Professional Documents

Culture Documents

Capital Budgeting Quiz

Uploaded by

Jen ZabalaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital Budgeting Quiz

Uploaded by

Jen ZabalaCopyright:

Available Formats

Finance I Capital Budgeting

January 26, 2011

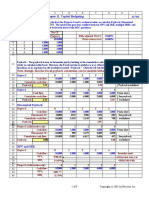

I. Payback Period. May Company is evaluating an investment proposal to acquire two new machines to be used in its manufacturing operations. The machines cost P60,000 each, inclusive of the value added tax of 10%. There is a P3,000 total installation cost for the machines. The useful life of the machines is 5 years, no salvage value. Annual net cash inflow from the two machines is P20,000. Required: Determine the payback period for the machines. II. Accounting Rate of Return. Sisa Company is evaluating a plan to expand its store space due to the expected increase in volume of activities in the next few months. The expansion would cost P200,000 and would have a useful life of 20 years, with no salvage value. The expected increase in sales revenue is P55,000 a year, and cash expenses are P20,000 a year. The income tax rate is 30%. Required: a. Compute the accounting rate of return b. If Sisas cost of capital is 15%, Should the project be accepted? III. Consider the following project proposal: Project A Cost of investment Annual net cash inflows Economic life Discount rate is at 10% Compute the following: a. Net Present Value (NPV) b. Profitability Index (PI) P 20,000 8,000 5 years 3.791 Project B P 40,000 16,000 5 years 3.791

Finance I Capital Budgeting

January 26, 2011

I. Payback Period. May Company is evaluating an investment proposal to acquire two new machines to be used in its manufacturing operations. The machines cost P60,000 each, inclusive of the value added tax of 10%. There is a P3,000 total installation cost for the machines. The useful life of the machines is 5 years, no salvage value. Annual net cash inflow from the two machines is P20,000. Required: Determine the payback period for the machines. Payback period = cash outflow = (60,000 x 2) +3,000 Net Cash inflow 20,000 = 6.15 years II. Accounting Rate of Return. Sisa Company is evaluating a plan to expand its store space due to the expected increase in volume of activities in the next few months. The expansion would coast P200,000 and would have a useful life of 20 years, with no salvage value. The expected increase in sales revenue is P55,000 a year, and cash expenses are P20,000 a year. The income tax rate is 30%. Required: c. Compute the accounting rate of return d. If Sisas cost of capital is 15%, Should the project be accepted? ARR = Average annual net income after taxes Cash outlay (investment) Sales Less: Expenses Depreciation (P 200,000/20) Net Income before Tax Less: Income tax @ 30% Net Income after Tax ARR = P 17,500 = 8.75% 200,000 P 55,000 20,000 10,000 25,000 7,500 P 17,500

III. Consider the following project proposal: Project A Cost of investment Annual net cash inflows Economic life Discount rate is at 10% Compute the following: a. Net Present Value (NPV) b. Profitability Index (PI) A. NPV PV of cash inflow (8,000 x 3.791) Less: cost if investment NPV B. PI Profitability Index = PV of cash inflow Investment Project A 30,328 20,000 10,328 Project A 30,328 20,000 =1.52 Project B (16,000 x 3.791) 60,656 40,000 20,656 Project B 60,565 40,000 = 1.52 P 20,000 8,000 5 years 3.791 Project B P 40,000 16,000 5 years 3.791

You might also like

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimDocument5 pagesSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesNo ratings yet

- 04 Cost-Volume Profit Relationships SolDocument42 pages04 Cost-Volume Profit Relationships SolDea Lyn BaculaNo ratings yet

- JIT SystemDocument2 pagesJIT SystemJona FranciscoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument6 pagesManila Cavite Laguna Cebu Cagayan de Oro Davaovane rondinaNo ratings yet

- Chapter 2: Asset-Based Valuation Asset-Based ValuationDocument6 pagesChapter 2: Asset-Based Valuation Asset-Based ValuationJoyce Dela CruzNo ratings yet

- Baggayao WACC PDFDocument7 pagesBaggayao WACC PDFMark John Ortile BrusasNo ratings yet

- Chapter 10Document9 pagesChapter 10Patrick Earl T. PintacNo ratings yet

- Assignment PDFDocument11 pagesAssignment PDFJanine Lerum100% (1)

- QUIZ REVIEW Homework Tutorial Chapter 5Document5 pagesQUIZ REVIEW Homework Tutorial Chapter 5Cody TarantinoNo ratings yet

- MAS Handout CH4 DiffCostAnaDocument2 pagesMAS Handout CH4 DiffCostAnaAbigail TumabaoNo ratings yet

- CAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityDocument7 pagesCAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- Strategic Cost Management Coordinated Quiz 1Document7 pagesStrategic Cost Management Coordinated Quiz 1Kim TaehyungNo ratings yet

- Variance Analysis (Practice Problems)Document7 pagesVariance Analysis (Practice Problems)Godwin De GuzmanNo ratings yet

- Quiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsDocument12 pagesQuiz 1 SCM Ay 2020 2021 Second Sem Sisc SolutionsAira Jaimee GonzalesNo ratings yet

- Basic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingDocument107 pagesBasic Concepts Capital Budgeting Defined Agency Problem in Capital BudgetingKang JoonNo ratings yet

- Chapter 9 - The Use of Budgets in Planning and Decision MakingDocument71 pagesChapter 9 - The Use of Budgets in Planning and Decision MakingGray JavierNo ratings yet

- Exam 7Document15 pagesExam 7mohit verrmaNo ratings yet

- Questions 3 and 4 Are Based On Kapritso CoDocument22 pagesQuestions 3 and 4 Are Based On Kapritso CoJohn Carlo Peru100% (2)

- Reviewer Mas5Document26 pagesReviewer Mas5Joyce Anne MananquilNo ratings yet

- CoonzDocument6 pagesCoonzlanimfa dela cruz100% (1)

- CA 51014 - Strategic Cost Management Capital BudgetingDocument9 pagesCA 51014 - Strategic Cost Management Capital BudgetingMark FloresNo ratings yet

- 2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxDocument7 pages2 Days $500,000 : 15% 2 $350,000 - ) Cost $100,000 Advantage of LockboxBryent GawNo ratings yet

- Chapter 05 AnswerDocument5 pagesChapter 05 AnswerErica DizonNo ratings yet

- Short Term FinancingDocument5 pagesShort Term FinancingLumingNo ratings yet

- Assignment #1 OH Variance With SolutionDocument14 pagesAssignment #1 OH Variance With SolutionJeannet LagcoNo ratings yet

- CH2 QuizkeyDocument5 pagesCH2 QuizkeyiamacrusaderNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- This Study Resource Was: Strategic Cost Management Master BudgetDocument5 pagesThis Study Resource Was: Strategic Cost Management Master BudgetNCTNo ratings yet

- Acctg 121Document3 pagesAcctg 121YricaNo ratings yet

- Expected Cash Receipts Classified by Source Expected Cash DisbursementsDocument6 pagesExpected Cash Receipts Classified by Source Expected Cash DisbursementsRimuru Tempest100% (1)

- Sales Agency AccountingDocument11 pagesSales Agency AccountingJade MarkNo ratings yet

- 04 Variable and Absorption CostingDocument8 pages04 Variable and Absorption CostingJunZon VelascoNo ratings yet

- Activity - Financial ManagementDocument5 pagesActivity - Financial ManagementKATHRYN CLAUDETTE RESENTENo ratings yet

- Chapter 4Document4 pagesChapter 4LyssaNo ratings yet

- Taxation Final Preboard CPAR 92 PDFDocument17 pagesTaxation Final Preboard CPAR 92 PDFomer 2 gerdNo ratings yet

- BFM 113 - Reviewer For Final Departmental Exam - Working Capital ManagementDocument8 pagesBFM 113 - Reviewer For Final Departmental Exam - Working Capital ManagementAudreyMaeNo ratings yet

- Responsibility Acctg Transfer Pricing GP AnalysisDocument21 pagesResponsibility Acctg Transfer Pricing GP AnalysisstudentoneNo ratings yet

- Property, Plant and Equipment Problems 5-1 (Uy Company)Document14 pagesProperty, Plant and Equipment Problems 5-1 (Uy Company)NaSheeng100% (1)

- Name: - : Problem 1Document2 pagesName: - : Problem 1Samuel FerolinoNo ratings yet

- Absorption Costing and Variable Costing QuizDocument3 pagesAbsorption Costing and Variable Costing QuizKeir GaspanNo ratings yet

- Group Quizbowl FormattedDocument17 pagesGroup Quizbowl FormattedSarah BalisacanNo ratings yet

- Business CombinationDocument3 pagesBusiness CombinationJia CruzNo ratings yet

- CapBud Problem Quiz 1Document4 pagesCapBud Problem Quiz 1Sittie Ayeenah Yusoph ArindigNo ratings yet

- Chapter 15 Managing ShortDocument44 pagesChapter 15 Managing ShortLede Ann Calipus Yap0% (1)

- BUSCOM ActivityDocument14 pagesBUSCOM ActivityLerma MarianoNo ratings yet

- 8 Capital Budgeting - Problems - With AnswersDocument15 pages8 Capital Budgeting - Problems - With AnswersIamnti domnateNo ratings yet

- Direct and Absorption Costing 2014Document15 pagesDirect and Absorption Costing 2014Aj de CastroNo ratings yet

- Cost-Volume-Profit Analysis: True / False QuestionsDocument25 pagesCost-Volume-Profit Analysis: True / False QuestionsNaddie50% (2)

- MAS 10 Capital BudgetingDocument9 pagesMAS 10 Capital BudgetingZEEKIRA100% (1)

- Capital Budgeting Lecture UpdatedDocument5 pagesCapital Budgeting Lecture UpdatedMark Gelo WinchesterNo ratings yet

- Variable (Direct) CostingDocument3 pagesVariable (Direct) CostingMela carlonNo ratings yet

- Managerial AccountingMid Term Examination (1) - CONSULTADocument7 pagesManagerial AccountingMid Term Examination (1) - CONSULTAMay Ramos100% (1)

- 2018 - 2019 MAS 01 70mcqDocument30 pages2018 - 2019 MAS 01 70mcqMarc Allen Anthony GanNo ratings yet

- AE 119 Quiz 4Document6 pagesAE 119 Quiz 4Ma Angelica BalatucanNo ratings yet

- Question of Capital BudgetingDocument7 pagesQuestion of Capital Budgeting29_ramesh170100% (2)

- Capital Investment Factors7to16Document15 pagesCapital Investment Factors7to16Spencer Tañada100% (1)

- Problems - Capital BudgetingDocument5 pagesProblems - Capital BudgetingDianne TorresNo ratings yet

- Acc 223 CB PS3 QDocument8 pagesAcc 223 CB PS3 QAeyjay ManangaranNo ratings yet

- For Students Capital BudgetingDocument3 pagesFor Students Capital Budgetingwew123No ratings yet

- Accounting and Finance AAF044-6Document14 pagesAccounting and Finance AAF044-6Trisa DasNo ratings yet

- Level 2 Test 02 Questions (Jan)Document44 pagesLevel 2 Test 02 Questions (Jan)Anonymus75% (4)

- Capital Budgeting DefinitionDocument8 pagesCapital Budgeting DefinitionBharti AroraNo ratings yet

- Cost and Management AccountingDocument143 pagesCost and Management Accountingnarunsankar100% (2)

- MBA5014 Assessment2-1Document7 pagesMBA5014 Assessment2-1AA TsolScholarNo ratings yet

- CPm322E CH6 Cash FlowDocument30 pagesCPm322E CH6 Cash Flowpapilolo2008No ratings yet

- Managerial Economics and Financial Analysisjntu K A R Aryasri Full ChapterDocument67 pagesManagerial Economics and Financial Analysisjntu K A R Aryasri Full Chaptersharon.clark673100% (5)

- AES Case Solution - WriteupDocument5 pagesAES Case Solution - Writeupedwinj20100% (1)

- 2016 Syllabus Cpa ExamDocument18 pages2016 Syllabus Cpa ExamJudy Angel Villanueva CalvarioNo ratings yet

- Capital Budgeting Techniques Practices in Eastern Bank and IFIC BankDocument44 pagesCapital Budgeting Techniques Practices in Eastern Bank and IFIC BankEdu WriterNo ratings yet

- Part 1. Worksheet For Chapter 11, Capital BudgetingDocument9 pagesPart 1. Worksheet For Chapter 11, Capital BudgetingIndrama PurbaNo ratings yet

- Fatima ReyesDocument26 pagesFatima ReyesNadia Che SafriNo ratings yet

- NPV Vs - IRRDocument6 pagesNPV Vs - IRRDibakar DasNo ratings yet

- TB Chapter11Document77 pagesTB Chapter11CGNo ratings yet

- Lesson 3 Applying Management Control in Accounting and MarketingDocument17 pagesLesson 3 Applying Management Control in Accounting and MarketingCJ DuapaNo ratings yet

- Finc 3310 - Actual Test 3Document5 pagesFinc 3310 - Actual Test 3jlr0911No ratings yet

- Finance For Non-Finance PeopleDocument41 pagesFinance For Non-Finance Peopleayman.elnajjar8916100% (3)

- Ebook PDF Corporate Finance 7th Canadian Edition by Stephen Ross PDFDocument41 pagesEbook PDF Corporate Finance 7th Canadian Edition by Stephen Ross PDFjennifer.browne345100% (34)

- Bachelor of Business AdministrationDocument58 pagesBachelor of Business AdministrationMukesh kumar PandeyNo ratings yet

- Finance Acumen For Non FinanceDocument55 pagesFinance Acumen For Non FinanceHarihar PanigrahiNo ratings yet

- FMP Assignement Key - Cases Fall 10Document16 pagesFMP Assignement Key - Cases Fall 10ahsan_anwar_1No ratings yet

- Midterm Quiz No 1 Relevant Costing and Capital BudgetingDocument2 pagesMidterm Quiz No 1 Relevant Costing and Capital BudgetingLian GarlNo ratings yet

- Corporate Finance QBDocument27 pagesCorporate Finance QBVelu SamyNo ratings yet

- Balaji VefarDocument53 pagesBalaji VefarSunny Bhatt50% (2)

- Kerzner, CH 7Document32 pagesKerzner, CH 7Fisiha FikiruNo ratings yet

- Timothy - Chap 11Document24 pagesTimothy - Chap 11Chaeyeon JungNo ratings yet

- Functions of Finance ManagerDocument5 pagesFunctions of Finance ManagerB112NITESH KUMAR SAHUNo ratings yet

- University of Zimbabwe Business Studies Department Corporate Finance 1: Course Code: Bs204 Lecturer in Charge: G MupondaDocument4 pagesUniversity of Zimbabwe Business Studies Department Corporate Finance 1: Course Code: Bs204 Lecturer in Charge: G MupondatatendaNo ratings yet

- Chaa-H Business Plan Group 1Document76 pagesChaa-H Business Plan Group 1Ali RizNo ratings yet

- Real Options in Capital Budgeting. Pricing The Option To Delay and The Option To Abandon A ProjectDocument12 pagesReal Options in Capital Budgeting. Pricing The Option To Delay and The Option To Abandon A ProjectKhiev ThidaNo ratings yet