

- Entrepreneurship DA 1Document13 pagesEntrepreneurship DA 1Pushpa MahatNo ratings yet

- UNIT-1 Class 12 CH 1Document44 pagesUNIT-1 Class 12 CH 1Khanika Singhvi100% (2)

- Riham Hani Bechir Yousseif Ashor - ENTREPRENEURSHIP Mid Term Exam PDFDocument5 pagesRiham Hani Bechir Yousseif Ashor - ENTREPRENEURSHIP Mid Term Exam PDFRihamH.YousseifNo ratings yet

- Building The Business PlanDocument5 pagesBuilding The Business PlanShahab Uddin ShahabNo ratings yet

- The Area of Internship and Learning ObjectivesDocument51 pagesThe Area of Internship and Learning ObjectivesNavonil Nag100% (2)

- How To Do Business Well in CityDocument8 pagesHow To Do Business Well in Citychhaihuo pengNo ratings yet

- Lesson 6 10 AnswersDocument3 pagesLesson 6 10 AnswerspornelkenjiNo ratings yet

- Chapter-2 New Ventures and Business PlanDocument36 pagesChapter-2 New Ventures and Business PlanLowzil Rayan AranhaNo ratings yet

- UNIT 3 - AnswerDocument6 pagesUNIT 3 - AnswerJessica PillaiNo ratings yet

- Final Project of Entrepreneurship: Introductory PageDocument14 pagesFinal Project of Entrepreneurship: Introductory PageShakeel ChughtaiNo ratings yet

- PM Yout Loan Scheme Business PlanDocument3 pagesPM Yout Loan Scheme Business PlanFawad AhmedNo ratings yet

- Chapter Three Developing Business PlanDocument21 pagesChapter Three Developing Business PlansmithNo ratings yet

- ESBM Notes Unit-4Document37 pagesESBM Notes Unit-4satyamtiwari44003No ratings yet

- Ripose EntreprenuershipDocument18 pagesRipose EntreprenuershipemronmavinNo ratings yet

- ConceptualizingDocument8 pagesConceptualizingHyacinth'Faith Espesor IIINo ratings yet

- PR 14Document3 pagesPR 14Dev PathakNo ratings yet

- Chapter Four Developing Business PlanDocument30 pagesChapter Four Developing Business PlanReffisa JiruNo ratings yet

- ORGMGT UNIT VIII Introduction To The Different Functional Areas of ManagementDocument5 pagesORGMGT UNIT VIII Introduction To The Different Functional Areas of ManagementVincent CorveraNo ratings yet

- Management: What Is Production Management? MeaningDocument10 pagesManagement: What Is Production Management? MeaningJunnuNo ratings yet

- Entrepreneurship Production of Goods and ServicesDocument2 pagesEntrepreneurship Production of Goods and ServicesMuhammad Shahood JamalNo ratings yet

- Cat One EntrepreneurshipDocument2 pagesCat One Entrepreneurshipalfredrunz7No ratings yet

- Chapter 2Document7 pagesChapter 2IanNo ratings yet

- Table of ContentsDocument17 pagesTable of ContentsJaycel Babe Verances0% (1)

- Guidelines On Provincial/Local Planning and Expenditure Management Volume 5Document169 pagesGuidelines On Provincial/Local Planning and Expenditure Management Volume 5CarlNo ratings yet

- Preparation of A Feasibility Study For NPPDocument143 pagesPreparation of A Feasibility Study For NPPIrfan YogaNo ratings yet

- Kalkidan and Adugna Final.Document12 pagesKalkidan and Adugna Final.Adugna EtanaNo ratings yet

- Object Oriented Software Engineering Solved Question Paper by MCA Scholar's GroupDocument23 pagesObject Oriented Software Engineering Solved Question Paper by MCA Scholar's GroupAkshad JaiswalNo ratings yet

- Feasibility Study and Entrepreneurial Success: Evidence From Selected Manufacturing Firms in Anambra StateDocument13 pagesFeasibility Study and Entrepreneurial Success: Evidence From Selected Manufacturing Firms in Anambra StateEditor IJTSRDNo ratings yet

- SSI SetupDocument22 pagesSSI SetupSomnath DasNo ratings yet

- Lesson 1 Preparing A Business PlanDocument6 pagesLesson 1 Preparing A Business PlanRey ViloriaNo ratings yet

- Final Feasibility Study Bus PlanDocument15 pagesFinal Feasibility Study Bus PlanHaimanot beleteNo ratings yet

- Synopsis ON ONLINE EXAMINATION SYSTEMDocument81 pagesSynopsis ON ONLINE EXAMINATION SYSTEMkinuabha93% (14)

- Machine Design Unit 1 Design PhilosophyDocument12 pagesMachine Design Unit 1 Design PhilosophyAnand Babu100% (3)

- Role of Economics Sector in Construction ManagementDocument9 pagesRole of Economics Sector in Construction Managementadiik221204No ratings yet

- The Role of Project Management in Achieving Project Success: Empirical Study From Local Ngos in Mogadishu-SomaliaDocument8 pagesThe Role of Project Management in Achieving Project Success: Empirical Study From Local Ngos in Mogadishu-SomaliaSiencia No Enjinaria DitNo ratings yet

- Swimming Pool GuideDocument126 pagesSwimming Pool Guideİsmet Sezer100% (4)

- Catering Decorating Services Feasibility ReportDocument20 pagesCatering Decorating Services Feasibility ReportzaheerNo ratings yet

- Hardware Sales and Servicing Information SystemDocument39 pagesHardware Sales and Servicing Information SystemSayeeda Anjum0% (1)

- Hospital Management SystemDocument4 pagesHospital Management Systemirfan_chand_mianNo ratings yet

- Discussion Chapters 1 and 2Document8 pagesDiscussion Chapters 1 and 2AzkaliverNo ratings yet

- Internship Report Core JavaDocument46 pagesInternship Report Core JavaAaditya Tyagi100% (1)

- Cockatoo Island SubmissionDocument30 pagesCockatoo Island SubmissionThe Sydney Morning Herald100% (1)

- Legal Feasibility: By:-Name - Rishi Kumar Gupta Stream - Int. BBA-MBA Reg No. - 161111017002Document6 pagesLegal Feasibility: By:-Name - Rishi Kumar Gupta Stream - Int. BBA-MBA Reg No. - 161111017002Brix ArriolaNo ratings yet

- Contoh Kasus Studi Kelayakan BisnisDocument11 pagesContoh Kasus Studi Kelayakan BisnisAyu Dwi LestariNo ratings yet

- Unit 5 MIS Planning and Development: StructureDocument22 pagesUnit 5 MIS Planning and Development: StructurePayal TayalNo ratings yet

- Galaxy Beauty Academy-1Document26 pagesGalaxy Beauty Academy-1aman tiwariNo ratings yet

- Unit 3.2Document7 pagesUnit 3.2Zone MusicNo ratings yet

- Python Mining ConsultantsDocument1 pagePython Mining ConsultantsgriveracNo ratings yet

- Saep 16Document18 pagesSaep 16Demac SaudNo ratings yet

- Requirement Elicitation Master ThesisDocument60 pagesRequirement Elicitation Master ThesisMuhammad Atif Aleem100% (1)

- RAEN 30013 - Railway Engineering OrientationDocument33 pagesRAEN 30013 - Railway Engineering Orientationjay7en7ramosNo ratings yet

- SAAD Lecture II - SDLCDocument100 pagesSAAD Lecture II - SDLCKisyenene JamusiNo ratings yet

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurFrom Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurRating: 4.5 out of 5 stars4.5/5 (3)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsFrom EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsRating: 5 out of 5 stars5/5 (48)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryFrom EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryRating: 4 out of 5 stars4/5 (26)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeFrom EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeRating: 4.5 out of 5 stars4.5/5 (90)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureFrom EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureRating: 4.5 out of 5 stars4.5/5 (100)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizFrom EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizRating: 4.5 out of 5 stars4.5/5 (112)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelFrom EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelRating: 5 out of 5 stars5/5 (51)

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthFrom EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthRating: 4.5 out of 5 stars4.5/5 (1027)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedFrom EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedRating: 4.5 out of 5 stars4.5/5 (38)

- Having It All: Achieving Your Life's Goals and DreamsFrom EverandHaving It All: Achieving Your Life's Goals and DreamsRating: 4.5 out of 5 stars4.5/5 (65)

- Entrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveFrom EverandEntrepreneurial You: Monetize Your Expertise, Create Multiple Income Streams, and ThriveRating: 4.5 out of 5 stars4.5/5 (89)

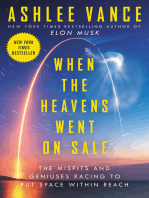

- When the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachFrom EverandWhen the Heavens Went on Sale: The Misfits and Geniuses Racing to Put Space Within ReachRating: 3.5 out of 5 stars3.5/5 (6)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveFrom EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNo ratings yet

- Every Tool's a Hammer: Life Is What You Make ItFrom EverandEvery Tool's a Hammer: Life Is What You Make ItRating: 4.5 out of 5 stars4.5/5 (249)

- Transformed: Moving to the Product Operating ModelFrom EverandTransformed: Moving to the Product Operating ModelRating: 4 out of 5 stars4/5 (1)

- Summary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberFrom EverandSummary of The E-Myth Revisited: Why Most Small Businesses Don't Work and What to Do About It by Michael E. GerberRating: 5 out of 5 stars5/5 (39)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyFrom EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyRating: 5 out of 5 stars5/5 (22)

- Be Fearless: 5 Principles for a Life of Breakthroughs and PurposeFrom EverandBe Fearless: 5 Principles for a Life of Breakthroughs and PurposeRating: 4 out of 5 stars4/5 (49)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldFrom Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldRating: 5 out of 5 stars5/5 (20)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleFrom EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleRating: 4.5 out of 5 stars4.5/5 (48)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisFrom EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisRating: 4.5 out of 5 stars4.5/5 (3)

- Think Like Amazon: 50 1/2 Ideas to Become a Digital LeaderFrom EverandThink Like Amazon: 50 1/2 Ideas to Become a Digital LeaderRating: 4.5 out of 5 stars4.5/5 (60)

- The Master Key System: 28 Parts, Questions and AnswersFrom EverandThe Master Key System: 28 Parts, Questions and AnswersRating: 5 out of 5 stars5/5 (62)

- Your Next Five Moves: Master the Art of Business StrategyFrom EverandYour Next Five Moves: Master the Art of Business StrategyRating: 5 out of 5 stars5/5 (802)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andFrom EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andRating: 4.5 out of 5 stars4.5/5 (709)

- The Kingdom Driven Entrepreneur's Guide: Doing Business God's WayFrom EverandThe Kingdom Driven Entrepreneur's Guide: Doing Business God's WayRating: 5 out of 5 stars5/5 (42)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessFrom EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessRating: 4.5 out of 5 stars4.5/5 (407)

- What Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessFrom EverandWhat Self-Made Millionaires Do That Most People Don't: 52 Ways to Create Your Own SuccessRating: 4.5 out of 5 stars4.5/5 (26)

- Summary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoFrom EverandSummary of $100M Offers: How To Make Offers So Good People Feel Stupid Saying NoRating: 4 out of 5 stars4/5 (1)