Professional Documents

Culture Documents

UCC Checklist

Uploaded by

ajordan23Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UCC Checklist

Uploaded by

ajordan23Copyright:

Available Formats

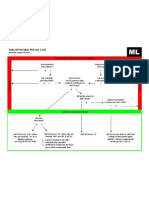

SECURED TRANSACTIONS: CHECKLIST 1) Scope a) Transactions 9-109 i) Security Interest ii) Agricultural Liens iii) Sale of Intangibles (4)

iv) Consignments v) Conditional Sales 2-401; 9-109; 1-201(37) vi) Leases Intended as Security 1-201(37) b) Collateral 9-102 i) Tangibles (1) Goods (a) Consumer (b) Equipment (c) Inventory (d) Farm Products (2) Fixtures ii) Intangibles (1) Money (2) Investment Property (3) Commercial Tort Claims (4) Chattel Paper (5) Instruments (a) Promissory Notes (b) Checks (c) Negotiable certificates of deposits (d) Drafts (6) Bank Accounts (7) Accounts (8) Documents (9) General Intangibles c) Exclusions 9-109 i) Transactions (1) Non-agricultural Liens (2) Assignment of deposit accounts in consumer transactions (3) Transfer of intangibles as part of going out of business sale or for collection purposes only (4) Transfer of single intangible, not chattel paper, to satisfy preexisting debt (5) Assignment of right to payment under contract to assignee who is obligated to perform as well ii) Collateral (1) Non-fixture real estate (2) Insurance except health care receivables (3) Non-commercial tort claims 2) Attachment UCC 9-203 a) Agreement and i) Authenticated Record (1) Authenticated (a) Signed or (b) Symbol with intent (2) Record (a) Retrievable (3) Description of Collateral (a) Reasonably identifies (b) No supergeneric (c) After Acquired (d) Future Advances ii) Possession UCC 9-313 (1) Collateral: Negotiable documents, goods, instruments, money or tangible chattel paper (2) Possession: creditor, agent, or third party not the debtor or under control of debtor iii) Control UCC 9-104 thru 9-107 (1) Bank Accounts (a) Bank (b) Agreement & Authenticated by Bank, Secured Party, & Debtor (c) Secured party named on account (customer) (2) Electronic Chattel Paper (a) Single authoritative copy (i) Unique, identifiable, generally unalterable (b) Identifies the secured party (c) Sent to and maintained by secured party (d) Changes only w/ participation of secured part (e) Copies and revisions readily identifiable as copy or authorized b) Value (Secured Party) i) Consideration for a simple contract UCC 1-201 c) Rights (Debtor) i) Ownership ii) Gift iii) Limited UCC 2-501 (1) Identification to the contract (2) Watch out for after acquired iv) Leasehold: Article 2A v) Voidable Title Exception UCC 2-403 (1) Good faith purchaser for value has rights and power to transfer rights d) Attachment to Proceeds 9-315 i) SI attaches to all identifiable proceeds ii) anything acquired upon disposition of collateral iii) Proceeds are either cash or non-cash iv) Lowest intermediate balance: SI follows cash into bank account and attaches to bank account v) Debtor spends non-proceeds first vi) SI attaches to the (1) value of proceed or (2)

balance of account, whichever is lower

3) Perfection a) Classify Collateral b) Permissible Methods i) Filing UCC 9-310 (1) Everything except Bank Accounts (2) Ag. Lien = Filing Only unless statute says otherwise ii) Possession UCC 9-313 (1) Farm Products (2) Consumer goods (3) Equipment (4) Inventory (5) Fixtures (6) Documents (7) Certificated securities (8) Instruments (9) Tangible chattel paper iii) Control UCC 9-314 (1) Deposit Accounts (Only Way) (2) Certificated Security (3) Investment Property (4) Electronic Chattel Paper iv) Automatic/Temporary UCC 9-309 (1) PMSI in Consumer Goods (2) PMSI in Fixtures that are Consumer Goods (3) Insignificant, One-Time Assignment of Single Account (4) Document: Temp. 20 Days (5) Certificated Security: Temp. 20 Days c) Filing i) Is filing permissible (1) Filing permissible for everything but bank accounts ii) What state: Debtor's location 9-301 (1) Debtor's location 9-307 (a) Copr. = State of Incorp (b) Individual = state of residence (c) Unincorp. = principle place of business or is several, chief executive office (d) Debtor's location is place of collateral only for fixtures iii) What Office 9-501 (1) Secretary of state or (2) Recorder of deeds for fixtures (3) Both if the collateral is equipment iv) Valid Filing (1) Must haves 9-502 (a) Debtor's name (b) SP's name (c) Indication of Collateral (2) Should Haves 9-516 (a) Addresses of debtor and creditor (b) Registration Numbers (c) Whether debtor is individual or corporation (3) Fixture Filing (a) Debtor & Secured party's name;

indication of collateral and (b) Statement that collateral is a fixture (c) Statement that FS will be filed in real estate records (d) Name of the owner of the real estate (4) Errors 9-506 (a) Wrong name on FS is seriously misleading unless (b) Standard search logic would reveal debtor's name (c) Trade names are insufficient (5) Changes in Debtor's name 9-507 (a) Is seriously misleading (b) Must amend within 4 months after change in name (c) If not, creditor is unperfected in all collateral acquired after the 4 month period (6) Change in Jurisdiction 9-316 (a) Creditor becomes unperfected in all its collateral against purchasers for value unless creditor files within 4 months after change in jurisdiction (b) Creditor only become unperfected in its collateral acquired after the 4 month period is over against non-purchasers (trustee in bankruptcy and lien creditor) (7) Authorization of Financing Statement 9-509 (a) Must be authorized by the debtor (b) Original security agreement is authorization (c) Original security agreement authorizes all amendments to the FS (8) Duration, Continuation, and Termination: 9513 and 9-515 (a) FS lasts for five years (b) Continuation must be done 6 months before the five year period ends (c) When five years is up, the FS terminates (d) If terminates, you are unperfected against purchasers for value (other secured creditors) (9) Amendments 9-512 (a) Amendment must identify the initial FS (b) Does not extend the five year period (c) If new collateral is added, five year starts from the date of amendment d) Other Methods i) Possession 9-313 (1) Perfect by possession (2) Perfection lasts as long as possession (3) Creditor possesses (4) Creditor's agent (5) Third party Bailee Issues document (a) Negotiable 9-312 (i) Possess the document

(ii) File against the document or

(iii) File against the goods (b) Non-negotiable 9-312 (i) Notice to bailee (ii) Have bailee issue non-neg. doc in SP's name (iii) File against the goods (c) No Document 9-313 (i) Bailee must acknowledge in authenticated record ii) Perfect by Control (1) Bank Accounts 9-104 (a) Bank is secured party (b) Secured party is customer of bank or (c) Bank, secured party, and debtor agree that creditor controls and bank will let him control (2) Electronic Chattel Paper (a) Single authoritative copy (b) Identifies secured party as assignee (c) Sent to and maintained by secured party (d) Changes made only with participation of secured party (e) Copies are marked as copies (f) Revisions are marked as authorized or not iii) Automatic Perfection 9-309 (1) PMSI Defined 9-103 (a) Seller finances or (b) Lender gives money to buy certain collateral and debtor in fact buys that collateral (2) PMSI is consumer goods is automatically perfected (3) Sale of a promissory note is automatically perfected (4) Assignment of a single, insignificant account is automatically perfected (RARE) iv) Temporary Perfection 9-312 (1) Negotiable documents and instruments are automatically perfected for 20 days IF (a) New value is give (no pre-existing debt) (b) Authenticated security agreement Perfection in Proceeds 9-315 i) Proceeds are automatically perfected for 20 days ii) Identifiable cash proceeds remain perfected after the 20 days iii) Non cash-proceeds are perfected after 20 days if (1) Creditor filed for the original collateral (2) Did not get the proceeds with cash and (3) Proceed can be filed in the same office as the original collateral (ALWAYS MET UNLESS THE PROCEED IS A FIXTURE) Perfection of Chattel Paper i) Security Interest + Note = perfection of goods and payment ii) Lease = perfection only in the payment not the

e)

f)

goods

4) Priority a) General Rules 9-322 i) Between secured creditors, first to file or perfect ii) Perfected beats unperfected iii) Between two unsecured creditors first to attach b) Perfection in Proceeds 9-322 i) If continuously perfected in original collateral, perfected in proceed ii) Date relates back to perfection of original collateral iii) Default rules apply c) Perfection in Future Advances i) Date relates back to original loan unless future advance was made during temporary perfection ii) Default rules apply d) Accession 9-335 i) Goods affixed to other goods ii) Default rules apply e) Exceptions i) PMSI In equipment 9-324 (1) Between PMSI and Non-PMSI, PMSI wins if perfected within 20 days of debtor's possession (2) Between conflicting PMSI (a) Both must be perfected within 20 days of debtor's possession (b) Seller beats non-seller (c) If neither is a seller, first to perfect wins ii) PMSI in Inventory and Farm Products 9-324 (1) Perfect at or before debtor takes possession (2) Will win if gives notice to other creditors (3) Inventory: notice within 5 years (4) Farm Products: notice within 6 months iii) Bank Accounts 9-327 (1) One party will control, the other will have a proceed interest in the bank account (2) Control beats non-control (non-control would be the proceed interest) (3) Between two that control, the first to control (4) Bank beats other SP perfected by control (5) SP is customer of bank, beats everybody iv) Fixtures 9-334 (1) Mortgage beats SI in fixtures unless (a) PMSI in fixtures (i) Mortgage occurred before the goods became fixtures and (ii) Fixture filing within 20 days after good became a fixture (b) Non-PMSI in fixtures wins if (i) Filed in real estate office before the mortgage attached (c) SI in readily removable fixtures wins if goods are (i) Offices machines (ii) Equipment not usually used for real property or (iii) Replaced Domestic appliances

v) Lien Creditors 9-317 (1) Defined: Obtains Judgment against debtor (2) Beats unsecured creditors (3) Loses to secured creditors if secured creditor (a) Perfects before lien attaches or (b) Pre-files and one of the agreement requirements 9-203 are met (i) Security Agreement in authenticated record (ii) Agreement and control or (iii) Agreement and possession (4) Loses to security interest in future advances if (a) Advance made within 45 days after lien attaches (b) Advance made after 45 days without knowledge (c) Lien Creditor WINS if advance made with actual knowledge of the lien after 45 day period vi) Trustee in Bankruptcy Bkrtcy Code 547 (APPLY WHEN THERE IS A TRUSTEE) (1) Trustee beats all unperfected security interests (2) Preferences will be set aside if (a) Transfer of interest in property (i) Transfer date 1. date of attachment if secured party perfected within 10 days after attachment 2. Otherwise, date of perfection (b) Made for the benefit of a creditor (c) On account of antecedent debt (d) While debtor was insolvent (presumed insolvent 90 days before the date of bankruptcy) (e) Made within 90 days before the date of bankruptcy AND (f) Creditor gets more through the transfer than they would have through bankruptcy (3) Exceptions to the Preference Rule (a) PMSI perfected within 20 days of the debtor's possession beats the trustee (b) Inventory Exception (i) The amount of unsecured debt on the date of bankruptcy cannot be less than the amount on the 90th day before the date of bankruptcy vii) Buyer of Goods 9-315, 320 (1) Security interest continues in collateral (2) 9-320: Buyer of debtor's inventory takes free if (a) Buyer (b) Good faith (c) Without knowledge of a violation (d) Buys in the ordinary course, not bulk

sales (e) And seller/debtor is engaged in the business of selling those goods (3) Buyer of Debtor's equipment takes free if (a) Secured party authorized (9-315) or (b) Secured party was unperfected (9-317) (4) Consumer Buyer of Consumer Debtor's Consumer Goods takes free if (a) Consumer goods in the buyer and seller's hand (b) NO KNOWLEDGE OF ANY SECURITY INTEREST (c) Buyer gives value and (d) Buyer buys before secured party files viii) Purchasers of Chattel Paper 9-330 (1) If chattel paper is a proceed of inventory, buyer takes free if (a) Purchaser (b) In good faith (c) Bought in the ordinary course of business (d) Gives new value (e) Possesses chattel paper (f) Chattel paper does not indicated on its face that it belongs to someone else (2) If interest in chattel paper is anything else: (a) Same requirements and (b) Purchaser cannot know of a violation of a security interest ix) Purchasers of Instruments 9-330; 331 (1) Holder of instrument in due course beats everything (2) Purchaser of instruments wins if (a) Purchaser (b) Good faith (c) Takes possession (d) Without knowledge of a violation (e) Purchaser gives value

You might also like

- CHANGES AND COMPETITIONS IN SECURED TRANSACTIONSDocument10 pagesCHANGES AND COMPETITIONS IN SECURED TRANSACTIONSAnonymous vXdxDlwKO89% (9)

- UCC Warranties ChartDocument1 pageUCC Warranties Chartzmeth144100% (1)

- CL UCC Comparison ChartDocument4 pagesCL UCC Comparison ChartAshli Braggs80% (10)

- UCC Provision ElaborationDocument3 pagesUCC Provision Elaborationj100% (5)

- UCC 2 207 Flow ChartDocument1 pageUCC 2 207 Flow ChartAshleigh Renfro95% (19)

- Secured Transactions Attack OutlineDocument15 pagesSecured Transactions Attack Outlinemkelly210990% (30)

- UND Law Homecoming CLE: Debtor-Creditor Law IllustratedDocument109 pagesUND Law Homecoming CLE: Debtor-Creditor Law IllustratedBunny Fontaine100% (3)

- UCC v. Common LawDocument2 pagesUCC v. Common LawJoe Schmoes33% (3)

- Flowchart - UCC RemediesDocument1 pageFlowchart - UCC RemediessgussackNo ratings yet

- UCC CommonLawDocument3 pagesUCC CommonLawOctavian Jumanca0% (1)

- Secured Transactions Flow Chart (Collateral)Document10 pagesSecured Transactions Flow Chart (Collateral)Kathleen Alcantara94% (16)

- Why Secured PartyDocument8 pagesWhy Secured PartyKas4ever89% (9)

- Ucc WorkbookDocument544 pagesUcc WorkbookShelomo1974100% (22)

- @ UCC Negotiable Instruments Outline - Masinter (Winter 2013)Document63 pages@ UCC Negotiable Instruments Outline - Masinter (Winter 2013)Kim BoSlice100% (9)

- UCC HandbookDocument77 pagesUCC HandbookKen Ian Talag100% (3)

- UCC and Common Law Contract DifferencesDocument3 pagesUCC and Common Law Contract Differencesjoe b100% (11)

- Debt Validation 01 UccDocument2 pagesDebt Validation 01 UccKNOWLEDGE SOURCENo ratings yet

- Secured Transactions OutlineDocument27 pagesSecured Transactions OutlineAlexandraMarie100% (6)

- Contracts - UCC Rule OutlineDocument5 pagesContracts - UCC Rule OutlineC DaNo ratings yet

- Secured Trans (Good Explanations)Document42 pagesSecured Trans (Good Explanations)JasonGershensonNo ratings yet

- UCC I OutlineDocument6 pagesUCC I OutlineRyan Hiler100% (1)

- Uniform Commercial CodeDocument66 pagesUniform Commercial CodeRuna Jully100% (2)

- Secured Transaction Outline 2012Document45 pagesSecured Transaction Outline 2012Isabella L100% (10)

- Secured Transactions RemediesDocument70 pagesSecured Transactions RemediesCarolina Jordan100% (1)

- Commercial Paper + Secured TransactionsDocument15 pagesCommercial Paper + Secured TransactionsDavid Shim100% (2)

- Art. 9 UCC Priority AnalysisDocument22 pagesArt. 9 UCC Priority Analysistestacct00% (1)

- Secured TransactionsDocument41 pagesSecured TransactionsSom RasouliNo ratings yet

- Secured Transactions, Governing Law: Law Essentials for Law School and Bar Exam PrepFrom EverandSecured Transactions, Governing Law: Law Essentials for Law School and Bar Exam PrepRating: 3 out of 5 stars3/5 (1)

- ContracrtDocument11 pagesContracrtroushan kumarNo ratings yet

- UCC ART 9 Creation, PerfectionDocument14 pagesUCC ART 9 Creation, Perfectiontom100% (2)

- Secured Transactions ChecklistDocument6 pagesSecured Transactions Checklistshacisa90% (10)

- Secured Transactions OutlineDocument22 pagesSecured Transactions Outlinetroberp100% (4)

- UCC Guide: Everything You Need to Know About the UCC ProgramDocument36 pagesUCC Guide: Everything You Need to Know About the UCC ProgramGrace ChandraNo ratings yet

- UCC Reference Chart 1Document13 pagesUCC Reference Chart 1acconway100% (11)

- Ucc LawDocument177 pagesUcc LawGatorNo ratings yet

- CONTRACTS I: SUMMARY OF KEY CONCEPTSDocument3 pagesCONTRACTS I: SUMMARY OF KEY CONCEPTSmwaymelNo ratings yet

- UCC DefinitionsDocument5 pagesUCC DefinitionsautumngraceNo ratings yet

- UCC SalesDocument47 pagesUCC SalesSean Austin Parker-O'Grady Pog100% (1)

- Secured Transations OutlineDocument153 pagesSecured Transations OutlineTara Patton100% (1)

- Contracts UCC SalesDocument89 pagesContracts UCC Salesalbtros100% (6)

- Secured-Transactions OutlineDocument43 pagesSecured-Transactions Outlinea thayn100% (2)

- Secured Transactions OutlineDocument59 pagesSecured Transactions OutlineGabby ViolaNo ratings yet

- Revised UCC Article 9Document124 pagesRevised UCC Article 9Jason Henry100% (2)

- How To Find Who Owns The NoteDocument2 pagesHow To Find Who Owns The Note900aday100% (4)

- Secured TransactionsDocument28 pagesSecured Transactionspatrick88% (8)

- Secured Transactions OutlineDocument121 pagesSecured Transactions Outlinemaureen P100% (2)

- 10 CreditorsRemediesandDebtorsAssistanceDocument50 pages10 CreditorsRemediesandDebtorsAssistanceWave Walker100% (3)

- Commercial Paper OutlineDocument4 pagesCommercial Paper Outlinezumieb100% (2)

- Diplomatic Immunity 3Document7 pagesDiplomatic Immunity 3Local Agency GodNo ratings yet

- Flowchart For UCC 2-207Document1 pageFlowchart For UCC 2-207Matthew LeaperNo ratings yet

- UCC Article 3Document68 pagesUCC Article 3mlo356100% (2)

- Collateral (Reasonable, More Specific Required For Consumer Goods or A Commercial Tort Claim Ex. "All of My Consumer Goods" Not SufficientDocument2 pagesCollateral (Reasonable, More Specific Required For Consumer Goods or A Commercial Tort Claim Ex. "All of My Consumer Goods" Not SufficientJaneNo ratings yet

- UCC 3 InstructionsDocument2 pagesUCC 3 InstructionsJason Henry0% (1)

- Ecured Ransactions: Cope OF RticleDocument15 pagesEcured Ransactions: Cope OF RticleccdubrowNo ratings yet

- Secured Transactions ChecklistDocument5 pagesSecured Transactions ChecklistJoseph Jeffrey100% (1)

- SECURED TRANSACTION BAR CHECKLISTDocument4 pagesSECURED TRANSACTION BAR CHECKLISTatw4377100% (1)

- Jaiib Sample QuestionsDocument4 pagesJaiib Sample Questionskubpyg100% (1)

- PRMS FAQsDocument3 pagesPRMS FAQsfriendbceNo ratings yet

- Power of Attorney (General)Document3 pagesPower of Attorney (General)champakNo ratings yet

- Statement 14-APR-23 AC 63755886 16042114Document6 pagesStatement 14-APR-23 AC 63755886 16042114Shauna DunnNo ratings yet

- Reinsurance Contract Nature and Original Insured InterestDocument2 pagesReinsurance Contract Nature and Original Insured InterestFlorena CayundaNo ratings yet

- Booklet 2Document127 pagesBooklet 2alok pandeyNo ratings yet

- Bank Reconciliation (Practice Quiz)Document4 pagesBank Reconciliation (Practice Quiz)MoniqueNo ratings yet

- The Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going ForwardDocument10 pagesThe Asian Financial Crisis of 1997 1998 Revisited Causes Recovery and The Path Going Forwardgreenam 14No ratings yet

- Ijaz KhanDocument78 pagesIjaz Khanwaqar ahmadNo ratings yet

- Van Den Berghs LTD V ClarkDocument6 pagesVan Den Berghs LTD V ClarkShivanjani KumarNo ratings yet

- Consolidated CSOFP of Jasin Bhd GroupDocument4 pagesConsolidated CSOFP of Jasin Bhd GroupNoor ShukirrahNo ratings yet

- FX Fluctuations, Intervention, and InterdependenceDocument9 pagesFX Fluctuations, Intervention, and InterdependenceRamagurubaran VenkatNo ratings yet

- GFR 12 - A Form of Utilisation Certificate For Autonomous Bodies of The Grantee OrgnisationDocument3 pagesGFR 12 - A Form of Utilisation Certificate For Autonomous Bodies of The Grantee OrgnisationRavi GuptaNo ratings yet

- Quiz Test 2 KMB FM 05Document1 pageQuiz Test 2 KMB FM 05Vivek Singh RanaNo ratings yet

- Topic 6 - Inventories Lecture Illustrations: RequiredDocument4 pagesTopic 6 - Inventories Lecture Illustrations: RequiredMitchell BylartNo ratings yet

- BankingDocument15 pagesBankingAnchu Theresa JacobNo ratings yet

- CBSE XII Accountancy Most Important QuestionsDocument15 pagesCBSE XII Accountancy Most Important QuestionsgauravNo ratings yet

- GST Session 38Document20 pagesGST Session 38manjulaNo ratings yet

- Accounts - Past Years Que CompilationDocument393 pagesAccounts - Past Years Que CompilationSavya SachiNo ratings yet

- AgreementDocument16 pagesAgreementarun_cool816No ratings yet

- 2026 SyllabusDocument28 pages2026 Syllabussatkargulia601No ratings yet

- Rothschild in Japan: Expert Advisory Services and Landmark DealsDocument4 pagesRothschild in Japan: Expert Advisory Services and Landmark DealsTiago PinheiroNo ratings yet

- AHAP Insurance Financial SummaryDocument2 pagesAHAP Insurance Financial SummaryluvzaelNo ratings yet

- Pradhan Mantri Fasal Bima Yojana (PMFBY) : Challenges and Way ForwardDocument17 pagesPradhan Mantri Fasal Bima Yojana (PMFBY) : Challenges and Way Forwardm_sachuNo ratings yet

- Ruchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesDocument3 pagesRuchi Soya Is One of The Largest Manufacturers of Edible Oil in India. Ruchi Soya IndustriesHarshit GuptaNo ratings yet

- AnnualReport 2016-17Document232 pagesAnnualReport 2016-17arunNo ratings yet

- Financial Analysis and Decision Making OutlineDocument8 pagesFinancial Analysis and Decision Making OutlinedskymaximusNo ratings yet

- Public Expert - Trend IndicatorsDocument21 pagesPublic Expert - Trend Indicatorsrayan comp100% (1)

- Functions of IDBI BankDocument37 pagesFunctions of IDBI Bankangelia3101No ratings yet

- ICE Cotton BrochureDocument6 pagesICE Cotton BrochureAmeya PagnisNo ratings yet