Professional Documents

Culture Documents

Results Tracker: Tuesday, 15 Nov 2011

Uploaded by

Mansukh Investment & Trading SolutionsOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Results Tracker: Tuesday, 15 Nov 2011

Uploaded by

Mansukh Investment & Trading SolutionsCopyright:

Available Formats

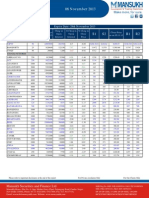

Results Tracker

Tuesday, 15 Nov 2011

make more, for sure.

Q2FY12

Results to be Declared on 15th Nov 2011

COMPANIES NAME

Abhishek Corp

AJEL

Garware Marn

Gennex Lab

Kilburn Office

Kinetic Motor

Pasupati Acry

Permanent Mag

Sonal Adhsv

Sparc Systems

AUNDE IND

Best & Crompton

Bhatinda Chem

Ceenik Expo

Chemcel Bio

Classic Elect

Gloster

Gokul Refoils

Gopal Iron

Graphic Charts

Gujarat Tool

HB Leasing

Laffans Petro

Lippi Systems

LN Polyesters

LOHIA SECURI

Longview Tea

Luminaire Tech

PRESHA MET

Prime Sec

Prudential Sug

Raja Bahadur Intl

Riga Sugar

Ritesh Intl

SPL Inds

SV Electricals

Swan Energy

SYNCOM HEAL

Systematix Sec

Tech Mahindra

Continental Contr

Cura Tech

Cybermate Info

Daikaffil Chem

Dhanus Tech

DJS Stock

Highland Inds

Hindustan Appl

ICSA India

IFL Promoters

ITDC

Jagson Airlines

Madhav Marbles

Matra Rlty

Mediaone Global

MGF

Morgan Ventures

MPS

Ritesh Prop

Rollatainers

Rotam Comm

SAH Petroleums

Sampada Chem

Samtel Color

Transgene Bio

Twilight Litaka

Usher Agro

Vaghani Tech

Vallabh Steel

Vardhman Inds

Dynacons Sys

Elder Health

Elpro Intl

Ester Inds

Fair Deal

Faze Three

First Winner

Jayabharat Cred

Karuturi Glob

KDL Biotech

KGN Inds

Khatau Exim

Khator Fibre

Kilburn Chem

MVL

Navcom Inds

NEWINFRA

Nikhil Adhsv

Niraj Cement

Omnitex Inds

ORG Informatics

Samtex Fashions

Satyam Silk

Scindia Steam

Shakti Press

Shikhar Leas

Shirpur Gold

Shree Bhawani

Victoria Mills

Volant Textile

VR Woodart

VSF Proj

Woodsvilla

Zenith Comp

Zenith Info

Results Announced on 14th Nov 2011 (Rs Million)

Mahindra & Mahindra

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

73606.2

2564.6

11304.7

298.3

11006.4

1257.1

9749.3

2375.5

0

7373.8

54343.6

2246.3

11196

158.1

11037.9

970

10067.9

2483

0

7584.9

Equity

PBIDTM(%)

2939.7

14.19

2852.2

18.79

% Var

35.45

Year ended

201109

201009

14.17

0.97

88.68

-0.29

29.6

-3.16

-4.33

0

-2.78

140941.6

3087

20800.5

552

20248.5

2355.9

17892.6

4470

0

13422.6

105944.6

2870.3

19575.8

350.3

19225.5

1946.2

17279.3

4070.5

0

13208.8

3.07

-24.5

2939.7

14.76

2852.2

18.48

% Var

33.03

201103

201003

7.55

6.26

57.58

5.32

21.05

3.55

9.81

0

1.62

234937.2

4306.7

38868.5

708.6

39334.7

4138.6

35196.1

8575.1

0

26621

186021.1

3283.9

32836.3

1568.5

32175.3

3707.8

28467.5

7590

0

20877.5

3.07

-20.13

2936.2

15.19

2829.5

16.1

% Var

26.3

31.15

18.37

-54.82

22.25

11.62

23.64

12.98

0

27.51

3.77

-5.64

The sales for the September 2011 quarter moved up 35.45% to Rs. 73606.20 millions as compared to Rs. 54343.60 millions during the

corresponding quarter last year.Net profit declined -2.78% to Rs. 7373.80 millions from Rs. 7584.90 millions.Operating Profit saw a

handsome growth to 11304.70 millions from 11196.00 millions in the quarter ended September 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

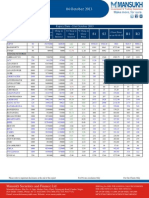

Results Tracker

Q2FY12

make more, for sure.

Rs Crore

Cipla

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

1731.83

1579.88

10

OPM %

25.27

23.2

PBDT

459.54

382.92

20

PBT

393.92

319.01

23

NP

308.97

263.01

17

Net profit of Cipla rose 17.47% to Rs 308.97 crore in the quarter ended September 2011 as against Rs 263.01 crore during the previous

quarter ended September 2010. Sales rose 9.62% to Rs 1731.83 crore in the quarter ended September 2011 as against Rs 1579.88 crore

during the previous quarter ended September 2010.

Jaiprakash Power Ventures

Particulars

Sales

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

649.73

246.99

163

OPM %

96.87

98.91

-2

PBDT

409.31

132.54

209

PBT

350.92

108.64

223

NP

280.65

86.98

223

Net profit of Jaiprakash Power Ventures rose 222.66% to Rs 280.65 crore in the quarter ended September 2011 as against Rs 86.98 crore

during the previous quarter ended September 2010. Sales rose 163.06% to Rs 649.73 crore in the quarter ended September 2011 as against

Rs 246.99 crore during the previous quarter ended September 2010.

Surya Pharmaceutical

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

470.16

396.65

19

OPM %

17.37

15.37

13

PBDT

29.87

39.67

-25

PBT

21.18

32.15

-34

NP

21.18

25.74

-18

Net profit of Surya Pharmaceutical declined 17.72% to Rs 21.18 crore in the quarter ended September 2011 as against Rs 25.74 crore

during the previous quarter ended September 2010. Sales rose 18.53% to Rs 470.16 crore in the quarter ended September 2011 as against

Rs 396.65 crore during the previous quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Adani Enterprises

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

1615.46

645.1

150

OPM %

1.95

-1.37

242

PBDT

67.81

200.49

-66

PBT

63.56

197.87

-68

NP

46.02

124.93

-63

Net profit of Adani Enterprises declined 63.16% to Rs 46.02 crore in the quarter ended September 2011 as against Rs 124.93 crore during

the previous quarter ended September 2010. Sales rose 150.42% to Rs 1615.46 crore in the quarter ended September 2011 as against Rs

645.10 crore during the previous quarter ended September 2010.

Oil India

Particulars

Sales

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

3270.27

2372.38

38

OPM %

52.2

58.91

-11

PBDT

2302.02

1562.66

47

PBT

1711.93

1380.19

24

NP

1138.52

916.03

24

Net profit of Oil India rose 24.29% to Rs 1138.52 crore in the quarter ended September 2011 as against Rs 916.03 crore during the previous

quarter ended September 2010. Sales rose 37.85% to Rs 3270.27 crore in the quarter ended September 2011 as against Rs 2372.38 crore

during the previous quarter ended September 2010.

Vakrangee Softwares

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

312.1

185.29

68

OPM %

16.69

16.5

PBDT

41.65

26.86

55

PBT

23.29

14.36

62

NP

16.17

10.87

49

Net profit of Vakrangee Softwares rose 48.76% to Rs 16.17 crore in the quarter ended September 2011 as against Rs 10.87 crore during the

previous quarter ended September 2010. Sales rose 68.44% to Rs 312.10 crore in the quarter ended September 2011 as against Rs 185.29

crore during the previous quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Dhampur Sugar Mills

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

394.67

428.35

-8

OPM %

10.98

-11.89

192

PBDT

15.61

-73.33

LP

PBT

4.39

-85.88

LP

NP

3.08

-73.46

LP

Dhampur Sugar Mills reported net profit of Rs 3.08 crore in the quarter ended September 2011 as against net loss of Rs 73.46 crore during

the previous quarter ended September 2010. Sales declined 7.86% to Rs 394.67 crore in the quarter ended September 2011 as against Rs

428.35 crore during the previous quarter ended September 2010.

Particulars Quarter Ended

Graphite India

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

461.56

323.86

43

OPM %

16.38

26.08

-37

PBDT

74.21

97.26

-24

PBT

64.32

87.42

-26

NP

41.88

49.19

-15

Net profit of Graphite India declined 14.86% to Rs 41.88 crore in the quarter ended September 2011 as against Rs 49.19 crore during the

previous quarter ended September 2010. Sales rose 42.52% to Rs 461.56 crore in the quarter ended September 2011 as against Rs 323.86

crore during the previous quarter ended September 2010.

Amara Raja Batteries

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

558.66

390.98

43

OPM %

15.78

14.22

11

PBDT

88.5

57.71

53

PBT

76.85

47.2

63

NP

51.85

31.6

64

Net profit of Amara Raja Batteries rose 64.08% to Rs 51.85 crore in the quarter ended September 2011 as against Rs 31.60 crore during the

previous quarter ended September 2010. Sales rose 42.89% to Rs 558.66 crore in the quarter ended September 2011 as against Rs 390.98

crore during the previous quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Fortis Healthcare (India)

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

68.18

62.55

OPM %

-9.21

7.31

-226

PBDT

-18.28

40.36

PL

PBT

-21.29

37.62

PL

NP

-21.29

37.62

PL

Fortis Healthcare (India) reported net loss of Rs 21.29 crore in the quarter ended September 2011 as against net profit of Rs 37.62 crore

during the previous quarter ended September 2010. Sales rose 9.00% to Rs 68.18 crore in the quarter ended September 2011 as against Rs

62.55 crore during the previous quarter ended September 2010.

Shipping Corporation of India

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

906.84

876.44

OPM %

10.82

25.05

-57

PBDT

3.4

251.88

-99

PBT

-141.73

148.63

PL

NP

-140.6

250.63

PL

Shipping Corporation of India reported net loss of Rs 140.60 crore in the quarter ended September 2011 as against net profit of Rs 250.63

crore during the previous quarter ended September 2010. Sales rose 3.47% to Rs 906.84 crore in the quarter ended September 2011 as

against Rs 876.44 crore during the previous quarter ended September 2010.

Shree Ganesh Jewellery

Particulars

Quarter Ended

Sep. 2011

Sep. 2010

% Var.

Sales

1482.48

1792.14

-17

OPM %

5.18

5.53

-6

PBDT

52.27

85.11

-39

PBT

46.15

84.36

-45

NP

42.62

84.21

-49

Net profit of Shree Ganesh Jewellery House declined 49.39% to Rs 42.62 crore in the quarter ended September 2011 as against Rs 84.21

crore during the previous quarter ended September 2010. Sales declined 17.28% to Rs 1482.48 crore in the quarter ended September 2011

as against Rs 1792.14 crore during the previous quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Rs Million

Rajesh Exports

Quarter ended

Year to Date

Year ended

Sales

201109

57670.32

201009

50395.93

% Var

14.43

201109

104979.45

201009

93230.32

% Var

12.6

201103

208456.79

201003

185113.54

% Var

12.61

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0.87

1571.87

495.7

1076.17

5.39

1070.78

0

0

1070.78

0.17

1186.12

435.34

750.78

13.36

737.42

0

0

737.42

411.76

32.52

13.87

43.34

-59.66

45.21

0

0

45.21

66.3

2948.39

915.83

2032.56

10.55

2022.01

0

0

2022.01

0.33

1973.15

743.93

1229.22

17.79

1211.43

0

0

1211.43

19990.91

49.43

23.11

65.35

-40.7

66.91

0

0

66.91

187.02

4330.04

1622.91

2707.13

19.56

2687.57

207.99

0

2479.58

180.94

3010.24

919.97

2090.27

17.8

2072.47

138.36

0

1934.11

3.36

43.84

76.41

29.51

9.89

29.68

50.33

0

28.2

Equity

PBIDTM(%)

295.26

2.73

283.49

2.35

4.15

15.81

295.76

2.81

283.49

2.12

4.33

32.7

295.26

2.08

265.82

1.63

11.08

27.73

The September 2011 quarter revenue stood at Rs. 57670.32 millions, up 14.43% as compared to Rs. 50395.93 millions during the

corresponding quarter last year.A good growth in profit of 45.21% reported to Rs. 1070.78 millions over Rs. 737.42 millions of

corresponding previous quarter.Operating profit for the quarter ended September 2011 rose to 1571.87 millions as compared to 1186.12

millions of corresponding quarter ended September 2010.

Bhushan Steel

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

24653.6

33.4

7244.1

3019.5

4224.6

1513.4

2711.2

642.4

0

2068.8

17189.1

116

5008.7

1005.5

4003.2

531

3472.2

882

0

2590.2

Equity

PBIDTM(%)

424.7

27.1

424.7

26.95

% Var

43.43

Year ended

201109

201009

-71.21

44.63

200.3

5.53

185.01

-21.92

-27.17

0

-20.13

46971.4

108.7

13929.8

5176.5

8753.3

3022.3

5731

1562.6

0

4168.4

30915.6

172.3

9143.9

1793.2

7350.7

1065.4

6285.3

1637.7

0

4647.6

0

0.56

424.7

29.66

424.7

29.58

% Var

51.93

201103

201003

-36.91

52.34

188.67

19.08

183.68

-8.82

-4.59

0

-10.31

70004.6

695.2

20999.1

4464.1

16535

2778.5

13756.5

3705.6

0

10050.9

56403.5

1177.8

15705.2

2100.1

13605.1

2091.4

11513.7

3055.7

832.2

8458

0

0.27

424.7

27.72

424.7

26.16

% Var

24.11

-40.97

33.71

112.57

21.54

32.85

19.48

21.27

-100

18.83

0

5.94

The sales for the September 2011 quarter moved up 43.43% to Rs. 24653.60 millions as compared to Rs. 17189.10 millions during the

corresponding quarter last year.The Net proft of the company remain more or less same to Rs. 2068.80 millions from Rs. 2590.20 millions

,decline by -20.13%.OP of the company witnessed a marginal growth to 7244.10 millions from 5008.70 millions in the same quarter last

year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

IL&FS Engg. & Const.

Quarter ended

Year to Date

201109

201009

Sales

2539.6

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

77.02

193.26

273.09

-134.08

156.08

-290.16

89.12

0

-379.28

Year ended

201109

201009

1864.94

% Var

36.18

201103

201003

3672.13

% Var

38.1

10681.67

9941.6

% Var

7.44

5071.35

18.25

-179.2

230.58

-369.35

158.62

-527.97

1.36

0

-529.33

322.03

-207.85

18.44

-63.7

-1.6

-45.04

6452.94

0

-28.35

147.96

428.19

505.51

-128.59

307.75

-436.34

89.12

0

-525.46

36.56

-267.4

484.99

-654.09

320.25

-974.33

1.36

0

-975.69

304.7

-260.13

4.23

-80.34

-3.9

-55.22

6452.94

0

-46.14

268.87

18.64

674.85

634.61

569.64

64.97

-60.69

0

125.66

116

-543.08

1412.94

-1561.21

836.73

-2397.94

0

0

-2397.94

131.78

-103.43

-52.24

-140.65

-31.92

-102.71

0

0

-105.24

Equity

773.7

743.1

4.12

773.7

743.1

4.12

773.7

588.51

31.47

-179.2

-215.95

-103.19

PBIDTM(%)

7.61

-9.61

8.44

-7.28

0.17

-5.46

The sales moved up 36.18% to Rs. 2539.60 millions for the September 2011 quarter as compared to Rs. 1864.94 millions during the yearago period.The Net Loss for the quarter ended September 2011 is Rs. -379.28 millions as compared to Net Loss of Rs. -529.33 millions of

corresponding quarter ended September 2010 Operating profit Margin for the quarter ended September 2011 improved to 193.26% as

compared to -179.20% of corresponding quarter ended September 2010.

Sobha Developers

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

3294

9

764

81

683

91

592

183

88

409

4308

5

976

109

867

69

798

209

-20

589

Equity

PBIDTM(%)

981

23.19

981

22.66

% Var

-23.54

Year ended

201109

201009

80

-21.72

-25.69

-21.22

31.88

-25.81

-12.44

-540

-30.56

6473

14

1392

182

1210

165

1045

327

194

718

7429

15

1583

214

1369

136

1233

301

-23

932

0

2.38

981

21.5

981

21.31

% Var

-12.87

201103

201003

-6.67

-12.07

-14.95

-11.61

21.32

-15.25

8.64

-943.48

-22.96

14561

66

3127

413

2714

278

2436

612

-22

1824

11140

45

2418

492

1926

323

1603

236

-21

1367

0

0.92

981

21.48

981

21.71

% Var

30.71

46.67

29.32

-16.06

40.91

-13.93

51.97

159.32

4.76

33.43

0

-1.06

The sales declined to Rs. 3294.00 millions for the September 2011 quarter as compared to Rs. 4308.00 millions during the corresponding

quarter last year.The Net Profit of the company slipped to Rs. 409.00 millions from Rs. 589.00 millions, a decline of -30.56% on QoQ

basis.The company reported a degrowth in operating Profit to 764.00 millions from 976.00 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

India Cements

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

10915.7

3.5

2548.2

895.2

1653

626.3

1026.7

329.6

163.1

697.1

8428.4

6.3

309.4

279.6

142.3

609.6

-467.3

-131

-131

-336.3

Equity

PBIDTM(%)

3071.8

23.34

3071.7

3.67

% Var

29.51

Year ended

201109

201009

-44.44

723.59

220.17

1061.63

2.74

-319.71

-351.6

-224.5

-307.29

21527.6

8.8

5014

1477.8

3499.8

1245

2254.8

537.4

119.7

1717.4

17256.3

270

1594.7

577.1

1014.6

1208.1

-193.5

-107

-107

-86.5

0

535.93

3071.8

23.29

3071.7

9.24

% Var

24.75

201103

201003

-96.74

214.42

156.07

244.94

3.05

-1265.27

-602.24

-211.87

-2085.43

35092.7

310.6

4732.9

1417.1

3339

2440.3

898.7

217.7

50

681

38054.5

28.1

8635.1

1426.4

7644.4

2331.2

5313.2

1769.8

136.6

3543.4

% Var

-7.78

1005.34

-45.19

-0.65

-56.32

4.68

-83.09

-87.7

-63.4

-80.78

0

152.03

3071.8

13.49

3071.7

22.69

0

-40.56

The sales figure stood at Rs. 10915.70 millions for the September 2011 quarter. The mentioned figure indicates a growth of about 29.51%

as compared to Rs. 8428.40 millions during the year-ago period.The Total Profit for the quarter ended September 2011 of Rs. 697.10

millions grew from Rs.-336.30 millionsOP of the company witnessed a marginal growth to 2548.20 millions from 309.40 millions in the

same quarter last year.

Gayatri Projects

Quarter ended

Year to Date

201109

201009

Sales

3216.45

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0.93

510.9

225.97

284.93

74.97

209.96

76.36

0

133.61

Equity

PBIDTM(%)

119.89

15.88

Year ended

201109

201009

2804.83

% Var

14.68

201103

201003

6230.82

% Var

16.05

14405.51

12524.86

% Var

15.02

7230.78

17.3

369.79

138.74

231.05

57.29

173.75

55.51

0

118.24

-94.62

38.16

62.87

23.32

30.86

20.84

37.56

0

13

23.69

1059.51

451.63

607.88

145.65

462.23

161.31

0

300.93

26.61

810.55

296.88

513.67

112

401.66

132.77

0

268.9

-10.97

30.71

52.13

18.34

30.04

15.08

21.5

0

11.91

56.42

2001.13

856.25

1144.88

227.33

917.55

293.41

0

624.14

42.05

1565.02

554.42

1010.6

200.57

810.03

276.54

0

533.49

34.17

27.87

54.44

13.29

13.34

13.27

6.1

0

16.99

113.92

13.18

5.24

20.48

119.89

14.65

113.92

13.01

5.24

12.64

119.89

13.89

111.05

12.5

7.96

11.17

The revenue for the September 2011 quarter is pegged at Rs. 3216.45 millions, about 14.68% up against Rs. 2804.83 millions recorded

during the year-ago period.The Company has registered profit of Rs. 133.61 millions for the quarter ended September 2011, a growth of

13.00% over Rs. 118.24 millions millions achieved in the corresponding quarter of last year.Operating profit surged to 510.90 millions

from the corresponding previous quarter of 369.79 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Gitanjali Gems

Quarter ended

Year to Date

Year ended

201109

201009

201009

201003

13580.77

37211.11

23558.15

% Var

57.95

201103

21057.79

% Var

55.06

201109

Sales

51224.72

33549.7

% Var

52.68

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

128.42

1268.15

334.56

933.59

9.18

924.42

71.38

-0.02

853.04

0.03

862.02

240.09

621.93

8.56

613.37

22.77

0.27

590.6

427966.67

47.11

39.35

50.11

7.24

50.71

213.48

-107.41

44.44

128.42

2293.31

633.53

1659.78

16.09

1643.7

89.3

0.4

1554.4

0.08

1650.1

491.05

1159.05

16.69

1142.35

40.52

0.52

1101.83

160425

38.98

29.02

43.2

-3.59

43.89

120.38

-23.08

41.07

7.98

3326.65

1003.44

2323.21

33.56

2289.65

43.62

-1.38

2246.03

1.71

2544.12

1011.14

1532.98

39.42

1493.56

72.64

0.95

1420.92

366.67

30.76

-0.76

51.55

-14.87

53.3

-39.95

-245.26

58.07

Equity

863.2

842.7

2.43

863.2

842.7

2.43

848.72

842.7

0.71

-5.12

-12.01

-14.36

PBIDTM(%)

6.02

6.35

6.16

7

6.49

7.58

The Turnover for the quarter ended September 2011 of Rs. 21057.79 millions increase by 55.06% from Rs. 13580.77 millions.An average

growth of 44.44% was recorded for the quarter ended September 2011 to Rs. 853.04 millions from Rs. 590.60 millions.Operating Profit

saw a handsome growth to 1268.15 millions from 862.02 millions in the quarter ended September 2011.

Unity Infraprojects

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

3896.55

32.76

658.74

313.85

344.89

50.67

294.22

88.27

0

205.95

3461.26

42.16

533.79

175.85

357.94

41.71

316.23

101

0

215.23

Equity

PBIDTM(%)

148.17

16.91

148.17

15.42

% Var

12.58

Year ended

201109

201009

-22.3

23.41

78.48

-3.65

21.48

-6.96

-12.6

0

-4.31

7656.87

89.78

1205.83

535.87

669.96

95.95

574.01

172.21

0

401.8

6859.16

77.37

1012.13

335.77

676.36

81.27

595.08

184.7

0

410.38

0

9.62

148.17

15.75

148.17

14.76

% Var

11.63

201103

201003

16.04

19.14

59.59

-0.95

18.06

-3.54

-6.76

0

-2.09

17015.24

173.04

2444.93

832.68

1612.25

179.93

1432.32

488.84

-1.88

943.48

14767.7

144.08

2057.19

583.87

1473.32

174.71

1298.61

447.29

-2.06

851.33

0

6.73

148.17

14.37

148.17

13.93

% Var

15.22

20.1

18.85

42.61

9.43

2.99

10.3

9.29

-8.74

10.82

0

3.15

The Revenue for the quarter ended September 2011 of Rs. 3896.55 millions grew by 12.58 % from Rs. 3461.26 millions.Net profit declined 4.31% to Rs. 205.95 millions from Rs. 215.23 millions.Operating profit surged to 658.74 millions from the corresponding previous quarter

of 533.79 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Prithvi Info Solns.

Quarter ended

Year to Date

Year ended

Sales

201109

2564.83

201009

3184.85

% Var

-19.47

201109

6041.85

201009

7180.98

% Var

-15.86

201103

15569.12

201003

19047.03

% Var

-18.26

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

60.34

145.25

65.71

79.54

26.12

53.4

4.71

0

48.69

-259.32

-179.64

63.11

-242.75

35.05

-277.79

0

0

-277.79

-123.27

-180.86

4.12

-132.77

-25.48

-119.22

0

0

-117.53

62.54

190.87

115.16

75.71

52.17

23.52

4.71

0

18.81

-187.59

-23.18

110.54

-133.87

59.88

-193.74

0

0

-193.74

-133.34

-923.43

4.18

-156.55

-12.88

-112.14

0

0

-109.71

206.15

132.61

225.37

252.33

88.1

164.23

76.33

0

87.9

53.16

363.49

214.34

133.73

68.24

65.49

11.03

0

54.46

287.79

-63.52

5.15

88.69

29.1

150.77

592.02

0

61.4

Equity

PBIDTM(%)

180.77

5.66

180.77

-5.64

0

-200.4

180.77

3.16

180.77

-0.32

0

-1078.66

180.8

0.85

180.8

1.91

0

-55.37

A decrease in the sales to Rs. 2564.83 millions was observed for the quarter ended September 2011. The sales stood at Rs. 3184.85 millions

during the similar quarter previous year.The Total Profit for the quarter ended September 2011 of Rs. 48.69 millions grew from Rs.-277.79

millions Operating profit Margin for the quarter ended September 2011 improved to 145.25% as compared to -179.64% of corresponding

quarter ended September 2010.

Balrampur Chini Mill

Quarter ended

Year to Date

201109

201009

Sales

5070.2

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

Equity

PBIDTM(%)

Year ended

201109

201009

5127.6

% Var

-1.12

201109

201009

10530.8

% Var

2.44

10788.2

5070.2

5127.6

% Var

-1.12

4.9

196.4

315.1

-118.7

275.7

-394.4

0

0

-394.4

3.7

-248.3

230.5

-478.8

292

-770.8

12.6

0

-783.4

32.43

-179.1

36.7

-75.21

-5.58

-48.83

0

0

-49.66

18.3

652.9

694.5

-41.6

551.4

-593

0

0

-593

6.1

395.3

478.3

-83

572.2

-655.2

16.9

0

-672.1

200

65.17

45.2

-49.88

-3.64

-9.49

0

0

-11.77

4.9

196.4

315.1

-118.7

275.7

-394.4

0

0

-394.4

3.7

-248.3

230.5

-478.8

292

-770.8

12.6

0

-783.4

32.43

-179.1

36.7

-75.21

-5.58

-48.83

0

0

-49.66

244.3

3.87

259.6

-4.84

-5.89

-179.99

246.8

6.05

259.6

3.75

-4.93

61.22

244.3

3.87

259.6

-4.84

-5.89

-179.99

Revenue showed a marginal decline at Rs. 5070.20 millions. For the quarter ended September 2011, as compared to corresponding quarter

of last year.The Net Loss for the quarter ended September 2011 is Rs. -394.40 millions as compared to Net Loss of Rs. -783.40 millions of

corresponding quarter ended September 2010 Operating profit Margin for the quarter ended September 2011 improved to 196.40% as

compared to -248.30% of corresponding quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Bilcare

Quarter ended

Year to Date

Year ended

201109

201009

201009

201003

1613.4

3612

3147.5

% Var

14.76

201103

1815.6

% Var

12.53

201109

Sales

6629

5644

% Var

17.45

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0

592.3

186.5

405.8

94.3

311.5

109.6

0

201.9

0

483.8

99.4

384.4

75.9

308.5

102.5

0

206

0

22.43

87.63

5.57

24.24

0.97

6.93

0

-1.99

0

1121.7

349.9

771.8

188.7

583.1

201.9

0

381.2

0

931.7

190.5

741.2

151.8

589.4

198

0

391.4

0

20.39

83.67

4.13

24.31

-1.07

1.97

0

-2.61

0

2003.8

448.4

1555.4

296.9

1258.5

388

0

870.5

0

1657.4

263.9

1393.5

264.7

1128.8

374.1

0

754.7

0

20.9

69.91

11.62

12.16

11.49

3.72

0

15.34

Equity

PBIDTM(%)

235.5

32.62

226.9

29.99

3.79

8.79

235.5

31.05

226.9

29.6

3.79

4.91

235.5

30.23

226.9

29.37

3.79

2.94

The September 2011 quarter revenue stood at Rs. 1815.60 millions, up 12.53% as compared to Rs. 1613.40 millions during the

corresponding quarter last year.The Net Profit of the company registered a slight decline of -1.99% to Rs. 201.90 millions from Rs. 206.00

millions.Operating profit for the quarter ended September 2011 rose to 592.30 millions as compared to 483.80 millions of corresponding

quarter ended September 2010.

Tanla Solutions

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

60.39

0.28

15.32

0

15.32

54.2

-38.87

-9.22

-9.22

-29.65

60.62

0.36

15.78

0

15.78

62.55

-46.77

-8.99

-8.99

-37.79

Equity

PBIDTM(%)

101.48

25.39

101.48

26.03

% Var

-0.38

Year ended

201109

201009

-22.22

-2.92

0

-2.92

-13.35

-16.89

2.56

2.56

-21.54

127.08

0.51

30.74

0

30.74

108.4

-77.65

-18.16

-9.22

-59.49

116.99

3.7

1.36

0

1.36

123.88

-122.52

-8.99

-8.99

-113.54

0

-2.48

101.48

24.19

101.48

1.16

% Var

8.62

201103

201003

-86.22

2160.29

0

2160.29

-12.5

-36.62

102

2.56

-47.6

287.05

5.34

59.88

0

59.88

312.17

-252.29

-73.79

-73.79

-178.49

510.55

66.84

176.17

0

176.17

181.5

-5.33

-37.98

-37.98

32.65

% Var

-43.78

-92.01

-66.01

0

-66.01

71.99

4633.4

94.29

94.29

-646.68

0

1980.82

101.48

20.86

101.48

34.51

0

-39.55

A slight decline in the revenue of Rs. 60.39 millions was seen for the September 2011 quarter as against Rs. 60.62 millions during year-ago

period.The Net Loss for the quarter ended September 2011 is Rs. -29.65 millions as compared to Net Loss of Rs. -37.79 millions of

corresponding quarter ended September 2010Operating Profit reported a sharp decline to 15.32 millions from 15.78 millions in the

corresponding previous quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Data Source : ACE Equity & Capital Line

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

You might also like

- Q2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionDocument5 pagesQ2FY12 Results Tracker 09 November 2011 - Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 - Results Tracker 28.10.11Document7 pagesQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 02 Nov 2011Document8 pagesResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 25 Oct 2011Document5 pagesResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 03 Nov 2011Document6 pagesResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 01 Nov 2011Document13 pagesResults Tracker: Tuesday, 01 Nov 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 19 Oct 2011Document6 pagesResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 18 Oct 2011Document4 pagesResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- AFS Agriculture Sector: by Ankit Chudawala-70 Jason Misquitta-88 Vikas Sarnobat-102 Mayur Sonawane-110 Swapnil Khot-120Document7 pagesAFS Agriculture Sector: by Ankit Chudawala-70 Jason Misquitta-88 Vikas Sarnobat-102 Mayur Sonawane-110 Swapnil Khot-120Mayur SonawaneNo ratings yet

- Results Tracker: Thursday, 20 Oct 2011Document6 pagesResults Tracker: Thursday, 20 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 21 Oct 2011Document8 pagesResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Thursday, 26 July 2012Document7 pagesResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Wednesday, 08 Aug 2012Document4 pagesResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 22.10.11Document14 pagesResults Tracker 22.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 14 July 2012Document4 pagesResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 18 August 2011Document3 pagesResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Friday, 20 July 2012Document7 pagesResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- FY 2069-70 Ten Month14Document5 pagesFY 2069-70 Ten Month14Roshan ManandharNo ratings yet

- Results Tracker: Saturday, 04 Aug 2012Document7 pagesResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Q2FY12 Results Tracker 14.10.11Document3 pagesQ2FY12 Results Tracker 14.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Research Report On Mahindra...Document8 pagesResearch Report On Mahindra...Sahil ChhibberNo ratings yet

- Gandhimathi Appliances Q1 FY13 net profit jumps 42Document11 pagesGandhimathi Appliances Q1 FY13 net profit jumps 42bob7878No ratings yet

- Q2FY12 Results Tracker 13.10.11Document2 pagesQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Tuesday, 07 Aug 2012Document7 pagesResults Tracker: Tuesday, 07 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- SRF Firstcall 031011Document20 pagesSRF Firstcall 031011srik48No ratings yet

- Hosoku e FinalDocument6 pagesHosoku e FinalSaberSama620No ratings yet

- Results Tracker: Thursday, 02 Aug 2012Document7 pagesResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker: Saturday, 28 July 2012Document13 pagesResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- Unaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Document1 pageUnaudited Standalone Financial Results For The Quarter and Nine Months Ended December 31, 2011Amar Mourya MouryaNo ratings yet

- Mayur Uniquoters Q1 FY12 Results UpdateDocument18 pagesMayur Uniquoters Q1 FY12 Results UpdateChiragNo ratings yet

- Eastern Financiers LTD: EF Market TimesDocument7 pagesEastern Financiers LTD: EF Market TimesdarshanmaldeNo ratings yet

- Hero Honda Motors LTD.: Results ReviewDocument7 pagesHero Honda Motors LTD.: Results ReviewVidhan KediaNo ratings yet

- IAPMDocument20 pagesIAPMvibhanshu_sinha2489No ratings yet

- Post Market Report 18th NovDocument6 pagesPost Market Report 18th NovDynamic LevelsNo ratings yet

- Asian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesDocument27 pagesAsian Paints Bse: 500820 - Nse: Asianpaint ISIN: INE021A01018 - Paints/VarnishesGaurav ShahareNo ratings yet

- IHCL Q1FY11 Result UpdateDocument5 pagesIHCL Q1FY11 Result UpdateSudipta Bose100% (1)

- Hold Hold Hold Hold: VST Industries LimitedDocument10 pagesHold Hold Hold Hold: VST Industries LimitedSwamiNo ratings yet

- Accounts AssignmentDocument15 pagesAccounts AssignmentGagandeep SinghNo ratings yet

- Pevc Q1Document8 pagesPevc Q1Ankit JohariNo ratings yet

- First Global: Canara BankDocument14 pagesFirst Global: Canara BankAnkita GaubaNo ratings yet

- Rs 490 Hold: Key Take AwayDocument5 pagesRs 490 Hold: Key Take AwayAnkush SaraffNo ratings yet

- IOB Reports 241% Rise in Net Profit at Rs. 434 Crore for Q4Document2 pagesIOB Reports 241% Rise in Net Profit at Rs. 434 Crore for Q4Sivashanmugam ThamizhselvanNo ratings yet

- Project Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav KaushalDocument19 pagesProject Prepared and Presented By:: Jinia Biswas Sruti Jain Vibhav Kaushalmanisha sonawaneNo ratings yet

- Atlas Honda LimitedDocument10 pagesAtlas Honda LimitedUnza TabassumNo ratings yet

- Amara Amara Raja Batteries LTD Raja Batteries LTDDocument12 pagesAmara Amara Raja Batteries LTD Raja Batteries LTDsagarbarsiyaNo ratings yet

- BJE Q1 ResultsDocument4 pagesBJE Q1 ResultsTushar DasNo ratings yet

- Spice JetDocument9 pagesSpice JetAngel BrokingNo ratings yet

- United Bank of IndiaDocument51 pagesUnited Bank of IndiaSarmistha BanerjeeNo ratings yet

- 1st Quarter ReportDocument9 pages1st Quarter ReportammarpkrNo ratings yet

- Results Tracker: Saturday, 21 July 2012Document10 pagesResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- HDFC Top 200 Fund holdings reportDocument3 pagesHDFC Top 200 Fund holdings reportVishwa Prasanna KumarNo ratings yet

- Maruti Suzuki financial analysisDocument2 pagesMaruti Suzuki financial analysishgosai30No ratings yet

- Q1FY12 Results Tracker 13th August-Mansukh Investment and TradingDocument16 pagesQ1FY12 Results Tracker 13th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsNo ratings yet

- Q1Fy12 Result Update Bajaj Auto Limited (Bal)Document7 pagesQ1Fy12 Result Update Bajaj Auto Limited (Bal)Dan RaoNo ratings yet

- Monthly Fund FactsheetDocument27 pagesMonthly Fund FactsheetAshik RameshNo ratings yet

- Results Tracker: Tuesday, 24 July 2012Document7 pagesResults Tracker: Tuesday, 24 July 2012Mansukh Investment & Trading SolutionsNo ratings yet

- RCL Q1CY12 Results Drive Carbon Sales Growth; Maintain BuyDocument4 pagesRCL Q1CY12 Results Drive Carbon Sales Growth; Maintain BuydidwaniasNo ratings yet

- SOUTHCO Performance Review Highlights Key IssuesDocument22 pagesSOUTHCO Performance Review Highlights Key IssueshavejsnjNo ratings yet

- Telecom Regulatory Authority of India: (Press Release No. 143/2012)Document18 pagesTelecom Regulatory Authority of India: (Press Release No. 143/2012)Ashwini KalantriNo ratings yet

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryFrom EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 08.11.2013Document3 pagesResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 09.11.2013Document3 pagesResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Results Tracker 07.11.2013Document3 pagesResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsNo ratings yet

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDocument5 pagesF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDocument3 pagesEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDocument3 pagesDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsNo ratings yet

- Financial Times UK. September 06, 2022Document24 pagesFinancial Times UK. September 06, 2022Mãi Mãi LàbaoxaNo ratings yet

- DeanDocument16 pagesDeanJames De TorresNo ratings yet

- Court Rules Expropriation for Private Subdivision Not Valid Public UseDocument489 pagesCourt Rules Expropriation for Private Subdivision Not Valid Public UseNico FerrerNo ratings yet

- IncomeTax MaterialDocument91 pagesIncomeTax MaterialSandeep JaiswalNo ratings yet

- Vidal-de-Roces-vs.-PosadasDocument9 pagesVidal-de-Roces-vs.-PosadasChristle CorpuzNo ratings yet

- Project Report (ABBOTT)Document29 pagesProject Report (ABBOTT)MohsIn IQbalNo ratings yet

- Microeconomics 19th Edition Samuelson Test BankDocument25 pagesMicroeconomics 19th Edition Samuelson Test BankRobertFordicwr100% (55)

- Form DGT - Certificate of Domicile of Nonresident (Indonesia WHT) - ExecutedDocument2 pagesForm DGT - Certificate of Domicile of Nonresident (Indonesia WHT) - ExecutedAjuna KaliantigaNo ratings yet

- FESCO GST Electricity bill detailsDocument2 pagesFESCO GST Electricity bill detailsSidraNo ratings yet

- Test 1: in ChargeDocument9 pagesTest 1: in ChargeT. JHONNo ratings yet

- IntermediateDocument139 pagesIntermediateabdulramani mbwanaNo ratings yet

- Market and Feasibility StudiesDocument35 pagesMarket and Feasibility StudiesprinthubphNo ratings yet

- Pacio V BillonDocument2 pagesPacio V BillonJazem Ansama100% (1)

- Chapter 7 SummaryDocument3 pagesChapter 7 SummaryAce Hulsey TevesNo ratings yet

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- Econ Final Review with Monopoly and Game Theory ExamplesDocument11 pagesEcon Final Review with Monopoly and Game Theory ExamplesMarcos PittmanNo ratings yet

- IGNTU EContent 456503968929 B.com 6 Prof - shailendraSinghBhadouriaDean& FINANCIALSERVICES AllDocument4 pagesIGNTU EContent 456503968929 B.com 6 Prof - shailendraSinghBhadouriaDean& FINANCIALSERVICES AllDinesh PKNo ratings yet

- Extra Book - June 2015 FinalDocument84 pagesExtra Book - June 2015 Finaldanishzafar100% (1)

- Ajay Bio-Tech (India) Limited: Gat No 879-At Post - Khalad-Taluka - PurandharDocument1 pageAjay Bio-Tech (India) Limited: Gat No 879-At Post - Khalad-Taluka - PurandharDnyaneshwar Dattatraya PhadatareNo ratings yet

- Interest calculation for various sections of Income Tax ActDocument25 pagesInterest calculation for various sections of Income Tax ActmukeshNo ratings yet

- Udhayakumar Rice MillDocument12 pagesUdhayakumar Rice Millcachandhiran0% (1)

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- Property CasesDocument95 pagesProperty CasesJohn Adrian MaulionNo ratings yet

- 06272023-Aurora Escalades-22e26Document4 pages06272023-Aurora Escalades-22e26Joone M GutierrezNo ratings yet

- Tax Laws in Tanzania Publication NumberDocument40 pagesTax Laws in Tanzania Publication Numberhelenmosha25No ratings yet

- Citi Flipkart credit card offer termsDocument4 pagesCiti Flipkart credit card offer termsShisArquamNo ratings yet

- BIR Quiz Remedies September 2020Document8 pagesBIR Quiz Remedies September 2020Randy ManzanoNo ratings yet

- Amit ConstDocument1 pageAmit Constks4427552No ratings yet

- FSA ASSIGNMENT-3 AnchalDocument4 pagesFSA ASSIGNMENT-3 AnchalAnchal ChokhaniNo ratings yet

- List of Purpose Codes 1: (For Use in Forms P/R Only)Document25 pagesList of Purpose Codes 1: (For Use in Forms P/R Only)Siti CleaningNo ratings yet