Professional Documents

Culture Documents

NNNN

Uploaded by

Niraj DahalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NNNN

Uploaded by

Niraj DahalCopyright:

Available Formats

CHAPTER - ONE INTRODUCTION 1.

1 Meaning and Definition of Bank

In simple word, bank is a financial institution, which accepts deposits and provides loans. In other word bank is a legal financial institution, which accepts the deposits, provides security, and gives the loan facilities to the customers. It is the secure place of depositing for the people having surplus amount of mount and source of borrowing for the people having inadequate amount. Bank collects money from the public and lends it to the people in need skill and entrepreneurship to use it productivity. It has greatly helped in economic growth of nation and it society as well. Bank never keeps the collected amount and deposits idel. It lends, invests, and mobilizes in various sectors, which gives return. Many economists define the meaning of the bank based on their work their function, but there is absence of suitable definition. A banker is the who in the ordinary course of his business, receives money which he pay by honoring cheques of persons from whom or whose account he receives it. H.L. Heart Bank is an establishment which to individuals such advances of money or other means of payments as may be required and safely made and to which individuals entrust money or means of payment not required by them for use. Kinley The function of bank categories in two parts. Primary function and secondary function. The primary function of bank are accepting deposits, providing loans, safety of wealth, and secondary function are issue of credit instrument, investment purchase and sales of securities, income receiving and payment, transfer of money, trustee and attorney etc.

1.2

History of Nepalese Bank

The history of bank in the word is very old. Bank of Vines is fist organized bank of the world established in 1157 A.D. The history of Nepalese bank c is very short. Nepal's first commercial bank, the Nepal Bank Limited, was established in 1937. The government owned 51 percent of the shares in the bank and controlled its operations to a large extent. Nepal Bank Limited was headquartered in Kathmandu and had branches in other parts of the country. There were other government banking institutions. Rastriya Banijya Bank (National Commercial Bank), a state-owned commercial bank, was established in 1966. The Land Reform Savings Corporation was established in 1966 to deal with finances related to land reforms. There were two other specialized financial institutions. Nepal Industrial Development Corporation, a state-owned development finance organization headquartered in Kathmandu, was established in 1959 with United States assistance to offer financial and technical assistance to private industry. Although the government invested in the corporation, representatives from the private business sector also sat on the board of directors. The Co-operative Bank, which became the Agricultural Development Bank in 1967, was the main source of financing for small agribusinesses and cooperatives. Almost 75 percent of the bank was state-owned; 21 percent was owned by the Nepal Rastra Bank and 5 percent by cooperatives and private individuals. Since the 1960s, both commercial and specialized banks have expanded. More businesses and households had better access to the credit market although the credit market had not expanded. In the mid-1980s, three foreign commercial banks opened branches in Nepal. The Nepal Arab Bank was co-owned by the Emirates Bank International Limited (Dubai), the Nepalese government, and the Nepalese public. The Nepal Indosuez Bank was jointly owned by the French Banque Indosuez, Rastriya Banijya Bank, Rastriya Beema Sansthan (National Insurance Corporation), and the Nepalese public. Nepal Grindlays Bank was co-owned

by a British firm called Grindlays Bank, local financial interests, and the Nepalese public. Nepal Rastra Bank was created in 1956 as the central bank. Its function was to supervise commercial banks and to guide the basic monetary policy of the nation. Its major aims were to regulate the issue of paper money; secure countrywide circulation of Nepalese currency and achieve stability in its exchange rates; mobilize capital for economic development and for trade and industry growth; develop the banking system in the country, thereby ensuring the existence of banking facilities; and maintain the economic interests of the general public. Nepal Rastra Bank also was to oversee foreign exchange rates and foreign exchange reserves. 1.3 Background of Bank of Kathmandu Ltd.

Bank of Kathmandu (BOK) was established in March 1995 with joint venture of Siam Commercial Bank of Thailand and Nepalese investors. In established time, its authorized capital was Rs.25 Crores, issued capital Rs.12 Crores, and paid up capital Rs. Crores. Syam Commercial Bank owns 30%, Nepalese promoters 25% and Nepalese public 25%. It established with the objective of to stimulate the Nepalese economy and take it to newer heights. BOK also aims to facilitate the nation's economy and to become more competitive globally. To achieve these, BOK has been focusing on its set objectives right from the beginning. To highlight its few objectives: To contribute to the sustainable development of the nation by mobilizing domestic savings and channeling them to productive areas

To use the latest banking technology to provide better, reliable and efficient services at a reasonable cost To facilitate trade by making financial transactions easier, faster and more reliable through relationships with foreign banks and money transfer agencies To contribute to the overall social development of Nepal

1.4

Focus of the Study

The focus of the study is analysis the financial ratio of BOK. The financial ratio analysis is a technique of analysis and interpretation of financial statement through mathematical expression. Financial ratios helpful to assessing operation of the business, helpful in measuring financial solvency, helpful in future forecasting, helpful to decision making etc.

1.5

Objective of the Study

The main objectives of this study are: To partial fulfillment of the requirement for the degree of B.B.S. To provide information regarding the profitability of BOK. To reflect the Solvency position of BOK. To measure the managerial efficiency of BOK. To make related information comparable. To measure strength and weakness of BOK. To facilitate managerial decision.

1.6

Signification of the Study

Significance to BOK. Significance to investors and stakeholders Significance to government Significance to make future decision

1.7

Limitation of the Study

During the preparation of this report, there were many limitations, which are as follows: All data are collected from secondary sources. The study is about BOK only. The deep analysis and study could not be done due to time and data limitation. Only few years are taken into consideration due to data unavailability. The staff of BOK is not helpful.

1.8

Method of Data Collection

Report writing is essential for the student of BBS. It helps the student to know about the practical implementation and environment of commercial bank. For preparing the report, first we should fix the subject, take one commercial bank for the study, collect the data from both the bank staffs and their annual reports, analyze the data, select and separate the relevant dates in their respective topics and use appropriate tools for analysis the data that indicates the actual performance of the bank. The more reliable and accurate the data is the more accurate will be study. The methods of data collections main objective are to collect the reliable and accurate data, select and separate it into different topics and use appropriate tools for indicating the sound performance. Method of data collections main aspect is to make the fieldwork accurate, specific, and reliable.

1.9

Study Procedures

This is the analytical data concentrated on investment analysis of Bank of Kathmandu. The data collected for this fieldwork are mostly from secondary sources. Inquiry with the staff of BOK wherever necessary. After collecting the datas from primary and secondary sources, they were analyzed and separated into its concerned topics. All the analyzed data represented the Bank of Kathmandu.

1.10 Tools Used for Analysis

1. 2. 3. Income Statement Balance Sheet Financial Ratios : a. Leverage Ratio i. Total debt to total ratio ii. Total debt to equity ratio iii. Equity multiplier ratio (M) iv. Total assets turnover ratio b. Profitable Ratios i. Profit margin ii. Net interest margin (NIM) iii. Return on assets (ROA) iv. Return on equity (ROE)

CHAPTER - TWO

PRESENTATION AND ANALYSIS OF DATA

2.1

Study of BOK Deposit

With more number of financial institutions entering the market, there was a competition amongst the commercial bank for deposits thus resulting in higher interest rates. Despite BOK deposit grew by 27.81 percent in the fiscal year 2064-65 in comparison to a growth of 18.15 percent in the previous year; reaching a total of NPR 15.83 billion. It collects the fund through the current account, saving account and fixed account. During the reporting period, BOK as per the needs of the customers has devised various innovative products like, Foreign Employment Savings Account; 24 Carat Fixed Deposit Account, Hello Savings Account and Share Plus Account. These products have contributed significantly to enhance the overall deposit portfolio of the bank. Some past years deposit collection of BOK are shown below: Table No. 2. 1 Table Showing Different Fiscal Years Deposits

Amount in Crores Years Deposits Saving

2060-61

Fixed 227.97 287.89 270.97

Current

Others

Total

2061-62 2062-63 2063-64 2064-65

244.85 13.96 774.16 246.47 35.46 894.27 292.11 27.26 1,048.53 552.73 303.71 362.82 19.63 1,238.92 659.62 370.32 529.04 24.39 1,583.371 th Sources : 14 annual report (2064-65) of BOK

287.38 324.45 458.19

This table shows that the deposit of BOK is increasing every year. BOK able to collect Rs.774.16 in fiscal year 2060-61, Rs. 894.27 in 2061-62,

Rs.1,048.53 in 2062-63, Rs. 1,238.92 in 2063-64 and Rs.1,583.371 in 2064-65. Pie Chart Showing Different Years Deposits of BOK In Different Account Amount in Crores

Figure No. 2.1

Otheres, 13.96 Cureent, 244.85 Saving 287.38

Fixed, 227.97

2060-61 Depsoit

Figure No. 2.2

Others, 35.46 Current, 246.47 Fixed, 287.89 Saving, 324.5

2061-62 Deposit

Figure No. 2.3

Others, 27.26 Current, 292.11 Saving, 458.19

Fixed, 270.97

2062-63 Deposit

Figure No. 2.4

Others, 19.63 Current, 362.82 Saving, 552.73

Fixed, 303.71

2063-64 Deposit

10

Figure No. 2.5

Others, 24.39 Current, 529.04 Saving, 659.62

2064-65 Deposit

This pie chart shows that most part of BOK deposits comes from saving, fixed and current account respectively. In current account, the bank does not bear any interest. Weather as bank should pay interest on saving and fixed account. Interest rate of fixed account is higher that saving account.

2.2

Studies of BOK Lending

BOK has made sustained efforts to devise customer oriented lending services. A variety of financing options, suiting diversified customer needs, has been introduced. Its schemes satisfy both the short and long-term funding requirements of our customers. Furthermore, lending terms are positioned in such a way that customers enjoy the most competitive terms. BOK facilities following different loan schemes to its different customers: i. Corporate and Business Loans Term Loan Overdraft/Working Capital Loan Demand/Short-Term Loan Trust Receipt/Importers Loan

11

Export Loan Small and Medium Business Financing Consortium Financing Loan Against Fixed Deposit ii. Consumer Loans Vehicle Finance Educational Loan Housing Loan BOK successfully utilized its deposit by providing good loans. From the following table we can see utilization of BOK fund.

Table No. 2.2 Table Showing Different Yeas Loan & Advance, Deposit and

Capita

Rs. in Lakh

Title

Capita Deposit Loans & Advances Fixed Property (Net)

2060-61 4,640

7,7420

2061-62 4,640

8,9430

2062-63 4,640 104,580 74,890 1,110

2063-64 6,030

2064-65 6,030

123,890 158,340 96,940 127,480 3,210 3,870

60,880 840

61,820 950

Sources :14th annual report (2064-65) of BOK

12

Figure No. 2.6

Graph Showing Different years Capital, Deposit and Loans & Advance

160,000

(Rs. in Lakh)

140,000 120,000

Amount in Rs.

100,000 Capital 80,000 60,000 40,000 20,000 0 2060-61 2061-62 2062-63 2063-64 2064-65 Deposit Loans & Advance Fixed Propety (Net)

Fiscal years

Sources : 14th annual report (2064-65) of BOK Above graph and chart show that deposits and loan of BOK increasing year by year. With few capital and assets, the company able to collects and invest the large amount. In the fiscal year 2060-61 the firm capital, deposit, loans & advance, fixed assets was only Rs. 4,640, Rs.77,420, Rs. 60,880, and Rs. 840 lakh respectively. With excellent managing of lending and borrowing of BOK firm able to made Rs. 6,030 lakh capital, 158,340 lakh deposit, 127,480 lakh fixed assets and Rs. 3,870 lakh fixed assets. It is very hard to achieve that figure.

13

2.3

Study of Different Years Income, Expenses and Profits The customers of Bank of Kathmandu (BOK) are increasing day by day due to its proper services and good customers cares. Satisfied customers are the main reason of BOK good performance. Good lending and borrowing policy of BOK is able to earning profit every year. The profits of last five year are shown below:

Table No. 2.3 Table Showing Different Fiscal Years Incomes and Expenses (Rs. in Lakh)

Title

2060-61

2061-62

2062-63

2063-64

2064-65

Operating Income Operating Expenses Operating profit Net Profit After Tax

4,400

5,140

5,770

6,770

8,630

1,340

1,540

1,770

2,080

2,610

3,060

3,600

4,000

4,690

6,020

1,280

1,400

2,020

2,620

3,616

Sources: 14th annual report (2064-65) of BOK

14

Figure No. 2.7

Graph Showing Different Years Income, Expenses and Profit

9,000 8,000 7,000 6,000

Rs. in Lakh

8,630

6,770 5,770 5,140 6,020

5,000 4,000

4,400 4,000 3,600 3,060

4,690

3,616 2,620 1,770 2,020 2,080 2,610

3,000 2,000 1,000 0 2060-61 Operating Income 2061-62 2062-63 1,540 1,400

1,340 1,280

2063-64

2064-65 Net Income After Tax

Oprerating Expences

Operating Profit

Sources : 14th annual report (2064-65) of BOK

The given table and graph dhows that the company is able to maintain high operating profit and net income maintain low expenses. In the given all five fiscal years company able to earn profit. It is good sign.

15

2.4

Financial Ratio Analysis of 2064-65 Financial Statement Table No. 2.4

Table Showing Fiscal Year 2064-65 Balance Sheet Balance Sheet As at Ashard 2065 Capital and Liabilities

1. 2. 3. 4. 5. 6. 7. 8. 9. Share Capital Reserve and Surplus Debenture and Bonds Borrowings Deposits Bills Payables Proposed and Dividend Payables Income Tax Liabilities Other Liabilities

Amount Rs.

603,141,300 738,932,488 200,000,000 100,000,000 15,833,737,799 51,576,245 32,804,204 161,733,151

Total Capital and Liabilities

17,721,925,187

536,747,143 606,049,072 297,670,728 72,679,836 3,204,067,718 12,462,637,541 387,274,153 452,978 154,346,018

Assets

1. Cash Balance 2. Balance with Nepal Rastra Bank 3. Balance with Banks/Financial Institutions 4. Money at Call and Short Notice 5. Investments 6. Loans, Advances and Bills Purchase 7. Fixed Assets 8. Non Banking Assets 9. Other Assets

Total Assets

17,721,925,187

Sources : 14th annual report (2064-65) of BOK

16

Table No. 2.5 Table Showing Income Statement of Fiscal Year 2064-65

Income Statement As on 31st Ashard 2065 Particulars

1. Interest Income 2. Interest Expenses Net Interest Income 3. Commission and Discount 4. Other Operating Income 5. Exchange Gain Total Operating Income 6. Employees Expenses 7. Other Operating Expenses 8. Exchange Loss Operating Profit before provision for possible losses 9 Provision for Possible Losses Operating Profit 10. Non Operating Income /(Loss) 11. Provision Written Back Profit from Ordinary Activities 12. Profit/(Loss) from extra-ordinary Activities Net profit after incorporating all Activities 13. Provision for Staff Bonus 14. Income Tax Expenses Current Tax Deferred Tax Previous Years Additional Tax Net Profit/(Loss )

Amount Rs.

1,034,157,874 417,543,432 616,614,442 129,415,582 23,167,724 93,765,039 862,962,787 90,601,920 170,480,908 601,879,959 38,438,498 563,441,461 810,748 61,832,950 626,085,159 (45,396,284) 580,688,875 52,789,898 166,402,098 162,535,369 3,866,729 361,496,879

Sources: 14th annual report (2064-65) of BOK

17

a. Leverage Ratio Leverage ratio reflects the extent to which the banks depend on debt in its capital structure. Financial leverage is the magnification of risk and return introduced through the user of fixed cost financing such as debt and preferred stock. In order to know the long-term financing position, leverage ratios are calculated. These ratios also called capital structure ratios. These ratios will indicate the proportion of debt and equity in the capital structure of bank. There are following important measures of leverage ratios. i. Total Debt to Total Asset ratio: It measures relationship between total debts and total assets. Debt to total asset ratio measures the proportion of total assets financed by the debt. This ratio is calculated as follows:

= 91.298% Where, Total debt = Debenture and Bonds + Borrowings + Deposits +

Bills Payables + Other Liabilities = 200,000,000 + 100,000,000 + 15,833,737,799 + 51,576,245 + 161,733,151 = 161,179,851,399

A low debt to total capital ratio represents security to creditors in extending credit. On the contrary, a high ratio represents a greater risk to creditors as well as shareholders. BOK 2064-65 debt to total ratio is 91.298% , which is very high. Its means BOK operating at high risk. In this condition, BOK may face problems. If BOK wants to increase additional capital in its current capital structure, it may

18

face great difficulty to collect additional debt. By chance if it get additional debt, the cost of debt cold high. There is also advantage of high debt. The shareholders may enjoy high return per share. ii. Total Debt to Equity Ratio: This ratio shows the relationship between firms debt and equity financing. It measures the relative interest of the creditors and owners. Debt equity ratio, an important toll of financial analysis, depicts an arithmetical relation between debt fund and owners fund. This ratio calculated as follows:

Where, Equity = Share capital + Reserve and Surplus + Proposed and

Dividend Payables = 603,141,300 + 738,932,488 + 32,804,204

= A high total debt to equity ratio ratio is more risky tan low ratio. Higher ratio shows that more of the funds invested in the business are provided by the outsider. The lower ratio shows that more of the funds invested in the business are provided by owners. A higher debt to equity shows the large share of financing by creditors as compared to that of owners. It indicated the margin of safety to the owners. The creditors prefer low debt to equity ratio. A low debt to equity ratio implies large safety margin for creditors.

19

iii. Equity Multiplier: It measures rupees amount of assts for rupees of equity. The equity multiplier ratio is amount of assets for each amount of equity. It is relationship between total assets and equity. It is calculated as:

= 12.889 times Here, 12.889 times equity multiplier means BOK able to produce assets 12.889 times of its equity. Higher ratio, the more efficient the management on utilization of capital. iv. Total Assets Turnover Ratio: The total assets turnover ratio indicates the efficiency with which the firm uses its asset to generate income. The most important turnover ratio for commercial banks is the total turnover ratio. It can be calculated as follows:

b. Profitability Ratios Profitability is the result of commercial banks. There are five methods of measures of profitability, namely profit margin, net interest margin, interest spread, return on assets, and return on equity.

20

i.

Profit Margin:

Profit margin is percentage relation between net income and operating profit. A high ratio is an indication of the higher overall efficiency of business and better utilization of total resources. Poor financial planning and low efficiency is the indicator of lower ratio. It is calculated as,

Here, BOK earn 41.89% profit margin. It is high. It indicates high overall efficiency of the business and better utilization of total resources. ii. Net Interest Margin:

Net interest margin measures the profitability of commercial banks. It is another most popular tools of profitability measurement. It can be calculated as follows:

Where, Interest earning assets = Balance in banks/financial institutions + Money at call & short notes + Investment + Loans, advance & Bills payable

21

= 297,670,726 + 72,679,832 +12,462,637,541 = 16,037,055,820

3,204,067,718

Here, the net interest margin of BOK is 3.865% ,which is very high. It indicates effectively utilization of fund. iii. Return on Assets (ROA):

This is the measurement of relationship between net income and total assets. The ratio of net income to total assets measures the return on total assets. It is calculated as,

This ratio measures the profitability of all financial resources invested in the firms assets. Hence, the higher ratio implies that available source and tools are efficiently.

iv.

Return on Equity:

This ratio shows the relation between the net profit after tax and shareholders fund. It is calculated as,

This ratio indicates how well the firm has used the resources contributed by the owners. It is good for the firm to be return on investment high.

22

Higher ratio, the more efficient the management and utilization of shareholders fund. Here return on equity is 26.90% . It is higher than market average return. It is result of efficient management.

2.5

Analysis of BOKs Different Years Major Financial Indicators Table No. 2.6

Table Showing Different Years Financial Indicators Title

Net Profit Margin Operating income/ Operating expenses

2060-61 29.09% 30.45% 19.60% 1.34% 84 8

2061-62 27.24% 29.96% 19.40% 1.42% 95 9

2062-63 35.01% 30.08% 24.10% 1.65% 111 11

2063-64 38.70% 30.72% 26.38% 1.80% 321 16

2064-65 41.83% 30.24% 26.90% 2.04% 387 23

Return on Equity Return on Assets Permanent Employees Branches

Sources : 14th annual report (2064-65) of BOK

This different Years financial indicator shows overall performance of BOK. The net profit margin of BOK every year increasing without year 2061-62. BOK able to achieve high returns 41.83% in fiscal year 2064-65. Operating income to expenses ratio over the five-year period was constant to the average 30%. Return on assets also increasing year by year. BOK higher return on assets was 2.04% in year 2064-65. With efficient managing BOK, successfully achieve return on equity more than average market return. It earns 19.60% in 2060-61,

23

19.40% in 2061-62, 24.10% in 262-63, 26.38% in 2063-64, and 26.90% in 2064-65. BOK rapidly increases their branches every year. End of fiscal year 2064-65 it was successfully operating 23 branches. Due to the increases in branches and services, it also is increasing their staff. Overall, the financial indicator of BOK shows the excellent performance.

24

CHAPTER 4

SUMMARY AND CONCLUSIONS 3.1 Summary Bank of Kathmandu Limited (BOK) is today a landmark in the Nepalese commercial banking sector, as it is managed entirely by Nepalese professionals and now has the largest public shareholding. BOK started its operation in March 1995 with the objective of stimulating the Nepalese economy and taking it to new heights. BOK aims to add to the nations economy and become globally competitive. BOK understands that peoples financial needs vary, so efforts are made to reach out to as many customers as possible in as many ways as it can. This is reflected in the portfolio of services available to our customers each specific service, with its unique features, is designed to satisfy a particular requirement. Ultimately, it helps our customers in many ways from ordinary day-to-day needs to complex life-changing decisions. Every way is a step closer to an easier, happier life . BOK has various personalized products and services that harmonize with the various banking requirements of our customers. Offering an array of features, BOKs deposit base comprises of depositors ranging from the general public to business houses, NGOs, INGOs, diplomatic agencies and institutional depositors. BOKs tailor-made deposit facilities truly meet our customers needs in todays fast-paced business world. They enable easy access to modern banking services, ensure attractive returns for surplus funds, and make personal banking convenient and efficient to suit everyones investment plans. BOK has made sustained efforts to devise customer oriented lending services. A variety of financing options, suiting diversified customer needs, has been introduced. Our schemes satisfy both the short and longterm funding requirements of our customers. Furthermore, lending terms are positioned in such a way that customers enjoy the most competitive terms.

25

3.2 Conclusions: The field report on Financial Ratio Analysis of BOK has provided me practical knowledge of commercial banks activities. As far as possible, I did my best to collect the accurate data of BOK. I could not find out data, annual report, any useful documents of past fiscal year in BOK. Some past years data were collect from previous fieldwork and most data were collected from BOK website. From the study and analysis of its, financial performance following conclusions are drawn: i. ii. BOK collects the deposit by offering different account. Most part of its deposits comes from saving, current and fixed account. BOK has made sustained efforts to devise customer oriented lending services. A variety of financing options, suiting diversified customer needs, has been introduced. Its schemes satisfy both the short and long-term funding requirements of our customers. BOK net operating income is increasing every year. It is good sign. BOK 2064-65 debt to equity ratio is 91.298%, which is too high. It means it may bring many problems. BOK equity multiplier of 2064-65 is 12.889 times which is excellent. Profit margin of BOK is increasing every year. Ti indicates high overall efficiency of the business and better utilization o total assets. The main area of BOK investment is loan & advance, government bonds and securities, deposit in other bank/financial institutes, common stock and bonds of different companies.

iii. iv. v. vi. vii.

viii. The lending facility in priority and deprived sector like agriculture, metal products, manufacturing machinery & electronics, auto parts and installation, other miscellaneous sectors, which is essential to generate public, is very low in comparison to other sector.

26

3.3 Suggestion and Recommendations:

From the study of Financial Ratio Analysis of BOK, following suggestions and recommendations regarding BOK can be made. i. BOK should increase its services and lending to priority and deprived sectors. Being a commercial bank, it should not only be profit motive. Lending on such sectors increases the economic condition of the general public. BOK 2064-65 debt to total ratio is 91.298%, which is very high. Its means BOK operating at high risk. In this condition, BOK may face credit problems. BOK should decrease its debt amount i.e. Decrease in debt to assets ratio should be made. Debt to equity ratio of BOK is 11.768 times which is very. High debt to equity ratio creates insecurity to both owners and creditors. It also creates high risk. Therefore, BOK should decrease debt to equity ratio. BOK return on equity of 2064-65 is 26.90%. It is higher than market average rate of return. It is better to reinvest the large part of profit into firm rather than distributed to shareholders. It maximizes the shareholders wealth. Large population of Nepal lives in rural area. They are away from banking services. BOK should open new branches in that area. Time to time, BOK should provide research and training facilities to its staff which increase the knowledge, experience, quality and efficiency. Experienced and well-trained staffs are the most important assets of any organization. Decision regarding loan grating should be decentralized. By it credit or loan manger can do his job smoothly and efficiency. Loan manager may be familiar with new systems and ideas regarding loan grating, which he he can implement efficiency and effectively.

ii.

iii.

iv.

v. vi.

vii.

27

BIBLIOGRAPHY Agrwal, Govind Ram (2007), Project Management in Nepal, M.k. Publishers and Distributors, Botahity, Kathmandu Cheney, John M., and Moses Edward A., Fundamentals of Investment, West Publishing Company, St. Paul Dangol, Ratna Man (2006), Accounting for Financial Analysis and Planning, Taleju Prakashan, Kathmandu Ghimire, Tirth Raj (2005), Fundamental of Financial Management, Asmita Publishers, and Distributors, Kathmandu Joshi, Padam Raj (2007), Fundamentals of Financial Management, Asmita Publishers, and distributors, Kathmandu Ninth Annual Report (2007/08) of NLIC Shrestha, Manohar K. and Dipak Bahadur Bhadari (2004), Financial Market and Distributors, Kathmandu

www.boknepal.com.np www.worldbanking.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Baisakh JesthaDocument1 pageBaisakh JesthaKushalGhimireNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Payment DetailDocument1 pagePayment DetailNiraj DahalNo ratings yet

- Payment DetailDocument1 pagePayment DetailNiraj DahalNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Sunrise Bank Calendar 2077 - April 2 - Final PDFDocument14 pagesSunrise Bank Calendar 2077 - April 2 - Final PDFPradeep BhattaraiNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- 14 Stone GraftingDocument9 pages14 Stone GraftingswordfinNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Y5098e PDFDocument184 pagesY5098e PDFkingNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- CoverDocument1 pageCoverNiraj DahalNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Livestock Management ?Document9 pagesLivestock Management ?adnhasNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Rent Agreement in NepaliDocument1 pageRent Agreement in NepaliNiraj Dahal60% (5)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- TV List of NepalDocument2 pagesTV List of NepalNiraj DahalNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- NepalDocument1 pageNepalNiraj DahalNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Nishan ExpeDocument1 pageNishan ExpeNiraj DahalNo ratings yet

- Avishekh Idbi ProjectDocument43 pagesAvishekh Idbi ProjectzishanmallickNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Test Bank For Auditing An InternationalDocument17 pagesTest Bank For Auditing An Internationalnevilalopariyahoo.comNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- 5 3 NotesDocument7 pages5 3 Notesapi-301176378No ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Acknowledgement (Tanzil Khan - 14-97982-2)Document3 pagesAcknowledgement (Tanzil Khan - 14-97982-2)Md. Saiful IslamNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Machinery Breakdown PolicyDocument7 pagesMachinery Breakdown PolicyDikshit KapilaNo ratings yet

- Actuarial Mathematics For Life Contingent RisksDocument7 pagesActuarial Mathematics For Life Contingent RisksIda Khairina KamaruddinNo ratings yet

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDocument5 pagesMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiNo ratings yet

- Account Opening-Board ResolutionDocument3 pagesAccount Opening-Board ResolutionAbubakar ShabbirNo ratings yet

- Marine GlossaryDocument10 pagesMarine GlossaryJoe BurgessNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Jose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiDocument7 pagesJose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiTrem GallenteNo ratings yet

- San Diego County Sheriff's Detention Service Policy and Procedure ManualDocument640 pagesSan Diego County Sheriff's Detention Service Policy and Procedure Manualsilverbull8No ratings yet

- Indus Motor Company Limited List of Shareholders As of 30-06-2021Document440 pagesIndus Motor Company Limited List of Shareholders As of 30-06-2021Hamza AsifNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- List of Bank in KarnatakaDocument43 pagesList of Bank in KarnatakaGunjanNo ratings yet

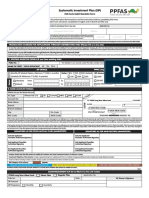

- Ppfas Sip FormDocument2 pagesPpfas Sip FormAmol ChikhalkarNo ratings yet

- FAKE Atm RECEIPT TEMPLATEDocument2 pagesFAKE Atm RECEIPT TEMPLATEDrop That Beat50% (2)

- Personal Accident Insurance - POLMBKBA82EFIJBDocument3 pagesPersonal Accident Insurance - POLMBKBA82EFIJBGiridharan VenkateshNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- 213 Keppel Cebu Vs Pioneer InsuranceDocument3 pages213 Keppel Cebu Vs Pioneer InsuranceHarry Dave Ocampo PagaoaNo ratings yet

- How To Fill The Foreign Inward Remittance FormDocument3 pagesHow To Fill The Foreign Inward Remittance FormSubrata DasNo ratings yet

- Car InsuranceDocument13 pagesCar InsuranceDipayan SatpathyNo ratings yet

- Fee Decleration FormDocument2 pagesFee Decleration FormMohit MohanNo ratings yet

- Specialized Marine DiplomaDocument3 pagesSpecialized Marine DiplomaAnkur PatilNo ratings yet

- IC 34 New - Q&A Module NewDocument25 pagesIC 34 New - Q&A Module NewAmanjit Singh100% (1)

- Kel 6 - Creve Couer Pizza IncDocument3 pagesKel 6 - Creve Couer Pizza IncTiara PradaniNo ratings yet

- OPM Part - B Volume - 1 ENGDocument42 pagesOPM Part - B Volume - 1 ENGkiflesemusimaNo ratings yet

- IFIC Final VIVA PrepDocument2 pagesIFIC Final VIVA PrepAbir Riyad50% (2)

- NEW Memorandum of LawDocument16 pagesNEW Memorandum of LawJohn Foster100% (3)

- Level 3 Integrated Advisory ServicesDocument1 pageLevel 3 Integrated Advisory ServicesAce RamosoNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Estate and Gift Tax Exam OutlineDocument55 pagesEstate and Gift Tax Exam OutlinejendiiNo ratings yet

- Financial Control of Public FundsDocument136 pagesFinancial Control of Public FundsDavid Abbam AdjeiNo ratings yet

- BUSANA1 Chapter 4: Sinking FundDocument17 pagesBUSANA1 Chapter 4: Sinking Fund7 bitNo ratings yet