Professional Documents

Culture Documents

Rabobank S&P Rating 29 November

Uploaded by

mrwonkishOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rabobank S&P Rating 29 November

Uploaded by

mrwonkishCopyright:

Available Formats

November 29, 2011

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Primary Credit Analysts: Craig Parmelee, New York (1) 212-438-7850; craig_parmelee@standardandpoors.com Santiago Carniado, Mexico City (52) 55-5081-4413; santiago_carniado@standardandpoors.com Ritesh Maheshwari, Singapore (65) 6239-6308; ritesh_maheshwari@standardandpoors.com Bernard de Longevialle, Paris (33) 1-4420-7334; bernard_delongevialle@standardandpoors.com David Harrison, London (44) 20-7176-7064; david_harrison@standardandpoors.com Jayan U Dhru, New York (1) 212-438-7276; jayan_dhru@standardandpoors.com Secondary Contacts: Carmen Y Manoyan, New York (1) 212-438-6162; carmen_manoyan@standardandpoors.com Ryan Tsang, Hong Kong (852) 2533-3532; ryan_tsang@standardandpoors.com Jesus Martinez, Madrid (34) 91-389-6941; jesus_martinez@standardandpoors.com Markus Schmaus, Frankfurt (49) 69-33-999-155; markus_schmaus@standardandpoors.com John Gibling, London (44) 20-7176-7209; john_gibling@standardandpoors.com Arturo Sanchez, Mexico City (52) 55-5081-4468; arturo_sanchez@standardandpoors.com

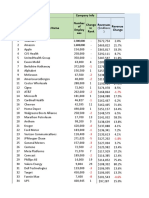

NEW YORK (Standard & Poor's) Nov. 29, 2011--Standard & Poor's Ratings Services today said it reviewed its ratings on 37 of the largest financial institutions in the world by applying its new ratings criteria for banks, which were published on Nov. 9, 2011. See the Ratings List for the ratings on these banks, their core and highly strategic subsidiaries, and other subsidiaries that we took rating actions on as a result of applying our new criteria to their parents. We will review all ratings that we placed on CreditWatch within 90 days. Ratings on CreditWatch are designated as Watch Neg or Watch Pos in the list below. We will publish individual research updates on the bank groups identified below, including a list of ratings on affiliated entities, as well as the ratings by debt type--senior, subordinated, junior subordinated, and preferred stock. The research updates will be available at www.standardandpoors.com/AI4FI and on RatingsDirect on the Global Credit Portal. Ratings on specific issues will be available on RatingsDirect on the Global Credit Portal and www.standardandpoors.com.

www.standardandpoors.com/ratingsdirect

1

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Standard & Poor's will be hosting two teleconferences to discuss the application of the newly revised criteria and the related ratings actions. See the teleconference information below the Ratings List.

RELATED CRITERIA AND RESEARCH Banks: Rating Methodology And Assumptions, Nov. 9, 2011 Group Rating Methodology And Assumptions, Nov. 9, 2011 Banking Industry Country Risk Assessment Methodology And Assumptions, Nov. 9, 2011 Bank Hybrid Capital Methodology And Assumptions, Nov. 1, 2011 RATINGS LIST The ratings listed below are issuer credit ratings. To Banco Bilbao Vizcaya Argentaria S.A. A+/Negative/A-1 BBVA Bancomer S.A. Global Scale Ratings BBB/Stable/A-3 National Scale Ratings mxAAA/Stable/mxA-1+ BBVA USA Bancshares Inc. A/Negative/A-1

From AA-/Negative/A-1+ BBB/Stable/A-3 mxAAA/Stable/mxA-1+ A/Stable/A-1

Banco Bradesco S.A. Global Scale Ratings National Scale Ratings Bradesco Capitalizacao S.A. National Scale Ratings Bradesco Seguros S.A. National Scale Ratings

BBB/Stable/A-3 brAAA/Stable/brA-1 brAAA/Stable/-brAAA/Stable/--

BBB/Stable/A-3 brAAA/Stable/brA-1 brAAA/Stable/-brAAA/Stable/--

Banco do Brasil S.A. BBB/Stable/A-3 Ativos S.A. Securitizadora de Creditos Financeiros National Scale Ratings brAAA/Stable/-BBB/Stable/A-3 brAAA/Stable/--

Banco Santander S.A. AA-/Negative/A-1+ Banco Espaol de Credito S.A. AA-/Negative/A-1+ Banco Santander (Brasil) S.A. Global Scale Ratings National Scale Ratings Banco Santander S.A. (Mexico) Global Scale Ratings BBB/Stable/A-3 brAAA/Stable/brA-1 BBB/Stable/A-3 AA-/Negative/A-1+ BBB-/Watch Pos/A-3 brAAA/Stable/brA-1 BBB/Stable/A-3 AA-/Negative/A-1+

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

2

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

National Scale Ratings Banco Santander Totta S.A. Santander Consumer Finance S.A.

mxAAA/Stable/mxA-1+ BBB-/Negative/A-3 A+/Negative/A-1

mxAAA/Stable/mxA-1+ BBB-/Negative/A-3 AA-/Negative/A-1+ A/Stable/A-1 A/Stable/A-1 AA-/Negative/A-1+

Santander Holdings U.S.A Inc. A+/Negative/A-1 Sovereign Bank A+/Negative/A-1 Santander UK PLC AA-/Negative/A-1+

Bank of America Corp. A-/Negative/A-2 BANA Holding Corp. A-/Negative/A-2 Banc of America Securities Ltd. A/Negative/A-1 Bank of America (California) N.A. A/Negative/-Bank of America Mexico S.A. mxAAA/Stable/mxA-1+ Bank of America N.A. A/Negative/A-1 Bank of America Rhode Island N.A. A/Negative/A-1 Countrywide Financial Corp. A-/Negative/A-2 Countrywide Home Loans Inc. A-/Negative/A-2 FIA Card Services N.A. A/Negative/A-1 Merrill Lynch & Co. Inc. A-/Negative/A-2 Merrill Lynch & Co., Canada Ltd. A-2 Merrill Lynch Bank & Trust Co. (Cayman) Ltd. A-/Negative/A-2 Merrill Lynch International A/Negative/A-1 Merrill Lynch International (Australia) Ltd. A-1 Merrill Lynch, Pierce, Fenner & Smith Inc. A/Negative/A-1 Merrill Lynch Mexico SA de CV Casa de Bolsa mxAAA/Stable/mxA-1+ U.S. Trust Company N.A. A/Negative/A-1 A+/Negative/A-1 A+/Negative/-mxAAA/Stable/mxA-1+ A+/Negative/A-1 A+/Negative/A-1 A/Negative/A-1 A/Negative/A-1 A+/Negative/A-1 A/Negative/A-1 A-1 A/Negative/A-1 A+/Negative/A-1 A-1 A+/Negative/A-1 mxAAA/Stable/mxA-1+ A+/Negative/A-1 A/Negative/A-1 A/Negative/A-1

www.standardandpoors.com/ratingsdirect

3

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Bank of China Ltd. Global Scale Ratings A/Stable/A-1 Greater China Scale Ratings cnAA+/--/cnA-1 Bank of China (Hong Kong) Ltd. Global Scale Ratings A+/Stable/A-1 Greater China Scale Ratings cnAAA/--/cnA-1+ Bank of China Group Insurance Co. Ltd. Global Scale Ratings A-/Stable/-Greater China Scale Ratings cnAA/--/--

A-/Stable/A-2 cnAA/--/cnA-1 A-/Positive/A-2 cnAA/--/cnA-1 A-/Stable/-cnAA/--/--

Bank of New York Mellon Corp. A+/Negative/A-1 Bank of New York Mellon (The) AA-/Negative/A-1+ AA/Stable/A-1+ Bank of New York Mellon S.A./N.V. (The) AA-/Negative/A-1+ AA/Stable/A-1+ Bank of New York (Luxembourg) S.A., Italian Branch (The) AA-/Negative/A-1+ AA/Stable/A-1+ Bank of New York Mellon (Ireland) Ltd. (The) AA-/Negative/A-1+ AA/Stable/A-1+ Bank of New York Mellon (Luxembourg) S.A. (The) AA-/Negative/A-1+ AA/Stable/A-1+ Bank of New York Mellon Trust Co. National Association (The) AA-/Negative/A-1+ AA/Stable/A-1+ BNY Mellon N.A. AA-/Negative/A-1+ AA/Stable/A-1+ BNY Mellon Trust of Delaware AA-/Negative/A-1+ AA/Stable/A-1+ Mellon Funding Corp. A+/Negative/A-1 AA-/Stable/A-1+ AA-/Stable/A-1+

Barclays PLC A/Stable/A-1 Barclays Bank PLC A+/Stable/A-1 Barclays Bank S.A. A/Stable/A-1 Barclays Bank Ireland PLC A-/Stable/A-2 Barclays Capital Inc. A+/Stable/A-1 Barclays Private Clients International Ltd. A+/Stable/A-1 AA-/Negative/A-1+ AA-/Negative/A-1+ A-/Stable/A-2 AA-/Negative/A-1+ AA-/Negative/A-1+ A+/Negative/A-1

BNP Paribas AA-/Stable/A-1+ AA-/Stable/A-1+

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

4

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Banca Nazionale del Lavoro SpA A/Negative/A-1 BancWest Corp. A/Negative/A-1 Bank of the West A/Negative/A-1 First Hawaiian Bank A/Negative/A-1 BGL BNP Paribas S.A. AA-/Stable/A-1+ BNP Paribas Personal Finance AA-/Stable/A-1+ BNP Paribas Cardif A+/Stable/-Cardif Assurance Vie AA-/Stable/-Cardif-Assurances Risques Divers AA-/Stable/-BNP Paribas (China) Ltd. Global Scale Ratings Greater China Scale Ratings BNP Paribas Securities Corp. BNP Paribas Securities Services AA-/Stable/A-1+ Fortis Bank S.A./N.V. AA-/Stable/A-1+ AA-/Stable/A-1+ AA-/Stable/A-1+ A+/Stable/A-1 cnAAA/--/cnA-1+ AA-/Stable/A-1+ AA-/Stable/-AA-/Stable/A-1+ cnAAA/--/cnA-1+ AA-/Stable/A-1+ AA-/Stable/-A+/Stable/-AA-/Stable/A-1+ AA-/Stable/A-1+ A+/Negative/A-1 A+/Negative/A-1 A+/Negative/A-1 A+/Negative/A-1

BPCE A+/Stable/A-1 BRED-Banque Populaire A+/Stable/A-1 Compagnie Europeenne de Garanties et Cautions A+/Stable/-Credit Foncier de France A/Stable/A-1 Locindus S.A. A/Stable/A-1 Natixis S.A. A+/Stable/A-1 Natixis Australia Pty Ltd. A+/Stable/A-1 Natixis Financial Products LLC A+/Stable/A-1 A+/Stable/A-1 A+/Stable/-A/Stable/A-1 A/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1

China Construction Bank Corp. Global Scale Ratings Greater China Scale Ratings

A/Stable/A-1 cnAA+/--/cnA-1

A-/Positive/A-2 cnAA+/--/cnA-1

www.standardandpoors.com/ratingsdirect

5

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Citigroup Inc. A-/Negative/A-2 Citibank N.A. A/Negative/A-1 Citibank N.A. (Canadian Branch) A/Negative/A-1 Citibank (South Dakota) N.A. Sioux Falls A/Negative/A-1 Citibank Europe PLC A/Negative/A-1 Citibank International PLC A/Negative/A-1 Citibank Japan Ltd. A/Negative/A-1 Citibank N.A. (Uruguay Branch) BB+/Stable/B Citibank Korea Inc. A-/Stable/A-2 Citigroup Global Markets Holdings Inc. A-/Negative/A-2 Citigroup Global Markets Inc. A/Negative/A-1 Citigroup Japan Holdings Corp. A-/Negative/A-2 Citigroup Pty Ltd. A-/Negative/A-2 Banco Citibank S.A. Global Scale Ratings BBB/Stable/A-3 National Scale Ratings brAAA/Stable/brA-1 Banco Nacional de Mexico S.A. (Banamex) Global Scale Ratings BBB/Stable/A-3 National Scale Ratings mxAAA/Stable/mxA-1+ A+/Negative/A-1 A+/Negative/A-1 A+/Negative/A-1 A+/Negative/A-1 A+/Negative/A-1 BB+/Stable/B BBB+/Stable/A-2 A/Negative/A-1 A+/Negative/A-1 A/Negative/A-1 A+/Negative/A-1 BBB-/Watch Pos/A-3 brAAA/Stable/brA-1 BBB/Stable/A-3 mxAAA/Stable/mxA-1+ A+/Negative/A-1 A/Negative/A-1

Commerzbank AG A/Negative/A-1 Commerzbank International S.A. A/Negative/A-1 Commerzbank Europe (Ireland) A/Negative/A-1 Eurohypo AG A-/Negative/A-2 EUROHYPO Europaeische Hypothekenbank S.A. A-/Negative/A-2 A-/Negative/A-2 A-/Negative/A-2 A/Negative/A-1 A/Negative/A-1 A/Negative/A-1

Cooperatieve Centrale Raiffeisen-Boerenleenbank B.A. (Rabobank Nederland) AA/Stable/A-1+ AAA/Negative/A-1+

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

6

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Rabobank Australia Ltd. AA/Stable/A-1+ Rabobank New Zealand Ltd. AA/Stable/A-1+ Rabobank USA Financial Corp. --/--/A-1+ Rabohypotheekbank N.V. AA/Stable/-AAA/Negative/---/--/A-1+ AAA/Negative/A-1+ AAA/Negative/A-1+

Credit Agricole S.A. A+/Stable/A-1 A+/Stable/A-1 Banque de Financement et de Tresorerie A/Stable/A-1 A/Stable/A-1 CA Consumer Finance A+/Stable/A-1 A+/Stable/A-1 CACEIS A+/Stable/A-1 A+/Stable/A-1 Cassa di Risparmio di Parma e Piacenza SpA A/Negative/A-1 A+/Negative/A-1 Credit Lyonnais A+/Stable/A-1 A+/Stable/A-1 Credit Agricole CIB Australia Ltd. A+/Stable/A-1 A+/Stable/A-1 Credit Agricole Corporate and Investment Bank A+/Stable/A-1 A+/Stable/A-1 Caisse Regionale de Credit Agricole Mutuel Alpes Provence Caisse Regionale de Credit Agricole Mutuel Alsace-Vosges Caisse Regionale de Credit Agricole Mutuel Atlantique Vendee Caisse Regionale de Credit Agricole Mutuel Brie Picardie Caisse Regionale de Credit Agricole Mutuel Centre-Est Caisse Regionale de Credit Agricole Mutuel Charente Perigord Caisse Regionale de Credit Agricole Mutuel Nord de France Caisse Regionale de Credit Agricole Mutuel Normandie Caisse Regionale de Credit Agricole Mutuel Paris Ile-de-France Caisse Regionale de Credit Agricole Mutuel Provence Cote d'Azur Caisse Regionale de Credit Agricole Mutuel Pyrenees-Gascogne Caisse Regionale de Credit Agricole Mutuel Sud Rhone-Alpes Caisse Regionale de Credit Agricole Mutuel Sud-Mediterranee Caisse Regionale de Credit Agricole Mutuel Toulouse 31 Caisse Regionale de Credit Agricole Mutuel d'Aquitaine Caisse Regionale de Credit Agricole Mutuel d'Ille et Vilaine Caisse Regionale de Credit Agricole Mutuel de Centre Loire Caisse Regionale de Credit Agricole Mutuel de Centre-France Caisse Regionale de Credit Agricole Mutuel de Champagne-Bourgogne Caisse Regionale de Credit Agricole Mutuel de Charente-Maritime Deux Sevres Caisse Regionale de Credit Agricole Mutuel de Franche-Comte Caisse Regionale de Credit Agricole Mutuel de Normandie-Seine Caisse Regionale de Credit Agricole Mutuel de l'Anjou et du Maine Caisse Regionale de Credit Agricole Mutuel de la Reunion

www.standardandpoors.com/ratingsdirect

7

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Caisse Caisse Caisse Caisse Caisse Caisse Caisse Caisse Caisse

Regionale Regionale Regionale Regionale Regionale Regionale Regionale Regionale Regionale

de de de de de de de de de

Credit Credit Credit Credit Credit Credit Credit Credit Credit

Agricole Mutuel de la Guadeloupe Agricole Mutuel de la Touraine et du Poitou Agricole Mutuel des Cotes D'Armor Agricole Mutuel des Savoie Agricole Mutuel du Centre Ouest Agricole Mutuel du Finistere Agricole Mutuel du Languedoc Agricole Mutuel du Morbihan Agricole Mutuel du Nord-Est A+/Stable/A-1 A+/Stable/A-1

Credit Suisse AG A+/Negative/A-1 Banco Credit Suisse Mexico S.A. mxAAA/Stable/mxA-1+ Casa de Bolsa Credit Suisse (Mexico) S. A. de C. V. mxAAA/Stable/mxA-1+ Credit Suisse Group AG A/Negative/A-1 Credit Suisse Holdings (USA) Inc. A+/Negative/A-1 Credit Suisse International A+/Negative/A-1 Credit Suisse Securities (USA) LLC A+/Negative/A-1 Credit Suisse (USA) Inc. A+/Negative/A-1 mxAAA/Stable/mxA-1+ mxAAA/Stable/mxA-1+ A/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1

Deutsche Bank AG A+/Negative/A-1 BHW Bausparkasse AG Hameln BBB/Stable/A-2 Deutsche Bank AG (Canada Branch) A+/Negative/A-1 Deutsche Bank Luxembourg S.A. A+/Negative/A-1 Deutsche Bank Mexico S.A. mxAAA/Stable/mxA-1+ Deutsche Bank National Trust Co. A+/Negative/A-1 Deutsche Bank Securities Inc. A+/Negative/A-1 Deutsche Bank Trust Corp. A+/Negative/A-1 Deutsche Bank Trust Co. Americas A+/Negative/A-1 Deutsche Bank Trust Co. Delaware A+/Negative/A-1 A/Stable/A-1 A/Stable/A-1 A/Stable/A-1 A+/Stable/A-1 A/Stable/A-1 mxAAA/Stable/mxA-1+ A+/Stable/A-1 A+/Stable/A-1 A-/Stable/A-2 A+/Stable/A-1

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

8

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Deutsche Postbank AG A/Negative/A-1 Deutsche Securities Inc. (Japan) A+/Negative/A-1 Deutsche Securities, S.A. de C.V., Casa de Bolsa National Scale Ratings mxAAA/Stable/mxA-1+ A+/Stable/A-1 mxAAA/Stable/mxA-1+ A/Stable/A-1

Dexia SA Not rated Dexia Credit Local BBB+/Watch Neg/A-2 A-/Watch Neg/A-2 Not rated

Goldman Sachs Group Inc. (The) A-/Negative/A-2 Goldman Sachs & Co. Goldman Goldman Goldman Goldman William A/Negative/A-1 Sachs Execution & Clearing L.P. A-/Negative Sachs International A/Negative/A-1 Sachs Japan Co. Ltd. A-2 Sachs Mitsui Marine Derivative Products L.P. AAA/Negative/-Street Commitment Corp. A-/Negative/A-2 A+/Negative/A-1 A/Negative A+/Negative/A-1 A-1 AAA/Negative/-A/Negative/A-1 A/Negative/A-1

HSBC Holdings PLC A+/Stable/A-1 Hang Seng Bank Ltd. Global Scale Ratings AA-/Stable/A-1+ Greater China Scale Ratings cnAAA/--/cnA-1+ Hang Seng Bank (China) Ltd. Global Scale Ratings AA-/Stable/A-1+ Greater China Scale Ratings cnAAA/--/cnA-1+ Hang Seng General Insurance (Hong Kong) Co. Ltd. Global Scale Ratings AA-/Watch Neg/-Greater China Scale Ratings cnAAA/Watch Neg/-Hang Seng Insurance Co. Ltd. Global Scale Ratings AA-/Stable/-Greater China Scale Ratings cnAAA/--/-HSBC Bank PLC AA-/Stable/A-1+ HSBC Bank Australia Ltd. AA-/Watch Neg/A-1+ HSBC Bank Bermuda Ltd. A+/Stable/A-1 AA-/Stable/A-1+ AA/Stable/A-1+ cnAAA/--/cnA-1+ AA-/Stable/A-1+ cnAAA/--/cnA-1+ AA/Watch Neg/-cnAAA/Watch Neg/-AA/Stable/-cnAAA/--/-AA/Stable/A-1+ AA/Stable/A-1+ AA-/Negative/A-1+

www.standardandpoors.com/ratingsdirect

9

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

HSBC Bank Canada AA-/Stable/A-1+ HSBC Bank (Taiwan) Ltd. Global Scale Ratings Greater China Scale Ratings HSBC Finance Corp. HSBC France AA-/Stable/A-1+ HSBC Holdings Luxembourg S.A. A+/Stable/A-1 HSBC Insurance (Asia) Ltd. Global Scale Ratings Greater China Scale Ratings HSBC Insurance (Bermuda) Ltd. AA-/Watch Neg/-cnAAA/Watch Neg/-AA/Stable/A-1+ AA/Watch Neg/-cnAAA/Watch Neg/-AA/Stable/-A+/Watch Neg/-AA/Stable/-cnAAA/--/-AA/Stable/A-1+ AA/Stable/A-1+ AA/Stable/A-1+ AA/Stable/A-1+ AA/Stable/A-1+ AA-/Stable/A-1+ AA/Stable/A-1+ AA/Stable/A-1+ cnAAA/--/cnA-1+ AA/Stable/A-1+ A+/Stable/A-1 cnAAA/--/cnA-1+ A/Negative/A-1 AA/Stable/A-1+ A+/Stable/A-1 cnAAA/--/cnA-1+ A/Negative/A-1

AA-/Stable/-HSBC Insurance (Singapore) Pte. Ltd. A+/Watch Neg/-HSBC Life (International) Ltd. Global Scale Ratings AA-/Stable/-Greater China Scale Ratings cnAAA/--/-HSBC Private Bank (C.I.) Ltd. AA-/Stable/A-1+ HSBC Private Bank (Monaco) S.A. AA-/Stable/A-1+ HSBC Private Bank (Suisse) S.A. AA-/Stable/A-1+ HSBC Private Banking Holdings (Suisse) S.A. A+/Stable/A-1 HSBC Securities (USA) Inc. AA-/Stable/A-1+ HSBC USA Inc. A+/Stable/A-1 HSBC Bank USA N.A. AA-/Stable/A-1+ Hongkong and Shanghai Banking Corp. Ltd. (The) Global Scale Ratings AA-/Stable/A-1+ Greater China Scale Ratings cnAAA/--/cnA-1+

Industrial and Commercial Bank of China Ltd. Global Scale Ratings A/Stable/A-1 Greater China Scale Ratings cnAA+/--/cnA-1

A/Stable/A-1 cnAA+/--/cnA-1

ING Groep N.V. A/Stable/A-1 ING Bank (Australia) Ltd. A/Stable/A-1 ING Bank N.V. A+/Stable/A-1 A/Stable/A-1

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

10

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

A+/Stable/A-1 ING Belgium S.A./N.V. A+/Stable/A-1

A+/Stable/A-1 A+/Stable/A-1

Intesa Sanpaolo SpA A/Negative/A-1 Banca Infrastrutture Innovazione e Sviluppo SpA (BIIS) A/Negative/A-1 Banca IMI SpA A/Negative/A-1 A/Negative/A-1 A/Negative/A-1 A/Negative/A-1

Itau Unibanco Holding S.A. Global Scale Ratings National Scale Ratings Banco Itau BBA S.A. Global Scale Ratings National Scale Ratings

BBB/Stable/A-3 brAAA/Stable/brA-1 BBB/Stable/A-3 brAAA/Stable/brA-1

BBB/Stable/A-3 brAAA/Stable/brA-1 BBB/Stable/A-3 brAAA/Stable/brA-1

JPMorgan Chase & Co. A/Stable/A-1 Banco JPMorgan S.A. mxAAA/Stable/mxA-1+ Bear Stearns Cos. LLC A/Stable/A-1 Chase Bank U.S. N.A. A+/Stable/A-1 JPMorgan Australia Ltd. A+/Stable/A-1 JPMorgan Chase Bank N.A. A+/Stable/A-1 JPMorgan Securities LLC A+/Stable/A-1 JPMorgan Securities Ltd. A+/Stable/A-1 JPMorgan Securities Japan Co. Ltd. A+/Stable/A-1 JP Morgan Casa de Bolsa S.A de C.V. mxAAA/Stable/mxA-1+ J.P. Morgan Clearing Corp. A+/Stable/A-1 AA-/Stable/A-1+ AA-/Stable/A-1+ mxAAA/Stable/mxA-1+ AA-/Stable/A-1+ AA-/Stable/A-1+ AA-/Stable/A-1+ AA-/Stable/A-1+ AA-/Stable/A-1+ A+/Stable/A-1 mxAAA/Stable/mxA-1+ A+/Stable/A-1

Lloyds Banking Group PLC A-/Stable/A-2 Bank of Scotland PLC A/Stable/A-1 Clerical Medical Investment Group Ltd. A+/Stable/A-1 A/Stable/A-1

www.standardandpoors.com/ratingsdirect

11

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

A/Stable/-HBOS PLC A-/Stable/A-2 Lloyds TSB Bank PLC A/Stable/A-1 Scottish Widows PLC A/Stable/--

A+/Stable/-A/Stable/A-1 A+/Stable/A-1 A+/Stable/--

Mitsubishi UFJ Financial Group Inc. A/Stable/-ACOM Co. Ltd. BB+/Negative/B Bank of Tokyo-Mitsubishi UFJ Ltd. A+/Stable/A-1 Bank of Tokyo-Mitsubishi UFJ (China) Ltd. Global Scale Ratings A+/Stable/A-1 Greater China Scale Ratings cnAAA/--/cnA-1+ BOT Lease Co. Ltd. BBB+/Stable/A-2 Master Trust Bank of Japan Ltd. A+/Stable/A-1 Mitsubishi UFJ Trust and Banking Corp. A+/Stable/A-1 UnionBanCal Corp. A/Stable/A-1 Union Bank N.A. A+/Stable/A-1

A/Stable/-BB+/Negative/B A+/Stable/A-1 A+/Stable/A-1 cnAAA/--/cnA-1+ BBB+/Stable/A-2 A+/Stable/A-1 A+/Stable/A-1 A/Stable/A-1 A+/Stable/A-1

Mizuho Financial Group Inc. A/Negative/-Mizuho Bank Ltd. A+/Negative/A-1 Mizuho Corporate Bank Ltd. A+/Negative/A-1 Mizuho Corporate Bank (China) Ltd. A+/Negative/A-1 Mizuho Trust & Banking Co. Ltd. A+/Negative/A-1 Trust & Custody Services Bank Ltd. A+/Negative/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A/Stable/--

Morgan Stanley A-/Negative/A-2 Morgan Stanley & Co. LLC A/Negative/A-1 Morgan Stanley & Co. International PLC A/Negative/A-1 A+/Negative/A-1 A+/Negative/A-1 A/Negative/A-1

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

12

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Morgan Stanley Bank International Ltd. A/Negative/A-1 Morgan Stanley Bank N.A. A/Negative/A-1

A+/Negative/A-1 A+/Negative/A-1

Nordea Bank AB Global Scale Ratings National Scale Short-Term Rtg Nordea Bank Danmark A/S Nordea Bank Finland PLC

AA-/Stable/A-1+ K-1 AA-/Stable/A-1+ AA-/Stable/A-1+

AA-/Stable/A-1+ K-1 AA-/Stable/A-1+ AA-/Stable/A-1+ AA-/Stable/A-1+ -/--/A-1+

Nordea Bank Norge ASA AA-/Stable/A-1+ Nordea Hypotek AB --/--/A-1+

Royal Bank of Scotland Group PLC (The) A-/Stable/A-2 Citizens Bank of Pennsylvania A/Stable/A-1 National Westminster Bank PLC A/Stable/A-1 RBS Citizens NA A/Stable/A-1 RBS Securities Inc. A/Stable/A-1 Royal Bank of Scotland N.V. (The) A/Stable/A-1 Royal Bank of Scotland PLC (The) A/Stable/A-1 Royal Bank of Scotland PLC (Connecticut Branch) (The) A/Stable/A-1 Ulster Bank Ltd. BBB+/Stable/A-2 Ulster Bank Ireland Ltd. BBB+/Stable/A-2

A/Stable/A-1 A-/Stable/A-2 A+/Stable/A-1 A-/Stable/A-2 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 BBB+/Negative/A-2 BBB+/Negative/A-2

Societe Generale A+/Stable/A-1 Banque Kolb S.A. A+/Stable/A-1 Banque Rhone Alpes S.A. A+/Stable/A-1 Banque Tarneaud S.A. A+/Stable/A-1 Credit du Nord S.A. A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1

www.standardandpoors.com/ratingsdirect

13

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

A+/Stable/A-1 Franfinance A+/Stable/A-1 Komercni Banka A.S. A+/Stable/A-1 SG Americas Securities LLC A+/Stable/A-1 Societe Generale Bank & Trust A+/Stable/A-1

A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1

State Street Corp. A+/Negative/A-1 State Street Bank and Trust Co., Boston, MA AA-/Negative/A-1+ A+/Stable/A-1 AA-/Stable/A-1+

Sumitomo Mitsui Financial Group Inc. A/Negative/A-1 Promise Co. Ltd. BB/Watch Pos/B SMBC Nikko Securities Inc. A+/Negative/A-1 Sumitomo Mitsui Banking Corp. A+/Negative/A-1 Sumitomo Mitsui Banking Corp. (China) Ltd. Global Scale Ratings A+/Negative/A-1 Greater China Scale Ratings cnAAA/--/cnA-1+ Sumitomo Mitsui Banking Corp. Europe Ltd. A+/Negative/A-1

A/Stable/A-1 BB/Watch Pos/B A+/Stable/A-1 A+/Stable/A-1 A+/Stable/A-1 cnAAA/--/cnA-1+ A+/Stable/A-1

UBS AG A/Negative/A-1 UBS AG (Jersey Branch) A/Negative/A-1 UBS AG (NY Branch) A/Negative/-UBS Bank (Canada) A/Negative/A-1 UBS Bank USA --/Watch Neg/A-1 UBS Loan Finance LLC A/Negative/A-1 UBS Ltd. A/Negative/A-1 UBS Securities LLC A/Negative/A-1 A+/Watch Neg/A-1 A+/Watch Neg/A-1 A+/Watch Neg/A-1 --/Watch Neg/A-1 A+/Watch Neg/A-1 A+/Watch Neg/-A+/Watch Neg/A-1 A+/Watch Neg/A-1

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

14

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

UniCredit SpA A/Negative/A-1 Bank Polska Kasa Opieki S.A. A-/Stable/A-2 UniCredit Bank AG A/Negative/A-1 UniCredit Bank Austria AG A/Negative/A-1 UniCredit Leasing SpA A/Negative/A-1 A/Negative/A-1 A/Negative/A-1 A/Negative/A-1 A-/Stable/A-2 A/Negative/A-1

Wells Fargo & Co. A+/Negative/A-1 Wells Fargo Bank International AA-/Negative/A-1+ Wells Fargo Bank N.A. AA-/Negative/A-1+ Wells Fargo Bank Northwest NA AA-/Negative/A-1+ Wells Fargo Securities LLC AA-/Negative/A-1+ Wells Fargo South Central N.A. AA-/Negative/A-1+ WFC Holdings Corp. A+/Negative/A-1 AA-/Negative/A-1+ AA/Negative/A-1+ AA/Negative/A-1+ AA/Negative/A-1+ AA/Negative/A-1+ AA/Negative/A-1+ AA-/Negative/A-1+

TELECONFERENCE DETAILS For North America, Latin America, and EMEA, the teleconference will take place on Wed., Nov. 30 at 10:30 a.m. EST and 3:30 p.m. GMT. Live dial-in numbers include: 1-866-617-1526 (U.S./Canada toll free); 0800-279-9630 (U.K. toll free); and 001-866-839-3438 (Mexico City toll free). The conference ID is 9969029, and the passcode is SANDP. For additional call-in numbers and other details, please visit: http://event.standardandpoors.com/content/FITcon_November302011 or www.standardandpoors.com/AI4FI. For the Asia-Pacific markets, a second teleconference will be hosted on Fri., Dec. 2 at 11:00 a.m. Singapore time. Live dial-in numbers include: 800 616 2259 (Singapore); 1800 153 721 (Australia); 800 933 733 (Hong Kong); and 0034 8004 00746 (Japan). The participant PIN is 635560. For additional call-in numbers and other details, please visit: http://microsite.standardandpoors.com/?elqPURLPage=1075.

Standard & Poor's, a part of The McGraw-Hill Companies (NYSE:MHP), is the world's foremost provider of credit ratings. With offices in 23 countries,

www.standardandpoors.com/ratingsdirect

15

917770 | 300000825

Standard & Poor's Applies Its Revised Bank Criteria To 37 Of The Largest Rated Banks And Certain Subsidiaries

Standard & Poor's is an important part of the world's financial infrastructure and has played a leading role for 150 years in providing investors with information and independent benchmarks for their investment and financial decisions. For more information, visit http://www.standardandpoors.com.

Standard & Poors | RatingsDirect on the Global Credit Portal | November 29, 2011

16

917770 | 300000825

Copyright 2011 by Standard & Poors Financial Services LLC (S&P), a subsidiary of The McGraw-Hill Companies, Inc. All rights reserved. No content (including ratings, credit-related analyses and data, model, software or other application or output therefrom) or any part thereof (Content) may be modified, reverse engineered, reproduced or distributed in any form by any means, or stored in a database or retrieval system, without the prior written permission of S&P. The Content shall not be used for any unlawful or unauthorized purposes. S&P, its affiliates, and any third-party providers, as well as their directors, officers, shareholders, employees or agents (collectively S&P Parties) do not guarantee the accuracy, completeness, timeliness or availability of the Content. S&P Parties are not responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the Content, or for the security or maintenance of any data input by the user. The Content is provided on an "as is" basis. S&P PARTIES DISCLAIM ANY AND ALL EXPRESS OR IMPLIED WARRANTIES, INCLUDING, BUT NOT LIMITED TO, ANY WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE, FREEDOM FROM BUGS, SOFTWARE ERRORS OR DEFECTS, THAT THE CONTENT'S FUNCTIONING WILL BE UNINTERRUPTED OR THAT THE CONTENT WILL OPERATE WITH ANY SOFTWARE OR HARDWARE CONFIGURATION. In no event shall S&P Parties be liable to any party for any direct, indirect, incidental, exemplary, compensatory, punitive, special or consequential damages, costs, expenses, legal fees, or losses (including, without limitation, lost income or lost profits and opportunity costs) in connection with any use of the Content even if advised of the possibility of such damages. Credit-related analyses, including ratings, and statements in the Content are statements of opinion as of the date they are expressed and not statements of fact or recommendations to purchase, hold, or sell any securities or to make any investment decisions. S&P assumes no obligation to update the Content following publication in any form or format. The Content should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and other business decisions. S&P's opinions and analyses do not address the suitability of any security. S&P does not act as a fiduciary or an investment advisor. While S&P has obtained information from sources it believes to be reliable, S&P does not perform an audit and undertakes no duty of due diligence or independent verification of any information it receives. S&P keeps certain activities of its business units separate from each other in order to preserve the independence and objectivity of their respective activities. As a result, certain business units of S&P may have information that is not available to other S&P business units. S&P has established policies and procedures to maintain the confidentiality of certain non-public information received in connection with each analytical process. S&P may receive compensation for its ratings and certain credit-related analyses, normally from issuers or underwriters of securities or from obligors. S&P reserves the right to disseminate its opinions and analyses. S&P's public ratings and analyses are made available on its Web sites, www.standardandpoors.com (free of charge), and www.ratingsdirect.com and www.globalcreditportal.com (subscription), and may be distributed through other means, including via S&P publications and third-party redistributors. Additional information about our ratings fees is available at www.standardandpoors.com/usratingsfees.

www.standardandpoors.com/ratingsdirect

17

917770 | 300000825

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Manuel Castells: Aftermath The Cultures of The Economic CrisisDocument14 pagesManuel Castells: Aftermath The Cultures of The Economic Crisismrwonkish100% (1)

- Leveraged Loan League TablesDocument31 pagesLeveraged Loan League TablescmoorefieldNo ratings yet

- Online Banking - Bank LoginDocument16 pagesOnline Banking - Bank LoginonliebankingNo ratings yet

- Exposing Mammon: Devotion To Money in A Market Society (Philip Goodchild)Document11 pagesExposing Mammon: Devotion To Money in A Market Society (Philip Goodchild)mrwonkishNo ratings yet

- Bursting The Brussels BubbleDocument216 pagesBursting The Brussels BubblegabalauiNo ratings yet

- Fritz W. Scharpf Political Legitimacy in A Non-Optimal Currency AreaDocument39 pagesFritz W. Scharpf Political Legitimacy in A Non-Optimal Currency AreamrwonkishNo ratings yet

- The Realism of Assumptions Does Matter: Why Keynes-Minsky Theory Must Replace Efficient Market Theory As The Guide To Financial Regulation PolicyDocument30 pagesThe Realism of Assumptions Does Matter: Why Keynes-Minsky Theory Must Replace Efficient Market Theory As The Guide To Financial Regulation PolicymrwonkishNo ratings yet

- Steve Keen: Instability in Financial Markets: Sources and RemediesDocument23 pagesSteve Keen: Instability in Financial Markets: Sources and Remediesmrwonkish100% (2)

- The Perfect Storm Energy, Finance and The End of GrowthDocument84 pagesThe Perfect Storm Energy, Finance and The End of GrowthmrwonkishNo ratings yet

- The Neoliberal Corporate Takeover of Everything (Henry Giroux)Document29 pagesThe Neoliberal Corporate Takeover of Everything (Henry Giroux)mrwonkishNo ratings yet

- DG Commentary Is Germany A Model To FollowDocument3 pagesDG Commentary Is Germany A Model To FollowAndreea WeissNo ratings yet

- Council On The Euro Zone Crisis - 23-7-12Document11 pagesCouncil On The Euro Zone Crisis - 23-7-12mrwonkishNo ratings yet

- Financial Capitalism - at Odds With Democracy: The Trap of An "Impossible" Profit RateDocument28 pagesFinancial Capitalism - at Odds With Democracy: The Trap of An "Impossible" Profit RatemrwonkishNo ratings yet

- Paul de Grauwe: How Not To Be A Lender of Last Resort (Ipaper/PDF)Document2 pagesPaul de Grauwe: How Not To Be A Lender of Last Resort (Ipaper/PDF)mrwonkishNo ratings yet

- John P. A. Ioannidis Why Most Published Research Findings Are FalseDocument6 pagesJohn P. A. Ioannidis Why Most Published Research Findings Are FalsemrwonkishNo ratings yet

- Why Eurozone Got Into Double Dip Recession, and How To Get Out of ItDocument6 pagesWhy Eurozone Got Into Double Dip Recession, and How To Get Out of ItmrwonkishNo ratings yet

- Crisis in 1000 Words or LessDocument2 pagesCrisis in 1000 Words or Lessmrwonkish100% (1)

- Eurozone Crisis 2.0Document1 pageEurozone Crisis 2.0mrwonkishNo ratings yet

- Billy Mitchel: The Fundamental Principles of Modern Monetary Economics (MMT/PDF)Document6 pagesBilly Mitchel: The Fundamental Principles of Modern Monetary Economics (MMT/PDF)mrwonkish100% (1)

- E-Book: Beyond The Minsky MomentDocument81 pagesE-Book: Beyond The Minsky MomentmrwonkishNo ratings yet

- World Bank - Global Economic ProspectsDocument164 pagesWorld Bank - Global Economic Prospectsrryan123123No ratings yet

- Merely Activating The Concept of Money Changes Personal and Interpersonal Behavior (Ipaper)Document5 pagesMerely Activating The Concept of Money Changes Personal and Interpersonal Behavior (Ipaper)mrwonkishNo ratings yet

- Political Orientations Are Correlated With Brain Structure in Young AdultsDocument4 pagesPolitical Orientations Are Correlated With Brain Structure in Young AdultsFelipe Alberto Cuevas PachecoNo ratings yet

- From Financial Crisis To Stagnation The Destruction of Shared Prosperity and The Role of EconomicsDocument10 pagesFrom Financial Crisis To Stagnation The Destruction of Shared Prosperity and The Role of EconomicsmrwonkishNo ratings yet

- Noam Chomsky: Freedom and PowerDocument18 pagesNoam Chomsky: Freedom and PowermrwonkishNo ratings yet

- Waiting For The Next Crash: The Minskyan Lessons We Failed To LearnDocument10 pagesWaiting For The Next Crash: The Minskyan Lessons We Failed To LearnmrwonkishNo ratings yet

- On The Brink: Fiscal Austerity Threatens A Global RecessionDocument4 pagesOn The Brink: Fiscal Austerity Threatens A Global RecessionmrwonkishNo ratings yet

- A Post-Keynesian Interpretation of The European Debt CrisisDocument37 pagesA Post-Keynesian Interpretation of The European Debt CrisismrwonkishNo ratings yet

- Food Markets in Dutch Dutch Banks and Pension Funds in Agricultural Derivatives Markets (Rens Van Tilburg - SOMO-)Document44 pagesFood Markets in Dutch Dutch Banks and Pension Funds in Agricultural Derivatives Markets (Rens Van Tilburg - SOMO-)mrwonkishNo ratings yet

- Food Commodities Speculation and Food Price Crises: Regulation To Reduce The Risks of Price VolatilityDocument14 pagesFood Commodities Speculation and Food Price Crises: Regulation To Reduce The Risks of Price Volatilitytomili85No ratings yet

- Food Commodities Speculation and Food Price Crises: Regulation To Reduce The Risks of Price VolatilityDocument14 pagesFood Commodities Speculation and Food Price Crises: Regulation To Reduce The Risks of Price Volatilitytomili85No ratings yet

- Levy Economics Institute of Bard College Strategic Analysis December 2011 Is The Recovery Sustainable?Document20 pagesLevy Economics Institute of Bard College Strategic Analysis December 2011 Is The Recovery Sustainable?mrwonkishNo ratings yet

- Customer Listing With Addresses For Tire Service ProvidersDocument57 pagesCustomer Listing With Addresses For Tire Service ProvidersEdukaCentar SplitNo ratings yet

- ApplicationsDocument415 pagesApplicationsRohitKumarNo ratings yet

- Fact Orders Tec Stored A To S 2022Document2,364 pagesFact Orders Tec Stored A To S 2022Mikel SUAREZ BARREIRONo ratings yet

- Bank Failures in 2010Document14 pagesBank Failures in 2010Richarnellia-RichieRichBattiest-CollinsNo ratings yet

- NO Nama Bank Kode BankDocument4 pagesNO Nama Bank Kode BankAndi Masnah AzisNo ratings yet

- Plan Prehrane FranoDocument4 pagesPlan Prehrane FranoJohnny PetrovicNo ratings yet

- New Text DocumentDocument3 pagesNew Text Documentngtkoanh100% (1)

- LEHMAN BROTHERS Bond PricesDocument22 pagesLEHMAN BROTHERS Bond PricesSouthey CapitalNo ratings yet

- Florida Companies ListDocument3 pagesFlorida Companies ListFaraz SMFZNo ratings yet

- Tallest20 2010 PreviewDocument1 pageTallest20 2010 PreviewHiren DesaiNo ratings yet

- Provider Id Numbers and Plan Codes: Medicaid Managed Care PlanDocument5 pagesProvider Id Numbers and Plan Codes: Medicaid Managed Care PlanMike DurkeeNo ratings yet

- TOP 40 REVENUESDocument52 pagesTOP 40 REVENUESJonNo ratings yet

- Thrifts by StateDocument5 pagesThrifts by StateCrypto SavageNo ratings yet

- Mississippi River Portsriverbend Map 2019 PrintDocument1 pageMississippi River Portsriverbend Map 2019 PrintSahil SinghNo ratings yet

- Madison - Signed KYC Structure Chart - 05!05!2023Document2 pagesMadison - Signed KYC Structure Chart - 05!05!2023emmanNo ratings yet

- Bines 2019Document7 pagesBines 2019Fernando SernaNo ratings yet

- List of Oil Companies and Representatives in EcuadorDocument12 pagesList of Oil Companies and Representatives in EcuadorCRISTINANo ratings yet

- Bank Keys Rev 2Document13 pagesBank Keys Rev 2Nitika MinhasNo ratings yet

- Utilities Info (Oh - Pa)Document14 pagesUtilities Info (Oh - Pa)samiullahmazari3No ratings yet

- SP 500 Eps EstDocument42 pagesSP 500 Eps EstIbn Faqir Al ComillaNo ratings yet

- Equity List 01 Feb 2022Document35 pagesEquity List 01 Feb 2022Akhil HussainNo ratings yet

- Bandhan Focused Equity FundDocument10 pagesBandhan Focused Equity FundArmstrong CapitalNo ratings yet

- BlackRock - Wikipedia, The Free EncyclopediaDocument6 pagesBlackRock - Wikipedia, The Free EncyclopediaFernanda FloresNo ratings yet

- Polaris Doc enDocument113 pagesPolaris Doc enLeidy FlórezNo ratings yet

- Ishares US ETFs - Dividends and Implied Volatility Surfaces ParametersDocument2 pagesIshares US ETFs - Dividends and Implied Volatility Surfaces ParametersQ.M.S Advisors LLCNo ratings yet

- Collection of M&A Analysis & Presentations Created by Investment BanksDocument15 pagesCollection of M&A Analysis & Presentations Created by Investment BanksSofía Aguayo LeónNo ratings yet

- Report TemplateDocument1,846 pagesReport Templatehindu_for_everNo ratings yet

- Active Shareholder Ownership RecordsDocument4,063 pagesActive Shareholder Ownership RecordsssdebNo ratings yet