Professional Documents

Culture Documents

European Autos & Parts 2009 Q4 Barclays

Uploaded by

AlphatrackerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

European Autos & Parts 2009 Q4 Barclays

Uploaded by

AlphatrackerCopyright:

Available Formats

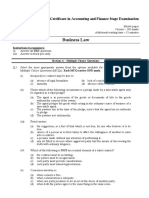

EQUITY RESEARCH

8 December 2009

EUROPEAN AUTOS & AUTO PARTS: INITIATION OF COVERAGE

PREPARE FOR POST-SCRAPPAGE PRICE WARS

Barclays Capital does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. This research report has been prepared in whole or in part by research analysts based outside the US who are not registered/qualified as research analysts with FINRA. PLEASE SEE ANALYST(S) CERTIFICATION(S) AND IMPORTANT DISCLOSURES BEGINNING ON PAGE 177.

Barclays Capital | European Autos & Auto Parts

EUROPEAN AUTOS & AUTO PARTS PREPARE FOR POST-SCRAPPAGE PRICE WARS

European Autos & Auto Parts Brian A. Johnson 1.212.526.5627 brian.johnson@barcap.com BCI, New York Kristina Church +44 (0)20 313 42199 kristina.church@barcap.com Barclays Capital, London

We see 2010 as a year of unintended consequences from the scrappage programmes of 2009 for the European Auto sector, and expect volumes to fall, excess capacity to be exposed and pricing to deteriorate. As a result we favour stocks that have unrecognized cost reduction potential. We are initiating coverage with three key 1-Overweight ideas: Renault, BMW and VW Prefs and two key 3-Underweights: Fiat and Daimler. Sector wise, we believe the sector is moderately expensive for what we see as a tougher than expected 2010 but reasonable in light of longer-term valuations. We are initiating with a 2-Neutral sector view and believe the time is right to refocus on stock selection. Specifically we believe that: The sector is no longer a near-term macro call with early cyclical recovery gains behind us; 2010 will be the year of unintended consequences from scrappage programme payback that will pressure not just on volumes but on pricing as the European consumer base becomes addicted to incentives; and Given the toughening environment, we prefer players who can exploit already established scale positions by driving further cost savings via further commonality and modularity over those still scrambling to establish scale. In terms of 1-Overweight, we are non-consensus on Renault. Among our 3-Underweight ratings, we are non-consensus on Daimler and Fiat. Stock selection: Prefer players who can extract cost savings from established scale Auto stocks have already priced in an economic bottom, with OEMs stocks outperforming YTD by 41% (on a raw basis vs. DJ STOXX, excluding VW ords). While investors are cautious toward sales declines in 2010, we believe they do not yet appreciate the degree to which pricing will be under pressure. This makes cost savings critical. To identify cost cutting potential, we believe investors should pay equal attention to the firms ability to increase modularity and commonality to exploit the scale as well as the workforce flexibility to bring the productivity savings to the bottom line. 1-Overweights We believe the market is underestimating Renaults potential to take the Nissan alliance to the next level; BMW, where modularity and workforce demographics likely set up further cost reduction; and VW prefs are cheap even assuming dilution and merger risks. 2-Equal Weight PSA as market appreciates product cadence and is already pricing in gains from a Mitsubishi alliance that will take years to extract; Porsche is primarily a vehicle to gather VW shares but with greater merger and dilution risk than the VW prefs. 3-Underweight Daimler as workforce demographics inhibit further cost cutting; Fiat as the market overestimates Chrysler potential. Sector view: 2-Neutral We are initiating with a 2-Neutral view on the auto sector for three reasons: 1) At 27% EV/sales for 2010E, the sector valuation is in line relative to history (29%) and investors confidence in the sector may be shaken as pricing and volume deteriorates and scrappage programmes expire in early 2010, 2) But at 23% for 2011E EV/sales, the sector still offers upside for longer-term holders and 3) our analysis shows it is time to buy stocks based on company specifics, which points to in-line performance after this years rally.

8 December 2009

Barclays Capital | European Autos & Auto Parts

Summary of our Rating, Price Target and Earnings in this Report

Company Rating Price Price Target EPS FY1 (E) EPS FY2 (E)

Old New 04-Dec-09 Old European Autos & Auto Parts BMW (BMW GY / BMWG.DE) Daimler AG (DAI GY / DAIGn.DE) Fiat SpA (F IM / FIA.MI) Peugeot SA (UG FP / PEUP.PA) Porsche Automobil Holding SE (PAH3 GY / PSHG_p.DE) Renault SA (RNO FP / RENA.PA) Volkswagen AG (VOW GY / VOWG.DE) Volkswagen AG-PFD Preferred (VOW3 GY / VOWG_p.DE) N/A 2-Neu N/A 1-OW N/A 3-UW N/A 3-UW N/A 2-EW N/A 2-EW N/A 1-OW N/A 2-EW N/A 1-OW 32.75 35.91 10.56 24.18 47.51 35.59 80.39 63.50

New %Chg Old New %Chg Old New %Chg

N/A 41.00 N/A 32.00 N/A 8.00 N/A 26.00 N/A 55.00 N/A 42.00 N/A 100.00 N/A 85.00

N/A 0.24 N/A -2.02 N/A 0.03 N/A -6.28 N/A -14.29 N/A -10.30 N/A 4.18 N/A 4.17

N/A 1.64 N/A 0.61 N/A 0.05 N/A -1.90 N/A 1.47 N/A 0.53 N/A 5.31 5.29

Source: Barclays Capital Share prices and target prices are shown in the primary listing currency and EPS estimates are shown in the reporting currency. FY1(E): Current fiscal year estimates by Barclays Capital. FY2(E): Next fiscal year estimates by Barclays Capital. Stock Rating: 1-OW: 1-Overweight 2-EW: 2-Equal Weight 3-UW: 3-Underweight RS: RS-Rating Suspended Sector View: 1-Pos: 1-Positive 2-Neu: 2-Neutral 3-Neg: 3-Negative

8 December 2009

Barclays Capital | European Autos & Auto Parts

CONTENTS

EUROPEAN AUTOS PREPARE FOR POST SCRAPPAGE PRICE WARS THE YEAR OF UNINTENDED CONSEQUENCES SCRAPPAGE HANGOVER LIKELY WORSE THAN CONSENSUS EXPECTATIONS EU PRODUCTION TO WEAKEN SEQUENTIALLY BUT GLOBAL GROWTH PICKS UP 1 5 9 15

DESPITE LONG-TERM DOWNSIZING, MID-TERM GROWTH IS IN VOLUME C AND ABOVE SEGMENTS AS SCRAPPAGE DISTORTION FADES 17 SCRAPPAGE AND LOAN PROGRAMMES PRESERVED EXCESS CAPACITY SCRAPPAGE SCHEMES MAY HAVE HOOKED EUROPEAN CONSUMER ON INCENTIVES SETTING UP PRICING PRESSURE CURRENCY SHIFTS PRESSURE US AND UK IMPORTS WE FAVOUR THOSE WITH DOMINANT HOME MARKET C & D POSITIONS 19

23 29 30

SCALE AND COMMONALITY PROVIDES BUFFER AGAINST UNINTENDED CONSEQUENCES 33 SECTOR VALUATION 2-NEUTRAL BMW POTENTIAL FOR FURTHER COST CUTS DRIVES 1-OVERWEIGHT RATING DAIMLER MARKET OVER OPTIMISTIC ON COST-CUTTING POTENTIAL 37 42 59

FIAT EXCESS CAPACITY AND LOWER CHRYSLER TURNAROUND ENTHUSIASM DRIVE 3-UNDERWEIGHT RATING 78 PEUGEOT STRONG MODEL CYCLE, BUT UNDERWHELMED BY NEW STRATEGY 2-EQUAL WEIGHT RATING PORSCHE MERGER BENEFITS MAY NOT FLOW TO PREF HOLDERS : 2-EQUAL WEIGHT

101

121

RENAULT POTENTIAL FOR GREATER COMMONALITY DRIVES 1-OVERWEIGHT RATING 132 VOLKSWAGEN SCALE TO WITHSTAND PRICE WARS 152

For Valuation Methodology and Risk section, please see page 174

8 December 2009

Barclays Capital | European Autos & Auto Parts

Current

Price Mkt Cap

Upside/ 2009

EPS 2010 2011 2009

EPS growth 2010 2011 2009

Sales 2010 2011 2009

Sales growth 2010 2011

Rating European OEMs BMW AG Daimler AG Fiat SpA Peugeot SA Porsche Renault SA 1-Overweight 3-Underweight

price

target downside

32.75 21,395 41.00 35.91 36,765 32.00 8.00 26.00 55.00 42.00 5,486 8,314 9,132

25% -11% -24% 8% 16% 18% 24% 34%

0.24 (2.02) 0.18

1.64 0.61 0.05

3.14 2.20 0.42 2.87 4.74 4.77 8.67 8.67

-53% -244% -88% NA -140% -563% -65% -65% -174% -88%

586% NA -71% NA NA NA 27% 27% 142% 27%

92% 259% 723% NA 222% 799% 63% 63% 317% 222%

41,341 42,316 45,215 65,785 69,512 76,660 48,398 44,852 46,602 45,393 45,923 49,115 6,260 7,094 8,362 30,230 30,831 33,089 94,485 94,299 104,402 94,485 94,299 104,402

-15% -24% -17% -14% -16% -15% -8% -8% -15% -15%

2% 6% -7% 1% 13% 2% 0% 0% 2% 2%

7% 10% 4% 7% 18% 7% 11% 11% 9% 9%

3- Underweight 10.56 13,061 2-Equal Weight 24.18 2-Equal Weight 47.51 1-Overweight 35.59

(6.28) (1.90) (14.29) 1.47 (10.30) 0.53 4.18 4.18 5.30 5.30

Volkswagen (Ords) 2-Equal Weight 80.39 32,169 100.00 Volkswagen (Prefs) 1-Overweight Mean Median 63.50 25,410 85.00

US OEMs Ford Motor Co. 2-Equal Weight $8.94 Rating

Current

$31,268

$9.00 52 week

1%

($0.38)

$0.60

$1.50

NA

NA P/E

148%

$103,508 $116,441 $133,130 EV/sales

-15%

12% EV/EBITDA

14%

Share price performance

price European OEMs BMW AG Daimler AG Fiat SpA Peugeot SA Porsche Renault SA 1-Overweight 3-Underweight 32.75 35.91

High

Low

Dec 08 1 month 3 month

YTD

2009

2010

2011

2009

2010

2011

2009

2010

2011

36.48 37.90 11.47 25.67 61.20 37.37 82.90

17.22 17.20 3.32 11.30 27.12 10.17 29.55

21.61 26.70 4.59 12.15 54.85 18.55 38.02

0% 10% -2% 4% -11% 11% -25% -7% -2% -1%

4% 7% 28% 14% 6% 8% -68% 9% 1% 8%

52% 34% 130% 99% -13% 92% -68% 67% 49% 59%

137.1x NA 59.7x NA NA NA 19.2x 15.2x 57.8x 39.5x

20.0x 58.6x 209.5x NA 32.3x 67.0x 15.2x 12.0x 59.2x 32.3x

10.4x 16.3x 25.4x 8.4x 10.0x 7.5x 9.3x 7.3x 11.8x 9.6x

20% 45% 34% 6% 187% 11% 67% 67% 55% 39%

18% 44% 35% 7% 40% 11% 27% 27% 26% 27%

18% 40% 32% 7% 27% 13% 20% 20% 22% 20%

2.2 x 11.7 x 4.5 x 1.1 x 9.2 x 1.7 x 6.6 x 6.6 x 5.4x 5.5x

1.5 x 5.4 x 4.9 x 1.1 x 1.9 x 1.2 x 2.2 x 2.2 x 2.6x 2.1x

1.1 x 3.7 x 4.1 x 0.9 x 1.3 x 1.1 x 1.7 x 1.7 x 1.9x 1.5x

3- Underweight 10.56 2-Equal Weight 24.18 2-Equal Weight 47.51 1-Overweight 35.59 63.50

Volkswagen (Ords) 2-Equal Weight 80.39 313.00 78.10 250.00 Volkswagen (Prefs) 1-Overweight Mean Median

US OEMs Ford Motor Co. 2-Equal Weight $8.94 $9.14 $1.50 $2.29 20.0% 11.6% 290.4% NA 14.8x 6.0x 54% 48% 38% 16.1 x 7.3 x 4.3 x

8 December 2009

Barclays Capital | European Autos & Auto Parts

THE YEAR OF UNINTENDED CONSEQUENCES

Effects of government interventions & scrappage schemes likely to linger

Governments in Europe and the US intervened on an unprecedented scale in automotive marketplaces in 2009. Various forms of scrappage programmes boosted sales by 3mn units in Europe and 700,000 units in the US. Government financial support to automakers included loans in France and Germany (Opel), and bailouts of Chrysler and GM in the US. But we see 2010 as a year of unintended consequences when volume falls, excess capacity is re-exposed and pricing deteriorates. As a result, we favour stocks that have unrecognised cost reduction potential. The positive, intended consequences of government interventions accounted for much of the rally in European autos since their lows of January 2009. With the prominence of automobile sector to European employment (2.2mn jobs in 2007, or 7% of manufacturing employment in the EU27), governments stepped in to cushion the fall. Germany, with over 800,000 jobs at stake, took the lead, followed by other major manufacturing countries. As a result, sales in pan-Europe (ex-Russia and Turkey) are likely to have fallen by only 5% from 2008 to 2009, note that sales would have fallen by 20% without scrappage programmes. After a dip in 1Q09 production to 3.4mn units, production in the remainder of 2009 will have averaged 4.3mn units a quarter. This led to a positive, albeit small contribution to 1H09 GDP at a cost of less than 0.1% of GDP in the euro area (see European Central Bank, Monthly Bulletin, October 2009). In the US, the Chrysler and GM bailouts preserved up to 600,000 jobs at GM and Chrysler and their suppliers, and prevented significant disruption in the supply chain and cascading supplier bankruptcies. However, 2010 and beyond will see the negative unintended consequences of the government interventions play out in Europe -- only some of which we believe are fully understood by investors: First, sales in Western Europe are likely to fall 13.6% (that is, we believe 400bp worse than consensus) as scrappage programmes expire and underlying demand remains anaemic. Second, excess capacity and globally uncompetitive labour rates will persist. Third, and perhaps least well understood, the scrappage programmes likely hooked the European consumer on incentives, leading to very weak pricing over the next several years all the way up to the luxury segment -- in stark contrast to the strong pricing that otherwise concentrated local markets have allowed. Fourth, in another sector of government intervention, the two governments which have been most aggressive in propping up their banks and expanding their national debt -the US and UK -- have and are likely to continue to suffer from weak currencies that hurt exporters into those geographies.

W Europe sales to fall near 14% in 2010E, 400bp worse than consensus forecasts

We are cautious on the sector as a whole 2010-11E likely weaker than market anticipates Excess capacity, pricing & currency pressures to weigh on sector most acutely on luxury manufacturers

8 December 2009

So what are investors to do? First, we are cautious on the overall sector. We expect 2010 to be weaker for the industry than most believe, although at current market prices we still see value out to 2011 and beyond as demand recovers allowing capacity utilisation and pricing to improve. Second, we believe pricing and currency pressures are most acute in the luxury segment, we do not favour luxury over volume. Finally, given the pressures, we are looking to companies that have superior resilience (at least relative to market expectations) to the weak pricing, currency and demand environment due to their market and cost positions.

Barclays Capital | European Autos & Auto Parts

BMW (1 Overweight, 41 price target) (see page 42)

BMWG.DE / BMW GY Stock Rating

1-OVERWEIGHT

Sector View

2-NEUTRAL

Price Target

41.00

Price (04-Dec-2009)

32.75

Potential Upside

We are initiating coverage of BMW with a 1-Overweight rating and 41 price target, based on a combination of EV/sales and PE metrics and historical and peer averages. Given the pricing, demand, and currency pressures we expect to continue in the premium market, we favour companies that can deliver and retain near and mid-term cost reductions ahead of market expectations. BMW is a well-understood story as regards its upcoming model launches; nevertheless, we believe the market is underestimating the companys potential for deeper and further cost savings via Strategy #1, both as a result of the full roll-out of its modular strategy and as a consequence of increased flexibility regarding employee costs due to an ageing workforce and extensive use of temporary workers. Moreover, while not part of Strategy #1, BMWs more extensive manufacturing presence in the UK and US provides more of a natural currency hedge offsetting the strength of the euro.

25%

Daimler (3- Underweight, 32 price target) (see page 59)

DAIGn.DE / DAI GY Stock Rating

3-UNDERWEIGHT

Sector View

2-NEUTRAL

Price Target

32.00

Price (04-Dec-2009)

35.91

Potential Downside

11%

We are initiating coverage of Daimler with a 3-Underweight rating and 32 price target due to our expectations that the market has run ahead of itself on its forecasts for Daimlers cost saving potential. We expect pricing, demand, and currency pressures to continue in the premium market and therefore favour companies that can deliver and retain near and midterm cost reductions ahead of market expectations. Although management have committed to an additional 4bn cost savings for 2010E, we are concerned that the majority of these will be absorbed be negative factors (price, FX and raw material costs), whereas we believe market assumptions are overestimating the retention potential. We believe that DAI is also more exposed to pricing risks than BMW, having unfortunately launched its E-class into a falling luxury market and with less natural hedging is more exposed to FX risks than its peer. We also think that with Mercedes youthful workforce, its lack of modular-focused savings (relative to BMW and especially Audi/Porsche), and its belated efforts in the field of fuel economy provide less fat to trim. Even using consensus estimates for the truck sector (which we believe is risky given that the market seems to be underestimating the tepid recovery potential for the European truck market) our forecasts still remain 40% below market expectations for 2010E. Valuation metrics further point us to prefer BMW (currently 18% 10E EV/sales vs 44% at DAI, though admittedly DAI also incorporates high-rated trucks) and lead us to initiate coverage of Daimler with a 3-Underweight rating and a 32 price target.

Fiat (3- Underweight, 8 price target) (see page 78)

FIA.MI / F IM Stock Rating

3-UNDERWEIGHT

Sector View

2-NEUTRAL

Price Target

8

Price (4-Dec-2009)

10.56

Potential Downside

24%

We are initiating coverage of Fiat with a 3-Underweight rating and a 8 price target. While Fiat has rallied recently on hopes for Chrysler and press speculation of an FGA spin-out, we believe that while Chrysler is likely to survive through 2011, even a strong turnaround (albeit below management projections) would be worth only 1.50 per Fiat share by 2012. Moreover, by Fiats own admission, the prospects for a spin-out of Fiat Group Automotive, which would in our view unlock the value of CNH and Iveco, are remote in 2010. As a result, we believe investors will refocus on the core automotive business, which faces a difficult year as scrappage programmes fade away across Europe. As the programmes fade, we think Fiat, which benefited significantly from the shift to A and B vehicle segments, will be hit hard as volumes fall and price competition sharpens. The fall in volume will once again reveal the excess capacity in Italy, leading to negative headlines and difficult negotiations as Fiat navigates the delicate task of closing Italian capacity. We are therefore initiating coverage of Fiat with a 3-Underweight rating and we value the Fiat share based on an average of EV/sales and EV/EBTIDA at historical and peer average multiples, which lead us to our 8 price target.

6

8 December 2009

Barclays Capital | European Autos & Auto Parts

Peugeot (2- Equal Weight, 26 price target) (see page 101)

PEUP.PA / UG FP Stock Rating

2-EQUAL WEIGHT

Sector View

2-NEUTRAL

Price Target

26.00

Price (04-Dec-2009)

24.18

Potential Upside

Our 2-Equal Weight rating on Peugeot is based on our concern regarding the companys lack of scale both geographically and on a platform-by-platform basis. We believe that the market is already well versed in Peugeots strong upcoming model line-up and is already over-crediting the companys revenue growth potential in 2010 and beyond. We also believe that of the targeted 3.3bn of gross cost savings, the company is only likely to retain 2.1bn. Though Peugeots superior product mix and the upside potential if a buyer were to be found for its Faurecia stake prevent us from taking an underweight stance, likewise, the companys lack of scale and the markets over-confidence in its future cost saving potential steer us away from an Overweight rating. As with Renault, we base our valuation on a SotP methodology, which we confirm against peer average EV/EBITDA multiples in order to reach our price target of 26. We are initiating coverage of Peugeot with a 2-Equal Weight rating. For equity investors who are looking for exposure (delta) to the underlying equity, but with the defensive characteristics of downside protection, senior status, an income advantage and strong takeover and dividend protection features our Barclays Capital convertibles analysts recommend Peugeots 2016 convertible.

8%

Porsche (2- Equal Weight, 55 price target) (see page 121)

PSHG_p.DE / PAH3 GY Stock Rating

2-EQUAL WEIGHT

Sector View

2-NEUTRAL

Price Target

55.00

Price (04-Dec-2009)

47.51

Potential Upside

16%

We are initiating coverage of Porsche with a 2-Equal Weight rating and a 55 price target reflecting the uncertainties and risks in the next 16-18 months. While Porsches near-term prospects as a sports car manufacturer are strong in the face of a challenging market, the real value of Porsches pref shares lie in the current 51% holding of VW shares and their eventual conversion into VW NewCo shares (likely prefs). While we maintain a positive stance toward VW prefs (with a 1-Overweight and 85 target), we believe that public shareholders in both firms face transactional risk around the future fundraising and eventual merger ratios. With VW we believe that the ultimate earnings power, against the near-term low valuation in light of Qatari share sales, offers better protection against the vagaries of offering dilution and exchange ratios than do the Porsche prefs. We base our price target for the Porsches preference shares using an average of EV/sales and EV/EBITDA metrics at historical and peer average multiples leading us to our 55 price target.

Renault (1- Overweight, 42 price target) (see page 132)

RENA.PA / RNO FP Stock Rating

3-OVERWEIGHT

Sector View

2-NEUTRAL

Price Target

42.00

Price (04-Dec-2009)

35.59

Potential Upside

18%

Our 1-Overweight rating on Renault is based on the thesis that the glass is half full in relation to future potential synergies from the Nissan alliance. Whilst we acknowledge that the company is currently in a far from secure position in balance sheet terms and is yet to show evidence of current profitability in its automotive business, we believe that this leaves plenty of upside to the current share price when recovery sets in. In the near term, Nissans exposure to the US and emerging markets will likely aid Renaults earnings but where we feel that real additional value can be extracted from the Renault share is via the longer-term potential for increased use of commonality on platforms shared with its Asian associate. The unlocking of such synergies has long caused heated debate among analysts but we believe that RNO management are now whole-heartedly focused on both near-term cash management but also on turning their association with Nissan into something more obviously tangible. We are optimistic that 2010E will herald the beginning of an improved cash management strategy, which will include the sale of selected property assets and of any non-strategic investments, such as the Volvo stake. As at Peugeot, we base our valuation on a SotP methodology, which we check against peer average EV/EBITDA multiples to reach a price target of 42, which in turn drives our 1-Overweight rating.

7

8 December 2009

Barclays Capital | European Autos & Auto Parts

Volkswagen Prefs (1- Overweight, price target 85) and Volkswagen Ords (2- Equal Weight, price target 100) (see page 152)

VOWG.DE / VOW GY VOWG_p.DE / VOW3 GY Stock Rating

1-OW prefs / 2-EW ords

Sector View

2-NEUTRAL

Price Target

85.00 prefs / 100.00 ords

Price (04-Dec-2009)

63.50 prefs / 80.39 ords

Potential Upside

34% prefs / 24% ords

We are initiating coverage of Volkswagen with a 1-Overweight rating for the pref shares and a 85 price target, and with a 2-Equal Weight and 100 price target for the ordinary shares. We believe that VW is the most advanced of the European auto makers in capturing economies of scale and is likely the world benchmark for modularity which should give it the cost position to withstand the intense price competition we expect in 2010. Moreover, we do not view the potential Porsche merger and attendant financial manoeuvring as posing significant downside risk to VW pref holders, as VW appears to have protected itself against an inordinate amount of net debt on Porsches balance sheet. Any potential overpayment for Porsche assets is only at most in the range of 6-7 per VW pref share small in light of the significant upside potential as VW returns to 4% EBIT margins by 2012 (which would be below our longer term projections of 6-7% in 2014-15). We value the VW shares based on an average of EV/sales and EV/EBITDA metrics at historical and peer average multiples, which lead us to our 85 price target for prefs and 100 for ords. At the same time, we recognize that VW is seen as a consensus overweight yet has been a stock that has repeatedly punished the consensus trade. Given the erratic movements of Volkswagens shares many investors are loath to enter into a position that could result in substantial losses. These investors should, in our view, consider options as an alternative to the shares, with the benefit that the maximum loss to a long call or put position is the premium paid.

8 December 2009

Barclays Capital | European Autos & Auto Parts

SCRAPPAGE HANGOVER LIKELY WORSE THAN CONSENSUS EXPECTATIONS

Consensus expectations for European sales in 2010E appear to be for a slight softening in the range of 8-10%. We believe that government interventions clearly distorted the European market in 2009, masking what would have been a steep 25% decline in total Europe, had scrappage schemes not been initiated. This will be a difficult hole to climb out of given limited spillover of scrappage programmes into 2010, likely effects of pull ahead of 2010E sales into 2009, and expected weak euro area macroeconomic growth.

2009 W European sales would have declined 19% to 11mn units without government interventions

W European sales to fall only -3.4% (-14% total Europe) in 2009E but masking a -19% drop (-25% total Europe) had scrappage schemes not proliferated.

The European auto downturn of 2008-09 came after nearly a decade of sales that fluctuated mildly in Western Europe (between 14.2mn units and 15.1mn) while growing healthily in Eastern Europe to 1.2mn in 2008. For the full year 2009, we expect sales to reach 13.1mn in Western Europe, 870,000 in Eastern Europe and 1.9m in Russia, Turkey and former Soviet Union states for a net decline of -3.4% in W Europe and -14% in total Europe (or a cumulative decline since 2007 of -12% and -18% respectively). However, nearly 3mn of the 13.1mn sales in W EU in 2009E are likely to have been subsidized by scrappage programmes, which were adopted to varying degrees by the five major Western European markets as well as well as five of the smaller WE states and two of the new EU members.

Figure 1: European car registrations historical and forecast, 2007A-2012E (units in 000s)

Registrations (units in 000s) 2007 Germany UK Italy France Spain Rest of W Europe Total W Europe New EU States Pan-EU Russia Turkey & FSU Countries Total Europe 3,147 2,404 2,493 2,065 1,615 3,075 14,798 1,162 15,960 2,364 1,054 19,377 2008 3,090 2,132 2,162 2,050 1,161 2,966 13,561 1,179 14,740 2,708 1,101 18,549 2009E 3,750 1,860 2,000 2,150 880 2,460 13,100 870 14,000 1,312 622 15,934 2010E* 2,543 1,773 1,746 1,934 744 2,579 11,320 932 12,252 1,462 670 14,385 2011E 2,892 1,882 1,932 2,109 807 2,725 12,347 978 13,300 1,708 820 15,828 2012E 3,228 1,904 2,384 2,071 1,087 2,876 13,550 1,117 14,700 2,000 938 17,638 2009E +21.4% -12.7% -7.5% +4.9% -24.2% -17.1% -3.4% -26.2% -5.0% -51.6% -43.5% -14.1% YoY Chg (%) 2010E -32.2% -4.7% -12.7% -10.0% -15.4% +4.8% -13.6% +7.1% -12.5% +11.4% +7.8% -9.7% 2011E +13.7% +6.1% +10.7% +9.0% +8.4% +5.7% +9.1% +5.0% +8.6% +16.9% +22.2% +10.0%

Note: * assumes low level of extension to scrappage schemes in Italy, France, UK & Spain. Source: ACEA, JD Powers, Barclays Capital

8 December 2009

Barclays Capital | European Autos & Auto Parts

Figure 2: European summary of current scrappage schemes

F: 1000 + staggered tax staggered tax rebate up to 5000 > 10 years New car max 160 gCO2/km (staggered) 220mn 1 year 2008 2009 Proposal for extension 2010 L: 1500/1750 > 10 years New car max 150 gCO2/km 1 months 2009 UK: 2000 > 10 years 400mn 10 months 2009-10 NL: 7501,000 cars 7501,750 LCVs > 13 years (petrol) > 9 years (diesel) 65mn 2009-10 D: 2500 further tax rebate for Euro 5/6 cars > 9 years Min Euro 4, max 1 year 5 bn 1 year 2009

A: 1500 > 13 years New car min Euro 4 45 mn 9 months 2009

P: 1000/1250 > 8 years, > 13 years, New car max 140 gCO2/km 5 months 2009

SK: 2000 > 10 years 22.1 mn 9 months 2009

RO: 1000 > 10 years Max 60,000 vehicles 11 months 2009

E: Plan 2000E: 2000 Plan VIVE: interest free loan (10,000 max) > 10 years, or 250,000 km car max 5 years, max 140gCO2/km 1.5 years 20082010

I: 1500 3000 cars 2500 6500 LCVs > 9 years New car max 130-140gCO2/km 11 months 2009

GR: new scheme announced: 1500 3200 cars 2000 3700 LCVs 7000 13000 HDVs 2009 2012

Campaigns underway

Source: ACEA

Discussions

While scrappage provided the largest and most-discussed boost in Germany, other countries showed significant boosts as well. We estimate that scrapping programmes in WE provided nearly 3mn units of sales, and had a relatively minor positive affect in Eastern Europe. However, as critics of the programmes point out, at least some of these sales would have occurred anyway in 2009. To estimate the base underling rate we assume that, depending on the design of the programme, between 30% and 35% of the buyers would have found their way into showrooms with or without scrappage incentives. Of the remaining scrappage sales, we estimate that c50% were incremental sales and c50% a pull-forward of 2010E sales in 2009E.

8 December 2009

10

Barclays Capital | European Autos & Auto Parts

Figure 3: Barclays Capital 2009E scrappage model

% of scrappage % of scrappage sales that 'would sales pulled have occurred' in forward from 2009E pro forma ex scrappage 2009E 2010E 25% 35% 30% 30% 30% 30% 35% 30% 35% 35% 35% 35% 2,550 1,675 1,720 1,877 740 2,425 10,987 30% 30% 842 11,829 1,934 13,763 -25.8%

2008A Germany UK Italy France Spain Rest of WE W Europe New EU States Pan-EU Turkey, Russia & FSU Total Europe (inc Russia) YoY chg(total Europe)

Source: ACEA, JD Powers and Barclays Capital

2009E 3,750 1,860 2,000 2,150 880 2,460 13,100 870 14,000 1,934 15,934 -14.1%

Scrappage boost 1,600 285 400 390 200 50 2,925 40 2,965 2,965

3,090 2,132 2,162 2,050 1,161 2,966 13,561 1,179 14,740 3,809 18,549 -4.3%

As opposed to the scrappage fuelled headline number of 13.1m 09E, we believe that the true underlying rate is closer to 11mn in WE a far deeper hole from which to climb out.

Backing out the estimated 2.0mn scrappage sales that otherwise would not have occurred in 2009E (assuming c.30% of total 2.9mn scrappage sales would have occurred in the year even without scrappage), brings the underlying base rate of sales to 11.0mn in 2009 in WE and 13.8mn in total Europe (incl. Russia) a YoY decline of 19% in WE and 26% overall. Note that while our 14% decline forecast for 2010E will bring sales down to 11.3mn, far lower than the comfortable 14mn run rate of recent months in WE (sales even reached a SAAR of 15mn in Oct 09), the -25% cumulative decline this will imply between 2008A and 2010E is on a par with levels at which the markets cleared prior to scrappage incentive interventions (as per Figure 4 below), and in line with the 25% declines seen in the US prior to cash for clunkers. Figure 4: YoY change in monthly W European car sales

20% 15% 10% 5% 0% -5% -10% -15% -20% -25% -30% Jul-07 Jul-08 Nov-07 Nov-08 Sep-07 Sep-08 Jul-09 Mar-07 Mar-08 May-07 May-08 Mar-09 May-09 Sep-09

11

Jan-07

Jan-08

EU(15) + EFTA(3)

Source: ACEA, Barclays Capital

8 December 2009

Jan-09

Barclays Capital | European Autos & Auto Parts

2010 sales of 11.3mn likely in W Europe - limited scrappage boost and modest euro area economic growth

We believe that extension of scrappage programmes could provide a further scrappage boost of 1.0mn units in 2010E, offsetting some of the payback from pull-ahead sales, and underlying euro area growth of 1.6% could provide an additional boost of, optimistically, 5% to auto sales, to bring total sales to 11.3mn in WE and 14.3mn in total Europe well below the consensus range which we estimate at c.12.2mn to 13mn in WE.

Figure 5: Barclays Capital 2010E scrappage model

2009E Germany UK Italy France Spain Rest of WE W Europe New EU States Pan-EU Russia Total Europe (inc Russia) YoY chg total Europe

Source: Barclays Capital

2010E 2,543 1,773 1,746 1,934 744 2,579 11,320 932 12,252 2,132 14,385 -9.7%

Pay back from Continued 2009 scrappage scrappage boost -560 -85 -140 -137 -70 -18 -1,010 -12 -1,020 400 100 80 100 60 50 790 60 850

Pro forma ex scrappage 2,703 1,759 1,806 1,971 754 2,547 11,540 884 12,500 2,132

change in base demand 6% 5% 5% 5% 2% 5% 5% 5%

3,750 1,860 2,000 2,150 880 2,460 13,100 870 14,000 1,934 15,934 -14.1%

5%

850

14,556

A few scrappage schemes still to play out in 2010 but not likely to offset payback from sales pulled forward in 2009

While the bulk of scrappage programmes played out in 2009, at least a few countries still have budget or plans for scrappage in 2010. In France, a government draft budget document is set to reduce the incentive support from the current level of EUR1,000 to EUR700mn on 1 January 2010 and to EUR500mn on 1 July 2010. The UK recently extended its scheme by an additional 100,000 vehicles and it is expected that the Spanish and Italian schemes will also be extended to some degree. Although, the German programme ran out of money in early September, and there has been no suggestion that an extension can be expected, there is still expected to be some carryforward into 2010E as the scheme was based on orders placed rather than on deliveries. In particular, we believe that VW likely as an order book of at least 500,000 units, of which 300,000 are likely to be delivered in 2010 in the winter and early spring. In addition, but not assumed in our analysis, German automakers appear to be pressing for a subsidy programme (or changes in personal taxation of company-provided cars to reflect actual price vs. list price) focused on company fleets, a segment in which sales fell from the normal range of 1.8mn units to 1.2mn units in 2009. At the same time, while we believe the scrappage programmes, particularly in Germany, attracted many customers who would not otherwise have bought a new car, some sales were undoubtedly pulled forward from 2010E as consumers accelerated purchases. As a result, the net impact of scrappage in 2010 will be negative a likely boost of 0.8mn from continuation of scrappage schemes but battling a headwind of 1.0mn sales that were pulled forward from 2010E into 2009.

8 December 2009

12

Barclays Capital | European Autos & Auto Parts

Overall, across the 2008-10 cycle, we expect a decline in Western Europe of 25% (with the aid of scrappage incentives), only slightly worse than the 1992-93 downturn but significantly worse than other post 1970 downturns.

Figure 6: W European historical car sales, 1970-2012E (units in 000s)

16,000 14,000 12,000 10,000 8,000 6,000 4,000 2,000 0 1970 1974 1978 1982 1986 1990 1994 1998 2002 2006 2010E '73-74 -13% '79-81 -8% '92-93 -17% '00-03 -7% 08A-10E -25%

W European Car Market Total ('000)

Source: ACEA, JD Powers, Barclays Capital

Macro boost of 4-5% is somewhat optimistic given history of rebounds

We are somewhat optimistically assuming that underlying base sales (that is, 2009 stripped of scrappage distortions) will grow 5% - yet we still remain significantly below consensus with our 11.3mn (-13.6%) estimate for Western Europe in 2010E (we believe consensus is expecting only an 8-10% decline). In looking at prior cycles in Western Europe, the average rebound was 3.4% or on average 0.7x the prior years downturn. The sharpest rebound was 6% in 1994, after a near-17% decline in 1993. Figure 7: Western European historical & forecast car sales cycle, 1970A-2015E

W EU car market total ('000) 1973 1974 1975 1976 1979 1980 1981 1982 1983 1984 1985 1986 1990 1991 1992 1993 1994 1995 9,431 8,160 8,416 9,532 10,636 10,107 9,817 10,004 10,460 10,152 10,664 11,684 13,517 13,416 13,498 11,252 11,938 12,034 YoY change % 1.2% -13.5% 3.1% 13.3% 3.9% -5.0% -2.9% 1.9% 4.6% -2.9% 5.0% 9.6% 0.5% -0.7% 0.6% -16.6% 6.1% 0.8% average of prior first year rebounds 3.4% average of prior 2nd year rebounds 7.0%

Source: JD Powers, ACEA, Barclays Capital

8 December 2009

13

Barclays Capital | European Autos & Auto Parts

Moreover, regression shows that for every 1% change in euro area GDP, automotive registrations will change about 1.8%. Note while we examined other macro factors, including income growth, unemployment and interest rates, GDP alone provided the best (albeit, with 23% R-squared, a somewhat weak) fit. Figure 8: Barclays Capital estimates for real GDP growth, 2008-2010E

Real GDP % over previous period, SAAR 1Q09 Europe and Africa Euro area Germany France Italy Spain Netherlands United Kingdom Sweden EM Europe & Africa Czech Repub. Hungary Poland Russia

Source: Barclays Capital

Real GDP % annual change 2Q10 2.1 1.7 2.5 1.1 1.4 0.3 3.1 1.9 2.4 3.0 2.8 1.2 2.4 2.5 3Q10 2.1 1.6 2.0 0.9 2.0 0.1 2.7 1.7 2.7 3.2 3.5 2.4 3.2 3.3 2008 1.5 0.6 1.0 0.3 -1.0 0.9 2.0 0.6 -0.4 4.0 3.0 0.5 4.9 5.6 2009 -4.3 -3.8 -4.8 -2.1 -4.8 -3.5 -4.4 -4.6 -4.7 -5.3 -4.7 -6.5 0.9 -7.5 2010 1.9 1.6 2.6 1.2 1.2 -0.3 2.0 1.3 1.8 2.9 2.0 0.5 2.9 3.0 1Q10 1.8 1.6 3.0 0.8 1.0 -0.7 3.1 2.0 2.0 2.1 0.4 0.8 1.6 1.5

2Q09 -0.6 -0.7 1.3 1.1 -2.0 -4.2 -4.4 -2.3 0.6 0.4 -2.7 -7.8 2.0 -2.2

3Q09 3.2 2.3 3.6 2.5 2.7 -0.1 -0.4 -1.0 0.8 7.3 4.4 -3.2 0.8 17.0

4Q09 3.1 1.6 2.9 1.4 0.7 -0.3 2.5 2.2 1.2 7.0 6.2 -1.4 0.0 13.7

-12.2 -9.6 -13.4 -5.4 -10.4 -6.2 -10.3 -9.6 -3.7 -19.7 -15.7 -8.5 1.2 -26.8

Overall, our BarCap economics colleagues forecast 1.6% growth in WE GDP for 2010, with growth rates varying from -0.3% in Spain to 2.6% in Germany. Using the 1.8x multiplier (where every 1% change in Real GDP correlates to 1.8% change in auto registrations as per Figure 10 below), this implies registration growth of 3.4% (consistent with prior rebounds), with the strongest growth in base demand likely in Germany which had the greatest scrappage distortion. However, when we back out the likely scrappage payback in 2010E, we are left to forecast just 2.5mn units, somewhat below consensus expectation of 2.7mn units in Germany in 2010E. There are still a few scrappage schemes to play out in 2010 but not likely to offset payback from sales pulled forward in 2009 (see scrappage section later in this report). Figure 9: EU car registrations vs. real GDP YoY Chg (%), 1995-2009

15% 10% 5% 0% -5% -10% Dec-95 Dec-97 Dec-99 Dec-01 Dec-03 Dec-05 Dec-07 -15% 5% 4% 3% 2% 1% 0% -1% -2% -3% -4% -5% -6%

Figure 10: Correlation of EU car registrations to real GDP (YoY Chg %), 1995-2009

15% Registrations (yoy % c 10% 5% 0% -5% -10% -15% -6%

R2 = 0.23 1% change in Real GDP = 1.8% change in registrations

-4%

-2%

0%

2%

4%

6%

Car Registrat.

Source: ACEA, Haver Analytics, Barclays Capital

Real GDP

Real GDP (YoY % chg)

Source: Haver Analytics, Barclays Capital

8 December 2009

14

Barclays Capital | European Autos & Auto Parts

EU PRODUCTION TO WEAKEN SEQUENTIALLY BUT GLOBAL GROWTH PICKS UP

Supported by the regions scrappage programmes, European production in 2009 recovered somewhat from 3.4mn units in 1Q09 to an estimated 4.4mn in 4Q09. However, with most government incentives ending in 2009, the region is likely to experience some payback from pulled forward demand, in our view. As a result, we expect European production to decline in 2010 to 15.9mn units, down from an estimated 16.2mn units in 2009. Figure 11: Pan European production (including LCVs and Russia): 2007-2015E (and quarterly), units in mn

21.7 22.3

20.5 18.6 16.2 15.9 17.1

19.8

21.0

5.8

5.9

4.8

4.0

3.4

4.2

4.2

4.4

4.0

4.0

3.7

4.2

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

2007

2008

2009E

2010E

2011E

2012E

2013E

2014E 2014E

4Q09E

1Q10E

2Q10E

3Q10E

Source: CSM, Barclays Capital

At the same time, we expect North American production to increase from an estimated 8.6mn units in 2009 to 11.2mn units in 2010, as recent US sales performance suggests signs of a recovery. Indeed, US sales have improved modestly in 4Q09, with November SAAR reaching 10.9mn, up from 10.5mn in October and a 1H09 average of 9.6mn. Furthermore, North American production volumes in 2009 were depressed due to the industrys need to correct for excess inventory, which we do not expect to reoccur in 2010. Figure 12: North America light vehicle production 2007-15E (and quarterly), units in mn

4Q10E

15.1 12.6 11.2 8.6 13.5 12.5

15.0

14.4 14.5

3.5

3.5

3.0

2.7 1.7

1.8

2.4

2.7

2.5

2.9

2.6

3.1

1Q08

2Q08

3Q08

4Q08

1Q09

2Q09

3Q09

2007

4Q09E

1Q10E

2Q10E

3Q10E

4Q10E

2008

2009E

2010E

2011E

2012E

2013E

Source: CSM, Barclays Capital

8 December 2009

2015E

15

2015E

Barclays Capital | European Autos & Auto Parts

On a global basis, we expect light vehicle production to increase, fuelled by a rebound in North America and continued growth in BRIC countries. Figure 13: Global light vehicle production 2008-15E

77.7 72.6 65.4 5.0 3.7 1.7 14.4 7.5 20.5 16.2 12.6 2008 8.6 2009E 55.7 4.6 3.6 1.6 10.7 10.5 66.6 61.1 5.3 3.9 1.7 12.1 11.1 15.9 11.2 2010E 6.0 4.1 1.9 13.0 11.9 17.1 12.5 2011E 6.9 4.7 2.0 13.5 13.4 18.6 13.5 2012E 7.4 5.0 2.1 14.2 14.2 19.8 15.0 2013E

79.5 7.8 5.3 2.1 14.1 14.8

81.7 8.1 5.6 2.2 13.8 15.3 South Asia South America Middle East/Africa Japan/Korea Greater China Pan Europe North America

21.0 14.4 2014E

22.3

14.5 2015E

Source: CSM, Barclays Capital

8 December 2009

16

Barclays Capital | European Autos & Auto Parts

DESPITE LONG-TERM DOWNSIZING, MID-TERM GROWTH IS IN VOLUME C AND ABOVE SEGMENTS AS SCRAPPAGE DISTORTION FADES

In addition to boosting volumes well above their base run rate, the European scrappage programmes, by design, shifted mix dramatically downward. Going forward, however, even acknowledging the longer-term shift to A (city car, eg, Fiat Panda) and B class (subcompact, eg, VW Polo, Ford Fiesta) vehicles, in the mid-term we expect mix to somewhat renormalize in a recovering market. As a result, we believe the fastest growing segments through 2012 will actually be volume C segments (compact, eg, VW Golf, Ford Focus) and C/D and D segments (midsize, eg, VW Passat, Ford Mondeo).

In 2009, in the volume market, the A segment gained 270 points of segment share over 2008, the B segment 360bp while C segment lost 180bp and

29.5%

Figure 14: Western Europe mass vehicle segment mix 2008 vs. 2009E

33.1% 31.4% 29.6%

13.7% 10.5% 8.0% 7.0%

B 2008 2009

Source: JD Powers, Barclays Capital

The shift in segment share across Europe can more than be accounted for by the scrappage programmes in the top five countries for example, the German programme alone contributed 4.2 share points in 2009 to the overall European increase in volume B segment share vs. 2008.

Figure 15: A-C volume segment market share and YoY chg by country, 2009E vs 2008A

A segment 2008 segment market share YoY Chg by Country: France Germany Italy Spain UK Other Memo: total change 2009 segment market share

Source: JD Powers, Barclays Capital

B segment 29.5%

C segment 31.4%

10.5%

0.9% 1.7% 0.4% -0.1% 0.3% 0.3% 3.2% 13.7%

0.5% 4.2% 0.2% -0.4% -0.2% -0.8% 3.7% 33.1%

0.0% 1.6% -0.2% -0.8% -1.0% -2.5% -1.8% 29.6%

The 320bp one-year increase in A share and 370bp change in B share is well ahead of the longer term trendline shift to smaller vehicles. For example, the A segment only grew by 350bp between its 2003 low of 6.4% and 2008, while was actually flat in the ten year period 1998-2008. The B segment grew by 400bp over the same ten-year period.

8 December 2009

17

Barclays Capital | European Autos & Auto Parts

Figure 16: Western Europe overall segment share 1994-2008

40.0% 35.0% 30.0% 25.0% 20.0% 15.0% 10.0% 5.0% 0.0% 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 A

Source: JD Power, Barclays Capital

Going forward, we expect some renormalisation of mix.

Figure 17: A to D volume market segment share 2006-12E

2006 A - Basic B - Small Memo: A + B C - Lower Medium D - Upper Medium Memo: C + D Memo: A - D

Source: Barclays Capital

2007 8.4% 29.7% 38.1% 31.9% 8.4% 40.3% 78.4%

2008 10.5% 29.5% 40.0% 31.4% 8.0% 39.5% 79.4%

2009 13.7% 33.1% 46.8% 29.6% 7.0% 36.6% 83.4%

2010 11.4% 31.4% 42.8% 32.6% 6.7% 39.3% 82.1%

2011 11.5% 32.8% 44.3% 31.8% 6.2% 38.1% 82.4%

2012 12.0% 32.8% 44.8% 31.0% 6.1% 37.1% 81.9%

8.2% 29.9% 38.1% 31.4% 9.6% 41.0% 79.1%

As a result, the A and B segments are likely to shrink by almost 1mn units, while the D segment should grow slightly and the C segment remain flat.

Figure 18: Change in volume by segment 2009 to 2012E

F - Luxury E - Executive D - Upper Medium C - Lower Medium B - Small -540 A - Basic -600 -413 -500 -400 -300 -200 -100 -45

-4 38 89

100

200

Change in units 2009-12E (000)

Source: Barclays Capital

8 December 2009

18

Barclays Capital | European Autos & Auto Parts

SCRAPPAGE AND LOAN PROGRAMMES PRESERVED EXCESS CAPACITY

With well-known restrictive labour relations in most Western European countries, the European market has been plagued by excess capacity, with capacity utilisation averaging only 84% from 2001 to 2007. Figure 19: European capacity utilisation rates, 2001-2015E vs 6yr historical average

95% 90% 85% 80% 75% 70% 2001

2003

2005

2007

2009E

2011E

2013E

2015E

European Capacity Utilisation

Source: CSM, Barclays Capital

Historical average

Government interventions during the downturn of 2009 forestalled the capacity reduction that might normally accompany a sharp cyclical downturn. European capacity (excluding Russia and Turkey) stood at 20.8mn units in 2005, and is likely to close 2010 at 18.2mn units. Note that the downturn has only resulted in 3.9mn units of capacity reduction in the overall European market, whereas production has fallen by 4.3mn units during the same period, causing utilisation rates for the industry as a whole to stall at below 80% until 2011E and below the 6-year historical average for the overall market of 84% until at least 2012E.

Figure 20: European total production & capacity 2005A2010E (mn)

24.0 22.0 20.0 18.0 16.0 14.0 12.0 2005

Figure 21: European overall market production vs capacity utilisation 2005-2015E

19.0 18.0 85.0% 17.0 16.0 15.0 75.0% 14.0 13.0 70.0% 2008 2010E 2012E 2014E European capacity 80.0% 90.0%

2006

2007

2008

2009E

2010E

European Capacity (mil)

Source: CSM, Barclays Capital

European Production (mil)

European Production (LHS)

Source: CSM, Barclays Capital

8 December 2009

19

Barclays Capital | European Autos & Auto Parts

Volume capacity particularly hampered by government interventions

Having averaged 83% from 2001 to 2007, capacity utilisation for the volume market is not likely to surpass 80% until 2012 and will not reach 90% levels until 2015, when production volumes are expected to attain near pre-crisis levels. Figure 22: European volume* production vs capacity utilisation 2008-2015E

14.0 90.0%

13.0 Millions

85.0%

12.0

80.0%

11.0

75.0%

10.0 2008 2009E 2010E 2011E 2012E 2013E 2014E 2015E

70.0%

European Volume Production (LHS)

EU volume capacity utilisation % (RHS)

Source: CSM, Barclays Capital *total market ex-BMW, Mercedes, Porsche Audi & JLR/Tata

Although EU volume manufacturers will maintain utilisation above market average from 2010E onwards, they will be overtaken by their Asian peers in 2011E and will still linger below the 85% level until 2014. Government intervention to hinder major capacity reduction plans, eg, 6bn loaned by govt to PSA and RNO dependent on no plant closures in France.

Figure 23: European volume capacity utilisation by company type 2008-2015E

95% 90% 85% 80% 75% 70% 65% 2008

2009E

2010E

2011E

2012E

2013E Asian

2014E

2015E

European Volume*

US based

Volume avg

Source: CSM, Barclays Capital *European volume comprises Fiat, PSA, Renault & Volkswagen ex-Audi

PSA is likely to achieve the highest utilisation rates in the market in the next three years peaking at 95% in 2012E, even trumping premium peers, helped partly by rationalisation schemes at Aulnay and Rennes and also by upcoming model launches in C-segment. However, we believe that PSAs cost-cutting efforts are well understood by the market and that by contrast, RNO, which has the greater amount of savings to achieve since it has one of the lowest capacity utilisation rates in the market, will actually surprise the market by its ability to significantly increase the scale-effects with Nissan (see RNO section later in this report).

8 December 2009

20

Barclays Capital | European Autos & Auto Parts

Premium manufacturers suffer from lack of demand but more room to manoeuvre

The premium market suffers from overcapacity, albeit not to the same extent as its volume peers, nor was capacity artificially preserved by explicit government intervention. Capacity utilisation fell to 77% in 2009 (from a six-year historical average of 91%), but could reach 88% by 2012E and 95% by 2015, spurred by rebound in export demand and modest expansion of European demand.

Although average historical utilisation at 91% far exceeds excess capacity will linger for premium OEMs in 2010 with only 81% utilisation.

3.0 85.0% 2.0 1.0 0.0 2008 2009E 2010E 2011E 2012E 2013E 2014E 2015E 80.0% Millions

Figure 24: European premium* production vs capacity utilisation 2008-2015E

5.0 4.0 95.0%

that of the volume market,

90.0%

75.0%

EU Premium Production

EU premium capacity utilisation % (RHS)

Source: CSM, Barclays Capital *BMW, Mercedes, Audi, Porsche & JLR/Tata

The premium market excess capacity is not evenly distributed -- BMW, Audi and Porsche are likely to maintain capacity utilisation in 2010 of 93%, 85% and 84%, while Mercedes and Tata (Jaguar/Land Rover) will stall at 74% and 77% respectively. In terms of units, Daimler likely will have about 370,000 units of excess capacity, compared to 80,000 for BMW and 135k for Audi.

Figure 25: European volume OEM excess capacity by company 2010e

Volkswagen Ford Renault PSA Fiat General Motors Toyota Nissan Honda Hyundai 0

Source: CSM, Barclays Capital

Figure 26: European volume OEM capacity utilisation by company 2008-2015E

95% 90% 85% 80% 75% 70% 65% 60% 55% 2008 2009E 2010E 2011E 2012E 2013E 2014E 2015E

885 401 354 287 268 239 126 125 96 74 200 400 600 800 1,000

Fiat

PSA

Renault

VW ex-Audi

Source: CSM, Barclays Capital

8 December 2009

21

Barclays Capital | European Autos & Auto Parts

Figure 27: European premium excess capacity by company 2008-2015E

400 350 Thousands 300 250 200 150 100 50 0 BMW Daimler Audi Tata Porsche 78 17 133 112 369

Figure 28: European OEM capacity utilisation by company 2010E

100% 95% 90% 85% 80% 75% 70% 65% 60% 2008 2009E 2010E 2011E 2012E 2013E 2014E 2015E BMW Audi Porsche

Source: CSM, Barclays Capital

Excess production capacity

Source: CSM, Barclays Capital

Mercedes Tata/JLR Premium avg

8 December 2009

22

Barclays Capital | European Autos & Auto Parts

SCRAPPAGE SCHEMES MAY HAVE HOOKED EUROPEAN CONSUMER ON INCENTIVES SETTING UP PRICING PRESSURE

Perhaps the most insidious unintended consequence of the scrappage programmes may be a potential breakdown in pricing discipline in key European markets, leading to more transparent pricing and a price shopping, deal seeking consumer as has developed in the US. Historically, the weak capacity utilisation in Western Europe has been counterbalanced by relatively robust pricing in the volume car market. In particular, the more concentrated major markets, France and Germany, which have local companies with high volume share, tend to have higher list prices than less concentrated markets such as Spain and the UK without indigenous manufacturers. Figure 29: European list prices for volume segments A-D, Jan 2009

IE PT BE D LU FR ES AT IT NL FI CY EL M UK

Source: European Commission

10,878 10,870 10,799 10,747 10,681 10,548 10,498 10,454 10,286 9,993 9,810 9,703 9,462 9,272 List price (Euros) 7,613

According to a recent report published by the European Commission1, real (ie, inflationadjusted) car prices declined in 23 out of 27 Member States between January 2008 and January 2009. The EU price index for cars (reflecting nominal prices paid by consumers, including VAT and registration taxes) decreased by 1.3%, against a 1.8% rise in overall prices, translating into a fall in real car prices of 3.1%. In new Member States, consumer are even more price-sensitive as lower incomes have historically led a high share of consumers to opt for second-hand cars, manufacturers are facing particularly price-sensitive consumers. As a result, real prices in EE countries decreased on average (-6.9%). However, this data only assesses manufacturer list prices and does not take account of the recent surge in incentive discounts which differ from country to country and have a significant impact on manufacturer profitability.

Even excluding the effects of scrappage incentives across the EU, real car prices fell 3% in 2008 and are likely to have fallen even more sharply in 2009E

A combination of a dramatic fall in consumer demand and a sea change in consumer pricing expectations, induced by both government scrappage schemes and companies own attempts to drive down overstockage via pricing promotions, also mean that manufacturers are not now in a position to significantly raise prices in countries affected by currency devaluations. Prior to the scrappage programmes, manufacturer rebates had been minimal and sporadic in most countries, and rarely widely advertised. But the various scrappage

1

European Commission Car Price Report at 1.1.2009, published June 2009

8 December 2009

23

Barclays Capital | European Autos & Auto Parts

programmes led to intense media coverage around the level of government 'cash on the bonnet,' which ranged from 1,000 to 2,500 per vehicle, with even additional rebates in some countries for the most environmentally friendly cars. Figure 30: Scrappage incentive levels per vehicle by country (EUR)

2,500 2,000 1,500 1,000 1,120

France

UK

Italy

Spain

Germany

Source: ACEA & Country statistics

In addition, some manufacturers would offer up to double the government cash in heavily advertised offers. Figure 31: Examples of incentivised cars in Germany (prices in )

Vehicle Base price Govt rebates OEM rebates TOTAL rebates Net price Advertising pitch Fiat Panda 9,690 2,500 2,200 4,700 4,990 Fiat Grande Punto 11,550 2,500 2,360 4,860 6,690 Fiat Bravo 15,950 2,500 3,460 5,960 9,990

Weniger ist mehr, weniger ist besser, weniger ist genial [Less is more, less is better, less is genius]

Vehicle Base price Govt rebates OEM rebates TOTAL Rebates Net price Advertising pitch

Nissan Micra 11,220 2,500 4,000 6,500 4,720

Nissan Note 16,790 2,500 4,000 6,500 10,290

Nissan Qashquai 20,190 2,500 4,000 6,500 13,690

Jetzt bis zu 6,500 prmien sichern [Save up to 6,500 - secure your rebate now]

Source: Company data, trade press

8 December 2009

24

Barclays Capital | European Autos & Auto Parts

In Germany list prices are currently about 5.5% more than the average for the 16 eurodenominated countries, which allows greater flexibility for manufacturer/dealer incentive packages. The German governments Umweltprmie or 5bn scrappage incentive programme ran out of money in September, prompting carmakers to step up discounts yet further: for instance Ford is currently offering zero-percent financing and a 2,000 rebate for the Focus, Fiesta and Ka compacts in Germany and a package of cheap loans, insurance and servicing provides savings of as much as 1,330 on most VW models. Figure 32: Government scrappage schemes have led automakers to heavily boost their own incentives in 2009

Avg OEM incentives in Germany Avg incentive/car () Incentive as % of list price (%)

Source: KBA, Barclays Capital

Oct 2009 2,485 11.6%

Sep 2009 2,292 10.7%

Dec 2008 2,528 11.8%

In the US market, a somewhat analogous anti-recession incentive programme (albeit only company funded) led to a marked deterioration in pricing that persisted for years, leading to a relatively profit-less recovery. After the events of September 11, showroom traffic slowed dramatically, threatening US automotive production further in the midst of the post techboom recession. To restart its own sales (and arguably to reboot a key part of the US economy), GM launched its 'Keep America Rolling' programme, offering zero-percent financing. The programme, quickly matched by both domestic and transplant manufacturers, led to a marked rebound in sales, which rose from a SAAR of 16.1mn units in September 2001 to a peak of 21.3mn in the following month -- as average incentives rose steadily from US$1.5/car in early 2001 to $2.7k in October and to over $3k/car in late 2002. Figure 33: US monthly sales (000s) and monthly incentives per car (US$)

400 350 300 250 200 150 $4,500 $4,000 $3,500 $3,000 $2,500 $2,000 $1,500

Thousands

Jan-02

Jul-02

Jan-03

Jul-03

Jan-04

Jul-04

Jan-05

Jul-05

Jan-06

Jul-06

Jan-07

US monthly car sales

Source: Autodata

Avg monthly incentive per car (US$)

However, sales fell in late 2001 due to payback. Rather than accepting the decline, US auto makers boosted incentives to restart sales (and, at least for GM to 'run the business for cash' to cover fixed costs), leading to three years of rising incentives but stalled sales.

8 December 2009

Jul-07

25

Barclays Capital | European Autos & Auto Parts

Figure 34: US monthly sales (000s) and monthly incentives per car (US$), 2002-07A

400 350 300 250 200 150 $4,500 $4,000 $3,500 $3,000 $2,500 $2,000 $1,500

Thousands

Jul-02

Jul-03

Jul-04

Jul-05

Jul-06

Jan-02

Jan-03

Jan-04

Jan-05

Jan-06

US monthly car sales

Source: Autodata

Avg monthly incentive per car (US$)

While manufacturers attempted to the boost list price to offset some of the incentives, the real price of new cars and trucks fell steadily until this past year, when manufacturers finally resisted the urge to cut prices in the face of falling demand in the US market. Figure 35: Real new car CPI -- US market 1996-09A, YoY chg %

6% 4% 2% 0% -2% -4% -6% -8% -10% Mar-96 Mar-97 Mar-98 Mar-99 Mar-00 Mar-01 Mar-02 Mar-03 Mar-04 Mar-05 Mar-06 Mar-07 Mar-08 Mar-09

26

Real CPI YoY Chg %

New car

Source: US Bureau of Labor Statistics

New truck

In Europe, as incentive programmes wind down, pricing stands on the cusp of following the profitless American-style path. Already in 2009, pricing appears to have deteriorated by 3.1% on a real basis. With residual value depreciation comprising c47% of the total cost of vehicle ownership, a softer new vehicle pricing environment will also likely have a knock on negative effect on second-hand pricing which will impact both consumers and leasing-exposed manufacturers alike.

8 December 2009

Jan-07

Jul-07

Barclays Capital | European Autos & Auto Parts

Figure 36: Total cost of ownership for average vehicle in Europe

Taxes Tyres 5% 5% Maintenance 8% Interest 8% Residual value depreciation 47% Admin 1%

Insurance 12% Fuel 14%

Source: EurotaxGlass

Our recent conversations with OEMs, as well as the 3Q09 result discussions, revealed pricing concerns across the spectrum. Three points stood out: Luxury makers reported that pricing in key markets was coming under pressure as consumers and dealers demanded rebates to match those offered under scrappage programmes to volume makers. To date, this pressure has been only partially buffered by new model roll outs. Volume manufacturers point to manufacturer incentives being frequently added on top of government incentives, with intense competition during many programmes. With the conclusion of scrappage program in Germany, manufacturer incentives are remaining constant, albeit with falling order volumes leading to risks of future price cuts. Most manufacturers believe pricing pressure is more acute in the retail market, while corporate programme buyers show less price sensitivity.

Figure 37: Euro area new and second-hand car prices, YoY chg %

4% 2% 0% -2% -4% -6% -8%

Figure 38: Selected European country new car nominal CPI

4% 3% 2% 1% 0% -1% -2%

Nov-08

Jan-08

Mar-08

Jan-09

May-08

Mar-09

May-09

Jul-08

Sep-08

Jul-09

Sep-09

-3%

Mar-08

May-08

Mar-09

May-09

Jul-08

Nov-08

Jan-08

Sep-08

Jan-09

Jul-09

NL

France Spain

Source: Eurostat

Germany Euro zone

Italy UK

Source: Eurostat

Germany

France

8 December 2009

Sep-09

27

Barclays Capital | European Autos & Auto Parts

Figure 39: Manheim index of residual values, YoY chg %

Figure 40: Average European OEM monthly incentive spending per car in US market, Jan 01 to date (US$)

$4,500 $4,000 $3,500 $3,000 $2,500 $2,000 $1,500 $1,000 $500 $0 Jan-01 Jan-02 Jan-03 Jan-04 Jan-05 Jan-06 Jan-07 Jan-08

15% 10% 5% 0% -5% -10% -15% Aug-07 Aug-08 May-07 May-08 May-09 Aug-09 Nov-06 Nov-07 Nov-08 Feb-07 Feb-08 Feb-09

European Car Average US incentive

Source: Manheim Consulting Source: Autodata

8 December 2009

Jan-09

28

Barclays Capital | European Autos & Auto Parts

CURRENCY SHIFTS PRESSURE US AND UK IMPORTS

Arguably, the aggressive fiscal and monetary stimulus taken by the UK and US governments have led to a weakening of their currencies, creating further pressures (perhaps unintended) on importers into those markets. Over the last year, the pound has fallen 15% relative to the euro while the US dollar has slipped 12%. Although of the European OEMs BMW has one of the highest proportions of sales in the UK and US markets (22% of sales in the US market and 11% in UK), but with a significant manufacturing presence in the UK and the US, BMW is also one of the most insulated in our coverage to both the US and UK. All other manufacturers have meaningful pound sterling exposure, especially after PSA chose to close its UK, Ryton plant. Fiat, PSA and VWs low proportion of sales in the US (and VWs plant in Mexico and future plant Tennessee, US) leave them less exposed to the US dollar weakness, while Nissan is partially hedged. Of all OEMs, Daimler has the biggest FX exposure being exposed both to the US and to the UK and with very little natural hedging in either region.

Figure 41: Current EURUSD spot rates painful to importers

1.70 1.60 1.50 1.40 1.30 1.20 1.10 1.00 Jan-05

Figure 42: EURUSD forward rates remain close to US$1.5

1.492 1.490 1.488 1.486 1.484 1.482 1.480 1.478 1.476 1.474 1 day

Jan-06

Jan-07

Jan-08

Jan-09

1 month

3 month

9 month

2 year

EURUSD

Source: Datastream Source: Datastream

EURUSD forward rates

Figure 43: Current EURGBP spot rates painful to importers

1.00 0.90 0.80 0.70 0.60 0.50 Jan-05

Figure 44: Forward rates do not imply GBP burden will ease

0.915 0.910 0.905 0.900 0.895 0.890 0.885 1 day

Jan-06

Jan-07

Jan-08

Jan-09

1 month

3 month

9 month

2 year

EURGBP

Source: Datastream Source: Datastream

EURGBP forward rates

8 December 2009

29

Barclays Capital | European Autos & Auto Parts

WE FAVOUR THOSE WITH DOMINANT HOME MARKET C & D POSITIONS

Overall the WE volume market is highly fragmented, but home country hegemony offers profit pockets in Western Europe

The threat of a pricing war could upset what has been a historically attractive pricing environment in Europe driven by local market concentration. While WE appears fragmented on an overall basis (HHI under 1,500, no player over 25% share), many volume segment/country markets (eg, B car in Italy) are highly concentrated, offering competitors pricing power.

WE appears fragmented on an overall basis (HHI under 1500, no player over 25% share)

Figure 45: Overall Western European market shares

Group 2006 2009E Share change

Porsche-VW Group PSA Group Renault-Nissan Group Ford Group Fiat Group GM/Opel Daimler Group Toyota Group BMW Group Hyundai Group Honda Group Other

18.9% 13.8% 11.8% 10.1% 8.3% 9.8% 5.8% 5.6% 4.7% 3.2% 1.5% 6.3%

20.7% 14.1% 11.1% 10.4% 9.5% 8.7% 5.4% 5.1% 4.5% 3.6% 1.7% 5.4%

1.8% 0.3% -0.8% 0.3% 1.2% -1.2% -0.3% -0.6% -0.2% 0.3% 0.1% -1.0%

Concentration index (HHI) Top 3 share

Source: JD Powers, Barclays Capital

1039 44.6%

1101 45.9% 1.3%

Segment/country concentration favours home country incumbents -- despite years of EU directives aimed at harmonization, home country preferences in volume market remain strong (eg, French have 40% share in France, VW 30% share in Germany, Fiat 45% share in Italy A/B car, Ford still seen as UK local firm with 25% of C market).

8 December 2009

30

Barclays Capital | European Autos & Auto Parts

Figure 46: Home company share by country/segment volume market*

69% 70% 59% 44% 28% 47% 51% 42%

67%

24% 13% 1%

France A

Germany B C D

Italy

Source: JD Powers, Barclays Capital (ie, market share of domestic manufacturers -- RNO & PSA combined share in France; Smart & VW in Germany; Fiat in Italy)

As a result, several pockets of concentration remain, offering pricing power if the lead competitor chooses to set a price umbrella, and other competitors follow suit. Note we measure concentration using the Hehrfindal-Hirschman index (HHI), which is the sum of the squares of the market shares of the participants. An HHI of 10,000 would be a one-layer market (10000 = 100*100 ), while a two-player market with each player at 50% share would have an HHI of 5000 (= 50*50 + 50*50). A market over 1,800 is considered concentrated, while a market over 3,000 is considered highly concentrated. Figure 47: Concentration ratios & degree of concentration by country/segment volume OEMs

HHI Ratios: A B C D E G sports MPV Pickup SUV Van

France Germany Italy Spain UK

Degree of concentration::

2945 1343 3050 2090 1715

2429 1359 2199 1497 1280

2112 2483 1260 1523 1483

3184 2655 2643 1740 1614

4311 3528 9450 3431 4444

3133 4263 3688 3853 3293

2715 2211 1885 1442 2256

2821 3176 2855 2783 2938

2753 3021 2627 2104 2267

2745 2152 2020 2019 1705

France Germany Italy Spain UK

MEDIUM LOW HIGH MEDIUM LOW

MEDIUM LOW MEDIUM LOW LOW

MEDIUM MEDIUM LOW LOW LOW

HIGH MEDIUM MEDIUM LOW LOW

HIGH HIGH HIGH HIGH HIGH

HIGH HIGH HIGH HIGH HIGH

MEDIUM MEDIUM MEDIUM LOW MEDIUM

MEDIUM HIGH MEDIUM MEDIUM MEDIUM

MEDIUM HIGH MEDIUM MEDIUM MEDIUM

MEDIUM MEDIUM MEDIUM MEDIUM LOW

Note: Concentration ratio is sum of squares of market shares, over 1800 is considered concentrated, over 3000 highly concentrated Source: JD Powers, Barclays Capital

8 December 2009

31

Barclays Capital | European Autos & Auto Parts

Figure 48: Key Western European markets: estimated volume by segment 2011E (units)

1.0 0.9 0.8 0.7 0.6 0.5 0.4 0.3 0.2 0.1 0.0 A - Basic B - Small C - Lower Medium Germany Italy D - Upper Medium Spain UK Van Millions

France

Source: JD Powers, Barclays Capital

The luxury market remains highly concentrated -- which has in the past supported strong pricing. The risk going forward is the three-party concentration can quickly pivot from price discipline to a price war as each of the three vie for share in a flat market. Figure 49: Concentration ratios by country: A and B volume segments

UK Spain Italy Germany France 1,359 1,343 2,429 2,945 1,280 1,715 1,497 2,090 2,199 3,050

Figure 50: Concentration ratios by country: C and D volume segments

UK Spain Italy Germany France 1,614 1,483 1,740 1,523 2,643 1,260 2,655 2,483 3,184 2,112 Concentration index C

Source: JD Powers, Barclays Capital

Concentration index

A

Source: JD Powers, Barclays Capital

Figure 51: Western European premium market shares by segment/manufacturer, 2009E

B C D E F G MPV SUV Total

BMW Group Daimler Group Porsche-VW Group Renault-Nissan Group Tata Group Toyota Group Other

2009 units (000) HHI

100.0% 0.0% 0.0% 0.0% 0.0% 0.0% 0.0%

132 10,000

30.5% 33.7% 35.8% 0.0% 0.0% 0.0% 0.0%

541 3,347

35.2% 24.5% 37.0% 0.2% 1.6% 1.5% 0.0%

536 3,210

26.4% 37.0% 30.0% 0.0% 5.9% 0.5% 0.2%

263 3,005

39.5% 35.9% 17.9% 0.0% 5.1% 1.5% 0.0%

29 3,200

8.2% 44.0% 44.0% 1.2% 1.5% 0.1% 1.0%

196 3,939

12.4% 80.5% 0.0% 7.1% 0.0% 0.0% 0.0%

17 6,679

30.5% 22.1% 36.8% 0.4% 6.7% 3.5% 0.0%

237 2,828

33.7% 29.4% 33.3% 0.3% 2.3% 0.9% 0.1%

1,954 3,112

Source: JD Powers, Barclays Capital

8 December 2009

32

Barclays Capital | European Autos & Auto Parts

SCALE AND COMMONALITY PROVIDES BUFFER AGAINST UNINTENDED CONSEQUENCES

OEM strategies are starkly similar, implying the real differentiation will be in starting point and execution (especially versus market expectations). Virtually every OEM articulates four common strategic themes: 1. Reengineer operational and administrative costs short term 2. Seek/leverage global scale and parts commonality (that is, reach 1mn units per platform) via market share gains (especially around product cadence), alliance, merger, internal cooperation to lower engineering and product costs 3. Drive fuel efficiency/carbon reduction via both ICE incremental improvements and varying degrees of hybridization 4. Pursue growth in emerging markets, especially BRIC countries In our view, the strategic lever most impactful to differentiating performance over the midterm is likely to be the quest for global scale and commonality especially as OEMs face the unintended consequences of scrappage programmes in the form of potential pricing pressures and sticky labour costs and capacity. Moreover, the competitive edge is likely to evolve from simply posting 1mn unit scale in key volume platforms, to exploiting the scale through common engineering and parts specifications (not just purchasing volumes).

Global OEMs are evolving through three distinct phases in their search for scale and commonality of cost savings

In phase 1, scale-driven procurement, OEMs sought bulk purchasing price discounts from suppliers. Rather then offering any 'win win' solutions, OEMs threatened to pull business from suppliers unless demands for price cuts were met. The global element was not focused around engineering commonality, but simply a brute threat that if supplier fails to cut price in one region, the OEM would punish the supplier by taking away business in another region. This approach was first launched in the early 1990s at GM and then VW (brought over by Jose Ignacio Lopez de Arriortua, whom VW hired away from GM). While saving up to 20% on purchased parts, with annual price downs of 1 to 2 percent, the procurement approach helped OEM profits - although at the expense of supplier profits and arguably innovation. Moreover, the procurement approach failed to address internal OEM costs such as engineering. The sheer brute force of Phase 1 favoured the manufacturers with the largest global production volumes (eg, GM), regardless of the degree of commonality across platforms and geographies. Most OEMs are still pursuing varying degrees of phase 2, platform commonality. In this approach, OEMs seek to commonise parts across vehicles within a platform -- at first, variants within a region and then in vehicles across regions. For the OEM, platform commonality unlocks engineering savings, up to 60 percent on the common vehicles depending on how far out the scale curve. If extended globally, OEMS can gain further benefit from leveraging lower cost production sites and by supporting smaller-run variants to address niche segments. Platform commonality can be win-win for suppliers, who can similarly leverage their engineering and tooling costs across larger runs, as well as more easily move production across different plants in different geographies. Japanese OEMs such as Honda, with their export driven approach, were early leaders, although virtually all OEMs are at some stage of phase 2. Overall savings can range from 5-10%, depending on scale and commonality.

8 December 2009 33

Barclays Capital | European Autos & Auto Parts

Figure 52: Estimated impact of increasing commonality

Cost components Impact on Product Cost view Est. cost Potential Pro forma margin improvement impact (bp) Comment/lever

EBIT Labour Materials and engineering

of which: Vehicle-specific Powertrain Additional common components Modular architectures Product potential

5% 5% 90% 25% 25% 11% 29%

5% 10% 7% 15% 20%

100

Capacity utilisation

124 248 79 439

889

Design/procurement Engineering/mfg Design/procurement Engineering/mfg

Impact on Capex/ER&D view

Capex and R&D/sales Engineering

Total ER&D

5.5% 3.0%

8.5%

70% 60% 66%

385 180

565

Source: Company reports, Barclays Capital

In phase 2, scale by platform is the starting point. Nissan-Renault have the largest scale in the B segment, with over 2mn units in 2011, albeit with we believe little commonality across vehicles. VW, with 1.5mn units, is likely the leader when volume and commonality are considered together. Despite its strength in the B segment in Europe, Fiats lack of an Asian or integrated North America presence has it trailing most competitors (except for GM) in the B segment. Hyundai has, somewhat surprisingly, the largest scale in the C segment, with close to 2mn units in 2011. VW and Ford are second and third, although Ford will only get to a truly common platform in C car with the Focus relaunch in 2010/11. Figure 53: Global production of major B segment platforms by OEM (000s units) 2011E

2,103 1,460 1,215 796 596 378 1,112 926 745

Fiat TYPE 169 (500)

Ford B2e (Fiesta)

GM Global Gamma (Aveo) Europe Asia

Honda GSP (Fit)

Hyundai PB PSA PF1 (207) (Accent)

RenaultNissan B (Versa)

Toyota NBC-2 VW (Yaris) PQ24/PQ25 (Polo)

Middle East/Africa

North America

South America

Source: CSM, Barclays Capital

8 December 2009

34

Barclays Capital | European Autos & Auto Parts

Toyotas strength lies in the D segment, with over 3.6mn units on the Camry platform, followed at a distinct second and third by Hyundai and Honda. Phase 3 involves modular architectures - that is, parts commonality not just within a platform, but across platforms (and across geography). By further driving down the scale curve additional efficiencies result - as well as lowering the overall complexity of the organisation and supporting manufacturing flexibility (multiple platforms on the same assembly lines). VW is acknowledged by competitors as the global benchmark for modularity, with plans to compress to two sets of modules (MQB for traverse, generally volume) and MLB for longitudinal, generally premium) Figure 54: Global production of major C segment platforms by OEM (000s units) 2011E

1,946 1,352 1,426 1,132 1,372

1,788 1,369

1,814 1,301

Fiat TYPE 199 (Punto)

Ford C1 (Focus)

GM Global Delta (Cruze)

Honda C5 (Civic)

Hyundai HD PSA PF2 (308) (Elantra)

RenaultNissan C (Sentra)

Toyota MC-C (Corolla)

VW PQ35/PQ36 (Golf)

Europe

Source: CSM, Barclays Capital

Asia

Middle East/Africa

North America

South America

Figure 55: Global production of major D segment platforms by OEM (000s units) 2011E

3,685

315

934

1,048

1,208

1,221 994 233 842

Fiat C-Evo (Milano)

Ford CD4 GM Global (Fusion/Mondeo) Epsilon (Malibu)

Honda D-5 (Accord)

Hyundai NF/CM PSA PF3 (408) Renault-Nissan D Toyota MC-M (Sonata) (Altima) (Camry)

VW MLB (A4)

Europe

Source: CSM, Barclays Capital

Asia

Middle East/Africa

North America

South America