Professional Documents

Culture Documents

27-Local Government Internal Audit Rules, 2004

Uploaded by

Humayoun Ahmad FarooqiOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

27-Local Government Internal Audit Rules, 2004

Uploaded by

Humayoun Ahmad FarooqiCopyright:

Available Formats

Local Government (Internal Audit) Rules, 2004 GOVERNMENT OF THE PUNJAB LOCAL GOVERNMENT & RURAL DEVELOPMENT DEPARTMENT

Dated Lahore, the 22nd October, 2004. NOTIFICATION

449

No. SOR(LG)38-1/2004.In exercise of the powers conferred under sub-section (1) of Section 191 read with Sr. No. 13 of Part-I of the Fifth Schedule of the Punjab Local Government Ordinance 2001, (XIII of 2001), the Governor of Punjab is pleased to make the following Rules: 1. Short title, extent and commencement.- (1) These Rules may be called the Punjab Local Government (Internal Audit) Rules, 2004. (2) They shall extend to all District Governments and Tehsil/Town Municipal Administrations of the Province of the Punjab. (3) They shall come into force with immediate effect.

2. Definitions.- In these Rules, unless there is anything repugnant to the subject or context. 3. Audited Entity.- means an office or organization of a Local Government established, created or registered under the PLGO, 2001. 4. Control.- means the policies, procedures, practices and organizational structures in place, designed to provide reasonable assurance that the objectives of a local government are achieved effectively & efficiently and to avert detect and correct undesirable events well in time. 5. Control Risk.- includes the risk of an error that could be material individually or in combination with other errors, is not prevented or detected and corrected within the time frame specified for such correction by internal control system. 6. Control Systems.- include the controls established and maintained by a local government for an audited entity defined in these rules to collect, record and process data and report the resulting information. 7. Council.- means a Zila Council and a Tehsil/Town Council.

8. Economy.- means acquiring resources at the competitive lowest cost without compromising the quality with regards to the objectives of a local government. 9. Effectiveness.- means the relationship of an output to what is / was intended to be achieved. 10. Efficiency.- means the relationship of inputs to outputs in terms of optimum

450 utilization of resources.

Compendium of Rules framed under PLGO-2001 (Volume-IV)

11. Executive.- includes all officers of a Local Government assigned to discharge the respective affairs of a Local Government. 12. Governance.- means a leadership process through which the Executives set and oversee implementation of the policies, designed to achieve better performance of functions and ensure accountability. 13. Government.- means Government of the Punjab.

14. Government Organizations.- means all administrative departments and subordinate offices under the direct or indirect control of the Government of the Punjab. 15. Internal Audit.- means an independent and objective assurance, appraisal and consulting activity designed to add value and to improve the operations of a Local Government to achieve the agreed objectives of its policy by bringing a systematic, disciplined approach to evaluate and improve the effectiveness of risk management, control and governance processes. 16. 17. Nazim.- means a Zila Nazim and a Tehsil/Town Nazim. Ordinance.- means the Punjab Local Government Ordinance, 2001 (as amended).

18. Principal Accounting Officer.- includes District Coordination Officer of a District or City Government and Tehsil/Town Municipal Officer in case of a Tehsil/Town Municipal Administration, and any other officer who is exercising the assigned authority as such. 19. Quality Services and Standards Office.- means the Office working under the control of internal auditor and responsible for conducting internal .audit and other ancillary functions as specified in these rules, 20. Internal Auditor.- means head of Quality Services and Standards Office appointed or designated by the Local Government concerned to conduct internal audit of an audited entity under these Rules. 21. Regulation.- means regulations made under these Rules.

22. Risk.- means the degree to which operations of a Local Government are exposed to breaches in ethics, financial indiscipline or loss, inappropriate disclosure of data or ineffective use of resources and includes an act or event occurring that would have an adverse effect on Local Government office and its systems. 23. Risk Management.- means systematic approach to setting the best course of action under uncertainty by identifying, assessing, understanding, acting on and

Local Government (Internal Audit) Rules, 2004

451

communicating risk issues. Risk management involves designing and implementing strategic plans and processes to manage risk issues at a level acceptable to the management of a Local Government. 24. Appointment, Qualification, Terms and Conditions of Service of the Internal Auditor.- (1) The Nazim of each District or City District Government and Tonsil/Town Administration, as the case may be, may appoint/designate an Internal Auditor. (2) The qualifications, pay and allowances, tenure in office and other terms and conditions, of service of the Internal Auditor shall be prescribed by the government on the recommendation of the Council. (3) The Internal Auditor and his staff shall be the employees of the Local Government concerned. 25. The Internal Auditor shall not hold another office in a local government, which creates or may create a conflict of interest with his position as such. 26. The Internal Auditor shall not hold another position in a local government in which he serves as head of the Quality Services and Standards Office, except where the holding of said additional office would not compromise the discharge his functions as an Internal Auditor. 27. The employees of the Quality Services and Standards Office shall receive instructions from Internal Auditor only, who shall report to the Principal Accounting Officer, Nazim and the Council. 28. Save as otherwise provided in the law or rules, the Internal Auditor may not be removed or suspended before the end of the term for which he has been appointed, except with the approval of the Council. 29. Professional Independence and Objectivity.- (1) The Internal Auditor shall serve as the Principal Support Officer to the Nazim concerned and shall provide information and make recommendations to the Principal Accounting Officer, Nazim, members of the councils and heads of the audited entities. (2) He shall have direct access to the Nazim and the Principal Accounting Officer of a Local Government in the discharge of his assigned functions. (3) The scope of work of the internal auditor shall include a broad range of advisory services, gathering information on all functions of the Local Government, including evaluation of design and systems, and formulation of advice with the objective to build quality and ensure timely delivery of services. 30. The opinions, views, assessment, valuation and recommendations of the internal auditor shall be an advisory and consulting activity, designed to add value and to improve the Local Government operations, and shall be given due consideration and weight by the

452

Compendium of Rules framed under PLGO-2001 (Volume-IV)

Local Government while taking corrective measures/actions. 31. The internal auditor shall discharge all functions, and act in accordance with the provisions of the Ordinance and these Rules without any outside influence. The independence and professional work of the internal auditor and his staff shall not be subject to interference, obstruction and scrutiny by any executive authority of the Local Government; 32. The professional work of the internal auditor shall be based on objective criteria and he shall perform his professional work impartially and fairly. 33. The internal auditor and his office shall not interfere in the functioning of the local government and any office or body created under a statute or any other law in force. 34. Guidelines.- (1) The internal auditor shall help the Local Government to accomplish all its major policy objectives by bringing a systematic and disciplined approach to the process of evaluation to improve the effectiveness of risk management, control systems and governance processes. The internal auditor may issue appropriate guidelines, strictly consistent with the provisions of the laws and rules in force and such guidelines may include advice on modifications of existing systems and procedures, introduction of new systems, procedures, forms, etc., for carrying out the purpose of these rules. (2) The Nazim may, with the approval of the Council, enlarge or restrict the scope of the objectives, or change, amend, alter, vary or modify the systematic and disciplined approach for the required evaluation and improvement of the effectiveness of risk management, control and governance processes. 35. Obligation to conduct Internal Audit.- (1) Internal Audit shall be a continuous management function of a Local Government. (2) The internal auditor shall have access at all reasonable lines to relevant documents, minutes, files, books, papers, accounts and vouchers of the Local Government Offices, and shall be entitled to enquire from the executives, such information and explanations which are necessary for the performance of his functions. (3) In case of any classified/secret information, restrictions imposed by law regarding the eligibility to have access to information shall also apply to the internal auditor. (4) The officer of Quality Services and Standards Office concerned, so long as the records remain in his custody, shall be responsible for its safely ensuring that such record is not destroyed, mutilated, damaged or tampered within any manner, whatsoever. 36. Functions, Duties and Responsibilities of the Internal Auditor.- (1) The Internal Auditor shall examine, inter alia, whether the audited entity has in place:

Local Government (Internal Audit) Rules, 2004 (i)

453

Mechanisms to ensure compliance with the policies, laws, rules and regulations and effective systems of internal control to achieve its objectives; Strategies to manage risks and measures to manage resources economically, efficiently and effectively; Procedures to safeguard the assets of the Local Government concerned; Reliable information systems including information and financial management; that of accounting

(ii) (iii) (iv) (v) (vi)

Mechanisms to prevent and detect fraud, abuse and waste of public resources; Effective procedures for the rectification of deficiencies in the operations and systems of the Local Government identified by Internal Auditor;

(vii) Mechanisms for citizens participation in performance evaluation of Local Government offices; and (viii) Mechanisms for redressal of grievance of citizens in accordance with Section 188 of PLGO, 2001; (2) Without prejudice to the generality of the above, the functions of Internal Auditor include: (i) (ii) Evaluation of adherence to laws, regulations and approved policies and procedures. Evaluation of the institutional processes, including human resource, management, information flows, office accountability mechanisms of a local government to safeguard resources against fraud, waste abuse and mis-management. Reviewing of systems of Internal Control and evaluate systems and processes of the Local Government and making recommendations for improvements to promote orderly, economical, efficient and effective operations. Investigation of specific matters as directed by the Nazim or as recommended by the Council.

(iii)

(vi)

(vii) Using citizen based inputs concerning service delivery, institutional processes and actual performance. (viii) Interaction with other stakeholders to update performance indicators and standards of service delivery, and

454 (ix)

Compendium of Rules framed under PLGO-2001 (Volume-IV) Any other ancillary task assigned by the Nazim or the Council. Explanation: The objective of internal audit is to help the audited entity to improve its risk management, control and governance through its recommendations to achieve the policy objectives of the Local Government. (3) The Internal Auditor shall ensure that: (i) (ii) the internal audit is conducted in a manner consistent with the highest Ethical Standards. the Nazim and the Principal Accounting Officer of a local government as the Audited Entity are fully and currently informed concerning frauds, abuses and deficiencies relating to the implementation of policies administered or financed by the Audited Entity and recommend corrective actions concerning such problems, abuses, deficiencies and to report on the progress made in this regard.

37. Reporting.- (1) The internal auditor shall present an Annual Report on the performance of his office to the Nazim with a copy to the Council. (2) The internal auditor shall, according to the annual audit programme, conduct detailed internal audits of selected offices and present his findings through periodic reports to the Nazim with a copy to the Council. 38. Follow-Up on the reported findings to determine that corrective actions were taken and/or achieving the desired results.- (1) Not later than two months after an internal audit report is issued, the Internal Auditor shall follow-up on repelled findings in order to ascertain whether the corrective actions were taken, and the desired results achieved or not. (2) The Quality Services and Standards Officer shall inform the Nazim and the Principal Accounting Officer on the status, of the follow-up on the supervision of the programme, activity, function or Organizational unit audited. (3) If a follow-up report is issued, the Internal Auditor shall submit the report to the Nazim as well as the Principal Accounting Officer. The follow-up report shall be provided upon request to any legislative, executive, or judicial body, and/or to legislative auditor or an external auditor after approval by the Nazim. 39. Access of Information to Public.- (1) Audit working papers and reports shall be public records to the extent that they do not include information specifically made confidential pursuant to laws in force. (2) Nothing in this section shall be construed to authorize the public disclosure and information that is: (i) (ii) specifically prohibited from disclosure by any other law, a part of an on-going criminal investigation.

Local Government (Internal Audit) Rules, 2004

455

40. Duties and Responsibilities of the Nazims and the Principal Accounting Officer in Respect of Internal Audit.- (1) The Nazim and the Principal Accounting Officer of a Local Government shall take measures to restructure the existing inspection, monitoring and evaluation functions of the respective Local Government on the recommendations the Internal Auditor, provided that such restructuring is consistent with the laws and rules in force. (2) The Nazim and the Principal Accounting Officer shall ensure that the rights and privileges granted to the Internal Auditor under these Rules are not infringed upon by an act of any officer or staff under their administrative control. (3) Any person hindering or obstructing the work of Quality Services and Standards Office in the performance of its functions or denying or willfully delaying access to information required by the Quality Services & Standards Office under these Rules shall be subject to disciplinary action under relevant Efficiency and Discipline Rules, or any other law for the time being in force, applicable to such person. 41. Reporting a Criminal Offense.- (1) In the event that the internal audit of an Organization raises a basis to believe that a criminal offence has been committed, the Quality Services and Standards Office shall bring the matter to the attention of the Principal Accounting Officer and the Nazim without delay. ----------

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Assignment # 01 Name: Javeria Zahid Enrollment # 01-398201-042 MSPM Sec A Ocean'S ElevenDocument2 pagesAssignment # 01 Name: Javeria Zahid Enrollment # 01-398201-042 MSPM Sec A Ocean'S Elevenjaveria zahidNo ratings yet

- List of Sahaba R.A - UpdatedDocument92 pagesList of Sahaba R.A - UpdatedShadab Shaikh69% (13)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Constitution of Pakistan 1973 in Urdu VerDocument256 pagesConstitution of Pakistan 1973 in Urdu Vermuradlaghari82% (159)

- Sap SCM Tutorial PDFDocument79 pagesSap SCM Tutorial PDFShahnawaz Baig100% (2)

- Pension Increases Table PunjabDocument2 pagesPension Increases Table PunjabHumayoun Ahmad Farooqi78% (18)

- The Punjab Urban Immovable Property Tax ActDocument12 pagesThe Punjab Urban Immovable Property Tax ActHumayoun Ahmad FarooqiNo ratings yet

- Week 3 MC QuestionsDocument3 pagesWeek 3 MC QuestionsHamza AsifNo ratings yet

- Business PlanDocument27 pagesBusiness Plansameer khanNo ratings yet

- COBIT 2019 Design Toolkit With Description - Group X.XLSX - DF1Document8 pagesCOBIT 2019 Design Toolkit With Description - Group X.XLSX - DF1Aulia NisaNo ratings yet

- E Marketing NotesDocument65 pagesE Marketing Notesshreyasgbt38% (8)

- Business Intelligence For Small Enterprises: An Open Source ApproachDocument46 pagesBusiness Intelligence For Small Enterprises: An Open Source Approachrstml100% (1)

- Pay Fixation PunjabDocument79 pagesPay Fixation PunjabHumayoun Ahmad Farooqi100% (2)

- Punjab Delegation of Financial Rules Updated 2012Document394 pagesPunjab Delegation of Financial Rules Updated 2012Humayoun Ahmad FarooqiNo ratings yet

- AffidavitDocument2 pagesAffidavitHumayoun Ahmad FarooqiNo ratings yet

- Regularization of Contract Employees Grade 1-15 Punjab GovtDocument3 pagesRegularization of Contract Employees Grade 1-15 Punjab GovtHumayoun Ahmad Farooqi100% (5)

- Tanbeeh Ul-Ghafileen by Shaykh Abu Laith Samarqandi R.A Urdu TranslationDocument328 pagesTanbeeh Ul-Ghafileen by Shaykh Abu Laith Samarqandi R.A Urdu TranslationTalib Ghaffari86% (7)

- 50% Allowance ClarificationDocument2 pages50% Allowance ClarificationHumayoun Ahmad FarooqiNo ratings yet

- Final Seniority List of DDAO/DTO/DOADocument6 pagesFinal Seniority List of DDAO/DTO/DOAHumayoun Ahmad FarooqiNo ratings yet

- Bachon Ke Liay Ibtidai Deeni Taleemaat by Sheikh Mufti Ehsanullah ShaiqDocument59 pagesBachon Ke Liay Ibtidai Deeni Taleemaat by Sheikh Mufti Ehsanullah ShaiqMusalman BhaiNo ratings yet

- Bermuda Tikon Aur Dajjal by Sheikh Umar AsimDocument277 pagesBermuda Tikon Aur Dajjal by Sheikh Umar AsimMusalman Bhai100% (1)

- DAJJAL Kaun Kaab Kaaha by Mufti Abu Lubaba Shah MansoorDocument250 pagesDAJJAL Kaun Kaab Kaaha by Mufti Abu Lubaba Shah MansoorHumayoun Ahmad Farooqi100% (3)

- Islami Mahino Ke Fazail o Ahkaam Molana RoohullahDocument236 pagesIslami Mahino Ke Fazail o Ahkaam Molana RoohullahKamrans_Maktaba_Urdu0% (2)

- Aqeeda Zahoor e Mehdi Ahadith Ki Roshni MayDocument191 pagesAqeeda Zahoor e Mehdi Ahadith Ki Roshni MayISLAMIC LIBRARYNo ratings yet

- Building and Road B&R Code, DFRDocument286 pagesBuilding and Road B&R Code, DFRHumayoun Ahmad Farooqi100% (1)

- Punjab Medical Attendance RulesDocument55 pagesPunjab Medical Attendance RulesHumayoun Ahmad Farooqi78% (9)

- District Budget RulesDocument98 pagesDistrict Budget RulesHumayoun Ahmad FarooqiNo ratings yet

- Intergovernmental TransfersDocument31 pagesIntergovernmental TransfersHumayoun Ahmad FarooqiNo ratings yet

- Final Manual of DaosDocument265 pagesFinal Manual of DaosHumayoun Ahmad Farooqi100% (1)

- The Punjab Motor Vehicles Taxation ActDocument10 pagesThe Punjab Motor Vehicles Taxation ActHumayoun Ahmad FarooqiNo ratings yet

- Electronic Crimes Act 2004Document12 pagesElectronic Crimes Act 2004Humayoun Ahmad FarooqiNo ratings yet

- ETODocument25 pagesETOAltaf SheikhNo ratings yet

- The Punjab Land Revenue ActDocument65 pagesThe Punjab Land Revenue ActHumayoun Ahmad FarooqiNo ratings yet

- The Punjab Court FeesDocument1 pageThe Punjab Court FeesHumayoun Ahmad FarooqiNo ratings yet

- PEEDA ActDocument11 pagesPEEDA ActFurzan AbbasNo ratings yet

- The Punjab Government Servants Housing Foundation Act 2004Document6 pagesThe Punjab Government Servants Housing Foundation Act 2004Humayoun Ahmad FarooqiNo ratings yet

- The Punjab Agricultural Income Tax Act 1997Document11 pagesThe Punjab Agricultural Income Tax Act 1997Humayoun Ahmad FarooqiNo ratings yet

- The On-Farm Water ManagementDocument7 pagesThe On-Farm Water ManagementHumayoun Ahmad FarooqiNo ratings yet

- By Shaivi Shah & Aryaman PalweDocument18 pagesBy Shaivi Shah & Aryaman PalweSHAIVI SHAHNo ratings yet

- Rob Austin CVDocument10 pagesRob Austin CVStefanus Adrian WinartoNo ratings yet

- Chapter 2 Developing Market Strategies and PlansDocument71 pagesChapter 2 Developing Market Strategies and PlansAleena LiaqatNo ratings yet

- Citizen Charter PDFDocument7 pagesCitizen Charter PDFAshish GuptaNo ratings yet

- Zaras Secret For Fast Fashion PDFDocument3 pagesZaras Secret For Fast Fashion PDFAnonymous 20rY9XWVwNo ratings yet

- Raj Ramachandran - Accenture Learning Trend - Deep Specialization and AcademiesDocument15 pagesRaj Ramachandran - Accenture Learning Trend - Deep Specialization and AcademiesDipankar GhoshNo ratings yet

- Julekha Mohanty: ProfileDocument3 pagesJulekha Mohanty: Profilevikrant sharmaNo ratings yet

- Lloyd's Register GroupDocument6 pagesLloyd's Register GroupRhegina Mariztelle ForteNo ratings yet

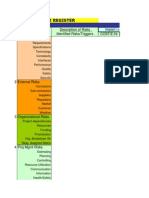

- Risk RegisterDocument34 pagesRisk RegisterMohamedMoideenNagoorMeeran33% (3)

- Audit Theory - Sample QuizzerDocument7 pagesAudit Theory - Sample Quizzercandy louiseNo ratings yet

- Marketing Strategy For B2BDocument8 pagesMarketing Strategy For B2B2qzrkmxfn2No ratings yet

- Corporate Brochure-Koncepo Scientech InternationalDocument12 pagesCorporate Brochure-Koncepo Scientech InternationalNITHIN CHERIANNo ratings yet

- Cost Accounting Spoilage and Rework and ScrapDocument33 pagesCost Accounting Spoilage and Rework and Scrapsmnth rsrrctnNo ratings yet

- Q1W7 Nature Types Levels PlanningDocument22 pagesQ1W7 Nature Types Levels PlanningDaisiree PascualNo ratings yet

- FY2022 HCL Sustainability Report-2 PDFDocument79 pagesFY2022 HCL Sustainability Report-2 PDF35SHREYANSH PANDEYNo ratings yet

- Project ManagementDocument30 pagesProject ManagementAbhishek Rajawat100% (1)

- Project Termination and Close - OutDocument15 pagesProject Termination and Close - OutMedine berrerNo ratings yet

- SMUDocument10 pagesSMUAbhisek Sarkar0% (1)

- Employment Opportunities: The Nelson Mandela African Institute of Science and Technology (NM-AIST)Document8 pagesEmployment Opportunities: The Nelson Mandela African Institute of Science and Technology (NM-AIST)Rashid BumarwaNo ratings yet

- Evolution of NDMA: Prime Minister of India Disaster Management Act, 2005Document2 pagesEvolution of NDMA: Prime Minister of India Disaster Management Act, 2005Adhish KackerNo ratings yet

- Agile ManufacturingDocument23 pagesAgile Manufacturingjhpatel100% (1)

- BAT 153 Human Resource ManagemntDocument3 pagesBAT 153 Human Resource ManagemntnirakhanNo ratings yet

- WEEK 2-The Organization Context Strategy, Structure and Culture (Compatibility Mode)Document39 pagesWEEK 2-The Organization Context Strategy, Structure and Culture (Compatibility Mode)Chan HyNo ratings yet