Professional Documents

Culture Documents

0621macau Gaming Sector

Uploaded by

Kumaran Systems Inc.Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

0621macau Gaming Sector

Uploaded by

Kumaran Systems Inc.Copyright:

Available Formats

Regional Industry Focus

Macau Gaming

DBS Group Research Equity 21 June 2010

HSI : 20,287

Bet on the leaders

Favourable demand/supply dynamics in 2010, but sizeable new supply at Cotai post-2011 As competition intensifies, we prefer concessionaires with strong branding, strategic properties at Macau Peninsula, and strong balance sheets Macau gaming sector is a good proxy to Chinas fast growing domestic consumption; initiate coverage with Wynn Macau and SJM as top picks Growth holding up. Thus far, Chinas visa restriction and monetary tightening have not dampened Macaus gross gaming revenue (GGR) growth. GGR growth has rebounded strongly since 3Q09 (partly from a low base), with 5M10 GGR at a staggering MOP72b (+67% y-o-y). We expect growth to ease in 2H10 but remain decent to average 28% in 2010F (MOP153b) and 11% in 2011F (MOP170b). This would represent 2.5x and 1.1x Chinas GDP growth respectively, within historical range of 1.1-4.4x. Macaus gaming industry would be supported by Chinas macro factors: (i) low gaming penetration rate; (ii) accelerating GDP growth; (iii) increased discretionary spending with rising income; (iv) improving transport infrastructure; and (v) extension of individual visa scheme to more provinces. EBITDA margins should also gradually improve with higher mass-market contribution and more direct VIPs, along with positive impact from junket commission cap (effective since Dec 09). Better demand/supply at Macau Peninsula. 2010F will see the slowest supply growth since the liberalization of Macaus gaming sector, with only Encore opening. But there will be large new supply of integrated resorts in 2011-12F at less matured Cotai (Galaxy Macau, Parcels 5 & 6). Table cap although raises uncertainty, should help ensure industry stability. Cotai may be the next growth story, but this could materialise later rather than sooner as the hard-core gaming mentality of mainland Chinese cannot change overnight, and most infrastructure improvements will be completed post2013. Undemanding valuation for strong growth, at 12.1x 2011 EV/EBITDA vs 2-year EBITDA CAGR of 23%. Macau gaming stocks are trading at 9-16% discount to Chinas consumer stocks. As competition intensifies, we prefer proven market leaders with strong branding, strategic properties in Macau Peninsula, and healthy balance sheets. Top picks: SJM and Wynn Macau. We also like Galaxy, which should see a rerating with the opening of Galaxy Macau in 1Q11 (boost long-term growth/market share and diversify earnings).

In Singapore, this research report or research analyses may only be distributed to Institutional Investors, Expert Investors or Accredited Investors as defined in the Securities and Futures Act, Chapter 289 of Singapore. www.dbsvickers.com Refer to important disclosures at the end of this report ed: SGC / sa: DC

Chinas macro factors will support Macaus robust gaming Analyst Yee Mei Hui +603 2711 1332 revenue growth

Ken Chen +852 2863-8923 ken_chen@hk.dbsvickers.com

meihui@hwangdbsvickers.com.my

Recipients of this report, received from DBS Vickers Research (Singapore) Pte Ltd (DBSVR), are to contact DBSVR at +65 6398 7954 in respect of any matters arising from or in connection with this report.

TOP PICKS Mkt Cap (US$m) SJM Holdings (880 HK) Wynn Macau (1128 HK) Galaxy Entertainment (27 HK) Sands China (1928 HK) 25,706 64,533 14,663 103,013 Price Target Price Potential (HK$) (HK$) Upside 6.60 13.20 4.11 12.06 8.10 15.40 5.00 12.40 23 17 22 3 Rating BUY BUY BUY HOLD

Source: DBS Vickers

SJM Holdings : Incumbent with largest market share by number of casinos, gaming revenue and tables. Owns 23 casinos mainly at Macau Peninsula, namely Grand Lisboa, Lisboa, Oceanus, Jai Alai and thirdparty promoted casinos/slot halls. Wynn Macau : Owns Wynn Macau and newly opened Encore at Macau Peninsula. Potential Cotai expansion at 52-acre site. Galaxy Entertainment : Owns Starworld and City Clubs at Macau Peninsula. Galaxy Macau at Cotai completing in early-2011. Sands China : Largest exposure to Cotai - owns Venetian Macao, Plaza Macao, Parcels 5 & 6 (opening in Sep 2011) and rights to develop Parcels 3, 7 & 8. Also owns Macaus first Las Vegas-styled casino ie Sands Macau at Macau Peninsula.

Figure 1: GGR riding on Chinas robust domestic consumption

(MOPb) 180 160 140 120 100 80 60 40 20 0 2003 2004 2005 2006 2007 2008 2009 2010F 2011F (%) 14 13 12 11 10 9 8 7 6

Gross Gaming Rev enue (LHS)

Real GDP growth (RHS)

Source: CEIC, DBS Vickers

Industry Focus Macau Gaming

Yee Mei Hui Ken Chen

(603) 2711 1332 meihui@hwangdbsvickers.com.my (852) 2863-8923 ken_chen@hk.dbsvickers.com

Table of Contents

Investment Summary Wind Beneath Macau Wings VIP Segment: Still Expanding Mass Segment: Potential New Growth Driver A Tale of Two Cities Biggest Market Share Gainers: Wynn, Galaxy Risks Valuation: Still Room for Expansion Strategy and Stock Picks Stock Profiles

SJM Wynn Macau Galaxy Sands China 28 44 58 74

3 5 12 14 16 20 21 23 26

Recipients of this report, received from DBS Vickers Research (Singapore) Pte Ltd (DBSVR), are to contact DBSVR at +65 6398 7954 in respect of any matters arising from or in connection with this report.

Appendices

92

Page 2

Industry Focus Macau Gaming

Investment Summary

We initiate coverage of the Macau gaming sector because it is a good proxy to Chinas rapidly growing domestic consumption. Macaus gaming revenue growth will be supported by Chinas macro factors: a) Low gaming penetration rate (0.3% of GDP vs 0.6% in the US); b) Accelerating GDP growth (2010F: 11%; 2011F: 10% vs 2009: 8.7%) and improving consumer sentiment; c) Increased discretionary spending with rising income; d) Improving transport infrastructure in China and accessibility to Macau; and e) Extension of individual visa scheme to more provinces/cities. Although 4Q09-May10s strong GGR growth may not be sustainable (>50% y-o-y), we expect it to be decent in 2010-11F at 28% (MOP153b) and 11% (MOP170b) representing 2.5x and 1.1x Chinas GDP growth respectively (within historical range of 1.1-4.4x). Impact of monetary tightening may be less damaging than feared as money supply is still expanding, while property prices have largely held up despite administrative measures. Europes sovereign debt crisis and nascent US economic recovery should have minimal impact on Chinas GDP (largely domestic-driven) and could lead to further deferment of interest rate hikes. Gongbei Gate expansion and Guangzhou-Zhuhai Mass Rapid Transit, expected to be completed within the next 614 months, could attract new demand. 2010 will be a sweet spot given minimal new supply (only Encores opening at Macau Peninsula in Apr10). But the environment could be challenging from 2011 given new supply of integrated resorts at less matured Cotai (Galaxy Macau in early 2011, Parcels 5 & 6 in 3Q11-1Q12). Incremental demand is unlikely to match supply perfectly in the short-term, as Cotai may be a longer-term story with its higher non-gaming offering. EBITDA margins should gradually improve with: a) Higher mass-market contribution driven by infrastructure improvements reaching out to cities further away, b) More direct VIPs (junkets however will still be important, so long as China still has capital controls and do not recognize gaming debts), and c) Positive impact from junket commission cap at 1.25% rolling chip (since Dec 09). With stronger competition ahead, we prefer concessionaires with strong branding and strategic properties at Macau Peninsula (highest potential to grow/defend market share) as well as solid balance sheets. Top picks are SJM and Wynn Macau. Macau should be relatively less affected by rising regional competition as 82% of visitor arrivals originate from China and Hong Kong, with day-trippers constituting 52%. Macau will remain the preferred gaming destination given its proximity, convenience, and credit availability (via junkets). We see policy risk as the biggest concern, but the Macau government will likely be pragmatic as gaming tax contributes a significant 77% to public revenue. The imposition of table cap (5,500 up to 2013 vs 1Q10s 4,811) although raises uncertainty, should help ensure industry stability. The table cap could affect Parcels 5 & 6 (670 tables) more than Galaxy Macau (600 tables), given the formers later opening date but may be partially mitigated by reallocation of tables from existing properties and introduction of more electronic table games. Macau gaming sectors valuation remains undemanding at 12.1x 2011 EV/EBITDA, for a strong 23% earnings growth (2-year EBITDA CAGR). Some individual stocks are trading at 9-16% discounts to China consumer stocks. Stock picks: SJM (Buy; TP HK$8.10). This Macau incumbent has the largest market share by gaming revenue (32%) and tables (36%). Earnings growth will be driven by maiden contribution from Oceanus (100% mass-market), two new VIP floors at Grand Lisboa (opening in 4Q10), and restructuring of third-party service agreements. Its HK$4.2b net cash should help support expansion plans ie redevelopment of Portugese school site next to Grand Lisboa, renovation of Casino Lisboa, and potential Cotai ventures. SJM is attractive while trading at 7.4x 2011 EV/EBITDA vs sectors 12.1x and China mid-cap consumer stocks 8.4x, despite stronger EBITDA growth (2-year CAGR: 31% vs 23%, 17% respectively). SJM is the only Macau gaming company with a dividend policy (50% of distributable profits). Wynn Macau (Buy; TP HK$15.40). The recent opening of VIP-centric Encore should help boost EBITDA (2-year CAGR: 25%) and market share (17% from 14%), while creating synergy by allowing adjoining Wynn Macau to expand in the more profitable grind segment. The company deserves to trade at a premium given its strong brand name, management and balance sheet (which should help support its Cotai venture). Valuation is attractive at 12.7x 2011 EV/EBITDA vs large-cap Chinese consumer stocks 15.2x, with comparable earnings growth. Galaxy (Buy; TP HK$5.00). Potential re-rating with the opening of Galaxy Macau in 1Q11, which should boost long-term earnings growth potential/market share and diversify earnings from Starworlds VIP operations which is expected to continue to do well given its strategic location at Macau Peninsula (adjacent to Wynn Macau and Grand Lisboa). Although Galaxy is trading on par with the sector (11.8x 2011 EV/EBITDA vs 12.1x) and premium to China mid-cap consumer stocks 8.4x, but on EV/EBITDA relative to growth basis, Galaxy looks attractive at 0.3x vs the latters 0.5x. Plus, we have used conservative assumptions for Galaxy Macau even then, Galaxy is expected to have the strongest EBITDA growth in the sector (2-year CAGR: 39%).

Page 3

Industry Focus Macau Gaming

Figure 2: Sector valuation

Share price (LC$) Mac au Sands China Wynn Macau SJM Galaxy Melco 12.06 13.20 6.60 4.11 3.37 M arket Cap (USDm) 12,466 8,795 4,279 2,081 533 28,154 Hold Buy Buy Buy NR Rating TP Upside 2-year CAGR (%) 14 25 31 39 n.m. 23 2009 (x) 17.8 22.3 12.3 16.8 n.m. 18.3 EV /EBITDA 2010F (x) 15.8 15.3 8.0 18.6 32.0 14.4 2011F (x) 13.8 12.7 7.4 11.8 27.8 12.1 2011F EV/ EBITDA vs growth (x) 1.0 0.5 0.2 0.3 n.m. 0.5 PE 2009 (x) 58.3 33.1 36.4 18.3 n.m. 66.4 2010F (x ) 34.5 21.6 14.4 31.6 n.m. 25.0 2011F (x) 29.8 18.5 12.6 27.1 80.2 21.3 2010F Divd Yield (%) 0.0 0.0 2.6 0.0 0.0 0.5 P/BV

(HK$) 12.40 15.40 8.10 5.00 n.a.

(%) 3 17 23 22 n.a.

(x ) 3.4 18.2 3.9 2.0 0.6 5.6

Source: DBS Vickers

Figure 3: Comparison between casino operators

Company Stock code FY09A Casinos - Macau Peninsula - Cotai Tables Slots Revenue (HK$bn) - VIP - Mass - Slots Revenue mix (%) - VIP - Mass - Slots Market Share - VIP - Mass EBITDA (HK$bn) - Growth - Margin Cotai Exposure 59% 38% 3% 29% 25% 36% 2.3 43% 6% 60% 37% 3% 29% 25% 39% 3.6 58% 8% Yes No schedule Net Gearing Net Cash 64% 33% 3% 27% 25% 32% 3.9 9% 9% 72% 20% 8% 14% 15% 12% 3.2 38% 23% 81% 13% 6% 17% 20% 11% 4.5 12% 21% Yes Early 2014 Net Cash 28% 82% 12% 5% 17% 21% 10% 4.0 5% 21% 78% 16% 6% 9% 11% 4% 1.1 106% 9% 87% 12% 1% 9% 11% 4% 1.4 21% 9% Yes Early 2011 97% 96% 84% 15% 2% 11% 13% 6% 2.2 61% 11% 54% 38% 8% 23% 18% 32% 6.3 18% 25% 55% 38% 7% 20% 16% 30% 7.1 13% 25% Yes Operational and developing (3Q11-1Q12) 51% 48% 44% 55% 37% 8% 21% 17% 30% 8.2 15% 26% 18 16 2 320 4,567 34.1 20.0 13.0 1.0 SJM 880 HK FY10F 18 16 2 360 4,567 44.1 26.5 16.2 1.4 FY11F 18 16 2 360 4,567 45.7 29.3 15.2 1.3 FY09A 1 1 1 196 1,195 16.9 12.2 3.4 1.3 Wynn Macau 1128 HK FY10F 1 1 1 233 1,290 26.1 21.2 3.4 1.4 FY11F 1 1 1 233 1,290 29.6 24.4 3.7 1.5 FY09A 5 4 1 213 502 10.8 8.4 1.7 0.7 Galaxy 27 HK FY10F 5 4 1 235 502 13.5 11.8 1.6 0.1 FY11F 6 5 1 635 1,502 17.9 15.0 2.6 0.3 FY09A 3 1 2 1,128 3,491 27.1 14.5 10.4 2.1 Sands China 1928 HK FY10F 3 1 2 1,128 3,491 30.6 16.8 11.5 2.2 FY11F 4 1 3 1,528 5,691 35.2 19.5 13.0 2.7

Source: Respective companies, DBS Vickers

Page 4

Industry Focus Macau Gaming

Wind beneath Macaus wings

Proven resilience. Despite the financial crisis and Influenza A (H1N1) outbreak, Macaus gross gaming revenue (GGR) continued to hit fresh highs of US$15.4b (+10% y-o-y) in 2009 - maintaining its position as the worlds largest gaming market. GGR staged a remarkable rebound in 2H09 (+36% y-o-y), making up for 1H09s 12% y-o-y contraction. Growth was strongest in the VIP segment (+42% y-o-y), which constitute 69% of GGR, followed by mass tables (+24% y-o-y) and slots (+18% y-o-y). GGR has been growing consistently for the past six years (27% CAGR), driven by Chinas healthy GDP growth and influx of Las Vegas-style casinos which tripled the number of casinos to 33. We expect GGR to continue to expand steadily driven by conducive macro factors in China: (i) low gaming penetration rate; (ii) accelerating economic growth; (iii) rising discretionary spending; (iv) infrastructure improvements; and (v) extension of visas to more provinces/cities. Figure 4: Strong GGR growth driven by VIP segment

(MOPb) 180 160 140 120 100 80 60 40 20 0 2004 2005 2006 2007 2008 2009 2010F 2011F V IP Mass YOY Chg (%) 50 45 40 35 30 25 20 15 10 5 0

Should growth revert to 2006-08 average of 2.9x Chinas GDP growth, 2010F GGR may touch MOP159b (+32%) implying a monthly average of MOP12.3b for Jun-Dec10. Although 2H10 growth will not be as explosive as 1H10, it could still be a decent 10% y-o-y in line with GDP growth. For 2011F, we expect GGR to expand by 11% to MOP170b driven by 10% and 15% growth in the VIP and mass segments. This puts GGR growth rate at 1.1x Chinas GDP growth of 10% (house estimate) lower end of historical average, after the explosive growth seen in 2010F. There could be potential upside to our estimates with the completion of Guangzhou-Zhuhai Mass Rapid Transit by end-10 (cut travelling time from 2-3 hours to 47 minutes), and Gongbei Gate expansion by Aug11 (capacity to handle 350k-500k visitors daily vs 150k currently), which could attract new mass market demand. Figure 5: Strong growth momentum since Jul 09

(MOPb) 18 16 14 12 10 8 6 4 2 0 J ul-05 J ul-06 J ul-07 J ul-08 J ul-09 -20 -40 % YOY Chg (RHS) Monthly gaming rev enue (LHS) (%) 100 80 60 40 20 0

Source: CEIC

Figure 6: Ratio of GGR growth to Chinas GDP growth

Gaming Revenue MOPb 29 41 46 57 83 109 119 152 170 GGR Growth (%) 44 11 23 47 31 10 28 11 China Real GDP growth (%) 10.0 10.1 10.4 11.6 13.0 9.6 8.7 11.0 10.0 Ratio (x) 4.4 1.1 2.0 3.6 3.2 1.1 2.5 1.1

Source: CEIC, DBS Vickers

Hitting new highs. We expect GGR to grow by 28% y-o-y to MOP153b in 2010F, breaking 2009s record MOP120b. 5M2010 GGR was a staggering MOP72b (+67% y-o-y), with May10 coming in at MOP17b (+95% y-o-y) - rewriting previous benchmarks set in Apr10 (MOP14.3b) and Jan10 (MOP14.0b). But since 2H10 could see GDP/money supply growth moderating and administrative measures kicking in to affect property prices, we conservatively based our forecast for the remaining months on 2H09 average monthly GGR of MOP11.4b. Our GGR growth projection works out to 2.5x Chinas GDP growth (2010F: 11%) within the historical range of 1.1x-4.4x.

2003 2004 2005 2006 2007 2008 2009 2010F 2011F

Source: CEIC, DBS Vickers

Page 5

Industry Focus Macau Gaming

Chinas macro factors support gaming revenue growth a) Low gaming penetration rate We see ample room for continued GGR growth as China and Hong Kongs gaming penetration rate is only 0.3% vs 0.6%-5.2% for other markets. Based on US penetration rate of 0.6%, Macaus gaming sector has the potential to grow by 91% to US$29b even before factoring in Chinas strong GDP growth. Macau is currently the only legal gaming area in China. Figure 7: Chinas gaming penetration rate still low

Country Casino Revenue (US$b) 3.5 0.2 1.5 4.3 15.4 32.5 2.4 Total Gaming Revenue (US$b) 8.5 n/a 4.0 n/a 15.5 92.3 14.3 2009 GDP (US$b) 163 11 207 755 4,907 14,256 727 Casino Revenue as % GDP (%) 2.1% 1.8% 0.7% 0.6% 0.3% 0.2% 0.3% Gaming Revenue as % GDP Remarks (%) Estimates for 5.2% integrated resorts n/a 1.9% n/a 0.3% 0.6% 2.0% Based on China + HK GDP

Figure 8: GGR strongly correlated to Chinas GDP growth

70(%) 60 50 40 30 20 10 0 -10 -20 3Q05 1Q06 3Q06 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10

(%)

15 14

Gaming revenue growth (LHS) China Real GDP growth (RHS)

13 12 11 10 9 8 7 6

Source: CEIC

Singapore Cambodia Malaysia Australia Macau US South Korea

Source: Media reports, DBS Vickers

b) Accelerating GDP growth GGR has been strongly correlated to Chinas GDP growth (+0.7 since 2005), as mainlanders make up 50% of visitor arrivals to Macau, and Hong Kong 31%. Our house expects Chinas 2010-11 GDP growth to accelerate to 11% and 10% respectively vs 2009s 8.7%, while Hong Kong to 5.5% and 4.5% respectively vs 2009s -2.7%. Our economist believes Chinas economy is in good shape and should achieve a soft landing ahead in view of the sequence of macroeconomic policy implementation. Europes sovereign debt crisis and US nascent economic recovery will unlikely derail growth as Chinas primary growth driver is domestic demand, not trade. Our house still expects the central bank to raise the benchmark 1-Y lending rate/1-Y deposit rate by 27bps/18bps, respectively, in 3Q10, followed by another similar hike in 4Q10 to contain inflation expectations. That would raise rates to 5.85%/2.61% by the end of 2010, which are still below the 7.47%/4.14% levels in Sep 08, just before the US credit crisis spread.

Monetary tightening may be less damaging than expected. Historically, money supply growth tended to lead GGR growth by about two quarters. This could explain the strong growth seen since 2H09, especially for VIP segment that is mainly driven by junkets. Money supply growth has started to ease to 22% in Apr10 (vs 4Q09s 28%) while regulatory measures on property market have led to a substantial drop in sales volume (but prices have largely held up). Even then, GGR continued to hit fresh highs. It remains to be seen what impact falling property prices may have on wealth effect, although we believe gaming demand is relatively inelastic (bad habits die hard). Despite PBOCs acknowledgement of rising inflation expectation, senior officials have repeatedly emphasized the need to keep a moderately loose monetary policy stance. PBOCs target for M2 growth in 2010 has been set at 17%, while our economist expects money supply (M2) growth to be gradually reduced to its 10-year average of 16% in 2011 and beyond. Although growth would be slower, it would still be strong enough to drive gaming demand. Figure 9: Money supply growth leads GGR growth

80 60 40 20 0 1Q06 -20 -40 3Q06 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09

(%) VIP revenue growth (LHS) Money supply growth (RHS) (%)

30 28 26

Gaming revenue growth (LHS)

24 22 20 1Q10 18 16 14

Source: CEIC

Page 6

Industry Focus Macau Gaming

c) Rising income to boost discretionary spending Chinas GDP per capita has been rising rapidly at 13% CAGR since 2003 to RMB24k (USD3,500). Disposable income per capita for urban households (average for 36 cities in China) has leapt by 25% to RMB22k since 2006. Despite the global financial crisis, Chinas unemployment rate has remained stable at about 4.3% since 2002. These numbers will only improve with Chinas GDP growth accelerating to 11% in 2010 and 10% in 2011. Private consumption contributed 4.6ppt to 2009s GDP growth of 8.7%. Seven provinces have raised minimum wages by 10-15% to fend off rising inflationary pressure that could erode consumers real income. 20 more provinces will follow in the later half of this year. Labour disputes in Southern China in relation to demand for higher wages have seemingly increased with some successfully attaining wage hikes of 20-30%. In tandem with rising income, Chinas discretionary spending had doubled over the past 10 years, while number of outbound tourists grew 4-fold to 48m. This positive trend spilled-over to Macau as per capita visitor spending (excluding gaming) grew 29% to MOP7k in 2009, with strongest growth seen for China visitors (+60% to MOP14k). As Chinas income level continues to improve, we expect discretionary spending to expand further, which should augur well for the Macau gaming sector. Figure 10: Discretionary spending rising with higher income

(Per 100 household) 350 300 250 200 15 150 100 50 0 99 00 01 02 03 04 05 06 07 08 09 GDP per capita (RHS) 10 5 0 Discretionary spending (LHS) (RMB'000) 30 25 20

Figure 11: China visitor per capita spending rising steadily

(MOP'000) 4.5 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.5 0.0 1Q00 1Q01 1Q02 1Q03 1Q04 1Q05 1Q06 1Q07 1Q08 1Q09 Overall vistor per capita spending China visitor per capita spending

Source: CEIC

d) Potential extension of IVS to more provinces/cities Since its introduction in Jul 03, the Individual Visiting Scheme (IVS) has been extended to all 21 cities in Guangdong province and 28 other cities. IVS has contributed to the strong growth in visitor arrivals, which more than doubled between 2003 and 2007 (23% CAGR), before the financial crisis and Influenza A (H1N1) outbreak struck in 2008-2009. We expect IVS to be extended to more provinces/cities, driven by infrastructure improvements and rising domestic tourism. Although the government has been stricter on the IVS in the last 2-3 years to contain GGR growth to a more sustainable level, recent restrictions seemed to have minimal impact, unlike in the past. We understand VIP visitors (constitute 67% of 2009 GGR) get through under business visas, while mass market visitors join package tours (constituting 30% of mainland visitors from 20% two years ago). Although the recent strong GGR growth could prompt the central government to impose further restrictions, mainland visitor arrivals are expected to remain resilient, driven by: a) Strong population growth in Guangdong province: 5year CAGR of 3.7% vs national averages 0.6%. Guangdongs 95m population is the largest in China (7% market share); Macaus market share of Chinas domestic tourism is still low at 0.6%; More traveling and discretionary spending as affluence improves; Improving consumer sentiment with stronger economic outlook; Infrastructure improvements will improve accessibility to Macau and around China; and New supply of casinos at Cotai could attract new demand given more non-gaming offerings.

b) c) d) e) f)

Source: CEIC

Page 7

Industry Focus Macau Gaming

Figure 12: Minimal impact on China visitor arrivals from recent visa restrictions

(m) 1.4 J ul 08: IV S tightened to once every two months Aug 08: Stay of Chinese passport holders with permission to visit Macau before heading on to third destination reduced to 7 days from 14. Those who return to China without proceeding to third destination will be allowed only 2-day stay in Macau if apply using same method. For second offence, future applications will be rejected. Oct 09: IV S restricted again to once ev ery two months

1.2

1.0

0.8

0.6

May 08: IV S restricted to once from twice per month with extended waiting period of 15 from 10 day s. Corporate v isa restricted to 4 from 10.

Oct 08: IV S further restricted to one every three months Sep 09: IV S relaxed to once per month

0.4

0.2

Sep 08: Separate visa required by mainland Chinese residents for entry into Macau (prev iously entry into Macau from Hong Kong with Hong Kong v isa is permissable)

0.0 J an-08 Apr-08 J ul-08 Oct-08 J an-09 Apr-09 J ul-09 Oct-09 J an-10 Apr-10

Source: CEIC, media reports

Figure 13: Entry via package tours rising for China visitors

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2007 2008 2009 IVS, 48% IVS, 57% IVS, 44% Package tour, 20% Others, 14% Others, 32% Package tour, 29% Others, 26%

Figure 15: Strongest rebound in China visitor arrivals

(% YOY) 40 30 20 (% YOY) 100 80 60 40 1Q06 3Q06 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10 20 0 -20 Overall (LHS) Others (RHS) China (LHS) ASEAN (LHS) HK (LHS) -40

Package tour, 30%

10 0 -10 -20 -30 -40 -50

Source: CEIC

Source: CEIC

Figure 14: Visitors mainly from China and Hong Kong

Figure 16: GGR strongly correlated to visitor arrivals

(% YOY) 70 60 50 40 30 Gaming revenue

ASEAN 7%

Others 12%

Hong Kong 31%

China 50%

20 10 0 -10 1Q06 -20 -30 3Q06 1Q07 3Q07 1Q08 3Q08 1Q09 3Q09 1Q10

Visitor arrivals

Source: CEIC

Source: CEIC

Page 8

Industry Focus Macau Gaming

e) Infrastructure improvements Last year, Macau welcomed 11m mainland visitors - a fraction of Chinas 1.3b population. We believe the majority originated from adjacent Guangdong province, as 53% were day-trippers. With infrastructure improvements on the way, we expect more visitors not only from Guangdong, but from other provinces/ cities further away which have not been be tapped. Visitors generally prefer to enter Macau via land or sea, which account for 53% and 40% of arrivals, respectively. Currently, there are two gateways into Macau via land Barrier/Gongbei Gate at Macau Peninsula and Cotai Frontier Post at Taipa. There are also regular ferry rides (every 15-30 minutes) from Hong Kong Island, Kowloon and Shenzhen to ferry terminals at Macau Peninsula and Taipa, which journey takes 60-80 minutes. Alternatively, visitors can fly directly to Macau International Airport, hop onto a helicopter from Hong Kong/Shenzhen (15-25 minutes), or take a ferry/taxi directly from Hong Kong International Airport to Macau (30-45 minutes). Figure 17: Visitor arrivals mainly via land and sea

A ir 7%

Figure 18: Barrier Gate expansion

Before Site area Max. capacity for visitors Max. capacity for vehicles No. of immigration counters Electronic (self-processing) Vehicle lanes (entering Macau) Vehicle lanes (exiting Macau) 17,800 sq m 300,000/day 24,000/day 52 15 10 11 98 80 8 10 After 23,120 sq m 500,000/day

Source: Media reports

ii)

Cotai Checkpoint/ Lotus Bridge-Hengqin Island Gate. The new custom building has capacity to handle 70,000 visitors/day (36 counters including 12 electronic/self-processing counters), with 20 vehicle lanes added recently to boost capacity to 10,000 vehicles/day. The Guangzhou-Zhuhai Intercity Mass Rapid Transit to be completed at end-2010 will be connected to Cotai checkpoint. Guangzhou-Zhuhai Intercity Mass Rapid Transit (expected completion in Nov10). It will have capacity to handle 395k passengers daily and runs at 160-200kmh. Traveling time from Guangzhou to Gongbei Gate will be cut from 2 hours 45 minutes via coach to 47 minutes (non-stop)/ 76 minutes (including all stops), to Cotai checkpoint c. 55 minutes, and to Zhuhai Airport <1 hour. Another 5 intercity mass rapid transit routes within Guangdong province are expected to be constructed by 2014, linking most of the major cities in the Pearl River Delta region. High Speed Railway (expected completion by 2015). The 16,000km 4 longitude and 4 latitude network will link 9 cities in 6 provinces with an estimated population of 420m, with passengers able to transit easily to Macau via Guangzhou. At average speed of 250-350km/hr, estimated traveling time for BeijingGuangzhou and Guangzhou-Hong Kong will be reduced to 7 hours and 48 minutes, respectively. Macau-Zhuhai-Hong Kong Bridge (expected completion by 2015/2016; construction started in Dec 09). The 29.6km-bridge will cut driving time to just 1520 minutes from 4.5 hours currently, for an estimated charge of RMB100-150 each way. Golden Sea Bridge. The Zhuhai government announced plans in Dec 07 to build a 10.7km-bridge linking Zhuhai Airport and Henqin Island that will reduce travelling time to 20-30 minutes. No firm commencement date has been set (preliminary work has commenced), with construction expected to take two years.

iii)

Sea 40% - Macau Peninsula main L and 53% ferry terminal (28%) - Gongbei Gate (48%) - Taipa Pac Onn ferry - Cotai Checkpoint (4%) terminal (11%)

iv)

Source: CEIC

A string of infrastructure developments should improve Macaus accessibility further. These include: i) Gongbei/ Barrier Gate at Macau Peninsula. The recently completed expansion of the immigration and customs building at Barrier Gate (Macau side) raised daily visitor capacity to 500k from 300k. For Gongbei Gate (China side), the customs building will be extended by Aug 2011 to handle 350k-500k visitors daily from 150k currently, with >150 new counters. The Zhuhai Government may consider extending operating hours at Gongbei Gate to 24 hours from 17 hours currently (7am-12am). v)

vi)

Page 9

Industry Focus Macau Gaming

vii) Light Rail connecting Macau Peninsula, Taipa and Cotai (expected completion by 2014). Capacity will be up to 8000 passengers per hour per direction, 19 hours per day. The first phase will span over 20km comprising 23 stations (second phase yet to be confirmed). Currently, Macau Peninsula is connected to Taipa and Cotai via three bridges - Friendship Bridge, Macau-Taipa Bridge, and Sai Van Bridge. Figure 19: Current modes of transportation to/from Macau

Time Land (gateway) Barrier Gate COTAI Frontier Post Sea a) To/from HK Island Ferry terminal at Shun Tak Centre -TurboJET -Cotai Strip CotaiJet b) To/from Kowloon -First Ferry -Cotai Strip CotaiJet c) To/from Shenzhen -Yuet Tung Shipping Co -TurboJET Air Macau International Airport (Taipa Island) HK International Airport to Macau Ferry Terminal - Sea Express - Cross Boundary Passenger Ferry Terminal -Airport Express to HK Station in Central + Taxi to ferry terminal -Public Bus No. A11 -Taxi Helicopter Service -from Hong Kong -from Shen Zhen 45 min 24 min + 10-15min (taxi) 30-40min 30 min 16 min 15 min (day), 25 min (night) MOP235-335 HK$100 (single trip) + HK$15-20 (taxi fare) HK$40 HK$350-400 MOP2600- 2800 MOP2700-3190 Hourly Every 12 min Every 20-25 min n/a Every 30min, 15min on weekends/ peak holidays 5x daily 10am-10pm 5.54am-12.48am 6.10am-12.30am n/a 9am-11pm 11.45am- 8.30pm No need to pass through HK Customs and carry luggage to ferry terminal Cost Frequency Operating hours 7am-12am 9am-8pm Remarks

viii) Expansion of Pac On ferry terminal on Taipa (expected completion by 2013). Number of berths will be increased from 8 (for 400-passengers ferries) to 19, comprising 16 for 400-passengers ferries and 3 for 1000-passengers ferries. ix) Extension of Macau International Airport (expected completion by 2017). The Macau government plans to invest MOP60-100b to extend the airport within 10 years that could double the current capacity to 6m.

60 min 60 min 60-75 min

MOP142-275 MOP142-275 MOP140-275 MOP142-275 MOP171 MOP196-296

Every 15 min Every 30 min Every 30 min Every 30 min 4x daily 6x daily

24 hours 7am-1am 24 hours 7am-1am 8.15am-8.15pm 8.45am-7.30pm

Macau Ferry Terminal Macau Taipa Temporary Ferry Terminal Macau Ferry Terminal Macau Taipa Temporary Ferry Terminal Macau Taipa Temporary Ferry Terminal Macau Ferry Terminal

80 min 60 min

Source: Macau Government Tourist Office

Figure 20: Macaus distance from key cities in China

Source: Galaxy

Page 10

Industry Focus Macau Gaming

Figure 21: Proposed infrastructure improvements

Source: DBS Vickers

Page 11

Industry Focus Macau Gaming

VIP Segment: Still Expanding Growth may ease, but revenue still expanding nonetheless. Following the 19% y-o-y plunge in 1H09 due to the financial crisis and Influenza A (H1N1) outbreak, VIP revenue rebounded strongly by 42% y-o-y in 2H09. Successive new highs were seen since 3Q09, with 1Q10 coming in at MOP29b (+71% y-o-y). 2Q10 will likely be another record quarter with May10s strong GGR in conjunction with Chinas Golden Week. VIP revenue has been expanding at 24% p.a. since 2003, driven by the influx of Las Vegasstyled casinos and junkets growing in size (some have even gone for listing and operate casinos). Junkets contribute between 70-95% of VIP revenue. We expect 2010-2011F VIP revenue to increase to MOP107b (+34%) and MOP118b (+10%) respectively, from 2009s MOP80b, driven by higher rolling chip with minimal impact from normalization of win percentage (most major casinos hold were within the theoretical 2.7-3.0% range in 2009). Our VIP revenue growth projections are ahead of GDP growth by 3.1x and 1.0x respectively, well within the historical range of 0.9-4.0x. With 5M2010 GGR coming in at MOP72b (+67% y-o-y), VIP revenue may have hit MOP50b (assuming VIP constitute 70% of GGR, as seen in 1Q10). As 2H10 growth will likely ease, we have conservatively based our forecasts of the remaining months on 2H09 average monthly VIP revenue of MOP8b. As for 2011F, we used a more prudent ratio of 1.0x China's GDP growth in view of 2010Fs explosive growth. There could be potential upside to ours estimates given the rapid increase in private wealth in China. According to the latest surveys done by Boston Consultancy Group, China has the worlds third highest number of millionaire households (after US and Japan), +31% y-o-y in 2009. Total household wealth in China is expected to grow at a 5-year CAGR of 17.2% to reach US$7.6tn by 2013 (2009: ~US$4.5tn). No of millionaire households are also expected to grow at 13.6% over the same period to reach 788k (2009: 453k, already exceeded pre-crisis level). Figure 22: VIP revenue should continue to expand

(MOPb) 140 120 100 80 60 40 20 0 04 05 06 07 08 09 10F 11F YOY Chg (RHS) V IP Gross Rev enue (LHS) (%) 60 50 40 30 20 10 0 (10)

Figure 23: VIP revenue growth relative to sector and GDP

Gross Gaming Revenue Sector VIP (MOPb) (MOPb) 41,378 29,783 46,047 28,864 56,623 36,783 83,022 55,762 108,772 73,772 119,369 79,834 152,475 107,088 169,992 117,796 Growth GGR VIP (%) (%) 44 34 11 (3) 23 27 47 52 31 32 10 8 28 34 11 10 GDP Growth (%) 10 10 12 13 10 9 11 10 Ratio (VIP/GDP) (x) 3.4 (0.3) 2.4 4.0 3.4 0.9 3.1 1.0

2004 2005 2006 2007 2008 2009 2010F 2011F

Source: CEIC, DBS Vickers

Figure 24: Strong growth in rolling chip

(MOPb) 1000 Rolling chip (LHS) 900 800 700 600 500 400 1Q08 2Q08 3Q08 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 V IP rev enue (RHS) (MOPb) 31 29 27 25 23 21 19 17 15

Source: CEIC, Respective companies

Figure 25: Explosive growth in China private wealth

(US$tn) 8 7 6 5 4 3 2 1 0 2003 2004 2005 2006 2007 2008 2009 2013F 900 800 700 600 500 400 300 200 100 0

Household wealth (LHS)

No of millionaire households (RHS)

Source: Boston Consultancy Group

New casinos could attract fresh demand, but in longer-term. 2010F will see the opening of Encore in Apr 10 (37 VIP tables) and two newly refurbished VIP floors at Grand Lisboa (31 tables). Collectively, these 68 VIP tables at Macau Peninsula will boost total existing VIP tables supply by a manageable 5%. Next year could see 264 new VIP tables opening at Cotai: ~120 at Galaxy Macau in early-2011 and ~144 at Parcel 5 & 6 in Sep 2011-Mar 2012, which together will boost total VIP tables supply by 20% and Cotais by 60%.

Source: CEIC, DBS Vickers

Page 12

Industry Focus Macau Gaming

During the last supply boom in 2006-07, VIP revenue leapt by 2.4-4.0x China GDP growth partly due to the influx of VIP-centric Las Vegas-styled casinos which offered significantly improved gaming experience. It may be difficult to replicate previous explosive growth, as the new integrated resorts at Cotai are aimed at attracting mass market players and to a lesser extend direct VIPs. But higher offering of non-gaming entertainment may appeal to a more discerning market (likely in the longer term). Please see A Tale of Two Cities section for a more detailed discussion. VIP market share to gradually fall. VIPs contribution to GGR has fallen steadily from 77% in 2003 to 67% in 2009, but should inch up to 70% in 2010F with minimal incoming supply (only VIP-centric Encore and Grand Lisboa expansion). With new mega casinos opening in Cotai in 2011-12F, VIP market share will likely resume its descend although in the short-term, it could still hold up as the new Cotai casinos may rely more on junkets initially to bring in the dough (like for Venetian Macau and City of Dreams), before gradually attracting more mass market with the completion of most infrastructure improvements post-2013. Figure 26: VIP market share to gradually decline post-2010

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2004 2005 2006 2007 2008 2009 2010F 2011F 72% 63% 65% V IP 67% 68% 67% 70% 69% 28% 37% 35% 33% Mass 32% 33% 30% 31%

(typically 40% of net winnings). Most of the commission/profit share will be returned by the junkets to VIP patrons via rebates and non-monetary compensation (e.g. hotel room, food and beverage), averaging 0.9% of rolling chip. Concessionaires can also extend credit directly to players, offering rebates of 0.6-1.1% of rolling chip. This helps to double EBITDA margin to 21% (after factoring in higher marketing expenses) vs 10% under the junket VIP model. But it could also lead to higher bad debts/ provision for doubtful debts and create tension between casino operators and junkets (incumbent SJM has minimal direct VIPs to protect its long-standing relationship with junkets). Direct VIPs as a share of VIP GGR has been rising, with Venetian Macau achieving 30% (2008: 10%), and Wynn Macau and City of Dreams 20% each. Nevertheless, we expect junkets to still feature prominently given their entrenched position, and so long China still imposes capital controls and do not recognize gaming debts. Commission cap to drive up margins. Effective 1 Dec 09, junket commissions are capped at 1.25% of rolling chip in order to stem the price war among concessionaires which have hurt margins. EBITDA margins should improve in 2010F, as a 10bps saving in commission rate translates into higher VIP EBITDA margin of 10% vs 7% previously. All concessionaires stand to benefit from the commission cap, with Galaxy being the biggest winner as junket VIPs constitute 78% of GGR compared to 44-63% for other concessionaires. Figure 28: Galaxy biggest winner of commission cap

VIP as % of Total GGR (%) 87% 81% 60% 55% Junket as % of VIP GGR (%) 95% 80% 95% 80% Junket VIPs as % of Total GGR (%) 83% 65% 57% 44%

Source: CEIC, DBS Vickers

Higher margins with direct VIPs, but junkets still important. Concessionaires rely on junkets to bring in VIP patrons and manage credit risk, in return for a junket commission (currently capped at 1.25% of rolling chip) or profit share Figure 27: VIP segment cost structure

Junket VIP - before commission cap Rolling chip Win % (theoretical average) Net winning (gross revenue) Gaming tax @ 39% Junket @ 1.35% rolling chip Opex @ 6% of revenue EBITDA EBITDA margin 3,571 2.8% 100 39 61 48 6 7 7%

2010F Galaxy Wynn SJM Sands

Source: Respective companies, DBS Vickers

Junket VIP - after commission cap Rolling chip Win % (theoretical average) Net winning (gross revenue) Gaming tax @ 39% Junket @ 1.25% rolling chip Opex @ 6% of revenue EBITDA EBITDA margin 3,571 2.8% 100 39 61 45 6 10 10%

Direct VIP Rolling chip Win % (theoretical average) Net winning (gross revenue) Gaming tax @ 39% Rebate @ 0.6-1.1% rolling chip (assume 0.9% average) Opex @ 8% of revenue EBITDA margin 3,571 2.8% 100 39 61 32 8 21 21%

Source: DBS Vickers

Page 13

Industry Focus Macau Gaming

Mass Segment: Potential New Growth Driver Resilient demand. Despite the financial crisis and Influenza A (H1N1) outbreak, mass market revenue still grew 3% y-o-y in 1H09 (vs VIP segments 19% contraction). 2H09 saw a stronger growth of 23% y-o-y, while 1Q10 continued to set a new record of MOP12b (+33% y-o-y). Mass market revenue has been expanding at 35% p.a. since 2003 (ahead of the sectors 27%), driven by the extension of Chinas IVS scheme to more provinces/cities, infrastructure improvements, and influx of Las Vegas-styled casinos. We expect 2010-2011F mass market revenue to increase to MOP45k (+15%) and MOP52k (+15%) vs 2009s MOP40b, driven by higher visitor arrivals and average spending. Revenue growth is expected to be between 1.3-1.5x Chinas GDP growth, at the lower end of the 1.3-7.8x historical range. There could be potential upside to our estimates with the completion of Guangzhou-Zhuhai Mass Rapid Transit by end-10 (cut travelling time from 2-3 hours to 47 minutes), and Gongbei Gate expansion by Aug11 (capacity to handle 350k-500k visitors daily vs 150k currently), which could attract new demand. With Jan-May 2010 GGR hitting MOP72b (+67% y-o-y), mass revenue may have come in at MOP22b (assuming mass constituted 30% of GGR, as seen in 1Q10). We expect growth to ease in 2H10 with moderating GDP growth and potential normalization of win percentage for some properties (e.g. Venetian Macau: 25.1%; Plaza: 25.3% vs 18-20% average). Win percentage however may stay high depending on games mix, quality of players (which affects bet size) and hours spent (which may be prolonged by providing more non-gaming amenities to keep patron within the premises). We based our forecast for 2010F remaining period on 2H09 average monthly revenue of MOP3.5b. For 2011F, we used 1.5x Chinas GDP growth ahead of 2006s 1.3x at the beginning of the previous supply boom, as new incoming integrated resorts will focus more on grind market vs VIP-centric casinos previously. Figure 29: Mass revenue expansion intact

(MOPb) 55 45 35 25 15 5 -5 04 05 06 07 08 09 10F 11F YOY Chg (RHS) Mass Gross Rev enue (LHS) (%) 90 80 70 60 50 40 30 20 10 0

Figure 30: Mass revenue growth relative to sector and GDP

Gross Gaming Sector (MOPb) 41,378 46,047 56,623 83,022 108,772 119,369 152,475 169,992 Revenue Mass (MOPb) 11,595 17,183 19,840 27,260 35,000 39,535 45,388 52,196 Growth GGR Mass (%) (%) 44 79 11 48 23 15 47 37 31 28 10 13 28 15 11 15 GDP Growth (%) 10 10 12 13 10 9 11 10 Ratio (Mass/GDP) (x) 7.8 4.6 1.3 2.9 3.0 1.5 1.3 1.5

04 05 06 07 08 09 10F 11F

Source: CEIC, DBS Vickers

Visitor arrivals recovering. Visitor arrivals fell two years in a row (2008: -15%, 2009: -5%) due to the IVS tightening, global financial crisis, and Influenza A (H1N1) outbreak. 4Q09 saw a rebound (+5% y-o-y driven by 17% jump in mainland visitors), with 1Q10 already back above pre-crisis level at 6.1m (+12% y-o-y). We expect visitor arrivals to continue to improve on the back of: (i) better economic outlook, (ii) rising discretionary spending, (iii) infrastructure improvements, (iv) possible extension of IVS to more provinces/ cities, and (v) new casino openings. Figure 31: Visitor arrivals heading north

(m) 2.2 2.1 2.0 1.9 1.8 1.7 1.6 1.5 1.4 1.3 1.2 Jan 08 Jul 08 Jan 09 Jul 09 Jan 10 Total visitor arrivals China visitors (m) 1.2 1.1 1.0 0.9 0.8 0.7 0.6

Source: CEIC

Higher contribution from grind to boost EBITDA margin. Grind segment average EBITDA margin of 33% is 3-4x higher than the VIP segments 10%, so it is only natural for concessionaires to want to focus on this segment. Grind currently constitute just 30% of GGR that could rise in the longer run with infrastructure improvements reaching out to China cities further away/ cutting travelling time and new integrated resorts opening at Cotai which offers more nongaming entertainment to attract new demand. In addition, we should see full-year impact of the restructuring of service agreements for third-party promoted casinos. For SJM, 12 out of its 14 satellite casinos are operating under new agreements whereby SJM gets a fixed 3% (VIP) and 5% (mass) share of revenue. This compares favourably to previous agreements where SJM incurred losses or barely break-even after casino operating expenses. The new agreements effectively transfer the responsibility for opex to the service provider for a higher commission (SJM will still account for all the gaming revenue).

Source: CEIC, DBS Vickers

Page 14

Industry Focus Macau Gaming

Figure 32: Mass EBITDA margin

Self-promoted casinos HK$ 556 18.0% 100 39 61 28 33 33% EBITDA margin -7% Third-party operated casinos Old agreement Drop Win % (theoretical average) Net winning (gross revenue) Gaming tax @ 39% Third-party operator @ 40% Opex @ 25-30% of revenue EBITDA margin HK$ 556 18.0% 100 39 61 40 28 (7)

Drop Win % (theoretical average) Net winning (gross revenue) Gaming tax @ 39% Opex @ 25-30% of revenue EBITDA margin EBITDA margin

Melcos mocha clubs). We believe Venetian Macau at Cotai should be less affected given its unique product it is not only the most profitable property in Macau (highest EBITDA and margin), but also most popular with 23.8m visitors in 2009 (including multiple-entries) vs 21.7m total visitors to Macau. VIP-centric properties with strong branding strategically located at Macau Peninsula should also be insulated (e.g. Wynn Macau, Grand Lisboa, Starworld). In terms of concessionaire, Sands China will have the highest risk as it has the largest exposure to Cotai and mass market segment (likely to surpass current leader SJM with the completion of Parcels 5 & 6 by 2012F, and not to mention future developments at Parcels 3, 7 & 8). Figure 33: Sands China has biggest exposure to Cotai

Concessionaire Cotai Venetian Macau Parcel 5 & 6 Galaxy Macau City of Dreams Macau Peninsula Sands Macau Grand Lisboa MGM Opening Date Aug 08 Sep 11 Early-11 Jun 09 No of mass tables 441 432 320 353 Mass as % revenue 47% 45% 44% 22%

Source: Respective companies, DBS Vickers

But potential oversupply in Cotai in the short-term. 2010 will only see the addition of 24 mass tables with Encores opening at Macau Peninsula, a mere 1% of total existing supply. But 2011 will welcome ~912 new mass tables at Cotai, i.e. ~480 at Galaxy Macau and ~432 at Parcel 5 & 6. This will boost total existing mass tables supply by 26% and Cotais by 118%, which could create potential oversupply in the short-term as demand may not expand in tandem (although in the longer-term we expect it to catch up with infrastructure improvements and rising discretionary spending). See the next section A Tale of Two Cities for a more detailed discussion. Most at risk will be City of Dreams at Cotai which has not been performing below expectations since its Jun 09 opening (albeit improving), and smaller/older casinos (e.g. SJMs third-party promoted casinos, Galaxys city clubs,

Sands China Sands China Galaxy Melco/ MPEL

Sands China SJM MGM

May 04 Feb 07 Dec 07

335 245 308

44% 28% n/a

Source: Respective companies, DBS Vickers

Page 15

Industry Focus Macau Gaming

A Tale of Two Cities

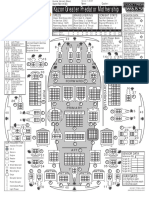

Minimal new supply in 2010. This year will see the slowest supply growth since Macau gaming market was liberalized in 2001, with just one new casino opening at Macau Peninsula, aside from SJM opening two new VIP floors at Grand Lisboa (31 tables in 4Q10). Wynns Encore (adjoining Wynn Macau) was launched on 22 Apr 2010, offering 61 tables (37 VIP, 24 mass) and 95 slots boosting existing supply by 1%. Encore should compliment Wynn Macau as it caters more to VIP patrons, releasing capacity for the latter to focus on the mass market. We expect Encore to do well given its strategic location at the matured Macau Peninsula and leverage on Wynns strong branding/VIP clientele. Figure 34: Incoming supply

VIP SJM Wynn Sands China Galaxy Melco MGM Total % of existing supply SJM Wynn Sands China Galaxy Melco MGM Total % market share SJM Wynn Sands China Galaxy Melco MGM Total Macau Peninsula Cotai Total % of existing supply Macau Peninsula Cotai Total % market share Macau Peninsula Cotai Total 295 196 259 201 280 80 1,311 Mass Existing Supply Total tables 1,562 1,857 209 405 869 1,128 247 448 331 611 280 360 3,498 4,809 Slots 5,051 1,195 3,491 1,006 2,760 880 14,383 VIP New supply in 2010F Total Slots Mass tables 31 31 37 24 61 95 VIP New supply in 2011F Total Slots Mass tables VIP 326 233 403 321 280 80 1,643 Mass Total Total tables 1,562 1,888 233 466 1,301 1,704 727 1,048 331 611 280 360 4,434 6,077 Slots Remarks

But massive incoming supply at Cotai in 2011. Two mega integrated resorts will be coming on stream: Galaxy Macau (600 tables, 1500 slots) in early 2011 and Sands Chinas Parcel 5 and 6 (576 tables, 2200 slots) in Sep 2011-Mar 2012. These will collectively add 1176 tables and 3700 slots, boosting total supply by 24% and 26% respectively. For Cotai alone, supply of tables and slots will jump by 97% and 107%, respectively, over the next 3 years. By 2012, Cotai is expected to have 39% market share of gaming tables (from 25% currently) with its mass market share expanding faster (38% from 22%) compared to VIP (44% from 33%).

144 120

432 480

576 600

2,200 1,500

68

24

92

95

264

912

1,176

3,700

5,051 1,290 Encore (Apr 10) 5,691 Parcel 5 & 6 (Sep 11) 2,506 GalaxyWorld (Early-11) 2,760 880 18,178

11% 19%

11%

2% 15%

8% 56% 60% 50% 194% 51% 134% 63% 149%

19% 56% 60%

11% 50% 194%

15% 51% 134%

8% 63% 149%

5%

1%

2%

1%

20%

26%

24%

26%

25%

27%

26%

26%

23% 15% 20% 15% 21% 6% 100% 873 438 1,311

45% 6% 25% 7% 9% 8% 100% 2,726 772 3,498

39% 8% 23% 9% 13% 7% 100% 3,599 1,210 4,809

35% 8% 24% 7% 19% 6% 100% 10,910 3,473 14,383 37 24 61 95 37 24 61 95 264 264 912 912 1,176 1,176 3,700 3,700

20% 14% 25% 20% 17% 5% 100% 910 702 1,612

35% 5% 29% 16% 7% 6% 100% 2,750 1,684 4,434

31% 8% 28% 17% 10% 6% 100% 3,660 2,386 6,046

28% 7% 31% 14% 15% 5% 100% 11,005 Encore Parcel 5 & 6, 7,173 GalaxyWorld 18,178

4%

1%

2%

1% 60% 118% 97% 107%

4% 60%

1% 118%

2% 97%

1% 107%

67% 33% 100%

78% 22% 100%

75% 25% 100%

76% 24% 100%

56% 44% 100%

62% 38% 100%

61% 39% 100%

61% 39% 100%

Source: Respective companies, DBS Vickers

Page 16

Industry Focus Macau Gaming

Build and they will come? Although we expect GGR to continue to expand, incremental demand may not match incoming supply perfectly especially since new supply will be mainly at less matured Cotai. Currently, only 15% of visitors enter Macau via Taipa/Cotai. Even though it takes 10-15 minutes each way to commute between Macau Peninsula and Cotai, Cotai casinos (Venetian Macau, City of Dreams, Four Seasons and Altira) only control ~20% of 2H09s GGR vs 25% market share of table supply. This could be due to: a) there being too few casinos at Cotai currently, and they are not as densely located as in Macau Peninsula which makes it convenient to hop from one to another, and b) relatively less accessible, although infrastructure improvements are underway. We believe Cotai is more of a longer term story as: a) Old habits die hard. The more wholesome entertainment, Cotai IRs may be the next earnings growth driver, catering to a more discerning crowd as affluence improves. But this could happen later rather than sooner as the hard-core gaming mentality of mainland patrons, which comprise 50% of Macau visitors, is hard to change overnight. Time is money, and the majority of visitors are day-trippers (52% of visitors) while average stay in Macau remains low at 1.5 days (albeit creeping up from 2003s 1.2 days). Some may blame this on the lack of non-gaming entertainment to make Macau a more wholesome tourist destination in the first place.

(days) 1.6 Average 1.5 1.4 1.3 1.2 1.1 1.0 Jan-98 Jan-00 Jan-02 Jan-04 Jan-06 Jan-08 Jan-10

Guangzhou-Zhuhai Intercity Mass Rapid Transit by Nov10 (Guangzhou to Cotai checkpoint in 55 minutes vs 3 hours previously); and (iv) Light Rail Transit (connecting Macau Peninsula, Taipa and Cotai) by 2014. c) Chicken and egg problem. Instead of demand leading supply, new casinos have been sprouting to draw in demand. The strategy has worked well to expand the Macau gaming pie, but incremental revenue has been waning with every new launch, especially at Cotai. Recent new casino openings such as City of Dreams and Four Seasons had been disappointing, albeit operating performance is improving. We assessed the impact of major casino openings, which had been picking up since 2006 (Figure 37). Almost all saw positive impact on GGR in the first 1-6 months of operations, helping to build an increasingly higher base. But average revenue/table fell with most new openings, although it had recently rebounded to 1Q06 levels. With robust gaming demand and limited new casino openings in 2010, we expect average daily win/table to expand by 11% before easing marginally by 1% in 2011 with new incoming supply. As visitors expectations grow with each new opening, upcoming casinos would need to be unique (not necessarily larger) to attract new visitors (especially if located in Cotai), in order to continue to expand the gaming pie (rather than only wrestling market share from existing casinos). Competition could intensify in the short-term as supply may take a while to be absorbed. Success of IRs will depend on: a) Location and accessibility, b) Design, product and brand, c) Management and financial strength. Figure 36: Massive incoming supply, especially at Cotai

40 35 No of casinos (LHS) ('000) 7 6 5 No of tables (RHS) 4 3 2 1 0 2004 2005 2006 2007 2008 2009 2010F 2011F

Figure 35: Average length of stay rising, but slowly

China visitors

30 25 20 15 10

Source: CEIC

5 0

b)

Infrastructure improvements will only be completed post-2013, more than two years after the large incoming supply in 2011. They include: (i) expansion of Pac On Ferry Terminal to 19 berths from 8 by 2013; (ii) Macau-Zhuhai-Hong Kong Bridge by 2015; (iii)

Source: CEIC, DBS Vickers

Page 17

Industry Focus Macau Gaming

Figure 37: Impact of new launches

(MOPb) 40

F H (MOPm) G

8.0 7.5 7.0 6.5

35 30 25

E A B C D

6.0 20 15 10 5 1Q06 3Q06 1Q07 3Q07 Gross gaming revenue

No of tables 515 286 252 591 388 108 489 280

Financial crisis, Influenza A (H1N1) outbreak

5.5 5.0 4.5 4.0

1Q08

3Q08 Average GGR/table

1Q09

3Q09

Date A B C D E F G H 6, 19 Oct 2006 11 Feb 2007 12 May 2007 28 Aug 2007 18 Dec 2007 28 Aug 2008 1 Jun 2009 15 Dec 2009

Major casino opening Wynn Macau, Star World Grand Lisboa Crown Macau Venetian Macau MGM Grand Four Seasons City of Dreams Oceanus

GGR yoy growth for first: 1 mth 3 mths 6 mths^ (%) (%) (%) 44 44 45 33 36 43 67 51 51 55 53 53 34 53 49 44 (1) (8) (17) 1 24 48 61 n/a

^ possible overlapping impact

Source: CEIC

Table cap should help ensure industry stability. Recently, the government announced that it would cap the number of gaming tables at 5500 up to 2013. While casinos which had obtained approvals earlier can proceed with their plans, the government will not accept anymore applications for the next three years. A regulatory body to monitor the growth of the gaming industry may also be set up. With 1Q10 table count at 4811, that leaves only 689 tables to be shared between Galaxy Macau and Parcels 5 & 6 significantly below the collective 1,176 tables planned. Parcels 5 & 6 may be at higher risk given its later opening date (3Q11-1Q12 vs Galaxy Macaus 1Q11). We understand Sands China is still targeting to open with 570 tables,

consisting of 400 new tables, 170 tables reallocated from other properties (likely from Venetian Macau), and 100 electronic table games (classified as slots). The recent finalization of financing package for both Galaxy Macau and Parcels 5 & 6 could be an indication that a favourable resolution may have been reached. We have assumed slower ramp-ups for both projects i.e. Galaxy Macau (60% capacity utilization in 2011F), and Parcels 5 & 6 (25%). The table cap may also affect approvals for future projects, e.g. Wynn Cotai (targeted for completion in 2014) yet to be factored in our Wynn Macau valuation.

Page 18

Industry Focus Macau Gaming

Figure 38: Map of current and future supply of casinos

Source: DBS Vickers

Page 19

Industry Focus Macau Gaming

Biggest Market Share Gainers: Galaxy, Wynn

Competition intensifies, but leaders should prevail. We expect Macaus competitive landscape to heat up with the large incoming supply from 2011 onwards. Demand may not be able to catch up with supply in the short-term (especially at Cotai), possibly leading to another price war as players jostle for market share. The grind segment will be most at risk, with tables supply jumping by 26% over the next 3 years (Cotai alone by 118%!). But battle scars from the previous junket commission price war may serve as a grim reminder. Junket commissions went up to as high as 1.45% of rolling chip during 2009s tough operating environment, before easing to 1.25% since Dec 09 with the commission cap. Every 10bps change in commission will have a 3ppt impact on EBITDA margin (currently ~10% for junket VIP segment). The recently announced table cap of 5500 over the next 3 years could help to ease some pressure, while infrastructure improvements should allow Macau to tap on cities further away (i.e. beyond Guangzhou) in the longer run. The new integrated resorts at Cotai, if unique enough, could attract new demand altogether, like Venetian Macau. We expect properties with strong branding in prime locations at Macau Peninsula to be relatively less affected by the large incoming supply, eg. Wynn Macau, Grand Lisboa, and Starworld. Biggest gainers: Wynn and Galaxy. Losing market share is not the end of the world - as more supply comes on stream, there are bound to be winners and losers. A smaller stake in a larger pie could be good, as long as earnings expand. Market share can also be affected by win percentage which fluctuates with luck factor. With only Encore opening in 2010F, Wynn is expected to gain significant mileage with its market share leaping by 3ppt to 17%. Similarly, Galaxy is expected to see its market share increasing by 2ppt to 11% in 2011F with the opening of Galaxy Macau. As for leader SJM, there could be a 2ppt dip in 2011F to 27% with the renovation of Casino Lisboa and loss of grind market share to newer IRs (especially at third-party promoted casinos). Sands China may see its market share decline to 20% in 2010F due to normalization of win percentage at Venetian and Plaza, but should rebound to 21% in 2011F with the opening of Parcels 5 & 6 in 3Q11. We expect other concessionaires (ie Melco and MGM) collective market share to continue to decline to 24% by 2011F with rising competition from new supply. Figure 39: Biggest overall market share gainers Galaxy, Wynn

100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 2007 2008 Wy nn Macau 2009 Sands China SJ M 2010F Galaxy Others 2011F 15% 16% 14% 17% 17% 21% 23% 23% 20% 21% 39% 12% 14% 27% 26% 9% 25% 9% 24%

8% 26%

11%

29%

29%

27%

Source: Respective companies, DBS Vickers

Figure 40: Venetian and Wynn most profitable properties

2009 Venetian Wynn Sands Grand Lisboa Starworld Lisboa City of Dreams Plaza Oceanus Altira 3rd party promoters Mocha Clubs City clubs Sub-total Others Industry GGR HKDm 15,687 16,894 9,387 9,436 9,435 9,418 5,834 1,985 681 7,749 14,529 741 1,346 103,122 16,247 119,369 Market share 13% 14% 8% 8% 8% 8% 5% 2% 1% 6% 12% 1% 1% 86% 14% 100% EBITDA HKDm 4,300 3,242 1,886 1,338 983 481 439 312 139 106 521 197 157 14,101 Market share 30% 23% 13% 9% 7% 3% 3% 2% 1% 1% 4% 1% 1% 100% EBITDA margin 27% 19% 20% 14% 10% 5% 8% 16% 20% 1% 4% 27% 12% 14%

Source: Respective companies, DBS Vickers

Page 20

Industry Focus Macau Gaming

Risks

Rising regional competition. With the success of Macau and Singapore, more countries are expanding/ opening up their gaming markets to boost tourism and economic activities. Although this could heat up competition especially in the VIP segment (mass market tend to be stickier), Asia has a large illegal gaming market yet to be fully tapped and the overall gaming pie is still growing with rising discretionary spending and improving infrastructure. Although the number of casinos in Macau jumped from 15 in 2004 to 33 in 2009, there was minimal cannibalization Macau GGR still grew at 6-year CAGR of 27% while Malaysia expanded by 11%. Recent new casino openings in the region i.e. Resorts World at Manila in Aug 09, Resorts World at Sentosa in Feb 10 and Marina Bay Sands in Apr 10 had minimal impact on Macau. 82% of Macaus visitors originate from China and Hong Kong with day-trippers constituting 52%. Macau will still be Figure 41: Incoming casinos in the region

No of casinos Existing markets Macau 7 n/a n/a Capped at 40 (vs 33 currently), freeze on new casino licence.. At US$15b Bagong Nayong Pilipino Manila Bay Tourism City (40ha). Phase 1 will comprise of 4 IRs by: a) Bloomsbury (owned by Crown Casinos James Packer, expected completion in 4Q12), b) Aruze (Japanese slot machine manufacturer, in partnership with Wynn), c) SM Investments (local retail chain), and d) Genting Hong Kong-Alliance Global. At Ho Tram strip. Asian Coast Development will build the first IR (capex: US$4.2b; operated by MGM) completing in 2013. Restrictions on local patronage, no proper gaming legislation yet, infrastructure still lacking. Flight from HK (hours) Flight from Guangzhou (hours) Remarks

their preferred gaming destination given its proximity (1-2 hours away via land and sea), convenience (similar language and custom), and credit availability via junkets (travelers are only permitted to carry RMB20k cash/US$5k foreign currency per trip and gaming debts are not enforceable in China). Even though Singapore has the capacity to offer higher junket commissions due to lower gaming taxes (VIP 12%/mass 22% vs Macaus 39% flat), Singapores stricter junket regulations could deter some junkets and VIP patrons who prefer more flexibility and less transparency. Most of the upcoming casinos in the region are >2 hours away by flight from China/Hong Kong. Some of them may even open later rather than sooner as proper gaming legislation and/or infrastructure are still not in place. Taiwan may be the biggest threat to Macau given its proximity and link to China (Special Administrative Region), but offshore islands will unlikely be conducive to attract mass market.

Phillippines

Vietnam

5 16

New markets Japan Taiwan Thailand 2-10 3 5 10-18 Total 26-34 4 2 3 4 2 3 Penghu referendum rejected, Kinmen (adjacent to Fujian province) next. Offshore islands not convenient and lack infrastructure, no proper gaming legislation yet. Strong opposition (including from Thai King), civil unrest.

Source: Media reports, DBS Vickers

Policy risk. The new Chief Executive Fernando Chui Sai On has pledged to stick to the previous policies announced by his predecessor, aimed at preventing the Macau gaming market from over-expanding. Key points from his recent maiden policy address: a) Number of gaming tables to be capped at 5500 over the next three years (1Q10: 4811). While casinos which have already obtained approvals earlier can still go ahead, the government will not accept new applications for the next three years. A regulatory body to monitor the growth of the gaming industry may also

be set up. Please see A Tale of Two Cities section for a more detailed discussion. b) Potential reclamation of idle land. The government will reclaim lands previously granted to gaming operators for casino project development that have been left idle for years, and which are found to have breached contracts signed with the government. The government was considering building public residential buildings on the lands that might be recovered, while auctioning off the others.

Page 21

Industry Focus Macau Gaming

Most at risk will be Sands Chinas Parcels 7 & 8 which development timeline remains uncertain. Construction work has just resumed for Parcels 5 & 6 while the development deadline for Parcel 3 was recently extended to 2014. Costs capitalized so far in respect of Parcels 3, 7 & 8 amounted to US$36m and US$116m, respectively (collectively 71% of 2009 earnings if written off). c) Relocation of slot machine parlours from residential neighborhoods to gaming & entertainment areas. Minimal impact expected as slot machines currently contribute just 5% of GGR. Most slot machines are found within casinos/hotels, with six slot machine establishments located outside, out of which only two are close to residential areas. Raising minimum age requirement to 21 from 18. Minimal impact expected as the change will be gradually implemented over three years. Currently, casinos employ >30k staff, including several thousand fresh secondary school graduates annually. choice. Las Vegas Sands also has exposure in Singapore (via Marina Bay Sands) which regulatory regime may be just as strict. Rising regional competition could force Macau to adopt better transparency and conformity with international standards (albeit have been improving with the influx of global casino operators). Another flu outbreak or economic crisis. Visitor arrivals to Macau fell two years in a row (2008: -15%, 2009: -5%) due to the global financial crisis and Influenza A (H1N1) outbreak. Although visitor arrivals have rebounded since 4Q09, visitor arrivals may be hit again should another flu outbreak occur or economic growth decelerates sharply. While the former is difficult to predict, the latter should be unlikely our economist expects Chinas GDP to grow 11% in 2010 and 10% in 2011 from 2009s 8.7%. Increased credit risk from rising direct VIPs, junket loans. Direct VIPs as a share of VIP GGR has been rising, up 30% of VIP revenue for some properties. Direct VIPs offer twice as high EBITDA margins, but could lead to higher bad debts/ provision for doubtful debts and create tension between casino operators and junkets. Concessionaires also extend temporary interest-free credit to promoters/ junkets as working capital, typically up to the amount of commission payable for the month. Among the concessionaires, Sands China has the largest overall exposure (7% of GGR), and Wynn the least (1%). SJM could also see potentially higher allowance for doubtful debts as 14% of receivables are >6 months overdue (albeit small relative to GGR). Figure 42: Sands China has highest credit risk exposure

Direct VIP Trade (% of VIP receivables* revenue) Sands China Wynn Macau SJM Galaxy 20% 20% 5% 5% (HK$m) 1,960 236 n/a n/a Aging >90 days 11% n/a^ n/a n/a % Total GGR 7% 1% n/a n/a Receivables from promoters* n/a n/a 823 414 % Aging >90 TotalG GR days n/a n/a 14% n/a n/a n/a 2% 4%

d)

The central government may also resume IVS tightening to contain Macaus strong GGR growth. However, the impact had been more muted recently and would not go hand in hand with the various infrastructure developments to improve Macaus accessibility. In any case, we believe the Macau government will be pragmatic given the gaming sectors importance to the economy (gaming tax constituted 77% of governments total revenue in 2009). Regulatory sanction from the US. In May09, the New Jersey Division of Gaming Enforcement found MGMs JV partner for MGM Grand Macau ie Pansy Ho of STDM, unsuitable and recommended that MGM disengage from any business association. As a result, MGM will be selling its 50% stake in Borgata Hotel Casino & Spa in Atlantic City as part of a settlement. Recently, there were also reports of alleged links between Las Vegas Sands and a junket promoter with triad links in Macau and that the Nevada Gaming Commission was carrying out its own investigations. Increased scrutiny by US regulatory authorities could force concessionaires to choose between maintaining exposure in Macau, or selling US-based assets, which may be a difficult

^ Fully provided for * Net provision, gaming related

Source: Respective companies, DBS Vickers

Page 22

Industry Focus Macau Gaming

Valuation: Still Room For Expansion The Macau gaming sector outperformed Hang Seng Index over the last 3 months (+27% vs -5%), driven by record GGR and recovery in visitor arrivals. But we still see value in the sector given its strong earnings growth potential. Macau gaming vs China consumer stocks: Macau gaming sectors valuation of 12.1x 2011 EV/EBITDA is comparable to China consumer sectors 12.2x, with similar EBITDA growth (2-year CAGR: 23% vs 20%). But bigger cap China consumer stocks are trading at much higher multiple of 15.2x vs Wynns 12.7x; Sands Chinas 13.8x. Similarly, SJM (7.4x) is still trading at a 12% discount to mid-cap China consumer stocks (8.4x). Although Galaxy (11.8x) is trading at a premium, on a EV/EBITDA relative to growth basis, it still looks cheap at 0.3x vs sectors 0.5x largely driven by explosive earnings growth with the opening of Galaxy Macau in early 2011. Macau gaming vs US gaming: Macau gaming sectors valuation of 12.1x 2011 EV/EBITDA is also comparable to US gaming sectors 12.2x. But Wynn Macau and Sands China are trading at a small 7-13% premium to parents Wynn Resorts and Las Vegas Sands due to their stronger long-term earnings growth potential. Wynn Macau contributed 67% to its parents 2009 EBITDA, while Sands China 78%. Figure 43: Macau gaming sector performance

(HK$)

Current vs historical valuation: A comparison with Macau gaming sectors historical valuations may not be meaningful given the current larger investable universe and short trading history (Wynn and Sands China were only listed in 4Q09, and SJM in Jul08). But we can benchmark against US gaming stocks historical performance as Macau contributes ~70% of earnings. US gaming stocks traded at >20x EV/EBITDA at the peak in 4Q07 and 5-10x at the trough in 1Q09, vs 12x currently, suggesting still some room for growth. Valuation methodology: Our target prices for the four Macau gaming companies for which we are initiating coverage in this report are based on sum-of-parts methodology. We value the individual major properties based on EV/EBITDA (typical for gaming sector given varied gearing levels) as follows: a) b) c) 15x 2011 EV/EBITDA for premium properties i.e. Wynn Macau and Venetian Macau; 10-12x 2011 EV/EBITDA for most i.e. Starworld, Grand Lisboa, Sands Macau, and Plaza Macau; 5-8x 2011 EV/EBITDA for assets that are older (Lisboa, third-party promoted casinos, city clubs), shorter earnings track record (Oceanus), or with lower earnings visibility (Galaxy Macau, Parcel 5 & 6).

(HK$)

14 12 10 8 6

SJM (LHS)

M elco (LHS)

Galaxy (LHS)

Sands China (RHS)

Wynn M acau (RHS)

14 13 12 11 10 9

4 2 0 Jan-08 Apr-08 Jul-08 Oct-08 Jan-09 Apr-09 Jul-09 Oct-09 Jan-10 Apr-10

8 7 6

Source: Bloomberg

Page 23

Industry Focus Macau Gaming

Figure 44: Gaming sector peer comparison

Sh are p ric e ( L C$ ) M ac au Sands China Wy nn Macau SJ M Galaxy Melco 12.06 13.20 6.60 4.11 3.37 M ark et Cap ( U SD m) 12,466 8,795 4,279 2,081 533 28,154 2009 ( U SD m) 809 411 291 144 (4) 1,651 EB IT D A 2010F ( U SD m) 914 574 460 173 19 2,141 2011F ( U SD m) 1,053 644 503 280 22 2,501 2 - y ear CA G R (% ) 14 25 31 39 n.m. 23 2009 (x) 17.8 22.3 12.3 16.8 n.m. 18.3 EV / EB IT D A 2010F (x) 15.8 15.3 8.0 18.6 32.0 14.4 2011F (x) 13.8 12.7 7.4 11.8 27.8 12.1 2 0 1 1 F EV / EB IT D A v s g ro w t h (x ) 1.0 0.5 0.2 0.3 n.m. 0.5 PE 2009 (x) 58.3 33.1 36.4 18.3 n.m. 66.4 2010F (x) 34.5 21.6 14.4 31.6 n.m. 25.0 2011F (x) 29.8 18.5 12.6 27.1 80.2 21.3 2010F D iv d Y ield (% ) 0.0 0.0 2.6 0.0 0.0 0.5 P/ B V

(x ) 3.4 18.2 3.9 2.0 0.6 5.6

US Las V egas Sands MGM Mirage Wy nn

26.72 12.18 85.55

17,644 5,375 10,549 33,568

736 1,142 674 2,552

1,610 1,188 929 3,727

2,132 1,403 1,028 4,563

70 11 24 34

35.3 15.4 18.1 21.9

16.1 14.8 13.2 15.0

12.2 12.6 11.9 12.2

0.2 1.2 0.5 0.4

n.m. n.m. 503.2 n . m.

111.8 n.m. 96.0 377.8

44.3 n.m. 64.1 57.5

0.1 0.0 0.5 0.2

3.2 1.4 3.4 2.7

A s ia- Pac if ic Genting Genting Malay sia Genting Singapore Kangw on Land Crow n TabCorp Sky City Ent

7.34 2.83 1.14 18,500 8.00 6.69 2.84

8,366 5,142 10,001 3,291 5,266 3,557 1,148 36,772 98,494

1,019 614 52 434 619 927 207 3,872 8,075

1,343 533 515 498 565 891 215 4,559 10,427

1,646 546 736 528 628 917 217 5,218 12,282

27 -6 277 10 1 -1 2 16 23

11.3 5.8 206.9 5.7 9.3 5.4 7.6 10.5 15.7

9.3 6.2 22.7 4.9 10.2 5.7 7.3 8.9 12.1

7.6 5.5 16.0 4.6 9.2 5.5 7.2 7.8 10.3

0.3 (1.0) 0.1 0.5 12.8 (9.9) 3.0 0.5 0.4

24.7 12.1 n.m. 9.7 n.m. 7.2 12.1 66.2 n . m.

19.9 13.8 54.3 9.3 21.6 8.4 12.3 17.9 30.2

16.1 13.4 29.6 8.8 16.8 8.3 11.5 15.1 22.6

1.1 2.2 0.0 5.4 4.5 8.6 5.5 3.9 2.2

2.0 1.6 3.3 2.1 1.8 1.2 2.1 2.0 3.4

Sec t o r

Source: Bloomberg, DBS Vickers

Figure 45: China consumer sector peer comparison

EBITDA Share price 18-Jun-10 (HK$) Macau gaming stocks Sands China Wynn Macau SJM Galaxy Melco Average China consumer stocks (market cap >HK$15b) Li & Fung Tingyi Holding Want Want China Hengan China Mengniu China Yurun Yue Yuen Li Ning Tsingtao Brewery - H China Food Big-cap (>HK$50b) Medium-cap (<HK$50b) 12.06 13.20 6.60 4.11 3.37 Market Cap (HK$m) 97,057 68,475 33,311 16,205 4,147 219,195 EV/EBITDA 2009 2010F 2011F (x) (x) (x) 17.8 22.3 12.3 16.8 n.m. 18.3 15.8 15.3 8.0 18.6 32.0 14.4 13.8 12.7 7.4 11.8 27.8 12.1 2-year CAGR (%) 14 25 31 39 n.m. 23 2011 EV/ EBITDA vs growth (%) 1.0 0.5 0.2 0.3 n.m. 0.5 2009 (x) 58.3 33.1 36.4 18.3 n.m. 66.4 PE 2010F (x) 34.5 21.6 14.4 31.6 n.m. 25.0 2011F (x) 29.8 18.5 12.6 27.1 80.2 21.3 P/BV 2011F (x) 3.4 18.2 3.9 2.0 0.6 5.6 ROE 2011F (%) 9.8 42.2 25.6 6.4 1.2 17.0 Div d Y ield 2011F (%) 2.6 0.5

38.30 19.06 6.50 61.50 25.00 24.50 24.40 27.45 38.65 4.76

144,939 106,484 85,876 74,988 43,430 43,200 40,234 28,784 25,318 13,292 606,546 412,287 194,258

31.6 17.1 25.7 24.8 15.4 18.4 8.5 15.7 17.7 10.6 18.2 23.9 11.9

23.3 14.4 19.9 21.9 13.9 16.0 7.4 13.1 16.3 9.2 15.0 19.1 10.2

17.2 12.2 15.6 17.6 10.8 12.7 6.7 10.5 14.3 6.5 12.2 15.2 8.4

35.0 15.5 28.6 20.1 20.2 23.2 11.8 19.1 9.8 30.7 20.7 24.2 16.7

0.5 0.8 0.5 0.9 0.5 0.5 0.6 0.5 1.5 0.2 0.6 0.6 0.5

41.7 35.7 35.3 35.4 34.1 24.8 10.8 26.7 35.6 23.4 30.2 37.4 21.4

28.6 30.1 27.5 31.3 26.6 22.6 10.2 22.0 31.9 17.3 24.8 29.2 18.7

20.6 25.5 21.8 25.5 20.8 18.5 9.0 17.9 28.4 12.1 19.8 22.8 15.6

6.7 6.7 8.1 6.6 3.4 3.8 1.4 5.5 2.1 1.9 4.4 6.9 2.5

34.3 28.5 39.8 27.6 17.4 22.0 16.2 34.2 7.7 16.8 23.8 32.5 17.1

3.9 1.9 4.0 2.5 1.0 1.6 4.9 2.3 0.6 3.3 2.9 3.2 2.3

Source: Bloomberg, DBS Vickers

Page 24

Industry Focus Macau Gaming

Figure 46: Wynns EV/EBITDA Historical Trend

(US$) 200 25x 150 100 50 0 Oct-02 (50) (100) Oct-03 Oct-04 Oct-05 Oct-06 Oct-07 Oct-08 Oct-09

20 0 Jan-00 (20) Jan-02 Jan-04 Jan-06 Jan-08 Jan-10

Figure 48: MGMs EV/EBITDA Historical Trend

(US$) 120 100 80 60 40 18x 16x 14x 12x 10x

20x 15x 10x 5x

Source: Bloomberg

Source: Bloomberg

Figure 47: Las Vegas Sands EV/EBITDA Historical Trend

(US$) 160 140 120 100 80 60 40 20 0 Dec-04 (20) Dec-05 Dec-06 Dec-07 Dec-08 Dec-09 30x 25x 20x 15x 10x

Source: Bloomberg

Page 25

Industry Focus Macau Gaming

Strategy & Stock Picks