Professional Documents

Culture Documents

House Property

Uploaded by

Rahul TanverOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

House Property

Uploaded by

Rahul TanverCopyright:

Available Formats

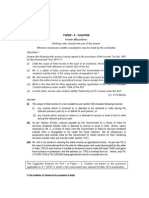

Three brothers A, B and C having equal share are co-owners of a house property consisting of six identical units, the

property was constructed on 31st May, 1992. Each of them occupies one unit for his residence and the other three units are let out at a rent of Rs. 5,000 per month per unit. The Municipal Value of the house property is Rs. 3,00,000 and the Municipal Taxes are 40% of such Municipal Value, which were paid during the year. The other expenses were as follows: Rs.

Repairs 20,000 Collection charges 5,000 Insurance Premium (paid) 11,000 Interest payable on loan taken for construction of house 1,20,000

One of the let out units remained vacant for three months during the year. A could not occupy his unit for six months as he was transferred to Mumbai. He does not own any other house. The other income of A, B and C are Rs. 50,000; Rs. 60,000; and Rs. 70,000 respectively. Compute the income under the head "Income from House Property" and the total income of the three brothers for assessment year 2008-09

Scribd Upload a Document Search Documents Explore Documents

Books - Fiction Books - Non-fiction Health & Medicine Brochures/Catalogs Government Docs How-To Guides/Manuals Magazines/Newspapers Recipes/Menus School Work + all categories Featured Recent

People

Authors Students Researchers Publishers Government & Nonprofits Businesses Musicians Artists & Designers Teachers + all categories Most Followed Popular Sign Up | Log In

/ 10

Download this Document for Free 1 Tax Supplement PROBLEMS ON INCOME FROM HOUSE PROPERTY 1. Mr. Mohan Swami owns two houses. Their particulars for the financial year 2008-2009 are given below: Particulars House I House II Construction completed on 1.04.2008 Self-occupied Let out Rs Rs Municipal valuation 10,00,000 15,00,000 Fair rent 12,00,000 14,00,000 Standard rent 8,00,000 16,00,000 Annual rent received /receivable Nil 18,00,000 Municipal taxes paid 1,20,000 150,000 Insurance premium paid 10,000 15,000 Repair expenses 1,50,000 2,00,000 Unrealised rent-conditions of Rule 4 satisfied Nil 4,50,000 Interest on loan for the pre-construction period 3,00,000 4,50,000

Interest on loan for the post construction period for the PY year 2008-2009 1,00,000 1,50,000 Date of borrowing the loan 31.12.2003 31.12.2003 Certificate of interest attached to the return. No No Determine the income from house property for the assessment year 2009-2010. Would you change your answer if construction is completed on 31-3-2009 and interest certificate is also attached? Computation of income from house property for the AY 2009-2010 House No. I-Self-occupied House No. II-Let out Date of completion Date of House No. II-Let out Interest 1-4-2008 failing completion certificate/Date of competing Particulars after 3 years from 31-3-2008 within construction are not relevant. the end of FY in 3 years from the which loan was end of FY in which taken which loan was taken Interest certificate Interest certificate Interest certinot relevant (a) attached (b) (I) ficate not attached (b)(ii) Rs Rs Rs Rs Gross annual value (a) ALV Nil Nil Nil

15,00,000 (b) Annual rent Nil Nil Nil 13,50,000 received excluding unrealised rent Whichever is higher, is GAV Nil Nil Nil 15,00,000 Less : Municipal taxes paid Nil Nil Nil (-) 1,50,000 Net annual value Nil Nil Nil 13,50,000 Less : Permissible deductions : Less : (I) Statutory deduction : Nil Nil Nil (-) 4,05,000 30% of Net annual value (ii) Interest on loan (-) 30,000 (-) 1,50,000 (-) 30,000 (-) 2,40,000 Income from house property (-) 30,000 (-) 1,50,000 (-) 30,000 7,05,000 http://success-gurus.blogspot.com 2

Tax Supplement Note : 1. Interest for House No. I-Self-occupied: (a) (i) Interest for pre-construction period 5:3,00,000 5 = Rs 60,000 (ii) Interest for post-construction period : Rs. 1,00,000 (i) + (ii) = Rs. 1,60,000 Where loan is taken on or after 1.04.1999 but the house is not completed within 3 years form the end of the financial year in which the loan was taken, maximum ceiling of interest, eligible for deduction is only Rs 30,000. It is operative from the AY 2004-2005 and subsequent years. In the instant case, self-occupied house is completed after the prescribed timelimit of 3 years. Hence, deduction is restricted to Rs 30,000. 2. Interest for House No. II. Deduction has been worked out as under : (i) Interest for pre-construction period : 4,50,000 5 = 90,000 (ii) Interest for post-construction period during 2006-2007 : 1,50,000 Interest eligible for deduction (i) + (ii) = 2,40,0000 3. No deduction is available for insurance premium and repair expenses incurred. 2. Mr.Som owns two houses, which are occupied by him for his own residence. The detailed particulars of houses and his other incomes for the pervious year 2008-2009 are given below: Particulars House A House B Rs Rs Fair rent 5,00,000 5,00,000 Municipal value 4,20,00 4,50,000 Standard rent 4,50,000 6,20,000 Municipal taxes paid 50,000 60,000 Interest on loan for the FY 2008-2009 1,60,000

2,20,000 Date of loan 1.12.1998 1.04.2000 Date of completion 31.03.2001 31.03.2002 Certificate of interest attached with return of income No Yes Mr.Som earns income from other sources amounting to Rs 2,00,000 Compute his total income and advise him which house should be opted for selfoccupation. Computation of income from house property under different options Particulars House A House B Rs Rs (a) Assuming both properties are self-occupied (SO) Annual value Nil Nil Less : Interest on loan (-) 30,000 (-) 1,50,000 Loss from house property (-) 30,000 (-) 1,50,000 http://success-gurus.blogspot.com 3 Tax Supplement (b) Assuming both properties as deemed let out (DLO) Gross annual value 4,20,000 6,00,000 Less : Municipal taxes paid (-) 50,000 60,000 Net annual value 3,70,000 5,40,000 Less : Permissible deduction : (i) Statutory deduction : 30% of Net annual value (-) 1,11,000 (-) 1,62,000 (ii) Interest on loan

(-) 1,60,000 (-) 2,20,000 Income from house property 99,000 1,58,000 (c) Criteria for selection of house for self-occupied : Lowest Option I Option II taxable income Income from house A (-) 30,000 99,000 Income from house B 1,58,000 (DLO) (DLO) (SO) Income from other sources 2,00,000 2,00,000 Total income 3,28,000 1,49,000 Conclusion: House B should be treated as self-occupied. 3. Dr.(Ms) Priyanka Chopra is the owner of a big house consisting of three units. Unit I consist of Compute her gross total income for the assessment year 2009-2010 Computation of Income from House Property for the Assessment Year 20092010 Particulars House House Let-out Self-occupied Rs. Rs. Gross annual value : (a) ALV : House let out (i) 40% of municipal value : Rs 80,000 or (ii) 40% of the standard rent : Rs 60,000 ALV is restricted to Rs 60,000 (b) Actual rent for 40% portion for 10 months : Rs 1,00,000 1,00,000 Nil

Gross annual value Less : Municipal taxes paid by the owner for 40% Portion 1 Rs. 100 40 100 15 2,00,000 Rs. = 12,000 Nil Net annual value 88,000 Nil http://success-gurus.blogspot.com 4 Tax Supplement Less : Deduction from net annual value (Sec. 24) 1. Statutory deduction : 30% of net annual value (-) 26,400 2. Interest on loan : 40% of Rs. 1,50,000 (-) 60,000 (-) 30,000 Taxable income 1600 (-) 30,000 Computation of taxable income from profession : Gross professional income 5,00,000 Less : Expenses for 30% portion used for profession 1. Municipal taxes 100 30 100 15 2,00,000 Rs.

(Sec. 30) 9,000 2. Repair : 30% of Rs 30,000 (Sec. 30)* 9,000 3. Ground rent : 30% of Rs 9000 (Sec. 30)* 2,700 4. Interest on loan : 30% of Rs. 1,50,000 [Sec. 36(1)(iii)]* 45,000 5. Insurance premium : 30% of Rs 6000 (Sec.30)* 1,800 6. Depreciation (Sec. 32) 15,000 82,500 82,500 4,17,500 Computation of total income : 1. Income from house property : (a) Let out 1600 (b) Self-occupied (-) 30,000 (-) 28,400 (-) 28,400 2. Income from profession 4,17,500 Gross total income/total income 3,89,100 4. Mr. Ranjit Sinha is employed with HUDCo. Ltd. @ Rs. 25,000 p.m. He is the owner of a house Rs. Municipal valuation 2,00,000 Municipal tax paid 20,000 Ground rent outstanding 5,000 Insurance premium paid http://success-gurus.blogspot.com 5 Tax Supplement

Case I Case II House House kept is occupied by Particulars Vacant During her sister in her absence her absence Rs. Rs Income from house property : Gross annual value Nil 2,00,000 Less : Municipal taxes paid Nil (-) 20,000 Net annual value Nil 1,80,000 Less : Permissible deduction (Sec. 24) (i) Statutory deduction 30% of Net annual value Nil (-) 54, 000 (ii) Interest on loan for renovation (-) 30,000 (-) 75,000 (-) 30,000 51,000 Statement of total income : Income from salary 3,00,000 3,00,000 Income from house property (-) 30,000 51,000 Total income 2,70,000 3,51,000 Advise : From tax angle it is not advisable to allow her sister to occupy the house in his absence.

5. Mr. Kalidas is the owner of a house property. Its municipal valuation is Rs 3,00,000. It has been Rs Expenses of water connection 10,000 Water charges 20,000 Lift maintenance 15,000 Salary of gardener 18,000 Lighting of stairs 6000 Maintenance of swimming pool 12,000 The landlord claims the following deductions : Repairs 30,000 Land revenue paid 6,000 Collection charges 10,000 Compute the taxable income from the house property for the assessment year 2009-10 http://success-gurus.blogspot.com 6 Tax Supplement Computation of income from house property for the assessment year 20092010. Gross annual value to be higher of the following : Rs (a) ALV : Municipal valuation : 3,00,000 Or (b) Actual rent : 3,69,000 (see note below) 3,69,000 Whichever is higher, is GAV Nil Less : Local taxes payable Rs 30,000 : 3,69,000 Net annual value 1,10,700 Less : Statutory deduction : 30% of net annual value

2,58,300 Taxable income 4,40,000 Note : Composite rent Less : Value of the amenties provided by the assessee : Rs (i) Water connection expenses : Not allowed beings capital expenditure (ii) Water charges 20,000 (iii) Lift maintenance 15,000 (iv) Salary of gardener 18,000 (v) Lighting of stairs 6,000 (vi) Maintenance of swimming pool 12,000 (-) 71,000 Actual rent 3,69,000 6. Mr.M.Saha is the owner of a house in Kolkata consisting of three identical floors, (ground floor, first floor and second floor). Ground floor is let out and the rest is occupied by him for his residence. The full particulars of the house for the previous year 2008-2009 are given below: Particulars Rs (i) Municipal valuation 12,00,000 (ii) Fair rent 5,00,000 (iii) Standard rent Nil (iv) Annual rent of the ground floor 6,00,000 (v) Municipal taxes paid by J 1,50,000 (vi) Water/sewerage benefit tax, paid to Kolkata Municipal Corporation 70,000 (vii) House remains vacant for 2 months :

(viii) Unrealized rent, condition of Rule 4 are satisfied 2,50,000 (x) Interest on loan, taken for the purchase of the house in April 2007 2,70,000 as per certificate Compute the income from the house property for the AY 2009-2010. http://success-gurus.blogspot.com 7 Tax Supplement Computation of Income from House Property for the AY 2009-2010 Particulars Ground I & II floor in floor self-occupancy Rs. Rs. Gross annual value (a) ALV 5,00,000 Nil (b) Actual rent received / receivable 2,50,000 Nil Even without vacancy, actual rent received is lower than the ALV : 4,00,000 Nil 6,00,0002,50,000 = 3,50,000. Thus, the loss is not wholly due to vacancy. Hence, only loss due to vacancy is to be deducted from ALV to determine GAV. GAV is (5,00,000-1,00,000) Less : Municipal taxes paid (-) 50,000 Nil Net annual value 3,50,00 Nil Less : (1) Statutory deduction 30% of AV. (-)1,05,000 (2) Interest on loan

(-) 90,000 (-) 1,50,000 Income from house property 1,55,000 (-) 1,50,000 7. Mr.Ashis discloses the following particulars of the property owned by him during the PY 2008-2009. Particulars House selfFlat alloted by HB Shops & occupied Society let out godwons let out Rs Rs Municipal value 5,00,000 2,00,000 4,00,000 Fair rent 4,00,000 2,50,000 5,00,000 Municipal taxes payable 60,000 80,000 80,000 (a) Paid by Ashis 60,000 30,000 (b) Paid by tenant 50,000 80,000 Annual rent 3,60,000 7,00,000 Expenses incurred by Ashis : Maintenance charges

12,000 Repairs 2,60,000 Collection charges 6,000 Electricity bills paid Nil Insurance premium 20,000 6,000 Ground rent 5,000 2,000 6,00 Depreciation 1,000 2,000 20,000 Other information: (ii) The flat has been purchased under EMI scheme of the Gujarat Apartment Cooperative House Building Society Ltd. He has to pay 120 EMI of Rs 10,000 each, which includes 50% http://success-gurus.blogspot.com

Tax Supplement charge on account of interest. He has defaulted in payment of the last 20 EMI. To repay theoutstanding EMI and penal interest of Rs, 20,000, he borrowed Rs 2,20,000 on 1 October2008 15% p.a. The flat remained vacant for 1.5 months and rent of 3/4th month could not be realised. Conditions of Rule 4 have been satisfied, (iii) Shops and godowns are held as stock-in-trade. However, till a suitable buyer is found,these are let out. P claims that income from letting should be computed under the headprofits and gains of business of profession. He has borrowed money to construct/repair the godowns/shops. He paid Rs 20,000 on account of brokerage for arranging the loan. Interest is payable outside India, in two equal instalments of Rs 50,000 each. The first instalmentwas paid net of tax at Rs 40,000. However, the second instalment was paid without deducting taxat sources as the recipient had given an undertaking in the prescribed form to pay the tax.Compute income from house property for the assessment year 2009-2010. Computation of Income from House Property for the Assessment Year 200910 Particulars House self-occupied Flat let-out Shops and godowns let out Rs. Rs. Rs. Gross Annual Value Nil 2,92,500 7,00,000 Less: Municipal taxes paid 30,000 by the assessee Net Annual Value Nil 2,62,500 7,00,000 Less: Deductions u/s 24 Statutory deduction 78,750 2,10,000

u/s 24(a) @ 30% of NAV Interest on Loan u/s 24(b) 24,000 37,500 50,000 Income from House Property (24,000) 1,46,250 4,40,000 Workings: 1. Gross Annual Value: ALV 2,50,000 Annual Rent 3,60,000 Less: Vacancy Allowance 45,000 Unrealised rent 22,500 2,92,500 The higher of ALV and Annual rent, is the Gross Annual Value Rs.2,92,500 2. Interest on loan taken for self- occupied: (i) Amount of interest = Rs.1,20,000 (ii) Period of interest = 01.07.2005 to 01.07.2007 = 2 years (iii) Pre-acquisition period = 01.07.2005 to 31.3.2007= 9 months (iv) Interest for pre-acquisition period = 1,20,000 x 9/24 (v) Interest for 2006-2007 = Rs 1,20,000/2 =Rs.60,000 (vi) Interest for 2007-2008 for 3 months = 1,20,000 x 3/24 = 15,000 (vii) Interest deductible during PY 2007-2008 = (45,000/ 5) + (15,000)= 24,000 http://success-gurus.blogspot.com

Tax Supplement 3. Interest for the flat: (i) Interest included in EMI from 01.04.2008 to 30.09.2008: Rs 10,000 6 / 2 = Rs.30,000 (ii) Interest on money borrowed to repay original loan interest Rs 10,000 20/ 2 = 1,00,000 15% 1/2 = 7,500 (iii) Total interest = Rs.(30,000 + 7,500 ) = Rs.37,500 (iv) No deduction is allowed for penal interest. 4. Letting out of shops and godowns, held as stock-in-trade: Section 22 excludes from its charge only such building as is occupied by the assessee for his business or profession, profits of which are chargeable to tax. In the instant case, as letting out is not the business of the assessee, so, it cannot be said thathe has occupied shop and godown for his business. Accordingly, income from letting out shop andbuilding, held as stock-in-trade is assessable under the head income from house property. Where an assessee is not holding shops and godowns as stock-in-trade but engaged in thebusiness of letting them on hire, the income is again chargeable under the head house propertyas it is a specific head of income dealing with letting out of buildings only. 5. Deduction in respect of other expenses: Section 24 does not allow any deduction in respect of(i) maintenance charges, (ii) repairs, (iii) collection charges, (iv) electricity, (v) fire insurance premium,(vi) ground rent, and (vii) depreciation. 8. Puja has occupied three houses for his self-occupancy. Their particulars for the previous year 2008-2009 are given below: Particulars House X House Y House Z Rs Rs Rs Municipal value 3,60,000 9,60,000 9,50,000 Municipal taxes paid 40,000 80,000 90,000 Fair rent

5,40,000 8,00,000 10,00,000 Standard rent 4,50,000 6,00,000 9,00,000 Repairs 1,50,000 2,50,000 3,00,000 Ground rent paid 20,000 25,000 30,000 Insurance premium paid 5,000 6,000 7,000 Interest on loantaken for purchase of H.P. 75,000 1,20,000 2,00,000 Year of the loan 1995-96 1998-99 2003-04 He has suffered loss in his business, amounting Rs 3,00,000 Compute his total income, advising him which house should be specified for self-occupancy concession: Solution : Computation of income from house property under different options: (a) Assuming all the properties are self-occupied (SO) House X House Y House Z (SO) Rs (SO) Rs (SO) Rs Annual value Nil Nil Nil

Less: Interest on loan 30,000 30,000 1,50,000 Loss from house property 30,000 30,000 1,50,000 http://success-gurus.blogspot.com

10 Tax Supplement (b) Assuming all the properties as Deemed Let Out (DLO) House X House Y

House Z (DLO) Rs (DLO) Rs (DLO) Rs Gross annual value 4,50,000 6,00,000 9,00,000 Less: Municipal taxes paid 40,000 80,000 90,000 Net annual value 4,10,000 5,20,000 8,10,000 Less: Statutory deduction u/s 24(a) @ 1,23,000 1,56,000 2,43,000 30% of net annual value Interest on Loan u/s 24(b) (-) 75,000 (-) 1,20,000 (-) 2,00,000 Income from house property 2,12,000 2,44,000 3,67,000 (c) Total Income under different options for self-occupancy: Particulars Option 1 Option 2 Option 3 House X House Y House Z Rs Rs Rs House X (-) 30,000 2,12,000 2,12,000 (SO)

(DLO) (DLO) House Y 2,44,000 (-) 30,000 2,44,000 (DLO) (SO) (DLO) House Z 3,67,000 3,67,000 (-) 1,50,000 (DLO) (DLO) (SO) Income from house property: 5,81,000 5,49,000 3,06,000 Loss from business (-) 3,00,000 (-) 3,00,000 (-) 3,00,000 Total income 2,81,000 2,49,000 (-) 6,000 Conclusion: A house with minimum income/maximum loss should be opted for self-occupancy concession to minimise the tax liability. The option can be changed from year to year. In the instant case, House Z should be treated as self-occupied. There will be no tax-liability, and the assessee will carry forward the unabsorbed business loss of Rs 94,000 for next 8 assessment years. http://success-gurus.blogspot.com For more information, question papers download visithttp://successgurus.blogspot.com ICWAI Income From House Property for June and December 2009 Examinations

Download this Document for FreePrintMobileCollectionsReport Document This is a private document. Info and Rating question paper test papers test paper icwai question paper download free (more tags) Follow

successgurus Share & Embed More from this user PreviousNext 1.

3 p.

55 p.

30 p.

2.

18 p.

30 p.

14 p.

3.

20 p.

3 p.

2 p.

4.

3 p.

3 p.

2 p.

5.

3 p.

2 p.

2 p.

6.

2 p.

3 p.

1 p.

7.

6 p.

3 p.

2 p.

8.

1 p.

1 p.

1 p.

9.

2 p.

Add a Comment

Submit Characters: 400

Send me the Scribd Newsletter, and occasional account related communications. Discover and connect with people of similar interests. Publish your documents quickly and easily. Share your reading interests on Scribd and social sites.

Email address: Submit Upload a Document Search Documents

Follow Us! scribd.com/scribd twitter.com/scribd facebook.com/scribd About Press Blog Partners Scribd 101 Web Stuff Support FAQ Developers / API Jobs Terms Copyright Privacy

Copyright 2011 Scribd Inc. Language: English scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd. scribd.

< div style="display: none;"><img src="//pixel.quantserve.com/pixel/p13DPpb-yg8ofc.gif" height="1" width="1" alt="Quantcast"/></div> <img src="http://b.scorecardresearch.com/p?c1=2&c2=9304646&cv=2.0&cj=1" />

You might also like

- Income Tax Law and PracticeDocument3 pagesIncome Tax Law and PracticeAbinash VeeraragavanNo ratings yet

- "Computation of Total Taxable Income": A. Income From Salary U/S 21Document8 pages"Computation of Total Taxable Income": A. Income From Salary U/S 21Onno Groher StanleyNo ratings yet

- Bíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆDocument8 pagesBíñüäpü Báár A®Üì¿Á Gçýé Ë Ýwüwüúwæ Eñü Äôä. Pýâç Püáâçæàoã E Üáãàwüpær A®Üáêüá C ÆSudhir SoudagarNo ratings yet

- Question Analysis: Taxation IDocument9 pagesQuestion Analysis: Taxation IIQBALNo ratings yet

- 28 5 Income TaxDocument50 pages28 5 Income Taxemmanuel JohnyNo ratings yet

- Tax Laws SummaryDocument8 pagesTax Laws SummaryPriya MalhotraNo ratings yet

- HP MCQDocument7 pagesHP MCQ887 shivam guptaNo ratings yet

- Tax Problem SolutionDocument5 pagesTax Problem SolutionSyed Ashraful Alam RubelNo ratings yet

- Tax H.P CompilorDocument6 pagesTax H.P CompilorKaran GuptaNo ratings yet

- 2nd, 4th and 6th Semester Books with 32GB Pendrive OTGDocument21 pages2nd, 4th and 6th Semester Books with 32GB Pendrive OTGvivek rajakNo ratings yet

- March 09 TaxDocument4 pagesMarch 09 TaxmimriyathNo ratings yet

- Taxation concepts and calculationsDocument34 pagesTaxation concepts and calculationsMeet GargNo ratings yet

- Mock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-ADocument9 pagesMock Test-I: Office: S.C.O. 361 (Level-2), Sector 44-D, Chd. Section-AKanwar M KaurNo ratings yet

- Income Under The Head "Income From House Property" and Its ComputationDocument20 pagesIncome Under The Head "Income From House Property" and Its ComputationAanchal SinghalNo ratings yet

- (April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document4 pages(April-18) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- Assignment MBA III: Business Taxation: TH THDocument4 pagesAssignment MBA III: Business Taxation: TH THShubham NamdevNo ratings yet

- Income Tax S5 Set IDocument5 pagesIncome Tax S5 Set ITitus ClementNo ratings yet

- Income from House Property CalculationDocument14 pagesIncome from House Property CalculationSarvar Pathan100% (3)

- TAXATION (Preps)Document5 pagesTAXATION (Preps)Navya GulatiNo ratings yet

- Income Tax Model PaperDocument5 pagesIncome Tax Model PaperSrinivas YerrawarNo ratings yet

- 2021 Unit 9 Tutorial QuestionsDocument3 pages2021 Unit 9 Tutorial Questions日日日No ratings yet

- KL Taxtaion I May June 2012Document2 pagesKL Taxtaion I May June 2012asdfghjkl007No ratings yet

- CFP Sample Paper Tax PlanningDocument8 pagesCFP Sample Paper Tax Planningchaitanya_koli2611No ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Pe III Taxation II May Jun 2010Document3 pagesPe III Taxation II May Jun 2010swarna dasNo ratings yet

- Income from salaries and house propertyDocument21 pagesIncome from salaries and house propertyAshish TomsNo ratings yet

- Model Question BBS 3rd Taxation in NepalDocument6 pagesModel Question BBS 3rd Taxation in NepalAsmita BhujelNo ratings yet

- Taxation 2004 SolvedDocument18 pagesTaxation 2004 Solvedapi-3832224100% (2)

- Capii Income Tax and Vat July2015Document15 pagesCapii Income Tax and Vat July2015casarokarNo ratings yet

- Income Tax - I 2020Document3 pagesIncome Tax - I 2020nimalpes21No ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- Taxation GuideDocument6 pagesTaxation GuideMff DeadsparkNo ratings yet

- Income From House Property-1Document18 pagesIncome From House Property-1Aaditya BhardwajNo ratings yet

- (April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Document3 pages(April-19) (MBC-106) Ii Semester Income Tax Law and Practice Time: 3 Hours Max - Marks: 60Bhuvaneswari karuturiNo ratings yet

- CFP Sample Paper Tax PlanningDocument4 pagesCFP Sample Paper Tax PlanningamishasoniNo ratings yet

- Tax 5301 Mid 2Document1 pageTax 5301 Mid 2Sabuj BhowmikNo ratings yet

- Income Tax Law and PracticeDocument5 pagesIncome Tax Law and PracticeHarsh chetiwal50% (2)

- 18222rtp PCC May10 Paper5Document37 pages18222rtp PCC May10 Paper5Kamesh IyerNo ratings yet

- House PropertyDocument2 pagesHouse PropertyJimmy ShergillNo ratings yet

- pcc-2011 TaxDocument19 pagespcc-2011 TaxHeena NigamNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument0 pages© The Institute of Chartered Accountants of IndiaP VenkatesanNo ratings yet

- Sample MCQs Income Tax - DEADocument15 pagesSample MCQs Income Tax - DEACrick CompactNo ratings yet

- Finance Management Specialisation - Ii 304 - B: Direct TaxationDocument3 pagesFinance Management Specialisation - Ii 304 - B: Direct TaxationRohit ParmarNo ratings yet

- Class 4 QuestionsDocument5 pagesClass 4 Questionsbaqarnaqvi6204No ratings yet

- Income Tax Law and PracticeDocument4 pagesIncome Tax Law and PracticeShruthi VijayanNo ratings yet

- CCCBA Intermediate Exam Taxation I AnswersDocument3 pagesCCCBA Intermediate Exam Taxation I AnswersAporupa BarNo ratings yet

- Income Tax Assessment and Procedure - 1Document3 pagesIncome Tax Assessment and Procedure - 1amaljacobjogilinkedinNo ratings yet

- Model Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFDocument5 pagesModel Questions Fundamentals of Taxation and Auditing BBS 3rd Year PDFShah SujitNo ratings yet

- I.TAx 302Document4 pagesI.TAx 302tadepalli patanjaliNo ratings yet

- B.Com. Degree Exam Income Tax PaperDocument0 pagesB.Com. Degree Exam Income Tax PaperbkamithNo ratings yet

- PrintDocument28 pagesPrintTanvir MahmudNo ratings yet

- Individual b4 B PracticeDocument4 pagesIndividual b4 B Practicedavid.ellis1245No ratings yet

- Caf Pac Mock With Solutions Compiled by Saboor AhmadDocument124 pagesCaf Pac Mock With Solutions Compiled by Saboor AhmadkamrankhanlagharisahabNo ratings yet

- 68 Practical Questions of House PropertyDocument14 pages68 Practical Questions of House PropertyshrikantNo ratings yet

- 2 - House Property Problems 22-23Document5 pages2 - House Property Problems 22-2320-UCO-517 AJAY KELVIN ANo ratings yet

- Computation of Total Income & TaxDocument3 pagesComputation of Total Income & TaxkhushhalibajajNo ratings yet

- TDS Final PDFDocument10 pagesTDS Final PDFvivekNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Economic Insights from Input–Output Tables for Asia and the PacificFrom EverandEconomic Insights from Input–Output Tables for Asia and the PacificNo ratings yet

- Reebok Report CSRDocument1 pageReebok Report CSRemran.haroon3589No ratings yet

- A Summer Training Report 2Document74 pagesA Summer Training Report 2Rahul TanverNo ratings yet

- Introduction To Stock ExchangeDocument9 pagesIntroduction To Stock ExchangeRahul TanverNo ratings yet

- Bombay Stock ExchangeDocument4 pagesBombay Stock ExchangeRahul TanverNo ratings yet

- Business Plan of Mineral Water PlantDocument27 pagesBusiness Plan of Mineral Water PlantArjunSahoo97% (112)

- Managerial Accounting (2-2 Marks Question)Document27 pagesManagerial Accounting (2-2 Marks Question)Shruti LatherNo ratings yet

- Unit-4 Accounting StandardsDocument19 pagesUnit-4 Accounting StandardsSameer XalkhoNo ratings yet

- Heineken's Global Growth StrategiesDocument5 pagesHeineken's Global Growth StrategiesPaolo GubotNo ratings yet

- STP Analysis For ICICI BankDocument27 pagesSTP Analysis For ICICI BankRohit Jain100% (1)

- Fundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookDocument7 pagesFundamental Notes and Conceptual Problem of Journal Ledger Trial Balance and Cash BookShekhar TNo ratings yet

- Cottage IndustryDocument51 pagesCottage Industrydipak_pandey_007No ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociateChiChi0% (1)

- GE1451 NotesDocument18 pagesGE1451 NotessathishNo ratings yet

- Study On Organization and Digital Banking Awareness Programme in State Bank of IndiaDocument41 pagesStudy On Organization and Digital Banking Awareness Programme in State Bank of IndiaShobiga VNo ratings yet

- ZVZCFGDG DFG Aadfagf FVZXCV./KJHFKHF KGJ.J: The Corporate Form of Organization Characteristics of CorporationsDocument2 pagesZVZCFGDG DFG Aadfagf FVZXCV./KJHFKHF KGJ.J: The Corporate Form of Organization Characteristics of CorporationsbeachsnowNo ratings yet

- Acknowledge Men 1Document3 pagesAcknowledge Men 1shamimasaubNo ratings yet

- PGBP QuestionsDocument6 pagesPGBP QuestionsHdkakaksjsb100% (2)

- 2015 Saln FormDocument4 pages2015 Saln FormSugar Fructose GalactoseNo ratings yet

- FINA 2201 and 2209 Final Exam ReviewDocument5 pagesFINA 2201 and 2209 Final Exam Reviewsxzhou23No ratings yet

- Acct 221 Final Exam - The Latest Version - UmucDocument8 pagesAcct 221 Final Exam - The Latest Version - UmucOmarNiemczyk100% (1)

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Application For Refund: Section 1 - Applicant InformationDocument3 pagesApplication For Refund: Section 1 - Applicant InformationDaniel Christian-Grafton HutchinsonNo ratings yet

- White Paper of AURICOINDocument29 pagesWhite Paper of AURICOINLuis Saul Castro GomezNo ratings yet

- Reward StrategiesDocument35 pagesReward Strategiesamruta.salunke4786100% (6)

- Decisions of AgmDocument1 pageDecisions of AgmVarun KhannaNo ratings yet

- Ch06 TB Hoggetta8eDocument16 pagesCh06 TB Hoggetta8eAlex Schuldiner93% (14)

- 2017 AfDocument249 pages2017 AfDaniel KwanNo ratings yet

- BIR Cannot Collect Deficiency After 5 YearsDocument2 pagesBIR Cannot Collect Deficiency After 5 YearsDiane Dee YaneeNo ratings yet

- MBA 533 Lecture 2 Introduction To Financial Accounting BasicsDocument59 pagesMBA 533 Lecture 2 Introduction To Financial Accounting BasicsGlentonNo ratings yet

- PGBPDocument61 pagesPGBPJyoti Kalotra0% (1)

- Business Valuation and Case Study at Petrom OMVDocument7 pagesBusiness Valuation and Case Study at Petrom OMVGrigoras Alexandru NicolaeNo ratings yet

- Danaher Corporation 2017 Overview Highlights Growth and Portfolio TransformationDocument30 pagesDanaher Corporation 2017 Overview Highlights Growth and Portfolio TransformationMichael Cano Lombardo100% (1)

- Concentrix CVG Philippines, Inc.: Description Hrs Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Taxable Earnings Mandatory Govt ContributionsJayJay HecitaNo ratings yet

- Sem 5 TaxDocument22 pagesSem 5 TaxPalash JainNo ratings yet