Professional Documents

Culture Documents

7 Ways Hospitality

Uploaded by

hareth123Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

7 Ways Hospitality

Uploaded by

hareth123Copyright:

Available Formats

7 Ways Electronic Invoicing and Online Payment Processing Accelerate Cash Flow for the Hospitality Industry

By Christopher R. Cauley

In spite of corporate efforts over the past few years to wring inefficiencies out of back-office processes, invoice-to-cash processing remains a costly proposition for most organizations. The challenge is especially tough in the hospitality industry, where companies must deal with high volumes of multi-page paper invoices with a requirement to attach backup documents such as receipts. Most AR departments in the hospitality industry also face a dizzying number of customer inquiries, a lot of partial- and shortpaid invoices that require research and resolution, and many disputed invoices. Against this backdrop, it's not surprising that the industry is plagued by high Days Sales Outstanding (DSO), overdue invoices, and manual payment posting and cash application. For companies in the hospitality industry, an answer to reducing DSO and accelerating cash flow -- as well as improving overall efficiency -- is electronic invoicing and online payment processing.

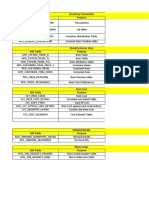

Electronic payment processing -- whether it's via Automated Clearing House (ACH) Network or card -- eliminates manual papercheck handling and payment posting, and with a high level of accuracy and security. Both solutions offer a compelling business case for weary AR departments. Take the example of a leading hospitality company boasting more than 1,000 hotels, a similar number of restaurants, and a chain of travel services locations. Like many of its industry peers, this company was challenged by large volumes of paper invoices -- many of them with attachments -- that needed to be distributed manually to its company owned hotels, franchisees, and group property management customers. Moreover, the company's business customers routinely disputed their invoices or short-paid invoices using paper checks. The company needed a better solution. After an exhaustive evaluation of solutions on the market, the company selected the Invoices On-Line (IOL) platform from Direct Insite. The hospitality firm's solution includes capabilities for:

Electronic invoice distribution Real-time notification of invoice disputes, deductions and short-

Sky High Accounts Receivable Costs To be sure, the high costs associated with invoice-to-cash processes go well beyond the hospitality industry. Research from Aberdeen Group paints a sobering picture. Aberdeens AR maturity index (June 2011) reports that between 45 and 80 percent of all invoices require manual intervention at 80 percent of companies. Further, based upon the Aberdeen Groups survey of over 160 companies conducted in May 2010, the average cost to process a paper check was $7.15. Considering that between nine and 16 percent of these invoices are past due for these companies, it's clear that even small improvements in AR could pay big dividends.

payments

Customer self-service ACH and credit card payment processing Real-time credit card authorization and settlement Real-time notifications and visibility into invoice and payment

status

PCI compliant, level-3 credit card processing Viewing and reporting of detailed payment remittance information Automated payment remittance posting into AR

The Benefits of Electronic Processing The Payoff Electronic invoicing enables companies, such as those in the hospitality industry, to transition from costly manual paper invoicing to electronic invoice distribution, dispute collaboration, and customer self-service. This migration to electronic invoicing can slash a company's costs by over 50 percent an invoice, while delivering a 5 to 10 percent reduction in cycle-time DSO over the adoption period. By deploying the Direct Insite platform, the hospitality company achieved seven critical benefits: 1. Eliminated paper-based invoicing and manual attachment of backup documents. Manually attaching and e-mailing backup documents to customers was a costly process that took the

Ph: +1.631.873.2900

W: www.directinsite.com

Copyright 201 1

hospitality company two to three days to complete. Now, backup documents are automatically attached to electronic invoices and made available to customers in real-time via Direct Insite's electronic invoicing portal. This has accelerated the company's billing cycle and enabled its customers to view invoices and other documents online, any time they want. 2. Provided customers with better visibility to charges. Direct Insite portal provides the company's customers with full line-item detail, on top of online access to backup documents, improving their AP reconciliation process and reducing inquiries and disputes. 3. Improved dispute and deduction processes. In the past, short payments and invoice disputes cost the company's credit and collections group a lot of time and money. With the real-time notification and online information provided by the Direct Insite electronic invoicing portal, the company now knows the moment a customer short-pays, the reason, the amount of the shortpayment, and the difference between the payment and the invoiced amount. This improved visibility and has saved the company's credit and collections group a ton of research time and facilitated faster communication and resolution with its customers. 4. Information presented by property location. With the Direct Insite portal, the hospitality company's customers can now view invoice information, including balance due, by property location. This has accelerated invoice approval processes as the initial AP reviewers and approvers are typically located at the property location and can make an informed decision.

5. Fewer paper checks. Direct Insite's payment portal enables the hospitality company's customers to pay via credit card or ACH, rather than paper check. In addition to being much cheaper to process than checks, online payments enable the company to know exactly which invoices are being paid, in turn, eliminating potential errors in cash application. 6. Lower credit card interchange fees. The hospitality company can now process its online credit card transactions with Level-3 payment data, ensuring that it qualifies for the lowest interchange rates possible this can save the merchant 1 percent or more in credit card interchange fees on qualifying transactions. 7. Streamlined payment posting. Like many of its industry peers, the hospitality company used to post payments manually. Now, the Direct Insite payment processing portal automatically generates a posting file that is directly received and reconciled by the company's enterprise resource planning (ERP)/AR system. Posting payments electronically has saved the company significant manual effort, reduced posting errors, and accelerated the posting process. The hospitality industry is not alone when it comes to challenges in receivables processing. And like other industries, it is finding a compelling solution in the deployment of electronic invoicing and payment processing solutions. By eliminating paper-driven accounts receivables processes, companies can accelerate cash flow, reduce cost, speed cycle times and enhance customer service.

For more information, visit www.directinsite.com or call 631-873-2900.

Ph: +1.631.873.2900

W: www.directinsite.com

Copyright 201 1

You might also like

- Online Paypers, Vol 5 Issue 12 TrialDocument9 pagesOnline Paypers, Vol 5 Issue 12 Trialhareth123No ratings yet

- 1348562625.5989sroke Gaurd SaudiDocument5 pages1348562625.5989sroke Gaurd Saudihareth123No ratings yet

- Business Plans in Private Banking and Wealth Management 21683Document10 pagesBusiness Plans in Private Banking and Wealth Management 21683hareth123No ratings yet

- Concept of Critical Care 2012 120406061222 Phpapp01Document42 pagesConcept of Critical Care 2012 120406061222 Phpapp01Liezel CauilanNo ratings yet

- Cost Accounting & Financial Management VOL. IIDocument428 pagesCost Accounting & Financial Management VOL. IIseektheraj86% (7)

- My Research Notes AboutDocument1 pageMy Research Notes Abouthareth123No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- C TERP10 65 Sample QuestionsDocument8 pagesC TERP10 65 Sample QuestionsGrimReaderNo ratings yet

- Ebs - Fusion TablesDocument26 pagesEbs - Fusion TablesSumit100% (2)

- TEST BANK-Auditing-ECDocument16 pagesTEST BANK-Auditing-ECAnonymous qi4PZkNo ratings yet

- Invoice Foe Mobile Oneplus UpDocument1 pageInvoice Foe Mobile Oneplus UpShantanu SinghNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Suresh RamasamyNo ratings yet

- Invoice 3033842509 Njgzndy3mza1mjqwmzg1otq1nl42odm0njczmduwnta4oduzmjq4Document1 pageInvoice 3033842509 Njgzndy3mza1mjqwmzg1otq1nl42odm0njczmduwnta4oduzmjq4SpandanaNo ratings yet

- C9370 Manual BookDocument28 pagesC9370 Manual BookJuan Norberto PerezNo ratings yet

- IRAS Etaxguide GST Guide On ImportsDocument31 pagesIRAS Etaxguide GST Guide On ImportsTalitha El IbrasaNo ratings yet

- ISU Master Data V0.5Document29 pagesISU Master Data V0.5SaChibvuri JeremiahNo ratings yet

- A Vendor May Have Multiple Bank Accounts and May Want You To MakeDocument18 pagesA Vendor May Have Multiple Bank Accounts and May Want You To MakeSantosh Vaishya67% (3)

- Facture Fartech2023Document1 pageFacture Fartech2023jeanmali484No ratings yet

- 1107-920-46-3559 e ADDENDUM2Document171 pages1107-920-46-3559 e ADDENDUM2asharani_ckNo ratings yet

- P6 Tips and TricksDocument60 pagesP6 Tips and TrickssbtailorNo ratings yet

- Quotation For Perfect ForgingsDocument10 pagesQuotation For Perfect ForgingsBaljinder Kumar SainiNo ratings yet

- Material Costing - Theory & Practical Questions-3Document12 pagesMaterial Costing - Theory & Practical Questions-3sakshi.sinha56327No ratings yet

- Chapter 6vat On SalesDocument24 pagesChapter 6vat On SalesNoriel Justine QueridoNo ratings yet

- Business License in CameroonDocument20 pagesBusiness License in Cameroonjemblem66No ratings yet

- 20130723-Trading Parner Guide To MODs E-Purchasing ProcessDocument32 pages20130723-Trading Parner Guide To MODs E-Purchasing ProcessFraser WalkerNo ratings yet

- Nov2023 NewDocument8 pagesNov2023 News.tajudeen1993No ratings yet

- Khwopa Secondary SchoolDocument17 pagesKhwopa Secondary SchoolMonkeyNo ratings yet

- Mandhana SD BBP-mumbai2Document75 pagesMandhana SD BBP-mumbai2Mukeshila2010No ratings yet

- P18 PDFDocument14 pagesP18 PDFsiva ramanNo ratings yet

- A Overview of Maharashtra Value Added Tax: IndexDocument10 pagesA Overview of Maharashtra Value Added Tax: IndexAdnan ParkarNo ratings yet

- Vat On Importation: Presumptive Input TaxDocument13 pagesVat On Importation: Presumptive Input TaxNerish PlazaNo ratings yet

- Form Job StreetDocument1 pageForm Job StreetRizky FerdinanNo ratings yet

- Ride Details Bill Details: Thanks For Travelling With Us, Shashank H NAYAKDocument3 pagesRide Details Bill Details: Thanks For Travelling With Us, Shashank H NAYAKAs PrashanthNo ratings yet

- Img 20200125 0001 PDFDocument1 pageImg 20200125 0001 PDFballav sarkarNo ratings yet

- Export and Import Clearance Procedures and DocumentationDocument38 pagesExport and Import Clearance Procedures and DocumentationAJESH100% (10)

- Tax Invoice: Billing Address Installation Address Invoice DetailsDocument1 pageTax Invoice: Billing Address Installation Address Invoice DetailsMurugan AyyaswamyNo ratings yet

- ERP Sample Test 2016Document18 pagesERP Sample Test 2016keyspNo ratings yet