Professional Documents

Culture Documents

Fraeda J. Lewis State Farm Mutual 972s95

Uploaded by

Thalia SandersCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fraeda J. Lewis State Farm Mutual 972s95

Uploaded by

Thalia SandersCopyright:

Available Formats

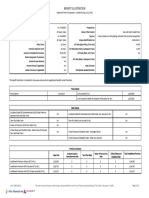

REPORTED IN THE COURT OF SPECIAL APPEALS OF MARYLAND No.

972 September Term, 1995

Fraeda J. Lewis v. State Farm Mutual Automobile Insurance Company

Murphy, C.J., Fischer, Alpert, Paul E. (Ret'd, specially assigned),

JJ.

Opinion by Fischer, J.

-1-

Filed: November 27, 1996

Fraeda Lewis (Mrs. Lewis) appeals from an order of the Circuit Court for Baltimore City that affirmed an administrative law

judge's (ALJ) finding that State Farm Mutual Automobile Insurance Company's (State Farm) decision to add a premium surcharge to Mrs. Lewis's automobile insurance policy was justified and proper.1 Following the Maryland Insurance Administration's (MIA) finding that State Farm's surcharge decision was proper, Mrs. Lewis

requested a hearing before the State Insurance Commissioner of Maryland (the Commissioner), which assigned the hearing to an ALJ of the Office of Administrative Hearings.2 The ALJ found that

State Farm's actions were justified and accordingly dismissed Mrs. Lewis's protest. Lewis then appealed to the circuit court, which Mrs. Lewis raises the following issue

affirmed the ALJ's decision.

for our review, which we have reworded and condensed as follows: I. Did the circuit court err by affirming the decision of the Administrative Law Judge?

FACTS

On November 13, 1993, Mr. Lewis was driving Mrs. Lewis's 1988 Mercedes automobile. passengers in the car. Mrs. Lewis and Fred and Joan Cohen were While in Baltimore City, Mr. Lewis lost

The premium surcharge took the form of State Farm removing Mrs. Lewis's "good driver" designation, therefore causing her premiums to increase. It is the Commissioner's regular practice to assign section 240AA hearings to an ALJ in the Office of Administrative Hearings. See COMAR 09.30.65.01 et seq. (detailing the procedures for an ALJ hearing).

2

-3-

control of the car and skidded into a guard rail.

At the time of

the accident, the road was still wet from a rainstorm that had occurred earlier in the day. No one in the car sustained injuries,

but the accident caused substantial damage to the car itself. Following the accident, Mrs. Lewis filed a claim with State Farm, her insurance company, under her collision coverage. State

Farm investigated the claim, determined that Mrs. Lewis's policy covered the accident, and paid $1,577.66 for repairs to the car.3 Subsequent to its payment to Mrs. Lewis, State Farm decided to impose a surcharge on Mrs. Lewis's policy based on its belief that Mr. Lewis was more than fifty percent at fault in causing the accident.4 State Farm then notified Mrs. Lewis of its plans to add Mrs. Lewis requested that the MIA investigate State The MIA did so and eventually confirmed that

the surcharge.

Farm's decision.

decision as proper and justified. After the MIA's decision, Mrs. Lewis requested a hearing with the Commissioner.

3

On November 3, 1994, a hearing was held before

The record indicates that the $1,577.56 was distributed in two payments, one of $1099.18 and a second of $478.38.

4

Mrs. Lewis's insurance policy reads, in part: An accident is chargeable if State Farm paid at least $400 or more . . . under the Property Damage Liability Coverage or, in the event of a one-car accident, under the Collision coverage. . . . . (Note: Accidents shall not be chargeable (1) if the driver was less than 50% at fault or (2) because of any payment made under the Personal Injury Protection Coverage.)

-4-

an ALJ, which found that: The Licensee's [State Farm's] proposed surcharge is in accordance with MD. ANN, CODE art. 48A, 240AA. It gave adequate notice to the Complainant [Mrs. Lewis] of its intention to surcharge her policy according to the terms of its established rating plan on file with the Maryland Insurance Administration. Furthermore, it used adequate and reasonable means to investigate the accident, determine liability under collision coverage and pay the resulting claim. Where there is a single-car accident, the provision that the driver must be 50% at fault does not apply. The Administrative Law Judge finds that the Licensee's actions to surcharge Fraeda J. Lewis's policy is lawful. Mrs. Lewis appealed this decision to the circuit court, which affirmed the ALJ. Following the circuit court's order, Mrs. Lewis

filed a timely appeal with this Court.

STANDARD OF REVIEW

In this case, the circuit court's revisory power over the ALJ's findings of fact and mixed questions of fact and law was limited to whether substantial evidence existed in the record to support the ALJ's decision. Comm'r, Lumbermen's Mut. Casualty v. Insurance The Court of Appeals has

302 Md. 248, 266 (1985).

described the substantial evidence standard as whether "a reasoning mind reasonably could have reached the factual conclusion the agency reached." Id.; see also Insurance Comm'r v. Nat'l Bureau, 248 Md. 292, 309-310 (1967) (stating that the judicial review under the substantial evidence standard is neither a judicial factfinding mission nor a substitution of a judicial judgment for an

-5-

agency judgment). Reviewing courts do not apply the substantial evidence test to every aspect of an agency decision. For example, a reviewing court

does not afford any deference to an agency's conclusion on a question of law. Liberty Nursing Ctr. v. Department of Health & Thus, the scope of

Mental Hygiene, 330 Md. 433, 443 (1993).

judicial review for findings of fact or mixed questions of fact and law is narrow, United Parcel Service, Inc. v. People's Counsel,

336 Md. 569, 576 (1994), but there is no such limitation on the review of questions of law.

DISCUSSION

Mrs. Lewis argues that the circuit court erred by affirming the decision of the ALJ. Specifically, Mrs. Lewis insists that

State Farm did not present sufficient evidence to demonstrate that Mr. Lewis was at least 50 percent at fault. State Farm counters

that there was substantial evidence to support the ALJ's decision. Md. Code (1957, 1994 Repl. Vol., 1995 Supp.), Art. 48A, 240AA establishes the procedures used in a proceeding for the cancellation, non-renewal, increase in premiums, or reduction of coverage under a motor vehicle liability insurance policy.5

Section 240AA (f) reads, in part, that "at the hearing the insurer has the burden of proving its proposed action to be justified, and,

Unless otherwise indicated, all statutory references are form Md. Code (1957, 1994 Repl. Vol., 1995 Supp.), Art. 48A, 1 et seq.

-6-

in doing so, may rely only upon the reasons set forth in its notice to the insured." Md. Code, Art. 48A, 240AA(f) (emphasis added).

This case, therefore, hinges on whether State Farm's premium surcharge was "justified;" a term that this Court and the Court of Appeals have not defined in the context of a premium surcharge, but have defined with respect to a cancellation and non-renewal.6 Because there is no language in section 240AA that says otherwise, the term "justified" has the same meaning in all

hearings and proceedings covered by section 240AA.

See Comptroller

v. Jameson, 332 Md. 723, 732 (1993) (stating that the foremost goal of statutory construction is to discern the legislature's intent and the primary source of this intent is the words of the statute itself); Atkinson v. State, 331 Md. 199, 215 (1993) (stating that

With respect to the cancellation or non-renewal of an insurance policy, section 234A adds a substantive requirement to complement the already existing procedural requirements outlined in section 240AA. Insurance Comm'r v. Nevas, 81 Md. App. 549, 558 (1990). Article 48A, 234A(a) reads, in part: No insurer, agent or broker shall cancel or refuse to underwrite or renew a particular insurance risk or class of risk for any reason based in whole, or in part upon race, color, creed, sex, or blindness of an applicant or policyholder or for any arbitrary, capricious, or unfairly discriminatory reason. . . . This substantive element therefore requires that an insurer demonstrate "the probability of a direct and substantial adverse effect upon losses or expenses of the insurer in light of the approved rating plan or plans of the insurer then in effect. . . ." Lumbermen's Mut. Casualty v. Ins. Comm'r, 302 Md. 248, 254 (1985) (quoting the preamble to Ch. 752 of the Acts of 1974, which amended the then existing 234A).

-7-

the words of the statute are accorded their ordinary meaning unless otherwise specified). Thus, we are bound by prior interpretations

of the term "justified." The Court of Appeals has held that under section 240AA(f) "the insurer must establish that its assigned reason [for cancelling a policy, increasing a premium, or reducing coverage] is an actual one, that is, genuine; and that the facts on which it is based are true." Insurance Comm'r v. Nevas, 81 Md. App. 549, 558 (1990)

(quoting Government Employees Ins. v. Insurance Comm'r, 273 Md. 467, 483 (1975). An insurer's reasons for adding a premium

surcharge are not genuine, and thus not "justified," if they are arbitrary, capricious, or unfairly discriminatory. See Government In other

Employees, 273 Md. at 483; Nevas, 81 Md. App. at 558-559.

words, to satisfy its burden that its actions were justified, an insurer has to explain the "basis for its conclusion that the insured was at fault." Nevas, 81 Md. App. at 558 (emphasis added).

In this case, there is insufficient evidence in the record to substantiate that State Farm's decision to add a premium surcharge to Mrs. Lewis's insurance policy was supported by substantial evidence. The State Farm claim representative's investigation

yielded only two pieces of evidence: (1) a statement from Mrs. Lewis claiming that Mr. Lewis lost control of the vehicle on the wet road and hit a guard rail; and (2) pictures of the damaged automobile. The investigation did not include any quantitative

analysis or test results indicating whether any other circumstances

-8-

contributed to the cause of the accident. The claim representative, therefore, based his entire

determination of fault on two facts: (1) Mr. Lewis was in an accident; and (2) the road was wet at the time of the accident. Maryland law, however, states that the mere fact that an automobile skids on a slippery road does not, in and of itself, constitute evidence of negligence. (1958). See Christ v. Wempe, 219 Md. 627, 635-637

To prove its case, State Farm had to present some

substantive evidence demonstrating that its premium surcharge was justified. driving in For example, evidence that Mr. Lewis was speeding or an otherwise unreasonable manner could have

substantiated State Farm's claim.

Simply presuming that Mr. Lewis

was more than fifty percent at fault because he was involved in a single-car accident on a wet road, however, was an arbitrary decision that falls outside the boundaries and requirements of section 240AA. At oral argument, State Farm averred that, under Fields v. Morgan, 39 Md. App. 82 (1978), it could rely on the theory of res ipsa loquitur to infer that Mr. Lewis was more than fifty percent at fault. 1. 2. 3. Res ipsa loquitur consists of three elements: A casualty of a sort which usually does not occur in the absence of negligence. Caused by an instrumentality within the defendant's exclusive control. Under circumstances indicating that the casualty did not result from the act or omission of the plaintiff.

-9-

Fields, 39 Md. App. at 85 (quoting Leikach v. Royal Crown, 261 Md. 541, 547-548 (1971). In this case, however, the doctrine of res ipsa loquitur is not applicable because the element of exclusive control is lacking. We cannot say that a driver, driving an automobile on a wet road, has exclusive control of the vehicle. prevailing circumstances. Control may depend upon

For example, when roads are wet or icy,

there are situations in which a driver may lose control of his vehicle regardless driving. For the aforegoing reasons, the decision of the circuit court must be reversed. JUDGMENT REVERSED. CASE REMANDED TO THE CIRCUIT COURT FOR BALTIMORE CITY WITH INSTRUCTIONS TO REMAND TO THE ADMINISTRATIVE LAW JUDGE FOR APPROPRIATE ORDER IN CONFORMANCE WITH THIS OPINION. APPELLEE TO PAY COSTS. of how carefully or reasonably he may be

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Market Definition PharmaDocument2 pagesMarket Definition Pharmagreat99869105492736No ratings yet

- Summer Training in CholamandalamDocument66 pagesSummer Training in Cholamandalamvvaryani100% (2)

- Jackson Cert Opp Brief WesternSkyFinancial v. D.jacksonDocument42 pagesJackson Cert Opp Brief WesternSkyFinancial v. D.jacksonThalia SandersNo ratings yet

- Coolidge v. New Hampshire - 403 U.S. 443 (1971)Document49 pagesCoolidge v. New Hampshire - 403 U.S. 443 (1971)Thalia SandersNo ratings yet

- Washington Post EXPRESS - 12032010Document40 pagesWashington Post EXPRESS - 12032010Thalia SandersNo ratings yet

- W.O.W. Evite 5x7 v4 FINALDocument1 pageW.O.W. Evite 5x7 v4 FINALThalia SandersNo ratings yet

- Daily Kos - Hey America! Can You Please Stop Killing Our (Usually) Innocent Black Male Children NowDocument88 pagesDaily Kos - Hey America! Can You Please Stop Killing Our (Usually) Innocent Black Male Children NowThalia SandersNo ratings yet

- Step by Step Guide To Denmark 2017Document8 pagesStep by Step Guide To Denmark 2017Pedro PeregrinoNo ratings yet

- DOMINION INSURANCE CORPORATION Vs CADocument2 pagesDOMINION INSURANCE CORPORATION Vs CAfermo ii ramosNo ratings yet

- Policy Document PMJJBY Form No 433Document24 pagesPolicy Document PMJJBY Form No 433ChanduNo ratings yet

- Nhis 2Document36 pagesNhis 2Saravanakumar RajaramNo ratings yet

- Internship ReportDocument79 pagesInternship ReportAfroza KhanomNo ratings yet

- RR 2-98 - Withholding TaxesDocument99 pagesRR 2-98 - Withholding TaxesbiklatNo ratings yet

- Managing Risks of Internet Banking - PresentationDocument32 pagesManaging Risks of Internet Banking - PresentationK T A Priam KasturiratnaNo ratings yet

- BancassuranceDocument41 pagesBancassuranceanand_lamaniNo ratings yet

- Interfacing With The General Ledger: Richard Byrom Oracle Applications ConsultantDocument17 pagesInterfacing With The General Ledger: Richard Byrom Oracle Applications Consultantrangafunny545No ratings yet

- ABC CostingDocument18 pagesABC Costingcl1ve0% (1)

- ComputerDocument3 pagesComputerKiran DNo ratings yet

- AE128 - VI.a. PDIC LawDocument4 pagesAE128 - VI.a. PDIC Lawjamie inasNo ratings yet

- Inch MareeDocument8 pagesInch MareeshilparabNo ratings yet

- Joint Venture AgreementDocument4 pagesJoint Venture AgreementDefit Archila KotoNo ratings yet

- 7.4 Evidence of Insurance H&M Hestia - EOI 2023 - Exp 20240531Document2 pages7.4 Evidence of Insurance H&M Hestia - EOI 2023 - Exp 20240531Mv HestiaNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 2sudithakur2023No ratings yet

- 2021.08.24 Parkhill FS - EMS Demolition Docs - FinalDocument331 pages2021.08.24 Parkhill FS - EMS Demolition Docs - FinalTony ParkNo ratings yet

- Property Reviewer-1Document4 pagesProperty Reviewer-1Jen ArcenasNo ratings yet

- Hailemichael SeyoumDocument84 pagesHailemichael SeyoumkindhunNo ratings yet

- Insurance by RianoDocument15 pagesInsurance by RianoCharm Tan-CalzadoNo ratings yet

- IRDA Chapter 1 - Introduction To InsuranceDocument36 pagesIRDA Chapter 1 - Introduction To Insuranceujjwal kumar 2106No ratings yet

- Government of India Government of India Government of India Government of IndiaDocument47 pagesGovernment of India Government of India Government of India Government of IndiaSubash Chaudhary100% (4)

- Resume 1Document2 pagesResume 1Quick LearningNo ratings yet

- Eastern Shipping Lines, Inc., vs. CA and Mercantile Insurance Company, Inc DigestDocument1 pageEastern Shipping Lines, Inc., vs. CA and Mercantile Insurance Company, Inc DigestDara RomNo ratings yet

- Abella - Sheet4 - Zaide V CA (G.R. Nos. L-46715-16. July 29, 1988.)Document2 pagesAbella - Sheet4 - Zaide V CA (G.R. Nos. L-46715-16. July 29, 1988.)Kiana AbellaNo ratings yet

- Benvolent FundDocument88 pagesBenvolent FundSakhawat Hussain0% (1)

- PRUdirect Protect Product Summary PDFDocument2 pagesPRUdirect Protect Product Summary PDFXhoneyra IraNo ratings yet

- Reading 3.1Document26 pagesReading 3.1Calvin HongNo ratings yet