Professional Documents

Culture Documents

Vaildation Form

Uploaded by

api-3847506Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vaildation Form

Uploaded by

api-3847506Copyright:

Available Formats

ONLY FOR USE IN COUNTIES APPROVED TO ACCEPT ONE-PART FORMS (See website address below for approved list)

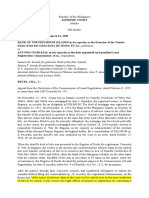

KANSAS REAL ESTATE SALES VALIDATION QUESTIONNAIRE

FOR COUNTY USE ONLY:

COV #

DEED __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ __ . __ __ __

BOOK _________ PAGE ________ __ __ __ __ __ __ CO. NO. MAP SEC SHEET QTR. BLOCK PARCEL OWN

RECORDING TYPE OF INSTRUMENT ________________ SPLIT MO YR TY AMOUNT S V

DATE ______/______/______ CR __________ RA ________ DE ________ MULTI __ __ __ __ __ _____________ __ __

SELLER (Grantor) BUYER (Grantee)

NAME __________________________________________________ NAME __________________________________________________________

MAILING ________________________________________________ MAILING _______________________________________________________

CITY/ST/ZIP _____________________________________________ CITY/ST/ZIP ____________________________________________________

PHONE NO. (______)_____________________________________ PHONE NO. (______)______________________________________________

IF AGENT SIGNS FORM, BOTH BUYER AND SELLER TELEPHONE NUMBERS MUST BE ENTERED.

BRIEF LEGAL DESCRIPTION Property / Situs Address: ______________________________________

___________________________________________________ Name and Mailing Address for Tax Statements

___________________________________________________ __________________________________________________________

___________________________________________________ __________________________________________________________

___________________________________________________ ____________________________________________________

CHECK ANY FACTORS THAT APPLY TO THIS SALE (See Instructions on back of form.)

1. SPECIAL FACTORS 6. ARE YOU AWARE OF ANY CHANGES IN THE PROPERTY

Sale between immediate family members: SINCE JAN. 1? YES NO

SPECIFY THE RELATIONSHIP _____________________ Demolition New Construction Remodeling Additions

Sale involved corporate affiliates belonging to the same Date Completed __________________________________

parent company 7. WERE ANY DELINQUENT TAXES ASSUMED BY THE

Auction Sale PURCHASER? YES NO AMOUNT $_______________

Deed transfer in lieu of foreclosure or repossession 8. METHOD OF FINANCING (check all that apply):

Sale by judicial order (by a guardian, executor, conservator, New loan(s) from a Financial Institution

administrator, or trustee of an estate) Seller Financing Assumption of Existing Loan(s)

Sale involved a government agency or public utility All Cash Trade of Property Not Applicable

Buyer (new owner) is a religious, charitable, or benevolent 9. WAS THE PROPERTY MADE AVAILABLE TO OTHER POTENTIAL

organization, school or educational association PURCHASERS? YES NO If not, explain _______________

Buyer (new owner) is a financial institution, insurance _______________________________________________________

company, pension fund, or mortgage corporation (SEE #9 INSTRUCTION ON BACK)

Would this sale qualify for one of the exceptions listed on 10. DOES THE BUYER HOLD TITLE TO ANY ADJOINING PROPERTY?

the reverse side of this form? (Please indicate # _______) YES NO

Sale of only a partial interest in the real estate 11. ARE THERE ANY FACTS WHICH WOULD CAUSE THIS SALE TO

Sale involved a trade or exchange of properties BE A NON-ARMS LENGTH / NON-MARKET VALUE TRANSACTION?

NONE OF THE ABOVE (SEE #11 INSTRUCTION ON BACK) YES NO

2. CHECK USE OF PROPERTY AT THE TIME OF SALE: _______________________________________________________

Single Family Residence Agricultural Land _______________________________________________________

Farm/Ranch With Residence Mineral Rights Included?

Condominium Unit Yes No 12. TOTAL SALE PRICE $_________________________________

Vacant Land Apartment Building

Other: (Specify) Commercial/Industrial Bldg. DEED DATE _______/_______/________

13. I CERTIFY THAT THE ADDERESS TO WHICH TAX STATEMENTS

3. WAS THE PROPERTY RENTED OR LEASED AT THE TIME FOR THE PROPERTY ARE TO BE SENT IS CORRECT.

OF SALE? YES NO I ALSO CERTIFY I HAVE READ ITEM NO. 13 ON THE

4. DID THE SALE PRICE INCLUDE AN EXISTING BUSINESS? REVERSE SIDE AND HEREBY CERTIFY THE ACCURACY

YES NO OF THE INFORMATION AND THAT I AM AWARE OF THE

5. WAS ANY PERSONAL PROPERTY (SUCH AS FURNITURE, PENALTY PROVISIONS OF K.S.A. 79-1437g.

EQUIPMENT, MACHINERY, LIVESTOCK, CROPS, BUSINESS

FRANCHISE OR INVENTORY, ETC.) INCLUDED IN THE SALE PRINT NAME _______________________________________________

PRICE? YES NO

If yes, please describe ______________________________

_________________________________________________ SIGNATURE _______________________________________________

Estimated value of all personal property items included in the

sale price $_________________________________________ GRANTOR (SELLER) GRANTEE (BUYER)

If Mobile Home Year __________ Model ______________ AGENT DAYTIME PHONE NO. (_____)______________________

PV-RE-21-OP-CG KANSAS REAL ESTATE SALES VALIDATION ONE-PART QUESTIONNAIRE WEBSITE ADDRESS:

(REV. 07/02) http://www.ksrevenue.org/pvdratiostats.htm

INSTRUCTIONS FOR COMPLETING THE SALES VALIDATION QUESTIONNAIRE

ITEM 1 Please check all boxes which pertain.

ITEM 2 Check the box which describes the current or most recent use of the property at the time of sale. Check all boxes which are applicable if the

property has multiple uses.

ITEM 3 Check yes; if the buyer assumed any long term lease(s) (more than 3 years remaining) at the time of sale.

ITEM 4 Check yes; if the purchase price included an operating business, franchise, trade license, patent, trademark, stock, bonds, technology, and/or

goodwill.

ITEM 5 Check yes; if any tangible and portable items of property were included in the sale price. If possible, provide a brief description and your

estimate of the total value of all personal property included in the sale price.

ITEM 6 Check yes; if the property characteristics have been changed since January 1. Indicate what type of change(s) took place by marking the

appropriate box. Indicate the date the change(s) took place.

ITEM 7 Check yes; if any delinquent taxes were assumed by the purchaser and included as part of the sale price. Do not consider any prorated taxes

for the year in which the property was sold that are part of normal escrow closings.

ITEM 8 Check the predominate method of financing used to acquire the property. Check "Not Applicable" if no money exchanged hands or refinancing

of an existing loan.

ITEM 9 Check yes; if the property was either advertised on the open market, displayed a for sale sign, listed with a real estate agent or offered by word

of mouth.

ITEM 10 Check yes; if the buyer owns or controls the property adjoining or adjacent to the property being purchased.

ITEM 11 Provide an explanation if you believe the buyer or seller did not act prudently, was not fully informed about the property or knowledgeable of the

local market, poorly advised, did not use good judgement in the negotiations, was acting under duress, or compelled out of necessity. Use an

additional sheet of paper if necessary.

ITEM 12 Provide the total sale price and date of sale. The date should be the date that either the deed or the contract for deed was signed, not the date

the deed was recorded.

ITEM 13 Please sign the questionnaire and list your phone number. The county appraiser may need to make a follow up phone call to clarify unusual

terms or conditions.

K.S.A. 79-1437g. Same; penalty for violations. Any person who shall falsify the value of real estate transferred shall be deemed guilty of a

misdemeanor and upon conviction thereof shall be fined not more than $500. (L. 1991, ch. 162, sec. 7; L. 1992, ch. 159, sec. 3; April 30.)

TRANSFERS OF TITLE THAT DO NOT REQUIRE A SALES VALIDATION QUESTIONNAIRE ARE AS FOLLOWS:

(1) Recorded prior to the effective date of this act, i.e., July 1, 1991;

(2) made solely for the purpose of securing or releasing security for a debt or other obligation;

(3) made for the purpose of confirming, correcting, modifying or supplementing a deed previously recorded, and without additional consideration;

(4) by way of gift, donation or contribution stated in the deed or other instruments;

(5) to cemetery lots;

(6) by leases and transfers of severed mineral interests;

(7) to or from a trust, and without consideration;

(8) resulting from a divorce settlement where one party transfers interest in property to the other;

(9) made solely for the purpose of creating a joint tenancy or tenancy in common;

(10) by way of a sheriff's deed;

(11) by way of a deed which has been in escrow for longer than five years;

(12) by way of a quit claim deed filed for the purpose of clearing title encumbrances;

(13) when title is transferred to convey right-of-way or pursuant to eminent domain;

(14) made by a guardian, executor, administrator, conservator or trustee of an estate pursuant to judicial order;

(15) when title is transferred due to repossession; or

(16) made for the purpose of releasing an equitable lien on a previously recorded affidavit of equitable interest, and without additional consideration.

(b) When a real estate sales validation questionnaire is not required due to one or more of the exemptions provided in 1-16 above, the exemption shall be clearly

stated on the document being filed.

If you have any questions or need assistance completing this form, please call the county appraiser's office.

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Legal Forms-Contracts and AgreementsDocument115 pagesLegal Forms-Contracts and AgreementsNiko Mangaoil Aguilar100% (2)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Wills & Trusts Outline 2020Document44 pagesWills & Trusts Outline 2020PaulMarieNo ratings yet

- I. Intellectual Property RightsDocument9 pagesI. Intellectual Property RightsJorrel BautistaNo ratings yet

- 3) Guardians TrusteesDocument3 pages3) Guardians TrusteesPaul EsparagozaNo ratings yet

- 68 Quirino v. Grospe DigeestDocument3 pages68 Quirino v. Grospe DigeestJames Evan I. ObnamiaNo ratings yet

- Real Estate Procedures: The Process of Sale and Purchase of Land in TanzaniaDocument36 pagesReal Estate Procedures: The Process of Sale and Purchase of Land in Tanzaniayusuph kawembeleNo ratings yet

- Deed of Sale Municipyo FormatDocument3 pagesDeed of Sale Municipyo FormatMark Rainer Yongis LozaresNo ratings yet

- Texas Foreclosure Timeline Chart For Non-Judicial ForeclosuresDocument1 pageTexas Foreclosure Timeline Chart For Non-Judicial Foreclosuresglallen01No ratings yet

- Dela Cruz V CapcoDocument2 pagesDela Cruz V CapcoStephen JacoboNo ratings yet

- Cancellation of Notice of Lis PendensDocument2 pagesCancellation of Notice of Lis Pendensyurets929No ratings yet

- Special Power of Attorney: Know All Men by These PresentsDocument2 pagesSpecial Power of Attorney: Know All Men by These PresentsReintegration CagayanNo ratings yet

- Lessor Sublease Consent FormDocument2 pagesLessor Sublease Consent FormRochelle Montesor de GuzmanNo ratings yet

- DD5 Scénario 3 La Secte Du Crâne - 4 Aventuriers de Niv 2Document5 pagesDD5 Scénario 3 La Secte Du Crâne - 4 Aventuriers de Niv 2Emmanuel PicardatNo ratings yet

- Freedom To OperateDocument19 pagesFreedom To OperateLalit AmbasthaNo ratings yet

- LTD Casimiro v. MateoDocument2 pagesLTD Casimiro v. MateoailynvdsNo ratings yet

- Deed of Sale of FirearmDocument2 pagesDeed of Sale of FirearmMinerva Vallejo AlvarezNo ratings yet

- CSA Publication Wood Utility Poles and Reinforcing StubsDocument90 pagesCSA Publication Wood Utility Poles and Reinforcing StubsYadvinderSinghNo ratings yet

- Succession TranscriptDocument58 pagesSuccession TranscriptLor BellezaNo ratings yet

- A Posterior Claim Based On Execution Sale Cannot Defeat An Anterior Claim of Adverse ClaimDocument4 pagesA Posterior Claim Based On Execution Sale Cannot Defeat An Anterior Claim of Adverse ClaimHangul Si Kuya AliNo ratings yet

- Commissioner of Income-Tax Vs Gangadhar Sikaria Family Trust ... On 1 June, 1982Document9 pagesCommissioner of Income-Tax Vs Gangadhar Sikaria Family Trust ... On 1 June, 1982Venkatesh JakkurNo ratings yet

- Quacks Incursion 2Document20 pagesQuacks Incursion 2ibraheemfahdahNo ratings yet

- Requisites in Wills and SuccessionDocument4 pagesRequisites in Wills and SuccessionAbombNo ratings yet

- 17 Seangio vs. Reyes GR No. 140371 72 11 27 2006Document8 pages17 Seangio vs. Reyes GR No. 140371 72 11 27 2006Rochelle GablinesNo ratings yet

- Assignment of Rights in Computer Software - With ReservationDocument9 pagesAssignment of Rights in Computer Software - With ReservationMuhamad AziziNo ratings yet

- ViewJournal PDFDocument3,111 pagesViewJournal PDFMistavedreRaoulNo ratings yet

- Short Terms and Conditions Letting AgreementDocument1 pageShort Terms and Conditions Letting AgreementIoana BădoiuNo ratings yet

- An Analysis of Section 6 of The Transfer of Property Act, 1882Document11 pagesAn Analysis of Section 6 of The Transfer of Property Act, 1882rishabhNo ratings yet

- Case LawsDocument2 pagesCase LawsAkki ChoudharyNo ratings yet

- Sample Lease ContractDocument5 pagesSample Lease ContractMichelle ArceNo ratings yet

- LRA Circular No 12-2020 - Guidelines For Conversion On DemandDocument2 pagesLRA Circular No 12-2020 - Guidelines For Conversion On DemandjosephNo ratings yet