Professional Documents

Culture Documents

Form8 2008 09

Uploaded by

api-3850174Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form8 2008 09

Uploaded by

api-3850174Copyright:

Available Formats

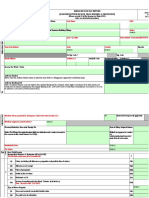

INDIAN INCOME TAX RETURN

Assessment

[Return for Fringe Benefits]

ITR-8 Year

(Please see Rule 12 of the Income-tax Rules,1962)

2008 - 09

(Also see attached instructions)

Part A-GEN GENERAL

Name PAN

PERSONAL INFORMATION

Is there any change in the company’s name? If yes, please furnish the old name

Flat/Door/Block No Name Of Premises/Building/Village Date of incorporation (DD/MM/YYYY)

Road/Street/Post Office Area/Locality Status – write 1 if firm, if public

company write 6, if private

company write 7 (as defined in

Town/City/District State Pin code the section 3 of the company

act) and write 8 if others

(STD code)-Phone

Email Address

Number

If domestic company tick

Range

Designation of Assessing Area Code AO AO

FILING STATUS

Officer

Code Return filed V ease see

Type No

Instruction number 9(i)]

Whether original or Revised return? (Tick) Original Revised

If revised, then enter Receipt No and Date of filing original return

(DD/MM/YYYY)

Residential Status (Tick) Resident Non-Resident Resident but Not Ordinarily Resident

In the case of non-resident, is there a permanent establishment (PE) in India (Tick) Yes No

Whether this return is being filed by a representative assessee ? (Tick) Yes No

If yes, please furnish following information –

(a) Name of the representative

(b) Address of the representative

Permanent Account Number (PAN) of the

(c)

representative

Are you liable to maintain accounts as per section 44AA? (Tick) Yes No

AUDIT INFORMATION

Are you liable for audit under section 44AB? (Tick) yes No If yes, furnish following

information-

(a) Name of the auditor signing the tax audit report

(b) Membership no. of the auditor

(c) Name of the auditor( proprietorship /firm)

Permanent Account Number (PAN) of the

(d)

proprietorship /firm

(e) Date of audit report.

For Office Use Only For Office Use Only

Receipt No

Date

Seal and Signature of receiving official

PART-B

Part-B C Computation of Fringe Benefits and fringe benefit tax

1 Value of fringe benefit

a for first quarter 1a

b for second quarter 1b

c for third quarter 1c

d for fourth quarter 1d

e Total fringe benefits (1a + 1b + 1c + 1d) ( also 24 iv of Schedule-FB) 1e

2 Fringe benefit tax payable [30% of 1e] 2

COMPUTATION OF TAXFRINGE BENEFITS AND FRINGE BENEFITs

3 Surcharge on 2 3

4 Education Cess on (2 + 3) 4

5 Total fringe benefit tax liability (2 + 3 + 4) 5

6 Interest payable

For default in payment of advance tax

a 6a

(section115WJ (3))

For default in furnishing the return (section

b 6b

115WK)

c Total interest payable 6c

7 Aggregate liability (5 + 6c) 7

8 Taxes paid

a Advance fringe benefit tax(from Schedule-FBT) 8a

b On self-assessment (from Schedule-FBT) 8b

c Total Taxes Paid (8a + 8b) 8c

9 Tax Payable (Enter if 7 is greater than 8c, else enter 0). 9

10 Refund (enter If 8c is greater than 7, else enter 0) also give the bank account 10

details in Schedule-BA

11 Enter your bank account number (mandatory in case of refund)

12 Do you want your refund by

REFUND

cheque, or deposited directly into your bank account? (tick as applicable)

13 In case of direct deposit to your bank account give additional details

MICR code Type of Account (tick as applicable) Savings Current

VERIFICATION

I, (full name in block letters), of

solemnly declare that to the best of my knowledge and belief, the information given in the return and the

schedules thereto is correct and complete and that the amount of total income/ fringe benefits and other

particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961,

in respect of income and fringe benefits chargeable to income-tax for the previous year relevant to the assessment

year . I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Place Date Sign here

Schedule - FBI Information regarding calculation of value of fringe benefits

Fringe benefit information

Are you having employees based both in and outside India? If yes write 1, and if no

1

write 2

2 If answer to ‘1’ is yes, are you maintaining separate books of account for Indian and

foreign operations? If yes write 1, and if no write 2

3 Total number of employees

a Number of employees in India 3a

b Number of employees outside India 3b

c Total number of employees 3c

Schedule FB Computation of value of fringe benefits

P Value of fringe

erc benefits

Amount/value of ent iv= ii x iii ÷ 100

Sl. Nature of expenditure

expenditure* -

No ag

e iv

i ii iii

Free or concessional tickets provided for private

journeys of employees or their family members

(the value in column ii shall be the cost of the 1iv

1 1ii 100

ticket to the general public as reduced by the

amount, if any, paid by or recovered from the

employee)

Any specified security or sweet equity shares

[sections 115WB(1)(d) [difference between the

fair market value on the investing date and

2iv

2 amount recovered from or paid by the employee 2ii 100

and Contribution to an approved superannuation

fund for employees (in excess of one lakh rupees

in respect of each employee)

3 Entertainment 3ii 20 3iv

Hospitality in the business other than business aiv

4 a aii 20

referred to in 4b or 4c or 4d

b Hospitality in the business of hotel bii 5 biv

VALUE OF FRINGE BENEFITS

Hospitality in the business of carriage of civ

c cii 5

passengers or goods by aircraft

Hospitality in the business of carriage of div

d dii 5

passengers or goods by ship

Conference (other than fee for participation by 5iv

5 5ii 20

the employees in any conference)

Sales promotion including publicity (excluding any

6 expenditure on advertisement referred to in 6ii 20 6iv

proviso to section 115WB(2)(D)

7 Employees welfare 7ii 20 7iv

Conveyance, in the business other than the

8 a aii 20 aiv

business referred to in 8b or 8c or 8d

b Conveyance, in business of construction bii 5 biv

Conveyance in the business of manufacture or

c cii 5 civ

production of pharmaceuticals

Conveyance in the business of manufacture or

d dii 5 div

production of computer software

Use of hotel, boarding and lodging facilities in

9 a the business other than the business referred aii 20 aiv

to in 9b or 9c or 9d or 9e

Use of hotel, boarding and lodging facilities in

b the business of manufacture or production of bii 5 biv

pharmaceuticals

Use of hotel, boarding and lodging facilities in

c the business of manufacture or production of cii 5 civ

computer software

Use of hotel, boarding and lodging facilities in

d the business of carriage of passengers or dii 5 div

goods by aircraft

Use of hotel, boarding and lodging facilities in

e the business of carriage of passengers or eii 5 eiv

goods by ship

Repair, running (including fuel), maintenance

of motor cars and the amount of depreciation

10 a thereon in the business other than the aii 20 aiv

business of carriage of passengers or goods by

motor car

Repair, running (including fuel), maintenance

of motor cars and the amount of depreciation

b bii 5 biv

thereon in the business of carriage of

passengers or goods by motor car

Repair, running (including fuel) and maintenance

of aircrafts and the amount of depreciation

11 11ii 20 11iv

thereon in the business other than the business

of carriage of passengers or goods by aircraft

*If answer to ‘2’of Schedule-FBI is yes, enter the figures in 1ii to 19ii on the basis of books of account

NOTE

maintained for Indian operation.

Schedule FBT Details of payment of Fringe Benefit Tax

Sl Date of Deposit Serial Number of

Name of Bank & Branch BSR Code Amount (Rs)

No (DD/MM/YYYY) Challan

NOTE Enter the total of v in 8a and 8b of PART-C

You might also like

- Form6 2008 09Document31 pagesForm6 2008 09api-3850174No ratings yet

- Form ITR-3Document32 pagesForm ITR-3Accounting & Taxation100% (1)

- Indian Income Tax Return FormDocument13 pagesIndian Income Tax Return FormPrakash AryaNo ratings yet

- Part A-GENDocument29 pagesPart A-GENsamaadhuNo ratings yet

- WARSI CORPORATION BALANCE SHEET AND GENERAL INFORMATIONDocument21 pagesWARSI CORPORATION BALANCE SHEET AND GENERAL INFORMATIONbiplab kumarNo ratings yet

- Form ITR-6Document35 pagesForm ITR-6Accounting & TaxationNo ratings yet

- Form PDF 454972120160318Document51 pagesForm PDF 454972120160318SHIKHA SHARMANo ratings yet

- Form PDF 654140500171020Document61 pagesForm PDF 654140500171020Sameer Shekhar ShuklaNo ratings yet

- 2019-01-24-Amit Swaroop 2 - Atgps5835e - 2016Document32 pages2019-01-24-Amit Swaroop 2 - Atgps5835e - 2016ApoorvNo ratings yet

- Form_pdf_168391951200919Document62 pagesForm_pdf_168391951200919ashokbehera708No ratings yet

- Divya Designo Tiles 201920 Itr - 1Document64 pagesDivya Designo Tiles 201920 Itr - 1Suman jhaNo ratings yet

- Itr6 English PDFDocument45 pagesItr6 English PDFPiya DeyNo ratings yet

- Form PDF 762569560050819Document61 pagesForm PDF 762569560050819vineet_knwrNo ratings yet

- Form8 2007 08Document5 pagesForm8 2007 08api-3850174No ratings yet

- ReturnDocument41 pagesReturnsamaadhuNo ratings yet

- ITR-5 Indian Income Tax ReturnDocument34 pagesITR-5 Indian Income Tax ReturnGurpreetNo ratings yet

- Form PDF 297846460200321Document63 pagesForm PDF 297846460200321anupam soniNo ratings yet

- Form ITR-3Document7 pagesForm ITR-3vinay.bpNo ratings yet

- Form PDF 500708580110315Document31 pagesForm PDF 500708580110315Tarak Sarkar AdminNo ratings yet

- Itr Ay 2021Document57 pagesItr Ay 2021Suman jhaNo ratings yet

- Form PDF 116487580060121Document60 pagesForm PDF 116487580060121Rishabh JainNo ratings yet

- 1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnDocument6 pages1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnIRSNo ratings yet

- 2021 01 10 22 32 14 198 - Dicpa9585b - 2020Document60 pages2021 01 10 22 32 14 198 - Dicpa9585b - 2020Ayush AgarwalNo ratings yet

- Divya Designo Tiles 201920 ItrDocument61 pagesDivya Designo Tiles 201920 ItrSuman jhaNo ratings yet

- Indian Income Tax Return ITR-1 Sahaj: Assessment Year 2 0 18 - 1 9Document16 pagesIndian Income Tax Return ITR-1 Sahaj: Assessment Year 2 0 18 - 1 9pingbadriNo ratings yet

- Form PDF 477365500200820Document30 pagesForm PDF 477365500200820Rajpreet gillNo ratings yet

- Form PDF 156692990090121Document61 pagesForm PDF 156692990090121Deepika Darkhorse ProfessionalsNo ratings yet

- US Internal Revenue Service: F1120a - 2005Document2 pagesUS Internal Revenue Service: F1120a - 2005IRSNo ratings yet

- A9Rfcwz1g A682zt AqwDocument46 pagesA9Rfcwz1g A682zt AqwSANJAY DUMBRENo ratings yet

- US Internal Revenue Service: F1120icd - 2005Document6 pagesUS Internal Revenue Service: F1120icd - 2005IRSNo ratings yet

- 2018 Itr4 PR2Document32 pages2018 Itr4 PR2pingbadriNo ratings yet

- (For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document37 pages(For Individuals and Hufs Not Having Income From Profits and Gains of Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Devanshi GoyalNo ratings yet

- (For Companies Other Than Companies Claiming Exemption Under Section 11) (Please See Rule 12 of The Income-Tax Rules, 1962)Document82 pages(For Companies Other Than Companies Claiming Exemption Under Section 11) (Please See Rule 12 of The Income-Tax Rules, 1962)Deeksha SinghNo ratings yet

- Itr6 EnglishDocument56 pagesItr6 EnglishKamal MulchandaniNo ratings yet

- Itr5 EnglishDocument39 pagesItr5 EnglishYogita SoniNo ratings yet

- Itr 2Document34 pagesItr 2Anurag SharmaNo ratings yet

- 2020 01 16 01 07 47 127 - Aaypp5220b - 2019Document55 pages2020 01 16 01 07 47 127 - Aaypp5220b - 2019Aman PorwalNo ratings yet

- 2020 08 08 16 54 23 843 - Aaecb8489p - 2019Document83 pages2020 08 08 16 54 23 843 - Aaecb8489p - 2019Jyoti MeenaNo ratings yet

- ITR2 English PDFDocument16 pagesITR2 English PDFavantgarde bwoyNo ratings yet

- 2021 10 06 18 57 44 748 - Aeopw6998r - 2020Document58 pages2021 10 06 18 57 44 748 - Aeopw6998r - 2020Jaydeep WayalNo ratings yet

- ITR-2 Acknowledgement for AY 2020-21Document32 pagesITR-2 Acknowledgement for AY 2020-21CA Nikhil Munjal100% (1)

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document66 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Nishkarsh eCornerNo ratings yet

- ITR Form AY 19-20Document56 pagesITR Form AY 19-20Anurag Kumar ReloadedNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)gautam_05121970No ratings yet

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document54 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Jaydeep WayalNo ratings yet

- asha itr 4Document11 pagesasha itr 4Niraj JaiswalNo ratings yet

- Form PDF 196652130280722Document58 pagesForm PDF 196652130280722CA kundan kumarNo ratings yet

- Form PDF 804649980151122Document15 pagesForm PDF 804649980151122RAMKISHAN SAHUNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument6 pagesITR-2 Indian Income Tax Return: Part A-GENsatyaagsNo ratings yet

- (DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)Document5 pages(DD/MM/YYYY) : (Please See Rule 12 of The Income-Tax Rules, 1962) (Also See Attached Instructions)anon-928287100% (1)

- Form PDF 973858280311220Document34 pagesForm PDF 973858280311220Sourabh PunshiNo ratings yet

- Incometax2020 2021Document83 pagesIncometax2020 2021Suman jhaNo ratings yet

- Form PDF 846262881191220Document80 pagesForm PDF 846262881191220Ravi KumarNo ratings yet

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document58 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Suman jhaNo ratings yet

- Chandan Itr 2form Downloaded 20-21Document33 pagesChandan Itr 2form Downloaded 20-21Ameet ChandanNo ratings yet

- ITR-3 Form for Individual with Business IncomeDocument57 pagesITR-3 Form for Individual with Business IncomeNeduri Kalyan SrinivasNo ratings yet

- ITR Form AY 20-21Document59 pagesITR Form AY 20-21Anurag Kumar ReloadedNo ratings yet

- (For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Document55 pages(For Individuals and Hufs Having Income From Profits and Gains Business or Profession) (Please See Rule 12 of The Income-Tax Rules, 1962)Eswar YallaNo ratings yet

- US Internal Revenue Service: F1120icd - 2000Document6 pagesUS Internal Revenue Service: F1120icd - 2000IRSNo ratings yet

- Form8 2007 08Document5 pagesForm8 2007 08api-3850174No ratings yet

- Form7 2008 09Document13 pagesForm7 2008 09api-3850174No ratings yet

- Form3 2008 09Document9 pagesForm3 2008 09api-3850174No ratings yet

- Form3 2007 08Document9 pagesForm3 2007 08api-3850174No ratings yet

- Form7 2007 08Document12 pagesForm7 2007 08api-3850174No ratings yet

- Form2 2008 09Document8 pagesForm2 2008 09api-3850174No ratings yet

- Form2 2007 08Document8 pagesForm2 2007 08api-3850174No ratings yet

- Income Tax Return Form 2007-08Document2 pagesIncome Tax Return Form 2007-08api-26893185No ratings yet

- Income Tax Return Form 2007-08Document2 pagesIncome Tax Return Form 2007-08api-26893185No ratings yet

- Acknowledgement 2007 08Document2 pagesAcknowledgement 2007 08api-3850174No ratings yet

- Acknowledgement 2007 08Document2 pagesAcknowledgement 2007 08api-3850174No ratings yet

- Government of Tamil Nadu Directorate of Technical Education Tamil Nadu Engineering Admission - 2020Document3 pagesGovernment of Tamil Nadu Directorate of Technical Education Tamil Nadu Engineering Admission - 2020kalaish123No ratings yet

- Law of Evidence I Standard of Proof Part 2: Prima Facie A.IntroductionDocument10 pagesLaw of Evidence I Standard of Proof Part 2: Prima Facie A.IntroductionKelvine DemetriusNo ratings yet

- Midterm Exam Partnership, Agency & Trust - Sy 2020-2021. 1 Sem InstructionsDocument2 pagesMidterm Exam Partnership, Agency & Trust - Sy 2020-2021. 1 Sem InstructionsPat RañolaNo ratings yet

- Assurance Services: Definition, Types and LimitationsDocument146 pagesAssurance Services: Definition, Types and LimitationsMudassar Iqbal0% (1)

- Professional Regulation Commission: Board of MidwiferyDocument4 pagesProfessional Regulation Commission: Board of MidwiferyDonnabel CapellanNo ratings yet

- Guingona v. Gonzales G.R. No. 106971 March 1, 1993Document1 pageGuingona v. Gonzales G.R. No. 106971 March 1, 1993Bernadette SandovalNo ratings yet

- Hacienda Fatima, Et Al. v. National Federation of Sugarcane Workers-Food and General Trade, G.R. No. 149440, Jan. 28, 2003Document8 pagesHacienda Fatima, Et Al. v. National Federation of Sugarcane Workers-Food and General Trade, G.R. No. 149440, Jan. 28, 2003Martin SNo ratings yet

- 11-8-21 Mohamend Yusuf FilingDocument15 pages11-8-21 Mohamend Yusuf FilingDave MinskyNo ratings yet

- Lucas TVS Price List 2nd May 2011Document188 pagesLucas TVS Price List 2nd May 2011acere18No ratings yet

- Licensure Exams Criminologist ReviewDocument34 pagesLicensure Exams Criminologist ReviewKulot SisonNo ratings yet

- Nissan Motors v Secretary of Labor illegal strike rulingDocument2 pagesNissan Motors v Secretary of Labor illegal strike rulingjenellNo ratings yet

- Oceanic v. CIRDocument1 pageOceanic v. CIRSarah Tarala MoscosaNo ratings yet

- Impact of Ownership Pattern On Independence of MediaDocument3 pagesImpact of Ownership Pattern On Independence of MediaVishek MadanNo ratings yet

- AsfsadfasdDocument22 pagesAsfsadfasdJonathan BautistaNo ratings yet

- Ra Construction and Development Corp.Document3 pagesRa Construction and Development Corp.janus jarderNo ratings yet

- Quotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesDocument7 pagesQuotation Eoi/Rfp/Rft Process Checklist Goods And/Or ServicesTawanda KurasaNo ratings yet

- Innovation Unlocks Access Transforming Healthcare Towards UHCDocument2 pagesInnovation Unlocks Access Transforming Healthcare Towards UHCkvn quintosNo ratings yet

- 6 Coca-Cola Vs CCBPIDocument5 pages6 Coca-Cola Vs CCBPINunugom SonNo ratings yet

- How May I Help You - Communication and Telephone Strategies - 1Document15 pagesHow May I Help You - Communication and Telephone Strategies - 1Gemma ManalastasNo ratings yet

- Succession 092418Document37 pagesSuccession 092418Hyuga NejiNo ratings yet

- TNGST ACT 2017 (With Amendments)Document168 pagesTNGST ACT 2017 (With Amendments)Darshni 18No ratings yet

- BL TestbankDocument47 pagesBL TestbankTrixie de LeonNo ratings yet

- Rahul IAS Notes on Code of Criminal ProcedureDocument310 pagesRahul IAS Notes on Code of Criminal Proceduresam king100% (1)

- 0.US in Caribbean 1776 To 1870Document20 pages0.US in Caribbean 1776 To 1870Tj RobertsNo ratings yet

- Dissertation On BrexitDocument37 pagesDissertation On BrexitChristopher P MurasiNo ratings yet

- The Law On Obligations and Contracts Midterms ExamDocument3 pagesThe Law On Obligations and Contracts Midterms ExamFrancis Ray Arbon Filipinas100% (1)

- PCM10 LA6741 schematics documentDocument37 pagesPCM10 LA6741 schematics documentrmartins_239474No ratings yet

- Xavier Institute of Management: PGPBFS 2010-2011Document21 pagesXavier Institute of Management: PGPBFS 2010-2011Tanmay MohantyNo ratings yet

- Denmark Trans Fats LawDocument2 pagesDenmark Trans Fats LawPerwaiz KhanNo ratings yet

- Khilafat Movement 1919 1924Document4 pagesKhilafat Movement 1919 1924obaidNo ratings yet