Professional Documents

Culture Documents

Interesting Measures For Mining Association Rules: FAST-NUCES, Lahore

Uploaded by

Jean SorelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Interesting Measures For Mining Association Rules: FAST-NUCES, Lahore

Uploaded by

Jean SorelCopyright:

Available Formats

Interesting Measures for Mining Association Rules

Liaquat Majeed Sheikh, Basit Tanveer, Syed Mustafa Ali Hamdani FAST-NUCES, Lahore liaquat.majeed@nu.edu.pk, basit.tanveer@gmail.com, mustafa.hamdani@gmail.com

Abstract

Discovering association rules is one of the most important tasks in data mining and many efficient algorithms were proposed in literature. However, the number of discovered rules is often so large, so the user cannot analyze all discovered rules. To overcome that problem several methods for mining interesting rules only have been proposed. Many measures have been proposed in literature to determine the interestingness of the rule. In this paper we have selected a total of eight different measures, we have compared these measures by using a data set, and we have made some recommendation about the use of the measures for discovering the most interesting rules.

Correlation, and Odds ratio. The second section gives us the calculation of each measure on our sample data (customer transactions) and the last section contains our recommendation on using which measure for discovering the interesting rules.

2. Description of Different Measures

To make the measures comparable all measures are defined using probabilities. The probability of encountering itemset X is given by

P( X ) =

count ( X ) |D|

1. Introduction

In the previous few years a lot of work is done in the field of data mining especially in finding association between items in a data base of customer transaction. Association rules identify items that are most often bought along with certain other items by a significant fraction of the customers. For example, we may find that95 percent of the customers who bought bread also bought milk. A rule may contain more than one item in the antecedent and the consequent of the rule. Every rule must satisfy two user specified constraints: one is a measure of statistical significance called support and the other a measure of goodness of the rule called confidence. In this paper we have identified a set of measures as proposed by the literature and we have tried to conclude that a single measure alone can not determine the interestingness of the rule. This paper is divided in to three sections the first section gives the formal definition (as presented in the literature) and some explanation of each measure. The measures we have chosen are Support, Confidence, Conviction, Lift, Piatetsky-Shapiro, Coverage,

Where, count(X) is the number of transactions that contain the itemset X and |D| is the size (number of transactions) of the database.

2.1. Support [1]

Introduced by R. Agrawal, T. Imielinski, and A. Swami. Mining associations between sets of items in large databases. In Proc. of the ACM SIGMOD Int'l Conference on Management of Data, pages 207-216, Washington D.C., May 1993.

Support ( X ) = P ( X )

Support is defined on itemsets and gives the proportion of transactions that contain Z and therefore is used as a measure of significance (importance) of an itemset. Since it basically uses the count of transactions it is often called a frequency constraint. An itemset with a support greater than a set minimum support threshold is called a frequent or large itemset. Supports main feature is that it possesses the downward closure property (anti-monotonicity) which means that all subsets of a frequent set are also frequent. This

-1-

property (actually, the fact that no super set of infrequent set can be frequent) is used to prune the search space (usually thought of as a lattice or tree of item sets with increasing size) in level-wise algorithms (e.g., the Apriori algorithm). The disadvantage of support is the rare item problem. Items that occur very infrequently in the data set are pruned although they would still produce interesting and potentially valuable rules. The rare item problem is important for transaction data which usually have a very uneven distribution of support for the individual items (few items are used all the time and most item are rarely used). Its values are in range [0; 1]. If antecedent and consequent are not occurring in transactions it is equal to 0. And if they are occurring in all transactions its value is equal to 1.

2.3. Conviction [1]

Introduced by Sergey Brin, Rajeev Motwani, Jeffrey D. Ullman, and Shalom Tsur. Dynamic itemset counting and implication rules for market basket data. In SIGMOD 1997, Proceedings ACM SIGMOD International Conference on Management of Data, pages 255-264, Tucson, Arizona, USA, May 1997.

conviction( X Y ) =

P( X ) P(Y ) P( X and Y )

2.2. Confidence [1]

Introduced by R. Agrawal, T. Imielinski, and A. Swami. Mining associations between sets of items in large databases. In Proc. of the ACM SIGMOD Int'l Conference on Management of Data, pages 207-216, Washington D.C., May 1993.

confidence( X Y ) =

P( X

and Y ) P( X )

Conviction was developed as an alternative to confidence which was found to not capture direction of associations adequately. Conviction compares the probability that X appears without Y if they were dependent with the actual frequency of the appearance of X without Y. In that respect it is similar to lift (see section about lift on this page), however, it contrast to lift it is a directed measure since it also uses the information of the absence of the consequent. An interesting fact is that conviction is monotone in confidence and lift. Its values are in range [0; + ]. If antecedent and consequent are independent it is equal to 1. For implications occurring in all cases measures value is equal to + .

Confidence is defined as the probability of seeing the rule's consequent under the condition that the transactions also contain the antecedent. Confidence is directed and gives different values for the rules X Y and Y X. Confidence is not down-ward closed and was developed together with support by Agrawal et al. (the so-called support-confidence framework). Support is first used to find frequent (significant) itemsets exploiting its down-ward closure property to prune the search space. Then confidence is used in a second step to produce rules from the frequent itemsets that exceed a min. confidence threshold. A problem with confidence is that it is sensitive to the frequency of the consequent (Y) in the database. Caused by the way confidence is calculated, consequents with higher support will automatically produce higher confidence values even if there exists no association between the items. Its values are in range [0; 1]. If antecedent and consequent are independent it is equal to 0. For implications occurring in all cases measures value is equal to 1.

2.4. Lift [1]

Introduced by S. Brin, R. Motwani, J. D. Ullman, and S. Tsur. Dynamic itemset counting and implication rules for market basket data. In Proc. of the ACM SIGMOD Int'l Conf. on Management of Data (ACM SIGMOD '97), pages 265-276, 1997.

lift ( X Y ) =

P( X and Y ) P( X ) P(Y )

Lift measures how many times more often X and Y occurs together than expected, if they where statistically independent. Lift is not down-ward closed and does not suffer from the rare item problem. Its values are in range [0; + ). Values lower than 1 mean, that satisfying condition of antecedent decreases probability of consequent in comparison to unconditional probability. Consequently, values higher than 1 mean, that satisfying condition of antecedent increases probability of consequent in comparison to unconditional probability. If antecedent and consequent are independent then lift is equal to 1.

-2-

2.5. Leverage [1]

Introduced by Piatetsky-Shapiro, G., Discovery, analysis, and presentation of strong rules. Knowledge Discovery in Databases, 1991: p. 229-248.

2.8. Odds Ratio

The odds-ratio is a statistical measure which is defined as the ratio of the odds of an event occurring in one group to the odds of it occurring in another group, or to a data-based estimate of that ratio. [3]

leverage X Y ) = P( X (

and Y ) P( X ) P(Y )

odds( X Y ) =

P( X P( X

and Y ) P( X and Y ) P( X

and Y ) and Y )

Leverage measures the difference of X and Y appearing together in the data set and what would be expected if X and Y where statistically dependent. The rational in a sales setting is to find out how many more units (items X and Y together) are sold than expected from the independent sells. Using minimum leverage thresholds at the same time incorporates an implicit frequency constraint. e.g., for setting a min. leverage thresholds to 0.01% (corresponds to 10 occurrence in a data set with 100,000 transactions) one first can use an algorithm to find all itemsets with minimum support of 0.01% and then filter the found item sets using the leverage constraint. Because of this property leverage also can suffer from the rare item problem.

Its values are in range [0; + ]. If antecedent and consequent are independent it is equal to 0. For strong associations its value is equal to + .

3. Comparison of Measures

This section compares all the measures, discussed in the first section. We have chosen a data set on which we have performed the A-priori algorithm to find out the frequent item set. All the measure are applied on each of the frequent item set, and then in the end the recommendation related to choosing a measure to decide which rule is interesting are given.

2.6. Coverage [1]

3.1. Sample Data

cov erage( X Y ) =

P( X

and Y ) P(Y )

It shows what part of itemsets from consequent is covered by a rule. Its values are in range [0; 1].

2.7. Correlation

Correlation is a statistical technique which can show whether and how strongly pairs of variables/itemsets are related.

The sample data for the analysis purpose is taken from a store database of customer transactions there are six different types of items and a total of ten transactions. In each transaction a 1 represents the presence of an item while a 0 represents the absence of an item from the market basket. Table 1: Sample Transactions Items A B C D E 1 1 1 0 1 0 2 1 0 1 1 0 3 1 0 1 1 0 4 0 1 1 1 0 5 0 1 0 1 1 6 1 0 0 0 1 7 1 0 1 0 1 8 0 0 1 0 0 9 0 1 1 1 0 10 1 1 0 1 1 Total 6 5 6 7 4 P(X) 0.6 0.5 0.6 0.7 0.4 TID

corr( X Y ) =

P( X

and Y ) P( X ) P(Y )

P( X ) P(Y )(1 P( X ))(1 P(Y ))

Correlation is a bi-variant measure of association (strength) of the relationship between two variables/itemsets. It varies from -1 (perfect negative linear relationship) to 1 (perfect linear relationship) and in between them 0 means no relationship. To the extent that there is a nonlinear relationship between the two variables being correlated, correlation will understate the relationship. [4]

F 1 1 1 0 0 1 1 0 0 0 5 0.5

-3-

Table 3: Calculation of Different Measures on Sample Datasets Rules AD DA AF FA BD DB CD DC Support 0.40 0.40 0.50 0.50 0.50 0.50 0.40 0.40 Confidence 0.67 0.57 0.83 1.00 1.00 0.71 0.67 0.57 Conviction 0.50 0.83 1.00 0.80 0.60 1.00 0.50 0.67 Lift 0.95 0.95 1.67 1.67 1.43 1.43 0.95 0.95 Leverage -0.02 -0.02 0.20 0.20 0.15 0.15 -0.02 -0.02 Coverage 0.57 0.67 1.00 0.83 0.71 1.00 0.57 0.67 Correlation -0.09 -0.09 0.82 0.82 0.65 0.65 -0.09 -0.09 1 1 Odds Ratio 0.67 0.67

3.2. Generating Frequent Itemsets

The frequent item set generated by the sample data using A-priori algorithm is shown in the following table: Table 2: Frequent Itemsets Itemset Support {A,D} 40% {A,F} 50% {B,D} 50% {C,D} 40% The minimum support used for the generation of the frequent item set is 40%.

Table 4: Subset of Sample Dataset Rules Measures Confidence Correlation Odds Ratio AF 0.83 0.82 FA 1.00 0.82 BD 1.00 0.65 DB 0.71 0.65 The table sown above contains the subset of measures and rules taken from the above table. The Odds Ratio in this table suggest that all the rules are interesting but if we look at the Correlation along with the Odds Ratio we will come to know that AF and FA are more strongly related to each other. On combining another measure i.e. Confidence with these two measures we will come to know that only the rule FA is more interesting.

3.3. Calculations

All the measures discussed in the first section are calculated for each rule, which is the output of the Apriori algorithm. The results are shown in table 3.

5. References

[1] http://wwwai.wu-wien.ac.at/~hahsler/research/ association_rules/measures.html [2] www.cise.ufl.edu/class/cis6930fa03dm/notes/ dm4part2.pdf [3] http://en.wikipedia.org/wiki/Odds-ratio [4] http://www2.chass.ncsu.edu/garson/pa765/ correl.htm [5] Discovering interesting rules from financial data Przemysaw Sodacki, Institute of Computer Science, Warsaw University of Technology Ul. Andersa 13, 00-159 Warszawa [6] Alternative Interest Measures for Mining Associations in Databases, Edward R. Omiecinski, Member, IEEE Computer Society.

3. Conclusion

Any measure alone cannot determine the Interestingness of the rules. We have to look at a combination of different measures in order to get the rule that is really interesting. There are two types of measures one is symmetric measures and the other is asymmetric If we look at a symmetric measure e.g. Odds Ratio we can conclude the AF, FA both the rules are interesting but the Confidence value of FA suggest that it is more interesting as compared to AF hence we can not conclude alone from a symmetric measure we also have to look for an asymmetric measure in order to know the interestingness of such types of rules AB, BA.

-4-

You might also like

- Introduction To Business Statistics Through R Software: SoftwareFrom EverandIntroduction To Business Statistics Through R Software: SoftwareNo ratings yet

- Differencial Link Analysis in Health Care Using Data MiningDocument27 pagesDifferencial Link Analysis in Health Care Using Data MiningveerabalajNo ratings yet

- Different Measures For Assosiation Rule MiningDocument6 pagesDifferent Measures For Assosiation Rule MiningEric KennedyNo ratings yet

- Expert Systems With Applications: Hamid Reza Qodmanan, Mahdi Nasiri, Behrouz Minaei-BidgoliDocument11 pagesExpert Systems With Applications: Hamid Reza Qodmanan, Mahdi Nasiri, Behrouz Minaei-BidgoliAtik FebrianiNo ratings yet

- DM Unit 3Document22 pagesDM Unit 3ajayagupta1101No ratings yet

- Fuzzy Logic - Retrieval of Data From DatabaseDocument7 pagesFuzzy Logic - Retrieval of Data From DatabaseiisteNo ratings yet

- Visualizing Association Rules: Introduction To The R-Extension Package ArulesvizDocument24 pagesVisualizing Association Rules: Introduction To The R-Extension Package ArulesvizDevendraReddyPoreddyNo ratings yet

- Visualizing Association Rules: Introduction To The R-Extension Package ArulesvizDocument24 pagesVisualizing Association Rules: Introduction To The R-Extension Package ArulesvizDevendraReddyPoreddyNo ratings yet

- Support: R. Agrawal, T. Imielinski, and A. Swami. Mining Associations Between Sets of Items in Large DatabasesDocument3 pagesSupport: R. Agrawal, T. Imielinski, and A. Swami. Mining Associations Between Sets of Items in Large DatabasesAnonymous TxPyX8cNo ratings yet

- Arules VizDocument24 pagesArules VizDhio MuhammadNo ratings yet

- Data Mining: 1 Task: ClusteringDocument36 pagesData Mining: 1 Task: ClusteringElNo ratings yet

- Association Rule LearningDocument16 pagesAssociation Rule Learningjoshuapeter961204No ratings yet

- Hyper ConfidenceDocument23 pagesHyper ConfidenceIndira Sivakumar0% (1)

- Data Analysis Using Apriori Algorithm & Neural Netwok: Ashutosh PadhiDocument27 pagesData Analysis Using Apriori Algorithm & Neural Netwok: Ashutosh PadhiMILANNo ratings yet

- International Journal of Computational Engineering Research (IJCER)Document8 pagesInternational Journal of Computational Engineering Research (IJCER)International Journal of computational Engineering research (IJCER)No ratings yet

- Data MiningDocument65 pagesData MiningbetterlukaroundNo ratings yet

- Arules VizDocument26 pagesArules VizMuneesh BajpaiNo ratings yet

- Assignment ON Data Mining: Submitted by Name: Manjula.TDocument11 pagesAssignment ON Data Mining: Submitted by Name: Manjula.TLõvey Dôvey ÃnanthNo ratings yet

- The Application of Machine Learning Algorithm in Underwriting ProcessDocument5 pagesThe Application of Machine Learning Algorithm in Underwriting Processpascal toguNo ratings yet

- Ekonometrika Terapan Lecture 1 2022Document34 pagesEkonometrika Terapan Lecture 1 2022erickNo ratings yet

- UNITDocument53 pagesUNITSravani GunnuNo ratings yet

- DWDM Unit 3 PDFDocument16 pagesDWDM Unit 3 PDFindiraNo ratings yet

- Hyper-Heuristic Decision Tree Induction: Alan Vella, David Corne Chris MurphyDocument6 pagesHyper-Heuristic Decision Tree Induction: Alan Vella, David Corne Chris MurphySigfrid SigfridsonNo ratings yet

- DWDM Unit-4Document27 pagesDWDM Unit-4Gopl KuppaNo ratings yet

- MODULE 3 - Question &answer-2Document32 pagesMODULE 3 - Question &answer-2Vaishnavi G . RaoNo ratings yet

- Ecotrix With R and PythonDocument25 pagesEcotrix With R and PythonzuhanshaikNo ratings yet

- Market Basket Analysis For A SupermarketDocument9 pagesMarket Basket Analysis For A Supermarketabhilashponnam@gmail.comNo ratings yet

- Extraction of Interesting Association Rules Using Genetic AlgorithmsDocument8 pagesExtraction of Interesting Association Rules Using Genetic AlgorithmsAnonymous TxPyX8cNo ratings yet

- 8 Data Mining AlgorithmsDocument8 pages8 Data Mining AlgorithmsPriscilla KamauNo ratings yet

- Compusoft, 3 (10), 1140-1142 PDFDocument3 pagesCompusoft, 3 (10), 1140-1142 PDFIjact EditorNo ratings yet

- Dependence Factor For Association Rules: Abstract. Certainty Factor and Lift Are Known Evaluation Measures of AssociaDocument2 pagesDependence Factor For Association Rules: Abstract. Certainty Factor and Lift Are Known Evaluation Measures of Associajkl316No ratings yet

- Association Analysis: Unit-VDocument12 pagesAssociation Analysis: Unit-VPradeepkumar 05No ratings yet

- Association Rule Mining: Applications in Various Areas: Akash Rajak and Mahendra Kumar GuptaDocument5 pagesAssociation Rule Mining: Applications in Various Areas: Akash Rajak and Mahendra Kumar GuptaNylyam Dela Cruz SantosNo ratings yet

- Mining Items From Large Database Using Coherent RulesDocument10 pagesMining Items From Large Database Using Coherent RulesIjesat JournalNo ratings yet

- Unit 3 - DM FULLDocument46 pagesUnit 3 - DM FULLmintoNo ratings yet

- Re-Mining Positive and Negative Association Mining ResultsDocument15 pagesRe-Mining Positive and Negative Association Mining ResultsertekgNo ratings yet

- p139 Data Mining MafiaDocument13 pagesp139 Data Mining Mafiajnanesh582No ratings yet

- Three Attitudes Towards Data Mining: Kevin D. Hoover and Stephen J. PerezDocument16 pagesThree Attitudes Towards Data Mining: Kevin D. Hoover and Stephen J. Perezspirit_abodeNo ratings yet

- Experiment No - 08: AIM: Implementation of Association Rule Mining in WEKA. TheoryDocument11 pagesExperiment No - 08: AIM: Implementation of Association Rule Mining in WEKA. TheoryMIHIR PATELNo ratings yet

- Unit-5 DWDMDocument7 pagesUnit-5 DWDMsanjayktNo ratings yet

- Math in ML ALgoDocument18 pagesMath in ML ALgoNithya PrasathNo ratings yet

- HR Analytics DifferencesDocument9 pagesHR Analytics Differences匿匿No ratings yet

- ArulesDocument37 pagesArulesSagar ZalavadiyaNo ratings yet

- Value Added Association Rules: T.Y. Lin San Jose State University Drlin@sjsu - EduDocument9 pagesValue Added Association Rules: T.Y. Lin San Jose State University Drlin@sjsu - EduTrung VoNo ratings yet

- Association Rules in RDocument37 pagesAssociation Rules in RYeshwanth BabuNo ratings yet

- UNIT-5 DWDM (Data Warehousing and Data Mining) Association AnalysisDocument7 pagesUNIT-5 DWDM (Data Warehousing and Data Mining) Association AnalysisVee BeatNo ratings yet

- Association Rule Mining by Using New Approach of Propositional LogicDocument5 pagesAssociation Rule Mining by Using New Approach of Propositional LogicInternational Journal of computational Engineering research (IJCER)No ratings yet

- Week 6: Test Bank Questions Data Mining and Data Warehousing - IT 446Document39 pagesWeek 6: Test Bank Questions Data Mining and Data Warehousing - IT 446Soma FadiNo ratings yet

- Unit 4 - Association AnalysisDocument12 pagesUnit 4 - Association Analysiseskpg066No ratings yet

- Exploratory Factor Analysis With SPSS Oct 2019Document26 pagesExploratory Factor Analysis With SPSS Oct 2019ZetsiNo ratings yet

- Introduction To Arules - A Computational Environment For Mining Association Rules and Frequent Item SetsDocument37 pagesIntroduction To Arules - A Computational Environment For Mining Association Rules and Frequent Item SetsZXuanHoNo ratings yet

- Unit 4 - Association AnalysisDocument12 pagesUnit 4 - Association AnalysisAnand Kumar BhagatNo ratings yet

- Generalized Association Rule Mining Using Genetic AlgorithmsDocument11 pagesGeneralized Association Rule Mining Using Genetic AlgorithmsAnonymous TxPyX8cNo ratings yet

- Datascience InterviewDocument31 pagesDatascience InterviewSenthil Kumar100% (1)

- Data Science Interview Preparation (30 Days of Interview Preparation)Document18 pagesData Science Interview Preparation (30 Days of Interview Preparation)Satyavaraprasad BallaNo ratings yet

- Factor Analysis Using SPSS: ExampleDocument14 pagesFactor Analysis Using SPSS: ExampleVijay Deo Narayan TripathiNo ratings yet

- Binary Logistic Regression and Its ApplicationDocument8 pagesBinary Logistic Regression and Its ApplicationFaisal IshtiaqNo ratings yet

- SOM-based Generating of Association RulesDocument5 pagesSOM-based Generating of Association RulesKishor PeddiNo ratings yet

- Chapter 4 Association Rule Mining1Document44 pagesChapter 4 Association Rule Mining1milkiyasgirma497No ratings yet

- ML Unit 3Document40 pagesML Unit 3Tharun KumarNo ratings yet

- SAP MM Module OverviewDocument15 pagesSAP MM Module OverviewAmit Kumar100% (1)

- Implementation 3-Axis CNC Router For Small Scale Industry: Telkom Applied Science School, Telkom University, IndonesiaDocument6 pagesImplementation 3-Axis CNC Router For Small Scale Industry: Telkom Applied Science School, Telkom University, IndonesiaAnonymous gzC9adeNo ratings yet

- LAB3Document5 pagesLAB3Kaishavi UmrethwalaNo ratings yet

- Clan Survey Pa 297Document16 pagesClan Survey Pa 297Sahara Yusoph SanggacalaNo ratings yet

- Computer Network-II Lab ProgramsDocument5 pagesComputer Network-II Lab ProgramsAnshul ChauhanNo ratings yet

- Solenoid ValvesDocument23 pagesSolenoid ValvesmcsecNo ratings yet

- Laboratorio de Microondas - Medicion en Lineas de TX Usando Lineas RanuradasDocument5 pagesLaboratorio de Microondas - Medicion en Lineas de TX Usando Lineas RanuradasacajahuaringaNo ratings yet

- Ignitability and Explosibility of Gases and VaporsDocument230 pagesIgnitability and Explosibility of Gases and VaporsKonstantinKot100% (3)

- Chapter 5e ch05 HallDocument9 pagesChapter 5e ch05 HallGlorden Mae Ibañez SalandananNo ratings yet

- Pelland Pumptrack2018Document60 pagesPelland Pumptrack2018ksnakaNo ratings yet

- Atm MachineDocument7 pagesAtm MachineNguyen TungNo ratings yet

- 4-2.0L Gasoline EngineDocument187 pages4-2.0L Gasoline EngineMarco Antonio Tomaylla Huamani100% (1)

- 01 Getting StartedDocument44 pages01 Getting StartedAsbokid SeniorNo ratings yet

- Design and Estimation of Dry DockDocument78 pagesDesign and Estimation of Dry DockPrem Kumar100% (4)

- Mdce InstallDocument67 pagesMdce Installrmehta26No ratings yet

- Schaeffler Kolloquium 2010 13 enDocument7 pagesSchaeffler Kolloquium 2010 13 enMehdi AlizadehNo ratings yet

- Mohit Soni ReportDocument104 pagesMohit Soni ReportMohitNo ratings yet

- Period Based Accounting Versus Cost of Sales AccountingDocument13 pagesPeriod Based Accounting Versus Cost of Sales AccountingAnil Kumar100% (1)

- Technical Service Bulletin 6.7L - Illuminated Mil With Dtcs P1291, P1292, P0191 And/Or P06A6 - Engine Harness Chafe 19-2231Document4 pagesTechnical Service Bulletin 6.7L - Illuminated Mil With Dtcs P1291, P1292, P0191 And/Or P06A6 - Engine Harness Chafe 19-2231Yaniss AlgeriaNo ratings yet

- CS-Z25XKEW - 1, Evaporator Specification SheetDocument1 pageCS-Z25XKEW - 1, Evaporator Specification SheetpaulNo ratings yet

- Fingerstyle Guitar - Fingerpicking Patterns and ExercisesDocument42 pagesFingerstyle Guitar - Fingerpicking Patterns and ExercisesSeminario Lipa100% (6)

- 1-18 Easy Fix Double Glazing Counter Price ListDocument16 pages1-18 Easy Fix Double Glazing Counter Price ListChris PaceyNo ratings yet

- Guideline On Smacna Through Penetration Fire StoppingDocument48 pagesGuideline On Smacna Through Penetration Fire Stoppingwguindy70No ratings yet

- Omni PageDocument98 pagesOmni Pageterracotta2014No ratings yet

- The GPSA 13th Edition Major ChangesDocument2 pagesThe GPSA 13th Edition Major Changespatrickandreas77No ratings yet

- Loupe S Dental Brochure Sur 6351Document16 pagesLoupe S Dental Brochure Sur 6351bernadinadwiNo ratings yet

- 2 - Way Ball ValvesDocument6 pages2 - Way Ball ValvesFitra VertikalNo ratings yet

- Promt MidjourneyDocument2 pagesPromt MidjourneyMarcelo PaixaoNo ratings yet

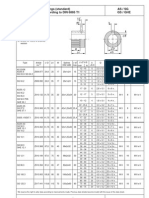

- As / SG Gs / Ghe Dimensions For Couplings (Standard) Bore With Keyway According To DIN 6885 T1Document1 pageAs / SG Gs / Ghe Dimensions For Couplings (Standard) Bore With Keyway According To DIN 6885 T1hadeNo ratings yet

- First Page PDFDocument1 pageFirst Page PDFNebojsa RedzicNo ratings yet