Professional Documents

Culture Documents

Form8 2007 08

Uploaded by

api-3850174Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form8 2007 08

Uploaded by

api-3850174Copyright:

Available Formats

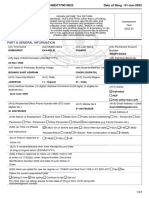

INDIAN INCOME TAX RETURN

[Return for Fringe Benefits] Assessment Year

ITR-8

(Please see Rule 12 of the Income-tax Rules,1962) 2007 - 08

(Also see attached instructions)

Part A-GEN GENERAL

Name PAN

Is there any change in the company’s name? If yes, please furnish the old name

Flat/Door/Block No Name Of Date of formation/ incorporation

Premises/Building/Village (DD/MM/YYYY)

Road/Street/Post Office Area/Locality Status-

Write 1 if company,

write2 if fir m, and

write 3 if others

Town/City/District State Pin code In case of company-

Email Address (STD code)-Phone Number If domestic, write ‘1’

( ) and if other than

domestic, write ‘2’

Designation of Area AO Range AO No Return filed

Assessing Officer Code Type Code under section (Enter Code)

[See instruction number-9(i)]

Whether original or Revised return? (Tick) Original Revised

If revised, then enter Receipt No and Date of filing

original return (DD/MM/YYYY)

In the case of non-resident, is there a permanent establishment (PE) in India (Tick) Yes No

Whether this return is being filed by a representative assessee? (Tick) Yes No

If yes, please furnish following information -

(a) Name of the representative

(b) Address of the representative

( c) Permanent Account Number (PAN) of the representative

Are you liable to maintain accounts as per section 44AA? (Tick) Yes No

Are you liable for audit under section 44AB? (Tick) Yes No, If yes, furnish following information-

(a) Name of the auditor signing the tax audit report

(b) Membership no. of the auditor

(c) name of the auditor(Proprietorship/firm)

(d) Permanent Account Number (PAN) of the proprietorship/ firm

(e) Date of audit report.

For Office Use Only For Office Use Only

Receipt No

Date

Seal and Signature of receiving official

PART-B

Part B Computation of Fringe Benefits and fringe benefit tax

1 Value of fringe benefits

a for first quarter 1a

b for second quarter 1b

c for third quarter 1c

d for fourth quarter 1d

e Total fringe benefits (1a + 1b + 1c + 1d) ( also 24 iv of Schedule- 1e

FB)

2 Fringe benefit tax payable [30% of 1e] 2

3 Surcharge on 2 3

4 Education Cess on (2 + 3) 4

5 Total fringe benefit tax liability (2 + 3 + 4) 5

6 Interest payable

a For default in payment of advance tax 6a

(section115WJ (3))

b For default in furnishing the return 6b

(section 115WK)

c Total interest payable 6c

7 Aggregate liability (5 + 6c) 7

8 Taxes paid

a Advance fringe benefit tax(from 8a

Schedule-FBT)

b On self-assessment (from Schedule- 8b

FBT)

c Total Taxes Paid (8a + 8b) 8c

9 Tax Payable (Enter if 7 is greater than 8c, else enter 0). 9

10 Refund (enter If 8c is greater than 7, else enter 0) also give the bank account 10

details in Schedule-BA

11 Enter your bank account number (mandatory in case of refund)

12 Do you want your refund by cheque, or deposited directly into your bank account?

(tick as applicable)

13 In case of direct deposit to your bank account give additional details

MICR Code Type of Account Savings Current

(tick as applicable)

11 E-filing Acknowledgement Number Date(DD/MM/YYYY)

VERIFICATION

I, …………….. …………… ……………….. …………………… …… (full name in block letters), son/ daughter of ……

……. ……………… ………………… solemnly declare that to the best of my knowledge and belief, the information

given in the return and the schedules thereto is correct and complete and that the amount of total

income/ fringe benefits and other particulars shown therein are truly stated and are in accordance with

the provisions of the Income-tax Act, 1961, in respect of income and fringe benefits chargeable to

income-tax for the previous year relevant to the assessment year ______________. I further declare

that I am making this return in my capacity as ___________ and I am also competent to make this

return and verify it.

Place Date Sign here

Schedule - FBI Information regarding calculation of value of fringe benefits

1 Are you having employees based both in and outside India? If yes write 1, and if no

write 2

2 If answer to ‘1’ is yes, are you maintaining separate books of account for Indian and

foreign operations? If yes write 1, and if no write 2

3 Total number of employees

a Number of employees in India 3a

b Number of employees outside India 3b

c Total number of employees 3c

Schedule FB Computation of value of fringe benefits

Sl. Nature of expenditure Amount/value of Percent Value of fringe benefits

No. expenditure* -age iv= ii x iii ÷ 100

i ii iii iv

1 Free or concessional tickets 1ii 100 1iv

provide d for private journeys

of employees or their family

members (the value in

column ii shall be the cost of

the ticket to the general

public as reduced by the

amount, if any, paid by or

recovered from the employee)

2 Contribution to an approved 2ii 100 2iv

superannuation fund for

employees (in excess of one

lakh rupees in respect of each

employee)

3 Entertainment 3ii 20 3iv

4 a Hospitality in the business aii 20 aiv

other than business

referred to in 4b or 4c or

4d

b Hospitality in the business bii 5 biv

of hotel

c Hospitality in the business cii 5 civ

of carriage of passengers

or goods by aircraft

d Hospitality in the business dii 5 div

of carriage of passengers

or goods by ship

5 Conference (other than fee for 5ii 20 5iv

participation by the employees

in any conference)

6 Sales promotion including 6ii 20 6iv

publicity (excluding any

expenditure on advertisement

referred to in proviso to

section 115WB(2)(D)

7 Employees welfare 7ii 20 7iv

8 a Conveyance, in the aii 20 aiv

business other than the

business referred to in 8b

or 8c or 8d

b Conveyance, in business bii 5 biv

of construction

c Conveyance in the cii 5 civ

business of manufacture

or production of

pharmaceuticals

d Conveyance in the dii 5 div

business of manufacture

or production of computer

software

9 a Use of hotel, boarding and aii 20 aiv

lodging facilities in the

business other than the

business referred to in 9b

or 9c or 9d or 9e

b Use of hotel, boarding and bii 5 biv

lodging facilities in the

business of manufacture

or production of

pharmaceuticals

c Use of hotel, boarding and cii 5 civ

lodging facilities in the

business of manufacture

or production of

computer software

d Use of hotel, boarding and dii 5 div

lodging facilities in the

business of carriage of

passengers or goods by

aircraft

e Use of hotel, boarding and eii 5 eiv

lodging facilities in the

business of carriage of

passengers or goods by

ship

10 a Repair, running (including aii 20 aiv

fuel), maintenance of

motor cars and the

amount of depreciation

thereon in the business

other than the business of

carriage of passengers or

goods by motor car

b Repair, running (including bii 5 biv

fuel), maintenance of

motor cars and the

amount of depreciation

thereon in the business of

carriage of passengers or

goods by motor car

11 Repair, running (including fuel) 11ii 20 11iv

and maintenance of air crafts

and the amount of

depreciation thereon in the

business other than the

business of carriage of

passengers or goods by

aircraft

12 Use of telephone (including 12ii 20 12iv

mobile phone) other than

expenditure on leased

telephone lines

13 Maintenance of any 13ii 20 13iv

accommodation in the nature

of guest house other than

accommodation used for

training purposes

14 Festival celebrations 14ii 50 14iv

15 Use of health club and similar 15ii 50 15iv

facilities

16 Use of any other club facilities 16ii 50 16iv

17 Gifts 17ii 50 17iv

18 Scholarships 18ii 50 18iv

19 Tour and Travel (including 19ii 5 19iv

foreign travel)

20 Value of fringe benefits (total of Column iv) 20iv

21 If answer to ‘1’ of Schedule-FBI is no, value of fringe benefits (same 21iv

as20iv)

22 If answer to ‘2’of Schedule-FBI is yes, value of fringe benefits (same 22iv

as20iv)

23 If answer to ‘2’of Schedule-FBI is no, value of fringe benefits ( 20iv x 23iv

3a of Schedule-FBI ÷3c of Schedule-FBI)

24 value of fringe benefits(21iv or 22iv or 23iv as the case may be) 24iv

NOTE *If answer to ‘2’of Schedule-FBI is yes, enter the figures in 1ii to 19ii on the basis of books of account

maintained for Indian operation.

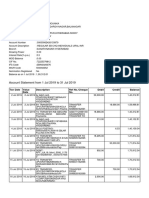

Schedule FBT Details of payment of Fringe Benefit Tax

Sl.No Name of Bank & Branch BSR Code Date of Serial No of the Amount (Rs)

Deposit Challan

i

ii

iii

iv

v

NOTE Enter the total of v in 8a and 8b of PART-B

You might also like

- Form2 2007 08Document8 pagesForm2 2007 08api-3850174No ratings yet

- Form3 2007 08Document9 pagesForm3 2007 08api-3850174No ratings yet

- Form3 2008 09Document9 pagesForm3 2008 09api-3850174No ratings yet

- Itr U EnglishDocument4 pagesItr U EnglishSHREYASNo ratings yet

- Itr4 PreviewDocument8 pagesItr4 PreviewMrinal PandeyNo ratings yet

- Form PDF 525102150231123Document10 pagesForm PDF 525102150231123premjyotisingh1990No ratings yet

- Form PDF 199358390040623Document9 pagesForm PDF 199358390040623suneetbansalNo ratings yet

- Asha Itr 4Document11 pagesAsha Itr 4Niraj JaiswalNo ratings yet

- Form PDF 819556980290723Document9 pagesForm PDF 819556980290723kambojnaresh693No ratings yet

- Form PDF 130495880310723Document10 pagesForm PDF 130495880310723Rahul ChowdhuryNo ratings yet

- Form PDF 284892120220923Document10 pagesForm PDF 284892120220923nishantsahab0786No ratings yet

- Form PDF 720742190260723Document10 pagesForm PDF 720742190260723rishika 61No ratings yet

- ITR Form-1 (Sahaj)Document1 pageITR Form-1 (Sahaj)NDTVNo ratings yet

- Form PDF 169967860090424Document11 pagesForm PDF 169967860090424akallinonesolutionNo ratings yet

- Form PDF 564435460211223Document10 pagesForm PDF 564435460211223ashimkarar19.akNo ratings yet

- Form PDF 151809980160523Document10 pagesForm PDF 151809980160523arvind singhalNo ratings yet

- Form PDF 160159480020823Document10 pagesForm PDF 160159480020823SanthoshRajNo ratings yet

- Form PDF 125631830310723Document10 pagesForm PDF 125631830310723Sumit SainiNo ratings yet

- Form PDF 645857770010622Document9 pagesForm PDF 645857770010622GURU KRUPANo ratings yet

- Form PDF 606473310030522Document9 pagesForm PDF 606473310030522mahayogiconsultancyNo ratings yet

- Form PDF 818771700290723Document10 pagesForm PDF 818771700290723akshayboss69No ratings yet

- Form PDF 634490090270522Document6 pagesForm PDF 634490090270522milan guptaNo ratings yet

- Form PDF 177155750160424Document11 pagesForm PDF 177155750160424dkassociate609No ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)MaheshNo ratings yet

- Itr File 2023:24Document9 pagesItr File 2023:24Aatif KhanNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Vikas CheedellaNo ratings yet

- Form PDF 197504840210823Document9 pagesForm PDF 197504840210823jassramgarhia2812No ratings yet

- Itr4 PreviewDocument10 pagesItr4 PreviewSK TOYFIK ALINo ratings yet

- Itr 3Document58 pagesItr 3Anurag SharmaNo ratings yet

- Form PDF 432385000170822Document9 pagesForm PDF 432385000170822Khan kingNo ratings yet

- Preview 4Document10 pagesPreview 4HarshVardhan Singh RathorNo ratings yet

- Form PDF 399351960101023Document10 pagesForm PDF 399351960101023knowthebest787No ratings yet

- Form PDF 398881510090723Document10 pagesForm PDF 398881510090723CA Anil SahuNo ratings yet

- Form PDF 588379620210723Document10 pagesForm PDF 588379620210723govindadv75No ratings yet

- Form PDF 338831280310722Document6 pagesForm PDF 338831280310722Sumit SainiNo ratings yet

- Itr2022 23Document7 pagesItr2022 23Debabrata pahariNo ratings yet

- Form For TaxationDocument6 pagesForm For TaxationAjay PanghalNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Gangi ReddyNo ratings yet

- Form PDF 390574310061023Document10 pagesForm PDF 390574310061023Fascino WhiteNo ratings yet

- Form PDF 360019890310722Document9 pagesForm PDF 360019890310722Sumit SainiNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)siddhartha barmanNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Dipannita DasNo ratings yet

- Form PDF 111631390310723Document10 pagesForm PDF 111631390310723lalitkaushik0317No ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewPowerNo ratings yet

- Form PDF 355023060310722Document7 pagesForm PDF 355023060310722Ashok Singh PatelNo ratings yet

- Form PDF 345858330310722Document10 pagesForm PDF 345858330310722narasimhahanNo ratings yet

- Form PDF 448030910271023Document10 pagesForm PDF 448030910271023prakashdebleyNo ratings yet

- Form PDF 237268260290722Document9 pagesForm PDF 237268260290722cfaprep040No ratings yet

- Form PDF 234225760140623Document7 pagesForm PDF 234225760140623neethinathan.citrusNo ratings yet

- Form PDF 261954020190623Document9 pagesForm PDF 261954020190623TANUJ CHAKRABORTYNo ratings yet

- Form PDF 170821030270722Document7 pagesForm PDF 170821030270722varalakshmi somaNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewPriyanshuNo ratings yet

- Itr1 PreviewDocument7 pagesItr1 PreviewRSC NabardNo ratings yet

- Form PDF 638711440230723Document10 pagesForm PDF 638711440230723taxindia610No ratings yet

- Itr1 PreviewDocument9 pagesItr1 PreviewAditya Kumar SinghNo ratings yet

- Itr1 PreviewDocument8 pagesItr1 PreviewManuj RathoreNo ratings yet

- Form PDF 494190400281221Document8 pagesForm PDF 494190400281221Suprava MishraNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Form7 2007 08Document12 pagesForm7 2007 08api-3850174No ratings yet

- Form7 2008 09Document13 pagesForm7 2008 09api-3850174No ratings yet

- Form6 2008 09Document31 pagesForm6 2008 09api-3850174No ratings yet

- Form2 2008 09Document8 pagesForm2 2008 09api-3850174No ratings yet

- Acknowledgement 2007 08Document2 pagesAcknowledgement 2007 08api-3850174No ratings yet

- Form8 2008 09Document6 pagesForm8 2008 09api-3850174No ratings yet

- Income Tax Return Form 2007-08Document2 pagesIncome Tax Return Form 2007-08api-26893185No ratings yet

- Income Tax Return Form 2007-08Document2 pagesIncome Tax Return Form 2007-08api-26893185No ratings yet

- Acknowledgement 2007 08Document2 pagesAcknowledgement 2007 08api-3850174No ratings yet

- Accounts NotesDocument482 pagesAccounts NotesVishnuReddyNo ratings yet

- Job Analysis NIB BankDocument15 pagesJob Analysis NIB BankKiran ReshiNo ratings yet

- Man With Two Shadows PLR3Document9 pagesMan With Two Shadows PLR3Lina JacovkisNo ratings yet

- Basic Elements of Business Letter and Optional PartsDocument8 pagesBasic Elements of Business Letter and Optional PartsMichelle Montalbo ParaliasNo ratings yet

- Government Securities Market in India - A PrimerDocument47 pagesGovernment Securities Market in India - A Primeruhyr ujdgbNo ratings yet

- Analyzing and Investing in Community Bank StocksDocument234 pagesAnalyzing and Investing in Community Bank StocksRalphVandenAbbeele100% (1)

- BPI v. SuarezDocument2 pagesBPI v. SuarezReymart-Vin MagulianoNo ratings yet

- Accounts of Banking Companies MCQ - Multiple Choice Questions and AnswersDocument10 pagesAccounts of Banking Companies MCQ - Multiple Choice Questions and AnswersShivam PatelNo ratings yet

- Standard Cipher Code American Railway 1906Document776 pagesStandard Cipher Code American Railway 1906Max Power100% (1)

- Case Counts PradnyaDocument15 pagesCase Counts PradnyaChaitali DegavkarNo ratings yet

- Firestone vs. Ca GR No. 113236Document2 pagesFirestone vs. Ca GR No. 113236REA RAMIREZNo ratings yet

- fb2019 Halaman PDFDocument180 pagesfb2019 Halaman PDFputrii auliaNo ratings yet

- "New Customer Acquisition of IDBI Bank": A Project Report OnDocument55 pages"New Customer Acquisition of IDBI Bank": A Project Report OnGaganpreet SinghNo ratings yet

- RemDocument15 pagesRemMohammad Yusof MacalandapNo ratings yet

- DM - ATM Security SolutionDocument41 pagesDM - ATM Security Solutionapi-3770143No ratings yet

- Guna FibreDocument21 pagesGuna FibreAirlangga Prima Satria MaruapeyNo ratings yet

- 1566740571410uf5Ngn9Nm9H6neju PDFDocument2 pages1566740571410uf5Ngn9Nm9H6neju PDFChandu GoudNo ratings yet

- Nri Banking 11Document45 pagesNri Banking 11dalvishweta100% (1)

- Accounting Workbook Section 4 AnswersDocument49 pagesAccounting Workbook Section 4 AnswersAhmed Zeeshan100% (22)

- Cosmopolitan Singapore - July 2013 PDFDocument164 pagesCosmopolitan Singapore - July 2013 PDFdrolfxil100% (2)

- Business Finance PPT 1Document10 pagesBusiness Finance PPT 1angelica beatriceNo ratings yet

- Part 1 The Philipine Financial SystemDocument17 pagesPart 1 The Philipine Financial SystemRona MaglahusNo ratings yet

- 1 (Read)Document259 pages1 (Read)Edris YawarNo ratings yet

- Supervisory Policy Manual: CR-S-5 Credit Card BusinessDocument43 pagesSupervisory Policy Manual: CR-S-5 Credit Card BusinessccnmiNo ratings yet

- JkumarDocument250 pagesJkumar80ALLAVINo ratings yet

- GA Tax GuideDocument46 pagesGA Tax Guidedamilano1No ratings yet

- A Study On AtmDocument143 pagesA Study On AtmAbhishek PandeyNo ratings yet

- 09 BankingDocument11 pages09 Bankingnaveen reddy MedimalliNo ratings yet

- Self-Test Audit of CashDocument8 pagesSelf-Test Audit of CashShane TorrieNo ratings yet

- International Management Journals: International Journal of Applied Public-Private PartnershipsDocument11 pagesInternational Management Journals: International Journal of Applied Public-Private Partnershipsarup_halderNo ratings yet