Professional Documents

Culture Documents

Week 3 Solution

Uploaded by

o0emi0oOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 3 Solution

Uploaded by

o0emi0oCopyright:

Available Formats

Week 3

1.

The Economic Basis for Government Activity

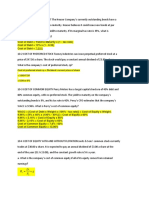

Supposes the marginal social cost for television sets is $100. This is constant and equal to the average cost of television sets. The annual demand for television sets is given by the following equation: Q = 200,000 500P, where Q is the quantity sold per year and P is the price of television sets. a). If television sets are sold in a perfectly competitive market, calculate the annual number sold. What are the CS and PS? Is the market efficient? Q* = 150,000 CS = 22,500,000 PS = 0 At Q* = 150k, MSC = MSB thus it is efficient.

b). Show the losses in well-being each year that would result from a law limiting sales of television sets to 100,000 per year. Show the effect on price, marginal social benefit, and marginal social cost of television sets. Show the net loss in well-being that will result from a complete ban on the sales of television sets. P = $200 DWL = 2,500,000 (it is the area between the demand and supply curve from 100k to 150k units) MSB at Q = 100k is $200 MSC = $100 The net loss in well-being when there is a complete ban on the sale is the CS area which equal to $22,500,000.

c). Suppose instead of a law that limits the sales of television sets, there is a price floor of $200. Will the market outcome be similar to that of part b)? Yes. We will get the same Q and DWL.

Econ 290 Week 3 Tutorial

Page 1

2.

Consider the market for cigarettes. Suppose the market demand and supply curves are as given below. In each case, quantity refers to millions of packs of cigarettes per month; price is the price per pack (dollars). Demand: P = 100 2Qd Supply: P = 10 + QS

a) Plot the demand and supply curves on a supply/demand diagram. I believe you can do it

b) Compute the equilibrium price and quantity. P* = $40 and Q* = 30

c) Now suppose the government imposes a tax of 15 dollars per pack. Show how does it affect the market equilibrium. What is the new consumer price and what is the new producer price? Show them on your diagram. Supply function with tax is P = 25 + Q Pc = $50 and Pp = $35, Qt = 25

d) Compute the total revenue raised by the cigarette tax. What share is paid by producers? What share is paid by consumer? Total tax revenue = $375 Tax paid by consumers = $250 Tax paid by producers = $125

e) What is the CS, PS and DWL associated with the tax? CS = $625 PS = $312.5 DWL = $37.5

Econ 290 Week 3 Tutorial Page 2

3.

Suppose that the following represents the labour for Toronto. Graph the following

information for the market.

Wages (In dollars per hour) 15 11 7 3

Quantity Demanded 3800 4200 4600 5000

Quantity Supplied 5000 4800 4600 4400

a) What is the equilibrium employment and wage in the Toronto labour market? L* = 4600 and W* = $7

b) Suppose that the government places $11 price control on the market, what kind of price control is this? (Please name it) Minimum wage

c) If this $11 wage control is imposed, show this on your graph. What is the new quantity supplied and quantity demanded in the market? How many jobs are destroyed by this policy. Ls = 4800 and Ld = 4200 Number of job destroyed = 4600 4200 = 400

d) Discuss what would be a rational for such intervention. Who gains from this policy and who loses? The government want to help the poor. Gainer: who still get employed Loser: employers and those who lose their jobs

Econ 290 Week 3 Tutorial

Page 3

You might also like

- Mini-Case 1 Ppe AnswerDocument11 pagesMini-Case 1 Ppe Answeryu choong100% (2)

- FMG 22-IntroductionDocument22 pagesFMG 22-IntroductionPrateek GargNo ratings yet

- Handouts 1 Partnership AccountingDocument5 pagesHandouts 1 Partnership AccountingRozel MontevirgenNo ratings yet

- Background of The StudyDocument4 pagesBackground of The StudymargeNo ratings yet

- Theory of Production Chapter 5Document24 pagesTheory of Production Chapter 5BelteshazzarL.CabacangNo ratings yet

- EcstasticDocument82 pagesEcstasticCristian D. BaldozNo ratings yet

- Cfas Cost Acctg QaDocument102 pagesCfas Cost Acctg QaLorielyn Mae Salcedo100% (1)

- Budgetary Planning Budgetary Planning: Answer KeyDocument112 pagesBudgetary Planning Budgetary Planning: Answer KeyaNo ratings yet

- ExpectationsDocument1 pageExpectationsDats DSNo ratings yet

- AprilDocument2 pagesAprilChery Sheil Valenzuela0% (2)

- P1 Day4 RMDocument15 pagesP1 Day4 RMSharmaine Sur100% (1)

- Activity 2 - Cash and Cash EquivalentsDocument2 pagesActivity 2 - Cash and Cash EquivalentsSean Lester S. NombradoNo ratings yet

- Esenmgt Case Study Group 3Document11 pagesEsenmgt Case Study Group 3Nikko Sigua VelasquezNo ratings yet

- Assignment AnswerDocument2 pagesAssignment AnswerMims ChiiiNo ratings yet

- An Update On The Philippine Banking Industry Group7Document9 pagesAn Update On The Philippine Banking Industry Group7Queen TwoNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- Bonus Assignment 1Document4 pagesBonus Assignment 1Zain Zulfiqar100% (2)

- Topic 3 - Stock ValuationDocument50 pagesTopic 3 - Stock ValuationBaby KhorNo ratings yet

- Problem 1-1 Multiple Choice (ACP)Document11 pagesProblem 1-1 Multiple Choice (ACP)Irahq Yarte Torrejos0% (1)

- Tutorial Chapter 8Document3 pagesTutorial Chapter 8fitrieyfiey0% (1)

- Chapter 4: Analysis of Financial StatementsDocument50 pagesChapter 4: Analysis of Financial StatementsHope Trinity EnriquezNo ratings yet

- APC Ch8sol.2011Document10 pagesAPC Ch8sol.2011dsadsadsNo ratings yet

- (Group 2) Cearts 1 - Philippine Popular CultureDocument3 pages(Group 2) Cearts 1 - Philippine Popular Culturerandom aestheticNo ratings yet

- Effects of RibaDocument1 pageEffects of RibaMimie LscNo ratings yet

- Rmyc Irr Nyepnyep NyoorayDocument29 pagesRmyc Irr Nyepnyep Nyooraylalala010899No ratings yet

- 05 Task Performance - ARG: RequirementsDocument3 pages05 Task Performance - ARG: Requirementssungit comiaNo ratings yet

- INVESTMENTSDocument9 pagesINVESTMENTSKrisan RiveraNo ratings yet

- FINACC-Homework Exercise 2Document3 pagesFINACC-Homework Exercise 2Jomel BaptistaNo ratings yet

- Development Economics - Chapter 7Document9 pagesDevelopment Economics - Chapter 7Joshua Miguel BartolataNo ratings yet

- Managerial EconomicsDocument10 pagesManagerial EconomicsFarhan HaseebNo ratings yet

- KeyWahlIndustries DuPontAnalysisDocument2 pagesKeyWahlIndustries DuPontAnalysisKhai EmanNo ratings yet

- Intermediate Accounting Exam SolutionsDocument11 pagesIntermediate Accounting Exam SolutionsDean Craig80% (5)

- Internal Control Cases: Bern Fly Rod CompanyDocument2 pagesInternal Control Cases: Bern Fly Rod CompanyTrixie Jane Bautista LeymaNo ratings yet

- Assignment Part 4Document3 pagesAssignment Part 4Darwin Dionisio ClementeNo ratings yet

- Decision Making IDocument1 pageDecision Making IMyra Dela Llana Tagalog100% (1)

- Uses of National Income DataDocument2 pagesUses of National Income Dataarchitjain7080% (5)

- PPL CupDocument9 pagesPPL CupErrol John P. SahagunNo ratings yet

- Anthony and Anjo-Audit of Stockholders' EquityDocument14 pagesAnthony and Anjo-Audit of Stockholders' EquityCodeSeeker75% (4)

- FInancial Accounting and Reporting1C6Document19 pagesFInancial Accounting and Reporting1C6Yen YenNo ratings yet

- PFRS 10 13Document2 pagesPFRS 10 13Patrick RiveraNo ratings yet

- Working CapitalDocument2 pagesWorking Capitalcmverma820% (1)

- Adjusting Entries ActsDocument5 pagesAdjusting Entries ActsLori100% (1)

- A. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareDocument109 pagesA. On November 27, The Board of Directors of India Star Company Declared A $.35 Per ShareChris Jay LatibanNo ratings yet

- Chap2 Case 1Document1 pageChap2 Case 1Xyza Faye RegaladoNo ratings yet

- PTAccountingDocument13 pagesPTAccountingLAN ONLINENo ratings yet

- Quantitative ProblemsDocument8 pagesQuantitative ProblemsrahimNo ratings yet

- PL Act#4Document2 pagesPL Act#4Jolina Pahayac50% (2)

- Reverand Father Layog Case StudyDocument2 pagesReverand Father Layog Case StudyJomsNo ratings yet

- IAS 20 Government GrantsDocument1 pageIAS 20 Government Grantsm2mlckNo ratings yet

- AcctDocument3 pagesAcctc蔡慧君No ratings yet

- Accounting Process With AnsDocument6 pagesAccounting Process With AnsMichael BongalontaNo ratings yet

- Statistics RevisionDocument5 pagesStatistics RevisionNicholas TehNo ratings yet

- PRACTICE SET Problem 257 258Document2 pagesPRACTICE SET Problem 257 258Jazzen Martinez0% (1)

- Assignment AnswersDocument15 pagesAssignment Answershiroshika wsabiNo ratings yet

- Lanimfa T.dela Cruz BSA-3A: Partnership OperationDocument4 pagesLanimfa T.dela Cruz BSA-3A: Partnership Operationleonard dela cruzNo ratings yet

- Cooperative Organization and Practical Applications (COOP 20073)Document2 pagesCooperative Organization and Practical Applications (COOP 20073)ErianneNo ratings yet

- Competitive Markets MEDocument24 pagesCompetitive Markets MEdheerajm880% (1)

- Chapter 7Document18 pagesChapter 7dheerajm88No ratings yet

- Tutorial 9 Suggested SolutionsDocument11 pagesTutorial 9 Suggested SolutionsChloe GuilaNo ratings yet

- 3070 PSet-7 SolutionsDocument13 pages3070 PSet-7 SolutionsvikasNo ratings yet

- AFI 90-901 Operational Risk ManagementDocument7 pagesAFI 90-901 Operational Risk ManagementJohan Lai100% (1)

- Filipino Chicken Cordon BleuDocument7 pagesFilipino Chicken Cordon BleuHazel Castro Valentin-VillamorNo ratings yet

- Sorsogon State College: Republic of The Philippines Bulan Campus Bulan, SorsogonDocument4 pagesSorsogon State College: Republic of The Philippines Bulan Campus Bulan, Sorsogonerickson hernanNo ratings yet

- Analysis of Pipe FlowDocument14 pagesAnalysis of Pipe FlowRizwan FaridNo ratings yet

- Congestion AvoidanceDocument23 pagesCongestion AvoidanceTheIgor997No ratings yet

- Black Body RadiationDocument46 pagesBlack Body RadiationKryptosNo ratings yet

- Succession CasesDocument17 pagesSuccession CasesAmbisyosa PormanesNo ratings yet

- Boylestad Circan 3ce Ch02Document18 pagesBoylestad Circan 3ce Ch02sherry mughalNo ratings yet

- Task 2 - The Nature of Linguistics and LanguageDocument8 pagesTask 2 - The Nature of Linguistics and LanguageValentina Cardenas VilleroNo ratings yet

- Electric Trains and Japanese Technology: Breakthrough in Japanese Railways 4Document9 pagesElectric Trains and Japanese Technology: Breakthrough in Japanese Railways 4Aee TrDNo ratings yet

- Compare Visual Studio 2013 EditionsDocument3 pagesCompare Visual Studio 2013 EditionsankurbhatiaNo ratings yet

- Module 5amp6 Cheerdance PDF FreeDocument27 pagesModule 5amp6 Cheerdance PDF FreeKatNo ratings yet

- Trainee'S Record Book: Technical Education and Skills Development Authority (Your Institution)Document17 pagesTrainee'S Record Book: Technical Education and Skills Development Authority (Your Institution)Ronald Dequilla PacolNo ratings yet

- Comparing ODS RTF in Batch Using VBA and SASDocument8 pagesComparing ODS RTF in Batch Using VBA and SASseafish1976No ratings yet

- National Healthy Lifestyle ProgramDocument6 pagesNational Healthy Lifestyle Programmale nurseNo ratings yet

- Analysis of The Tata Consultancy ServiceDocument20 pagesAnalysis of The Tata Consultancy ServiceamalremeshNo ratings yet

- WIKADocument10 pagesWIKAPatnubay B TiamsonNo ratings yet

- Question 1 (1 Point) : SavedDocument31 pagesQuestion 1 (1 Point) : SavedCates TorresNo ratings yet

- Types of Vegetation in Western EuropeDocument12 pagesTypes of Vegetation in Western EuropeChemutai EzekielNo ratings yet

- G.R. No. 186450Document6 pagesG.R. No. 186450Jose Gonzalo SaldajenoNo ratings yet

- Why Nations Fail - SummaryDocument3 pagesWhy Nations Fail - SummarysaraNo ratings yet

- Social Networking ProjectDocument11 pagesSocial Networking Projectapi-463256826No ratings yet

- Sycip v. CA (Sufficient Funds With The Drawee Bank)Document15 pagesSycip v. CA (Sufficient Funds With The Drawee Bank)Arnold BagalanteNo ratings yet

- Internship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeDocument45 pagesInternship Report On A Study of The Masterbranding of Dove: Urmee Rahman SilveeVIRAL DOSHINo ratings yet

- Governance Whitepaper 3Document29 pagesGovernance Whitepaper 3Geraldo Geraldo Jr.No ratings yet

- Cui Et Al. 2017Document10 pagesCui Et Al. 2017Manaswini VadlamaniNo ratings yet

- How To Use The ActionDocument3 pagesHow To Use The Actioncizgiaz cizgiNo ratings yet

- Civil and Environmental EngineeringDocument510 pagesCivil and Environmental EngineeringAhmed KaleemuddinNo ratings yet

- Isolated Foundation PDFDocument6 pagesIsolated Foundation PDFsoroware100% (1)

- Manual StereoDocument29 pagesManual StereoPeter Mac RedNo ratings yet